Professional Documents

Culture Documents

Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)

Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)

Uploaded by

MCopyright:

Available Formats

You might also like

- Simplified CHSP For Two Storey Residential HouseDocument5 pagesSimplified CHSP For Two Storey Residential HouseMark Roger Huberit IINo ratings yet

- Mcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaDocument11 pagesMcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaSajal GoyalNo ratings yet

- How The Strategy Process KilledDocument5 pagesHow The Strategy Process KilledDeji AdebolaNo ratings yet

- Roadworthiness Requirements AUDocument12 pagesRoadworthiness Requirements AUDrey GoNo ratings yet

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- UntitledDocument11 pagesUntitleddeepika devsaniNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- Taxation MTP 1 QuestionsDocument9 pagesTaxation MTP 1 QuestionsVishal Kumar 5504No ratings yet

- CA Inter N22 - Tax Model QPDocument14 pagesCA Inter N22 - Tax Model QPNAVEEN SURYA MNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument11 pagesTest Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionRaghavanNo ratings yet

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- DT 1 QDocument23 pagesDT 1 QG INo ratings yet

- Sa 2 DT NovDocument9 pagesSa 2 DT NovRishabh GargNo ratings yet

- MTP 2 TaxDocument10 pagesMTP 2 TaxPrathmesh JambhulkarNo ratings yet

- Sa 3 DT NovDocument9 pagesSa 3 DT NovRishabh GargNo ratings yet

- MTP Taxation Question Paper 2Document12 pagesMTP Taxation Question Paper 2CursedAfNo ratings yet

- 4) TaxationDocument25 pages4) TaxationvgbhNo ratings yet

- Bosmtpinterp 4 QDocument12 pagesBosmtpinterp 4 QUrvi MishraNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperVenkataRajuNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperLaavanya JainNo ratings yet

- Test Paper 1 CA INTER MAYNOV 2024 Basics & House PropertyDocument4 pagesTest Paper 1 CA INTER MAYNOV 2024 Basics & House Propertymshivam617No ratings yet

- MTP 10 17 Questions 1694188914Document11 pagesMTP 10 17 Questions 1694188914luvkumar3532No ratings yet

- Mock Test - 4-2Document16 pagesMock Test - 4-2Deepsikha maitiNo ratings yet

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument9 pagesTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- Mittal Commerce Classes Ca Intermediate - Mock Test (GI-1, GI-2, VI-VDI-SI-1,2)Document12 pagesMittal Commerce Classes Ca Intermediate - Mock Test (GI-1, GI-2, VI-VDI-SI-1,2)Planet ZoomNo ratings yet

- DT 2 New Question PaperDocument11 pagesDT 2 New Question Paperneha manglaniNo ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- Tax Nov 21 RTPDocument25 pagesTax Nov 21 RTPShailjaNo ratings yet

- J.K Shah Full Course Practice Question PaperDocument7 pagesJ.K Shah Full Course Practice Question PapermridulNo ratings yet

- CS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaDocument269 pagesCS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaParitoshNo ratings yet

- Tax - MTP2 - QP - M24 @CAInterLegendsDocument17 pagesTax - MTP2 - QP - M24 @CAInterLegendsPrince ManglaNo ratings yet

- MTP 19 50 Questions 1712317445Document13 pagesMTP 19 50 Questions 1712317445Nitin KumarNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- Test Paper - 3 CA FinalDocument3 pagesTest Paper - 3 CA FinalyeidaindschemeNo ratings yet

- Eco 11Document4 pagesEco 11ps5927510No ratings yet

- Final DT 30 QPDocument6 pagesFinal DT 30 QPshivam chaturvediNo ratings yet

- 27-3-24... 4110 GR I... Int-3019... Tax Mcq... QueDocument7 pages27-3-24... 4110 GR I... Int-3019... Tax Mcq... Quenikulgauswami9033No ratings yet

- CA Inter Tax Q MTP 2 May 2024 Castudynotes ComDocument13 pagesCA Inter Tax Q MTP 2 May 2024 Castudynotes ComineffableadityisticNo ratings yet

- Income Tax Assessment and Procedure - 1Document3 pagesIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Income Tax Quesion BankDocument22 pagesIncome Tax Quesion BankPaatrickNo ratings yet

- Term Test 1Document5 pagesTerm Test 1lalshahbaz57No ratings yet

- Final DT MCQ BookletDocument95 pagesFinal DT MCQ BookletSavya Sachi100% (1)

- Part - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceDocument12 pagesPart - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceShashwat SharmaNo ratings yet

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- 52595bos42131 Inter P4aDocument14 pages52595bos42131 Inter P4aabinesh murugesanNo ratings yet

- 71240bos57247 P7aDocument27 pages71240bos57247 P7abhagirath prakrutNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Document8 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Suppy PNo ratings yet

- TEST - 1 NOV 23 Batch Basics & HPDocument4 pagesTEST - 1 NOV 23 Batch Basics & HPyashsatardekar2206No ratings yet

- Tax MCQsDocument173 pagesTax MCQsHarleen Kaur100% (1)

- 1643296847cma Inter DT MCQ Jd22Document216 pages1643296847cma Inter DT MCQ Jd22Vibha Gupta100% (1)

- CAF 2 TAX Spring 2022Document6 pagesCAF 2 TAX Spring 2022Sumair IqbalNo ratings yet

- Direct Tax: Test Paper-8Document8 pagesDirect Tax: Test Paper-8Rishabh GargNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- SRC, Ppsa, LocDocument7 pagesSRC, Ppsa, LocKLNo ratings yet

- List of Sotho-Tswana ClansDocument4 pagesList of Sotho-Tswana ClansAnonymous hcACjq850% (2)

