Professional Documents

Culture Documents

Wiley Practice Quiz ch11

Wiley Practice Quiz ch11

Uploaded by

sabrina danteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wiley Practice Quiz ch11

Wiley Practice Quiz ch11

Uploaded by

sabrina danteCopyright:

Available Formats

lOMoARcPSD|5897741

CH-11 Practice Quiz Wiley Depreciation, Impairment

Intermediate Financial Accounting I (University of Toronto)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by sabrina dante (scraboroughangel9@hotmail.com)

lOMoARcPSD|5897741

CHAPTER-11 PRACTICE QUIZ WILEY

1. Depreciation is?

R= a means of cost allocation

2. Which of the following statements regarding the concept of depreciation is NOT correct?

a) It does not take into account factors such as obsolescence b) It requires various estimates c) It

continuously decreases the asset’s net book value

R= It ensures that the asset’s net book value will equal its recoverable value

3. The depreciation method that considers depreciation a function of the passage of time, rather

than a function of usage, is the?

R= Straight-line method

4. The depreciation method that does not deduct residual value in calculating depreciation is the?

a) Straight-line method b) Activity-based method

R= Diminishing-balance method

5. Which of the following statements regarding the concept of depreciation is not correct?

a) It does not take into account factors such as obsolescence b) It requires various estimates c) It

continuously decreases the asset’s net book value

R= It ensures that the net book value of the asset will equal its recoverable value

6. Normally, depletion expense is calculated using which allocation approach?

R= An activity-based method

7. Which of the following statements regarding the use of fair value (instead of the use of

amortized or depreciated cost) for long-lived assets is correct?

R= The use of fair value tends to provide more relevant information

8. A change in the estimates of the expected pattern of consumption of an asset’s benefits, useful

life, and residual value will require adjustments to depreciation expense related to that asset.

Which of the following is the correct treatment of an estimate change?

R= The company should account for a change in estimate prospectively

9. Various events and changes in circumstances might lead to the impairment of a long-lived

asset, including the following: a) A significant adverse change in legal factors or in the business climate

that affects an asset’s value b) A significant decrease in an asset’s market value c) A significant change in

the extent or manner in which an asset is used

R= All of the above may indicate impairment

10. Using the cost recovery impairment model (ASPE), an impairment loss is the excess of the

carrying amount of an asset over the:

R= Asset’s fair value

11. Using the rational entity impairment model (IFRS), an impairment loss is the excess of the

carrying amount of an asset over its recoverable amount. The recoverable amount is defined as:

R= The higher of its value in use and its fair value less costs to sell

12. The core difference between the rational entity impairment model (IFRS) and the cost

recovery impairment model (ASPE) is that:

R= The IFRS approach better reflects the economic circumstances underlying the asset’s usefulness to the

entity

13. Which of the following is NOT a true statement about long-lived assets classified as held for

sale? a) If certain criteria are met, the losses and subsequent recoveries from the long-lived asset are

reported as part of discontinued operations on the income statement b) These assets should be reported at

the lower of their carrying amount and fair value less costs to sell c) A long-lived asset classified as held for

sale will continue to be written down and further losses will be recognized if the net amount expected from

the asset continues to drop

R= They continue to be depreciated up to the date of sale

14. Which of the following must be recorded in the accounting records when an asset that is NOT

held for sale is derecognized? a) Removal of the asset b) Depreciation up until the date of derecognition

c) Gain or loss on derecognition

R= All of the above items must be recorded in the accounting records

15. The rate of return on assets is calculated by dividing?

R= Net income by average total assets

16. The depreciable amount of an asset is its original cost?

R= Less its residual value

17. All of the following are economic factors related to depreciation except:

a) Inadequacy b) Obsolescence c) Supersession

R= Wear and tear

18. Economic factors that shorten the service life of an asset include:

a) Inadequacy b) Obsolescence c) Supersession

R= All of these

Downloaded by sabrina dante (scraboroughangel9@hotmail.com)

lOMoARcPSD|5897741

19. The rational entity model in comparison to the cost recovery model:

R= It is more neutral.

