Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsPart A - JW Sports Supplies Cost Categorization and Calculation

Part A - JW Sports Supplies Cost Categorization and Calculation

Uploaded by

memo aliThis document provides cost categorization and income statement calculations for JW Sports Supplies. Direct materials, direct labor, electricity, and other manufacturing costs are categorized as variable manufacturing costs. Rent, depreciation, and the fixed portions of electricity and other manufacturing costs are categorized as fixed manufacturing costs. Selling, sales commissions, and administrative costs are categorized as non-manufacturing costs, with sales commissions being variable and the others fixed. Functional and contribution margin income statements are presented assuming production of 1,500 units at $100 per unit, showing revenue of $150,000 and profit of $20,000.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- JW SPORT SuppliesDocument5 pagesJW SPORT SuppliesVishvesh Soni100% (4)

- Columbia 2017 PDFDocument190 pagesColumbia 2017 PDFN100% (3)

- Michael Porters Model For Industry and Competitor AnalysisDocument9 pagesMichael Porters Model For Industry and Competitor AnalysisbagumaNo ratings yet

- Economic Nationalism - Claro M. RectoDocument58 pagesEconomic Nationalism - Claro M. RectoGabriel Achacoso Mon76% (17)

- Problem 2-14 Product Cost Sunk Cost Direct LaborDocument8 pagesProblem 2-14 Product Cost Sunk Cost Direct LaborarijitmajeeNo ratings yet

- UTS AkutansiDocument24 pagesUTS AkutansiAbraham KristiyonoNo ratings yet

- Problem Unit 4Document7 pagesProblem Unit 4meenasaratha100% (1)

- General Discussion Absorption Costing Variable Costing: FixedDocument4 pagesGeneral Discussion Absorption Costing Variable Costing: FixedHassan KhanNo ratings yet

- 05 Activity 3Document1 page05 Activity 3Reikenh SalesNo ratings yet

- Day 4 (My)Document11 pagesDay 4 (My)Jhilmil JeswaniNo ratings yet

- Variable Costing April Revenues 8,400,000Document10 pagesVariable Costing April Revenues 8,400,000Hiền NguyễnNo ratings yet

- Finals Unit 4 Exercise - Variable and Absorption CostingDocument2 pagesFinals Unit 4 Exercise - Variable and Absorption CostingMelo RiegoNo ratings yet

- Quiz No. 4 - Variable and Absorption CostingDocument2 pagesQuiz No. 4 - Variable and Absorption CostingRio Cyrel CelleroNo ratings yet

- Chapter 9 - Alwi Syahnur Nasution - 120104160048Document6 pagesChapter 9 - Alwi Syahnur Nasution - 120104160048Nugrah LesmanaNo ratings yet

- Narsee Monjee Institute of Management StudiesDocument8 pagesNarsee Monjee Institute of Management StudiesSHIVANGI AGRAWALNo ratings yet

- Accounting Chapter 06 Full SolutionDocument15 pagesAccounting Chapter 06 Full SolutionAsadullahil GalibNo ratings yet

- Chapter 10 SCMDocument15 pagesChapter 10 SCMAliyah Francine Gojo CruzNo ratings yet

- Variable and Absorption CostingDocument52 pagesVariable and Absorption CostingcruzchristophertangaNo ratings yet

- Ch8 PDFDocument11 pagesCh8 PDFGiang NguyenNo ratings yet

- Cost Accounting - ABC Vs Variable CostingDocument3 pagesCost Accounting - ABC Vs Variable CostingJaycel Yam-Yam VerancesNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing Decisionschintan desaiNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing DecisionsMae-shane SagayoNo ratings yet

- Assignment 2 - CMADocument9 pagesAssignment 2 - CMAVivek SharanNo ratings yet

- MAS.05 Drill Variable and Absorption CostingDocument5 pagesMAS.05 Drill Variable and Absorption Costingace ender zeroNo ratings yet

- Chapter 11 SCMDocument22 pagesChapter 11 SCMAliyah Francine Gojo CruzNo ratings yet

- Grand Test - Question PaperDocument3 pagesGrand Test - Question PaperWaseim khan Barik zaiNo ratings yet

