Professional Documents

Culture Documents

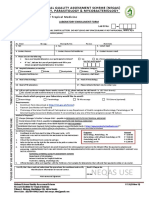

Audit Opinion

Audit Opinion

Uploaded by

ichwanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Opinion

Audit Opinion

Uploaded by

ichwanCopyright:

Available Formats

Jurnal Ilmiah Akuntansi Universitas Pamulang

Vol. 8, No. 1, Januari 2020

ISSN 2599-1922

DETECTION OF GOING CONCERN AUDIT OPINION BASED

ON DISCLOSURE, FINANCIAL CONDITION

AND OPINION SHOPPING

FIKA TRYA RAMADHANI, WIWIT APIT SULISTYOWATI*

Universitas Swadaya Gunung Jati

Email: fikatryar@gmail.com, wiwit.apit@gmail.com*

ABSTRACT

Going concern shows assumptions in the financial reporting of an entity relating

to the viability of an undertaking. Therefore, the role manager is critical to realize

its business continuity. This research aims to analyze the influence of disclosure,

financial condition, and opinion shopping on the acceptance of audit opinions

going concern on manufacturing companies of various industries listed on the

Indonesia Stock exchange for a period of years 2014 – 2016. This article uses the

verificative method and the sample selection using the purposive sampling

method. Sample selection results obtained 90 company data. This study used the

analysis of logistic regression, and the results showed that the opinion shopping

influence on the acceptance of the audit opinion of going concern while the

disclosure and financial condition does not affect the acceptance of the audit

opinion Going concern.

Keywords: Acceptance of Going Concern Audit Opinion; Disclosure; Financial

Condition; Opinion Shopping

1. INTRODUCTION

Going concern is the survival of a business and is an assumption in the

financial reporting of an entity. This assumption requires that the company to be

operational has the ability to sustain its survival and will continue its business in

the future. The company assumed neither intended nor wanted to liquidate or

reduce the scale of its business (Indonesian Institute of Accountants, 2017)

materially. While the opinion of the audit going concern is an opinion published

by the auditor to determine whether the company can maintain its survival

(Indonesian Institute of Accountants, 2017). Therefore, the study of going concern

became a challenge related to the exploration of management roles, audit

committees and auditors in publishing about business continuity (George &

Melinda, 2015). The statement reinforces this that receiving an audit's report with

a going-concern modification may impede an entity's ability to raise additional

capital (Foster & Shastri, 2016).

* Corresponding author’s e-mail: wiwit.apit@gmail.com

http://openjournal.unpam.ac.id/index.php/JIA 75

Jurnal Ilmiah Akuntansi Universitas Pamulang - Vol. 8, No. 1, Januari 2020 -

Ramadhani & Sulistyowati

Here are the phenomena about the many companies that accept the audit

opinion going concern, especially in the manufacturing company of various

industrial sectors listed at IDX in 2014-2016.

Table 1

Audit Opinion of Various Industrial Sectors

Description 2014 2015 2016 Total

Number of samples 33 29 28 90

Companies that accept 15 17 12 44

going concern audit

opinion

Companies that accept 18 12 16 46

non-going concern audit

opinion

Source: www.idx.go.id

Based on table 1 showed that the manufacturing company of various

industrial sectors listed at IDX in 2014-2016, which received the audit opinion

going concern several 44 of the total of all samples are 90 or 48% of the total

sample. The company that received the audit opinion of Going concern is several

44 companies while not receiving an audit opinion going concern several 46

companies. Audit opinions going concern can harm the company because the

recipient of audit opinions going concern can be predicted to experience

bankruptcy in the future.

Some factors that influence the opinion of the audit going concern include

the disclosure, financial condition, and opinion shopping. Disclosure is the

recording of company information to assist in providing a more accurate

description of the actual state of the company. Management's opinion about going

concern reported in the MD&A and the linguistic tone of the MD&A together

provide significant explanatory power in predicting whether A firm will cease as

A going concern. Moreover, the predictive ability of MD&A disclosure is

incremental to financial ratios, market-based variables, and even going concern

opinion from the auditor. We also find that the incremental predictive ability of

MD&A disclosures extends to three years before bankruptcy (Mayew et al.,

2014). According to the opinion of Jamaluddin (2018) that disclosure plays an

essential role in the audit opinion going concern.

The company's financial condition describes the real level of corporate

health (Murtin and Anam, 2008). Auditors have hardly ever issued an audit

opinion of going concern on companies that do not have financial difficulties.

Auditors will tend to issue an audit opinion going concern if the company is

experiencing financial distress so that it is within the threshold of bankruptcy

(Murtin and Anam, 2008). According to the opinion of Chen et al. (2016) that the

going concern opinion related to the decision of the capital structure to be taken

by the company.

Opinion shopping as defined by the SEC as an activity seeking auditors or

turnover of auditors who want to support the accounting treatment submitted by

* Corresponding author’s e-mail: wiwit.apit@gmail.com

http://openjournal.unpam.ac.id/index.php/JIA 76

Jurnal Ilmiah Akuntansi Universitas Pamulang - Vol. 8, No. 1, Januari 2020 -

Ramadhani & Sulistyowati

management to achieve the company's reporting objectives (Harris and Merianto,

2015). Opinion shopping is one of the actions of the company that will avoid the

audit opinion going concern to achieve specific objectives. The avoidance of the

audit opinion of going concern is done by the management of the company so that

stakeholders remain confident in the management of the company. Therefore, the

independence of auditors becomes a critical challenge or factor that is considered

when there is a long enough relationship between auditors and clients.

