Professional Documents

Culture Documents

Chapter 10 Vat Still Due

Chapter 10 Vat Still Due

Uploaded by

Hazel Jane EsclamadaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 10 Vat Still Due

Chapter 10 Vat Still Due

Uploaded by

Hazel Jane EsclamadaCopyright:

Available Formats

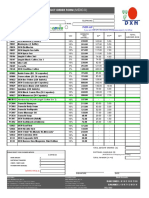

DETERMINATION OF VAT STILL DUE/PAYABLE

Output VAT xx

Less: Creditable Input VAT xx

Net VAT payable xx

Less: Tax credits/payments xx

Tax still due/(overpayment) xx

Tax Credits/Payments

1. VAT paid in the previous two months-for quarterly VAT returns

2. VAT paid in return previously filed, in the case of amended return

3. Advanced payments made to the BIR.

4. Final withholding VAT on sales to the government

5. Advanced VAT on certain goods

VAT Payments in the Monthly Returns

This tax credit applies to the quarterly VAT return. (BIR Form 2550Q). This is not applicable to the monthly VAT

return (BIR Form 2550M).

Advanced VAT

The owners or sellers of the following goods are required to pay advanced VAT before their withdrawal at the point

of production:

1. Refined sugar

2. Flour

3. Naturally grown and planted timber products

-advanced VAT is not an input VAT. However, unutilized advanced VAT in the period may form part of the Input

VAT carry-over if opted by the taxpayer.

Advanced VAT on the Sale of Sugar

Sugar owners refers to a person who has legal title over the sugar and may include sugar planters, traders, sugar

millers, cooperatives or associations.

Base price of advanced VAT: P1,400 per 50 kg. bag

Illustration 1

Mayumu Company buys sugar cane from farmers, processes it in its refinery and sells the output to wholesalers.

The following relates to its processing and refining activities during a month:

Purchase of cane sugar from cane farmers P2,000,000

Refining expenses, including P24,000 VAT 324,000

Total production of 50 kg-bag refined sugar 4,000 bags

The advanced input VAT to be paid prior to the withdrawal of the sugar from the refinery shall be:

Advanced VAT= 4,000 bags x P1,400 x 12% P672,000

Assuming Mayumu was able to sell 3,800 bags at P1,800/bag during the month, the VAT payable shall be

computed as:

Output VAT (3,800 bags x P1,800 x 12%) P820,800

Less: Input VAT

Presumptive input VAT (2M x 4%) P80,000

Regular input VAT 24,000 104,000

VAT payable 716,800

Less: Tax credits/payments

Advanced input VAT 672,000

Tax still payable/overpayment 44,800

Advanced VAT on the Sale of Flour by Millers

Flour millers is a person who is engaged in the milling of imported wheat to produce flour as finished product,

where such wheat may be directly imported or purchased from an importer/trader.

Wheat trader is a person who is engaged in the importing/buying and selling of imported wheat.

Basis of the advanced VAT

For wheat imported by millers-75% of the sum of:

a. Invoice value x currency exchange rate at the date of payment

b. Custom’s charges

c. And 5% of the sum of a and b

For wheat purchased by millers from wheat traders-75% of the sum of:

a. Invoice value

b. Estimated freight

c. And 5% of the sum of a and b

Illustration:

A VAT-registered flour miller imported wheat from abroad at a total invoice price of $100,000. P300,000 total

charges was estimated to be paid prior to the release of the wheat from Customs. The Peso-Dollar exchange rate

at the date of payment was P43.50 to $1.

The advanced input VAT shall be computed as:

Invoice price ($100,000 x P43.50) P4,350,000

Estimated custom's charges 300,000

Landed cost 4,650,000

Multiply b 105%

Total 4,882,500

Total 4,882,500

Multiply by: 75%

Advanced VAT base 3,661,875

Multiply by: 12%

Advanced VAT 439,425

• The payment order, together with the deposit slip issued by the authorized agent bank or the ROR issued

by the Revenue Collection officer, shall serve as proof for such advanced payment for purposes of

claiming input VAT.