- Accounting Act6Document2 pagesAccounting Act6Eren YeagerNo ratings yet

- Static Budgets and Performance Reports Static Budgets Are Prepared For A SingleDocument6 pagesStatic Budgets and Performance Reports Static Budgets Are Prepared For A SingleAbisheNo ratings yet

- Institute of Cost and Management Accountants of PakistanDocument11 pagesInstitute of Cost and Management Accountants of PakistanAsad RiazNo ratings yet

- Variable and Absorption Costing Problems Without SolutionsDocument4 pagesVariable and Absorption Costing Problems Without SolutionsMeca CorpuzNo ratings yet

- Flexible and Static Budgets ReviewerDocument13 pagesFlexible and Static Budgets ReviewerLilac heartNo ratings yet

- Budgeting and Budgetary ControlDocument2 pagesBudgeting and Budgetary ControlpalkeeNo ratings yet

- Jose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyDocument6 pagesJose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyBernadette CaduyacNo ratings yet

- Costing Systems - Lessons ExamplesDocument15 pagesCosting Systems - Lessons ExamplesNicolasNo ratings yet

- CMA-II BookDocument38 pagesCMA-II BookmaxsuzsxoxoNo ratings yet

- 5 Job CostingDocument22 pages5 Job CostingAbimanyu Shenil0% (1)

- Tut 8 - Management AccountingDocument29 pagesTut 8 - Management AccountingTao LoheNo ratings yet

- Problem 3 4 Chapter 14Document6 pagesProblem 3 4 Chapter 14freaann03No ratings yet

- MAE RevisionDocument57 pagesMAE RevisionsaloniNo ratings yet

- Departmental PEQDocument38 pagesDepartmental PEQRishikaNo ratings yet

- CostconDocument33 pagesCostconDanica VillaganteNo ratings yet

- Abc1 - FinalDocument7 pagesAbc1 - FinalSakshi ShardaNo ratings yet

- FINAL Acctg7Document5 pagesFINAL Acctg7Romcel FlorendoNo ratings yet

- Alvaro, Fernel Jean C. AE212-1741 TTHS 3-5PM Exercise 8-2. Joint Cost AllocationDocument4 pagesAlvaro, Fernel Jean C. AE212-1741 TTHS 3-5PM Exercise 8-2. Joint Cost AllocationNhel AlvaroNo ratings yet

- CAC Computations Chap 4 1 20Document9 pagesCAC Computations Chap 4 1 20rochelle lagmayNo ratings yet

- Marginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5Document5 pagesMarginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5신두No ratings yet

- ProblemsDocument11 pagesProblemsMohamed RefaayNo ratings yet

- Variableabsorption CostingDocument77 pagesVariableabsorption Costingandrea arapocNo ratings yet

- Byproduct Mission MCQDocument3 pagesByproduct Mission MCQRohit ThandarNo ratings yet

- Act.4-8 Ae23Document6 pagesAct.4-8 Ae23Damian Sheila MaeNo ratings yet

- Exercises Absorption and Variable CostingPAUL ANTHONY DE JESUSDocument4 pagesExercises Absorption and Variable CostingPAUL ANTHONY DE JESUSMeng DanNo ratings yet

- 1.2.1 Assignments - Cost Concepts and Classifications (Answers and Solutions)Document8 pages1.2.1 Assignments - Cost Concepts and Classifications (Answers and Solutions)Roselyn LumbaoNo ratings yet

- Marwa Year 1 Using Marginal Costing ApproachDocument6 pagesMarwa Year 1 Using Marginal Costing ApproachMak PussNo ratings yet

- DepartmentalDocument17 pagesDepartmentalPapiya DeyNo ratings yet

- Tutorial 1 - Topic 4 - OAR - QDocument6 pagesTutorial 1 - Topic 4 - OAR - QJong HannahNo ratings yet

- 8 33 PricingDocument1 page8 33 Pricinganonymous.me0201No ratings yet

- Ae 212 Exercise 8Document4 pagesAe 212 Exercise 8Nhel AlvaroNo ratings yet

- CMA Garrison SuggestedSolutions Chap2Document12 pagesCMA Garrison SuggestedSolutions Chap2PIYUSH SINGHNo ratings yet

