Professional Documents

Culture Documents

Corporate Accounting: Chapter - Esop

Corporate Accounting: Chapter - Esop

Uploaded by

Prachi PatwariCopyright:

Available Formats

You might also like

- Strategic Compensation in Canada Canadian 6th Edition Long Solutions ManualDocument7 pagesStrategic Compensation in Canada Canadian 6th Edition Long Solutions Manualmaximusnhator1100% (28)

- Workplace: 5 Language S AppreciationDocument49 pagesWorkplace: 5 Language S AppreciationIrma NosadseNo ratings yet

- Fall Protection Exam - Worksite Safety2Document6 pagesFall Protection Exam - Worksite Safety2Ian Jeff Landingin Dumayas0% (1)

- Problems - Share-Based PaymentsDocument3 pagesProblems - Share-Based PaymentshukaNo ratings yet

- Problems SBPDocument3 pagesProblems SBPSaurabh SinghNo ratings yet

- 1672494147Ch - 3 Accounting For Employee Stock Option Plans PDFDocument2 pages1672494147Ch - 3 Accounting For Employee Stock Option Plans PDFAnjali khanchandaniNo ratings yet

- ESOP Buyback LiquidationDocument36 pagesESOP Buyback LiquidationAbhishek GoenkaNo ratings yet

- Ch.3 Accounting of Employee Stock Option PlansDocument4 pagesCh.3 Accounting of Employee Stock Option PlansDeepthi R TejurNo ratings yet

- SharesDocument2 pagesSharesHannah Ann JacobNo ratings yet

- Extra Questions Added in Ind As 102Document2 pagesExtra Questions Added in Ind As 102Monu RaiNo ratings yet

- Advanced Accounting Test 3 CH 3 Unscheduled Nov 2023 Test PaperDocument5 pagesAdvanced Accounting Test 3 CH 3 Unscheduled Nov 2023 Test Paperdiyaj003No ratings yet

- Security Law Practical QuestionsDocument18 pagesSecurity Law Practical QuestionsIsha YadavNo ratings yet

- Hots CompanyDocument5 pagesHots CompanySaloni JainNo ratings yet

- Practice Sheet Issue of SharesDocument5 pagesPractice Sheet Issue of SharesAryan VermaNo ratings yet

- FR SBPDocument10 pagesFR SBPkandagatla prudhviiNo ratings yet

- Test Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingDocument8 pagesTest Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced Accountingmanish1318No ratings yet

- Share Capital Assignment PDFDocument6 pagesShare Capital Assignment PDFBHUMIKA JAINNo ratings yet

- Worksheet - Accounting For Share CapitalDocument6 pagesWorksheet - Accounting For Share CapitalPrisha SharmaNo ratings yet

- Class Assessment 3 - Class XII Accountancy (Sep 12)Document2 pagesClass Assessment 3 - Class XII Accountancy (Sep 12)Naresh RainaNo ratings yet

- 5share OptionsDocument21 pages5share OptionsnengNo ratings yet

- Financial Instruments Illustration 1Document10 pagesFinancial Instruments Illustration 1Deep KrishnaNo ratings yet

- Advanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversityDocument13 pagesAdvanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversitySaif Uddin33% (3)

- Numerical QuestionsDocument3 pagesNumerical QuestionsArchi JainNo ratings yet

- Staying Invested With Infosys LTD.:: Udayan DasDocument7 pagesStaying Invested With Infosys LTD.:: Udayan Dasgouri khanduallNo ratings yet

- PT I Acc Xii - 2023Document3 pagesPT I Acc Xii - 2023sindhuNo ratings yet

- CBSE Class 12 Accountancy - Issue of SharesDocument3 pagesCBSE Class 12 Accountancy - Issue of SharesSahyogNo ratings yet

- Worksheet-Issue of SharesDocument4 pagesWorksheet-Issue of SharesBhavika LargotraNo ratings yet

- Investment For Cap 11Document8 pagesInvestment For Cap 11binuNo ratings yet

- Class 12 Accountancy - Holiday AssignmentDocument4 pagesClass 12 Accountancy - Holiday AssignmentKritarth AgarwalNo ratings yet