- Footwear - PattensDocument100 pagesFootwear - PattensThe 18th Century Material Culture Resource Center100% (6)

- Greeting Lesson PlanDocument4 pagesGreeting Lesson Planhawanur266No ratings yet

- Uth Pack: Ufone Has Launched A New Package Plan Uth Pack For The Youth, Which Is Looking For A Lot More Than JustDocument2 pagesUth Pack: Ufone Has Launched A New Package Plan Uth Pack For The Youth, Which Is Looking For A Lot More Than JustM.IMRANNo ratings yet

- Why Would You Be A Good Fit For This PositionDocument2 pagesWhy Would You Be A Good Fit For This PositionchandraNo ratings yet

- Art Journal - 2nd Version - MidtermDocument70 pagesArt Journal - 2nd Version - MidtermDizon Rhean MaeNo ratings yet

- Workday 10 Critical Requirements WhitepaperDocument7 pagesWorkday 10 Critical Requirements Whitepaperswaroop24x7No ratings yet

- Assignment 3 Group 6 (Ta19171, Ta19092, Ta19160, Ta19121, Ta19120)Document6 pagesAssignment 3 Group 6 (Ta19171, Ta19092, Ta19160, Ta19121, Ta19120)kameeneNo ratings yet

- ÔN LUYỆN GIỚI TỪ LỚP 9 THEO UNITDocument2 pagesÔN LUYỆN GIỚI TỪ LỚP 9 THEO UNITLê Hồng KỳNo ratings yet

- Paragon Collective AgreementDocument38 pagesParagon Collective AgreementDebbyNo ratings yet

- Profile Summary: Charul BhanDocument1 pageProfile Summary: Charul Bhanricha khushuNo ratings yet

- Article 1447 Rodolfo To RicardoDocument2 pagesArticle 1447 Rodolfo To RicardoAudrey Kristina MaypaNo ratings yet

- Schwarz Value Surveys PresentationDocument28 pagesSchwarz Value Surveys PresentationLiuba BorisovaNo ratings yet

- Supreme Court: Panaguiton v. DOJ G.R. No. 167571Document5 pagesSupreme Court: Panaguiton v. DOJ G.R. No. 167571Jopan SJNo ratings yet

- People v. GarciaDocument8 pagesPeople v. GarciaKharol EdeaNo ratings yet

- XH-H-edit 3e PPT Chap06Document36 pagesXH-H-edit 3e PPT Chap06An NhiênNo ratings yet

- PM 02 03 Management ReviewDocument4 pagesPM 02 03 Management ReviewAllison SontowinggoloNo ratings yet

- Traditional Spanish Dresses: Guerra UnderDocument2 pagesTraditional Spanish Dresses: Guerra UnderConsueloArizalaNo ratings yet

- FRM Part2Document65 pagesFRM Part2Vidya MalavNo ratings yet

- Does V Boies Schiller Reply BriefDocument20 pagesDoes V Boies Schiller Reply BriefPaulWolfNo ratings yet

- 3 1 2 A LanduseanddevelopmentDocument6 pages3 1 2 A Landuseanddevelopmentapi-276367162No ratings yet

- New PPT mc1899Document21 pagesNew PPT mc1899RYAN JEREZNo ratings yet

- Expectations of Women in SocietyDocument11 pagesExpectations of Women in Societyliliana cambasNo ratings yet

- Iphone 15 - WikipediaDocument8 pagesIphone 15 - WikipediaaNo ratings yet

- ECO402 Solved Mid Term Corrected by Suleyman KhanDocument15 pagesECO402 Solved Mid Term Corrected by Suleyman KhanSuleyman KhanNo ratings yet

- Corporate Fin. Chapter 10 - Leasing (SLIDE)Document10 pagesCorporate Fin. Chapter 10 - Leasing (SLIDE)nguyenngockhaihoan811No ratings yet

Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)

Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)

Uploaded by

MOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)

Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)

Uploaded by

MCopyright:

Available Formats

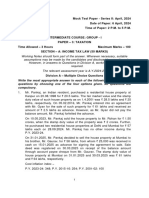

Test Series: March, 2021

MOCK TEST PAPER 1

INTERMEDIATE (NEW) COURSE

PAPER – 4: TAXATION

Time Allowed – 3 Hours Maximum Marks – 100

SECTION – A: INCOME TAX LAW (60 MARKS)

Working Notes should form part of the answer. Wherever necessary, suitable assumptions may be made by

the candidates and disclosed by way of a note. However, in answers to Question s in Division A,

working notes are not required.

The relevant assessment year is A.Y.2021-22.

Division A – Multiple Choice Questions

Write the most appropriate answer to each of the following multiple choice questions by choosing

one of the four options given. All questions are compulsory.

1. Mr. Ram, an Indian resident, purchased a residential house property at Gwalior on 28.05.1999 for

Rs. 28.5 lakhs. The fair market value and the stamp duty value of such house property as on 1.4.2001

was Rs. 33.5 lakhs and Rs. 32.4 lakhs, respectively. On 05.02.2012, Mr. Ram entered into an

agreement with Mr. Byomkesh for sale of such property for Rs. 74 lakhs and received an amount of

Rs. 3.9 lakhs as advance. However, as Mr. Byomkesh did not pay the balance amount, Mr. Ram

forfeited the advance.

On 15.04.2020, Mr. Ram sold the house property for Rs.2.10 crores, when the stamp duty value of the

property was Rs. 2.33 crores. Further, he purchased two residential house properties at Delhi and

Mumbai for Rs. 54 lakhs each on 28.08.2020.