20. Obsolescence is the replacement of one asset with another more efficient and economical

asset:

R= False

21. Total depreciation over an asset’s life cannot exceed an amount equal to cost minus estimated

salvage value:

R= True

22. The disclosure requirements for private companies are usually more comprehensive than for

their public counterparts:

R= False

23. The rational-entry approach used by IFRS recognizes that an asset is impaired if its carrying

amount exceeds its recoverable amount, whereas the cost recovery approach used by ASPE

recognizes that an asset is impaired if its carrying amount exceeds the net future undiscounted

cash flows from its future use and disposal:

R= True

24. The capital cost allowance method is most similar to which depreciation approach?

R= Declining-balance

Downloaded by sabrina dante (scraboroughangel9@hotmail.com)

You might also like

- Ias 36Document42 pagesIas 36Reever RiverNo ratings yet

- Data Analyst Associate Cert Training ResourcesDocument4 pagesData Analyst Associate Cert Training ResourcesjoseNo ratings yet

- Ch11 Test Bank For Intermediate Accounting Ifrs Edition 3eDocument40 pagesCh11 Test Bank For Intermediate Accounting Ifrs Edition 3eakid windrayaNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Communications, Navigation and Identification (CNI) Avionics For The F-35 Lightning IIDocument2 pagesCommunications, Navigation and Identification (CNI) Avionics For The F-35 Lightning IIjhawkes100% (1)

- Lecture - Notes17 - Economic Comparisons of Mutually Exclusive AlternativesDocument6 pagesLecture - Notes17 - Economic Comparisons of Mutually Exclusive AlternativesprofdanielNo ratings yet

- SYLLABUS For Field Study 1 - The Learner's Development and Environment by Prof. Eric Datu AgustinDocument5 pagesSYLLABUS For Field Study 1 - The Learner's Development and Environment by Prof. Eric Datu AgustinRoxane Rivera83% (12)

- Ch11 Kieso Ifrs Test BankDocument40 pagesCh11 Kieso Ifrs Test BankTrinh LêNo ratings yet

- ch11 PDFDocument39 pagesch11 PDFerylpaez89% (9)

- ch11 Doc PDF - 2 PDFDocument39 pagesch11 Doc PDF - 2 PDFRenzo RamosNo ratings yet

- PPE Depreciation & ImpairmentDocument25 pagesPPE Depreciation & ImpairmentSummer Star0% (1)

- CH 11Document40 pagesCH 11Corliss Ko100% (1)

- Lecture Notes Chapter 10 (2022) - Student VerDocument50 pagesLecture Notes Chapter 10 (2022) - Student VerThương Đỗ100% (1)

- Project Appraisal TechniquesDocument31 pagesProject Appraisal TechniquesRajeevAgrawal86% (7)

- Solved Problems Depreciation, Impairment and DepletionDocument22 pagesSolved Problems Depreciation, Impairment and DepletionCassandra Dianne Ferolino MacadoNo ratings yet

- Ias 36 - Impairment of Assets ObjectiveDocument9 pagesIas 36 - Impairment of Assets ObjectiveAbdullah Al Amin MubinNo ratings yet

- Eco Assign 2Document6 pagesEco Assign 2Muhammad MustafaNo ratings yet

- Evaluation MethodsDocument11 pagesEvaluation Methodshatem akeedyNo ratings yet

- Ias 16Document26 pagesIas 16Niharika MishraNo ratings yet

- IAS16 Defines Property, Plant and Equipment As "Tangible Items ThatDocument35 pagesIAS16 Defines Property, Plant and Equipment As "Tangible Items ThatMo HachimNo ratings yet

- Financial Statement Analysis-Test BankDocument41 pagesFinancial Statement Analysis-Test BankZyad MohamedNo ratings yet

- UntitledDocument145 pagesUntitleddhirajpironNo ratings yet

- Financial Management: A Project On Capital BudgetingDocument20 pagesFinancial Management: A Project On Capital BudgetingHimanshi SethNo ratings yet

- DepreciationDocument6 pagesDepreciationSYOUSUF45No ratings yet

- IPSAS 17 - Property, Plant and EquipmentDocument90 pagesIPSAS 17 - Property, Plant and EquipmentNassib SongoroNo ratings yet

- Capital BugetingDocument6 pagesCapital BugetingMichael ReyesNo ratings yet

- Appraisal Criteria - Capital BudgetingDocument50 pagesAppraisal Criteria - Capital BudgetingNitesh NagdevNo ratings yet