Stakeholders hope that auditors must be able to answer the report honestly and

provide assurance against shareholders concerning the reliability, compliance to

the regulatory body and accounting policies, reliability, and the truth and Fairness

of the client's financial statements (Salleh & Temporal, 2014).

The audit partner has to maintain regular contact with the client

management and client’s audit committee. They added that the new partner would

enhance the audit quality as the new audit partner brings “fresh and skeptical

eyes” into the audit despite the fact of new partner rotation create a new learning

curve for the incoming partner. Hence, it is essential to rotate audit partners to

reduce the familiarity threats and subsequently improve the quality of audit.

Besides, the audit quality is not only affected by audit firm rotation, but also the

duration of the audit partner holds office with the same client for several years)

(Newton et al., 2015). The quality of audit is considered vital because it becomes

a consideration of management in the responsibility of its management (Rosnidah

et al., 2018), (Rosnidah et al., 2017).

Prior Research predicts the audit opinion of going concern has been

conducted by Haron et al. (2009), O'reilly (2010), Blay et al., (2011), Carson et

al., (2012), Amin et al., (2014), Sundgren et al., (2014), Hapsoro et al., (2017).

Elmawati and Yuyetta (2014) stated that the disclosure was significant to the

acceptance of the audit opinion going concern, while Harris and Merianto said

(2015) that the disclosure was significantly negative to the acceptance of audit

opinions Going concern. Karyanti and Pratolo (2009) showed that the financial

condition does not affect the acceptance of the audit opinion going concern, while

according to Murtin and Anam (2008) Financial condition affects the acceptance

of the audit opinion going concern. Harris and Merianto (2015) show that opinion

shopping affects the acceptance of the audit opinion going concern, while Rianto

(2016) did not succeed in proving the influence.

The phenomenon shows that many industrial sector-wide manufacturing

companies listed on the IDX receive an audit opinion of going concern in the

period 2014-2016, as well as past inconsistent research. The majority of previous

studies review the audit opinion of going concern associated with funding issues

(Amin et al., 2014) and market reactions reflected in the stock price (O'reilly,

2010). Therefore, to fill the literature gap then this study is done by predicting the

opinion of the audit going concern by emphasizing the disclosure (Mayew et al.,

2014), Financial condition (Chen et al., 2016), and opinion shopping (Salleh &

Jasmani, 2014).

Based on the explanation, the research questions are:

a. What is the effect of disclosure on the audit opinion of going concern?

* Corresponding author’s e-mail: wiwit.apit@gmail.com

http://openjournal.unpam.ac.id/index.php/JIA 77

Jurnal Ilmiah Akuntansi Universitas Pamulang - Vol. 8, No. 1, Januari 2020 -

Ramadhani & Sulistyowati

b. What is the effect of financial condition on the audit opinion of going

concern?

c. What is the effect of opinion shopping affect the audit opinion of going

concern?

2. RESEARCH METHOD

Data Collection Techniques

This research data is secondary data collected

through www.idx.go.id access, which is the financial report of manufacturing

companies of various industries listed on the Indonesia Stock Exchange (IDX) in

2014-2016.

Operational Definitions of Variables

This research uses four variables, namely the Disclosure, financial

condition and Opinion Shopping as a free variable (independent) and the

acceptance of the audit opinion going concern as a dependent variable. The

dependent variable in this study is the opinion of the audit going concern (Y).

Audit opinions going concern is an audit opinion modification that, in

consideration of the auditor, there is a doubt over the ability of the company is

going concern, or there is significant uncertainty over the survival of the company

in carrying out Operation (SPAP, 2011). This variable is measured using a

dummy. Category 1 to auditee who received an audit opinion going concern and

category 0 for Auditee who received an audit opinion of ongoing concern

(unqualified opinion) (Elmawati and Yuyetta, 2014).

Disclosure is the disclosure or provision of information by the company,

both positive and negative (Astuti, 2012) (Elmawati and Yuyetta, 2014). This

variable is measured using indices that can be viewed from the disclosure level of

the company's financial information compared to the amount that the company

should have expressed. If the company discloses the information item in its

financial statement, a score of 1 will be given, and if the item is not disclosed, 0

will be awarded. After scoring, the disclosure level can be determined by the

following formula (Cooke, 1992) in (Elmawati and Yuyetta, 2014).

