Professional Documents

Culture Documents

FY 2009 HEXA Hexindo+Adiperkasa+Tbk

FY 2009 HEXA Hexindo+Adiperkasa+Tbk

Uploaded by

Anggit Dewi0 ratings0% found this document useful (0 votes)

11 views38 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

11 views38 pagesFY 2009 HEXA Hexindo+Adiperkasa+Tbk

FY 2009 HEXA Hexindo+Adiperkasa+Tbk

Uploaded by

Anggit DewiCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 38

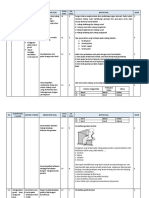

PT HEXINDO ADIPERKASA Tbk

Financial Statements

For Third Quarter ended December 31, 2009 and 2008

(in US Dollars)

FOR THIRD QUARTER ENDED DECEMBER 31, 2009 AND 2008

Balance Sheets

Statements of Income

Statements of Changes in Equity

Statements of Cash Flow

Notes to the Financial Statements

PT HEXINDO ADIPERKASA Tbk

FINANCIAL STATEMENTS.

Table of Contents

12

PT HEXINDO ADIPERKASA Tbk

KawatenInduet Plo Gadung

JLo Reming a Ht No.3

Joke 3730,

elo (21) 411688 Hunk)

Fo: (021 4611686

ip Iwewhesindotbkeoid

‘SURAT PERNYATAAN DIREKSI! DIRECTORS’ STATEMENT

TENTANG/ REGARDING

say

WT

TANGGUNG JAWAB ATAS LAPORAN KEUANGAN

THE RESPONSIBILITY FOR THE FINANCIAL STATEMENTS

UNTUK TRIWUI =

GAL 31 DESEMBER 2009

FOR THE THIRD QUARTERLY ENDED 31 DECEMBER 2008

PT. HEXINDO ADIPERKASA Tbk

‘Kami vena bertandatangen i bawah ii

We, tre undersigned

1. NamaiName Dis, Manuntun Stumorang

Alamat KantorOffice Address 4Jl Pula Kambing 1! Kav I-l No.33, Jakarta Timur

‘Alamat DomisiResidental Address - Pulo Gebang Petmai Blok H7/23

LOOT Rew.078, Cakung- Jakarta Timur

Nomor TeleponiTelephone 021-4811688

JabataniTtie President Director

2, NamaiNtame Hideo Satake

Alamat KantorOfice Address -JkPulo Karnbing It Kav Il No33, Jakarta Timur

‘Alamal Domisli/Residental Address | Oskwood Apartment - Mega Kuningan

Jakarta Setatan

‘Nomar TeleponiTelephone 021-4611688

JabataniTile Director

Menyatakan behwa

Daclare that

1 jawab atas inan den penvaiian snagn perusahaan:

We are responsible forthe preparation and the presentation of tha financial statement of the company:

2. Laporan keuangan aan telah disusun dan 19 sesuai dengan prinsio akuntanel vana besleku

mur.

The financial statements of the company have baen prepared and fairy presented in conformity with

accounting principles generally acoepted in Indonesia

3. a Semua int an Key jetusahaan telah di fan benar,

‘All information has been fully and corectly disclosed in the financial statements of the company:

b. uangan perusahaan tidak mengand: n aden

idak menghilangkan informas! atau fakta material,

‘The financial statements of the company do not contain false materia! information or facts, do not they

‘omit material information or facts;

4, Bertanaauna lawab atas sistem penaendalian intern d rusahean.

We are responsible for the internal contr systern of the company.

‘Demikian pemvataan ini di 39 sebenam

‘This our declaration, which has been made truly.

Jalcerta, January 28, 2010

Waugh rae

6000,

W Drs. Manuntun Situmorang Hideo Satake b

President Director Brestor

JAKARTA @ MEDAN @ PEKANBARU PADANG Q PANGKAL PINANG 4 JAMBI A PERAWANG A TANJUNG ENIM

‘A BANDAR LAMPUNG @ SURABAYA 4 SEMARANG 4 PONTIANAK @ BALIKPAPAN @ SANGATTA A SAMARINDA

‘A BANJARMASIN @ MAKASSAR PALU

PT HEXINDO ADIPERKASA Tbk.

BALANCE SHEETS

December 31, 2009 and 2008

(Expressed in US Dollars, unless Otherwise Stated)

ASSETS:

CURRENT ASSETS

Cash on hand and in hanks

Receivables

- Third partios ( Net of allowance for doubtful

accounts of US$ 1.552.394

as of December 31, 2009 and US$ 2,048,202

as of December 31, 2008)

- Related parties

Finance lease receivables - current portion

- Other receivables - third parties

Inventories

‘Advance payment

Prepaid expenses

Prepaid Tax

TOTAL CURRENT ASSETS

NON CURRENT ASSETS

Due from related parties

Investment in shares of stock

Finance lease receivables - long term portion

Estimated claim for tax refund

Deferred tax asacts - net

Fixed Assets

Acquisition cost

Accumulated Depreciation

Net - Book Value

Other assets

‘Total Non-Current Assets

TOTAL ASSETS

The accompanying notes form an integral part ofthese financial statements.

Notes

3

2b

2c,5a

31,6

24,8

10

20

26,5

of

2,6

20,16

2g, 11

2g, 11

1

2009 2008

USS uss

35,808,061 7,789,361

30,479,384 35,596,266

3,804,956 2.182.324

1,424,199 5,516,528

125,280 25.288

91,072,473 99,892,579

5,690,673 34,883

311,583 175.104

9,690,653 2023,888

177842,91

334,054 wan9

4612142 1,588,142

934.997 2295,996

1,300,479 1,099,552

2.734.956 134,256

417,608,072 127,848,

(20,043,094) (17,690,356)

27,564,978, 23,787,488

204.25

eRe 30,695 956

215.528.0838 _187,252,008.

ag

4

PT HEXINDO ADIPERKASA Tbk.

BALANCE SHEETS

December 31, 2009 and 2008

(Expressed in US Dollars, unless Otherwise Stated)

LIABILITIES AND EQUITY

Notes 2009 2008

CURRENT LIABILITIES USS USS

Short-term bank loans 2 15,000,000 18,000,000

‘Trade payables

Related parties 2e,be 61,735,815 57,985,351

= Third parties 13 3,738,977 2,571,906

Other payables 9,706,233 3,267,671

‘Accrued expenses 12,826,462 5227841

Taxes payables 8,963, 495 7,301,995,

Divident payables 5

Current maturities of long term

liabilities:

Bank loans 7 1,046,267 2,992,065

Finance lease obligation 18 16,917 73,31

Other payables 19 1,213,605, 7,484,360

Estimated liability for employes benefits 20 66,883 e

‘Total Current Liabilities 114,404,0"

Due to related parties 20, Bd 6,647,272 33,236

Derivative instrument payables 2m, 30f 145,054 903,141

Long-term liabilities-not of current portioy

Bank loan 17 6,359,599 3,595,799

Finance lease obligation 18 20,643 32,238

Other payables 19 803,016 2,016,717

Estimated liability for employees! benefits 20 1,873,523 1,804,709,

Total Non-Current Liabilities 14,749,106 3,585,540

EQUITY

Share capital - par value Rp100 per share

Authorized - 1.680,000.000 shares

Tesued and fully paid - 840.000.000

shares 121 23,282,926 23,232,026

Additional paid-in capital-net 1b}, 22 7,998,836 7,998,836

Retained earnings

Appropriated 23 2,622,530 2,138,630

Unappropriated 52,521,238 41,906,420

TOTAL EQUITY 36,375,523 75,271,712

‘TOTAL LIABILITIES AND EQUITY 215,528,683 187,252,068

Jakarta, January 26, 2010

1 staunan stare

President Director | 772p

The accompanying notes form an integral part of these financial statements

2

PT HEXINDO ADIPERKASA Tbk.

STATEMENTS OF INCOME

For Third Quarter Ended December 31, 2009 and 2008

(Expressed in US Dollars, unless Otherwise Stated)

Notes 2008

uss uss

26.2424

NET REVENUES 30b,306,3, 229875015 202,908,264

08

(COST OF REVENUES 20 2k,25

GROSS PROFIT

OPERATING EXPENSES 24,26

sling 11,898,022, 12,096,512

General and administrative 9,396,999 716,921

Totol operating expenses 2,204,960 20,812,455

OPERATING INCOME, 29657,079 28,668,522

‘OTHER INCOME (CHARGES)

Interest income 2iar 305,942 1,487,682

Gain on sales of property & equipment 21,756 37,898

Interst expenses 2028 (1,208,288) 1,313,822)

Loss on foreign exchange-net 2n (475,339) (31581,142)

Provision (reversal of allowance) for doubtful accounts 24 427.580 (246,550)

Miscelaneous - net 594.720 128.814

Other income (charges) - net (245.546) (8.626.922)

INCOME BEFORE

INCOME TAX

INCOME TAX BENEFIT (EXPENSES)

‘Current 20,18 (6,739,920)

Deferred 20:18 526,980

Income Tax Expense - Net (212,940)

NET INCOME 21,200,489 17,418,761

BASIC EARNINGS PER SHARE 2 os" oe

(in US Dollar

Jakarta, January 26, 2010

OWipewe tt

President Director By

‘The accompanying notes fom an irtegra part of hese financial statements

‘swwowojers eoueuy esau Jo Hed 1,80} Ue uN se}ou BUMUEdLERD® aL

cess oe Teevewes oes eaae Bea 865Z wewee ee Go0e Fe aGUEDEG TOUR

eoro02'1z cov 002'tz. - 6002 seqwesacr uty pouad awoout ron]

Kooo'ser) 0'ser ‘1u2sauj20U08 44 voneudoxddy

foro ve'on, \oso'sve'on) : 289 spuapip use9|

‘Ovoss0'9L ‘apleoozy oeseerz oes s6e wae Booz

wis'089 our'ts6) _ 10882 corse =

991 20687 ver sOoEY eee ‘S609 Liseee ee

2. Ana pue panes

fnba pereudoxideun | _paroudoxddy eee

we. ‘sbuwea pour feo a1eus.

