Professional Documents

Culture Documents

Assignment Dividend Warrant

Assignment Dividend Warrant

Uploaded by

Muhammad Faizan0 ratings0% found this document useful (0 votes)

28 views1 pageThe document provides information about a dividend warrant received by Muhammad Faizan with ID number 9948. It defines dividends as a share of company profits distributed to shareholders based on their investment. A dividend warrant contains details like the company name, shareholder details, exercise price, and serves as a financial instrument that can be deposited into a bank account like a cheque. It expires after six months like a normal cheque and must be reissued by filling out a form with the company if not deposited within that time period.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides information about a dividend warrant received by Muhammad Faizan with ID number 9948. It defines dividends as a share of company profits distributed to shareholders based on their investment. A dividend warrant contains details like the company name, shareholder details, exercise price, and serves as a financial instrument that can be deposited into a bank account like a cheque. It expires after six months like a normal cheque and must be reissued by filling out a form with the company if not deposited within that time period.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

28 views1 pageAssignment Dividend Warrant

Assignment Dividend Warrant

Uploaded by

Muhammad FaizanThe document provides information about a dividend warrant received by Muhammad Faizan with ID number 9948. It defines dividends as a share of company profits distributed to shareholders based on their investment. A dividend warrant contains details like the company name, shareholder details, exercise price, and serves as a financial instrument that can be deposited into a bank account like a cheque. It expires after six months like a normal cheque and must be reissued by filling out a form with the company if not deposited within that time period.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

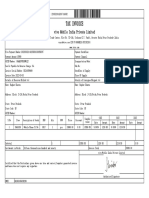

ASSIGNMENT

Name: Muhammad Faizan ID No. 9948

Dividend Warrant

Dividend is the share of profit distributed by company out of it’s earning to the company’s shareholders.

It is basically percentage earning of shareholders out of their investment in a company.

Dividends are mostly paid annually but can be quarterly or interim too.

Information of Dividend Warrant

A dividend warrant normally contains the following information:

S.N Information Meaning

o

1 Name of the company Complete legal name of a firm, the title by which a formally

organized or incorporated firm is known as a legal entity

2 Bank Details Identify a bank account, and are used when making or

receiving a payment, now especially electronically

3 Unique Warrant number it is a unique identifier unlike a collar number

4 Details of shareholders Shareholders are the owners of companies limited by shares

5 Exercise price The exercise price is the price at which an underlying security

can be purchased or sold when trading a call or put option,

respectively

6 Dividend warrants are turned A dividend paper warrant is a financial instrument in form of

into cash just like a cheque a cheque that is issued by a quoted company to its

shareholders through which dividend is paid to them

7 You just need to deposit it A deposit slip is a small paper form that a bank customer

with a filled bank deposit slip includes when depositing funds into a bank account. A

in the bank in your Bank deposit slip, by definition, contains the date, the name of the

Account depositor, the depositor's account number, and the amounts

being deposited

8 On expiry of warrant you need Warrants are generally issued by the company itself, not a

to fill the re issuance form and third party, tend to have much longer periods between issue

re issue the warrant from the and expiration

company

9 It also has an expiry date. It is Unless a cheque is presented within a reasonable time after

normally valid for six months the ostensible date of its issue, it should not be honoured.

just like a normal cheque Generally, speaking a cheque presented more than six

months after the ostensible date of its issue

10 It is very liquid (when An asset that can readily be converted into cash is similar to

received) and can readily be cash itself because the asset can be sold with little impact on

converted into cash its value

You might also like

- 2023 UBS AC Prep MaterialDocument6 pages2023 UBS AC Prep MaterialNora PetruțaNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- State Investment House Vs Court of Appeals (Case Digest)Document3 pagesState Investment House Vs Court of Appeals (Case Digest)Maria Anna M Legaspi50% (2)

- Assignment Dividend WarrantDocument1 pageAssignment Dividend WarrantMuhammad FaizanNo ratings yet

- Assignment Dividend WarrantDocument1 pageAssignment Dividend WarrantMuhammad FaizanNo ratings yet

- Assignment Dividend WarrantDocument1 pageAssignment Dividend WarrantMuhammad FaizanNo ratings yet

