Professional Documents

Culture Documents

Case Brief Case Name and Case Law

Case Brief Case Name and Case Law

Uploaded by

shubham kumar0 ratings0% found this document useful (0 votes)

18 views1 pageThe Supreme Court case involved whether compensation to states cess and GST could both apply to the same taxing event under Indian law. The facts discuss the introduction of GST in India in 2016 and the subsequent enactment of the Goods and Services Tax (Compensation to States) Act to compensate states for revenue losses from GST. The Supreme Court held in a 3 October 2018 judgment that cess can be levied in addition to an existing tax and is not considered double taxation, and that compensation cess and GST were two distinct things under law such that both could apply to a single taxing event.

Original Description:

cb

Original Title

Case Brief 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Supreme Court case involved whether compensation to states cess and GST could both apply to the same taxing event under Indian law. The facts discuss the introduction of GST in India in 2016 and the subsequent enactment of the Goods and Services Tax (Compensation to States) Act to compensate states for revenue losses from GST. The Supreme Court held in a 3 October 2018 judgment that cess can be levied in addition to an existing tax and is not considered double taxation, and that compensation cess and GST were two distinct things under law such that both could apply to a single taxing event.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views1 pageCase Brief Case Name and Case Law

Case Brief Case Name and Case Law

Uploaded by

shubham kumarThe Supreme Court case involved whether compensation to states cess and GST could both apply to the same taxing event under Indian law. The facts discuss the introduction of GST in India in 2016 and the subsequent enactment of the Goods and Services Tax (Compensation to States) Act to compensate states for revenue losses from GST. The Supreme Court held in a 3 October 2018 judgment that cess can be levied in addition to an existing tax and is not considered double taxation, and that compensation cess and GST were two distinct things under law such that both could apply to a single taxing event.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

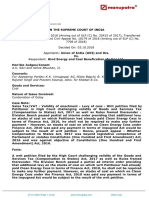

CASE BRIEF

CASE NAME AND CASE LAW:

Union of India vs. Mohit Mineral Pvt Ltd [Civil Appeal No. 10177

of 2018]

FACTS:

The Constitution (one hundred and first Amendment) Act, 2016

introduced the Goods and Services Tax (GST) which came in

to force from 8th September, 2016. Various states raised

concerns regarding substantial loss of revenue so the Goods

and Services Tax (Compensation to States) Act, 2017 was

enacted by Parliament in order to compensate the states for

this loss of revenue and levying & collecting of a cess for the

purpose of carrying out this compensation by the Union.

ISSUE:

Whether application of compensation to states cess and GST

on the same taxing event was allowed in law?

JUDGEMENT:

The SC on 3 October, 2018 by its division bench of A. Bhushan

and A. Sikri, JJ. held that cess is a tax which is applied due to

some special purpose and it can be levied in addition to a tax

which is existing and the court rejected the contentions of

double taxation. It was observed that GST and compensation

cess being were two different things in law and were not

prohibited. It was held that compensation cess must be seen as

an increment to GST.

You might also like

- Case Brief of Taxation Law by NidhiDocument5 pagesCase Brief of Taxation Law by Nidhinidhi gopakumarNo ratings yet

- Mohit Mineral v. Union of IndiaDocument4 pagesMohit Mineral v. Union of Indiaruchi raoNo ratings yet

- Delivery - Westlaw IndiaDocument14 pagesDelivery - Westlaw IndiayogitamadasuNo ratings yet

- Union of India UOI and Ors Vs Hind Energy and CoalSC20181710181039562COM524921Document22 pagesUnion of India UOI and Ors Vs Hind Energy and CoalSC20181710181039562COM524921Saurin ThakkarNo ratings yet

- Taxation (GST)Document14 pagesTaxation (GST)Favi SinglaNo ratings yet

- Supreme Court Judgement On Tax LawDocument35 pagesSupreme Court Judgement On Tax LawRavvoNo ratings yet

- Interest Is A Substantive Levy - SCDocument20 pagesInterest Is A Substantive Levy - SCYogi GabaNo ratings yet

- Skill Lotto Solutions, GST Can Be Levied On Prize MoneyDocument27 pagesSkill Lotto Solutions, GST Can Be Levied On Prize MoneyMonish RaghuwanshiNo ratings yet

- 23 IGST Other Than POS Akashy JAin 20211013111740Document97 pages23 IGST Other Than POS Akashy JAin 20211013111740Chirag AssociatesNo ratings yet

- Case List (Full) TaxDocument56 pagesCase List (Full) TaxShreyaNo ratings yet

- First Case Law On GSTDocument4 pagesFirst Case Law On GSTShankar ReddyNo ratings yet

- 22 IGST ActDocument140 pages22 IGST ActShantanu PatilNo ratings yet

- Indirect Tax 1Document22 pagesIndirect Tax 1Nmm MitzNo ratings yet

- GST An OverviewDocument10 pagesGST An OverviewSheik AllaudinNo ratings yet

- Supreme Court and High Court Weekly Round-UpDocument47 pagesSupreme Court and High Court Weekly Round-UpMohammed SadiqhNo ratings yet

