Professional Documents

Culture Documents

Performance-Related Components: Overview STI

Performance-Related Components: Overview STI

Uploaded by

Catrinoiu PetreCopyright:

Available Formats

You might also like

- Ajanta PackagingDocument6 pagesAjanta PackagingShreya GirotraNo ratings yet

- 012 CIMValDocument20 pages012 CIMValmdshoppNo ratings yet

- Transmile Group Assignment - Project Paper SampleDocument42 pagesTransmile Group Assignment - Project Paper SampleRied-Zall Hasan100% (11)

- Tutorial 5 Chapter 4&5Document3 pagesTutorial 5 Chapter 4&5Renee WongNo ratings yet

- Annual Employee Bonus Plan - Target - BonusDocument7 pagesAnnual Employee Bonus Plan - Target - BonuspgalegoNo ratings yet

- Nishat Mills LimitedDocument38 pagesNishat Mills LimitedTalha KhanNo ratings yet

- Ts309: Tourism Business Operation Major Group Assignment: Business PlanDocument40 pagesTs309: Tourism Business Operation Major Group Assignment: Business PlanJosephine LalNo ratings yet

- The Company Shares and Bonds: Benchmark GroupDocument1 pageThe Company Shares and Bonds: Benchmark GroupCatrinoiu PetreNo ratings yet

- Calculation of STI and LTI: The Company Shares and BondsDocument1 pageCalculation of STI and LTI: The Company Shares and BondsCatrinoiu PetreNo ratings yet

- Lecture 4Document54 pagesLecture 4premsuwaatiiNo ratings yet

- The Company Shares and Bonds: Corporate GovernanceDocument1 pageThe Company Shares and Bonds: Corporate GovernanceCatrinoiu PetreNo ratings yet

- Remuneration Structure (Without Other Emoluments, Pension Benefits)Document1 pageRemuneration Structure (Without Other Emoluments, Pension Benefits)Catrinoiu PetreNo ratings yet

- US CMA - Part 2 TerminologyDocument67 pagesUS CMA - Part 2 TerminologyAhad chyNo ratings yet

- Output 2121 - 50Document1 pageOutput 2121 - 50Catrinoiu PetreNo ratings yet

- Share Ownership Guideline / Short-Term and Long-Term Com-Ponents of The Variable Annual Cash RemunerationDocument1 pageShare Ownership Guideline / Short-Term and Long-Term Com-Ponents of The Variable Annual Cash RemunerationCatrinoiu PetreNo ratings yet

- 47047bosfinal p5 cp8Document89 pages47047bosfinal p5 cp8Mitali SharmaNo ratings yet

- SBA01 FSAnalysisPart1Document4 pagesSBA01 FSAnalysisPart1Hazel VillanuevaNo ratings yet

- Advantages and Limitations of The Discounted Cash Flow To Firm Valuation 1.4Document10 pagesAdvantages and Limitations of The Discounted Cash Flow To Firm Valuation 1.4One ChannelNo ratings yet

- Investment CentreDocument27 pagesInvestment CentreSiddharth SapkaleNo ratings yet

- Output 2121 - 51Document1 pageOutput 2121 - 51Catrinoiu PetreNo ratings yet

- Session 04Document26 pagesSession 04Sajini KaushalyaNo ratings yet

- Ratio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesDocument3 pagesRatio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesSapcon ThePhoenixNo ratings yet

- Ch12 ShowDocument36 pagesCh12 ShowMahmoud AbdullahNo ratings yet

- Divisional MeasurementDocument29 pagesDivisional MeasurementNagaraj UpparNo ratings yet

- Profitability RatiosDocument4 pagesProfitability RatiosDorcas YanoNo ratings yet

- Prudential PLC Ar 2020Document404 pagesPrudential PLC Ar 2020Lim KaixianNo ratings yet

- Global Business Strategy: Evaluation & ControlDocument19 pagesGlobal Business Strategy: Evaluation & ControlAyrton Cubas BulejeNo ratings yet

- 3Q17 Earnings PresentationDocument24 pages3Q17 Earnings PresentationJaime RamosNo ratings yet

- Assessing Financial Health (Part-A)Document17 pagesAssessing Financial Health (Part-A)kohacNo ratings yet

- Compensation Policy Applicable To Executive Officers in 2021Document7 pagesCompensation Policy Applicable To Executive Officers in 2021Ivan DidiNo ratings yet

- Remuneration Report 2022Document27 pagesRemuneration Report 2022U KNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisCIPRIANO, Rodielyn L.No ratings yet