Advanced VAT on the Transport of Naturally Grown and Planted Timber Products

Basis of advanced VAT

The 12% advanced VAT shall be based on per cubic meter (m3) of each species of naturally grown timber as

follows:

Luzon Visayas Mindanao

(Peso/m3) (Peso/m3) (Peso/m3)

Phil mahogany group, Manggasinor group, Manggachapui group, Narig

group, Palosapis group, Guijo group 1,400 1,400 1,425

Yakal Group 1,500 1,500 1,530

Apitong Group 1,260 1,260 1,260

Softwood Species except Igem 715 715 715

Igem 1,275 1,275 1,275

Nato 1,000 1,000 1,000

Furniture/construction hardwood 950 950 950

Premium species, allowed cut 3,000 3,000 3,000

Lesser-used 700 700 700

Pulpwood, chipwood and mathwood species (per m3) 95 95 95

Illustration:

Forester Isidoro is a VAT registered person and a licensee under a Private Forest Development Agreement with

the government in Kalinga Province in Luzon. He harvested 1,700 cubic meter of mahogany.

Forster Isidoro shall pay the following advanced VAT on the timber prior to the transport of the same:

Advanced VAT= 1,700 m3 x P1,400/ m3 x 12% P285,600

Unutilized Advanced VAT

At the option of the owner/seller/taxpayer or importer/miller/taxpayer be available for the issuance of a tax credit

certificate (TCC).

Requisite for TCC claim

1. The seller/owner or importer/miller must file a claim for credit within 2 years from the date of filing of the

fourth quarter VAT return of the year return was made.

2. Claim shall be limited to the unutilized VAT payment and shall not include excess input VAT.

When Input VAT may be claimed for refund

1. Unutilized input VAT on zero-rated sales

2. Unutilized input VAT upon cancellation of VAT registration due to retirement from or cessation of business.

When and where to claim for VAT refund or TCC for zero-rated sales (within 2 years)

1. BIR

2. BOI

3. One stop shop and Duty Drawback Center of the Department of Finance

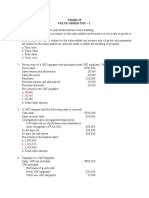

Illustration-VAT PAYABLE COMPUTATION

Illustration 1

Denver Company had the following transactions, net of VAT, in the first quarter of 2020:

January February March

Sales 1,000,000 1,200,000 1,400,000

Purchases

Goods and services 1,100,000 700,000 900,000

Building (3 year life) 2,400,000

The VAT payable shall be computed in the VAT return as:

January February March

Output VAT 120,000 144,000 432,000

Less: Input VAT

Input VAT carry-over 20,000

Goods/services 132,000 84,000 324,000

Building 8,000 8,000 24,000

Net VAT payable (20,000) 32,000 84,000

Less: Tax credit/payments

VAT paid-prior months 32,000

VAT due and payable (20,000) 32,000 52,000

Illustration 2

BYAHE Bus Lines is a VAT-registered operator of several buses. During the month, it had the following receipts

and payments:

Receipts from passengers 700,000

Receipts from baggage, cargoes, and mails 100,000

Purchase of diesel, inclusive of VAT 448,000

Bus maintenance and insurance, inclusive of VAT 134,400

Salaries and commission of staff 150,000

Life insurance of drivers 20,000

Office supplies, utilities and rental, inclusive of VAT 100,800

The total input VAT shall first be determined from the vatable purchases:

Purchase of diesel, inclusive of VAT 448,000

Bus maintenance and insurance, inclusive of VAT 134,400

Office supplies, utilities and rental, inclusive of VAT 100,800

Total purchases with VAT 683,200

Multiply by: x 12/112

Total input VAT 73,200

The creditable input VAT shall be:

P73,200 x P100,000/P800,000 9,150

The VAT payable shall be computed as follows:

Output VAT (100K x 12%) 12,000

Less: Creditable input VAT 9,150

Net VAT payable 2,850

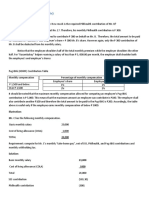

Illustration 3

A VAT taxpayer using the cash basis presented the following data during the month:

Professional fees billed, VAT-inclusive 896,000

Professional fees collected, VAT-inclusive 784,000

Client advances, VAT-exclusive 200,000

Salaries expense 300,000

Depreciation expense 50,000

Supplies expense, inclusive of VAT 33,600

During the month, an equipment with 8 year estimated useful life was purchased. An input VAT of P144,000 was

paid on the purchase.

