Professional Documents

Culture Documents

CY 2011 Budget Presentation Nick Trasente

CY 2011 Budget Presentation Nick Trasente

Uploaded by

DonnaAntonucci0 ratings0% found this document useful (0 votes)

689 views12 pagesCity of Hoboken CY 2011 Introduced Municipal and Parking Utility Budget SFY 2011 Budget Summary. Including 4 Year Salary Settlement with PBA and SOA including Retro Pay Absorbing $1,288,446 or 17.6% Increase to pension.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCity of Hoboken CY 2011 Introduced Municipal and Parking Utility Budget SFY 2011 Budget Summary. Including 4 Year Salary Settlement with PBA and SOA including Retro Pay Absorbing $1,288,446 or 17.6% Increase to pension.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

689 views12 pagesCY 2011 Budget Presentation Nick Trasente

CY 2011 Budget Presentation Nick Trasente

Uploaded by

DonnaAntonucciCity of Hoboken CY 2011 Introduced Municipal and Parking Utility Budget SFY 2011 Budget Summary. Including 4 Year Salary Settlement with PBA and SOA including Retro Pay Absorbing $1,288,446 or 17.6% Increase to pension.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 12

City of Hoboken

CY 2011

Introduced Municipal &

Parking Utility Budget

SFY 2011 Budget Summary

APROPRIATIONS REVENUES

Surplus Anticipated $9,585,000

Operations: Miscellaneous Revenues:

Within CAPS $83,587,271 Local Revenue $22,646,749

Total S&W $37,645,600 State Aid $11,113,035

Total O.E. $35,183,141 UCC Fees $683,500

Statutory Expenditures $10,734,812 Other Special Revenue $2,563,202

Outside Cap $14,842,225

Total Miscellaneous Revenue $37,665,313

Capital Improvements $ 250,000 Subtotal General Revenue $47,643,623

Municipal Debt Service $6,302,805

Total Deferred Charges $1,978,102 Amount To Be Raised by Taxes $54,078,242

Judgments $400,000

Reserve For Uncollected Taxes $3,292,369

Total General Revenues $101,721,865

Total General Appropriations $101,721,865

What Does This Budget Do

Reduces the Amount To Be Raised by 5.17% From TY10 and 9.91%

From FY10 While:

Including 4 Year Salary Settlement with PBA and SOA including Retro

Pay

Absorbing $1,288,446 or 17.6% Increase to Pension

Absorbing an Increase in General Liability and Health Benefits of Over

$2 Million or 11%

Including Amounts for Reserve for Uncollected Taxes, Tax Appeals, PY

Emergency Appropriations Not in FY10 equaling $5,127,369

Including a Reduction in Debt Service of $2,357,000.00 from FY10

Reduction In Total Salaries by $2,895,000 (approximately $4 million

inclusive of retroactive pay) from FY10

Absorbing a Reduction of State Aid of $3,400,000 from FY10

Cost Drivers

Retroactive Pay $3,000,000

Health Care Cost $1,640,000

Pension Increase $1,288,446

Deferred Charges $1,954,393

Salary Settlements $1,300,000

Decrease in State Aid $3,400,000

Surplus Analysis

Total Surplus $25,422,135.79

Less:

Due From State Senior/Vet Deduction 27,152.35

Deferred Charges 6,812,569.86

State Aid Receivable 3,864,299.50

Cash Surplus Available for Use $14,718,114.08

Less:

Amount Used For Budget 9,585,000.00

Surplus Balance for Bond Rating $5,133,114.08

Surplus Used In Budget

Surplus to Reduce Taxes (Regenerates) 4,250,000.00

Salary Settlement (Retro-One Time) 3,000,000.00

Tax Appeals (Limited Time) 1,500,000.00

PY Emergency Appropriation (One Time) 335,000.00

Salaries for Retirees (One Time) 300,000.00

Capital Improvement Fund

(Capital Infrastructure) 200,000.00

Total Surplus Used in Support of Municipal Budget:

$9,585,000.00

Discretionary Spending Analysis

Total Budget $101,721,865

Non Discretionary

Deferred Charges $1,978,102

Debt Service $6,302,805

Pension $8,594,672

Salary & Wages $37,645,600

Statutory Obligations $1,856,540

Health Benefits/other Insurance $17,054,246

Salary Settlements & Adjustments $4,300,000

Library $3,414,730

Other $7,414,840

Reserve For Uncollected Taxes $3,292,369

Total Non Discretionary $91,853,904

Discretionary Spending $9,867,961

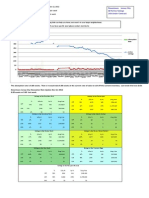

3 Year Budget Appropriations History

2011 vs. 2010 Budget Revenue

Comparison

Salary & Wage by Department

Comparison of Department Cost

to Total Budget

Salary & Wages vs. All

Appropriations

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- ICARUS BuyerDocument10 pagesICARUS BuyerRaghav JainNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Final Assignment 3 - HRM in CanadaDocument26 pagesFinal Assignment 3 - HRM in CanadaangeliaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- HRM425WK1Document5 pagesHRM425WK1Patricia MillerNo ratings yet

- Employee WelfareDocument91 pagesEmployee Welfarevaishalisonwane77No ratings yet