- AS 20 Earnings Per ShareDocument14 pagesAS 20 Earnings Per Sharefar_07No ratings yet

- Analysis & Interpretation: Prepared By: Sir Hamza Abdul HaqDocument10 pagesAnalysis & Interpretation: Prepared By: Sir Hamza Abdul HaqSrabon BaruaNo ratings yet

- Accounting Lecture Script - Topic 10 (Budgeting)Document58 pagesAccounting Lecture Script - Topic 10 (Budgeting)koosalwinnerNo ratings yet

- F5 - 14financial Performance MeasurementDocument7 pagesF5 - 14financial Performance Measurementsajid newaz khanNo ratings yet

- S7. Financial AnalysisDocument20 pagesS7. Financial AnalysisJoão Maria VigárioNo ratings yet

- Meaning Leverage: AccordingDocument5 pagesMeaning Leverage: AccordingSneha SenNo ratings yet

- 15 FINANCIAL Performance MeasurementDocument8 pages15 FINANCIAL Performance MeasurementJack PayneNo ratings yet

- CRM Q1 FY23 Earnings Press Release W FinancialsDocument16 pagesCRM Q1 FY23 Earnings Press Release W Financialsstan LeeNo ratings yet

- FM. Financial Analysis BookDocument31 pagesFM. Financial Analysis Bookahmedsoobi73No ratings yet

- Shahrukh - Final ZIPDocument5 pagesShahrukh - Final ZIPArsal MudassarNo ratings yet

- FM PPT Ratio AnalysisDocument12 pagesFM PPT Ratio AnalysisHarsh ManotNo ratings yet

- FS AnalysisDocument4 pagesFS Analysisserixa ewanNo ratings yet

- To Our ShareholdersDocument161 pagesTo Our ShareholdersOliver EggertsenNo ratings yet

- Financial RatiosDocument13 pagesFinancial RatioscheeriosNo ratings yet

- Cost of Capital: Sahil Kesarwani, F.Y. BAF (B), 192704Document10 pagesCost of Capital: Sahil Kesarwani, F.Y. BAF (B), 192704Rohit GadgeNo ratings yet

- Practice of Profitability RatiosDocument11 pagesPractice of Profitability RatiosZarish AzharNo ratings yet

- Options As A Strategic Investment PDFDocument5 pagesOptions As A Strategic Investment PDFArjun Bora100% (1)

- HSBC Global Investment Funds - US Dollar BondDocument2 pagesHSBC Global Investment Funds - US Dollar BondMay LeungNo ratings yet

- Covestro Overview Key DataDocument9 pagesCovestro Overview Key DataTobias JankeNo ratings yet

- SSRN Id944420Document10 pagesSSRN Id944420daffasyahNo ratings yet

- Chapter 8 - Budgeting, Planning ControlDocument16 pagesChapter 8 - Budgeting, Planning ControlAnonymous pJQwUSf100% (1)

- Financial Ratios - Non Financial Sector - March2021Document11 pagesFinancial Ratios - Non Financial Sector - March2021karishmapatel93No ratings yet

- Financing Decision - LeverageDocument6 pagesFinancing Decision - Leverageஇலக்கியச்செல்வி உமாபதிNo ratings yet

- Financial Statement AnalysisDocument50 pagesFinancial Statement AnalysisNouf ANo ratings yet

- AFMA Cha 4 MBA TT at 2020Document38 pagesAFMA Cha 4 MBA TT at 2020sheawNo ratings yet

- Chapter 3 FINANCIAL RATIOSDocument17 pagesChapter 3 FINANCIAL RATIOSLinh ChiNo ratings yet

- Meaning of Ratio AnalysisDocument45 pagesMeaning of Ratio AnalysisSunny LalakiaNo ratings yet

- ACCA110-Financial Statement Analysis and RatioDocument7 pagesACCA110-Financial Statement Analysis and RatioJhovet Christian M. CariÑoNo ratings yet

- SSF From LinnyDocument80 pagesSSF From Linnymanojpatel51No ratings yet

- AEV A17Q Q2Jun2012 (3oct2012)Document42 pagesAEV A17Q Q2Jun2012 (3oct2012)cuonghienNo ratings yet

- Controls For Differentiated Strategies & Measuring of Assets EmployedDocument35 pagesControls For Differentiated Strategies & Measuring of Assets EmployedRohit_Kaul_8049No ratings yet