The gross receipt and output VAT shall be computed as:

Professional fees collected (784,000/112) 700,000

Client advances 200,000

Gross receipt 900,000

Multiply by: 12%

Output VAT 108,000

The creditable input VAT shall be computed as:

Input VAT on equipment (144k/60mos.) 2,400

Input VAT on supplies (33.6k x 12/112) 3,600

Total 6,000

The VAT payable shall be:

Output VAT 108,000

Less: Input VAT 6,000

Net VAT payable 102,000

Illustration 4

Danube Corporation reported the following sales and purchases during the third calendar quarter:

July August September

Sales 1,100,000 1,340,100 1,240,000

Unsold consignment sales from:

May 64,800 12,800

June 86,200 37,500 -

July 122,800 80,400 48,000

August 150,000 90,000

Purchases:

Goods from VAT suppliers 896,000 1,008,000 784,000

Machineries from non-VAT suppliers 1,232,000

Additional information:

1. The reported sales include direct sales and those made by consignees but excludes sales of goods previously

deemed sold.

2. All amounts are inclusive of VAT.

The VAT payable in each month may be computed as:

July August September

Vatable sales

Direct sales 1,100,000 1,340,100 3,680,100

Deemed sales (60-day old) 64,800 37,500 150,300

Total 1,164,800 1,377,600 3,830,400

Multiply by: 12/112 12/112 12/112

Output VAT 124,800 147,600 410,400

Less:

Vatable purchase 896,000 1,008,000 2,688,000

Multiply by: 12/112 12/112 12/112

Input VAT 96,000 108,000 288,000

VAT paid in prior months 68,400

Total 96,000 108,000 356,400

VAT due and payable 28,800 39,600 54,000

Illustration 5

Nasam-it Sugar Company produces refined sugar. It had the following transactions during the month:

Total production (50-kg bag) 2,000 bags

Total bags exported at $55/bag 400 bags

Total bags sold to local buyers at P2,000/bag 1,600 bags

Purchase of sugar cane P1,200,000

Purchase of other supplies (VAT inclusive) 224,000

Electricity bill (VAT inclusive) 44,800

The current exchange rate is P42.50: $1

The advanced VAT to be paid shall be computed as follows:

Presumptive input VAT (P1.2m x 4%) 48,000

Advanced input VAT 336,000

Regular input VAT

Electricity bill (P224,000x 12/112) 24,000

Other supplies (44,800 x 12/112) 4,800

Total creditable input VAT 412,800

The VAT payable shall be:

Output VAT (1,600 bags x P2,000 x 12%) 384,000

Less: Creditable input VAT 412,800

Net VAT payable (28,800)

Note:

1. There is no need to allocate the P412,800 total creditable input VAT in this case because there are only two types of vatable sales and export

sales. Note that any input VAT allocable to export sales would still be creditable against output VAT.

2. Allocation is necessary if the taxpayer intends to claim the input VAT traceable to export sale as tax refund or tax credit.

Compliance Requirement

1. Invoicing requirement

-Vat invoice/receipt

-separate single/mixed invoice or receipt

2. Accounting requirement

All persons subject to VAT shall maintain

1. Regular accounting records

2. Subsidiary sales journal

3. Subsidiary purchase journal

3. Filing of VAT return

Where to file the VAT return?

1. Authorized agent bank under the jurisdiction of the RDO/LTO

2. Revenue Collection officer

3. Duly authorized treasurer of the municipality or city

Manual filing (20/20/25)

Electronic Filing and Payment System (eFPS)

Monthly Filing (Group A, B, C, D, E) / 25/24/23/22/21 days following the end of the month

4. Filing of quarterly summary lists

Quarterly summary lists to be submitted by all VAT taxpayers

1. Sales to regular buyers or customers (6 times), casual buyers or customers (individual purchase 100k or

more) and output tax.

2. Local purchases and input tax

3. Importation

A taxpayer’s quarterly sales and purchases are submitted to the BIR’s website through RELIEF Data Entry System.

These shall be submitted by the taxpayer before the 25th day of the month following the close of the taxable year.