- PCL Chap 2 en Ca PDFDocument45 pagesPCL Chap 2 en Ca PDFRenso Ramirez JimenezNo ratings yet

- Jersey City Stats Public Archive Till Dec 2012Document28 pagesJersey City Stats Public Archive Till Dec 2012DonnaAntonucciNo ratings yet

- Hoboken Price ReductionDocument69 pagesHoboken Price ReductionDonnaAntonucciNo ratings yet

- JC Stats Archive (Public) - 01-2012 To 05-2012Document16 pagesJC Stats Archive (Public) - 01-2012 To 05-2012DonnaAntonucciNo ratings yet

- Exclusive Right To SellDocument1 pageExclusive Right To SellDonnaAntonucciNo ratings yet

- One To 4 Family Home Sales For Q1, Q2, Q3 2011.: Mls # Address City Class Status Price TypeDocument5 pagesOne To 4 Family Home Sales For Q1, Q2, Q3 2011.: Mls # Address City Class Status Price TypeDonnaAntonucciNo ratings yet

- 1212 Washington - PottsDocument2 pages1212 Washington - PottsDonnaAntonucciNo ratings yet

- Hoboken Revolt Questionnaire 2011 - CunninghamlDocument4 pagesHoboken Revolt Questionnaire 2011 - CunninghamlDonnaAntonucciNo ratings yet

- One To 4 Fam 2010Document6 pagesOne To 4 Fam 2010DonnaAntonucciNo ratings yet

- BOE Questionnaire12 - 10Document1 pageBOE Questionnaire12 - 10DonnaAntonucciNo ratings yet

- Case Digest Aquino Vs NLRCDocument2 pagesCase Digest Aquino Vs NLRCNneka VillacortaNo ratings yet

- The Civil Service System of Bangladesh: Sk. Tawfique M. Haque and M. Mahfuzul HaqueDocument24 pagesThe Civil Service System of Bangladesh: Sk. Tawfique M. Haque and M. Mahfuzul HaqueMD Mahbub Ul IslamNo ratings yet

- Introduction To Financial Management FIN 254 (Assignment) Spring 2014 (Due On 24th April 10-11.00 AM) at Nac 955Document10 pagesIntroduction To Financial Management FIN 254 (Assignment) Spring 2014 (Due On 24th April 10-11.00 AM) at Nac 955Shelly SantiagoNo ratings yet

- Schedule1 Pawan SirDocument6 pagesSchedule1 Pawan SirRohit SinghNo ratings yet

- 10 Divine Word Vs MinaDocument5 pages10 Divine Word Vs MinaChiang Kai-shekNo ratings yet

- RA English07Document28 pagesRA English07mcastilho100% (2)

- The Daily Star 2 July 2024Document6 pagesThe Daily Star 2 July 2024jobayer shifatNo ratings yet

- Elementary English Lessons 1-10Document13 pagesElementary English Lessons 1-10Matt Drew100% (15)

- Chapter 9. Consequences of Being On Sick LeaveDocument9 pagesChapter 9. Consequences of Being On Sick LeaveMirasol BaykingNo ratings yet

- Module 9 Inclusions and Exclusions From Gross IncomeDocument10 pagesModule 9 Inclusions and Exclusions From Gross IncomeKurt CyrilNo ratings yet

- 15.1 - PH II - PF, Pension, Gratuity, Leave EncashmentDocument72 pages15.1 - PH II - PF, Pension, Gratuity, Leave EncashmentRanjeet SinghNo ratings yet

- 2023 Slides On Exempt IncomeDocument31 pages2023 Slides On Exempt IncomeSiphesihleNo ratings yet

- WctariffDocument127 pagesWctariffNio Kumar100% (1)

- Karnataka Bank LTDDocument7 pagesKarnataka Bank LTDVishal BhojaniNo ratings yet

- Rapid MetroRail Gurgaon LimitedDocument33 pagesRapid MetroRail Gurgaon LimitedMeenakshi Arjun AnandNo ratings yet

- Towards (De-) Financialisation: The Role of The State: Ewa KarwowskiDocument27 pagesTowards (De-) Financialisation: The Role of The State: Ewa KarwowskieconstudentNo ratings yet

- TNCWWB HandbookDocument117 pagesTNCWWB HandbookAnjali MohanNo ratings yet

- Chapter Four CorrectedDocument10 pagesChapter Four CorrectedLawrence EbosieNo ratings yet

- Taxation Notes by RISEDocument24 pagesTaxation Notes by RISEsidra awanNo ratings yet

- Deduction of Tax at SourceDocument71 pagesDeduction of Tax at Sourcegurusha bhallaNo ratings yet

- The Transcendent ManDocument48 pagesThe Transcendent Manapi-26032005No ratings yet

- Facilities at A Glance (18.07.2019)Document18 pagesFacilities at A Glance (18.07.2019)Ratan SinghNo ratings yet

- Code Head Appendix-IvDocument29 pagesCode Head Appendix-IvPrashant AtreNo ratings yet

- MQ q3 ch01Document46 pagesMQ q3 ch01Lee DickensNo ratings yet

- Dr.C.S.RANGARAJAN Vs UNIVERSITY OF MADRASDocument3 pagesDr.C.S.RANGARAJAN Vs UNIVERSITY OF MADRASCHETSUNNo ratings yet