- Group AssignmentDocument7 pagesGroup Assignmentsaidkhatib368No ratings yet

- Master Question (Mixed With Process Costing) - Q ADocument3 pagesMaster Question (Mixed With Process Costing) - Q AMuaaz NayyarNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Batch: 2018 - 2021 Academic Year: 2020 - 2021 Subject: Management Accounting Date: 5 January 2021Document24 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Batch: 2018 - 2021 Academic Year: 2020 - 2021 Subject: Management Accounting Date: 5 January 2021Madhuram SharmaNo ratings yet

- Bio Coal EstimateDocument1 pageBio Coal EstimateDhananjay KulkarniNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Financial Ratio Analysis of Square Pharmaceuticals Limited: Asif AhmedDocument24 pagesFinancial Ratio Analysis of Square Pharmaceuticals Limited: Asif AhmedMD. MUNTASIR MAMUN SHOVONNo ratings yet

- Topic 11 - Open-Economy Macroeconomics - Basic Concepts.Document36 pagesTopic 11 - Open-Economy Macroeconomics - Basic Concepts.Trung Hai TrieuNo ratings yet

- Quiz Module 1 FINALDocument4 pagesQuiz Module 1 FINALeia aieNo ratings yet

- Tax Invoice: Agarwal Impex 21-22/745 5-Feb-2022Document2 pagesTax Invoice: Agarwal Impex 21-22/745 5-Feb-2022bhola.vilesh7No ratings yet

- Final CompilationDocument85 pagesFinal CompilationRakesh KushwahaNo ratings yet

- Ajax Fiori-R-07092017Document7 pagesAjax Fiori-R-07092017parimal.rodeNo ratings yet

- SMO 105 Group Course Work Group 4I "Bright Future Food LLC" (Shavelle Lee Vasca, Ming Yang, Shuo Chen) Market Entry Strategies and RationaleDocument3 pagesSMO 105 Group Course Work Group 4I "Bright Future Food LLC" (Shavelle Lee Vasca, Ming Yang, Shuo Chen) Market Entry Strategies and Rationaleshavelle leevascaNo ratings yet

- Melihat Sisi Pengusaha Sosial Dengan Bottle Refill Station Sebagai Solusi Pengendalian Kemasan Sekali Pakai Untuk Kelestarian LingkunganDocument18 pagesMelihat Sisi Pengusaha Sosial Dengan Bottle Refill Station Sebagai Solusi Pengendalian Kemasan Sekali Pakai Untuk Kelestarian LingkunganCuters TresnoNo ratings yet

- Tle EntrepreneurshipDocument2 pagesTle EntrepreneurshipMark Anthony LibecoNo ratings yet

- Digital Marketing PPT - 2021 - ConsellingDocument32 pagesDigital Marketing PPT - 2021 - ConsellingDolly DharmshaktuNo ratings yet

- Contoh Studi Kasus ZachmanDocument15 pagesContoh Studi Kasus Zachmanindra sunardiNo ratings yet

- Kuaishou Technology Announces Fourth Quarter and Full Year 2021 Financial ResultsDocument4 pagesKuaishou Technology Announces Fourth Quarter and Full Year 2021 Financial Resultsmuhamad.ariapujaNo ratings yet

- MANG6296 AssignmentDocument28 pagesMANG6296 Assignmentxu zhenchuanNo ratings yet

- Investment Decision - IciciDocument8 pagesInvestment Decision - Icicimohammed khayyumNo ratings yet

- BCG NBFC Sector Update H1FY24Document48 pagesBCG NBFC Sector Update H1FY24ashi.reportsNo ratings yet

- Dayton Hudson Corporation Conscience and ControlDocument15 pagesDayton Hudson Corporation Conscience and Controlsajal sazzadNo ratings yet

- Corp Law Yash TiwariDocument30 pagesCorp Law Yash TiwariMani YadavNo ratings yet

- Hsieh Mcconnell DonationsDocument9 pagesHsieh Mcconnell DonationsResourcesNo ratings yet

- Support To Operational PlanDocument2 pagesSupport To Operational PlanreshadNo ratings yet

- Module 5 BankingDocument42 pagesModule 5 Bankingg.prasanna saiNo ratings yet

- HRM Project Ultra Tech CementDocument51 pagesHRM Project Ultra Tech CementRoy Yadav100% (1)

