Professional Documents

Culture Documents

RWJ Chap 15 No 1

RWJ Chap 15 No 1

Uploaded by

kntl fvck0 ratings0% found this document useful (0 votes)

20 views1 pageA company issued new shares at $70 each through a rights offering to existing shareholders. The calculations show the new market value is $36.2 million based on 400,000 existing shares valued at $81 each and 60,000 new shares. Shareholders would need 6.67 rights to purchase one new share at $80 each. The price per share after the offering is $78.70. The value of each right is $1.30, the difference between the price paid and the post-offering price. Rights offerings protect existing shareholders' proportional ownership and guard against underpricing new shares.

Original Description:

Original Title

rwj chap 15 no 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA company issued new shares at $70 each through a rights offering to existing shareholders. The calculations show the new market value is $36.2 million based on 400,000 existing shares valued at $81 each and 60,000 new shares. Shareholders would need 6.67 rights to purchase one new share at $80 each. The price per share after the offering is $78.70. The value of each right is $1.30, the difference between the price paid and the post-offering price. Rights offerings protect existing shareholders' proportional ownership and guard against underpricing new shares.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

20 views1 pageRWJ Chap 15 No 1

RWJ Chap 15 No 1

Uploaded by

kntl fvckA company issued new shares at $70 each through a rights offering to existing shareholders. The calculations show the new market value is $36.2 million based on 400,000 existing shares valued at $81 each and 60,000 new shares. Shareholders would need 6.67 rights to purchase one new share at $80 each. The price per share after the offering is $78.70. The value of each right is $1.30, the difference between the price paid and the post-offering price. Rights offerings protect existing shareholders' proportional ownership and guard against underpricing new shares.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

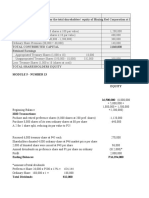

1.

a New market value = 400,000($81) + 60,000($70) = $36,200,000

b. Number of rights needed = 400,000 old shares/60,000 new shares = 6.67 rights per new share

c. PX = $36,200,000/(400,000 + 60,000) = $78.70

d. Value of a right = $80.00 – 78.70 = $1.30

e. A rights offering usually costs less, it protects the proportionate interests of existing share-holders

and also protects against underpricing.

You might also like

- MECN430 Homework 1Document6 pagesMECN430 Homework 1Ramon GondimNo ratings yet

- Initial Margin $12,840 - $6,100 $6,740Document1 pageInitial Margin $12,840 - $6,100 $6,740LiamNo ratings yet

- Sol. Man. - Chapter 10 She 1Document9 pagesSol. Man. - Chapter 10 She 1Miguel AmihanNo ratings yet

- Raising CapitalDocument3 pagesRaising Capitaljauharotul izzatiNo ratings yet

- CH 15Document8 pagesCH 15Ansley0% (1)

- LectureDocument5 pagesLectureKarenNo ratings yet

- Midterm Examination AnswersDocument3 pagesMidterm Examination AnswersMilani Joy LazoNo ratings yet

- Fin SolutionsDocument9 pagesFin SolutionsTania Kalila HernandezNo ratings yet

- Tutorial No. 3 - CVP Analysis Answer Section: 1. ANS: B 2. ANS: A 3. ANS: B 4. ANS: A 5Document3 pagesTutorial No. 3 - CVP Analysis Answer Section: 1. ANS: B 2. ANS: A 3. ANS: B 4. ANS: A 5Hu-Ann KeymistNo ratings yet

- Assignment 1 (Anggelina Ariresta)Document1 pageAssignment 1 (Anggelina Ariresta)anggelina arirestaNo ratings yet

- Chapter 10 Shareholders' 1Document8 pagesChapter 10 Shareholders' 1Thalia Rhine AberteNo ratings yet

- Soal 1: Jurnal Penerbitan Satu Lembar Saham BiasaDocument11 pagesSoal 1: Jurnal Penerbitan Satu Lembar Saham Biasakevin phillipsNo ratings yet

