Professional Documents

Culture Documents

Master Budget Project

Master Budget Project

Uploaded by

api-302651176Copyright:

Available Formats

You might also like

- Medical Office Procedures 10Th Edition Nenna L Bayes Full ChapterDocument67 pagesMedical Office Procedures 10Th Edition Nenna L Bayes Full Chapteralbert.davis797100% (6)

- Unit Tests. Poziom Podstawowy: KluczDocument9 pagesUnit Tests. Poziom Podstawowy: KluczIza WłochNo ratings yet

- Medical Terms in MandarinDocument17 pagesMedical Terms in MandarinmrhoNo ratings yet

- Drawing Conclusions Lesson PlanDocument3 pagesDrawing Conclusions Lesson Planapi-385115220No ratings yet

- Hostel Allocation System C++ ProjectDocument18 pagesHostel Allocation System C++ ProjectSuruchi Jha100% (1)

- Chapter 9 HomeworkDocument2 pagesChapter 9 Homeworkapi-311464761No ratings yet

- Ivan Madrigals Comprehensive Master Budget Project Version ADocument5 pagesIvan Madrigals Comprehensive Master Budget Project Version Aapi-315768301No ratings yet

- Aruba 5400R Switch Series Technical Product GuideDocument25 pagesAruba 5400R Switch Series Technical Product GuideWK OngNo ratings yet

- Tanner McqueenDocument4 pagesTanner Mcqueenapi-242859321No ratings yet

- Masterbudget Acct2020Document4 pagesMasterbudget Acct2020api-249190933No ratings yet

- Excel Budget ProjectDocument7 pagesExcel Budget Projectapi-341205347No ratings yet

- Acct 2020 Excel Budget Problem Student Template 1Document5 pagesAcct 2020 Excel Budget Problem Student Template 1api-316764247No ratings yet

- Excel Budget ProblemDocument5 pagesExcel Budget Problemapi-313254091No ratings yet

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-356769323No ratings yet

- Managerial Accounting Final ProjectDocument5 pagesManagerial Accounting Final Projectapi-382641983No ratings yet

- Acct 2020 EportfolioDocument5 pagesAcct 2020 Eportfolioapi-311375616No ratings yet

- Ponderosa-IncDocument6 pagesPonderosa-IncpompomNo ratings yet

- Budget Assignment Norma GDocument5 pagesBudget Assignment Norma Gapi-242614310No ratings yet

- Acct 2020 Excel Budget ProblemDocument6 pagesAcct 2020 Excel Budget Problemapi-307661249No ratings yet

- Comprehensive BudgetDocument5 pagesComprehensive Budgetapi-317125310No ratings yet

- Sales Budget Jan Feb Mar April May TotalDocument2 pagesSales Budget Jan Feb Mar April May Totalwhat everNo ratings yet

- ASYNCHRONOUS ACTIVITY 4 WorksheetsDocument12 pagesASYNCHRONOUS ACTIVITY 4 WorksheetsAbejero Trisha Nicole A.No ratings yet

- Excel Budget ProjectDocument6 pagesExcel Budget Projectapi-314303195No ratings yet

- Acct 2020 Excel Master BudgetDocument6 pagesAcct 2020 Excel Master Budgetapi-302665852No ratings yet

- Key To Corrections - LEVEL 2 MODULE 7Document9 pagesKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNo ratings yet

- Sales Budget Q1 Q2 Q3 Q4 Year 2021Document9 pagesSales Budget Q1 Q2 Q3 Q4 Year 2021Judith DurensNo ratings yet

- Answer 4Document7 pagesAnswer 4Sinclair faith galarioNo ratings yet

- Presidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument28 pagesPresidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualMarc Jim Gregorio100% (1)

- Sales BudgetDocument12 pagesSales BudgetMai YếnNo ratings yet

- Bigbud 4th Ed Womack BaileyDocument26 pagesBigbud 4th Ed Womack Baileyapi-356759536No ratings yet