On 28.02.2021, Mr. Ram decided to sell the house property at Mumbai to his nephew, Mr. Vaibhav, for

Rs. 58 lakhs, from whom Rs. 19,000 was received in cash on 15.01.2021 as advance for signing the

agreement to sale. Sale deed was registered on 30.03.2021 on receipt of the balance amount through

account payee cheque from Mr. Vaibhav. The stamp duty value of house property at Mumbai on

28.02.2021 and 30.03.2021 was Rs. 61 lakhs and Rs. 64 lakhs, respectively.

Cost inflation index –

P.Y. 2020-21: 301; P.Y. 2011-12: 184; P.Y. 2001-02: 100

Based on the above information, choose the most appropriate option of the following Multiple Choice

Questions (MCQs):-

(i) What shall be the indexed cost of acquisition of residential house property at Gwalior for

computation of capital gains in the hands of Mr. Ram?

(a) Rs. 1,00,83,500

(b) Rs. 97,52,400

(c) Rs. 85,78,500

(d) Rs. 89,09,600

(ii) The amount of capital gains taxable for A.Y. 2021-22 in the hands of Mr. Ram for sale of

residential house property at Gwalior is -

(a) Rs. 39,21,500

(b) Rs. 93,21,500

(c) Rs. 35,90,400

1

© The Institute of Chartered Accountants of India

(d) Rs. 24,16,500

(iii) The amount of capital gains taxable for A.Y. 2021-22 in the hands of Mr. Ram for sale of

residential house property at Mumbai is -

(a) Rs. 3 lakhs

(b) Rs. 6 lakhs

(c) Rs. 61 lakhs

(d) Rs. 64 lakhs

(iv) The amount taxable under section 56(2)(x) in the hands of Mr. Vaibhav, if any, is -

(a) Rs. 3 lakhs

(b) Nil

(c) Rs. 6 lakhs

(d) Rs. 5.50 lakhs

(v) What shall be the total tax credit available with Mr. Ram with respect to sale of two house

properties during P.Y. 2020-21 assuming the tax was fully deducted by both the buyers at the

time of payment?

(a) Rs. 2,01,000

(b) Rs. 2,53,500

(c) Rs. 2,68,000

(d) Rs. 2,81,000 (5 x 2 Marks)

2. TPR & Co., a partnership firm selling its product X through the digital facility provided by MKY Limited

(an E-commerce operator). MKY Limited has credited in its books of account, the account of TPR &

Co. on 31st January, 2021 by sum of Rs. 4,80,000 for the sale of product X made during the month of

January 2021. Out of Rs. 4,80,000, it made payment for Rs. 4,00,300 on 3 rd February, 2021. Further,

Mr. Pawan, who purchased the product X through the facility provided by MKY Limited, has made the

payment of sum of Rs. 40,000 directly to TPR & Co. on 15th January. 2021. Which statement is

correct regarding requirement of deduction of tax at source by MKY Limited?

(a) No tax is required to be deducted at source.

(b) MKY Limited is required to deduct tax at source Rs. 4,800 under section 194C.

(c) MKY Limited is required to deduct tax at source Rs. 3,900 under section 194O.

(d) MKY Limited is required to deduct tax at source Rs. 5,200 under section 194O. (2 Marks)

3. Mr. Harry, an Indian citizen, is a marketing consultant who provides consultancy to various

countries around the globe. Due to his profession, he is required to travel across various

countries throughout the year. His marketing project does not last for more than 40 days and therefore

his stay in any country including India usually never exceeds 40 days during a year. His income is

Rs. 80 lakhs across the globe which is not liable to tax in any country. During the P.Y. 2020-21, an

Indian company provides him a marketing project in India. His stay in India for the project is expected

to be only 25 days and his income from that project would be Rs. 30 lakhs. Being a highly qualified

professional, he consults you about the tax regime on his income and his residential status in India.

(a) He shall be treated as resident but not ordinarily resident and shall be liable to pay tax on

Rs. 30 lakhs.

(b) He shall be treated as resident and ordinarily resident and shall be liable to pay tax on Rs. 80

lakhs.

(c) He shall be treated as non-resident and shall not be liable to any tax.

2

© The Institute of Chartered Accountants of India

(d) He shall be treated as resident but not ordinarily resident and shall be liable to pay tax on his

entire income of Rs. 80 lakhs earned across the globe. (2 Marks)

4. Mr. Vyas, aged 80, is a retired government employee. On 1 St April 2020, he received the maturity

amount of his LIC policy amounting to Rs. 3,50,000. This policy was taken by Mr. Vyas on 1 st April

2013 on which the sum assured was Rs. 3,00,000 and the annual premium was Rs. 40,000. His other

income comprised of pension amounting to Rs. 85,000. Mr. Vyas furnishes a declaration in Form 15H

for non-deduction of tax at source to the insurance company stating that his net tax liability for the

year is NIL.

Choose the correct statement from below:

(a) The declaration made by Mr. Vyas is wrong and the insurance company has to deduct tax of

Rs. 3,500 under section 194DA.

(b) The claim by Vyas is right and insurance company is not required to deduct tax at source.

(c) The insurance company has to deduct tax under section 194DA since declaration in Form 15H

cannot be made for tax deduction under section 194DA.

(d) The declaration made by Mr. Vyas is wrong and the insurance company has to deduct tax of

Rs. 1,000 under section 194DA. (2 Marks)

5. During the A.Y. 2021-22, Mr. Kabir has a loss of Rs. 6 lakhs under the head “Income from house

property”, loss of Rs. 5 lakhs from business of profession and income of Rs. 3 lakhs from long term

capital gains. He filed his return of income for the A.Y. 2021-22 on 31.12.2021. Determine the total

income of Mr. Kabir for A.Y. 2021-22 and the amount of loss which can be carried forward in a manner

most beneficial to him?