- Ipo Very RecentDocument10 pagesIpo Very RecentJugal ShahNo ratings yet

- Share CapitalDocument10 pagesShare CapitalShreyas PremiumNo ratings yet

- Adv Acc - ESOPDocument3 pagesAdv Acc - ESOPrshyams165No ratings yet

- Corporate AccountingDocument7 pagesCorporate AccountingSuraksha SaharanNo ratings yet

- FA CH 4 PDF 2Document2 pagesFA CH 4 PDF 2DarrylNo ratings yet

- CA Inter Group 1 Accounts MarathonDocument33 pagesCA Inter Group 1 Accounts MarathonNikitaa SanghviNo ratings yet

- Adobe Scan May 13, 2024Document1 pageAdobe Scan May 13, 2024Rakesh AgarwalNo ratings yet

- Assignment -3 (1)Document1 pageAssignment -3 (1)sc1453869No ratings yet

- SHARESDocument5 pagesSHARESMohammad Tariq AnsariNo ratings yet

- Topic Wise Test Investment AccountsDocument2 pagesTopic Wise Test Investment AccountsChinmay GokhaleNo ratings yet

- Business Studies Handwritten Notes SPCCDocument94 pagesBusiness Studies Handwritten Notes SPCCkurdiyapiyush9No ratings yet

- CMSL ICSI All Question Papers Practical QuestionsDocument25 pagesCMSL ICSI All Question Papers Practical Questionskaranprajapatu9737No ratings yet

- This Study Resource Was: Date of RecordDocument8 pagesThis Study Resource Was: Date of RecordMarjorie PalmaNo ratings yet

- Ind AS 102 - Share Based Payment - QuestionsDocument3 pagesInd AS 102 - Share Based Payment - QuestionsKashika AgarwalNo ratings yet

- Options SumsDocument15 pagesOptions SumsTamarala SrimanNo ratings yet

- Guidance Notes 2Document12 pagesGuidance Notes 2bhaw_shNo ratings yet

- 162.materials 3.share - Based.payment 001Document2 pages162.materials 3.share - Based.payment 001jpbluejnNo ratings yet

- FR 2 New Question PaperDocument7 pagesFR 2 New Question PaperkrishNo ratings yet

- Problem Quizzes IntermediateDocument7 pagesProblem Quizzes IntermediateEngel QuimsonNo ratings yet

- IPCC MTP2 AccountingDocument7 pagesIPCC MTP2 AccountingBalaji SiddhuNo ratings yet

- Untitled DocumentDocument3 pagesUntitled Documentnyssapandey9No ratings yet

- 12qq 2015Document12 pages12qq 2015brainhub50No ratings yet

- COA Unit 2 Issue of Shares - ProblemsDocument3 pagesCOA Unit 2 Issue of Shares - ProblemsGayatri Prasad BirabaraNo ratings yet

- Shareholder's EquityDocument18 pagesShareholder's EquityTrisha TeNo ratings yet

- Accountancy GoodwillDocument5 pagesAccountancy GoodwillPrachi SanklechaNo ratings yet

- 1) AccountsDocument21 pages1) AccountsKrushna MateNo ratings yet

- CBSE 12th Accountancy 2014 Unsolved Paper Outside DelhiDocument7 pagesCBSE 12th Accountancy 2014 Unsolved Paper Outside DelhiAmlan ChakravortyNo ratings yet

- Bài kiểm tra trắc nghiệm chủ đề - Thanh toán bằng cổ phiếu - - Xem lại bài làmDocument13 pagesBài kiểm tra trắc nghiệm chủ đề - Thanh toán bằng cổ phiếu - - Xem lại bài làmAh TuanNo ratings yet

- 12 Accountancy Sample Paper 2014 04Document6 pages12 Accountancy Sample Paper 2014 04artisingh3412No ratings yet

- Issue of Right Shares and Bonus SharesDocument5 pagesIssue of Right Shares and Bonus Sharesnemewep527No ratings yet