- Sales Budget: Q1 Q2 Q3 Q4 YearDocument23 pagesSales Budget: Q1 Q2 Q3 Q4 YearMuhamad Izuan RamliNo ratings yet

- Departmental Accounts PDFDocument7 pagesDepartmental Accounts PDFMwajuma mohamediNo ratings yet

- Exercise 1: Schedule of Expected Cash CollectionDocument7 pagesExercise 1: Schedule of Expected Cash CollectionLenard Josh IngallaNo ratings yet

- Exhibit 1 Salem Data Services Summary of Computer: Source: CasewriterDocument5 pagesExhibit 1 Salem Data Services Summary of Computer: Source: CasewriterJagvir Singh Jaglan ms21a025No ratings yet

- WOODDocument12 pagesWOODJayson ReyesNo ratings yet

- Business Name Patatasty Currency Symbol P Year End Month December Reporting Year 2020 Year End Reporting Date 29 February 2020Document35 pagesBusiness Name Patatasty Currency Symbol P Year End Month December Reporting Year 2020 Year End Reporting Date 29 February 2020Raschelle MayugbaNo ratings yet

- Tut Mene AccDocument7 pagesTut Mene Accnatasya angelNo ratings yet

- BigbudhunterkaarlsenDocument25 pagesBigbudhunterkaarlsenapi-356428418No ratings yet

- 08 Task PerformanceDocument3 pages08 Task PerformanceBetchang AquinoNo ratings yet

- Chapter 4 ExercisesDocument23 pagesChapter 4 ExercisesLiza Mae MirandaNo ratings yet

- P23-1A 1. Sale Budget Quarter 1 2 TotalDocument7 pagesP23-1A 1. Sale Budget Quarter 1 2 TotalVõ Huỳnh BăngNo ratings yet

- Problems: Set A: SolutionDocument8 pagesProblems: Set A: Solutionapi-395519937No ratings yet

- FM - Master BudgetDocument5 pagesFM - Master BudgetChristine Angeli AritaNo ratings yet

- Cost Accounting Week 3 - AnswersDocument10 pagesCost Accounting Week 3 - AnswersFiles OrganizedNo ratings yet

- Ahmad 134 AccountingDocument3 pagesAhmad 134 AccountingAhMad ButtNo ratings yet

- Jjcute Functional Budget SolutionDocument4 pagesJjcute Functional Budget Solutionjanjan3256No ratings yet

- 02 - Task - Performance - 2 - To Give To Students 10.10.22Document3 pages02 - Task - Performance - 2 - To Give To Students 10.10.22Justine OrdonioNo ratings yet

- Activity No. 4 - Attach Your Activity With The Filename SURNAME - SECTION - ACT#4Document3 pagesActivity No. 4 - Attach Your Activity With The Filename SURNAME - SECTION - ACT#4-st3v3craft-No ratings yet

- Cost & Management Accounting Question PaperDocument8 pagesCost & Management Accounting Question Paperpradhiba meenakshisundaramNo ratings yet

- P9-57a 5th Ed Blank Worksheet OnlyDocument7 pagesP9-57a 5th Ed Blank Worksheet Onlyapi-2483356370% (1)

- SolutionDocument8 pagesSolutionSajakul SornNo ratings yet

- Tutorial #3 - Group 5 - PA1 - MarkedDocument8 pagesTutorial #3 - Group 5 - PA1 - MarkedThanh NguyenNo ratings yet

- Fixed Assets Amount Depreciation (Years) Notes: You Are Fully Funded (Balanced)Document4 pagesFixed Assets Amount Depreciation (Years) Notes: You Are Fully Funded (Balanced)Paulo TorresNo ratings yet

- Numbers Sheet Name Numbers Table NameDocument8 pagesNumbers Sheet Name Numbers Table NameAhmed MahmoudNo ratings yet