- Razelle Ann B. Dapilaga 11 Abm, Peter DruckerDocument3 pagesRazelle Ann B. Dapilaga 11 Abm, Peter DruckerJasmine ActaNo ratings yet

- Whitepaper 2Document8 pagesWhitepaper 2Minhayati BklNo ratings yet

- Price List OGOship Logistics 2022 DE-SOL ENDocument17 pagesPrice List OGOship Logistics 2022 DE-SOL ENDraganaNo ratings yet

- Rangga Fakhrurriza - Kelompok 6 Konflik Dan NegosiasiDocument6 pagesRangga Fakhrurriza - Kelompok 6 Konflik Dan NegosiasiRangga FakhrurrizaKls AAkt 2021No ratings yet

- Presentation On Government BudgetingDocument2 pagesPresentation On Government BudgetingSherry Gonzales ÜNo ratings yet

- China Pastry Bread Mfg. Industry Profile Cic1411Document8 pagesChina Pastry Bread Mfg. Industry Profile Cic1411AllChinaReports.comNo ratings yet

Part A - JW Sports Supplies Cost Categorization and Calculation

Part A - JW Sports Supplies Cost Categorization and Calculation

Uploaded by

memo ali0 ratings0% found this document useful (0 votes)

6 views1 pageThis document provides cost categorization and income statement calculations for JW Sports Supplies. Direct materials, direct labor, electricity, and other manufacturing costs are categorized as variable manufacturing costs. Rent, depreciation, and the fixed portions of electricity and other manufacturing costs are categorized as fixed manufacturing costs. Selling, sales commissions, and administrative costs are categorized as non-manufacturing costs, with sales commissions being variable and the others fixed. Functional and contribution margin income statements are presented assuming production of 1,500 units at $100 per unit, showing revenue of $150,000 and profit of $20,000.

Original Description:

Original Title

0 - نسخة

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides cost categorization and income statement calculations for JW Sports Supplies. Direct materials, direct labor, electricity, and other manufacturing costs are categorized as variable manufacturing costs. Rent, depreciation, and the fixed portions of electricity and other manufacturing costs are categorized as fixed manufacturing costs. Selling, sales commissions, and administrative costs are categorized as non-manufacturing costs, with sales commissions being variable and the others fixed. Functional and contribution margin income statements are presented assuming production of 1,500 units at $100 per unit, showing revenue of $150,000 and profit of $20,000.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views1 pagePart A - JW Sports Supplies Cost Categorization and Calculation

Part A - JW Sports Supplies Cost Categorization and Calculation

Uploaded by

memo aliThis document provides cost categorization and income statement calculations for JW Sports Supplies. Direct materials, direct labor, electricity, and other manufacturing costs are categorized as variable manufacturing costs. Rent, depreciation, and the fixed portions of electricity and other manufacturing costs are categorized as fixed manufacturing costs. Selling, sales commissions, and administrative costs are categorized as non-manufacturing costs, with sales commissions being variable and the others fixed. Functional and contribution margin income statements are presented assuming production of 1,500 units at $100 per unit, showing revenue of $150,000 and profit of $20,000.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Managerial Accounting Week 2

Peer Graded Assignment

Mridul Mathur

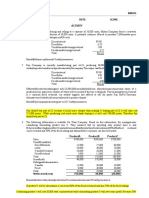

Part A - JW Sports Supplies Cost Categorization and Calculation

Assumptions :

Quantity 1,500

Price / Unit $100

Revenue $150,000

(A)

Cost Category Type Reason

Direct Material Variable, Mfg Direct Material will vary according to units made, If no units are made, the direct material cost will be zero owing to no material requirement. So, it is a Variable Mfg cost

Direct Labor Variable, Mfg Direct Labor will vary according to units made, If no units are made, the direct material cost will be zero owing to no labor requirement. So, it is a Variable Mfg cost

Rent Fixed, Mfg Rent is afixed Manufacturing cost, since irrespective of production volume, the rent still has to be paid

Depreciation Fixed, Mfg Depreciation is a fixed Manufacturing cost, since irrespective of production volume, the asset will still lose it's book value over time and require depreciation

Electricity Mixed, Mfg Electricity is a mixed manufacturing cost, as there is a component required to run machines which will vary with production volume, however, the lighting component will remain fixed