- Problems On Redemption of Pref SharesDocument7 pagesProblems On Redemption of Pref SharesYashitha CaverammaNo ratings yet

- Index Funds & Stock Market Investing: A Beginner's Guide to Build Wealth with a Diversified Portfolio Using ETFs, Stock Picking, Technical Analysis, Options Trading, Penny Stocks, Dividends, and REITSFrom EverandIndex Funds & Stock Market Investing: A Beginner's Guide to Build Wealth with a Diversified Portfolio Using ETFs, Stock Picking, Technical Analysis, Options Trading, Penny Stocks, Dividends, and REITSRating: 5 out of 5 stars5/5 (43)

- Diwali Dhamaka 2020Document25 pagesDiwali Dhamaka 2020Prachi PatwariNo ratings yet

- Avendus Announces The First Close of Its Future Leaders Fund II With Aggregate Commitments of INR 584 CroreDocument2 pagesAvendus Announces The First Close of Its Future Leaders Fund II With Aggregate Commitments of INR 584 CrorePrachi PatwariNo ratings yet

- CapitalGainLossSummary pcpw052Document5 pagesCapitalGainLossSummary pcpw052Prachi PatwariNo ratings yet

- SAUDA DETAIL REPORT cl3Document1 pageSAUDA DETAIL REPORT cl3Prachi PatwariNo ratings yet

- DownloadedFile PDFDocument1 pageDownloadedFile PDFPrachi PatwariNo ratings yet

- Mid and Small Cap Model Portfolio: Objective StrategyDocument3 pagesMid and Small Cap Model Portfolio: Objective StrategyPrachi PatwariNo ratings yet

- BFL LAS Product Note INTERNAL 27.04.17Document3 pagesBFL LAS Product Note INTERNAL 27.04.17Prachi PatwariNo ratings yet

- ORDERSTATUS XSIP pcpw149 PDFDocument1 pageORDERSTATUS XSIP pcpw149 PDFPrachi PatwariNo ratings yet

- Product Note - Diwali Picks - 13 - Nov - 2020Document3 pagesProduct Note - Diwali Picks - 13 - Nov - 2020Prachi PatwariNo ratings yet

- CapitalGainLossSummary pcpw055Document6 pagesCapitalGainLossSummary pcpw055Prachi PatwariNo ratings yet

- Wipro Buy BackDocument1 pageWipro Buy BackPrachi PatwariNo ratings yet

- Memorendum FormatDocument2 pagesMemorendum Formathhhj0% (1)

- Pay Structures: Proprietary Content. ©great Learning. All Rights Reserved. Unauthorized Use or Distribution ProhibitedDocument23 pagesPay Structures: Proprietary Content. ©great Learning. All Rights Reserved. Unauthorized Use or Distribution Prohibitedaahana100% (1)

- A Study On Employee Engagement: September 2011Document10 pagesA Study On Employee Engagement: September 2011Chandan ChatterjeeNo ratings yet

- Scope of The StudyDocument3 pagesScope of The Studysavan50% (2)

- What Is Green HRMDocument3 pagesWhat Is Green HRMAlbert HangsingNo ratings yet

- In A Highly Collectivist Culture, Performance Appraisals Should Be Focused OnDocument10 pagesIn A Highly Collectivist Culture, Performance Appraisals Should Be Focused OnSOUVIK ROY MBA 2021-23 (Delhi)No ratings yet

- Attendance Quotas Infotype (2007) (SAP Library - Personnel Time Management (PT) )Document2 pagesAttendance Quotas Infotype (2007) (SAP Library - Personnel Time Management (PT) )Chetan ManjunathNo ratings yet

- Chapter 8Document9 pagesChapter 8ahmed100% (1)

- HRM Presntation On IncentiveDocument30 pagesHRM Presntation On Incentiveanubha_2304No ratings yet

- Ashwini Chavan HR ProjectDocument67 pagesAshwini Chavan HR ProjectDivyeshNo ratings yet