- Name: Domingo, Sarah Nicole P. Abm-1 Activity-2 AHMS-1Document2 pagesName: Domingo, Sarah Nicole P. Abm-1 Activity-2 AHMS-1DOMINGO SARAH NICOLE P.No ratings yet

- Dividend Policy & Long-Term Financing Overview: Session 10Document17 pagesDividend Policy & Long-Term Financing Overview: Session 10May CancinoNo ratings yet

- Unit 4 The Financing DecisionDocument6 pagesUnit 4 The Financing Decisionajith.yamaneNo ratings yet

- Debentures: Specialised AccountingDocument18 pagesDebentures: Specialised AccountingFirezegi TeklehaymanotNo ratings yet

- Redemption of Debentures PDFDocument22 pagesRedemption of Debentures PDFVikas MandloiNo ratings yet

- Module 3Document22 pagesModule 3Noel S. De Juan Jr.No ratings yet

- FM GA2 FinalDocument15 pagesFM GA2 FinalTulsi GovaniNo ratings yet

- Week 6 and Week 7Document49 pagesWeek 6 and Week 7Muneeb AmanNo ratings yet

- Borrowing Powers (Debentures and Charges) : Dr. Bharat G. KauraniDocument25 pagesBorrowing Powers (Debentures and Charges) : Dr. Bharat G. Kauranishubham kumarNo ratings yet

- Business Finance Project - DebenturesDocument16 pagesBusiness Finance Project - DebenturesMuhammad TalhaNo ratings yet

- DEBENTURESDocument6 pagesDEBENTURESsuraj singh officialNo ratings yet

- Chapter 5 Activities Credit and CollectionDocument4 pagesChapter 5 Activities Credit and CollectionhtagleNo ratings yet

- External vs. Internal Finance Long-Term vs. Short-Term Finance Equity vs. Debt Finance Factors That Influence The Financing DecisionDocument18 pagesExternal vs. Internal Finance Long-Term vs. Short-Term Finance Equity vs. Debt Finance Factors That Influence The Financing Decisionnurul_jafriNo ratings yet

- Issue of DebentureDocument17 pagesIssue of DebentureCma Vikas RajpalaniNo ratings yet

- Infographic Plan - Bugayong, Trisha Karylle L.Document1 pageInfographic Plan - Bugayong, Trisha Karylle L.Trisha BugayongNo ratings yet

- Bank Accounts and Credit Securities: Lesson 2: FM 42 Investment and Portfolio ManagementDocument25 pagesBank Accounts and Credit Securities: Lesson 2: FM 42 Investment and Portfolio ManagementSarah Jane OrillosaNo ratings yet

- 19 DebenturesDocument2 pages19 DebenturesTEXTILIONSNo ratings yet

- Negotiable InstrumentsDocument3 pagesNegotiable InstrumentsMuhammadUmarNazirChishtiNo ratings yet

- Sources of Capital: Term Structure of FundsDocument5 pagesSources of Capital: Term Structure of FundsRasheed LawalNo ratings yet

- BBA VI TH Sem Financial Institution & MarketsDocument2 pagesBBA VI TH Sem Financial Institution & MarketsJordan ThapaNo ratings yet

- Equity Securities Market Final05272023Document39 pagesEquity Securities Market Final05272023Bea Bianca MadlaNo ratings yet

- Investment LawDocument90 pagesInvestment LawROHIT SINGH RajputNo ratings yet

- debenturesDocument11 pagesdebenturesizahharis3No ratings yet

- Meaning of DebenturesDocument13 pagesMeaning of DebenturesAmal DevadasNo ratings yet

- Different Types of Debentures and Their UseDocument10 pagesDifferent Types of Debentures and Their UseMansangat Singh KohliNo ratings yet

- Non Non Non Non - Current Liabilities Current Liabilities Current Liabilities Current LiabilitiesDocument93 pagesNon Non Non Non - Current Liabilities Current Liabilities Current Liabilities Current LiabilitiesBantamkak FikaduNo ratings yet

- Convertible Note (UPenn)Document14 pagesConvertible Note (UPenn)Robert ScottNo ratings yet

- Introduction To Business Finance: Anila DeviDocument30 pagesIntroduction To Business Finance: Anila DeviM Hamza SultanNo ratings yet