(a) Total income Nil; loss of Rs. 4,00,000 from house property and loss of Rs. 4,00,000 from

business or profession .

(b) Total income Rs. 1,00,000; loss of Rs. 4,00,000 from house property.

(c) Total income Nil; No loss is allowed to be carried forward.

(d) Total income Nil; loss of Rs. 6,00,000 from house property. (2 Marks)

Division B – Descriptive Questions

Question No. 1 is compulsory

Attempt any two questions from the remaining three questions

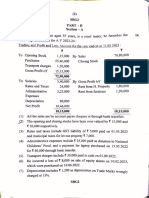

1. You are required to compute the total income and tax payable by Mr. Alok, aged 58 years, a resident

individual. Mr. Alok is an advocate and furnishes you the receipts and payments account for the

financial year 2020-21.

Receipts and Payments Account

Receipts Rs. Payments Rs.

Opening Balance Staff salary and bonus to clerks 17,50,000

(01-04-2020)

Cash & Bank 80,000 Other general and administrative 22,00,000

expenses

Fee from legal services 49,60,000 Office rent 1,48,000

Motor car loan from SBI @12% p.a. 5,00,000 Life Insurance Premium (Sum 49,000

interest Assured Rs. 5,00,000]

Sale receipts of 5,800 listed equity 5,95,000 Motor car (Acquired in January 9,50,000

shares (sold on 31st March 2021) 2021 by way of NEFT)

3

© The Institute of Chartered Accountants of India

Books bought by way of A/c payee 80,000

cheque in the month of May, June

and September 2020 (annual

publications)

Computer acquired on 1-11-2020 52,000

for professional use (payment

made by A/c payee cheque)

Domestic drawings 6,23,000

Motor car maintenance 72,000

Public Provident Fund subscription 1,50,000

Closing balances (31-03-2021)

Cash & Bank 61,000

61,35,000 61,35,000

Other information:

(i) Listed equity shares on which STT was paid were acquired in August 2016 for Rs. 1,21,800. The

fair market value of such shares as on 31 st January 2018 and on 1 st April 2018 was Rs. 75 per

share and Rs. 85 per share, respectively.

(ii) Motor car was put to use for both official and personal purposes.1/3rd of the motor car is for

personal purpose. No interest on car loan was paid during the previous year 2020-21.

(ii) Mr. Alok purchased a flat in Kanpur for Rs. 35,00,000 in July 2013 cost of which was partly

financed by a loan from Punjab National Housing Finance Limited of Rs. 25,00,000, his own-

savings Rs. 1,00,000 and a deposit from Repco Bank for Rs. 9,00,000. The flat was given to

Repco Bank on lease for 10 years @ Rs. 35,000 per month. The following particulars are

relevant:

(a) Municipal taxes paid by Mr. Alok Rs. 8,200 per annum

(b) House insurance Rs. 11,000

As per interest certificate issued by Punjab National Housing Finance Limited for the financial year

2020-21, he paid Rs. 1,80,000 towards principal and Rs. 2,01,500 as interest.

(iii) He earned Rs. 1,20,000 in share speculation business and lost Rs. 1,80,000 in commodity

speculation business.

(iv) Mr. Alok received a gift of Rs. 21,000 each from four of his family friends.

(v) He contributed Rs. 1,21,000 to PM Cares Fund by way of bank draft.

(vi) He donated to a registered political party Rs. 3,50,000 by way of cheque.

(vii) He follows cash system of accounting.

(viii) Cost Inflation Index : F.Y. 2016-17 – 264; F.Y. 2018-19 – 280; F.Y. 2020-21 – 301

Assume Mr. Alok is not willing to opt for the provisions of section 115BAC. (14 Marks)

2. (a) Determine the residential status and total income of Mr. Raghu for the assessment year 2021-22

from the information given below.

Mr. Raghu (age 62 years), an American citizen, is employed with a multinational company in

Gurugram. Mr. Raghu holds a senior level position as researcher in the company, since 2009. To

share his knowledge and finding in research, company gave him an opportunity to travel to other

group companies outside India while continuing to be based at the Gurugram office.

© The Institute of Chartered Accountants of India

The details of his travel outside India for the financial year 2020-21 are as under:

Country Period of stay

USA 25 August, 2020 to 10 November, 2020

UK 20 November, 2020 to 23 December, 2020

Germany 10 January, 2021 to 24 March, 2021

During the last four years preceding the previous year 2020-21, he was present in India for 380

days. During the last seven previous years preceding the previous year 2020-21, he was present

in India for 700 days. During the P.Y. 2020-21, he earned the following incomes:

(1) Salary Rs. 15,80,000. The entire salary is paid by the Indian company in his Indian bank

account.

(2) Dividend amounting to Rs. 48,000 received from Treat Ltd., a Singapore based company,

which was transferred to his bank account in Singapore.

(3) Interest on fixed deposit with Punjab National Bank (Delhi) amounting to Rs. 10,500 was

credited to his saving account. (7 Marks)

(b) Determine the advance tax payable by Mr. Deepak with their due dates for the assessment year

2021-22.

Amount (Rs.)

Total estimated tax payable 5,50,000

TDS (deductible but not deducted) 70,000

TCS (collected) 20,000

(3 Marks)

(c) Mr. Praveen, due to inadvertent reasons, failed to file his income-tax return for the assessment

year 2021-22 on or before the due date of filing such return of income.

(i) Can he file the above return after due date of filing return of income? If yes, which is the

last date for filing the above return?