- HR CaseDocument1 pageHR CasePar KlengNo ratings yet

- Beijing-EAP - Q1Document2 pagesBeijing-EAP - Q1JitendraNo ratings yet

- An Analysis On Employee-Attrition in It Industry: Vinaya SarafDocument8 pagesAn Analysis On Employee-Attrition in It Industry: Vinaya Saraffurkaanmir719No ratings yet

- Work Life Balance QuestionnaireDocument4 pagesWork Life Balance QuestionnaireIndu SumeshNo ratings yet

- The Strategic Role of Human Resource ManagementDocument25 pagesThe Strategic Role of Human Resource Managementسارة ستوران.No ratings yet

- Disadvantage of 7 Principles of Quality Management: 1. Customer ForcusDocument4 pagesDisadvantage of 7 Principles of Quality Management: 1. Customer ForcusBãoNo ratings yet

- Business ResearchDocument32 pagesBusiness ResearchHazel BatitayNo ratings yet

- Criteria of Measuring QWLDocument10 pagesCriteria of Measuring QWLAbhishek SharmaNo ratings yet

- Dunn 12Document16 pagesDunn 12KenosiNo ratings yet

- Group Assignment 1 Amazon HRDocument3 pagesGroup Assignment 1 Amazon HRMohona Jahan MunaNo ratings yet

- Human Resource Planning: Topic 5Document17 pagesHuman Resource Planning: Topic 5HtetThinzarNo ratings yet

- Oam MidtermDocument50 pagesOam MidtermSantos Kim0% (1)

- Google's Plan For The Future of Work: Privacy Robots and Balloon WallsDocument4 pagesGoogle's Plan For The Future of Work: Privacy Robots and Balloon WallsoktaNo ratings yet

- Chapter 4Document4 pagesChapter 4Vhernyze Faye BruniaNo ratings yet

- Factors Affecting The Level of Employee Performance of Aa ManufacturingDocument22 pagesFactors Affecting The Level of Employee Performance of Aa ManufacturingKezia EscarioNo ratings yet

- Business Comm AssignmentDocument6 pagesBusiness Comm AssignmentTanvir Hasan SohanNo ratings yet

- 08 Staffing Organizations Case Study.Document2 pages08 Staffing Organizations Case Study.Sadaf IqbalNo ratings yet

Corporate Accounting: Chapter - Esop

Corporate Accounting: Chapter - Esop

Uploaded by

Prachi PatwariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Accounting: Chapter - Esop

Corporate Accounting: Chapter - Esop

Uploaded by

Prachi PatwariCopyright:

Available Formats

CORPORATE ACCOUNTING ACTUATORS

CHAPTER - ESOP

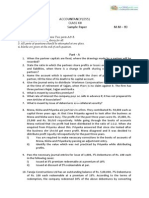

1. A Company grants 1,000 Options to its Employees on 01.04.2016 at ₹60. The Vesting

Period is two and a half years. The maximum Exercise Period is one year. Market Price

on that date is ₹90. Assume all the options were exercised on 31.12.18. Journalise, if

the Face Value of Equity Share is ₹10 per share.

2. A Company grants 1,000 Employees Stock Options on 01.04.2015 at ₹40, when the

Market price is ₹160. The Vesting Period is 2 ½ years and the Maximum Exercise

Period is 1 year. 300 Unvested Options lapse on 30.06.2017. 600 Options are

exercised on 30.06.2018. 100 Vested Options lapse at the end of the Exercise Period.

Pass Journal Entries giving suitable narrations.

3. A Company has its Share Capital divided into equity shares of ₹10 each. On 1st

October, it granted 20,000 Employees’ Stock Option at ₹50 per Share, when Market

Price was ₹120 per Share. The options were to be exercised between 10th December

and 31st March. The Employees exercised their options for ₹16,000 Shares only, and

the remaining options lapsed. The Company closes its books on 31st March every year.

Show Journal Entries as would appear in the Company’s books.