- Discount RateDocument2 pagesDiscount RateAngeline RamirezNo ratings yet

- BFJPIA Cup 1 - Theory of AccountsDocument7 pagesBFJPIA Cup 1 - Theory of AccountsAnne Lorrheine CasanosNo ratings yet

- The Financial Statement Analysis Test BankDocument27 pagesThe Financial Statement Analysis Test BankhtethtethlaingNo ratings yet

- Case Study RevisedDocument7 pagesCase Study Revisedbhardwaj_manish44100% (3)

- Chapter 3Document173 pagesChapter 3Maria HafeezNo ratings yet

- PpeDocument4 pagesPpeRed DerrNo ratings yet

- Midterm Exams ReviewDocument5 pagesMidterm Exams ReviewJeanette LampitocNo ratings yet

- Accounting TheoryDocument61 pagesAccounting TheoryxorelliNo ratings yet

- Depreciation: Depreciation Is A Term Used inDocument10 pagesDepreciation: Depreciation Is A Term Used inalbertNo ratings yet

- Answer Capital Investment Sw2Document38 pagesAnswer Capital Investment Sw2Xandae MempinNo ratings yet

- Topic 1 - MFRS116 - PpeDocument38 pagesTopic 1 - MFRS116 - PpeAmir DanialNo ratings yet

- Accounting 2 MarksDocument25 pagesAccounting 2 MarksM.Jenifer ShylajaNo ratings yet

- Chapter 8: Capital Budgeting Decisions-Part IiDocument18 pagesChapter 8: Capital Budgeting Decisions-Part IiAtaii Ckaa Ü LolzNo ratings yet

- Capital Bud GettingDocument27 pagesCapital Bud Gettingcindysia000No ratings yet

- 4E Analysis (Wed - 15-11-2023) - Final Mid-TermDocument32 pages4E Analysis (Wed - 15-11-2023) - Final Mid-TermahmedNo ratings yet

- Chapter 4Document52 pagesChapter 4XI MIPA 1 BILLY SURYAJAYANo ratings yet

- ADocument7 pagesATân NguyênNo ratings yet

- How To Make Capital Budgeting DecisionsDocument37 pagesHow To Make Capital Budgeting DecisionsMikezCimafrancaDiputadoNo ratings yet

- Chapter 8 - Non-Current AssetsDocument22 pagesChapter 8 - Non-Current AssetsMei MeiNo ratings yet

- OrcaDocument201 pagesOrcaFritzie Ann ZartigaNo ratings yet

- Multiple ChoiceDocument11 pagesMultiple ChoiceAnna Carlaine PosadasNo ratings yet

- The Accounting Rate of Return - (ARR)Document2 pagesThe Accounting Rate of Return - (ARR)Kathlaine Mae ObaNo ratings yet

- Chapter 6: Accounting Adjustments IIDocument9 pagesChapter 6: Accounting Adjustments IIetextbooks lkNo ratings yet

- Financial Statement Analysis-Test BankDocument35 pagesFinancial Statement Analysis-Test BankSameh Yassien100% (1)

- Property, Plant and EquipmentDocument35 pagesProperty, Plant and EquipmentNimona BeyeneNo ratings yet

- What Are The Main Types of Depreciation Methods?: #1 Straight-Line Depreciation MethodDocument23 pagesWhat Are The Main Types of Depreciation Methods?: #1 Straight-Line Depreciation MethodShamarat RahmanNo ratings yet

- Hapter: Investments in Noncurrent Operating Assets-Utilization and RetirementDocument43 pagesHapter: Investments in Noncurrent Operating Assets-Utilization and RetirementMaskter TwinsetsNo ratings yet

- Depreciation, Impairments, and Depletion: Multiple ChoiceDocument36 pagesDepreciation, Impairments, and Depletion: Multiple ChoiceElene SamnidzeNo ratings yet

- Ifm10 Ch13 ImDocument14 pagesIfm10 Ch13 ImSheriYar KhattakNo ratings yet

- TB Ch08 Capital Budgetting Decisions Part 2Document13 pagesTB Ch08 Capital Budgetting Decisions Part 2kimberly agravante100% (1)