5. Government withholding

You might also like

- VAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDocument103 pagesVAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDGAENo ratings yet

- Reg CC Funds Availability ChartDocument1 pageReg CC Funds Availability Chartslade1jeNo ratings yet

- Chapter 13 B TaxDocument16 pagesChapter 13 B TaxEmmanuel PenullarNo ratings yet

- Excise TaxDocument15 pagesExcise TaxDaniella MananghayaNo ratings yet

- DocxDocument14 pagesDocxtrisha100% (1)

- Other Percentage TaxDocument3 pagesOther Percentage TaxHafi DisoNo ratings yet

- Chapter 9 Input VatDocument10 pagesChapter 9 Input VatHazel Jane EsclamadaNo ratings yet

- Chapter 4 Exempt SalesDocument23 pagesChapter 4 Exempt SalesHazel Jane Esclamada0% (2)

- Problems (Donor's Tax)Document3 pagesProblems (Donor's Tax)Jevyl CajandabNo ratings yet

- Quiz 3Document252 pagesQuiz 3Mary Denize100% (1)

- Chapter 10 Determination of Vat Still DueDocument29 pagesChapter 10 Determination of Vat Still DueChristian Pelimco100% (1)

- Quiz On Percentage Tax and Documentary Stamps TaxDocument4 pagesQuiz On Percentage Tax and Documentary Stamps Taxncllpdll100% (4)

- 1.1 Problems On VAT (PRTC) PDFDocument17 pages1.1 Problems On VAT (PRTC) PDFmarco poloNo ratings yet

- DocxDocument28 pagesDocxGrace Managuelod GabuyoNo ratings yet

- Estate Tax PayableDocument8 pagesEstate Tax PayableHazel Jane Esclamada100% (2)

- Chapter 17 Donor's TaxDocument7 pagesChapter 17 Donor's TaxHazel Jane Esclamada100% (3)

- Course Financial Management Developer and Their Background: See Assignment / Agreement SectionDocument33 pagesCourse Financial Management Developer and Their Background: See Assignment / Agreement SectionHazel Jane Esclamada100% (1)

- Chapter 3 Introduction To Business TaxationDocument27 pagesChapter 3 Introduction To Business TaxationHazel Jane Esclamada100% (1)

- Adyen Payment MethodsDocument17 pagesAdyen Payment MethodsCristián SmithNo ratings yet

- VAT QuizzerDocument28 pagesVAT Quizzerlc100% (1)

- Ae 206: Business and Transfer Taxation Quiz # 1: CH - 1: Introduction To Consumption Taxes TRUE OR FALSE - Answered and ReturnedDocument6 pagesAe 206: Business and Transfer Taxation Quiz # 1: CH - 1: Introduction To Consumption Taxes TRUE OR FALSE - Answered and ReturnedJinuel PodiotanNo ratings yet

- Other Percentage TaxespdfDocument5 pagesOther Percentage TaxespdfAngeilyn RodaNo ratings yet

- Chapter 1 Introduction To Business Taxes PDFDocument6 pagesChapter 1 Introduction To Business Taxes PDFDudz Matienzo100% (1)

- Tax2 Quiz2 FinalsDocument11 pagesTax2 Quiz2 Finalsishinoya keishiNo ratings yet

- Chapter 9 TaxDocument27 pagesChapter 9 TaxJason MalikNo ratings yet

- VAT (Chapter 8 Compilation of Summary)Document36 pagesVAT (Chapter 8 Compilation of Summary)Dianne LontacNo ratings yet

- Exercises On Estate Tax Additional ProblemsDocument8 pagesExercises On Estate Tax Additional ProblemsMidas Troy VictorNo ratings yet

- Other Percentage TaxDocument7 pagesOther Percentage TaxJudeBragaisNo ratings yet

- Output TaxDocument15 pagesOutput TaxAmie Jane MirandaNo ratings yet

- Quizzers On Percentage TaxationDocument10 pagesQuizzers On Percentage Taxation?????No ratings yet

- Business Tax MidtermDocument7 pagesBusiness Tax MidtermRenalyn Paras50% (2)

- Tax 3216Document5 pagesTax 3216Rich William PagaduanNo ratings yet

- Module 2 - Estate TaxDocument16 pagesModule 2 - Estate TaxMaryrose SumulongNo ratings yet

- Part 1 of Chapter 5Document3 pagesPart 1 of Chapter 5RB Janelle YTNo ratings yet

- Activity 3-Bustax 1Document4 pagesActivity 3-Bustax 1Nhel AlvaroNo ratings yet

- TAX 1301 Answers Accounting Periods MethodsDocument6 pagesTAX 1301 Answers Accounting Periods Methodsrav dano100% (1)

- Module 5 - Donors TaxDocument5 pagesModule 5 - Donors TaxBella RonahNo ratings yet