Disclosure level = total score of disclosure/total maximum score

The company's financial condition describes the actual health level of the

company during certain periods (Elmawati and Yuyetta,2014). Financial

conditions are described as the company's health level, to describe the health level

of the company's used predictive models Zscore Altman (1968, 1983) (Murtin and

Anam, 2008). The models are used as follows:

Zi = 1.2 Z1 + 1.4 Z2 + 3.3 Z3 + 0.6 Z4 + 1.0 Z5

Description:

Z1: Working capital/Total Asset

Z2: Retained Earnings/Total asset

Z3: EBIT/Total assets

Z4: Market capitalization/book value of debt

* Corresponding author’s e-mail: wiwit.apit@gmail.com

http://openjournal.unpam.ac.id/index.php/JIA 78

Jurnal Ilmiah Akuntansi Universitas Pamulang - Vol. 8, No. 1, Januari 2020 -

Ramadhani & Sulistyowati

Z5: Sales/Total assets

Based on this analysis if the Z value of the company studied is smaller

than 1.80 high risk of bankruptcy, if the value of Z located between 1.81 to 2.99 is

said to have a risk of bankruptcy still, if above the value of 2.99 or Z > 2.99

Secure bankruptcy against the conditions of competition (Elmawati and

Yuyetta,2014).

Opinion shopping is defined by the SEC (1985) in (Harris and

Merianto,2015) as an activity seeking auditors who want to support the

accounting treatment submitted by the management to achieve the company's

reporting objectives. This variable uses a dummy variable, code 1 is given to the

company that performs the turnover of auditors when it gets the opinion of going

concern, and 0 if it does not change the auditor when it gets opinions going

concern (Harris and Merianto, 2015).

Sample Collection Techniques

The population in this research is a manufacturing company of various

industrial sectors listed on the Indonesia Stock Exchange (IDX) in 2014-2016.

Sample research using the Purposive sampling method. The criteria in sampling

are as follows:

a) The manufacturing company of various industries listed on Indonesia Stock

Exchange (IDX) in 2014-2016

b) Issue an annual report audited by an independent auditor during 2014-2016.

c) Provide auditor's report on the company's annual report.

Based on the criteria in the sample selection, in this research the selected

samples are 90 sample data in manufacturing companies of various industries

listed on the Indonesia Stock Exchange in 2014-2016.

Data Analysis Techniques

This research uses logistical regression, with regression models as follows:

Description:

α = constant

Ln = opinion going concern

DISC = Disclosure

ZSCORE = Financial Conditions

OPSH = Opinion Shopping

E = Error

The hypothesis testing in this study was conducted with the following stages:

1) Test Model Fit

A fit model test is used to assess which model has been hypothesized to

have been fitted or not against data. Hypotheses to assess fit models are:

H0: Models that are hypothesized to fit with data

HA: Models that are hypothesized to not fit with data

* Corresponding author’s e-mail: wiwit.apit@gmail.com

http://openjournal.unpam.ac.id/index.php/JIA 79

Jurnal Ilmiah Akuntansi Universitas Pamulang - Vol. 8, No. 1, Januari 2020 -

Ramadhani & Sulistyowati

The smaller the value-2LogL, which has a minimum value of 0, then the

better the model, and otherwise, the bigger the value-2LogL, the less useful the

model.

2) Feasibility Test Model regression

The feasibility of a regression model is assessed by using Hosmer and

Lemeshow's Goodness of Fit Test. This Model to test the zero hypothesis that

empirical data fit or fits the model (no difference between the model and the

data so that the model can be told fit).

3) Estimation of parameters and interpretations

The estimation of the parameters can be assessed through a regression

coefficient of each of the tested variables, whether the form of a relationship

between variables is done by comparing the probability (sign) values for

testing Hypothesis. Hypothesis testing on logistic regression was conducted

using the significance rate (α) of 5%. The hypothesis acceptance or rejection

criteria will be based on the P-value value. Decisions are based on the

following probability:

If P-value is > 0.05, then the hypothesis is rejected

If P-value is < 0.05, then the hypothesis is accepted.

3. DATA ANALYSIS AND DISCUSSION

Data Analysis

Here is the test result table coefficient of determination:

Table 2

Coefficient test Result determination

Step -2 log Cox & Snell Nagelke

likelihood R Square R Square

1 112,240 ,126 ,168

Source: secondary data processed (2019)

Table 2 shows that the value of Nagelkerke's is at 0.168. This explains that

the percentage of disclosure, financial condition, and opinion shopping in

explaining the opinion of the audit going concern in the manufacturing company

of various industrial sectors amounted to 16.8%, while the remaining 83.2% can

be explained by other variables Not used in this study. Here is a hypothesis test

result table:

Table 3

Hypotheses Result

Variable Sig.

Disclosure .408

Financial condition .093

Opinion shopping .004

Source: secondary data processed (2019)

* Corresponding author’s e-mail: wiwit.apit@gmail.com

http://openjournal.unpam.ac.id/index.php/JIA 80

Jurnal Ilmiah Akuntansi Universitas Pamulang - Vol. 8, No. 1, Januari 2020 -

Ramadhani & Sulistyowati

Discussion

Disclosure and going concern audit opinion

Based on the results of the hypothesis testing through a logistic regression

test, a signification rate of 0.408 > 0.05 H1 test results showed that the disclosure

did not affect the acceptance of the audit opinion of going concern. The results of

this research following the research conducted by Fahmi (2015) which indicates

that the disclosure does not affect the acceptance of the audit opinion going

concern. Nevertheless, the results of this study were not in line with Elmawati and

Yuyetta's research (2014), indicating that the disclosure was influential on the

acceptance of the audit opinion going concern. This can be because the company

has not been able to reach the value of items that should be disclosed. In this

study, the majority of the value of the disclosure level declined, while the majority

of opinions received by sample companies were non-going concern audit

opinions. Therefore, the disclosure does not affect the acceptance of the audit

opinion going concern.