‘002 pue 600% ‘be 1oquie29q pepua JoUeND pul JO

ALiNOa NI S3ONVHO 40 SINSMSLVIS

HAL VSYIUAdIGY OGNIXSH “Ld |

PT HEXINDO ADIPERKASA Tbk.

[STATEMENTS OF CASH FLOWS:

For Third Quarter Ended December 31, 2009 and 2008,

(Expressed in US Dollars, Unless Otherwise Statod)

2000 2008

(CASH FLOWS FROM OPERATING ACTIVITIES USS. USS

(Cash receipts from customers 282,817.038, 172330768

Cash pai to

‘Suppliers (161,246,600) (153,341,742)

(Operating activites (12:428,416) (40,140,626)

‘Salaries, wages and benefit of employees 11.397 813) 10,525,114

Net cash proved by operations 17,804,120 (1.976.714)

‘Received frm intrest income 395,042 287297

Payment of interest expenses (1.483287) (734947)

Payments for income taxes Ga12827) (e00.318)

Payments for value added taxes (4388-280

Net ash provid by used in)

Operating Activities 65,475,469 (2,533,742)

(CASH FLOWS FROM INVESTING ACTIVITIES

Proceeds from sales of property equipment aura sagrt

‘Acausilons of property and equipment 2.231.876) (4,405,832)

Construction in progress (657.405) (4.901.961)

Payment of investment in shares of sock (1'389\283)

Adltional of advance payment (4.548.131) 33,402,

Not cash used in investing

‘Activities (7,413,634) (7,599,193)

(CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds fom shor-torm bank loan 12,000,000 18,180,183,

Proceeds ftom iong-term bank loan ci 5352320

Cash dvent (10,844,010) (810.860)

Paymeatof short-term bank loan (31,000,000), (15,875,068)

Payment of ong-erm bank oan (1,156,026) 1,068,317)

Payment of otter payables z (6,850,634)

Payment of nance lease obligation 179.134 109,772)

Net cash proved by (used in)

Financing Actives 94,179.17 982,232)

‘Not increaso (Decrease) in cash on hand 27,882,688 (14.15,187)

‘and in banks

Cash on hand and in bank at beginning of period 7.920.408 18,904,520

‘CASH ON HAND AND IN BANK AT END OF PERIOD 35,003, I

The accompanying notes form an integral part ofthese financial statements.

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2009 and 2008

(Expressed in US$ Unless Otherwise Stated)

1 GENERAL

a

Establishment of the Company

PT Hexindo Adiperkasa Tbk (the “Company*) was established in Indonesia based on Notarial

Deed dated November 28, 1988 No. 37 of Mohamad Ali, S.H. The Deed of Establishment was

approved by the Ministry of Justice of Republic Indonesia in its Decision Letter No, C2-

4389,HT.01.01.TH.89 dated -May 12, 1989, and was published in Supplement No. 1251 of the

State Gazette No, 54, dated July-7, 1989. Its Articles of Association has been amended several

times, the latest amendment was notarized through Notarial Deed No. 163 and 164, June 29,

2009 and No. 61, August 20, 2009 of Robert Purba, S.H.. These amendments will register to the

Department of Justice and Human Rights of Republic Indonesia

‘The Company started its commercial operations in January 1989.

‘According to Article 3 of the Company's Articles of Association, its scope of activities comprises

of trading and rental of heavy equipment and rendering of after-sales services. Presently, the

Company acts as a distributor of certain heavy equipment and related spare parts under Hitachi,

John Deere and Krupp trademarks. The Company is domiciled in Jakarta, located at Kawasan

Industri Pulo Gadung, Jalan Pulo Kambing I! Kav. I! No, 33, Jakarta 13930. As of December 31,

2008, the Company has 11 main branches, 2 sub-branches, 9 representative offices and 10

project offices, which are all located at various places in Indonesia,

Company's Initial Public Offering

‘The Company's registration statement for its public offering of its 10 milion shares (with Rpt,000

(full amount) par value per share) at an offer price of Rp2,800 (full amount) per share became

effective in accordance with the Letter No. S-1958/PM/1994 dated December 5, 1994 issued by

the Chairman of the Capital Market and Financial Institution Supervisory Agency (BAPEPAM-LK),

‘All of the Company's shares have been registered in the Indonesia Stock Exchange since

February 13, 1995.

‘The Company's registration statement for its First Limited Public Offering of 42 million shares.

(with Rp1,000 (full amount) par value per share) to shareholders with pre-emptive rights at an

offer price of Rp1,000 (full amount) per share became effective in accordance with Letter No. S-

1264/PM/1998 dated June 19, 1998 issued by the Chairman of BAPEPAM-LK

In the minutes of the Extraordinary Shareholders’ Meeting of the Company held on June 12,

2000, as covered by Notarial Deed No. 12 on the same date of Fathiah Helmi, S.H., the

shareholders resolved fo amend its Articles of Association, which include, among others, change

in par value from Rp1,000 (full amount) per share to RP500 (full amount) per share. These

amendments were accepted and recorded by the Department of Justice and Human Rights of

Republic indonesia in its Letter No. C-21025 HT.01.04.Th.2000 dated September 20, 2000. On

July 28, 2002, the stock split was effectively implemented

1

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2009 and 2008

(Expressed in USS Unless Otherwise Stated)

GENERAL (Continued)

In the minutes of the Extraordinary Shareholders’ Meeting of the Company held on June 15,

2004, as covered by Notarial Deed No. 24 on the same date of Fathiah Helmi, S.H., the

shareholders resolved to change the par value from Rp500 (full amount) per share to Rp100 (full,

amount) per share. This amendment was accepted and recorded by the Department of Justice

and Human Rights of Republic Indonesia in its Letter No. C-23337 HT.01.04.Th.2004 dated

‘September 17, 2004. On September 1, 2005, the change of the par value was effectively

implemented.

Boards of Commissioners, Directors, Audit Committee and Employees.

‘The composition of the Company's boards of commissioners and directors as of December 31,

2009 are as follows:

Board of Commissioners:

Kardinal Alamsyah Karim, MM. = -——~President Commissioner

Harry Danui = Commissioner

Donald Christian - Commissioner

Directors:

Manuntun Situmorang President Director

Toshiaki Takase - Director

Hideo Satake = Director

Yoshiya Hamamachi - Director

Shinichi Hirota - Director

Hideo Kumagai ~ Director

Tony Endroyoso. - Director

‘Shogo Yokoyama - Director

Toru Sakai - Director

‘The composition of the Company's audit committee as of December 31, 2009 are as follows:

Harry Danui - Chairman

Danny Lolowang, = Member

Bambang Wiharto - Member

‘The composition of the Company's boards of commissioners and directors as of December 31,

2008 are as follows

Board of Commissioners:

Kardinal Alamsyah Karim, MM. --—_—~President Commissioner

Harry Danui - Commissioner

Donald Christian = Commissioner

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2009 and 2008

(Expressed in USS Unless Otherwise Stated)

¢. Boards of Commissioners, Directors, Audit Committee and Employees (Continued)

Directors:

Manuntun Situmorang - President Director

Toshiaki Takase - Director

Hideo Satake = Director

Yoshiya Hamamachi = Director

Shinichi Hirota - Director

Tetsuo Maruyama - Director

Tony Endroyoso - Director

Naoki Kito = Director

Yasushi Ochiai - Director

‘The composition of the Company's audit committee as of December 31, 2008 are as follows:

Harry Danui - Chairman

Danny Lolowang. - Member

Bambang Wiharto - Member

The salaries and other compensations benefits incurred for the Company's commissioners and

directors amounted to US$889,288 for December 31, 2009 and USS 933,093 for December 31,

2008

‘As of December 31, 2009 and December 31, 2008, the Company had 997and 956 permanent

employees

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a. Basis of Preparation of the Financial Statements

The financial statements are prepared in accordance with generally accepted accounting

principles in Indonesia, which are the Statements of Financial Accounting Standards (PSAK),

BAPEPAM-LK regulations and the Guidelines for Financial Statements Presentation as circulated

by BAPEPAMLLK for trading companies, which offer their shares to the public.

‘The financial statements are prepared on the historical cost basis, except for inventories which

are valued at the lower of cost or net realizable value and derivative instrument which are valued

at fair value. The financial statements are prepared based on accrual basis, except for the

statements of cash flows.