- Question: A VAT Subject Real Estate Dealer Sold A Residential Lot On January 15, 2014. The FollowingDocument1 pageQuestion: A VAT Subject Real Estate Dealer Sold A Residential Lot On January 15, 2014. The Followingnaztig_017No ratings yet

- Answer: 2,000,000 Solution:: Sample ProblemDocument17 pagesAnswer: 2,000,000 Solution:: Sample ProblemJohayra AbbasNo ratings yet

- Bus Tax Chap 6Document3 pagesBus Tax Chap 6yayayaNo ratings yet

- Vat Quizzer 1 Draft PDFDocument6 pagesVat Quizzer 1 Draft PDFJosephine CastilloNo ratings yet

- Taxation (Input Taxes)Document30 pagesTaxation (Input Taxes)Lara Joy Junio100% (4)

- Activity in Excise TaxDocument2 pagesActivity in Excise TaxLucy Heartfilia67% (3)

- PRELIMDocument2 pagesPRELIMlatte aeriNo ratings yet

- Tax2 FinalsDocument8 pagesTax2 FinalsKevin Elrey Arce100% (2)

- W7-Module Concept of Income-Part 2Document21 pagesW7-Module Concept of Income-Part 2Danica VetuzNo ratings yet

- Chapter 11 Excise TaxDocument10 pagesChapter 11 Excise TaxAmzelle Diego LaspiñasNo ratings yet

- ModuleDocument6 pagesModuledennissabalberinojrNo ratings yet

- Module 8 - Value Added TaxDocument28 pagesModule 8 - Value Added TaxKyrah Angelica DionglayNo ratings yet

- Business TaxationDocument5 pagesBusiness TaxationMajoy BantocNo ratings yet

- Tax2 Quiz1 FinalsDocument9 pagesTax2 Quiz1 Finalsishinoya keishiNo ratings yet

- Input TaxDocument18 pagesInput TaxAmie Jane MirandaNo ratings yet

- Applicable Property Regime in Default of An AgreementDocument3 pagesApplicable Property Regime in Default of An AgreementMarie Tes LocsinNo ratings yet

- Compilation of MCQDocument34 pagesCompilation of MCQDaphnie Bolo100% (1)

- Quiz Donor S Tax ACT 193Document14 pagesQuiz Donor S Tax ACT 193Haks MashtiNo ratings yet

- Answers, Solutions and Clarifications To Form 6Document5 pagesAnswers, Solutions and Clarifications To Form 6Annie LindNo ratings yet

- A Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsDocument1 pageA Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsAmie Jane MirandaNo ratings yet

- Lecture Chapter 10 Determination of Vat Still DueDocument24 pagesLecture Chapter 10 Determination of Vat Still DueChristian PelimcoNo ratings yet

- Determination: of Vat Still DueDocument30 pagesDetermination: of Vat Still DueAjey MendiolaNo ratings yet

- Determination: of Vat Still DueDocument31 pagesDetermination: of Vat Still DueTokis SabaNo ratings yet

- Concept and Nature of Vat: Input Tax Carry Over Vat and Discount For Senior Citizen and PWDDocument29 pagesConcept and Nature of Vat: Input Tax Carry Over Vat and Discount For Senior Citizen and PWDNIKKI JOY FRANCISQUETENo ratings yet

- Tax Chapter 10Document24 pagesTax Chapter 10Farhani Sam RacmanNo ratings yet

- Chapter-13 (SOLVED PAST PAPTERS OF ICMA STAGE IV PDFDocument14 pagesChapter-13 (SOLVED PAST PAPTERS OF ICMA STAGE IV PDFDani QureshiNo ratings yet

- Financial Statement - Without AdjustmentDocument29 pagesFinancial Statement - Without AdjustmentAnmol SinghNo ratings yet

- Bus Tax Notes 2Document44 pagesBus Tax Notes 2Zhaneah Rhej SaradNo ratings yet

- Philhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationDocument5 pagesPhilhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationMaraiah InciongNo ratings yet

- ICMA Sales Tax (1) - 1Document13 pagesICMA Sales Tax (1) - 1Numan Rox100% (1)

- Output and Input VAT: Business TaxDocument13 pagesOutput and Input VAT: Business TaxKathleen AgustinNo ratings yet

- Report - Roles of CEODocument2 pagesReport - Roles of CEOHazel Jane EsclamadaNo ratings yet