- Problem Lecture - MANUFACTURING 2 With ANSWERSDocument4 pagesProblem Lecture - MANUFACTURING 2 With ANSWERSNia BranzuelaNo ratings yet

- Cameron Fisher Excel Budget ProjectDocument2 pagesCameron Fisher Excel Budget Projectapi-340519862No ratings yet

- 4 5845855793034823827Document4 pages4 5845855793034823827Gena HamdaNo ratings yet

- Chapter - 1 Cost Sheet - Problems - & - Solution - 3-9Document12 pagesChapter - 1 Cost Sheet - Problems - & - Solution - 3-9Legends CreationNo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Financial Plan OkDocument7 pagesFinancial Plan OkSYED ARSALANNo ratings yet

- Test 1 & Test 2 - MADocument8 pagesTest 1 & Test 2 - MAChi Nguyễn Thị KimNo ratings yet

- Depreciation Expense For First Year ofDocument6 pagesDepreciation Expense For First Year ofDanara Ann MeanaNo ratings yet

- Midterm Review QuestionsDocument6 pagesMidterm Review QuestionsnamiyuartsNo ratings yet

- Budgeting ProblemDocument8 pagesBudgeting ProblemMihrima MishuNo ratings yet

- Acctg 202Document9 pagesAcctg 202Lore Desa CenizaNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Ipmv NotesDocument125 pagesIpmv Notessniper x4848 PillaiNo ratings yet

- The EarthDocument12 pagesThe EarthKather ShaNo ratings yet

- By: Saurabh S SawhneyDocument28 pagesBy: Saurabh S SawhneyMaria100% (1)

- Pharmacognosy 2 2021 Solution For Most Important QuestionsDocument21 pagesPharmacognosy 2 2021 Solution For Most Important Questionspapov95193No ratings yet

- Baydoun Willett (2000) Islamic Corporate Reports PDFDocument20 pagesBaydoun Willett (2000) Islamic Corporate Reports PDFAqilahAzmiNo ratings yet

- Microsoft Age of Empires III Trial Readme File: September 2005Document4 pagesMicrosoft Age of Empires III Trial Readme File: September 2005Yoga RajNo ratings yet

- Guia de Estudio Aguilar Romero Claudia Angelica 109Document3 pagesGuia de Estudio Aguilar Romero Claudia Angelica 109claudia aguilarNo ratings yet

- TSQL Coding Standards ChecklistDocument5 pagesTSQL Coding Standards ChecklistSaman AzeemNo ratings yet

- UTS ENGLISH - 112011192 - Netta Delyana PutriDocument2 pagesUTS ENGLISH - 112011192 - Netta Delyana Putrinetta delyana putriNo ratings yet

- SupaulDocument11 pagesSupaulImran ShiekhNo ratings yet

- A Major Project Report ON: HR Policies and Their Implementation in Cheema Spintex LTDDocument64 pagesA Major Project Report ON: HR Policies and Their Implementation in Cheema Spintex LTDsuchitraNo ratings yet

- Group 3Document11 pagesGroup 3Sharp MIER TVNo ratings yet

- Dell 2000 StorageDocument115 pagesDell 2000 Storagests100No ratings yet

- KCET 2020 Chemistry Paper Questions and SolutionsDocument33 pagesKCET 2020 Chemistry Paper Questions and SolutionsSaroja RajuNo ratings yet

- Study Plan EPE FinalDocument1 pageStudy Plan EPE FinalRamini AshwinNo ratings yet

- An Analysis of The FIBA Governing Council in The Czech RepublicDocument17 pagesAn Analysis of The FIBA Governing Council in The Czech RepublicAbbie AyorindeNo ratings yet

- Full Metal Plate Mail 1.7Document100 pagesFull Metal Plate Mail 1.7Ezra Agnew100% (1)