4. A Company has its Share Capital divided into Shares of ₹10 each. On 1st April, it

granted 5,000 Employees Stock Option at ₹50, when the Market Price was ₹140. The

Options were to be exercised between 1st December and 28th February. The Employees

exercised their Options for 4,800 Shares only, the remaining Options lapsed. Pass

necessary Journal Entries.

5. Choice Ltd grants 100 Stock Options to each of its 1,000 Employees for ₹20,

depending upon the Employees at the time of vesting of options. The Market Price of

the share is ₹50. These Options will vest at the end of the Year 1 if the earning of

Choice Ltd increases 16% or it will vest at the end of the second year if the average

earning of 2 years will increase by 15% or it will vest at the end of the third year if the

average earning of 3 years will increase by 10%. 5,000 Unvested Options lapsed on

Year 1 end. 4,000 Unvested Options lapsed on Year 2 end and finally 3,500 Unvested

Options lapsed on Year 3 end.

The earning in % of Choice Ltd are – for the (a) Year 1 – 14%, (b) Year 2 – 14%, (c) Year

3 – 7%.

850 employees exercised their vested options within a year and remaining options

were unexercised at the end of the contractual life. Pass Journal Entries for the above.

6. On 1st April, a Company offered 100 Shares to each of its 500 Employees at ₹40 per

Share. The Employees are given a month to decide whether or not to accept the offer.

The Shares issued under the plan shall be subject to lock-in on transfer for 3 years

from Grant Date. The Market Price of Shares of the company on the Grant Date is ₹50

per share. Due to post-vesting restrictions on transfer, the Fair Value of Shares issued

under the plan is estimated at ₹48 per Share.

CA Ankit Patwari Page 1

CORPORATE ACCOUNTING ACTUATORS

On 30th April, 400 Employees accepted the offer and paid ₹40 per Share purchased.

Nominal Value of each Share is ₹10. Record the issue of Shares in books of the

Company under the aforesaid Plan.

CA Ankit Patwari Page 2

You might also like

- Strategic Compensation in Canada Canadian 6th Edition Long Solutions ManualDocument7 pagesStrategic Compensation in Canada Canadian 6th Edition Long Solutions Manualmaximusnhator1100% (28)

- Workplace: 5 Language S AppreciationDocument49 pagesWorkplace: 5 Language S AppreciationIrma NosadseNo ratings yet

- Fall Protection Exam - Worksite Safety2Document6 pagesFall Protection Exam - Worksite Safety2Ian Jeff Landingin Dumayas0% (1)

- Problems - Share-Based PaymentsDocument3 pagesProblems - Share-Based PaymentshukaNo ratings yet

- Problems SBPDocument3 pagesProblems SBPSaurabh SinghNo ratings yet

- 1672494147Ch - 3 Accounting For Employee Stock Option Plans PDFDocument2 pages1672494147Ch - 3 Accounting For Employee Stock Option Plans PDFAnjali khanchandaniNo ratings yet

- ESOP Buyback LiquidationDocument36 pagesESOP Buyback LiquidationAbhishek GoenkaNo ratings yet

- Ch.3 Accounting of Employee Stock Option PlansDocument4 pagesCh.3 Accounting of Employee Stock Option PlansDeepthi R TejurNo ratings yet

- SharesDocument2 pagesSharesHannah Ann JacobNo ratings yet

- Extra Questions Added in Ind As 102Document2 pagesExtra Questions Added in Ind As 102Monu RaiNo ratings yet

- Advanced Accounting Test 3 CH 3 Unscheduled Nov 2023 Test PaperDocument5 pagesAdvanced Accounting Test 3 CH 3 Unscheduled Nov 2023 Test Paperdiyaj003No ratings yet

- Security Law Practical QuestionsDocument18 pagesSecurity Law Practical QuestionsIsha YadavNo ratings yet

- Hots CompanyDocument5 pagesHots CompanySaloni JainNo ratings yet

- Practice Sheet Issue of SharesDocument5 pagesPractice Sheet Issue of SharesAryan VermaNo ratings yet