- Global Lottery Strengthening Industy Leadership With Accelerated Recurring Revenue Growth OutlookDocument21 pagesGlobal Lottery Strengthening Industy Leadership With Accelerated Recurring Revenue Growth Outlookadityakumar8960860No ratings yet

- 03-Measures of Perfomance in Private SectorDocument5 pages03-Measures of Perfomance in Private SectorHastings KapalaNo ratings yet

- Remuneration of The Members of The Supervisory Board of Henkel Management AGDocument1 pageRemuneration of The Members of The Supervisory Board of Henkel Management AGCatrinoiu PetreNo ratings yet

- Fundamental Principles of The Group: Operational ActivitiesDocument1 pageFundamental Principles of The Group: Operational ActivitiesCatrinoiu PetreNo ratings yet

- Shareholders' Committee Remuneration 2019: The Company Shares and BondsDocument1 pageShareholders' Committee Remuneration 2019: The Company Shares and BondsCatrinoiu PetreNo ratings yet

- Calculation of Target Achievement / LTI RemunerationDocument1 pageCalculation of Target Achievement / LTI RemunerationCatrinoiu PetreNo ratings yet

- Calculation of STI and LTI: The Company Shares and BondsDocument1 pageCalculation of STI and LTI: The Company Shares and BondsCatrinoiu PetreNo ratings yet

- Remuneration Policy For Members of The Supervisory Board and of The Shareholders' Committee of Henkel Ag & Co. KgaaDocument1 pageRemuneration Policy For Members of The Supervisory Board and of The Shareholders' Committee of Henkel Ag & Co. KgaaCatrinoiu PetreNo ratings yet

- Pension Benefits (Retirement Pensions and Survivors' Benefits)Document1 pagePension Benefits (Retirement Pensions and Survivors' Benefits)Catrinoiu PetreNo ratings yet

- Miscellaneous: The Company Shares and BondsDocument1 pageMiscellaneous: The Company Shares and BondsCatrinoiu PetreNo ratings yet

- Provisions Governing Termination of Position On The Management BoardDocument1 pageProvisions Governing Termination of Position On The Management BoardCatrinoiu PetreNo ratings yet

- The Company Shares and Bonds: Benchmark GroupDocument1 pageThe Company Shares and Bonds: Benchmark GroupCatrinoiu PetreNo ratings yet

- Share Ownership Guideline / Short-Term and Long-Term Com-Ponents of The Variable Annual Cash RemunerationDocument1 pageShare Ownership Guideline / Short-Term and Long-Term Com-Ponents of The Variable Annual Cash RemunerationCatrinoiu PetreNo ratings yet

- Remuneration Structure (Without Other Emoluments, Pension Benefits)Document1 pageRemuneration Structure (Without Other Emoluments, Pension Benefits)Catrinoiu PetreNo ratings yet

- The Company Shares and Bonds: Corporate GovernanceDocument1 pageThe Company Shares and Bonds: Corporate GovernanceCatrinoiu PetreNo ratings yet

- Output 2121 - 51Document1 pageOutput 2121 - 51Catrinoiu PetreNo ratings yet

- Output 2121 - 48Document1 pageOutput 2121 - 48Catrinoiu PetreNo ratings yet

- Output 2121 - 52Document1 pageOutput 2121 - 52Catrinoiu PetreNo ratings yet

- Output 2121 - 49Document1 pageOutput 2121 - 49Catrinoiu PetreNo ratings yet

- Output 2121 - 50Document1 pageOutput 2121 - 50Catrinoiu PetreNo ratings yet

- The Company Shares and Bonds: Corporate GovernanceDocument1 pageThe Company Shares and Bonds: Corporate GovernanceCatrinoiu PetreNo ratings yet

- The Company Shares and Bonds: Corporate GovernanceDocument1 pageThe Company Shares and Bonds: Corporate GovernanceCatrinoiu PetreNo ratings yet

- The Basic Structure of The U.S. Financial MarketsDocument10 pagesThe Basic Structure of The U.S. Financial MarketsRocaya SaripNo ratings yet

- Tower 1, Office Block, 4th Floor, Plate-A, Adjacent To Ring Road, NBCC, Kidwai Nagar (East), New Delhi - 110023Document4 pagesTower 1, Office Block, 4th Floor, Plate-A, Adjacent To Ring Road, NBCC, Kidwai Nagar (East), New Delhi - 110023Mantu KumarNo ratings yet

- CM Practioners HandbookDocument22 pagesCM Practioners Handbookwilli brordusNo ratings yet