- CONFIRMALDocument50 pagesCONFIRMALSri SaiNo ratings yet

- Datasheet (Signal Booster)Document4 pagesDatasheet (Signal Booster)Shrisha BhatNo ratings yet

- Final Seats Matrix Ss Counelling - 2022 D.M M.CHDocument55 pagesFinal Seats Matrix Ss Counelling - 2022 D.M M.CHMinerva Medical Treatment Pvt LtdNo ratings yet

- Sustainable Incorporation of Lime-Bentonite Clay Composite For Production of Ecofriendly BricksDocument21 pagesSustainable Incorporation of Lime-Bentonite Clay Composite For Production of Ecofriendly BricksWaqas HaroonNo ratings yet

- IJSARTV6I738053Document3 pagesIJSARTV6I738053VISHAL BHOJWANINo ratings yet

- San Miguel CorporationDocument8 pagesSan Miguel CorporationLeah BautistaNo ratings yet

- Dioscorea Bulbifera: L. DioscoreaceaeDocument6 pagesDioscorea Bulbifera: L. DioscoreaceaeAlarm GuardiansNo ratings yet

Master Budget Project

Master Budget Project

Uploaded by

api-302651176Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Master Budget Project

Master Budget Project

Uploaded by

api-302651176Copyright:

Available Formats

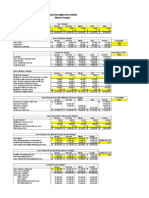

WASATCH MANUFACTURING

Master Budget

NOTE: Cells highlighted in blue contain static numbers (inputs) and not formulas.