(ii) What are the consequences of non-filing the return within the due date under section

139(1)? (4 Marks)

3. (a) Mr. Naveen and Mr. Vikas constructed their houses on a piece of land purchased by them at

Delhi. The built up area of each house was 1,800 sq. ft. ground floor and an equal area in the first

floor. Naveen started construction on 1-04-2018 and completed on 1-04-2020. Vikas started the

construction on 1-04-2018 and completed the construction on 30-09-2020. Naveen occupied the

entire house on 01-04-2020. Vikas occupied the ground floor on 01-10-2020 and let out the first

floor for a rent of Rs.20,000 per month. However, the tenant vacated the house on

31-12-2020 and Vikas occupied the entire house during the period 01-01-2021 to 31-03-2021.

Following are the other information

(i) Fair rental value of each unit Rs. 1,00,000 per annum

(ground floor /first floor)

(ii) Municipal value of each unit (ground floor / first floor) Rs. 72,000 per annum

(iii) Municipal taxes paid by Naveen – Rs. 8,000

Vikas – Rs. 8,000

(iv) Repair and maintenance charges paid by Naveen – Rs. 28,000

Vikas – Rs. 30,000

5

© The Institute of Chartered Accountants of India

Naveen has availed a housing loan of Rs. 15 lakhs @ 12% p.a. on 01-04-2018. Vikas has availed

a housing loan of Rs. 10 lakhs @ 10% p.a. on 01-07-2018. No repayment was made by either of

them till 31-03-2021. Compute income from house property for Naveen and Vikas for the

previous year 2020-21. (7 Marks)

(b) Mr. Samaksh is a Marketing Manager in Smile Ltd. From the following information, you are

required to compute his income chargeable under the head Salary for assessment year 2021-22.

(i) Basic salary is Rs. 70,000 per month.

(ii) Dearness allowance @ 40% of basic salary

(iii) He is provided health insurance scheme approved by IRDA for which Rs. 20,000 incurred

by Smile Ltd.

(iv) Received Rs. 10,000 as gift voucher on the occasion of his marriage anniversary from

Smile Ltd.

(v) Smile Ltd. allotted 800 sweat equity shares in August 2020. The shares were allotted at

Rs. 450 per share and the fair market value on the date of exercising the option by

Mr. Samaksh was Rs. 700 per share.

(vi) He was provided with furniture during September 2016. The furniture is used at his

residence for personal purpose. The actual cost of the furniture was Rs. 1,10,000. On 31st

March, 2021, the company offered the furniture to him at free of cost. No amount was

recovered from him towards the furniture till date.

(vii) Received Rs. 10,000 towards entertainment allowance.

(viii) Housing Loan@ 4.5% p.a. provided by Smile Ltd., amount outstanding as on 01.04.2020 is

Rs. 12 Lakhs. Rs. 50,000 is paid by Mr. Samaksh every quarter towards principal starting

from June 2020. The lending rate of SBI for similar loan as on 01.04.2020 was 8%.

(ix) Facility of laptop costing Rs. 50,000 (7 Marks)

4. (a) Compute the gross total income of Mr. Farhan and show the items eligible for carry forward and

the assessment years upto which such losses can be carry forward from the following

information furnished by him for the year ended 31-03-2021:

Particulars Amount

(Rs.)

Loss from speculative business MNO 12,000

Income from speculative business BPO 25,000

Loss from specified business covered under section 35AD 45,000

Income from salary (computed) 4,18,000

Loss from house property 2,20,000

Income from trading business 2,80,000

Long-term capital gain from sale of urban land 2,05,000

Long-term capital loss on sale of equity shares (STT not paid) 85,000

Long-term capital loss on sale of listed equity shares in recognized stock 1,10,000

exchange (STT paid at the time of acquisition and sale of shares)

Short-term capital loss under section 111A 85,000

Following are the brought forward losses:

(1) Brought forward loss from speculative business MNO Rs. 18,000 relating to A.Y. 2017-18.

(2) Brought forward loss from trading business of Rs. 12,000 relating to A.Y. 2015-16.

6

© The Institute of Chartered Accountants of India

(3) Unabsorbed depreciation Rs. 1,00,000 relating to A.Y. 2020-21

Assume Mr. Farhan has furnished his return of income on or before the due date specified under

section 139(1) in all the above previous years. (7 Marks)

(b) Compute the deduction available to Mr. Dhyanchand under Chapter VI-A for A.Y.2021-22.

Mr. Dhyanchand, aged 65 years, is working with ABC Ltd. His income comprises of salary of

Rs. 18,50,000 and interest on fixed deposits of Rs. 75,000. He submits the following particulars

of investments and payments made by him during the previous year 2020-21:

- Deposit of Rs. 1,50,000 in public provident fund

- Payment of life insurance premium of Rs. 62,000 on the policy taken on 01.4.2017 to insure

his life (Sum assured – Rs. 4,00,000).

- Deposit of Rs. 45,000 in a five year term deposit with bank.

- Contributed Rs. 2,10,000, being 15% of his salary (basic salary plus dearness allowance,

which forms part of retirement benefits) to the NPS of the Central Government. A matching

contribution was made by ABC Ltd.

- On 1.4.2020, mediclaim premium of Rs. 1,08,000 and Rs. 80,000 paid as lumpsum to

insure his and his wife (aged 58 years) health, respectively for four years

- Incurred Rs. 46,000 towards medical expenditure of his father, aged 85 years, not

dependent on him. No insurance policy taken for his father.

- He spent Rs. 6,000 for the preventive health-check up of his wife.

- He has incurred an expenditure of Rs. 90,000 for the medical treatment of his mother,

being a person with severe disability. (7 Marks)

© The Institute of Chartered Accountants of India

SECTION B - INDIRECT TAXES (40 MARKS) NEW COURSE

QUESTIONS

(i) Working Notes should form part of the answers. However, in answers to Question in Division A,

working notes are not required.