- Mas 3 Module 1 Fs AnalysisDocument19 pagesMas 3 Module 1 Fs AnalysisHazel Jane EsclamadaNo ratings yet

- Introduction To Financial ManagementDocument43 pagesIntroduction To Financial ManagementHazel Jane EsclamadaNo ratings yet

- Photography 3 (Updated)Document28 pagesPhotography 3 (Updated)Hazel Jane EsclamadaNo ratings yet

- Introduction To Donor's TaxDocument7 pagesIntroduction To Donor's TaxHazel Jane EsclamadaNo ratings yet

- MAS-3-Roque - Answer KeyDocument6 pagesMAS-3-Roque - Answer KeyHazel Jane Esclamada100% (1)

- Photography 2Document48 pagesPhotography 2Hazel Jane EsclamadaNo ratings yet

- Topic 4 - EXERCISES6 - Capital Current Liabilities ManagementDocument36 pagesTopic 4 - EXERCISES6 - Capital Current Liabilities ManagementHazel Jane Esclamada100% (1)

- Warranties, Provisions and Contingent LiabilitiesDocument31 pagesWarranties, Provisions and Contingent LiabilitiesHazel Jane EsclamadaNo ratings yet

- Topic 3 & 4 - EXERCISES3 - Working Capital Management - TheoriesDocument36 pagesTopic 3 & 4 - EXERCISES3 - Working Capital Management - TheoriesHazel Jane EsclamadaNo ratings yet

- Inventory Management: Multiple Choice QuestionsDocument3 pagesInventory Management: Multiple Choice QuestionsHazel Jane Esclamada33% (3)

- Working Capital FinanceDocument12 pagesWorking Capital FinanceYeoh Mae100% (4)

- Module Far1 Unit-1 Part-1c.1Document6 pagesModule Far1 Unit-1 Part-1c.1Hazel Jane EsclamadaNo ratings yet

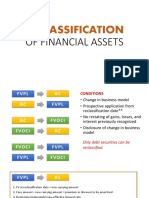

- Reclassification: of Financial AssetsDocument15 pagesReclassification: of Financial AssetsHazel Jane EsclamadaNo ratings yet

- Module 2.1 (Property, Plant, and Equipment)Document15 pagesModule 2.1 (Property, Plant, and Equipment)Hazel Jane EsclamadaNo ratings yet

- Concept of Succession and Estate Tax and Gross Estate Common Rules & Special Rules (Married Decedents)Document12 pagesConcept of Succession and Estate Tax and Gross Estate Common Rules & Special Rules (Married Decedents)Hazel Jane Esclamada100% (1)

- Module Far1 Unit-1 Part-1bDocument5 pagesModule Far1 Unit-1 Part-1bHazel Jane EsclamadaNo ratings yet

- Introduction To Transfer TaxationDocument6 pagesIntroduction To Transfer TaxationHazel Jane EsclamadaNo ratings yet

- MODULE FinalTerm FAR 3 Operating Segment Interim Reporting Events After Reporting Period 1Document19 pagesMODULE FinalTerm FAR 3 Operating Segment Interim Reporting Events After Reporting Period 1Hazel Jane Esclamada0% (1)

- What To Do With Perceived Environmental ViolationsDocument15 pagesWhat To Do With Perceived Environmental ViolationsHazel Jane EsclamadaNo ratings yet

- Topic 7 Transfer PricingDocument3 pagesTopic 7 Transfer PricingHazel Jane EsclamadaNo ratings yet

- Topic 4 - Current Liabilities Sample ProblemsDocument8 pagesTopic 4 - Current Liabilities Sample ProblemsHazel Jane EsclamadaNo ratings yet

- TSU PNP New Rank Classification The Meaning of The Symbols in The Seal and Badge of The PNPDocument3 pagesTSU PNP New Rank Classification The Meaning of The Symbols in The Seal and Badge of The PNPHazel Jane EsclamadaNo ratings yet

- Chapter 1 Tax 2Document5 pagesChapter 1 Tax 2Hazel Jane EsclamadaNo ratings yet

- Orden de Compra DXNDocument1 pageOrden de Compra DXNLa lectora de BorgesNo ratings yet

- Statement JAN2024 967279555 UnlockedDocument11 pagesStatement JAN2024 967279555 Unlockedkaifbhai2003No ratings yet

- Account Statement From 4 Apr 2022 To 21 Jul 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument9 pagesAccount Statement From 4 Apr 2022 To 21 Jul 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceMOHIT JINDALNo ratings yet