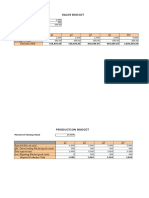

Sales Budget

December January February March April May

Unit sales 7,000 8,000 9,000 8,600 9,400 6,800

Unit selling price $15 $15 $15 $15 $15 $15

Total sales Revenue $105,000 $120,000 $135,000 $129,000 $141,000 $102,000

Req. 1

Cash Collections Budget

January February March Quarter

Cash sales $36,000 $40,500 $38,700 $115,200

Credit sales $73,500 $84,000 $94,500 $252,000

Total collections $109,500 $124,500 $133,200 $367,200

Req. 2

Production Budget

January February March Quarter

Unit sales 8,000 9,000 8,600 25,600

Plus: Desired ending inventory 1,800 1,720 1,880 1,880

Total needed 9,800 10,720 10,480 27,480

Less: Beginning inventory 1,600 1,800 1,720 1,600

Units to produce 8,200 8,920 8,760 25,880

Req. 3

Direct Materials Budget

January February March Quarter

Units to be produced 8,200 8,920 8,760 25,880

Multiply by: Quantity of DM needed per unit 4 4 4 4

Quantity of DM needed for production 32,800 35,680 35,040 103,520

Plus: Desired ending inventory of DM 5,352 5,256 7,104 7,104

Total quantity of DM needed 38,152 40,936 42,144 110,624

Less: Beginning inventory of DM 4,920 5,352 5,256 4,920

Quantity of DM to purchase 33,232 35,584 36,888 105,704

Multiply by: Cost per pound $1 $1 $1 $1

Total cost of DM purchases $33,232 $35,584 $36,888 $105,704

April May

Unit Sales 9,400 6,800

Plus: Desired End Inventory 1,360

Total Needed 10,760

Less: Beginning Inventory 1,880

Units to produce 8,880

DM needed per unit 4

Quantity of DM needed for production $35,520

Req. 4

Cash Payments for Direct Material Purchases Budget

January February March Quarter

December purchases (From AP) $37,000 $37,000

January purchases $8,308 $24,924 $33,232

February purchases $8,896 $26,688 $35,584

March purchases $9,222 $9,222

Total disbursements $45,308 $33,820 $35,910 $115,038

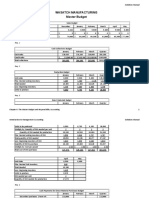

Req. 5

Cash Payments for Direct Labor Costs

January February March Quarter

Units Produced 8,200 8,920 8,760 25,880

Multiply by: Hours per unit 0.10 0.10 0.10 0.10

Direct Labor Hours 820 892 876 2,588

Multiply by: Direct Labor rate per hour $15 $15 $15 $15

Direct Labor Cost $12,300 $13,380 $13,140 $38,820

Req. 6

Cash Payments for Manufacturing Overhead Budget

January February March Quarter

Rent (fixed) $10,000 $10,000 $10,000 $30,000

Other MOH (fixed) $6,000 $6,000 $6,000 $18,000

Variable manufacturing overhead $10,250 $11,150 $10,950 $32,350

Total disbursements $26,250 $27,150 $26,950 $80,350

Req. 7

Cash Payments for Operating Expenses Budget

January February March Quarter

Variable operating expenses $10,400 $11,700 $11,180 $33,280

Fixed operating expenses $2,200 $2,200 $2,200 $6,600

Total disbursements $12,600 $13,900 $13,380 $39,880

Req. 8

Combined Cash Budget

January February March Quarter

Cash balance, beginning $17,000 $15,042 $15,292 $17,000

Plus: cash collections (req. 1) $109,500 $124,500 $133,200 $367,200

Total cash available $126,500 $139,542 $148,492 $384,200

Less cash payments:

DM purchases (req. 4) $45,308 $33,820 $35,910 $115,038

Direct labor (req. 5) $12,300 $13,380 $13,140 $38,820

MOH costs (req 6) $26,250 $27,150 $26,950 $80,350

Operating expenses (req 7) $12,600 $13,900 $13,380 $39,880

Tax payment $28,000 $28,000

Equipment purchases $20,000 $8,000 $25,000 $53,000

Total cash payments $116,458 $124,250 $114,380 $355,088

Ending cash before financing $10,042 $15,292 $34,112 $29,112

Financing:

Borrowings $5,000 $5,000

Repayments -$5,000 -$5,000

Interest -$188 -$188

Total financing $5,000 $0 -$5,188 -$188

Cash balance, ending $15,042 $15,292 $28,925 $28,925

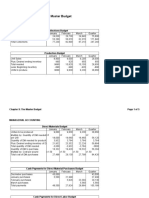

Req. 9

Budgeted Manufacturing Cost per Unit

Direct materials cost per unit $4.00

Direct labor cost per unit $1.50

Variable MOH cost per unit (given data) $1.25

Fixed MOH per unit (given data) $0.75

Cost of manufacturing each unit $7.50

Req. 10

Wasatch Manufacturing

Budgeted Income Statement

For the Quarter Ended March 31

Sales $384,000

Cost of goods sold $192,000

Gross profit $192,000

Operating expenses $39,880

Depreciation expense (given data) $10,000

Operating income $142,120

Less: interest expense $188

Less: provision for income tax $32,731

Net income $109,577

You might also like

- Medical Office Procedures 10Th Edition Nenna L Bayes Full ChapterDocument67 pagesMedical Office Procedures 10Th Edition Nenna L Bayes Full Chapteralbert.davis797100% (6)

- Unit Tests. Poziom Podstawowy: KluczDocument9 pagesUnit Tests. Poziom Podstawowy: KluczIza WłochNo ratings yet

- Medical Terms in MandarinDocument17 pagesMedical Terms in MandarinmrhoNo ratings yet

- Drawing Conclusions Lesson PlanDocument3 pagesDrawing Conclusions Lesson Planapi-385115220No ratings yet

- Hostel Allocation System C++ ProjectDocument18 pagesHostel Allocation System C++ ProjectSuruchi Jha100% (1)

- Chapter 9 HomeworkDocument2 pagesChapter 9 Homeworkapi-311464761No ratings yet

- Ivan Madrigals Comprehensive Master Budget Project Version ADocument5 pagesIvan Madrigals Comprehensive Master Budget Project Version Aapi-315768301No ratings yet