‘The statements of cash flows presents cash receipts and payments classified into operating,

investing and financing activities using the direct method.

In accordance with the minutes of the Extraordinary Shareholders’ Meeting of the Company held

on July 21, 2008, as covered by Notarial Deed No. 159 on the same date of Robert Purba, S.H.,

the shareholders resolved to change the Company's fiscal year from January to December to

April to March that will be effective for 2009 fiscal year. The change was approved by the

Directorate General of Tax in its decision letter No. KEP-00003/THBK/ WPJ.07/KP.0803/2008.

‘The reporting currency used in the financial statements is United State Dolla.

8

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2009 and 2008

(Expressed in US$ Unless Otherwise Stated)

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

b. Allowance for Doubtful Accounts

‘The Company provides allowance for doubtful accounts based on the certain percentage of

accounts receivable balance and review on the condition of each customer at balance sheet date.

¢. Transactions with Related Parties

‘The Company has transactions with certain related parties, Related parties are defined in

accordance with PSAK No. 7, "Related Parly Disclosures’

Alll transactions with related parties are disclosed in the notes to the financial statements

d. Inventories

Effective January 1, 2009, the Company has applied PSAK No. 14 (Revised 2008), "inventories",

which supersedes PSAK No. 14 (1994), “Inventories”. The adobtion of this revised PSAK did not

result in a significant effect in the Company's financial statements.

Inventories are stated at the lower of cost or net realizable value. Cost of heavy equipment

inventories reclassified from heavy equipment previously being leased out, at the end of the lease

terms are stated at net book value

The cost of heavy equipment inventories is determined by the specific identification method while

the cost of spare parts is determined using the average method.

Net realizable value is the estimated selling price in the ordinary course of business, less

estimated cost of completion and the estimated cost necessary to make the sale.

Allowance for inventories obsolescence is provided based on a review of the condition of the

inventories at balance sheet date

e. Prepaid Expenses

Prepaid expenses are charged to operations over the periods benefited

f. Investment in shares of stock

Investment in shares in which the Company has ownership ess than 20% is recorded using cost

method,

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2009 and 2008

(Expressed in USS Unless Otherwise Stated)

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Q. Property and Equipment

1 Direct ownership

Effective January 1, 2008, the Company applied PSAK No. 16 (Revised 2007). “Fixed Assets’

which supersedes PSAK No. 16 (1994), “Fixed Assets and Other Assets’, and PSAK No. 17

(1994), "Accounting for Depreciation”, whereby the Company has chosen the cost model. The

adoption of this revised PSAK did not result in a significant effect in the Company's financial

statements.

Property and equipment is stated at cost less accumulated depreciation and impairment losses.

‘Such cost includes the cost of replacing part of the property and equipment when that cost

incurred, f the recognition criteria are met. Likewise, when a major inspection is performed, its

cost is recognized in the carrying amount of the property and equipment as a replacement if the

recognition criteria are met. All other repairs and maintenance costs that do not meet the

recognition criteria are recognized in profit or loss as incurred

Depreciation, except for heavy equipment being leased out, is computed using the straight-line

method over the estimated useful lives of the assets as follows:

Year Rate

Building 20 5%

Vehicles, office equipment, furniture

and fixtures and machineries 5 20%

Tools for after-sales service 2 50%

Depreciation for heavy equipment being leased out is based on operational hours and over the

term of the lease, which are in line with the related leased agreements

‘An item of property and equipment is unrecognized upon disposal or when no future economic

benefits are expected from ifs use or disposal. Any gain or loss arising from unrecognized of the

asset (calculated as the difference between the net disposal proceeds and the carrying amount of

the asset) is included in profit or oss in the year the asset is unrecognized

‘The asset's useful lives and methods of depreciation are reviewed, and adjusted prospectively if

appropriate, at each financial year end

Costs incurred in connection with the acquisition or renewal of landrights are deferred and

amortized over the lower of legal terms of the related landrights or economic lives of the land

using the straight-line method. The deferred charges are presented as part of ‘Other Assets”

account in the balance sheets.

2 Construction in progress

Construction in progress represents the accumulated cost of materials and other costs related to

the asset under construction. When the asset is completed and ready for its intended use, these

costs are reclassified to the related accounts

10

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended Decombor 31, 2009 and 2008

(Expressed in US$ Unless Otherwise Stated)

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

h

Impairment in Assets Value

‘At balance sheet date, the Company conducts a review for any indication of impairment due to

possible events or changes in circumstances that the carrying value may not be fully recoverable,

Impairment in asset value, if any, is recognized as loss in the statement of income of the current

year.

Lease

Effective January 1, 2008, the Statement of Financial Accounting Standards (PSAK) No. 30

(Revised 2007), "Leases" supersedes PSAK No. 30 (1990), “Accounting for Leases”. Based on

PSAK No. 30 (Revised 2007), the determination of whether an arrangement is, or contains a

lease is based on the substance of the arrangement at inception date and whether the fulfilment

of the arrangement is dependent on the use of a specific asset and the arrangement conveys a

Tight to use the asset. Under this revised PSAK, leases that transfer substantially o the lessee all

the risks and rewards incidental to ownership of the leased item are classified as finance leases,

Moreover, leases which do not transfer substantially all the risks end rewards incidental to

ownership of the leased item are classified as operating leases,

The Company as a lessee

Based on PSAK No. 30 (Revised 2007), under a finance leases, the Company shall recognize

assets and liabilities in their balance sheets at amounts equal to the fair value of the leased

property of, if lower, the present value of the minimum lease payments, each determined at the

inception of the lease. Minimum lease payments shall be apportioned between the finance charge

and the reduction of the outstanding liability. The finance charge shall be allocated to each period

during the lease term so as to produce a constant periodic rate of interest on the remaining

balance of the liabilty. Finance charges are reflected in profit and loss. Capitalised leased assets,

(presented under the account of property and equipment) are depreciated over the shorter of the

estimated useful life of the assets and the lease term, if there is no reasonable certainty that the

Company will obtain ownership by the end of the lease term,

Under an operating lease, the Company recognized lease payments as an expense on a straight-

line basis over the lease term

The Company as a lessor

Based on PSAK No.30 (Revised 2007), under a finance lease, the Company shall recognise

assets held under a finance lease in its balance sheets and present them as a receivable at an

‘amount equal to the net investment in the lease. Lease payment receivable is treated as

repayment of principal and finance income. The recognition of finance income shall be based on

a pattem reflecting a constant periodic rate of retum on the Company's net investment in the

finance lease

"

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2009 and 2008

(Expressed in USS Unless Otherwise Stated)

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Lease (Continued)

Under an operating lease, the Company shall present assets subject to operating leases in its

balance sheets according to the nature of the asset. Initial direct cost incurred in negotiating an

operating lease are added to the carrying amount of the leased asset and recognized over the

lease term on the same basis as rental income. Lease income from operating leases shall be

recognized as income on a straight-line basis over the lease term,

‘At the application of this revised PSAK, the Company has chosen to apply this revised PSAK

retrospectively in which all leases transactions that existed before January 1, 2008, were

evaluated by the Company to determine their classifications in accordance with this revised PSAK

and treated as if it had been applied since the commencement of the lease term,

Additional Paid-in Capital - Net

‘Additional paid-in capita -netis the difference between the offering price and the par value of

share capital issued, net ofthe costs incurred in connection with the public offering,

k. Revenue and Expense Recognition

Revenue from sales of heavy equipment and spare parts are recognized when the heavy

equipment and spare parts are delivered to the customers. Revenue from repairs and

‘maintenance services and commission income are recognized when the services are rendered to

the customers. Revenue from rental of heavy equipment is recognized based on the usage of

heavy equipment in accordance with the related agreement.

Expenses are recognized when incurred (accrual basis).

1. Estimated Liability for Employees’ Benefits

The Company adopts PSAK No. 24 (Revised 2004), “Employee Benefits’ that recognizes the

accounting and disclosures of estimated labilty for employees’ benefits. Total estimated liability

for employees’ benefits is calculated in acoordance with the Labor Law No. 13 Year 2003 dated

March 25, 2003. Under PSAK No. 24 (Revised 2004), the defined benefit obligation, current

service cost and past service cost are calculated using the projected unit credit actuarial valuation

method. Actuarial gains and losses are recognized as income or expense when the net

cumulative unrecognized actuarial gains and losses at the end of the previous reporting year

exceeded 10% of the present value of defined benefit obligation at that date, These actuarial

gains or losses are recognized on a straight line basis over the expected average remaining

‘working lives of the employees. Further, past-service costs arising from the introduction of a

defined benefit plan or changes in the benefit payable of an existing plan are required to be

amortized over the period until the benefits concerned become vested

12

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2009 and 2008

(Expressed in US$ Unless Otherwise Stated)

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

m. Derivative Instruments

Every derivative instrument (including embedded derivatives) is recorded in the balance sheets

as either asset or liability and measured at their fair values of each contract. Changes in

derivative fair value are recognized in current earnings unless for specific hedges which allow a

derivative's gains and losses to offset related results on the hedged item in statements of income.