Other Mfg. Mixed, Mfg Other Mfg is a mixed manufacturing cost, as cost material such as thread/ order processing although will vary with production units; however, labor such as maintainance will have a fixed component

Selling Fixed, Non Mfg Selling is a fixed salary paid to sales executives, therefore should be a fixed, non manufacturing cost

Sales Commission Variable, Non Mfg Sales commission will vary with no. of units sold, thus is a variable non manufacturing cost

Administrative Fixed, Non Mfg Administrative cost consists of non mfg cost such as accounting payroll etc, that will remain fixed irrespective of no. of units, therefore is a fixed non mfg

(From Exhibit 4) Component Calculation Cost for 1500 Units

Amount Amount Variable / Unit Total Variable Total Fixed Variable Cost Fixed Cost Product/ Period/ Non Mfg. Non Mfg. Non. Mfg.

Cost Category Total Cost Variable Fixed Mfg. Fixed

(T1) (T2) (V = ΔT /ΔQ) VC = (V* Q) FC = T - VC (V * 1500) (FC) Mfg. Mfg. Variable Variable Fixed

Units produced and Sold (Q) 1,200 1,900 1,500

Direct Material 36,000 57,000 30 36,000 0 45,000 0 45,000 Y Y 45,000 - - -

Direct Labor 18,000 28,500 15 18,000 0 22,500 0 22,500 Y Y 22,500 - - -

Rent 5,000 5,000 0 0 5,000 0 5,000 5,000 Y Y - 5,000 - -

Depreciation 4,000 4,000 0 0 4,000 0 4,000 4,000 Y Y - 4,000 - -

Electricity 4,400 5,800 2 2,400 2,000 3,000 2,000 5,000 Y Y Y 3,000 2,000 - -

Other Mfg. 19,600 21,700 3 3,600 16,000 4,500 16,000 20,500 Y Y Y 4,500 16,000 - -

Selling 8,000 8,000 0 0 8,000 0 8,000 8,000 Y Y - - - 8,000

Sales Commission 12,000 19,000 10 12,000 0 15,000 0 15,000 Y Y - - 15,000 -

Administrative 5,000 5,000 0 0 5,000 0 5,000 5,000 Y Y - - - 5,000

Total 112,000 154,000 90,000 40,000 130,000 75,000 27,000 15,000 13,000

(B) (C ) (E ) (F)

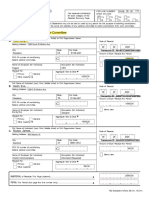

Part B - Functional Income Statement for Price / Unit @ $100, Unit @ 1,500

Revenue (A) $150,000

- Manufacturing Cost - Variable (B) 75,000 (Included Direct Material, Direct Labor, Elec (V), Other Mfg (V))

- Manufacturing Cost - Fixed (C ) 27,000 (Included Rent, Depreciation, Elec (F), Other Mfg (F))

= Gross Margin (D) $48,000 D = A - (B+C)

- Non Manufacturing - Variabe (E ) 15,000 (Included Sales Commission)

- Non Manufacturing - Fixed (F ) 13,000 (Included Selling, Administrative)

= Profit (G) $20,000 G = D -E -F

Part C - Contribution Margin Income Statement for Price / Unit @ $100, Unit @ 1,500

Revenue (A) $150,000

- Variable Manufacturing Cost (B) 75,000 (Included Direct Material, Direct Labor, Elec (V), Other Mfg (V))

- Variable Non Manufacturing Cost (E ) 15,000 (Included Sales Commission)

= Contribution Margin (D) $60,000 D = A - (B+E)

- Fixed Manufacturing Cost (C ) 27,000 (Included Rent, Depreciation, Elec (F), Other Mfg (F))

- Fixed Non Manufacturing Cost (F) 13,000 (Included Selling, Administrative)

= Profit (G) $20,000 G = D - C -F

Mridul Mathur_Week2_JW Inc Statements 1804.xlsx

You might also like

- JW SPORT SuppliesDocument5 pagesJW SPORT SuppliesVishvesh Soni100% (4)

- Columbia 2017 PDFDocument190 pagesColumbia 2017 PDFN100% (3)

- Michael Porters Model For Industry and Competitor AnalysisDocument9 pagesMichael Porters Model For Industry and Competitor AnalysisbagumaNo ratings yet