Financial condition and going concern audit opinion

Based on hypothesis testing results through logistics regression tests, with

a significant degree of 0.093 > 0.05, H2 test results showed that financial

conditions did not affect the acceptance of the audit opinion going concern. The

results of this research following the research conducted by Karyanti and Pratolo

(2009) which indicates that the financial condition does not affect the acceptance

of the audit opinion going concern. Nevertheless, the results of this research are

not in line with the research of Murtin and Anam (2008), which suggests that the

financial condition affects the acceptance of the audit opinion going concern.

Based on the results of the calculation of model Z-score Altman from the financial

condition that has been researched, that from 35 companies manufacturing various

industrial sectors with 90 sample data in this study the majority of the 64 sample

data received bankruptcy risk And as many as 26 safe sample data from

bankruptcy risk. This can be caused by the majority of the sample data at risk of

bankruptcy, while the majority of the sample data examined receives non-going

concern audit opinions, and the risks in the research year are decreasing.

Therefore, the financial condition does not affect the acceptance of the audit

opinion going concern.

Opinion shopping and going concern audit opinion

Based on the results of the hypothesis testing through a logistic regression

test, a significant degree of 0.004 < 0.05 H3 test results showed that the opinion

shopping was influential on the acceptance of the audit opinion going concern.

The results of this study following the research conducted by Harris and Merianto

(2015), which shows that the opinion shopping effect on the acceptance of the

audit opinion going concern. However, the results of this research are not in line

with research Rianto (2016) which shows that opinion shopping does not affect

the acceptance of the audit opinion going concern. Companies that do opinion

shopping will likely be able to get the opinion of the audit going concern

compared to companies that do not do opinion shopping. This can be due to the

* Corresponding author’s e-mail: wiwit.apit@gmail.com

http://openjournal.unpam.ac.id/index.php/JIA 81

Jurnal Ilmiah Akuntansi Universitas Pamulang - Vol. 8, No. 1, Januari 2020 -

Ramadhani & Sulistyowati

majority of the sample data does not do opinion shopping, and the majority of

corporate data receives non-going concern audit opinions. Therefore, companies

that do opinion shopping tend to get audit opinions going concern.

4. CONCLUSION

The results showed that the disclosure and financial condition did not

affect the audit opinion of going concern. This can be due to the majority of the

level of disclosure on companies that become samples decreased, while the

majority of companies gained an audit opinion going concern. Reviewed from the

financial condition, the majority of companies that become risky samples are

experiencing bankruptcy. While the opinion shopping affects the audit opinion is

going concern, because the majority of the sample data does not do opinion

shopping, and the majority of the sample data received an audit opinion non-going

concern.

The effect of opinion shopping on the audit opinions going concern gives

implications on the evaluation of agency relationships. In this case, the company

is managed by agents who do opinion shopping because there is potential

acceptance of the audit opinion going concern. Therefore, company managers

need to improve the management of resources, both financial and non-financial, to

keep business continuity.

Fit Model Test results show the contribution of all research variables by

16.8%, while the remaining 83.2% can be explained by other variables not tested

in this study. Therefore, recommendations for subsequent research are to analyze

from the company's characteristics, such as profitability and the debt level of the

company.

REFERENCES

Amin, K., Krishnan, J., & Yang, J. S. (2014). Going concern opinion and cost of

equity. Auditing: A Journal of Practice & Theory, 33(4), 1-39.

Blay, A. D., Geiger, M. A., & North, D. S. (2011). The auditor's going-concern

opinion as a communication of risk. Auditing: A Journal of Practice &

Theory, 30(2), 77-102.

Carson, E., Fargher, N. L., Geiger, M. A., Lennox, C. S., Raghunandan, K., &

Willekens, M. (2012). Audit reporting for going-concern uncertainty: A

research synthesis. Auditing: A Journal of Practice & Theory, 32(sp1),

353-384.

Chen, P. F., He, S., Ma, Z., & Stice, D. (2016). The information role of audit

opinions in debt contracting. Journal of Accounting and Economics,

61(1), 121–144. doi:10.1016/j.jacceco.2015.04.002

* Corresponding author’s e-mail: wiwit.apit@gmail.com

http://openjournal.unpam.ac.id/index.php/JIA 82

Jurnal Ilmiah Akuntansi Universitas Pamulang - Vol. 8, No. 1, Januari 2020 -

Ramadhani & Sulistyowati

Elmawati, D., & Yuyetta, E. N. A. (2014). Pengaruh Reputasi Kantor Akuntan

Publik (Kap), Audit Tenure, Dan Disclosure Terhadap Penerimaan

Opini Audit Going Concern (Doctoral dissertation, Fakultas Ekonomika

dan Bisnis).

Foster, B. P., & Shastri, T. (2016). Determinants of going concern opinions and

audit fees for development stage enterprises. Advances in

accounting, 33, 68-84.

George-Silviu, C., & Melinda-Timea, F. (2015). New Audit Reporting

Challenges: Auditing the Going Concern Basis of Accounting. Procedia

Economics and Finance, 32, 216–224. doi:10.1016/s2212-

5671(15)01385-4

Hapsoro, D., & Suryanto, T. (2017). Consequences of going concern opinion for

financial reports of business firms and capital markets with auditor

reputation as a moderation variable: an experimental study. European

Research Studies, 20(2), 197.