- Derivations: - ComputationalDocument5 pagesDerivations: - ComputationalAndrin LlemosNo ratings yet

- Buying and Selling SecuritiesDocument6 pagesBuying and Selling SecuritiesChaituNo ratings yet

- Kunci Jawaban Chapter 03 - EquityDocument3 pagesKunci Jawaban Chapter 03 - EquityHilma Nahla SawalyaNo ratings yet

- ActivityDocument1 pageActivitySanyln AclaNo ratings yet

- Solution-Corporate FinanceDocument4 pagesSolution-Corporate FinanceNHI NGUYEN PHAM YNo ratings yet

- Scanner1 of Eco and AccountDocument2 pagesScanner1 of Eco and AccountUndead banNo ratings yet

- Tutorial 2 - SolutionsDocument8 pagesTutorial 2 - SolutionsstoryNo ratings yet

- Workshop2 SEOs SolutionsDocument10 pagesWorkshop2 SEOs Solutionsriyat0601No ratings yet

- Problem 16 18Document19 pagesProblem 16 18Shaira BugayongNo ratings yet

- Tutorial 11 (Answers) : Answer 1Document2 pagesTutorial 11 (Answers) : Answer 1rifat AlamNo ratings yet

- CF - Questions and Practice Problems - Chapter 20Document3 pagesCF - Questions and Practice Problems - Chapter 20Mai PhạmNo ratings yet

- (GR1) TCDN - Case 3Document19 pages(GR1) TCDN - Case 3Thắng Vũ Nguyễn ĐứcNo ratings yet

- D E+ D X RD+ E D+ E X : Return Richard ExpectDocument5 pagesD E+ D X RD+ E D+ E X : Return Richard ExpectSu Suan TanNo ratings yet

- 1920-1-ACCO 20073 - Solutions To STD Cost ProblemsDocument4 pages1920-1-ACCO 20073 - Solutions To STD Cost ProblemsRaegharp Constantioul100% (1)

- 6 - Solutions To 13 and 14 CHPT 20Document2 pages6 - Solutions To 13 and 14 CHPT 20abguyNo ratings yet

- Prelim - Midterm Financial MarketsDocument2 pagesPrelim - Midterm Financial Marketsadarose romaresNo ratings yet

- STANDARD COSTING With GP VARIANCE ANALYSIS KEY ANSWERSDocument19 pagesSTANDARD COSTING With GP VARIANCE ANALYSIS KEY ANSWERSaziel caith florentinNo ratings yet

- M&A Lecture 2Document21 pagesM&A Lecture 2fady.shawky30No ratings yet

- Module 3-2 Business ComDocument2 pagesModule 3-2 Business ComChinee CastilloNo ratings yet

- Module 5 Exercises 3 and 13Document3 pagesModule 5 Exercises 3 and 13Reign TambasacanNo ratings yet

- Dac 318 AssignmentDocument6 pagesDac 318 AssignmentLenny MuttsNo ratings yet

- Payout Policy MathDocument2 pagesPayout Policy MathAAM26No ratings yet

- Untitled Document PDFDocument13 pagesUntitled Document PDFChinish KalraNo ratings yet

- Exercise Activity 1Document6 pagesExercise Activity 1ScribdTranslationsNo ratings yet

- So The Net Present Value of The Project $7,600,000.00Document4 pagesSo The Net Present Value of The Project $7,600,000.00Thasya Ivonne HaldisNo ratings yet

- Chapter 1&2 AnswerDocument2 pagesChapter 1&2 AnswerSwee Yi LeeNo ratings yet

- Answer CHT 3 HWDocument7 pagesAnswer CHT 3 HWscamtesterNo ratings yet

- Derivations: - ComputationalDocument3 pagesDerivations: - ComputationalEdiane QuilezaNo ratings yet