‘An entity must formally document, designate and assess the effectiveness of transactions that

meet hedge accounting. The Company’s derivative instruments are not designated as hedging

instruments for accounting purposes.

n. Foreign Currency Transactions and Balances

Transactions involving foreign currencies are recorded in US Dollar atthe rates of exchange

prevailing atthe time the transactions are made. At balance sheet date, monetary assets and

Jiabilties denominated in foreign currencies are adjusted to Rupiah to reflect the rates at such

date. The resulting gains or losses are credited or charged to operations for the period

‘As of December 31, 2009 and December 31, 2008, the rates of exchange used are, as follows

(full amount of US Dollar):

2009 2008

1 Euro (EUR) 13,510 15,432

1 United States Dollar (USS) 9,400 10,950

1 Australian Dollar (AUD) 8432 7,555

1 Singapore Dollar (SGD) 6699 7,607

1 Japanese Yen (JP¥) 102 121

©. Income Tax

Current tax expense is provided based on the estimated taxable income for the period. Deferred

tax assets and liabillies are recognized for temporary differences between the financial and the

tax bases of assets and labililes at each reporting date. Future tax benefits are also recognized

to the extent that realization of such benefits is probable,

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the

period when the asset is realized or the liability is settled, based on tax rates (and tax laws) that

have been enacted or substantively enacted at the balance sheet date. Changes in the carrying

‘amount of deferred tax assets and liabilities due to a change in tax rates is charged to current

period operations.

Atbalance sheet date, the carrying amount of deferred tax asset is reviewed and adjusted to the

extent that its no longer probable that part or all ofthat deferred tax assets willbe realized in the

future

‘Amendments to tax obligations are recorded when an assessment is received or, if appealed

against by the Company, when the result of the appeal is determined.

13

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2009 and 2008

(Expressed in USS Unless Otherwise Stated)

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

p. Basic Earnings per Share

Basic earnings per share is computed by dividing the net income for the period with the weighted-

average number of the shares outstanding during the period. The weighted-average number of

shares outstanding as of December 31, 2009 and 2008 is 840,000,000 shares,

@. Segment Information

The Company classifies its segment reporting as follows:

i) Business segment (primary) based on the nature of its products sold, consists of sales and

rental of heavy equipment, sales of spare parts of heavy equipment and repairs and

maintenance services

ii) Geographical segment (secondary) based on location of sales, consists of within Java

island and outside Java island,

F, _Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting

principles in Indonesia requires management to make estimations and assumptions that affect

‘amounts reported therein. Due to inherent uncertainty in making estimates, actual results

reported in future periods might be based on amounts that differ from those estimates.

s. _ Revised Statements of Financial Accounting Standards

‘The following summarizes the revised Statements of Financial Accounting Standards (PSAK)

which have been issued by the Indonesian Institute of Accountants but not yet effective in 2009;

1 PSAK No. 50 (Revised 2006), “Financial Instruments: Presentation and Disclosure:

contains the requirements for the presentation of financial instruments and identification of

the information that should be disclosed. The presentation requirements apply to the

Classification of financial instruments, from the perspective of the issuer, into financial

assets, financial liabilities and equity instruments; the classification of related interests,

dividends, losses and gains; and the circumstances in which financial assets and financial

liabilties should be offset. This standard requires the disclosure, among others, of

information about factors that affect the amount, timing and certainty of an entity's future

‘cash flows relating to financial instruments and the accounting policies applied to those

instruments, PSAK No. 50 (Revised 2006) supersedes PSAK No. 50, "Accounting for

Certain Investments in Securities” and is applied prospectively for the periods beginning on

or after January 1, 2009 (which was subsequently revised to become on or after January 1,

2010). Earlier application is permitted and should be disclosed

14

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2009 and 2008

(Expressed in US$ Unless Otherwise Stated)

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

2 PSAK No. 55 (Revised 2006), "Financial Instruments: Recognition and Measurement’,

establishes the principles for recognising and measuring financial assets, financial

liabiliies, and some contracts to buy or sell non-financial items. This standard provides for

the definitions and characteristics of a derivative, the categories of financial instruments,

recognition and measurement, hedge accounting and determination of hedging

relationships, among others. PSAK No. 55 (Revised 2006) supersedes PSAK No. 55,

“Accounting for Derivative Instruments and Hedging Activities’, and is applied

prospectively for financial statements covering the periods beginning on or after January 1,

2009 (which was subsequently revised to become on or after January 1, 2010). Earlier

application is permitted and should be disclosed

3 PSAK No. 26 (Revised 2008) "Borrowing cost’ prescribes the accounting treatment for

borrowing cost, and supersedes PSAK No. 26 (1997). This revised PSAK provides

guidance on borrowing cost of that are directly attributable to the acquisition, construction

r production of a qualifying asset form part of the cost of that asset. Other borrowing

costs are recognized as an expense. This revised PSAK is effective start on January 1,

2010. Earty application is permitted

4 PSAK No. 10 (Revised 2009), "The Effect of Changes in Foreign Exchange Rates’, this

PSAK supersedes PSAK No. 10 (1994), PSAK No. 11 (1994) and PSAK No. 52 (1997)

‘This revised PSAK is effective start on January 1, 2011.

5 PSAK No. 48 (Revised 2006), "Impairment Of Assets", this PSAK revised PSAK No. 48,

(1998). This revised is effective start on January 1, 2011

‘The Company is currently evaluating the effect of the above revised PSAK and has not

determined the effect on its financial statements.

15

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quartor Ended December 31, 2009 and 2008

(Expressed In US Dollars, unioss Otherwise Stated)

‘GASH ON HAND AND IN BANKS

This account consist of

December 2000 December 2008

Cash on hand USS USS:

Cash, RP 962,928,010 as of December 31, 2000 and 102439 38.22

RP. 417 439,637 as of December 31, 2008

‘cash in bank

Rupiah accounts

PT Bank CIMB Niage Tok (Frovicusly Bank Lippo Tox)

(@PO5%4570114 sof Deambee 3, 2008 an

AP 1394073817 aso December 3,208) 112,188, 1,245,730

PT Bank Reson Perdania

APO CO4BIT asf Dever, 2008) 8.525 7.400

PT Bank Intertiona Indonesia Thc

(92 5484160884 a Decree 31,200 snd 580,230 422539

[e426 8070 oo Deca’ 31,2003)

PT Bank Rakyat Indonesia

(fi 022447105 ce Denar, 2000 and

RP 126 90.05 arc December, 2008) 87.491 11397

PT Bank Danamon Tbk.

(2206056240 a of Deeb 3, 0094

Rp 16 720 a Desembar1,2009) 218,099 53,088

PT Bank Mandi

(F102 170.02 a of December 3, 009

"RP 1.89 8.4 af Date 2008) 409.487 165,923,

PT Bank Mega

(625750406 a8 of Deember 9,200

‘RP 061150 240 a cf Deer 9, 708) 676,340 708,428

Clbenkc NA, Jakarta

(2P 162235365 of Decanter 31,2009

RP 135044.00 asf Docent, 208) 172801 105,800

PT Bank Negara Indonesia (Perse) TOK

(9 125400112 Deconber 3,200 sd

Fe ep200,719 act December 3, 2000) 1347 6.064

PT. Bank Mizuho Indonesia

(70707758 eset December 1, 200028

[RPO7O4 178 eof Decber 9,208) 11033 04

‘The Bank of Tokyo Mitsubishi UFJ, Lid, Jakarta

(FP 345270285 of Deoanber 3,200 and

"RP-.98 720882 a of Does 1, 2008) 367,318 310,204

ark Samoan oncla

(8 097032248 Dovaner 2,200) 11062

Total Rupiah Accounts 3,247,650. 3,116,396

United States Dollars accounts

PT Bank Resona Perdania 2503 2.543

PT Bank Intemational Indonesia To 25,490,947 4.923.027,

“Tho Bank of Tokyo Mitsubishi UFJ, Ltd. Singapore 432.839 411.097

PT Bank Mega 739,692 59,181

Citbank NA, Jokarta 231,538 292,189

PT. Bank Mizuho Indonesia 111053, 7.485

PT Bank Shinta| 195 195

‘Tne Bank of Tokyo mitsubishi UFJ, Lid 5.445577 1,987,742

Bank Sumitomo Mitsui Indonesia Tort

‘otal United States Dolor Accounts Baa 454 F553 570

Japanese Yon accounts

Tho Bonk Tokyo MMS UF, kta

(PY 165722191 eect Deconbe 3,20 ant

JPY 8.70048 2 Decent 208) 20,006 70618

(JP 1915828 a of December 31, 208 a

“PY s79 85898 Grcanber 1, 08) 1424 10,846

Total Japanese Yen accounts 21516 31,464

“otal cash in Banks 5700622 751239

“otal eash on hand an in banks 35,808,061 7,788,364

16

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 34, 2009 and 2008

(Exprossod in US Dollar, unless Otherwise Stated)

4. TRADE RECEIVABLES - THIRD PARTIES

“This account cepcesents trade reetvables- tid pares arising from:

December 2000 December 2008

USS. iss

Sales and rental of heavy equipment, used in

Plantation and loging 4,288,038 8276260

Contretons 7874 31872

‘Ming 3,426,987, 12,446,491

Tosa 702.590 20,754,623

Repairs and maintonace services 9,605,648 7,863,616

Sales of spare parts 14633531 9.028 229

Tota 32,031,778, 37,644,408,

Allowance for doubiful accounts 1.852,308 (2,048,202)