Haron, H., Hartadi, B., Ansari, M., & Ismail, I. (2009). Factors influencing

auditor’s going concern opinion. Asian Academy of Management

Journal, 14(1), 1-19.

Harris, R., & Meiranto, W. (2015). Pengaruh Debt Default, Disclosure, Opini

Audit Tahun Sebelumnya, Ukuran Perusahaan, dan Opinion Shopping

terhadap Penerimaan Opini Audit Going Concern. Diponegoro Journal

of Accounting, 4(4), 298-308.

Indonesia, I. A. (2009). Standar akuntansi keuangan.

Jamaluddin, M. (2018). The Effect Of Financial Distress And Disclosure On

Going Concern Opinion Of The Banking Company Listing In

Indonesian Stock Exchange. International Journal of Scientific

Research and Management, 6(01).

Mayew, W. J., Sethuraman, M., & Venkatachalam, M. (2014). MD&A Disclosure

and the Firm's Ability to Continue as a Going Concern. The Accounting

Review, 90(4), 1621-1651.

Murtin, A., & Anam, C. (2008). Pengaruh Kualitas Audit, Debt Default Dan

Kondisi Keuangan Perusahaan Terhadap Penerimaan Opini Going

Concern. Journal of Accounting and Investment, 9(2), 197-207.

Newton, N. J., Persellin, J. S., Wang, D., & Wilkins, M. S. (2015). Internal

control opinion shopping and audit market competition. The Accounting

Review, 91(2), 603-623.

O'Reilly, D. M. (2010). Do investors perceive the going‐concern opinion as useful

for pricing stocks?. Managerial Auditing Journal.

Rianto, K., Hasan, A., & Al Azhar, A. (2016). Pengaruh Kualitas Auditor, Debt

Default, Opinion Shopping, Opini Audit Tahun Sebelumnya Dan

Reputasi Kap Terhadap Penerimaan Opini Audit Going Concern (Studi

* Corresponding author’s e-mail: wiwit.apit@gmail.com

http://openjournal.unpam.ac.id/index.php/JIA 83

Jurnal Ilmiah Akuntansi Universitas Pamulang - Vol. 8, No. 1, Januari 2020 -

Ramadhani & Sulistyowati

Empiris Pada Perusahaan Manufaktur Di BEI). Jurnal Online

Mahasiswa Fakultas Ekonomi Universitas Riau, 3(1), 264-278.

Rosnidah, I., Sulistyowati, W. A., & Yulianto, A. (2017). The Effects of Ethical

Orientation and Moral Intensity on the Ethical Decision of an

Auditor. Devotio: Journal of Business and Economic Studies, 11(1), 55-

70.

Rosnidah, I., Sulistyowati, W. A., & Yulianto, A. (2018). DILEMA ETIS PADA

CALON AUDITOR: SEBUAH EKSPERIMEN. Jurnal Akuntansi

Indonesia, 7(2), 35-48.

Salleh, K., & Jasmani, H. (2014). Audit Rotation and Audit Report: Empirical

Evidence from Malaysian PLCs over the Period of Ten Years. Procedia

- Social and Behavioral Sciences, 145, 40–

50. doi:10.1016/j.sbspro.2014.06.009

Sundgren, S., & Svanström, T. (2014). Auditor‐in‐charge characteristics and

going‐concern reporting. Contemporary Accounting Research, 31(2),

531-550

* Corresponding author’s e-mail: wiwit.apit@gmail.com

http://openjournal.unpam.ac.id/index.php/JIA 84

You might also like

- Unit 1 IMC Study TextDocument336 pagesUnit 1 IMC Study TextChirag Sinai100% (4)

- 1256-Article Text-2169-1-10-20180126 PDFDocument7 pages1256-Article Text-2169-1-10-20180126 PDFAndiarfanNo ratings yet

- Influence of Profitability Solvability and CompanyDocument9 pagesInfluence of Profitability Solvability and CompanyAhlamNo ratings yet

- 68-Article Text-119-1-10-20180217 PDFDocument10 pages68-Article Text-119-1-10-20180217 PDFAndiarfanNo ratings yet

- 070 CG 37Document25 pages070 CG 37Gea Cherlita PutradyNo ratings yet

- 10 1108 - Ajar 09 2020 0078Document13 pages10 1108 - Ajar 09 2020 0078Melvin ZhenNo ratings yet

- Article 10 Effect of Debt Default PDFDocument12 pagesArticle 10 Effect of Debt Default PDFBara HakikiNo ratings yet

- Pengaruh Profit Likuid Solva Terhdap Opini GC Persh ManufakturDocument10 pagesPengaruh Profit Likuid Solva Terhdap Opini GC Persh ManufakturHanny FadhillahNo ratings yet

- 121-Article Text-182-2-10-20191016Document10 pages121-Article Text-182-2-10-20191016shahfira yassmienNo ratings yet

- The Effects of Audit LagDocument16 pagesThe Effects of Audit LagAfrizar PaneNo ratings yet