- GuidelineDocument8 pagesGuidelineMuhammad NazdmiNo ratings yet

- Budget Making Process in KenyaDocument24 pagesBudget Making Process in Kenyaemmanuel inganjiNo ratings yet

- What Were The Reasons Behind The 1991 Economic Reforms in IndiaDocument6 pagesWhat Were The Reasons Behind The 1991 Economic Reforms in Indiaadeol5012No ratings yet

- Calculus Mathematics For BusinessDocument112 pagesCalculus Mathematics For BusinessR. Mega MahmudiaNo ratings yet

- CP575Notice 1640617328139Document2 pagesCP575Notice 1640617328139Dawson BanksNo ratings yet

- Foreign Currency Transaction and TranslationDocument4 pagesForeign Currency Transaction and TranslationKrizia Mae Flores100% (1)

- Day 2 AscentofMoneyBulliontoBubblesMovieWorksheeDay 2Document2 pagesDay 2 AscentofMoneyBulliontoBubblesMovieWorksheeDay 2Roxana FrunzăNo ratings yet

- Askari BankDocument175 pagesAskari Bankmuhammadtaimoorkhan50% (4)

- Sonam Tshewang PDFDocument13 pagesSonam Tshewang PDFsonamtshewangNo ratings yet

- How To Create Investment Banking Pitch BooksDocument7 pagesHow To Create Investment Banking Pitch BooksRaviShankarDuggiralaNo ratings yet

- Maulini VDocument1 pageMaulini VSean GalvezNo ratings yet

- EFB210 Finance 1, Tutorial 01 (Tutors)Document14 pagesEFB210 Finance 1, Tutorial 01 (Tutors)Joseph ChuanNo ratings yet

- Credit and Collection For The Small Entrepreneur: By: John Xavier S. Chavez, MFMDocument46 pagesCredit and Collection For The Small Entrepreneur: By: John Xavier S. Chavez, MFMRheneir MoraNo ratings yet

- Magno v. CADocument10 pagesMagno v. CAChristine Karen BumanlagNo ratings yet

- Minimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Document48 pagesMinimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Andrea Renice S. FerriolNo ratings yet

- Rent Control Act RADocument3 pagesRent Control Act RAJanna SalvacionNo ratings yet

- Determinants of The Decision To Adopt Islamic Finance: Evidence From OmanDocument21 pagesDeterminants of The Decision To Adopt Islamic Finance: Evidence From OmanAnonymous f7wV1lQKRNo ratings yet

- Commercial Real Estate Case StudyDocument2 pagesCommercial Real Estate Case StudyKirk SummaTime Henry100% (1)

- AUSL Bar Operations 2017 LMT Property EditedDocument6 pagesAUSL Bar Operations 2017 LMT Property EditedEron Roi Centina-gacutanNo ratings yet

- 74703bos60485 Inter p1 cp6 U2Document25 pages74703bos60485 Inter p1 cp6 U2Just KiddingNo ratings yet

- Rusame33492Document1 pageRusame33492jinalpatel004No ratings yet

Performance-Related Components: Overview STI

Performance-Related Components: Overview STI

Uploaded by

Catrinoiu PetreOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Performance-Related Components: Overview STI

Performance-Related Components: Overview STI

Uploaded by

Catrinoiu PetreCopyright:

Available Formats

Henkel Annual Report 2019 53

Performance-related components

The Company

Shares and bonds Variable annual cash remuneration (Short Term Incentive, STI)

Corporate governance 21

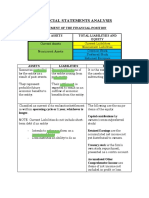

Overview STI

Combined management report Components Basis for assessment / Parameters Weighting Lower threshold 100 % target achievement Upper threshold

Financial targets (bonus) Organic sales growth 1 (OSG) 50 % Minimum OSG OSG target Maximum OSG

Consolidated financial statements

(50 % OSG target amount) (100 % OSG target amount) (150 % OSG target amount)

Further information Adjusted earnings per preferred share 50 % 80 % of the prior-year figure 100 % of the prior-year figure 120 % of the prior-year figure

(EPS) 2 (50 % EPS target amount) (100 % EPS target amount) (150 % EPS target amount)

Individual multiplier • Individually agreed targets

• Absolute and relative performance

compared to market / competition Multiplier ranging from 0.8 to 1.2

• Personal contribution to general

Henkel goals

Performance period Fiscal year (remuneration year)