- Term Paper On DebentureDocument13 pagesTerm Paper On DebentureAakanchhya BhattaNo ratings yet

- KFC Project CorpDocument14 pagesKFC Project CorpShreyaNo ratings yet

- Finance Research Paper2Document11 pagesFinance Research Paper2NITYA JHANWARNo ratings yet

- Credit InstrumentsDocument67 pagesCredit InstrumentsAnne Gatchalian100% (2)

- (Issue) Key Terms and Chapter Summary-8Document2 pages(Issue) Key Terms and Chapter Summary-8Gyro SplashNo ratings yet

- Participation in The Market: A Portion ofDocument5 pagesParticipation in The Market: A Portion ofRonah Abigail BejocNo ratings yet

- Sources of Financing To Non-GovtDocument14 pagesSources of Financing To Non-GovtCorolla SedanNo ratings yet

- Creditorship Securities or DebenturesDocument6 pagesCreditorship Securities or DebenturesAditya Sawant100% (1)

- AccountsDocument6 pagesAccountsAaditya KumarNo ratings yet

- Topic 4 - Sources of Finance - BasicsDocument36 pagesTopic 4 - Sources of Finance - BasicsSandeepa KaurNo ratings yet

- Deb An TuresDocument10 pagesDeb An TuresWeNo ratings yet

- Genmath Reviewer Jes A Q2Document23 pagesGenmath Reviewer Jes A Q2pr.nc.ss.abad28No ratings yet

- Script For CMCP ReportingDocument5 pagesScript For CMCP ReportingTrisha Mariz CayagoNo ratings yet

- Learning Material 5Document15 pagesLearning Material 5jdNo ratings yet

- Zaki Ali Syjc-J Roll No-1909Document11 pagesZaki Ali Syjc-J Roll No-1909Zain aliNo ratings yet

- Securities Regulation CodeDocument118 pagesSecurities Regulation CodedasdsadsadasdasdNo ratings yet

- 2 Types of SecuritiesDocument2 pages2 Types of SecuritiesMark MatyasNo ratings yet

- Non-Current LiabilitiesDocument74 pagesNon-Current LiabilitiesHawi BerhanuNo ratings yet

- Bonds PayableDocument2 pagesBonds PayableanonymousjoeyNo ratings yet

- Fis C1Document17 pagesFis C1Eman SaeedNo ratings yet

- Stock and BondsDocument14 pagesStock and Bondsvince scottNo ratings yet

- Lesson - Sources of FundsDocument14 pagesLesson - Sources of FundsJohn Paul GonzalesNo ratings yet

- Chapter 5 Non-Current Liabilities-Kieso IfrsDocument67 pagesChapter 5 Non-Current Liabilities-Kieso IfrsAklil TeganewNo ratings yet

- Treasury 4Document22 pagesTreasury 4MpNo ratings yet

- Borrowed Fund-Long Term Source of FinanceDocument13 pagesBorrowed Fund-Long Term Source of FinanceAizaz AlamNo ratings yet

- Chapter 16, TeroDocument15 pagesChapter 16, TeroJurie MayNo ratings yet

- Chapter 5 DiscussionsDocument5 pagesChapter 5 DiscussionsLeonisa TorinoNo ratings yet

- Waiting For Godot by Samuel BeckettDocument13 pagesWaiting For Godot by Samuel BeckettMuhammad FaizanNo ratings yet

- CNG Filling Station2Document28 pagesCNG Filling Station2Muhammad FaizanNo ratings yet

- WACC ExamplesDocument2 pagesWACC ExamplesMuhammad FaizanNo ratings yet

- WACC ExamplesDocument2 pagesWACC ExamplesMuhammad FaizanNo ratings yet

- Assignment Dividend WarrantDocument1 pageAssignment Dividend WarrantMuhammad FaizanNo ratings yet

- Assignment Dividend WarrantDocument1 pageAssignment Dividend WarrantMuhammad FaizanNo ratings yet

- Assignment Dividend WarrantDocument1 pageAssignment Dividend WarrantMuhammad FaizanNo ratings yet

- WACC ExamplesDocument2 pagesWACC ExamplesMuhammad FaizanNo ratings yet

- ME51N-Create A Purchase Requisition For ServicesDocument6 pagesME51N-Create A Purchase Requisition For ServicesAndrea EllisNo ratings yet