- Pengaruh Profitabilitas, Likuiditas Dan Ukuran Perusahaan Sebagai Variabel ModerasiDocument19 pagesPengaruh Profitabilitas, Likuiditas Dan Ukuran Perusahaan Sebagai Variabel ModerasiRifadoni SyahrainNo ratings yet

- International Journal of Environmental, Sustainability, and Social Sciences ISSN 2720-9644 (Print) ISSN 2721-0871 (Online)Document5 pagesInternational Journal of Environmental, Sustainability, and Social Sciences ISSN 2720-9644 (Print) ISSN 2721-0871 (Online)aditeguhNo ratings yet

- Factors Affecting Going Concern Audit Opinions: Sarah Fitriani Istiqomah Prijanto PutriDocument9 pagesFactors Affecting Going Concern Audit Opinions: Sarah Fitriani Istiqomah Prijanto PutriaijbmNo ratings yet

- Pengaruh Prediksi Kebangkrutan Model Altman Z-Score, Reputasi Auditor Dan Opinion Shopping Terhadap Opini Audit Going ConcernDocument13 pagesPengaruh Prediksi Kebangkrutan Model Altman Z-Score, Reputasi Auditor Dan Opinion Shopping Terhadap Opini Audit Going ConcernFaradillaNo ratings yet

- Audit Report LagDocument11 pagesAudit Report LagEny AstutiNo ratings yet

- 6093 17799 1 PBDocument13 pages6093 17799 1 PBkiyutNo ratings yet

- 2145-Article Text-6578-1-10-20210331Document15 pages2145-Article Text-6578-1-10-20210331MujahidinNo ratings yet

- The Influence of Solvability, Profitability, and Prior Audit Opinion On Going Concern Audit OpinionDocument6 pagesThe Influence of Solvability, Profitability, and Prior Audit Opinion On Going Concern Audit OpinionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Artike Kedua STIEDocument11 pagesArtike Kedua STIEdarmiati indahNo ratings yet

- ARM AssignmentDocument39 pagesARM AssignmentdemolaojaomoNo ratings yet

- 348-Article Text-1570-1-10-20210202Document10 pages348-Article Text-1570-1-10-20210202Ainin NikmahNo ratings yet

- Going ConcernDocument13 pagesGoing ConcernAyak PietraNo ratings yet

- Ijsar 6048 PDFDocument10 pagesIjsar 6048 PDFInsyiraah Oxaichiko ArissintaNo ratings yet

- Jurnal Dirvi Surya Abbas 2Document18 pagesJurnal Dirvi Surya Abbas 2VictorOtonekwuNo ratings yet

- Pengaruh Kualitas Auditor Dan Audit Tenure Terhadap Opini Audit Going Concern Serta Implikasinya Terhadap Nilai PerusahaanDocument11 pagesPengaruh Kualitas Auditor Dan Audit Tenure Terhadap Opini Audit Going Concern Serta Implikasinya Terhadap Nilai PerusahaanyohanaNo ratings yet

- Presented By: S. M. Talib (6426) Presented To: Arsalan HashmiDocument14 pagesPresented By: S. M. Talib (6426) Presented To: Arsalan HashmiSyed Muhammad TalibNo ratings yet

- The Determinants of Going Concern Audit Opinion An Empirical Study On Non Bank Financial Institutions 2017Document20 pagesThe Determinants of Going Concern Audit Opinion An Empirical Study On Non Bank Financial Institutions 2017Bangsawan DuniaNo ratings yet

- Machmuddah, Iriani, St. Utomo - 2020 - Influencing Factors of Audit Report Lag Evidence From Indonesia-AnnotatedDocument9 pagesMachmuddah, Iriani, St. Utomo - 2020 - Influencing Factors of Audit Report Lag Evidence From Indonesia-Annotatedahmad lutfieNo ratings yet

- Peer Reviewed - International Journal Vol-2, Issue-3, 2018 (IJEBAR)Document16 pagesPeer Reviewed - International Journal Vol-2, Issue-3, 2018 (IJEBAR)Silvia LestariNo ratings yet

- Jurnal AkuntansiDocument13 pagesJurnal AkuntansiZAHRAH IBNU SALIM -No ratings yet

- Factors Affecting The Audit Delay and Its Impact o PDFDocument9 pagesFactors Affecting The Audit Delay and Its Impact o PDFFistaNo ratings yet

- Faktor Yg Mempengaruhi Opini Audit GCDocument10 pagesFaktor Yg Mempengaruhi Opini Audit GCHanny FadhillahNo ratings yet

- SIPE-6687 - CamerafullpaperDocument17 pagesSIPE-6687 - CamerafullpaperliaapriniNo ratings yet

- 309-Article Text-1894-6-10-20220429Document10 pages309-Article Text-1894-6-10-20220429Bryan GPNo ratings yet

- 4 FB 5Document12 pages4 FB 5Rusli RusliNo ratings yet

- The Effects of Profitability, Leverage, and Liquidity On Financial Distress On Retail Companies Listed On Indonesian Stock ExchangeDocument8 pagesThe Effects of Profitability, Leverage, and Liquidity On Financial Distress On Retail Companies Listed On Indonesian Stock ExchangeThảo Trần Thị ThuNo ratings yet