Cap 3 150 % of the STI target amount (= 3,000,000 euros 4)

1 Figures derived from financial ambitions.

2 At constant exchange rates, versus prior year (actual-to-actual comparison).

3 Including individual multiplier.

4 Remuneration paid to a Management Board member, given a functional factor of 1.

The performance parameters for the annual variable cash The OSG target is derived from our financial ambitions. EPS

remuneration (STI) are the achieved financial targets for each performance is measured on the basis of actual-to-actual com-

fiscal year (“remuneration year”) – the so-called bonus – and parison, i.e. the EPS at constant exchange rates in the year of

the individual performance of each Management Board mem- payment is compared to the EPS from the previous year.

ber, to which a multiplier ranging from 0.8 to 1.2 is applied.

An appropriate remuneration scale has been established for

Bonuses are determined on the basis of achievement of the both key financials. Thresholds have also been defined;

following additively linked financial targets in the respective payment is withheld if the minimum targets are not met,

remuneration year, each with a 50-percent weighting: organic and capped if they are exceeded. If adjusted EPS at constant

sales growth (OSG) (i.e. sales growth adjusted for foreign exchange rates in the year of payment is more than 20 percent

exchange and acquisitions / divestments) and earnings per above or below the comparable prior-year figure as a result of

preferred share (EPS) adjusted for one-time charges / gains, extraordinary events, the Supervisory Board of Henkel Man-

restructuring expenses and foreign exchange. agement AG may, at its discretion and after due consideration,

decide to adjust the target, or may determine a new reference

value for measuring performance in the following year.

You might also like

- Ajanta PackagingDocument6 pagesAjanta PackagingShreya GirotraNo ratings yet

- 012 CIMValDocument20 pages012 CIMValmdshoppNo ratings yet

- Transmile Group Assignment - Project Paper SampleDocument42 pagesTransmile Group Assignment - Project Paper SampleRied-Zall Hasan100% (11)

- Tutorial 5 Chapter 4&5Document3 pagesTutorial 5 Chapter 4&5Renee WongNo ratings yet

- Annual Employee Bonus Plan - Target - BonusDocument7 pagesAnnual Employee Bonus Plan - Target - BonuspgalegoNo ratings yet

- Nishat Mills LimitedDocument38 pagesNishat Mills LimitedTalha KhanNo ratings yet

- Ts309: Tourism Business Operation Major Group Assignment: Business PlanDocument40 pagesTs309: Tourism Business Operation Major Group Assignment: Business PlanJosephine LalNo ratings yet

- The Company Shares and Bonds: Benchmark GroupDocument1 pageThe Company Shares and Bonds: Benchmark GroupCatrinoiu PetreNo ratings yet

- Calculation of STI and LTI: The Company Shares and BondsDocument1 pageCalculation of STI and LTI: The Company Shares and BondsCatrinoiu PetreNo ratings yet

- Lecture 4Document54 pagesLecture 4premsuwaatiiNo ratings yet

- The Company Shares and Bonds: Corporate GovernanceDocument1 pageThe Company Shares and Bonds: Corporate GovernanceCatrinoiu PetreNo ratings yet

- Remuneration Structure (Without Other Emoluments, Pension Benefits)Document1 pageRemuneration Structure (Without Other Emoluments, Pension Benefits)Catrinoiu PetreNo ratings yet

- US CMA - Part 2 TerminologyDocument67 pagesUS CMA - Part 2 TerminologyAhad chyNo ratings yet

- Output 2121 - 50Document1 pageOutput 2121 - 50Catrinoiu PetreNo ratings yet

- Share Ownership Guideline / Short-Term and Long-Term Com-Ponents of The Variable Annual Cash RemunerationDocument1 pageShare Ownership Guideline / Short-Term and Long-Term Com-Ponents of The Variable Annual Cash RemunerationCatrinoiu PetreNo ratings yet

- 47047bosfinal p5 cp8Document89 pages47047bosfinal p5 cp8Mitali SharmaNo ratings yet

- SBA01 FSAnalysisPart1Document4 pagesSBA01 FSAnalysisPart1Hazel VillanuevaNo ratings yet

- Advantages and Limitations of The Discounted Cash Flow To Firm Valuation 1.4Document10 pagesAdvantages and Limitations of The Discounted Cash Flow To Firm Valuation 1.4One ChannelNo ratings yet

- Investment CentreDocument27 pagesInvestment CentreSiddharth SapkaleNo ratings yet