- PTBNISecurities FixedIncomeDailyReport-29March2021 Mar 28 2021Document7 pagesPTBNISecurities FixedIncomeDailyReport-29March2021 Mar 28 2021Dylan AdrianNo ratings yet

- On Social Cost Benefit Analysis by Anup Kumar OjhaDocument15 pagesOn Social Cost Benefit Analysis by Anup Kumar Ojhaanupojha0% (1)

- Mock Exam Life Insurance Actuarial Controlling 1Document9 pagesMock Exam Life Insurance Actuarial Controlling 1david AbotsitseNo ratings yet

- 054/DM/18 (Turn OverDocument14 pages054/DM/18 (Turn OverkumloveNo ratings yet

- Tax Invoice: Vivo Mobile India Private LimitedDocument1 pageTax Invoice: Vivo Mobile India Private LimitedRaghav SharmaNo ratings yet

- Introduction To Investments Prof. S G Badrinath Rates of Return-Review and MoreDocument2 pagesIntroduction To Investments Prof. S G Badrinath Rates of Return-Review and MoreAneesh KrishnaNo ratings yet

- Investor Agreement FormatDocument23 pagesInvestor Agreement FormatMay AdvNo ratings yet

- Feizi 2016 The Impact of The Financial Distress On Tax Avoidance in Listed FirmsDocument10 pagesFeizi 2016 The Impact of The Financial Distress On Tax Avoidance in Listed Firmsgiorgos1978No ratings yet

- BSE Limited National Stock Exchange of India LimitedDocument390 pagesBSE Limited National Stock Exchange of India LimitedDivyank SharmaNo ratings yet

- Act Q4Document12 pagesAct Q4Fatima Elsan OrillanNo ratings yet

- Book 1Document6 pagesBook 1Jitendra kumarNo ratings yet

- Capital Structure Problems AssignmentDocument3 pagesCapital Structure Problems AssignmentRamya Gowda100% (2)

- Sample Paper 2Document15 pagesSample Paper 2TrostingNo ratings yet

- Torts CasesDocument45 pagesTorts CasesMary Therese Gabrielle EstiokoNo ratings yet

- How To Start Trading: The No-Bs GuideDocument42 pagesHow To Start Trading: The No-Bs GuideAli Naqvi100% (1)

- Pre-Eliminary ImplementationDocument10 pagesPre-Eliminary Implementationyosdi harmenNo ratings yet

- Bond Fundamentals, Valuation and Bond Portfolio ManagementDocument60 pagesBond Fundamentals, Valuation and Bond Portfolio ManagementRinku KumarNo ratings yet

- Valencia FBT Chapter 6 5th EditionDocument8 pagesValencia FBT Chapter 6 5th EditionJacob AcostaNo ratings yet

- CH 22 - 26Document43 pagesCH 22 - 26Mahammad AliyevNo ratings yet

- For The Last Round, My Comments Here Are Going To Be Back To BasicsDocument56 pagesFor The Last Round, My Comments Here Are Going To Be Back To BasicsRahul SinghNo ratings yet

- ABDC Journal Quality List 2013Document43 pagesABDC Journal Quality List 2013Sindh Jobs HelperNo ratings yet

- Introduction To InvestmentDocument12 pagesIntroduction To Investmentyusnifarina100% (1)

- Dse MKT Rep 7.03.2022Document6 pagesDse MKT Rep 7.03.2022Antony KashubeNo ratings yet

- Freddie Mac AccountingDocument2 pagesFreddie Mac AccountingKusum MachalNo ratings yet

- 04 - STOCKS AND THEIR VALUATION - PROBLEMS With AnswersDocument5 pages04 - STOCKS AND THEIR VALUATION - PROBLEMS With AnswersMerr Fe Painagan100% (3)

- Financial Statement (Without Adjustments) 03 - Class Notes - (Aarambh 11th Commerce)Document13 pagesFinancial Statement (Without Adjustments) 03 - Class Notes - (Aarambh 11th Commerce)Keshav MarwahNo ratings yet

- Rich and Ppor Dad BookDocument1 pageRich and Ppor Dad BookŤŕī ŚhāñNo ratings yet