- Levy of Entry Tax Pan India ScenarioDocument14 pagesLevy of Entry Tax Pan India ScenarioAnupam BaliNo ratings yet

- Time Limit To File Appeals in GSTATDocument3 pagesTime Limit To File Appeals in GSTATGST& CENTRAL EXCISE KARAIKAL DIVISIONNo ratings yet

- SLS Pune Presentation 17.08.17Document68 pagesSLS Pune Presentation 17.08.17Sanyam MishraNo ratings yet

- Tax Law ProjectDocument5 pagesTax Law ProjectAyashkant ParidaNo ratings yet

- GST Manuscript IJCLPDocument4 pagesGST Manuscript IJCLPShabih FatimaNo ratings yet

- Chapter - 1 GST - IntroductionDocument24 pagesChapter - 1 GST - IntroductionhanumanthaiahgowdaNo ratings yet

- Interstate Trade and Commerce Under Indian Constitution: K. AnushaDocument6 pagesInterstate Trade and Commerce Under Indian Constitution: K. AnushaTushar GuptaNo ratings yet

- Topic: Goods and Services Tax Prospect in IndiaDocument8 pagesTopic: Goods and Services Tax Prospect in IndiaNaresh ElgaboinaNo ratings yet

- BCO 08 Block 01Document38 pagesBCO 08 Block 01Anand GhadeiNo ratings yet

- Section 18 of Goods and Services Tax Act, 2016 GST (Compensation To States) Act, 2017Document5 pagesSection 18 of Goods and Services Tax Act, 2016 GST (Compensation To States) Act, 2017aniket chaudharyNo ratings yet

- Black Book ProjectDocument70 pagesBlack Book Projectrashmi sahaNo ratings yet

- The Integrated Goods and Service Tax Act, 2017: Statement of Objects and ReasonsDocument49 pagesThe Integrated Goods and Service Tax Act, 2017: Statement of Objects and ReasonsChirag AssociatesNo ratings yet

- LEX TEMPLUM CLAT LLM ALL INDIA MOCK TEST-1 - Q&A FinalDocument38 pagesLEX TEMPLUM CLAT LLM ALL INDIA MOCK TEST-1 - Q&A FinalPooja Vikram0% (1)

- Jindal Stainless Steal V UoiDocument5 pagesJindal Stainless Steal V UoiMuskaan VermaNo ratings yet

- Annexure GST OptionsDocument12 pagesAnnexure GST OptionsIshita GoyalNo ratings yet

- GSTDocument4 pagesGSTThendralzeditzNo ratings yet

- GST and Indirect TaxesDocument84 pagesGST and Indirect TaxesSreepada KameswariNo ratings yet

- GST Compensation To StatesDocument24 pagesGST Compensation To StatesBarun GargNo ratings yet

- GST in India NotesDocument92 pagesGST in India NotesemfdataupeNo ratings yet

- GST NotesDocument47 pagesGST NotesChetanya KapoorNo ratings yet

- III BBA GST NotesDocument6 pagesIII BBA GST Notespremshetty48No ratings yet

- K. D. Kamath & Co. V - CITDocument1 pageK. D. Kamath & Co. V - CITShriKant ShakyaNo ratings yet

- 1-GST Chapter 1Document86 pages1-GST Chapter 1durairajNo ratings yet

- 1 PreliminaryDocument85 pages1 PreliminarySandilya CharanNo ratings yet

- Interpretation of Taxing Statutes Taxing StatuteDocument7 pagesInterpretation of Taxing Statutes Taxing StatuteSubhayan Boral100% (1)

- 08 Strict Construction of Taxing StatutesDocument4 pages08 Strict Construction of Taxing StatutesSarika MahurkarNo ratings yet

- Jindal Stainless Steel Ltd. v. State of Haryana and Ors.Document2 pagesJindal Stainless Steel Ltd. v. State of Haryana and Ors.rajeshwari sivakumarNo ratings yet

- Memo AnkitaDocument26 pagesMemo AnkitaCinema BhaktNo ratings yet

- Taxation LawsDocument2 pagesTaxation Lawspunyaslok.guruNo ratings yet

- Compendium PetitionerDocument5 pagesCompendium PetitionerShreeji PatelNo ratings yet

- The Fundamentals of Goods and Services Tax (GST) Regime - Olive Greens Institute Blog - Olive Greens Institute SSB - NDA - CDSDocument6 pagesThe Fundamentals of Goods and Services Tax (GST) Regime - Olive Greens Institute Blog - Olive Greens Institute SSB - NDA - CDSAshwini ShrivastavaNo ratings yet

- GST IN India - AN: Learning OutcomesDocument1,090 pagesGST IN India - AN: Learning OutcomesMayank GargNo ratings yet