- Module 12 PAS 36Document6 pagesModule 12 PAS 36Jan JanNo ratings yet

- IAS-16 (Property, Plant & Equipment)Document20 pagesIAS-16 (Property, Plant & Equipment)Nazmul HaqueNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- T REC G.984.4 200911 I!Amd2!PDF EDocument164 pagesT REC G.984.4 200911 I!Amd2!PDF ERoberto CardosoNo ratings yet

- Take Stunning Natural Light PortraitsDocument7 pagesTake Stunning Natural Light Portraitsjeffreygovender5745100% (1)

- Systems Neuroscience and Rehabilitation (Surjo R. Soekadar, Niels Birbaumer Etc.) (Z-Library)Document154 pagesSystems Neuroscience and Rehabilitation (Surjo R. Soekadar, Niels Birbaumer Etc.) (Z-Library)Ashish RaiNo ratings yet

- University of The Philippines Open University IS 295a: Faculty-In-ChargeDocument3 pagesUniversity of The Philippines Open University IS 295a: Faculty-In-ChargeFernan EnadNo ratings yet

- Differences Between Fresnel and Fraunhofer Diffraction PatternsDocument5 pagesDifferences Between Fresnel and Fraunhofer Diffraction PatternsAndrea EspinosaNo ratings yet

- EcologyDocument4 pagesEcologyAbdullahi MohamedNo ratings yet

- Marketing Plan Presentation RubricsDocument2 pagesMarketing Plan Presentation RubricsisabeloroseangelNo ratings yet

- Direct To FCE WorksheetsDocument64 pagesDirect To FCE WorksheetsElena MelenoiDe100% (2)

- Art NouveauDocument73 pagesArt NouveauRuqayya AhmedNo ratings yet

- 2017 Acacia Annual Report AccountsDocument180 pages2017 Acacia Annual Report AccountsDeus SindaNo ratings yet

- Coral Triangle PhiDocument105 pagesCoral Triangle PhiDenny Boy MochranNo ratings yet

- IRR RA 9292 - ECE LawDocument30 pagesIRR RA 9292 - ECE LawSchuldich SchwarzNo ratings yet

- SR-750 C 611762 GB 1034-4Document12 pagesSR-750 C 611762 GB 1034-4ck_peyNo ratings yet

- Ardrox AV 30: Material Safety Data SheetDocument5 pagesArdrox AV 30: Material Safety Data SheetMueed LiaqatNo ratings yet

- Listado de Gruas: Item Marca Modelo Serial MotorDocument2 pagesListado de Gruas: Item Marca Modelo Serial MotorOliver SemecoNo ratings yet

- Aba For Slps Bcba AutismoDocument48 pagesAba For Slps Bcba AutismoRafael AlvesNo ratings yet

- C32 - PFRS 5 Noncurrent Asset Held For SaleDocument4 pagesC32 - PFRS 5 Noncurrent Asset Held For SaleAllaine ElfaNo ratings yet

- Sf4 ConceptDocument10 pagesSf4 ConceptAndrás FarkasNo ratings yet

- Intermediate PhonicsDocument128 pagesIntermediate PhonicsRIchard Longmire-BownsNo ratings yet

- Play Format ExampleDocument3 pagesPlay Format ExamplemegbenignoNo ratings yet

- WS Emergency Echo SYMCARD 2022Document33 pagesWS Emergency Echo SYMCARD 2022IndRa KaBhuomNo ratings yet

- Strap Grid Tubular Plate - A New Positive Plate For Lead-Acid BatteriesDocument36 pagesStrap Grid Tubular Plate - A New Positive Plate For Lead-Acid Batteriesantony2288No ratings yet

- Trouble Shooting FilingDocument6 pagesTrouble Shooting FilingTripurari KumarNo ratings yet

- Collaborative Journalling As A Professional Development ToolDocument13 pagesCollaborative Journalling As A Professional Development ToolBurcu SenerNo ratings yet

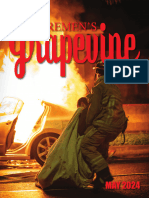

- May 2024Document64 pagesMay 2024Eric SantiagoNo ratings yet

- Maintenance ScheduleDocument12 pagesMaintenance ScheduleVanHoangNo ratings yet

- The Coat of ArmsDocument3 pagesThe Coat of Armsnaseeb100% (1)