- Aruba 5400R Switch Series Technical Product GuideDocument25 pagesAruba 5400R Switch Series Technical Product GuideWK OngNo ratings yet

- Tanner McqueenDocument4 pagesTanner Mcqueenapi-242859321No ratings yet

- Masterbudget Acct2020Document4 pagesMasterbudget Acct2020api-249190933No ratings yet

- Excel Budget ProjectDocument7 pagesExcel Budget Projectapi-341205347No ratings yet

- Acct 2020 Excel Budget Problem Student Template 1Document5 pagesAcct 2020 Excel Budget Problem Student Template 1api-316764247No ratings yet

- Excel Budget ProblemDocument5 pagesExcel Budget Problemapi-313254091No ratings yet

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-356769323No ratings yet

- Managerial Accounting Final ProjectDocument5 pagesManagerial Accounting Final Projectapi-382641983No ratings yet

- Acct 2020 EportfolioDocument5 pagesAcct 2020 Eportfolioapi-311375616No ratings yet

- Ponderosa-IncDocument6 pagesPonderosa-IncpompomNo ratings yet

- Budget Assignment Norma GDocument5 pagesBudget Assignment Norma Gapi-242614310No ratings yet

- Acct 2020 Excel Budget ProblemDocument6 pagesAcct 2020 Excel Budget Problemapi-307661249No ratings yet

- Comprehensive BudgetDocument5 pagesComprehensive Budgetapi-317125310No ratings yet

- Sales Budget Jan Feb Mar April May TotalDocument2 pagesSales Budget Jan Feb Mar April May Totalwhat everNo ratings yet

- ASYNCHRONOUS ACTIVITY 4 WorksheetsDocument12 pagesASYNCHRONOUS ACTIVITY 4 WorksheetsAbejero Trisha Nicole A.No ratings yet

- Excel Budget ProjectDocument6 pagesExcel Budget Projectapi-314303195No ratings yet

- Acct 2020 Excel Master BudgetDocument6 pagesAcct 2020 Excel Master Budgetapi-302665852No ratings yet

- Key To Corrections - LEVEL 2 MODULE 7Document9 pagesKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNo ratings yet

- Sales Budget Q1 Q2 Q3 Q4 Year 2021Document9 pagesSales Budget Q1 Q2 Q3 Q4 Year 2021Judith DurensNo ratings yet

- Answer 4Document7 pagesAnswer 4Sinclair faith galarioNo ratings yet

- Presidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument28 pagesPresidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualMarc Jim Gregorio100% (1)

- Sales BudgetDocument12 pagesSales BudgetMai YếnNo ratings yet

- Bigbud 4th Ed Womack BaileyDocument26 pagesBigbud 4th Ed Womack Baileyapi-356759536No ratings yet

- Sales Budget: Q1 Q2 Q3 Q4 YearDocument23 pagesSales Budget: Q1 Q2 Q3 Q4 YearMuhamad Izuan RamliNo ratings yet

- Departmental Accounts PDFDocument7 pagesDepartmental Accounts PDFMwajuma mohamediNo ratings yet

- Exercise 1: Schedule of Expected Cash CollectionDocument7 pagesExercise 1: Schedule of Expected Cash CollectionLenard Josh IngallaNo ratings yet

- Exhibit 1 Salem Data Services Summary of Computer: Source: CasewriterDocument5 pagesExhibit 1 Salem Data Services Summary of Computer: Source: CasewriterJagvir Singh Jaglan ms21a025No ratings yet

- WOODDocument12 pagesWOODJayson ReyesNo ratings yet

- Business Name Patatasty Currency Symbol P Year End Month December Reporting Year 2020 Year End Reporting Date 29 February 2020Document35 pagesBusiness Name Patatasty Currency Symbol P Year End Month December Reporting Year 2020 Year End Reporting Date 29 February 2020Raschelle MayugbaNo ratings yet