- Output 2121 - 51Document1 pageOutput 2121 - 51Catrinoiu PetreNo ratings yet

- Session 04Document26 pagesSession 04Sajini KaushalyaNo ratings yet

- Ratio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesDocument3 pagesRatio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesSapcon ThePhoenixNo ratings yet

- Ch12 ShowDocument36 pagesCh12 ShowMahmoud AbdullahNo ratings yet

- Divisional MeasurementDocument29 pagesDivisional MeasurementNagaraj UpparNo ratings yet

- Profitability RatiosDocument4 pagesProfitability RatiosDorcas YanoNo ratings yet

- Prudential PLC Ar 2020Document404 pagesPrudential PLC Ar 2020Lim KaixianNo ratings yet

- Global Business Strategy: Evaluation & ControlDocument19 pagesGlobal Business Strategy: Evaluation & ControlAyrton Cubas BulejeNo ratings yet

- 3Q17 Earnings PresentationDocument24 pages3Q17 Earnings PresentationJaime RamosNo ratings yet

- Assessing Financial Health (Part-A)Document17 pagesAssessing Financial Health (Part-A)kohacNo ratings yet

- Compensation Policy Applicable To Executive Officers in 2021Document7 pagesCompensation Policy Applicable To Executive Officers in 2021Ivan DidiNo ratings yet

- Remuneration Report 2022Document27 pagesRemuneration Report 2022U KNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisCIPRIANO, Rodielyn L.No ratings yet

- AS 20 Earnings Per ShareDocument14 pagesAS 20 Earnings Per Sharefar_07No ratings yet

- Analysis & Interpretation: Prepared By: Sir Hamza Abdul HaqDocument10 pagesAnalysis & Interpretation: Prepared By: Sir Hamza Abdul HaqSrabon BaruaNo ratings yet

- Accounting Lecture Script - Topic 10 (Budgeting)Document58 pagesAccounting Lecture Script - Topic 10 (Budgeting)koosalwinnerNo ratings yet

- F5 - 14financial Performance MeasurementDocument7 pagesF5 - 14financial Performance Measurementsajid newaz khanNo ratings yet

- S7. Financial AnalysisDocument20 pagesS7. Financial AnalysisJoão Maria VigárioNo ratings yet

- Meaning Leverage: AccordingDocument5 pagesMeaning Leverage: AccordingSneha SenNo ratings yet

- 15 FINANCIAL Performance MeasurementDocument8 pages15 FINANCIAL Performance MeasurementJack PayneNo ratings yet

- CRM Q1 FY23 Earnings Press Release W FinancialsDocument16 pagesCRM Q1 FY23 Earnings Press Release W Financialsstan LeeNo ratings yet

- FM. Financial Analysis BookDocument31 pagesFM. Financial Analysis Bookahmedsoobi73No ratings yet

- Shahrukh - Final ZIPDocument5 pagesShahrukh - Final ZIPArsal MudassarNo ratings yet

- FM PPT Ratio AnalysisDocument12 pagesFM PPT Ratio AnalysisHarsh ManotNo ratings yet

- FS AnalysisDocument4 pagesFS Analysisserixa ewanNo ratings yet

- To Our ShareholdersDocument161 pagesTo Our ShareholdersOliver EggertsenNo ratings yet

- Financial RatiosDocument13 pagesFinancial RatioscheeriosNo ratings yet

- Cost of Capital: Sahil Kesarwani, F.Y. BAF (B), 192704Document10 pagesCost of Capital: Sahil Kesarwani, F.Y. BAF (B), 192704Rohit GadgeNo ratings yet

- Practice of Profitability RatiosDocument11 pagesPractice of Profitability RatiosZarish AzharNo ratings yet

- Options As A Strategic Investment PDFDocument5 pagesOptions As A Strategic Investment PDFArjun Bora100% (1)

- HSBC Global Investment Funds - US Dollar BondDocument2 pagesHSBC Global Investment Funds - US Dollar BondMay LeungNo ratings yet

- Covestro Overview Key DataDocument9 pagesCovestro Overview Key DataTobias JankeNo ratings yet

- SSRN Id944420Document10 pagesSSRN Id944420daffasyahNo ratings yet

- Chapter 8 - Budgeting, Planning ControlDocument16 pagesChapter 8 - Budgeting, Planning ControlAnonymous pJQwUSf100% (1)

- Financial Ratios - Non Financial Sector - March2021Document11 pagesFinancial Ratios - Non Financial Sector - March2021karishmapatel93No ratings yet