- Economic Nationalism - Claro M. RectoDocument58 pagesEconomic Nationalism - Claro M. RectoGabriel Achacoso Mon76% (17)

- Problem 2-14 Product Cost Sunk Cost Direct LaborDocument8 pagesProblem 2-14 Product Cost Sunk Cost Direct LaborarijitmajeeNo ratings yet

- UTS AkutansiDocument24 pagesUTS AkutansiAbraham KristiyonoNo ratings yet

- Problem Unit 4Document7 pagesProblem Unit 4meenasaratha100% (1)

- General Discussion Absorption Costing Variable Costing: FixedDocument4 pagesGeneral Discussion Absorption Costing Variable Costing: FixedHassan KhanNo ratings yet

- 05 Activity 3Document1 page05 Activity 3Reikenh SalesNo ratings yet

- Day 4 (My)Document11 pagesDay 4 (My)Jhilmil JeswaniNo ratings yet

- Variable Costing April Revenues 8,400,000Document10 pagesVariable Costing April Revenues 8,400,000Hiền NguyễnNo ratings yet

- Finals Unit 4 Exercise - Variable and Absorption CostingDocument2 pagesFinals Unit 4 Exercise - Variable and Absorption CostingMelo RiegoNo ratings yet

- Quiz No. 4 - Variable and Absorption CostingDocument2 pagesQuiz No. 4 - Variable and Absorption CostingRio Cyrel CelleroNo ratings yet

- Chapter 9 - Alwi Syahnur Nasution - 120104160048Document6 pagesChapter 9 - Alwi Syahnur Nasution - 120104160048Nugrah LesmanaNo ratings yet

- Narsee Monjee Institute of Management StudiesDocument8 pagesNarsee Monjee Institute of Management StudiesSHIVANGI AGRAWALNo ratings yet

- Accounting Chapter 06 Full SolutionDocument15 pagesAccounting Chapter 06 Full SolutionAsadullahil GalibNo ratings yet

- Chapter 10 SCMDocument15 pagesChapter 10 SCMAliyah Francine Gojo CruzNo ratings yet

- Variable and Absorption CostingDocument52 pagesVariable and Absorption CostingcruzchristophertangaNo ratings yet

- Ch8 PDFDocument11 pagesCh8 PDFGiang NguyenNo ratings yet

- Cost Accounting - ABC Vs Variable CostingDocument3 pagesCost Accounting - ABC Vs Variable CostingJaycel Yam-Yam VerancesNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing Decisionschintan desaiNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing DecisionsMae-shane SagayoNo ratings yet

- Assignment 2 - CMADocument9 pagesAssignment 2 - CMAVivek SharanNo ratings yet

- MAS.05 Drill Variable and Absorption CostingDocument5 pagesMAS.05 Drill Variable and Absorption Costingace ender zeroNo ratings yet

- Chapter 11 SCMDocument22 pagesChapter 11 SCMAliyah Francine Gojo CruzNo ratings yet

- Grand Test - Question PaperDocument3 pagesGrand Test - Question PaperWaseim khan Barik zaiNo ratings yet

- Accounting Act6Document2 pagesAccounting Act6Eren YeagerNo ratings yet

- Static Budgets and Performance Reports Static Budgets Are Prepared For A SingleDocument6 pagesStatic Budgets and Performance Reports Static Budgets Are Prepared For A SingleAbisheNo ratings yet

- Institute of Cost and Management Accountants of PakistanDocument11 pagesInstitute of Cost and Management Accountants of PakistanAsad RiazNo ratings yet

- Variable and Absorption Costing Problems Without SolutionsDocument4 pagesVariable and Absorption Costing Problems Without SolutionsMeca CorpuzNo ratings yet

- Flexible and Static Budgets ReviewerDocument13 pagesFlexible and Static Budgets ReviewerLilac heartNo ratings yet

- Budgeting and Budgetary ControlDocument2 pagesBudgeting and Budgetary ControlpalkeeNo ratings yet

- Jose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyDocument6 pagesJose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyBernadette CaduyacNo ratings yet

- Costing Systems - Lessons ExamplesDocument15 pagesCosting Systems - Lessons ExamplesNicolasNo ratings yet