- Engaruh Rasio Keuangan Terhadap Penerimaan Opini Audit Going Concern Tahun (2016-2018)Document9 pagesEngaruh Rasio Keuangan Terhadap Penerimaan Opini Audit Going Concern Tahun (2016-2018)Rifky ApriandiNo ratings yet

- Implementation of Regression Logistics For Audit SwitchingDocument21 pagesImplementation of Regression Logistics For Audit SwitchingAnnisa FithriNo ratings yet

- The Effect of Financial Distress, Company Growth Rate and Company Complexity On Auditor Switching in Manufacturing CompaniesDocument7 pagesThe Effect of Financial Distress, Company Growth Rate and Company Complexity On Auditor Switching in Manufacturing CompaniesAJHSSR JournalNo ratings yet

- 2023 - Aisyah-Firman-Pratiwi - The Effect of Audit Quality and Capital Intensity Ratio On Earning Management in Sharia Listed CompaniesDocument22 pages2023 - Aisyah-Firman-Pratiwi - The Effect of Audit Quality and Capital Intensity Ratio On Earning Management in Sharia Listed CompaniesasmeldiNo ratings yet

- Harke Jurnal PPAkDocument11 pagesHarke Jurnal PPAkHarke Revo Leonard PoliiNo ratings yet

- CAN AUDIT QUALITY PREDICT EARNINGS PERSISTENCEAsian Academy of Management JournalDocument23 pagesCAN AUDIT QUALITY PREDICT EARNINGS PERSISTENCEAsian Academy of Management JournalAgung Giantino ManfaNo ratings yet

- Jurnal Iman Dan Usman PDFDocument20 pagesJurnal Iman Dan Usman PDFCintya AnggunNo ratings yet

- Point of View Research Accounting and Auditing: Muhammad Su'un Hajering Hajering Dewi SartikaDocument7 pagesPoint of View Research Accounting and Auditing: Muhammad Su'un Hajering Hajering Dewi SartikaSilvia LestariNo ratings yet

- Factors Affecting Audit Firms Rotation Jordanian CaseDocument20 pagesFactors Affecting Audit Firms Rotation Jordanian CaseSarah FawazNo ratings yet

- Impact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysisDocument8 pagesImpact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysissaefulNo ratings yet

- Jurnal 7Document14 pagesJurnal 7lalu wira juniartaNo ratings yet

- 179-Article Text-1014-1-10-20210725Document15 pages179-Article Text-1014-1-10-20210725Eka TriwulandariNo ratings yet

- Audit Quality and Accounting Going Concern Evidence From Listed Non-Financial Firms in NigeriaDocument10 pagesAudit Quality and Accounting Going Concern Evidence From Listed Non-Financial Firms in NigeriaIdorenyin OkonNo ratings yet

- Agency Theory - 84391Document9 pagesAgency Theory - 8439101022682327001No ratings yet

- Rida Prihatni & Diena Noviarini: State University of Jakarta, Accounting Major, Faculty of Economics, IndonesiaDocument8 pagesRida Prihatni & Diena Noviarini: State University of Jakarta, Accounting Major, Faculty of Economics, IndonesiaTJPRC PublicationsNo ratings yet

- Measuring Financial Health of A Public Limited Company Using Z' Score Model - A Case StudyDocument18 pagesMeasuring Financial Health of A Public Limited Company Using Z' Score Model - A Case Studytrinanjan bhowalNo ratings yet

- 10.7176@RJFA@10 22 07Publicationdate@November30th2019Document10 pages10.7176@RJFA@10 22 07Publicationdate@November30th2019Salsabil Shafa 350No ratings yet

- Shopping Terhadap Penerimaan Opini Audit Going ConcernDocument11 pagesShopping Terhadap Penerimaan Opini Audit Going ConcernFirda RahmayantiNo ratings yet

- Pengaruh Karakteristik Komite Audit Terhadap Profitabilitas: Bukti Data PanelDocument12 pagesPengaruh Karakteristik Komite Audit Terhadap Profitabilitas: Bukti Data PanelFikri HanifNo ratings yet

- Analysis of The Influence of Company Size On The Timeliness of Financial Reporting by Mediating Profitability and Leverage in Companies Listed On The Indonesian Stock ExchangeDocument7 pagesAnalysis of The Influence of Company Size On The Timeliness of Financial Reporting by Mediating Profitability and Leverage in Companies Listed On The Indonesian Stock ExchangeInternational Journal of Business Marketing and ManagementNo ratings yet

- 4566 7034 1 PBDocument14 pages4566 7034 1 PBsecretadmirer 26No ratings yet

- Denny Novi Satria, Syahril Ali, Denny Yohana: Faculty of Economics Andalas University Padang, West Sumatera, IndonesiaDocument8 pagesDenny Novi Satria, Syahril Ali, Denny Yohana: Faculty of Economics Andalas University Padang, West Sumatera, IndonesiaKarina AprilliaNo ratings yet

- The Effect of Audit Quality On Firm Performance: A Panel Data ApproachDocument16 pagesThe Effect of Audit Quality On Firm Performance: A Panel Data ApproachFaraz Khoso BalochNo ratings yet

- Pengaruh Profitabilitas, Likuiditas, Ukuran Perusahaan Dan Pertumbuhan Perusahaan Terhadap Opini Audit Going ConcernDocument10 pagesPengaruh Profitabilitas, Likuiditas, Ukuran Perusahaan Dan Pertumbuhan Perusahaan Terhadap Opini Audit Going ConcernPraharsini MadasNo ratings yet