- FR SBPDocument10 pagesFR SBPkandagatla prudhviiNo ratings yet

- Test Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingDocument8 pagesTest Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced Accountingmanish1318No ratings yet

- Share Capital Assignment PDFDocument6 pagesShare Capital Assignment PDFBHUMIKA JAINNo ratings yet

- Worksheet - Accounting For Share CapitalDocument6 pagesWorksheet - Accounting For Share CapitalPrisha SharmaNo ratings yet

- Class Assessment 3 - Class XII Accountancy (Sep 12)Document2 pagesClass Assessment 3 - Class XII Accountancy (Sep 12)Naresh RainaNo ratings yet

- 5share OptionsDocument21 pages5share OptionsnengNo ratings yet

- Financial Instruments Illustration 1Document10 pagesFinancial Instruments Illustration 1Deep KrishnaNo ratings yet

- Advanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversityDocument13 pagesAdvanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversitySaif Uddin33% (3)

- Numerical QuestionsDocument3 pagesNumerical QuestionsArchi JainNo ratings yet

- Staying Invested With Infosys LTD.:: Udayan DasDocument7 pagesStaying Invested With Infosys LTD.:: Udayan Dasgouri khanduallNo ratings yet

- PT I Acc Xii - 2023Document3 pagesPT I Acc Xii - 2023sindhuNo ratings yet

- CBSE Class 12 Accountancy - Issue of SharesDocument3 pagesCBSE Class 12 Accountancy - Issue of SharesSahyogNo ratings yet

- Worksheet-Issue of SharesDocument4 pagesWorksheet-Issue of SharesBhavika LargotraNo ratings yet

- Investment For Cap 11Document8 pagesInvestment For Cap 11binuNo ratings yet

- Class 12 Accountancy - Holiday AssignmentDocument4 pagesClass 12 Accountancy - Holiday AssignmentKritarth AgarwalNo ratings yet

- Ipo Very RecentDocument10 pagesIpo Very RecentJugal ShahNo ratings yet

- Share CapitalDocument10 pagesShare CapitalShreyas PremiumNo ratings yet

- Adv Acc - ESOPDocument3 pagesAdv Acc - ESOPrshyams165No ratings yet

- Corporate AccountingDocument7 pagesCorporate AccountingSuraksha SaharanNo ratings yet

- FA CH 4 PDF 2Document2 pagesFA CH 4 PDF 2DarrylNo ratings yet

- CA Inter Group 1 Accounts MarathonDocument33 pagesCA Inter Group 1 Accounts MarathonNikitaa SanghviNo ratings yet

- Adobe Scan May 13, 2024Document1 pageAdobe Scan May 13, 2024Rakesh AgarwalNo ratings yet

- Assignment -3 (1)Document1 pageAssignment -3 (1)sc1453869No ratings yet

- SHARESDocument5 pagesSHARESMohammad Tariq AnsariNo ratings yet

- Topic Wise Test Investment AccountsDocument2 pagesTopic Wise Test Investment AccountsChinmay GokhaleNo ratings yet

- Business Studies Handwritten Notes SPCCDocument94 pagesBusiness Studies Handwritten Notes SPCCkurdiyapiyush9No ratings yet

- CMSL ICSI All Question Papers Practical QuestionsDocument25 pagesCMSL ICSI All Question Papers Practical Questionskaranprajapatu9737No ratings yet

- This Study Resource Was: Date of RecordDocument8 pagesThis Study Resource Was: Date of RecordMarjorie PalmaNo ratings yet

- Ind AS 102 - Share Based Payment - QuestionsDocument3 pagesInd AS 102 - Share Based Payment - QuestionsKashika AgarwalNo ratings yet

- Options SumsDocument15 pagesOptions SumsTamarala SrimanNo ratings yet

- Guidance Notes 2Document12 pagesGuidance Notes 2bhaw_shNo ratings yet

- 162.materials 3.share - Based.payment 001Document2 pages162.materials 3.share - Based.payment 001jpbluejnNo ratings yet

- FR 2 New Question PaperDocument7 pagesFR 2 New Question PaperkrishNo ratings yet