- Financing Decision - LeverageDocument6 pagesFinancing Decision - Leverageஇலக்கியச்செல்வி உமாபதிNo ratings yet

- Financial Statement AnalysisDocument50 pagesFinancial Statement AnalysisNouf ANo ratings yet

- AFMA Cha 4 MBA TT at 2020Document38 pagesAFMA Cha 4 MBA TT at 2020sheawNo ratings yet

- Chapter 3 FINANCIAL RATIOSDocument17 pagesChapter 3 FINANCIAL RATIOSLinh ChiNo ratings yet

- Meaning of Ratio AnalysisDocument45 pagesMeaning of Ratio AnalysisSunny LalakiaNo ratings yet

- ACCA110-Financial Statement Analysis and RatioDocument7 pagesACCA110-Financial Statement Analysis and RatioJhovet Christian M. CariÑoNo ratings yet

- SSF From LinnyDocument80 pagesSSF From Linnymanojpatel51No ratings yet

- AEV A17Q Q2Jun2012 (3oct2012)Document42 pagesAEV A17Q Q2Jun2012 (3oct2012)cuonghienNo ratings yet

- Controls For Differentiated Strategies & Measuring of Assets EmployedDocument35 pagesControls For Differentiated Strategies & Measuring of Assets EmployedRohit_Kaul_8049No ratings yet

- Global Lottery Strengthening Industy Leadership With Accelerated Recurring Revenue Growth OutlookDocument21 pagesGlobal Lottery Strengthening Industy Leadership With Accelerated Recurring Revenue Growth Outlookadityakumar8960860No ratings yet

- 03-Measures of Perfomance in Private SectorDocument5 pages03-Measures of Perfomance in Private SectorHastings KapalaNo ratings yet

- Remuneration of The Members of The Supervisory Board of Henkel Management AGDocument1 pageRemuneration of The Members of The Supervisory Board of Henkel Management AGCatrinoiu PetreNo ratings yet

- Fundamental Principles of The Group: Operational ActivitiesDocument1 pageFundamental Principles of The Group: Operational ActivitiesCatrinoiu PetreNo ratings yet

- Shareholders' Committee Remuneration 2019: The Company Shares and BondsDocument1 pageShareholders' Committee Remuneration 2019: The Company Shares and BondsCatrinoiu PetreNo ratings yet

- Calculation of Target Achievement / LTI RemunerationDocument1 pageCalculation of Target Achievement / LTI RemunerationCatrinoiu PetreNo ratings yet

- Calculation of STI and LTI: The Company Shares and BondsDocument1 pageCalculation of STI and LTI: The Company Shares and BondsCatrinoiu PetreNo ratings yet

- Remuneration Policy For Members of The Supervisory Board and of The Shareholders' Committee of Henkel Ag & Co. KgaaDocument1 pageRemuneration Policy For Members of The Supervisory Board and of The Shareholders' Committee of Henkel Ag & Co. KgaaCatrinoiu PetreNo ratings yet

- Pension Benefits (Retirement Pensions and Survivors' Benefits)Document1 pagePension Benefits (Retirement Pensions and Survivors' Benefits)Catrinoiu PetreNo ratings yet

- Miscellaneous: The Company Shares and BondsDocument1 pageMiscellaneous: The Company Shares and BondsCatrinoiu PetreNo ratings yet

- Provisions Governing Termination of Position On The Management BoardDocument1 pageProvisions Governing Termination of Position On The Management BoardCatrinoiu PetreNo ratings yet

- The Company Shares and Bonds: Benchmark GroupDocument1 pageThe Company Shares and Bonds: Benchmark GroupCatrinoiu PetreNo ratings yet

- Share Ownership Guideline / Short-Term and Long-Term Com-Ponents of The Variable Annual Cash RemunerationDocument1 pageShare Ownership Guideline / Short-Term and Long-Term Com-Ponents of The Variable Annual Cash RemunerationCatrinoiu PetreNo ratings yet

- Remuneration Structure (Without Other Emoluments, Pension Benefits)Document1 pageRemuneration Structure (Without Other Emoluments, Pension Benefits)Catrinoiu PetreNo ratings yet

- The Company Shares and Bonds: Corporate GovernanceDocument1 pageThe Company Shares and Bonds: Corporate GovernanceCatrinoiu PetreNo ratings yet