Net 30,479,384 35,596,266,

“The movements of allowance for doubtful accounts during the petad are ftows:

December 2009 _Decerrher 2008

USS i

Begining balance 11979,745, 1,968,160

Proviso daring the period "164,869 198,046

Reverso allowanee for account receivables (680,952) 3

‘Write off of acces during te period 1,068 (118.90

ating balance 1,552,304 2,048,202

“The aging analysis of trade receivables - thi parties based on due dates areas folowe:

‘December 2009 ‘December 2008,

Sales and rentl of heavy equips USS

(Curent and les than 3 months 7,318,108

3-6 ments 280.656

(Over 6 moms 1 year 30.228,

Over I year 65,508,

Tota 7,702,599 20,754623

Reps and raierance sevice:

Curren nls thin months 9,543,588, 7977.608

3-6 ments 109,900 119518

‘Over months 1 year 16457 28,559

Ove yeae 25613 37,931

Tota 9.695.648, 7,883,616,

Soles of sare parts

(Current rl esi than 3 months 14,540,801 8,905,749,

3-6 months 43637 "103,282

Over 6 months- ear 33,887 5310

Over I year 15.116 11917,

‘oval 14,633,531 9,026,229

etal of trade recelvables- tied partes based en original currencies areas folwn:

December 2009 __Decernber 2008_

USS USS:

Unted States Dears 28,165,552 35,097,707

Rui 3,885,226,

Total 32,031,778,

v

PT HEXINDO ADIPERKASA Tok

NOTES TO THE FINANCIAL STATEMENTS.

For Third Quartor Ended Decomber 3, 2008 and 2008

(Expressed in US Dollars, unless Otherwise Stated)

&_ BALANCES AND TRANSACTIONS WITH RELATED PARTIES

2 Trade Receivables

Details tae seni fom rested nates onsale ansctionare a fllows

December 2002 _Dacomber 2008

uss USS

isch Consbuction Machinery Asa and esi Pe Lt

Singapore 1270428 2,180,324

Hitachi Construction Machinery Thaiand 2227

SHOM Service 5.875 :

PP Hitachi Construction Machinery Finance Indonesia 2017 426 7

“Total 3.304.956, Zia

December 2009 _Dacomber 2008

. Other Receivables USS USS.

Employees 278.537 282,167

Hitachi Construction Machinery Asia and

Paciic Pe, Lid, Singapura er

Hitachi Construction Machinery Co,

Japan 50,192 east

Hitachi Construction Truck Menufectring Lid

Canada : 98.824

PT Hiachi Construction Machinery Finance indonesia 5.385

Toto ee ee rr

“Total of receivables from related partes 369,010

Percentage

FRocchtles rom emoyees manly represent noninterest bearing for housing loans ellectibe through manly pal deductons.

© Teale Payales

esl of tae payabesto relied partis on prc transaction areas follows

Deemer 2009, December 2008,

USS USS

PT Hitachi Construction Machinery

Indonesia 40812632 244703320

‘Hitachi Construction Machinery Asia & Pasi Pte, Lis 20,778,498 31,991,907

Singapore

Hitachi Construction Machinery Co, id.

Japan 123,354 305,430

Hitachi Construction Truck Manufacturing Lis

‘Canada 12,140 27685

HOM Trading 8.991 :

oval SRE RIS ep ars

Payables oP Hitachi Consteton Machinery Indonesa represent payables on purchases of spare parts Inventories and heat equipment

Payables to Hitachi Construction Machinery Asia and Pacific Pte, Lid, Singapore (HMAP), represent payables cn purchases of spare parts

inventories and heavy equipment, and deposits received bythe Company om HMAP's customers for purchases of heavy eauipment 10

HMAP, of which the Company isthe sales agent

Payables to Hitachi Construction Machinery Co.,Ltd, Japan, represent payables cn purchases of spee pats inventories,

Payables to Flach Construction Truck Manufecturing ic, Canada (HTN), represent portion of revenue sharing of HTM for the rental of

hhezuy equipment ned by HTM to certn custmer

18

PT HEXINDO ADIPERKASA Tok

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2009 and 2008

(Exprossed in US Dollars, unless Othorwise Stated)

6

BALANCES AND TRANSACTIONS WITH RELATED PARTIES (continued)

December 2000 December 2008 ame or

Cher Payables USS USS * *

Fitch Consituction Machinery Co. td,

Japan 210,630 9732 om oat

Hitachl Construction Machinery Asia & Posie Pte, 16 5,333,902 - an

‘Otners (below Fip:300 milion each) 2740 23508 om aw

otal 5.547.272 ao om

‘The nature of relationship ofthe Company with related partes areas follows:

‘Name of Related Pats Relationship

4. Hitch Construction Machinery Ca, Lid, Japan ‘Shareholder

2. Hitachi Construction Machinery Asia Pasiie Pe, Lid, Singapore ‘Shareholder

3. tect Corporation, Japan ‘Shareholder

4. Hilachi Construction Truck Menvfacturing Li, Cana Afliated Company

5. PT Hiachi Construction Machinery Indonesia Afiaed Company

6. Michi Construction Machinery (Shargha) Co., Lt, Cina Afftaed Compeny

FINANCE LEASE RECEIVABLES

The {ure collection fnance lease receivtles required under the lease agreements ae as folows:

December 2009 December 2008 _

uss. uss.

Finance lease resiables 2,359,198, tos12.824

LUncarned finance lease income A -

Total Zaoise = SCSC«OBTSD

{Less Curent potion (1424-199) (8,516,528)

Lone erm potion 954.937 2,295,996,

Finance lease receivables represent receivables from PT Kaltim Prima Coal (KPC) in cennection with rentals of 14 units of heavy

‘equipment purchased from Mitsubishi Corperation

‘The Company/s management bllves hall fence lease receivables can be collected, and thus no alowsnce for doubtful accounts were

rowed for.

OTHERS RECEIVABLES - THIRD PARTI

This account consist of:

December 2008 December 2008

uss USS

‘Anglo Coal South Aca : 4en

(CiptaKrca Bahan 2.500

(Gracemount Pesut ay 67.953,

‘a bangun Persada 354

Machani Talatah Nusa 17933 10.995,

AMA Persada 4820

Ptroconas a2 ;

“Trackspare PT 1,005

Waratah : 41352

Others sor 4525

Tova 125,300 25,228

PT HEXINDO ADIPERKASA Tok

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 34, 2009 and 2008

(Expressed in US Dollars, unloss Otherwise Stated)

INVENTORIES - WET

“his aocount consis of:

December 2000 December 2008,

uss uss

Merchandise inentoies

Heavy equipment 31,787,735 49.007.672

Spare pars en 714834 51422971,

Total 93,502,589 707.330.648

Less allowance for inventories cbsolescence 2.430.096) (1,438,084)

Net 91,072473 99,092,578

The movements of allowance fer inventeris cbsclescence during the period are as follow:

ecornber 2008, ‘December 2008

USS. USS

Balance at beginning of year 1.304,306 1057,619

Provision cing the parod 11378553 787,708

Reversal of allowance during th year (42.38%) és

Wiite-ff during the period 407,261)

Balance zt end of year ZeBODEE. 738,084,

“The Companys management betowes that he allowance for inventories obsolescence is adequate to cover posible losses frm inventories

obsolescence.

‘Allinventoric (except fr inventros in trans are covered by insurance aginst losses from fie an other ks unde blanket policies of

-Rp499,466,000,000 (equivalent. USS48,845,578) as of December 31, 2009 and Rp416, 169,000 000 (equhalent USS45, 113,171) as of

December 20, 2008, which the Company's management bates tat the insurance coverage is adequate lo cover possible losses arising

from such risk,

2

10.

PT HEXINDO ADIPERKASA Tbk

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2009 and 2008

(Expressed in US Dollars, Unless Otherwise Stated)

PREPAID TAXES

Prepayment of income taxes:

Atticle 22.

Article 23,

Avticle 25

Total prepayment of income taxes

Value Added Tax

Total prepaid taxes

Estimated tax receivables:

Income taxes:

~ Period 2007

- Period 2008

Total estimated tax receivables

ADVANCE PAYMENT

This acount consists of:

Purchasing goods

Travelling

Others

Total

December 2008 December 2008

USS, USS.

615,096

4,221,373 5

5,176,579 -

8,013,048 7

4,677,605 2,023,838

9,690,653 2,023,838

December 2009 December 2008

USS USS

5,279,444 336,984

42,712 :

17,899

354,883

24

PTHEXINDO ADIPERKASA Tok

NOTES TO THE FINANCIAL STATEMENTS.

Fox Third Quarter Ended Decanter 21, 2009 and 2008

(Expressed in US Doers, Unless Otherwise Stated)

PROPERTY AND EQUIPMENT

“Thi scznt con ot

Dlcest owmershio —___________Aitbecomber 000

Beginning Balance pare Deducfon ending Balance

Recastestons) __(Recsaiteatin)

cost uss uss. uss us,

tee ats8 eae : 9240404

Baty es.a72 a.se.004 4 s7asgo

‘verses s.stoo04 7ss00 235085 078.500

Ofc equpment sseasi2 94400 40948 aera

niu 8 fos 74998 aor. 1612002

Mocneares 1.78857 ease 20871 2529.98

Toa er ahersles

serene a.s.t85 sass 59.000 5.981

Heavy eqveront-rena s.8c0957 : ‘0.005, 1.409.202

Lenses asst

vere soar : 480007

Const noes eo.7r8 es7405 sasoeu eager

Teta cot ss75.504 soase.4 eazasea 700072

‘Accumulated Depreciation

Und .