- Problem Quizzes IntermediateDocument7 pagesProblem Quizzes IntermediateEngel QuimsonNo ratings yet

- IPCC MTP2 AccountingDocument7 pagesIPCC MTP2 AccountingBalaji SiddhuNo ratings yet

- Untitled DocumentDocument3 pagesUntitled Documentnyssapandey9No ratings yet

- 12qq 2015Document12 pages12qq 2015brainhub50No ratings yet

- COA Unit 2 Issue of Shares - ProblemsDocument3 pagesCOA Unit 2 Issue of Shares - ProblemsGayatri Prasad BirabaraNo ratings yet

- Shareholder's EquityDocument18 pagesShareholder's EquityTrisha TeNo ratings yet

- Accountancy GoodwillDocument5 pagesAccountancy GoodwillPrachi SanklechaNo ratings yet

- 1) AccountsDocument21 pages1) AccountsKrushna MateNo ratings yet

- CBSE 12th Accountancy 2014 Unsolved Paper Outside DelhiDocument7 pagesCBSE 12th Accountancy 2014 Unsolved Paper Outside DelhiAmlan ChakravortyNo ratings yet

- Bài kiểm tra trắc nghiệm chủ đề - Thanh toán bằng cổ phiếu - - Xem lại bài làmDocument13 pagesBài kiểm tra trắc nghiệm chủ đề - Thanh toán bằng cổ phiếu - - Xem lại bài làmAh TuanNo ratings yet

- 12 Accountancy Sample Paper 2014 04Document6 pages12 Accountancy Sample Paper 2014 04artisingh3412No ratings yet

- Issue of Right Shares and Bonus SharesDocument5 pagesIssue of Right Shares and Bonus Sharesnemewep527No ratings yet

- Problems On Redemption of Pref SharesDocument7 pagesProblems On Redemption of Pref SharesYashitha CaverammaNo ratings yet

- Index Funds & Stock Market Investing: A Beginner's Guide to Build Wealth with a Diversified Portfolio Using ETFs, Stock Picking, Technical Analysis, Options Trading, Penny Stocks, Dividends, and REITSFrom EverandIndex Funds & Stock Market Investing: A Beginner's Guide to Build Wealth with a Diversified Portfolio Using ETFs, Stock Picking, Technical Analysis, Options Trading, Penny Stocks, Dividends, and REITSRating: 5 out of 5 stars5/5 (43)

- Diwali Dhamaka 2020Document25 pagesDiwali Dhamaka 2020Prachi PatwariNo ratings yet

- Avendus Announces The First Close of Its Future Leaders Fund II With Aggregate Commitments of INR 584 CroreDocument2 pagesAvendus Announces The First Close of Its Future Leaders Fund II With Aggregate Commitments of INR 584 CrorePrachi PatwariNo ratings yet

- CapitalGainLossSummary pcpw052Document5 pagesCapitalGainLossSummary pcpw052Prachi PatwariNo ratings yet

- SAUDA DETAIL REPORT cl3Document1 pageSAUDA DETAIL REPORT cl3Prachi PatwariNo ratings yet

- DownloadedFile PDFDocument1 pageDownloadedFile PDFPrachi PatwariNo ratings yet

- Mid and Small Cap Model Portfolio: Objective StrategyDocument3 pagesMid and Small Cap Model Portfolio: Objective StrategyPrachi PatwariNo ratings yet

- BFL LAS Product Note INTERNAL 27.04.17Document3 pagesBFL LAS Product Note INTERNAL 27.04.17Prachi PatwariNo ratings yet

- ORDERSTATUS XSIP pcpw149 PDFDocument1 pageORDERSTATUS XSIP pcpw149 PDFPrachi PatwariNo ratings yet

- Product Note - Diwali Picks - 13 - Nov - 2020Document3 pagesProduct Note - Diwali Picks - 13 - Nov - 2020Prachi PatwariNo ratings yet