- Tut Mene AccDocument7 pagesTut Mene Accnatasya angelNo ratings yet

- BigbudhunterkaarlsenDocument25 pagesBigbudhunterkaarlsenapi-356428418No ratings yet

- 08 Task PerformanceDocument3 pages08 Task PerformanceBetchang AquinoNo ratings yet

- Chapter 4 ExercisesDocument23 pagesChapter 4 ExercisesLiza Mae MirandaNo ratings yet

- P23-1A 1. Sale Budget Quarter 1 2 TotalDocument7 pagesP23-1A 1. Sale Budget Quarter 1 2 TotalVõ Huỳnh BăngNo ratings yet

- Problems: Set A: SolutionDocument8 pagesProblems: Set A: Solutionapi-395519937No ratings yet

- FM - Master BudgetDocument5 pagesFM - Master BudgetChristine Angeli AritaNo ratings yet

- Cost Accounting Week 3 - AnswersDocument10 pagesCost Accounting Week 3 - AnswersFiles OrganizedNo ratings yet

- Ahmad 134 AccountingDocument3 pagesAhmad 134 AccountingAhMad ButtNo ratings yet

- Jjcute Functional Budget SolutionDocument4 pagesJjcute Functional Budget Solutionjanjan3256No ratings yet

- 02 - Task - Performance - 2 - To Give To Students 10.10.22Document3 pages02 - Task - Performance - 2 - To Give To Students 10.10.22Justine OrdonioNo ratings yet

- Activity No. 4 - Attach Your Activity With The Filename SURNAME - SECTION - ACT#4Document3 pagesActivity No. 4 - Attach Your Activity With The Filename SURNAME - SECTION - ACT#4-st3v3craft-No ratings yet

- Cost & Management Accounting Question PaperDocument8 pagesCost & Management Accounting Question Paperpradhiba meenakshisundaramNo ratings yet

- P9-57a 5th Ed Blank Worksheet OnlyDocument7 pagesP9-57a 5th Ed Blank Worksheet Onlyapi-2483356370% (1)

- SolutionDocument8 pagesSolutionSajakul SornNo ratings yet

- Tutorial #3 - Group 5 - PA1 - MarkedDocument8 pagesTutorial #3 - Group 5 - PA1 - MarkedThanh NguyenNo ratings yet

- Fixed Assets Amount Depreciation (Years) Notes: You Are Fully Funded (Balanced)Document4 pagesFixed Assets Amount Depreciation (Years) Notes: You Are Fully Funded (Balanced)Paulo TorresNo ratings yet

- Numbers Sheet Name Numbers Table NameDocument8 pagesNumbers Sheet Name Numbers Table NameAhmed MahmoudNo ratings yet

- Problem Lecture - MANUFACTURING 2 With ANSWERSDocument4 pagesProblem Lecture - MANUFACTURING 2 With ANSWERSNia BranzuelaNo ratings yet

- Cameron Fisher Excel Budget ProjectDocument2 pagesCameron Fisher Excel Budget Projectapi-340519862No ratings yet

- 4 5845855793034823827Document4 pages4 5845855793034823827Gena HamdaNo ratings yet

- Chapter - 1 Cost Sheet - Problems - & - Solution - 3-9Document12 pagesChapter - 1 Cost Sheet - Problems - & - Solution - 3-9Legends CreationNo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Financial Plan OkDocument7 pagesFinancial Plan OkSYED ARSALANNo ratings yet

- Test 1 & Test 2 - MADocument8 pagesTest 1 & Test 2 - MAChi Nguyễn Thị KimNo ratings yet

- Depreciation Expense For First Year ofDocument6 pagesDepreciation Expense For First Year ofDanara Ann MeanaNo ratings yet