Baadeg asnarra 5480 4s 007197

venetes seanaes arate 20.133 4.500200

fio eqment 010724 sesc00 eon sua.712

Fane & tures 4,198,508 4908 2035 40717

actrees samen 169,179 aoe sate.st

“oot ser saos

serves eure waar ss0se a.am4s7

Hay caveman rer 60.19 79.008 1208 casart

eased ast

vena seus com 20.908

Total Assumes Depredaion 1051000 24.510 arrzat___agssona

Book vie

Direct ownership

Und 118656 199708 e eign

Bats ‘ves7s00 soar ro.1m8674

Vetice 79540 amen 4946 1.168.208

otic equipment 1.5.88 sae 1.951 1 2y0278

Future & ures 219,600 enese a 306485

ectinees ArT 998 5502 : si34sr

Tel for ater ste ;

servone aro 0.380 “ asta

eau eqspment etal 1.004.698 (279.005) 6,022 xr

veces aonga exe) : nase

ation ha omares aso.776 eras seen ‘47

Net ook vale 75573666 7.915 ‘actor 27 se478

22

PTHEXINDO ADIPERKASA Tb

[NOTES TO THE FINANCIAL STATEMENTS

For Third Quartr Endod Decomber 31, 2009 and 2008,

(xpreseed in US Doors, Unless Ohervee Stat)

PROPERTY AND EQUIPMENT (continued)

Direct ownership Apt December 2008

. ‘adiens ry

Begining Belace——asereemenins) ——_(Rotnneny _Estng Balance

cost uss uss uss USE

Land 3.383.620 z2071 : 9.115697

Building 8.763504 32.520 5 8.706.034

venicles 5520830 124409 241.583 403,717

ffce equipment 4066,873 187388 37.169 4.167.052

Furniture & otros 11380885 o4s72 aa sanior

Mactineries 1,490,880 8.480 1268 1,722,102

“Too fr afer ealoe

sonices 2060458 34488, 35,091 3,106,050

Heavy equement rental 1.492.052 : 1.402.892

Vehisies 41955 sn ase037

‘Sonstucton in oars 7584 seressr ss7251

Tota cost ET om 168 sre6 aa

‘Accumulated Depreciation

Land °

uling 3700201 390,198 : ‘4,060,504

Vehicles 905,088 133.505 2at.138 4797455,

foe enue 2.686,887 307,242 19.359 292,770

Furmiore &fures 4102558 72856 412 saToz02

Machineries 4189560 92.456 7288 szas.rs7

Tool for aftersales

senvicns 2597 408 176458 asa67 2.788088

Heavy equipment rental 72408) ro1aza : ere.908

essed set 5

Vehicies 79529 2502 5 149.001

‘Sonstucion in eoares °

Total Accumulated Depreciation 76 086,036 1.076355, ‘72.088 17680,368

Book value

Land 3.885,620 ze0r7 : 9.115607

Bulaing 5.083.113 297,068) : 4738440

Voices 615,742 (9.065) a5, 06,281

Ofce equipment 11967. 988 (9874) 3.820 1,204,202

Fumiture & ftures 270.297 e790) 3 ‘240,10

Mochinorios serait 6,034 : 4850s

Tool er ater-sales : :

services 252,860 195.028 2 area

Heauy equipment rental 1,685,378, 31.422) : 873.054

Lessectasset - : : °

Vonicos 342,606 (20.020) 22976

constuction in peoares 7584 so7s97 5887251

Bock value - net z

70784866 08.305 zi, 2787488

I 2207S AOD

23

PT HEXINDO ADIPERKASA Thi

[NOTES TO THE FINANCIAL STATEMENTS

For Ths Quarter Ended Decembar 31, 2009 and 2008

(Expressedin US Dolars, Unoes Othenise Stated)

1

PROPERTY AND EQUIPMENT (continued)

Depreciston charged fo operations ae a oows:

Seconbee 2000 December 2008

uss US

Seling Tre 612,080

General and administrative e792 asiez7

Cost of rental heavy equipment 378,098 191422

Total 763,534 1.506.028

‘The Company's land are under “Hak Guna Bangunan (HGB)" (non-ownership with limited duration) and "Hak Mii

of December 31, 2009, the related lancrights under HGB will expire between 2017 to 2038 and the Company's

management believes that these rights are renewable upon thelr expiry

Property and equipment, except for land, are covered by insurance against losses by fire and other risks under blanket

policies of Rp220, 186,000,000 (equivalent USS21,§32,127) as of December 31, 2009 and Rp158,620,000,000

{equivalent USS17, 194,580) as of December 31, 2008, which the Company's management believes thatthe insurance

| adequate to cover possible losses arising from such risks.

‘As of December 31, 2009 and December 31, 2008, the Company's management believes that there is no events or

Conditions that may indicate impairment of assets.

Leased assets are acquired through financing from PT Orix Indonesia Finance. The leased assets are pledged against

the related finance lease obligations.

24

PT HEXINDO ADIPERKASA Tok

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended Decomber 31, 2008 and 2008

(Expressed in US Dotrs, unless Otherwise Stated)

72, SHORT-TERM BANK LOANS

‘This account represents short-term bank loan cbtained fram various banks, as follow:

December 2009 Docombor 2008,

USS

‘he Bank of Totyo-Mitaish UR, Lx 15,000,000

Total 15,000,000 16,000,000

‘The Banko Tokyo Misi UF Li

“The Company and PT Hach Construction Machinery Indonesia etained @ muti-curency loan fait fem The Bank of Tokyo.

Mitsubishi UF Lid, Jakarta (BTMU Jakarta) wth a maximum creat fect of US$25,000,000 and USS49,000,000, respec

“The tem of this fait is 38 months since dae ofthe agreement. The oufstancng principals ea the date of payment of he

interest every mont but subject orl-over every date of payment of intrest unt the end of ce faciity. The fan bears Interest

{10.26% above LIBOR per year for 2009 and 2008. Tis loan is guarantee by Hitachi Construction Machinery Co. Lid. Japan, 8

shareholder. The outstanding balance as of December 31, 2009 and December 31, 2008 are USS15, 000,000 and UISS1,000,000,

respectively.

“The losn obtained fom The Bank of Tokyo Mitsubishi UFJ, Lid. Singapore (TMU Singapore) fs @ mult curency oan fect for

the Company ands ested partes (Le. Hilachi Construction Machinery Asia and Pact Pe. Ld, Singapore Hitachi

Construction Machinery Thaland Co., Lid, Taland, PT Hitachi Consttuction Machinery Indonesia, Htachi Consicton

Machinery San, Bhd, Malaysia and Cableprice (NZ) Limited) with a maémum cred acy amounting to USS30,000,000,

‘The term ofthis Fait is 98 months since date ofthe agreement. The oustanding principal is due atthe date of payment ofthe

interest every month but subject 0 rl-over every dat of payment of intrest unt the end fered fait. The oon bears interest

‘0.25% above LIBOR per year.

‘On July 28, 2009, the Company obtained an unsecured short Lem working capital fait from The Bank of Tokyo-Mitsubishi UFJ,

Uc, Jakarta Branch witha maximm credit faclty of US$ 10,000,000. Avaiabity period on July 22, 2008 - March 31, 2010. Te

loan bears interest at 0.70% above SIBOR per yer.

Each oon can be drawdown through BIMU Singspore andor BTMU Jara, Thien granted by Hitachi Consrustion Machinery Co

Lad, Sapna shareholder.

“The related lean agreements vith BTMU Jakarta and BTMU Singapore contain certain restriction an the Cempany, among others,

change ofits business, and sel lease transferor lnerwise dispose substantial pat of is assets, unless such acta is made in.

the ortnary course ofthe Company's business,

Cink NA

(On ie 5, 2006, tbe Company cba a short-term working capt aility fom Cisbank, NA. Jakarta with maximum ee: ily of

'USB15,000,000 "This oa ait ave been extended seve ins, tlt was ui June 5,201. The lan bers interes at 075% above

[LIOR per year and ie payable in 3 mons

PL sh i

(On Apri'24, 2009, the Company obtained a short term werking capital faci from PT Bank Mizuho Indonesia wih @ maximum

credit faity of US$10,000,000. Tis Ian faciity have been extended several times, the lest was until July 27.2008, The loan

bears inforest at 0.75% above SIBOR per year, Is payable in 3 months. The laan contains certain restriction an the Company,

‘among others, o consolidate wih o merge into any ther corporation and change oe buslness

13. TRADE PAVABLES THIRD PARTIES

Details ude payables hd partesin relation with purchases of goods and avis are a flows

December 2008 December 2008,

USS USS

Heavy equipment 129,453, “419,913,

Spare pats 1.485.003 41201/340

Repairs and maintonance ‘585,543 “on 372

others 1437-260 249.281,

Totat 3.738377 ZSTI,506

xeon

Current and les than 3 months 120.453, 419913

3-6 months é :

‘Over 6 months - 1 year : :

(Overt year :

Totat [es ee

PT HEXINDO ADIPERKASA Th

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2008 and 2008

(Expressed n US Dollars, unless Othervice Stated)

42. TRADE PAVABLES— THIRD PARTIES (Continwed)

Srare-pnts

‘Current and less than 3 monthe 1485,093, 41201,340

3-6 months 5

(Over 6 months - 1 year :

Over 1 year

Total

Rensissnd

Current andiess than 3 months 686.543 ronsre

3-6 months :

Over 6 months - 1 year :

Over 1 year 2

Total Be TT

‘sof December 31, 2009 and 2008, the aging of alia payables - third pares was Curent and less than 3 months

14, OTHER PAYABLES - THIRD PARTIES

‘This sccount consists of

December 2008

USS.