(ii) Wherever necessary, suitable assumptions may be made by the candidates, and disclosed by way of

note.

(iii) All questions should be answered on the basis of the position of GST law as amended up to 3 1st

October, 2020.

(iv) The GST rates for goods and services mentioned in various questions are hypothetical and may not

necessarily be the actual rates leviable on those goods and services. Further, GST compensation

cess should be ignored in all the questions, wherever applicable.

Division A - Multiple Choice Questions (MCQs)

Write the most appropriate answer to each of the following multiple choice questions by choosing

one of the four options given. All questions are compulsory.

Total Marks: 12 Marks

Each MCQ under Question No. 1 carries 2 Marks each

1. Explore Logistics, a Goods Transport Agency registered under GST provided GTA services (taxable @

5%) to the following persons-

(a) Sahil Traders, an unregistered Partnership firm.

(b) Mr. Aadi, a casual taxable person, who is not registered under GST.

(c) Small Traders co-operative society registered under Societies Registration Act.

In a particular consignment, Explore Logistics transported the following-

(a) Defence Equipments

(b) Railway Equipments

(c) Organic Manure

Explore Logistics opted to charge GST @ 12% from October. It provided GTA Services to Mahajan

Steels Pvt. Ltd. on 1 st October and issued an invoice dated 5 th November. Payment was received on

6th November.

It provided both inter-State and intra-State service to various registered as well as unregistered

persons.

Based on the information provided above, choose the most appropriate answer for the following

questions 1.1 to 1.5-

1.1 Which of the following persons are liable to pay GST on reverse charge in respect of the GT A

services (taxable @ 5%) provided by Explore Logistics

i Sahil Traders

ii Mr. Aadi

iii Small Traders Co-operative society

(a) i & ii

(b) ii & iii

(c) i & iii

8

© The Institute of Chartered Accountants of India

(d) i, ii & iii

1.2 Out of items transported by Explore Logistics, which of the following is/ are exempt from GST?

i. Defence Equipments

ii. Railway Equipments

iii. Organic Manure

(a) i

(b) i & ii

(c) i & iii

(d) i , ii & iii

1.3 What will be the time of supply in respect of the services provided by Explore Logistics to

Mahajan Steels Pvt. Ltd.?

(a) 6th November

(b) 5th November

(c) 30th November

(d) 1st October

1.4 Which of the following statements is correct in respect of services provided by Explore Logistics

to Mahajan Steels Pvt. Ltd.

(a) Mahajan Steels Pvt. Ltd. is liable to pay GST

(b) Explore Logistics is liable to pay GST

(c) Service provided by Explore Logistics to Mahajan Steels Pvt. Ltd. is exempt under GST

(d) Mahajan Steels Pvt. Ltd. is liable to pay 50% GST and remaining 50% will be paid by

Explore Logistics

1.5 In respect of which of the following supplies, Explore Logistics has to provide invoice-wise details

in GSTR-1?

i. Inter-State supplies to registered person with invoice value not exceeding Rs. 2,50,000

ii. Inter-State supplies to unregistered person with invoice value not exceeding Rs. 2,50,000

iii. Inter-State supplies to unregistered person with invoice value exceeding Rs. 2,50,000

iv. Intra-State supplies to registered person with invoice value not exceeding Rs. 2,50,000

(a) i & iv

(b) i & ii

(c) ii & iii

(d) i, iii & iv (5 x 2 Marks = 10 Marks)

2. Lovely & Co., a registered person, supplies taxable goods to unregistered persons. It need not issue

tax invoice for the goods supplied on 16 th April, if the value of the goods is and the recipient

does not require such invoice.

(a) Rs. 1,200

(b) Rs. 600

(c) Rs. 150

(d) Rs. 200 (2 Marks)

© The Institute of Chartered Accountants of India

Division B - Descriptive Questions

Question No. 1 is compulsory.

Attempt any two questions out of remaining three questions.

Total Marks: 28 Marks

1. Bunty Pvt. Ltd., a supplier of goods, pays GST under regular scheme. It has made the following

outward taxable supplies in a tax period:

Particulars Amount (Rs.)

Intra-State supply of goods 11,20,000

Inter-State supply of goods 4,20,000

It has also furnished the following information in respect of purchases made by it in that tax period:

Particulars Amount (Rs.)

Intra-State purchases of goods 2,80,000

Inter-State purchases of goods 70,000

The company has following ITCs with it at the beginning of the tax period:

Particulars Amount (Rs.)

CGST 79,800

SGST Nil

IGST 98,000

Note:

(i) Rates of CGST, SGST and IGST are 9%, 9% and 18% respectively.

(ii) Both inward and outward supplies are exclusive of taxes, wherever applicable.

(iii) All the conditions necessary for availing the ITC have been fulfilled.

Compute the minimum GST, payable in cash, by Bunty Pvt. Ltd. for the tax period. Make suitable

assumptions as required. (8 Marks)

2. (a) Hangover Ltd., Delhi, a registered supplier, is manufacturing taxable goods. It provides the

following details of taxable inter-State supply made by it during the month of March:-

S. Particulars Amount

No. (Rs.)

(i) List price of taxable goods supplied inter-State (exclusive of taxes) 24,00,000

(ii) Subsidy received from the Central Government for supply of taxable goods 3,36,000

to Government School (exclusively related to supply of goods included at

S. No. 1)

(iii) Subsidy received from an NGO for supply of taxable goods to an old age 80,000

home (exclusively related to supply of goods included at S. No. 1)

(iv) Tax levied by Municipal Authority 32,000

(v) Packing charges 24,000

(vi) Late fee paid by the recipient of supply for delayed payment of 9,600

consideration (Recipient has agreed to pay Rs. 9,600 in lump sum and no

additional amount is payable by him)

10

© The Institute of Chartered Accountants of India

The list price of the goods is net of the two subsidies received. However, the other

charges/taxes/fee are charged to the customers over and above the list price.