- Audittt BaikDocument11 pagesAudittt BaikichwanNo ratings yet

- Literature Review of Audit OpinionDocument9 pagesLiterature Review of Audit OpinionichwanNo ratings yet

- Accounting Analysis Journal: Fatihatur Rahma AndsukirmanDocument8 pagesAccounting Analysis Journal: Fatihatur Rahma AndsukirmanichwanNo ratings yet

- Accuracy of Audit Opinion: Factors That Influence It: Www/http/jurnal - Unsyiah.ac - id/JAROEDocument14 pagesAccuracy of Audit Opinion: Factors That Influence It: Www/http/jurnal - Unsyiah.ac - id/JAROEichwanNo ratings yet

- t1 - Introduction of School Financial ManagementDocument15 pagest1 - Introduction of School Financial ManagementSARIPAH BINTI ABDUL HAMID MoeNo ratings yet

- Money and Banking: Unit IIIDocument69 pagesMoney and Banking: Unit IIIBharti SutharNo ratings yet

- Abul Hasan Miah: Career ObjectiveDocument5 pagesAbul Hasan Miah: Career ObjectiveAbul Hasan MiahNo ratings yet

- Risk As Financial IntermediationDocument20 pagesRisk As Financial Intermediationkaytokyid1412No ratings yet

- What Are The Risks Associated With Hedging Foreign Currency Risk and Interest Rate Risk?Document2 pagesWhat Are The Risks Associated With Hedging Foreign Currency Risk and Interest Rate Risk?InsanNo ratings yet

- Rbi Act 1934Document50 pagesRbi Act 1934manisha sonawaneNo ratings yet

- Practical Problems: Lustration 1 After 8Document4 pagesPractical Problems: Lustration 1 After 8Kiran Kumar KBNo ratings yet

- Genral Project (Genaral Insurance and Its Impoact in IndiaDocument84 pagesGenral Project (Genaral Insurance and Its Impoact in Indiapooja pawarNo ratings yet

- NEQAS Enrollment Form V7.0 PDFDocument2 pagesNEQAS Enrollment Form V7.0 PDFMyline CampoamorNo ratings yet

- Asia Pacific Licensure ExaminationDocument12 pagesAsia Pacific Licensure ExaminationTGiF TravelNo ratings yet

- SAP FICO Tcode - 2Document2 pagesSAP FICO Tcode - 2Ati Siti FathiahNo ratings yet

- Marjorie Knaus An Architect Organized Knaus Architects On January 1Document2 pagesMarjorie Knaus An Architect Organized Knaus Architects On January 1Amit PandeyNo ratings yet

- Chapter 2Document19 pagesChapter 2Juan Oliver Onde100% (1)

- Saraswat Bank (4908)Document27 pagesSaraswat Bank (4908)manya009pNo ratings yet

- Project Report On TATA MOTORS 1Document32 pagesProject Report On TATA MOTORS 1kartikNo ratings yet

- Retirement Module IDocument16 pagesRetirement Module IJ.SreenivasanNo ratings yet

- Crystal Report Viewer 1Document2 pagesCrystal Report Viewer 1David Lemayian SalatonNo ratings yet

- W6 Lesson 5 Transaction Cycle, Business Processes and Its Associated Controls - Part II - ModuleDocument13 pagesW6 Lesson 5 Transaction Cycle, Business Processes and Its Associated Controls - Part II - ModuleBellaNo ratings yet

- CAlAMBA AND SANTIAGO - TUGOTDocument2 pagesCAlAMBA AND SANTIAGO - TUGOTAndrea Tugot100% (1)

- Vdocuments - MX - The Following Data Pertain To Lincoln Corporation On December 31Document8 pagesVdocuments - MX - The Following Data Pertain To Lincoln Corporation On December 31Kerby Gail Rulona100% (1)

- Invoice: PI#: SEOUT024576Document1 pageInvoice: PI#: SEOUT024576RuodNo ratings yet

- AS 19 Leases: Bright LightsDocument7 pagesAS 19 Leases: Bright LightsRamNo ratings yet

- Wealth Management Assignment 8: 1. What Are Mutual Funds?Document2 pagesWealth Management Assignment 8: 1. What Are Mutual Funds?Darshan ShahNo ratings yet

- Arens AAS17 SM 22Document17 pagesArens AAS17 SM 22Nurul FarzanaNo ratings yet

- Account Statement 13-2-24Document2 pagesAccount Statement 13-2-24Anuj SinghNo ratings yet

- Banking System in CambodiaDocument41 pagesBanking System in CambodiaYuthea Em100% (3)

- Annex "B"-Barangay Inventory and Turnover Form No. 1 Initial Inventory of BPFRDsDocument1 pageAnnex "B"-Barangay Inventory and Turnover Form No. 1 Initial Inventory of BPFRDsCyrus John Velarde100% (1)

- Repayment Schedule PDFDocument3 pagesRepayment Schedule PDFsan_sam3No ratings yet

- Debit Card Service ChargesDocument3 pagesDebit Card Service ChargesVinodkumar ShethNo ratings yet