Heavy equipment 12,496,087

Spe pars 112271 27.184

Service and Maintanance 11331 13.230

Others 720220

Total 5267 671

48 ACCRUED EXPENSES

“This account consists of:

December 2009, December 2008

USS:

Salaries ard employer” benefits 1,969,618 865,008

Interest 67.393, 183,085,

Marketing expenses 10,986 435, 3414275

ters. zaps crete 765.413

Tota! 12,526,462, 227.844

46, TAXES PAYABLES

“Tses payable represts income aes payableson

December 2000 December 2008

Estimated tax payable in curent USS.

period 8,730,020, 4.057.221

‘The ther tmees payables

‘ile 2126 wire 551.489

‘ile 2326 45,263, 28610

Ale 4(2) 8.061

Artie 25 2,856,605.

Total ERIE 7:301,995

Income Tox Expense Curent

‘The reconciliation between income before income tx, a shown inthe statements of income and taxable income for nine months

ended December 31,2009 and forthe year ended December 31, 2008, area falls:

December 2000 December 2008,

USS: uss

Income before income tax expense

er statement of income 9.413.433 25,041,600

Add (deduct) temporary ferences:

Provsion (reversal of alowance) for

Inventories obsolescence 692,108 715,658

Inventories witten-off (683,409)

Provision for employee benef : 400,136

Payment of employee benefits : 01.725)

Depreciation of rope sn equipment 2227318) (98.948)

Deposition ofleased ass 69,906, 54,535,

Depreciation -Asets leased z

Provision fr doubt accounts 164.860 208,343

Revers ofallonance for dou acouns 622220) -

Finance lease receivables 35,269

ain on seo property and equipment (21,758) 65.77)

PT HEXINDO ADIPERKASA Tok

NOTES TO THE FINANCIAL STATEMENTS.

For Third Quarter Ended December $1, 2009 and 2008

(rpressed in US Dolars, unless Otherwise Stated)

76. TAKES PAYABLES (continued)

Added pe

Donation

neces income aleady ibe to

‘inal tax

Rental Revenue

Salres and wages

Tres cent

Payment of fiance le obligation

Entertainment

Others expenses

Taxable Income

oz

(996,141)

3,957,408

180,708

26.242

(4595)

35,168

22's6a

31214,122

2010

(68,972)

24.545

zai 19

(8,025)

138813

347 245

26,400,692

tions of deferred income tax benefit (expense) on temporary differences between commercial and tax reporting purposes.

sing the maimum tax rate of 28% and 30% for nine months ended December 31, 2009 and the yeer ended December 312008,

respectively, areas follows

Depreciation of property and equipment

Depreciation of leased assets

Depreciation on rental assets

Gain onsale of property and equipment

Provion fr employee - bono net

Provsion for douifl accounts

Provision (reversal of alowance) for Inventories cbsclescence

Finance ease receivables

Payment of finance lease obligation

Total

Reduction on tax rate

Deferred income tax tenet net

Taxable income

Estimated Income tax expenses

“The deferred tax assets and lables as of Decernbor 31, 2009 and December $1, 2008, are ae flows:

Deferred tax assets

‘Alowance fr doubtful accounts

‘Alowance for vento obsolescence

Estimated Fabity foe

‘employees’ benefits

Defered tax acsiment

Total deterred taxassets

Deferred tx abies

Depreciation of property and equipment

Depreciation of eased assots

Depresition on rental assets

Finance lease reeivable

Payment of finance easo bigation

Interest income

Gain (oss) foreign exchange

Gain on sale of property and equipment

“Tota deferred taxiabities

Doterred tax assets - net

‘Twable income

Tome tx expense -curent

Prepayment of income tes:

aie 22

rise 23,

atee 25,

‘otal pressymentofincome tax

evomber 2009, December 2008,

USS USS

(o79.648) (29.084)

19.574 16.360

(6,002) (49,733)

2597 62,568,

«e717 86,503,

193,814 99674

1,108,099 10587

(1.687) 20.407)

"525.960 175.587

(268,851

525,960 (93284)

Brzt4,122 75.400,022

8,739,920 7529.54

December 2009, December 2008,

USS USS

435,367 sra010

543.067 302,800

425,970 301,848

ra a

(188,137) (115,500)

50,586 27.884

(6,388,755) (2,884,160)

5,304,900 4511399

67013) (atzaty

1,032,865), (1,086,986)

‘581452 396,026

(54516) 60.776)

770,652, 76,520

2.734.956 73a 266

“The compustions of income tax expense ad ta payable of December 3, 2009 and December 31,2008, areas fllows

Deoember 2008 December 2008

uss" USS

31214,122 26,409 632

8,730,920 7.520.558

December 2000 ‘Hezember 2008 —

USS USS.

11815,095, 1.897.848

1221373, 1560,164

5,176,579 6,301

8,018,048 Bare. 334

725 572 4.057.221

Estimated ta ese) papa

PT HEXINDO ADIPERKASA Tok

NOTES TO THE FINANCIAL STATEMENTS

Foc Third Quarte Ended December 31, 2009 and 2008,

(Expressed in US Dallas, unless Otherwise Stated)

17. LONG-TERM BANK LOAN

‘This acoount represents longterm bank loan . a8 flow:

December 2009, December 2008

‘The Bank of Tokyo Mitsubishi UFJ, Lt, Indonesia USS USS:

(fp 68.604.000.000 2s of Deceriber 31, 2009 ana 7.406 886 5,927,854

Rp 64.910.000,000 as of December 31, 208)

Curent maturities (1,088,287), 2,382,055)

portion 6,350,590 3.505.709,

Loans obiained from The Bank of Tokyo Mitsubishi UFJ, Lid. Jakarta (BTM Jekarta) are uncom ered facil fer investment

‘purposes that were obtained in December 28, 2007 and various dates in 2008 and 2009 wit a tla maximum cred acy of Rp

118,000,000,000. These loans are payable on instalment basis every manth for 3 yoars. These loans bear annual intrest a 0.50%

above cost of fund fr relevant interest period as determined by TMU Jakarta,

‘The related loan agrourent slated thal the Company cannot enter into the various transactions, among others, o el, lease, transfer

oc othennise dispose of part ofits assets and obtain 2 loan from any other pay, unless suen act is made in the ordinary course of

the Company's business; to deciare or pay chdend to tne shareheldors; to consolidate or merge wth athe party, and to change of ts

‘composition of share cata, shareholders ce their shareholdings, composition of the Boars of Directors and Cornmissioners oils

‘Aricles of Association, without prior writin consent to BTM Jakarta,

In cetation vith payment of dividend tothe shareholders, changes inthe composton ofthe Board of Directors and amencment ofits

Arts of Association n 2008, the Company had obtained Consent Ltter trom ETTU on February 24, 2009,

18, FINANCE LEASE OBLIGATION

‘Lease assets are acquired through fnancing fram PT Orix Indonesia Finance, The leased acts are pledged agalnt the rested

finance lease olgatione,

‘The future misimum finance leese payment required under the lease agreements ar as follows:

Years. December 2009, Dovember 2008

USS uss

2009 18072 183,006

2010 19,501 30.495

zon 2.185 3.750

Total 39848 7.191

{Less amnt applicable to interest (2,288) 11.616)

Present value of minimum

Finance lease payer 37,550 105,575

curren mittee 16.917) (73.337)

Lone erm portion 20,643 32.258

19, LONG-TERM OTHER PAYADLES

‘This account repress ong erm payables to Mitsbishi Corporation, apn, n US Dolla crreneyin elation to purchases of I unis of es

‘supe that ar leased otto PT Kam Prin Coal (Not 5. Tis aan is payable in quel inlet in yeas sl Dear average interes at

850% per year. The payablesare guaranteed by eertsin heavy egret beng least oi, The itr nallmentpayaent of tee payables re as

fallows

December 2009 __December 2008,

USS USS

2008 : 7.907.500

2010 2.000.450 2.000458,

Total 209,458 70057061

Lesaneutaplabetieest 72837) (608.954)

Net 016.621 3451077

(ret mares (243,605) 494/360

Langer pation ‘m3,016 2016717

20, ESTIMATED LIABILITY FOR EMPLOYEES’ BENEETTS

“This account consist of

December 2000 Decerer 2008

uss uss

nee beefy "940.408 4,804,700

Cree mites (65,883)