Calculate the total value of taxable supplies made by Hangover Ltd. during the month of March.

Rate of IGST is 18%. (6 Marks)

(b) M/s Shubhank Associates, a partnership firm, provided recovery agent services to Neelkanth

Credits Ltd., a non-banking financial company and a registered supplier, on 15 th January. Invoice

for the same was issued on 7 th February and the payment was made on 18 th April by Neelkanth

Credits Ltd. Bank account of the company was debited on 20 th April.

Determine the following:

(i) Person liable to pay GST

(ii) Time of supply of service (4 Marks)

3. (a) Fair Oils, Delhi has supplied machine oil and high-speed diesel in the month of April as per the

details given in table below. Fair Oils is not yet registered.

Sl. No. Particulars Amount

(Rs.)*

(i) Supply of machine oil in Delhi 9,00,000

(ii) Supply of high speed diesel in Delhi 18,00,000

(iii) Supply of machine oil made in Punjab by Fair Oils from its branch 12,00,000

located in Punjab

*excluding GST

Determine whether Fair Oils is liable for registration. (6 Marks)

(b) Narayan Singh, a registered supplier, has received advance payment with respect to services to

be supplied to Shelly. His accountant asked him to issue the receipt voucher with respect to

such services to be supplied. However, he is apprehensive as to what would happen in case a

receipt voucher is issued, but subsequently no services are supplied. You are required to advise

Narayan Singh regarding the same. (4 Marks)

4. (a) Briefly explain the leviability of GST or otherwise on petroleum crude, diesel, petrol, Aviation

Turbine Fuel (ATF) and natural gas. (5 Marks)

(b) If a return has been filed, how can it be revised if some changes are required to be made?

(5 Marks)

11

© The Institute of Chartered Accountants of India

You might also like

- Simplified CHSP For Two Storey Residential HouseDocument5 pagesSimplified CHSP For Two Storey Residential HouseMark Roger Huberit IINo ratings yet

- Mcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaDocument11 pagesMcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaSajal GoyalNo ratings yet

- How The Strategy Process KilledDocument5 pagesHow The Strategy Process KilledDeji AdebolaNo ratings yet

- Roadworthiness Requirements AUDocument12 pagesRoadworthiness Requirements AUDrey GoNo ratings yet

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- UntitledDocument11 pagesUntitleddeepika devsaniNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- Taxation MTP 1 QuestionsDocument9 pagesTaxation MTP 1 QuestionsVishal Kumar 5504No ratings yet

- CA Inter N22 - Tax Model QPDocument14 pagesCA Inter N22 - Tax Model QPNAVEEN SURYA MNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument11 pagesTest Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionRaghavanNo ratings yet

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- DT 1 QDocument23 pagesDT 1 QG INo ratings yet

- Sa 2 DT NovDocument9 pagesSa 2 DT NovRishabh GargNo ratings yet

- MTP 2 TaxDocument10 pagesMTP 2 TaxPrathmesh JambhulkarNo ratings yet

- Sa 3 DT NovDocument9 pagesSa 3 DT NovRishabh GargNo ratings yet

- MTP Taxation Question Paper 2Document12 pagesMTP Taxation Question Paper 2CursedAfNo ratings yet

- 4) TaxationDocument25 pages4) TaxationvgbhNo ratings yet

- Bosmtpinterp 4 QDocument12 pagesBosmtpinterp 4 QUrvi MishraNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperVenkataRajuNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperLaavanya JainNo ratings yet

- Test Paper 1 CA INTER MAYNOV 2024 Basics & House PropertyDocument4 pagesTest Paper 1 CA INTER MAYNOV 2024 Basics & House Propertymshivam617No ratings yet

- MTP 10 17 Questions 1694188914Document11 pagesMTP 10 17 Questions 1694188914luvkumar3532No ratings yet

- Mock Test - 4-2Document16 pagesMock Test - 4-2Deepsikha maitiNo ratings yet

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument9 pagesTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- Mittal Commerce Classes Ca Intermediate - Mock Test (GI-1, GI-2, VI-VDI-SI-1,2)Document12 pagesMittal Commerce Classes Ca Intermediate - Mock Test (GI-1, GI-2, VI-VDI-SI-1,2)Planet ZoomNo ratings yet

- DT 2 New Question PaperDocument11 pagesDT 2 New Question Paperneha manglaniNo ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- Tax Nov 21 RTPDocument25 pagesTax Nov 21 RTPShailjaNo ratings yet

- J.K Shah Full Course Practice Question PaperDocument7 pagesJ.K Shah Full Course Practice Question PapermridulNo ratings yet

- CS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaDocument269 pagesCS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaParitoshNo ratings yet

- Tax - MTP2 - QP - M24 @CAInterLegendsDocument17 pagesTax - MTP2 - QP - M24 @CAInterLegendsPrince ManglaNo ratings yet

- MTP 19 50 Questions 1712317445Document13 pagesMTP 19 50 Questions 1712317445Nitin KumarNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- Test Paper - 3 CA FinalDocument3 pagesTest Paper - 3 CA FinalyeidaindschemeNo ratings yet

- Eco 11Document4 pagesEco 11ps5927510No ratings yet

- Final DT 30 QPDocument6 pagesFinal DT 30 QPshivam chaturvediNo ratings yet

- 27-3-24... 4110 GR I... Int-3019... Tax Mcq... QueDocument7 pages27-3-24... 4110 GR I... Int-3019... Tax Mcq... Quenikulgauswami9033No ratings yet