- Investment Analysis Portfolio Management Solutions Manual PDF For PDF Solutions Manual and Test Bank Investment List Keith C Brown Solution Manual ForDocument2 pagesInvestment Analysis Portfolio Management Solutions Manual PDF For PDF Solutions Manual and Test Bank Investment List Keith C Brown Solution Manual ForKofi Ewoenam100% (1)

- 4277187Document4 pages4277187mohitgaba19No ratings yet

- Akmen 3Document4 pagesAkmen 3Ramadhani AwwaliaNo ratings yet

- Business Decisions Using Cost Behaviour: Cost-Volume-Profit AnalysisDocument11 pagesBusiness Decisions Using Cost Behaviour: Cost-Volume-Profit Analysismishabmoomin1524No ratings yet

- Untitled Document PDFDocument14 pagesUntitled Document PDFChinish KalraNo ratings yet

- PROBLEM SET 2 - Increase Familiarity With Synergy Split and Share Exchange OffersDocument3 pagesPROBLEM SET 2 - Increase Familiarity With Synergy Split and Share Exchange OffersMarkus TNo ratings yet

- FOH Rate Rp.180.000.000: Jawaban Soal 1: 1. PT. Kopindo Persada RP 6.000 / DLH 30.000 Traditional CostingDocument4 pagesFOH Rate Rp.180.000.000: Jawaban Soal 1: 1. PT. Kopindo Persada RP 6.000 / DLH 30.000 Traditional Costingabd storeNo ratings yet

- FCF 7the Chapter16 StuDocument13 pagesFCF 7the Chapter16 StuTalha Bin AsimNo ratings yet

- FERNANDEZ - Solutions For Problem 4-7 BVPSDocument4 pagesFERNANDEZ - Solutions For Problem 4-7 BVPSJeric TorionNo ratings yet

- Kelompok 6 Latihan Soal EquityDocument7 pagesKelompok 6 Latihan Soal EquityTria SalzanabillaNo ratings yet

- Accounting For Biological Asset Tutorial IVDocument5 pagesAccounting For Biological Asset Tutorial IVJohn TomNo ratings yet

- Chapter 11 DrillsDocument6 pagesChapter 11 DrillsBaderNo ratings yet

- Exercise 1 Fs AnalysisDocument2 pagesExercise 1 Fs AnalysisMishael PeterNo ratings yet

- Assign Chap 2Document6 pagesAssign Chap 2Mustafa MuhamedNo ratings yet

- Chapter16 Buenaventura MC QuestionsDocument5 pagesChapter16 Buenaventura MC QuestionsAnonnNo ratings yet

- Week 2: Solutions To Homework Problems: BKM Chapter 3Document4 pagesWeek 2: Solutions To Homework Problems: BKM Chapter 3Dean PhamNo ratings yet

- واجب متوسطه 2 مسائل الواجب الثالثDocument5 pagesواجب متوسطه 2 مسائل الواجب الثالثmode.xp.jamelNo ratings yet

- Module 2: Assignment: PROBLEM 9 - Treasury SharesDocument8 pagesModule 2: Assignment: PROBLEM 9 - Treasury SharesYvonne DuyaoNo ratings yet

- Equity Financing SolutionsDocument2 pagesEquity Financing SolutionsSleepy marshmallowNo ratings yet

- Organizational TransformationDocument21 pagesOrganizational Transformationkntl fvckNo ratings yet

- Customer LoyaltyDocument9 pagesCustomer Loyaltykntl fvckNo ratings yet

- Strategic Human Resource Management and Organizational Performance: Mediating Role of Employee Well-Being in The Indian It IndustryDocument9 pagesStrategic Human Resource Management and Organizational Performance: Mediating Role of Employee Well-Being in The Indian It Industrykntl fvckNo ratings yet

- Effects of Micro Transactions On Video Games IndusDocument20 pagesEffects of Micro Transactions On Video Games Induskntl fvckNo ratings yet