- CapitalGainLossSummary pcpw055Document6 pagesCapitalGainLossSummary pcpw055Prachi PatwariNo ratings yet

- Wipro Buy BackDocument1 pageWipro Buy BackPrachi PatwariNo ratings yet

- Memorendum FormatDocument2 pagesMemorendum Formathhhj0% (1)

- Pay Structures: Proprietary Content. ©great Learning. All Rights Reserved. Unauthorized Use or Distribution ProhibitedDocument23 pagesPay Structures: Proprietary Content. ©great Learning. All Rights Reserved. Unauthorized Use or Distribution Prohibitedaahana100% (1)

- A Study On Employee Engagement: September 2011Document10 pagesA Study On Employee Engagement: September 2011Chandan ChatterjeeNo ratings yet

- Scope of The StudyDocument3 pagesScope of The Studysavan50% (2)

- What Is Green HRMDocument3 pagesWhat Is Green HRMAlbert HangsingNo ratings yet

- In A Highly Collectivist Culture, Performance Appraisals Should Be Focused OnDocument10 pagesIn A Highly Collectivist Culture, Performance Appraisals Should Be Focused OnSOUVIK ROY MBA 2021-23 (Delhi)No ratings yet

- Attendance Quotas Infotype (2007) (SAP Library - Personnel Time Management (PT) )Document2 pagesAttendance Quotas Infotype (2007) (SAP Library - Personnel Time Management (PT) )Chetan ManjunathNo ratings yet

- Chapter 8Document9 pagesChapter 8ahmed100% (1)

- HRM Presntation On IncentiveDocument30 pagesHRM Presntation On Incentiveanubha_2304No ratings yet

- Ashwini Chavan HR ProjectDocument67 pagesAshwini Chavan HR ProjectDivyeshNo ratings yet

- HR CaseDocument1 pageHR CasePar KlengNo ratings yet

- Beijing-EAP - Q1Document2 pagesBeijing-EAP - Q1JitendraNo ratings yet

- An Analysis On Employee-Attrition in It Industry: Vinaya SarafDocument8 pagesAn Analysis On Employee-Attrition in It Industry: Vinaya Saraffurkaanmir719No ratings yet

- Work Life Balance QuestionnaireDocument4 pagesWork Life Balance QuestionnaireIndu SumeshNo ratings yet

- The Strategic Role of Human Resource ManagementDocument25 pagesThe Strategic Role of Human Resource Managementسارة ستوران.No ratings yet

- Disadvantage of 7 Principles of Quality Management: 1. Customer ForcusDocument4 pagesDisadvantage of 7 Principles of Quality Management: 1. Customer ForcusBãoNo ratings yet

- Business ResearchDocument32 pagesBusiness ResearchHazel BatitayNo ratings yet

- Criteria of Measuring QWLDocument10 pagesCriteria of Measuring QWLAbhishek SharmaNo ratings yet

- Dunn 12Document16 pagesDunn 12KenosiNo ratings yet

- Group Assignment 1 Amazon HRDocument3 pagesGroup Assignment 1 Amazon HRMohona Jahan MunaNo ratings yet

- Human Resource Planning: Topic 5Document17 pagesHuman Resource Planning: Topic 5HtetThinzarNo ratings yet

- Oam MidtermDocument50 pagesOam MidtermSantos Kim0% (1)

- Google's Plan For The Future of Work: Privacy Robots and Balloon WallsDocument4 pagesGoogle's Plan For The Future of Work: Privacy Robots and Balloon WallsoktaNo ratings yet

- Chapter 4Document4 pagesChapter 4Vhernyze Faye BruniaNo ratings yet

- Factors Affecting The Level of Employee Performance of Aa ManufacturingDocument22 pagesFactors Affecting The Level of Employee Performance of Aa ManufacturingKezia EscarioNo ratings yet

- Business Comm AssignmentDocument6 pagesBusiness Comm AssignmentTanvir Hasan SohanNo ratings yet

- 08 Staffing Organizations Case Study.Document2 pages08 Staffing Organizations Case Study.Sadaf IqbalNo ratings yet