- CA Inter Tax Q MTP 2 May 2024 Castudynotes ComDocument13 pagesCA Inter Tax Q MTP 2 May 2024 Castudynotes ComineffableadityisticNo ratings yet

- Income Tax Assessment and Procedure - 1Document3 pagesIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Income Tax Quesion BankDocument22 pagesIncome Tax Quesion BankPaatrickNo ratings yet

- Term Test 1Document5 pagesTerm Test 1lalshahbaz57No ratings yet

- Final DT MCQ BookletDocument95 pagesFinal DT MCQ BookletSavya Sachi100% (1)

- Part - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceDocument12 pagesPart - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceShashwat SharmaNo ratings yet

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- 52595bos42131 Inter P4aDocument14 pages52595bos42131 Inter P4aabinesh murugesanNo ratings yet

- 71240bos57247 P7aDocument27 pages71240bos57247 P7abhagirath prakrutNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Document8 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Suppy PNo ratings yet

- TEST - 1 NOV 23 Batch Basics & HPDocument4 pagesTEST - 1 NOV 23 Batch Basics & HPyashsatardekar2206No ratings yet

- Tax MCQsDocument173 pagesTax MCQsHarleen Kaur100% (1)

- 1643296847cma Inter DT MCQ Jd22Document216 pages1643296847cma Inter DT MCQ Jd22Vibha Gupta100% (1)

- CAF 2 TAX Spring 2022Document6 pagesCAF 2 TAX Spring 2022Sumair IqbalNo ratings yet

- Direct Tax: Test Paper-8Document8 pagesDirect Tax: Test Paper-8Rishabh GargNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- SRC, Ppsa, LocDocument7 pagesSRC, Ppsa, LocKLNo ratings yet

- List of Sotho-Tswana ClansDocument4 pagesList of Sotho-Tswana ClansAnonymous hcACjq850% (2)

- Footwear - PattensDocument100 pagesFootwear - PattensThe 18th Century Material Culture Resource Center100% (6)

- Greeting Lesson PlanDocument4 pagesGreeting Lesson Planhawanur266No ratings yet

- Uth Pack: Ufone Has Launched A New Package Plan Uth Pack For The Youth, Which Is Looking For A Lot More Than JustDocument2 pagesUth Pack: Ufone Has Launched A New Package Plan Uth Pack For The Youth, Which Is Looking For A Lot More Than JustM.IMRANNo ratings yet

- Why Would You Be A Good Fit For This PositionDocument2 pagesWhy Would You Be A Good Fit For This PositionchandraNo ratings yet

- Art Journal - 2nd Version - MidtermDocument70 pagesArt Journal - 2nd Version - MidtermDizon Rhean MaeNo ratings yet

- Workday 10 Critical Requirements WhitepaperDocument7 pagesWorkday 10 Critical Requirements Whitepaperswaroop24x7No ratings yet

- Assignment 3 Group 6 (Ta19171, Ta19092, Ta19160, Ta19121, Ta19120)Document6 pagesAssignment 3 Group 6 (Ta19171, Ta19092, Ta19160, Ta19121, Ta19120)kameeneNo ratings yet

- ÔN LUYỆN GIỚI TỪ LỚP 9 THEO UNITDocument2 pagesÔN LUYỆN GIỚI TỪ LỚP 9 THEO UNITLê Hồng KỳNo ratings yet

- Paragon Collective AgreementDocument38 pagesParagon Collective AgreementDebbyNo ratings yet

- Profile Summary: Charul BhanDocument1 pageProfile Summary: Charul Bhanricha khushuNo ratings yet

- Article 1447 Rodolfo To RicardoDocument2 pagesArticle 1447 Rodolfo To RicardoAudrey Kristina MaypaNo ratings yet

- Schwarz Value Surveys PresentationDocument28 pagesSchwarz Value Surveys PresentationLiuba BorisovaNo ratings yet

- Supreme Court: Panaguiton v. DOJ G.R. No. 167571Document5 pagesSupreme Court: Panaguiton v. DOJ G.R. No. 167571Jopan SJNo ratings yet

- People v. GarciaDocument8 pagesPeople v. GarciaKharol EdeaNo ratings yet

- XH-H-edit 3e PPT Chap06Document36 pagesXH-H-edit 3e PPT Chap06An NhiênNo ratings yet

- PM 02 03 Management ReviewDocument4 pagesPM 02 03 Management ReviewAllison SontowinggoloNo ratings yet

- Traditional Spanish Dresses: Guerra UnderDocument2 pagesTraditional Spanish Dresses: Guerra UnderConsueloArizalaNo ratings yet

- FRM Part2Document65 pagesFRM Part2Vidya MalavNo ratings yet

- Does V Boies Schiller Reply BriefDocument20 pagesDoes V Boies Schiller Reply BriefPaulWolfNo ratings yet

- 3 1 2 A LanduseanddevelopmentDocument6 pages3 1 2 A Landuseanddevelopmentapi-276367162No ratings yet

- New PPT mc1899Document21 pagesNew PPT mc1899RYAN JEREZNo ratings yet

- Expectations of Women in SocietyDocument11 pagesExpectations of Women in Societyliliana cambasNo ratings yet

- Iphone 15 - WikipediaDocument8 pagesIphone 15 - WikipediaaNo ratings yet

- ECO402 Solved Mid Term Corrected by Suleyman KhanDocument15 pagesECO402 Solved Mid Term Corrected by Suleyman KhanSuleyman KhanNo ratings yet

- Corporate Fin. Chapter 10 - Leasing (SLIDE)Document10 pagesCorporate Fin. Chapter 10 - Leasing (SLIDE)nguyenngockhaihoan811No ratings yet