- CMA-II BookDocument38 pagesCMA-II BookmaxsuzsxoxoNo ratings yet

- 5 Job CostingDocument22 pages5 Job CostingAbimanyu Shenil0% (1)

- Tut 8 - Management AccountingDocument29 pagesTut 8 - Management AccountingTao LoheNo ratings yet

- Problem 3 4 Chapter 14Document6 pagesProblem 3 4 Chapter 14freaann03No ratings yet

- MAE RevisionDocument57 pagesMAE RevisionsaloniNo ratings yet

- Departmental PEQDocument38 pagesDepartmental PEQRishikaNo ratings yet

- CostconDocument33 pagesCostconDanica VillaganteNo ratings yet

- Abc1 - FinalDocument7 pagesAbc1 - FinalSakshi ShardaNo ratings yet

- FINAL Acctg7Document5 pagesFINAL Acctg7Romcel FlorendoNo ratings yet

- Alvaro, Fernel Jean C. AE212-1741 TTHS 3-5PM Exercise 8-2. Joint Cost AllocationDocument4 pagesAlvaro, Fernel Jean C. AE212-1741 TTHS 3-5PM Exercise 8-2. Joint Cost AllocationNhel AlvaroNo ratings yet

- CAC Computations Chap 4 1 20Document9 pagesCAC Computations Chap 4 1 20rochelle lagmayNo ratings yet

- Marginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5Document5 pagesMarginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5신두No ratings yet

- ProblemsDocument11 pagesProblemsMohamed RefaayNo ratings yet

- Variableabsorption CostingDocument77 pagesVariableabsorption Costingandrea arapocNo ratings yet

- Byproduct Mission MCQDocument3 pagesByproduct Mission MCQRohit ThandarNo ratings yet

- Act.4-8 Ae23Document6 pagesAct.4-8 Ae23Damian Sheila MaeNo ratings yet

- Exercises Absorption and Variable CostingPAUL ANTHONY DE JESUSDocument4 pagesExercises Absorption and Variable CostingPAUL ANTHONY DE JESUSMeng DanNo ratings yet

- 1.2.1 Assignments - Cost Concepts and Classifications (Answers and Solutions)Document8 pages1.2.1 Assignments - Cost Concepts and Classifications (Answers and Solutions)Roselyn LumbaoNo ratings yet

- Marwa Year 1 Using Marginal Costing ApproachDocument6 pagesMarwa Year 1 Using Marginal Costing ApproachMak PussNo ratings yet

- DepartmentalDocument17 pagesDepartmentalPapiya DeyNo ratings yet

- Tutorial 1 - Topic 4 - OAR - QDocument6 pagesTutorial 1 - Topic 4 - OAR - QJong HannahNo ratings yet

- 8 33 PricingDocument1 page8 33 Pricinganonymous.me0201No ratings yet

- Ae 212 Exercise 8Document4 pagesAe 212 Exercise 8Nhel AlvaroNo ratings yet

- CMA Garrison SuggestedSolutions Chap2Document12 pagesCMA Garrison SuggestedSolutions Chap2PIYUSH SINGHNo ratings yet

- Group AssignmentDocument7 pagesGroup Assignmentsaidkhatib368No ratings yet

- Master Question (Mixed With Process Costing) - Q ADocument3 pagesMaster Question (Mixed With Process Costing) - Q AMuaaz NayyarNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Batch: 2018 - 2021 Academic Year: 2020 - 2021 Subject: Management Accounting Date: 5 January 2021Document24 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Batch: 2018 - 2021 Academic Year: 2020 - 2021 Subject: Management Accounting Date: 5 January 2021Madhuram SharmaNo ratings yet

- Bio Coal EstimateDocument1 pageBio Coal EstimateDhananjay KulkarniNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Financial Ratio Analysis of Square Pharmaceuticals Limited: Asif AhmedDocument24 pagesFinancial Ratio Analysis of Square Pharmaceuticals Limited: Asif AhmedMD. MUNTASIR MAMUN SHOVONNo ratings yet

- Topic 11 - Open-Economy Macroeconomics - Basic Concepts.Document36 pagesTopic 11 - Open-Economy Macroeconomics - Basic Concepts.Trung Hai TrieuNo ratings yet