- Output 2121 - 51Document1 pageOutput 2121 - 51Catrinoiu PetreNo ratings yet

- Output 2121 - 48Document1 pageOutput 2121 - 48Catrinoiu PetreNo ratings yet

- Output 2121 - 52Document1 pageOutput 2121 - 52Catrinoiu PetreNo ratings yet

- Output 2121 - 49Document1 pageOutput 2121 - 49Catrinoiu PetreNo ratings yet

- Output 2121 - 50Document1 pageOutput 2121 - 50Catrinoiu PetreNo ratings yet

- The Company Shares and Bonds: Corporate GovernanceDocument1 pageThe Company Shares and Bonds: Corporate GovernanceCatrinoiu PetreNo ratings yet

- The Company Shares and Bonds: Corporate GovernanceDocument1 pageThe Company Shares and Bonds: Corporate GovernanceCatrinoiu PetreNo ratings yet

- The Basic Structure of The U.S. Financial MarketsDocument10 pagesThe Basic Structure of The U.S. Financial MarketsRocaya SaripNo ratings yet

- Tower 1, Office Block, 4th Floor, Plate-A, Adjacent To Ring Road, NBCC, Kidwai Nagar (East), New Delhi - 110023Document4 pagesTower 1, Office Block, 4th Floor, Plate-A, Adjacent To Ring Road, NBCC, Kidwai Nagar (East), New Delhi - 110023Mantu KumarNo ratings yet

- CM Practioners HandbookDocument22 pagesCM Practioners Handbookwilli brordusNo ratings yet

- GuidelineDocument8 pagesGuidelineMuhammad NazdmiNo ratings yet

- Budget Making Process in KenyaDocument24 pagesBudget Making Process in Kenyaemmanuel inganjiNo ratings yet

- What Were The Reasons Behind The 1991 Economic Reforms in IndiaDocument6 pagesWhat Were The Reasons Behind The 1991 Economic Reforms in Indiaadeol5012No ratings yet

- Calculus Mathematics For BusinessDocument112 pagesCalculus Mathematics For BusinessR. Mega MahmudiaNo ratings yet

- CP575Notice 1640617328139Document2 pagesCP575Notice 1640617328139Dawson BanksNo ratings yet

- Foreign Currency Transaction and TranslationDocument4 pagesForeign Currency Transaction and TranslationKrizia Mae Flores100% (1)

- Day 2 AscentofMoneyBulliontoBubblesMovieWorksheeDay 2Document2 pagesDay 2 AscentofMoneyBulliontoBubblesMovieWorksheeDay 2Roxana FrunzăNo ratings yet

- Askari BankDocument175 pagesAskari Bankmuhammadtaimoorkhan50% (4)

- Sonam Tshewang PDFDocument13 pagesSonam Tshewang PDFsonamtshewangNo ratings yet

- How To Create Investment Banking Pitch BooksDocument7 pagesHow To Create Investment Banking Pitch BooksRaviShankarDuggiralaNo ratings yet

- Maulini VDocument1 pageMaulini VSean GalvezNo ratings yet

- EFB210 Finance 1, Tutorial 01 (Tutors)Document14 pagesEFB210 Finance 1, Tutorial 01 (Tutors)Joseph ChuanNo ratings yet

- Credit and Collection For The Small Entrepreneur: By: John Xavier S. Chavez, MFMDocument46 pagesCredit and Collection For The Small Entrepreneur: By: John Xavier S. Chavez, MFMRheneir MoraNo ratings yet

- Magno v. CADocument10 pagesMagno v. CAChristine Karen BumanlagNo ratings yet

- Minimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Document48 pagesMinimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Andrea Renice S. FerriolNo ratings yet

- Rent Control Act RADocument3 pagesRent Control Act RAJanna SalvacionNo ratings yet

- Determinants of The Decision To Adopt Islamic Finance: Evidence From OmanDocument21 pagesDeterminants of The Decision To Adopt Islamic Finance: Evidence From OmanAnonymous f7wV1lQKRNo ratings yet

- Commercial Real Estate Case StudyDocument2 pagesCommercial Real Estate Case StudyKirk SummaTime Henry100% (1)

- AUSL Bar Operations 2017 LMT Property EditedDocument6 pagesAUSL Bar Operations 2017 LMT Property EditedEron Roi Centina-gacutanNo ratings yet

- 74703bos60485 Inter p1 cp6 U2Document25 pages74703bos60485 Inter p1 cp6 U2Just KiddingNo ratings yet

- Rusame33492Document1 pageRusame33492jinalpatel004No ratings yet