- Test BankDocument36 pagesTest BankJaybie John Palco EralinoNo ratings yet

- Chapter 3 - Practice ProblemsDocument6 pagesChapter 3 - Practice ProblemsRosa Julia LawrenceNo ratings yet

- Budget Request - BUSINESS TRIPDocument2 pagesBudget Request - BUSINESS TRIPMellie MorcozoNo ratings yet

- PDFDocument2 pagesPDFsrikanth manchikatlaNo ratings yet

- 12 Jun 2019 PDFDocument12 pages12 Jun 2019 PDFAnonymous dy7g4jzo7No ratings yet

- Account Statement From 2 Nov 2015 To 1 Feb 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 2 Nov 2015 To 1 Feb 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceGirish ChowdaryNo ratings yet

- Canara BankDocument18 pagesCanara BankKripa Mary JosephNo ratings yet

- Posb Manual Volume - 2Document108 pagesPosb Manual Volume - 2K V Sridharan General Secretary P3 NFPE100% (2)

- Jeromedjavier : Cocacolafemsaphilsinc Murciardbrgymansilangan 6100bacolodcitynegrosoccDocument6 pagesJeromedjavier : Cocacolafemsaphilsinc Murciardbrgymansilangan 6100bacolodcitynegrosoccJerome JavierNo ratings yet

- US Internal Revenue Service: p54 - 2000Document43 pagesUS Internal Revenue Service: p54 - 2000IRSNo ratings yet

- Invoice TerbaruDocument2 pagesInvoice TerbaruRide And GrillNo ratings yet

- 210 - RFP - Sewa Ruangan, Internet, Listrik & Over Time SguDocument8 pages210 - RFP - Sewa Ruangan, Internet, Listrik & Over Time SguSulis SetioriniNo ratings yet

- PIAIC Student PortalDocument2 pagesPIAIC Student PortalJhanzaib SaleemNo ratings yet

- Business Law Unit - IVDocument9 pagesBusiness Law Unit - IVKaran Veer SinghNo ratings yet

- 6 ACR-Checkliste: Filing AMS ISF ACI AFR CaatDocument1 page6 ACR-Checkliste: Filing AMS ISF ACI AFR CaatCatalin NichitaNo ratings yet

- Electronic Filing and Payment System (eFPS) : Its Importance and Effectiveness To The Taxpayer's of Cauayan City, IsabelaDocument94 pagesElectronic Filing and Payment System (eFPS) : Its Importance and Effectiveness To The Taxpayer's of Cauayan City, IsabelaMa Jessica Maramag BaroroNo ratings yet

- Preview PDFDocument7 pagesPreview PDFBasil SrayihNo ratings yet

- Not Payable in Case Subsidized Canteen Facilities Are ProvidedDocument1 pageNot Payable in Case Subsidized Canteen Facilities Are Providedsurabhiarora1No ratings yet

- Waleed Mohammed Elhasan Elmubarak: 2072020: 0233120720200001: Saving Plus:: 31-01-2022Document8 pagesWaleed Mohammed Elhasan Elmubarak: 2072020: 0233120720200001: Saving Plus:: 31-01-2022knoor33No ratings yet

- Key Payment and Service Information: What Is Paypal?Document4 pagesKey Payment and Service Information: What Is Paypal?AnaMTSMCamposNo ratings yet

- Current & Saving Account Statement: Parimalarajan Dno 70 Middle Street Mangalur Rettakurichi Po Thittakudi TK CuddaloreDocument35 pagesCurrent & Saving Account Statement: Parimalarajan Dno 70 Middle Street Mangalur Rettakurichi Po Thittakudi TK Cuddaloress netzoneNo ratings yet

- Statement of Account 3 16 Jul 19 To 15 Aug 19 881515334: Total Amount Due: P1,832.18Document2 pagesStatement of Account 3 16 Jul 19 To 15 Aug 19 881515334: Total Amount Due: P1,832.18NerosaMaryjoyNo ratings yet

- Account StatementDocument3 pagesAccount StatementSekhar RayuduNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument4 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureK.s. LubanaNo ratings yet

- Hotel Details Check in Check Out Rooms: Guest Name: DateDocument1 pageHotel Details Check in Check Out Rooms: Guest Name: DateChanchal MishraNo ratings yet