- Quiz Module 1 FINALDocument4 pagesQuiz Module 1 FINALeia aieNo ratings yet

- Tax Invoice: Agarwal Impex 21-22/745 5-Feb-2022Document2 pagesTax Invoice: Agarwal Impex 21-22/745 5-Feb-2022bhola.vilesh7No ratings yet

- Final CompilationDocument85 pagesFinal CompilationRakesh KushwahaNo ratings yet

- Ajax Fiori-R-07092017Document7 pagesAjax Fiori-R-07092017parimal.rodeNo ratings yet

- SMO 105 Group Course Work Group 4I "Bright Future Food LLC" (Shavelle Lee Vasca, Ming Yang, Shuo Chen) Market Entry Strategies and RationaleDocument3 pagesSMO 105 Group Course Work Group 4I "Bright Future Food LLC" (Shavelle Lee Vasca, Ming Yang, Shuo Chen) Market Entry Strategies and Rationaleshavelle leevascaNo ratings yet

- Melihat Sisi Pengusaha Sosial Dengan Bottle Refill Station Sebagai Solusi Pengendalian Kemasan Sekali Pakai Untuk Kelestarian LingkunganDocument18 pagesMelihat Sisi Pengusaha Sosial Dengan Bottle Refill Station Sebagai Solusi Pengendalian Kemasan Sekali Pakai Untuk Kelestarian LingkunganCuters TresnoNo ratings yet

- Tle EntrepreneurshipDocument2 pagesTle EntrepreneurshipMark Anthony LibecoNo ratings yet

- Digital Marketing PPT - 2021 - ConsellingDocument32 pagesDigital Marketing PPT - 2021 - ConsellingDolly DharmshaktuNo ratings yet

- Contoh Studi Kasus ZachmanDocument15 pagesContoh Studi Kasus Zachmanindra sunardiNo ratings yet

- Kuaishou Technology Announces Fourth Quarter and Full Year 2021 Financial ResultsDocument4 pagesKuaishou Technology Announces Fourth Quarter and Full Year 2021 Financial Resultsmuhamad.ariapujaNo ratings yet

- MANG6296 AssignmentDocument28 pagesMANG6296 Assignmentxu zhenchuanNo ratings yet

- Investment Decision - IciciDocument8 pagesInvestment Decision - Icicimohammed khayyumNo ratings yet

- BCG NBFC Sector Update H1FY24Document48 pagesBCG NBFC Sector Update H1FY24ashi.reportsNo ratings yet

- Dayton Hudson Corporation Conscience and ControlDocument15 pagesDayton Hudson Corporation Conscience and Controlsajal sazzadNo ratings yet

- Corp Law Yash TiwariDocument30 pagesCorp Law Yash TiwariMani YadavNo ratings yet

- Hsieh Mcconnell DonationsDocument9 pagesHsieh Mcconnell DonationsResourcesNo ratings yet

- Support To Operational PlanDocument2 pagesSupport To Operational PlanreshadNo ratings yet

- Module 5 BankingDocument42 pagesModule 5 Bankingg.prasanna saiNo ratings yet

- HRM Project Ultra Tech CementDocument51 pagesHRM Project Ultra Tech CementRoy Yadav100% (1)

- Razelle Ann B. Dapilaga 11 Abm, Peter DruckerDocument3 pagesRazelle Ann B. Dapilaga 11 Abm, Peter DruckerJasmine ActaNo ratings yet

- Whitepaper 2Document8 pagesWhitepaper 2Minhayati BklNo ratings yet

- Price List OGOship Logistics 2022 DE-SOL ENDocument17 pagesPrice List OGOship Logistics 2022 DE-SOL ENDraganaNo ratings yet

- Rangga Fakhrurriza - Kelompok 6 Konflik Dan NegosiasiDocument6 pagesRangga Fakhrurriza - Kelompok 6 Konflik Dan NegosiasiRangga FakhrurrizaKls AAkt 2021No ratings yet

- Presentation On Government BudgetingDocument2 pagesPresentation On Government BudgetingSherry Gonzales ÜNo ratings yet

- China Pastry Bread Mfg. Industry Profile Cic1411Document8 pagesChina Pastry Bread Mfg. Industry Profile Cic1411AllChinaReports.comNo ratings yet