- Midterm Review QuestionsDocument6 pagesMidterm Review QuestionsnamiyuartsNo ratings yet

- Budgeting ProblemDocument8 pagesBudgeting ProblemMihrima MishuNo ratings yet

- Acctg 202Document9 pagesAcctg 202Lore Desa CenizaNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Ipmv NotesDocument125 pagesIpmv Notessniper x4848 PillaiNo ratings yet

- The EarthDocument12 pagesThe EarthKather ShaNo ratings yet

- By: Saurabh S SawhneyDocument28 pagesBy: Saurabh S SawhneyMaria100% (1)

- Pharmacognosy 2 2021 Solution For Most Important QuestionsDocument21 pagesPharmacognosy 2 2021 Solution For Most Important Questionspapov95193No ratings yet

- Baydoun Willett (2000) Islamic Corporate Reports PDFDocument20 pagesBaydoun Willett (2000) Islamic Corporate Reports PDFAqilahAzmiNo ratings yet

- Microsoft Age of Empires III Trial Readme File: September 2005Document4 pagesMicrosoft Age of Empires III Trial Readme File: September 2005Yoga RajNo ratings yet

- Guia de Estudio Aguilar Romero Claudia Angelica 109Document3 pagesGuia de Estudio Aguilar Romero Claudia Angelica 109claudia aguilarNo ratings yet

- TSQL Coding Standards ChecklistDocument5 pagesTSQL Coding Standards ChecklistSaman AzeemNo ratings yet

- UTS ENGLISH - 112011192 - Netta Delyana PutriDocument2 pagesUTS ENGLISH - 112011192 - Netta Delyana Putrinetta delyana putriNo ratings yet

- SupaulDocument11 pagesSupaulImran ShiekhNo ratings yet

- A Major Project Report ON: HR Policies and Their Implementation in Cheema Spintex LTDDocument64 pagesA Major Project Report ON: HR Policies and Their Implementation in Cheema Spintex LTDsuchitraNo ratings yet

- Group 3Document11 pagesGroup 3Sharp MIER TVNo ratings yet

- Dell 2000 StorageDocument115 pagesDell 2000 Storagests100No ratings yet

- KCET 2020 Chemistry Paper Questions and SolutionsDocument33 pagesKCET 2020 Chemistry Paper Questions and SolutionsSaroja RajuNo ratings yet

- Study Plan EPE FinalDocument1 pageStudy Plan EPE FinalRamini AshwinNo ratings yet

- An Analysis of The FIBA Governing Council in The Czech RepublicDocument17 pagesAn Analysis of The FIBA Governing Council in The Czech RepublicAbbie AyorindeNo ratings yet

- Full Metal Plate Mail 1.7Document100 pagesFull Metal Plate Mail 1.7Ezra Agnew100% (1)

- CONFIRMALDocument50 pagesCONFIRMALSri SaiNo ratings yet

- Datasheet (Signal Booster)Document4 pagesDatasheet (Signal Booster)Shrisha BhatNo ratings yet

- Final Seats Matrix Ss Counelling - 2022 D.M M.CHDocument55 pagesFinal Seats Matrix Ss Counelling - 2022 D.M M.CHMinerva Medical Treatment Pvt LtdNo ratings yet

- Sustainable Incorporation of Lime-Bentonite Clay Composite For Production of Ecofriendly BricksDocument21 pagesSustainable Incorporation of Lime-Bentonite Clay Composite For Production of Ecofriendly BricksWaqas HaroonNo ratings yet

- IJSARTV6I738053Document3 pagesIJSARTV6I738053VISHAL BHOJWANINo ratings yet

- San Miguel CorporationDocument8 pagesSan Miguel CorporationLeah BautistaNo ratings yet

- Dioscorea Bulbifera: L. DioscoreaceaeDocument6 pagesDioscorea Bulbifera: L. DioscoreaceaeAlarm GuardiansNo ratings yet