- Classification of StatutesDocument19 pagesClassification of StatutesharinisrinivasaganNo ratings yet

- GSTDocument5 pagesGSTAditya KumarNo ratings yet

- "Aspect Theory" Justify Overlapping of Central and State TaxesDocument8 pages"Aspect Theory" Justify Overlapping of Central and State TaxesNimalanNo ratings yet

- GST - Concept and Constitutional FrameworkDocument9 pagesGST - Concept and Constitutional FrameworkarmsarivuNo ratings yet

- New & Old Syllabus Marathon: Goods & Service Tax - (Cs-Executive)Document68 pagesNew & Old Syllabus Marathon: Goods & Service Tax - (Cs-Executive)sanjay patidarNo ratings yet

- Assignment - TaxationDocument7 pagesAssignment - TaxationTarique AzizNo ratings yet

- National Conference On Backlog of Cases & Court Management: Indian Income Tax Law & Protracted Litigation - A StudyDocument16 pagesNational Conference On Backlog of Cases & Court Management: Indian Income Tax Law & Protracted Litigation - A Studykartikeya gulatiNo ratings yet

- Bos 46137 CP 1Document36 pagesBos 46137 CP 1dharmesh vyasNo ratings yet

- 1 - What Is GST?: Basis of ComparisionDocument14 pages1 - What Is GST?: Basis of ComparisionneelredNo ratings yet

- Do You Know GST August 2020Document12 pagesDo You Know GST August 2020CA Ranjan MehtaNo ratings yet

- Introduction To GST: What Is Tax (Not For Exams)Document95 pagesIntroduction To GST: What Is Tax (Not For Exams)faarehaNo ratings yet

- Chanakya Vs Pricipal Commissioner of Service Tax PDFDocument3 pagesChanakya Vs Pricipal Commissioner of Service Tax PDFDIALOGIC INDUSTRIESNo ratings yet

- Arunav Talukdar Diss 2018Document86 pagesArunav Talukdar Diss 2018shubham kumarNo ratings yet

- Law of Crimes AssignmentDocument18 pagesLaw of Crimes Assignmentshubham kumarNo ratings yet

- Environmental Laws AssignmentDocument12 pagesEnvironmental Laws Assignmentshubham kumarNo ratings yet

- IPR and Cyberspace-Indian Perspective With Special Reference To Software PiracyDocument16 pagesIPR and Cyberspace-Indian Perspective With Special Reference To Software Piracyshubham kumarNo ratings yet

- February 2019: AWS Elating To Maintenance of Wife in IndiaDocument48 pagesFebruary 2019: AWS Elating To Maintenance of Wife in Indiashubham kumarNo ratings yet

- Contempt of Courts Act 1971 Detailed StudyDocument58 pagesContempt of Courts Act 1971 Detailed Studyshubham kumarNo ratings yet

- Investment Project WorkDocument18 pagesInvestment Project Workshubham kumarNo ratings yet

- Intellectual Property Issues in CyberspaceDocument15 pagesIntellectual Property Issues in Cyberspaceshubham kumarNo ratings yet

- Borrowing Powers (Debentures and Charges) : Dr. Bharat G. KauraniDocument25 pagesBorrowing Powers (Debentures and Charges) : Dr. Bharat G. Kauranishubham kumarNo ratings yet

- Impact of Non-Performing Assets On Banking Industry: The Indian PerspectiveDocument8 pagesImpact of Non-Performing Assets On Banking Industry: The Indian Perspectiveshubham kumarNo ratings yet

- Impact of Npas On Profitability of Indian BanksDocument26 pagesImpact of Npas On Profitability of Indian Banksshubham kumarNo ratings yet

- History of Insurance Law in India:: Section 2 (11), Insurance Act, 1938 Defines "Life Insurance Business"Document20 pagesHistory of Insurance Law in India:: Section 2 (11), Insurance Act, 1938 Defines "Life Insurance Business"shubham kumarNo ratings yet

- Non Performing Assets and Profitability of Indian Banks: A ReviewDocument6 pagesNon Performing Assets and Profitability of Indian Banks: A Reviewshubham kumarNo ratings yet

- Causes and Effects of Non-Performing Assets in The Banking SectorDocument10 pagesCauses and Effects of Non-Performing Assets in The Banking Sectorshubham kumarNo ratings yet

- Flemingo Travel Retail Limited Versus Union of India Ti Be EditedDocument13 pagesFlemingo Travel Retail Limited Versus Union of India Ti Be Editedshubham kumarNo ratings yet

- Swati Raju Final ReportDocument62 pagesSwati Raju Final Reportshubham kumarNo ratings yet

- Case Brief TemplateDocument1 pageCase Brief Templateshubham kumarNo ratings yet

- Law of InsuranceDocument37 pagesLaw of Insuranceshubham kumarNo ratings yet