‘Long term potion 1.873.523, 1,808,708

26

PT HEXINDO ADIPERKASA Tok

[NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended Deoember 31, 2009 and 2008

(Cxgxezsed in US Dolla, unless Otherwise Stated)

20, ESTIMATED LIABILITY FOR EMPLOYEES? BENEFITS (Continued)

The movement of exited ability for employees Benefits during the ero ae elo

December 2008

uss

Beginsingbalnce "606.323

Benefit costs during the period 409,302

Payment during the period (75,308)

Ending tlarce 7.940.408,

24, SHARE CAPITAL,

‘The sar ownership sof December 31,209 ard Decenber 31,2008 based onthe report fom

PTSirea Datapro Ped, the shares adinstetor bres, tll

December 2009

Namner of Shares

sada ily Pat Percentage of

Starbolders Rp 100 Onnership

Local

Commissioner

™ Donald Chistian Sie 164,500 0.008%

Diretor

Tony Endroyaso 50,000 0.006%

“Toru Sakai 1580,000, 0.188%

Public (below 5%

counership each) 149,043,000 17.850%

Foreign

itachi Construction Machinay

Co. Lid, Japan 408,180,000 48,550%

Iochu Corperaten, Japan 189,400,000 22540%

itachi Constrstion Machine

‘Asa and Pcie Pe, Lid, Singipore 42,620,000, 076%

Public (below 5% owrrship each) 48,162,500 5.734%

Balance as of December, 942008 840,000,000, 100.0%

‘Decerbar 2008

unio of Shes

Sharcholders sla ly Pad Percentage of

Rp 100 Ounership.

Local

Commissioner

Donald Chistian Sie 25,000 0.003%

Direeor

Tony Endeoyoso 50,000 oor

Public (below 5%

‘ownership each) 1716140000 20.45%

Foreign

Hitachi Construction Machinery

Co., Lid, Japan 408,180,000 48.50%

!tochu Corporation, Japan 189,400,000 22.55%

itachi Consrastion Machinery

‘Asia and Pasitic Poe, Lid, Singapore 42,620,000 sor%

Public (below 5% ownership each) 28,111,000, 335%

‘lance as of Dacerber 31,2008, 340,000,000. 100.00%

22, ADDITIONAL paidin CAPITAL NET

“This ccourt cons of ‘Amount

USS

‘ditional pain cial, '8557,001

Stock ssenee costs (558,165)

Not 7,596,836

‘Amount

1784

4.988

43,700

4,147,160

11,289,543,

5.238.472

4.178,704

332,000

23,232,926

Amount

uss

601

41,988

4,740,542

11,289,543,

5238472

1.178,704

777501

23,232,926

PT HEXINDO ADIPERKASA TH

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31, 2009 and 2008

(@xpressed in US Dolers, unless Otherwise Stated)

23, CASH DIVIDENDS AND GENERAL RESERVE

Inaccordane wit th minses ofthe Annual Shareholders’ Meeting of te Company held on June 29, 2009, the minutssof which were rotrized

‘by Notaral Deed No, 168 ae 164 on th sme dt of Robert Pr, SH, the shears reve to deca cash vided tating

p81 560.00.00 (equivalent USE, 956 52) and Rp 19320 000.00 (equivalent USS 889,986) fr the #40000 000 shares or R109 and Rp 23

(l anount) per sre, alo appropriate fo nea eve fom tana earings amonating to RpS00, 00,000 (equivalee USS489, 08). Ths

‘ah dividends wee fly paid fo he turebolders or Aus 7, 2009 ad in September 2003.

24, NET REVENUES

Detals of net revenues are as flow:

December 2000 December 2008,

USS USS

‘Ses and ental of heavy equipment

“Td partes 119,585,578 126,622,123

Relate partes 17,484,635, 5.142.037

Sales of spare parts

Tha parties 54,484,965 39,761,653

Repais and maintenance services

Thi partes 39,882,182 31,481,851

Related partes 4.167.555 :

Total Revenue 220,575,015 202,908,264

25. COST OF REVENUES.

Desailsofeos of revere ea flows:

December 2008 December 2008

Salesand rental hea equipment USS USS

Begining balance of inventories 96,550.520 vasiori2

Purchasing 112.450.820 141,997/965

‘Alla inventories fr sales 149,020:349, 156;317,685

‘Allowance for inverteries obsolescence 5

Ending tnventeres 31,787,735) (48,07 672)

Cost o sles and renal heavy equipment 117.232.6146 106,409 983

Spare pars:

Begining balance of inventories 53,960,265

Purchasing 40,281,108

‘Avalablepats inventories 9424465

‘Alowance fr inentaries obsolescence 1.378.553 787,706

Ending balance of part inventories (51714894) 51,422,971)

Cost of spare pars sales 33,005,162, 23,445.156

Repairs and maintenance services cost 27,485,180 23:572.162

Total cost of revenue 179622.976 153,427,509,

26, OPERATING PXPENSES,

Details of pesing experses ave a fallow

December 2008 December 2008,

2 Seling Expenses: uss USS

Salaries, wages and employee benefits 445577708 5.018.840,

Traveling 11522,980.73 tavern

Depreciation 778646.14 ‘12/980

(Communication 458,11428 380.483

Warehcusing and shiping 446,113.62 508,135

“Transporation 2,255,681.55 2,247,096,

pais and maintenance 187275.15 ‘st.191

Entertainment 20,776.68 127.982

Rental 208/947:55 148.817

Alter sales services 813,178.77 586,035

“Training and esveation 178.918.01 274,716

Professional feos 449,288.52 429;362

‘Sales and promotion 124,392.78 168.118,

“Total seting expenses 11,808,022 12,096,512,

0

PT HEXINDO ADIPERKASA Tok

NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended December 31,2009 and 2008

‘(Expressed in US Dolars, unless Otherwise Stated)

26. OPERATING EXPENSES (Continued)

» General and Administrative Expenses:

Salaries, wages and employee benefits 4.122888. 4041,930

‘Stationery and office supplies 2.567,084.06 2:387/700

Depreciation ern 79183 ‘4811627

pais and maintenance 421.054.85, 420.975,

Communication| 390.245.50 324,126

Bank charges 66,857.10 71,720

Asutansi 397,505.08, 347,203

Water, gas an electcty 402,227.82 341,056

Toes 8747308, yor.32

Donation 20,776.88 24.060

Membership 21,498.21, 23,408

Otners 8

“Total General and administrative expenses, 396,930 al

“Total Operating expenses 21,284 960 20812435,

27 INTEREST INCOME

‘This account represents interest income from ecomber 2000 December 2008

USS USS

“Time Deposst - -

Curent accounts 72,184 50.972

Financing leases 319.958 11368.038

Trade receivables 001 19672

Total Fis 942 aa 682

28. INTEREST EXPENSES.

“This account represents interest pense cn:

Dosombor 2000 ecomber 2008

USS USS

‘Bank loons 850,452 483,192

Finance leases 6,300 14,768,

Longer othe payables 342/635 835,662

Total 7.208.265, T3302

28, MONETARY ASSETS AND LIABILITIES IN FOREIGN CURRENCIES:

‘sof December 31,2008, the Conpary hus nonetary ass andihltiesdenominaed in eign cree flows

auivatent ia

Foreign Currencies Uss'

Assets

(Ca on an orks

pian 1g 31,490,638,668

Jopan Yen uPy 1,988.818.19

‘Trade rooeables

Rupiah or 36,288,316,308

[Now Trade receivables

Rupiah 10R 292,549,625

“Total Assets

Liabities

“rade psables

Rupiah 10R 23,506, 484,020 2,501,303,

AUD AUD 3981.51 3.553

EURO € 153.58 zat

aan Yen wPY_835,692 9,042

300 860 21,045.58 15639,

Other payables

Rupiah or 6,127,128,047 651,026

‘sco ‘SCD 55 830.00 39,785

EURO € 308.32 31

YEN wPr 30,251,148 sare

‘Bankloan Short em

Rupiah IR 5 800,328,947 or7.155

‘Bankloan - Long potion

Rupiah 1oR63.803,605.414 6,788,710

‘otal Libis 10,955,578

[Net monetary lilies 3,697,827,

at

PT HEXINDO ADIPERKASA Tok

[NOTES TO THE FINANCIAL STATEMENTS

For Third Quarter Ended Dacember31, 2009 and 2008

(Expressed in USS Unless Otherwise Stated)

30, SIGNIFICANT AGREEMENTS AND COMMITMENTS

Royalty Agreement

In May 1999, the Company entered into royally agreement with Hitachi Construction Machinery Co, Lid, Japan (HCMJ),@

sharehokler. Based on tis agreement, HCR agreed to furish the Company wit cense, technical information and traning in order

to reranufacture heavy equipment components. As compensation, the Company shall pay HCN royalty fe forthe lence at 1 of

certain product sales and technical assistance services related to heavy equipment component remanufacturing, Ths agreement

‘expired on December 31, 2008.

Distributorship Agreements,

‘The Company has several distrbutorship agreements in elation fo the sale of cera heavy equipment adits spare pars wth several

[censed companies, among others, HCMJ, Hitachi Construction Machinery Asia and Paciie Pie, Lid, Singapore (HMAP), a