Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

16 viewsA. Fifo Gross Profit Ending Inventory

A. Fifo Gross Profit Ending Inventory

Uploaded by

Achmad ArdanuThe document compares three inventory costing methods - FIFO, LIFO, and weighted average - by showing the calculation of gross profit and ending inventory for each method. [LIFO results in the lowest ending inventory balance and gross profit compared to FIFO and weighted average]. Under LIFO, the company would report a lower net income and pay less in taxes for the current year.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Athletic KnitDocument31 pagesAthletic KnitNish A0% (1)

- Sr. No Name Roll No Programme: Case Analysis Section 2 Toffee Inc. Course: Operations Management (Tod 221)Document6 pagesSr. No Name Roll No Programme: Case Analysis Section 2 Toffee Inc. Course: Operations Management (Tod 221)Harshvardhan Jadwani0% (1)

- Lupin's Foray Into Japan - SolutionDocument14 pagesLupin's Foray Into Japan - Solutionvardhan100% (1)

- Volume 2 India Ver 141005 PDFDocument222 pagesVolume 2 India Ver 141005 PDFLittin Thankachan82% (17)

- Treasure Trophy CompanyDocument12 pagesTreasure Trophy CompanyArslan ShaikhNo ratings yet

- Boston Beer ExcelDocument6 pagesBoston Beer ExcelNarinderNo ratings yet

- 2009 CFA Level 1 Mock Exam MorningDocument38 pages2009 CFA Level 1 Mock Exam MorningForrest100% (1)

- Inventory ValuationDocument4 pagesInventory ValuationFyaj RohanNo ratings yet

- Exercises For Final PDFDocument11 pagesExercises For Final PDFThanh HằngNo ratings yet

- A2 Recognition, Measurement, Valuation, and Disclosure PDFDocument7 pagesA2 Recognition, Measurement, Valuation, and Disclosure PDFbernard cruzNo ratings yet

- PV & Thermal Payback Calculator Jan 12 v1Document2 pagesPV & Thermal Payback Calculator Jan 12 v1andriaorgNo ratings yet

- PDC Pricelist 15-03-2022Document12 pagesPDC Pricelist 15-03-2022anirban 007No ratings yet

- Data Produksi Minyak Mentah 3 4 5Document10 pagesData Produksi Minyak Mentah 3 4 5Irsalina NHNo ratings yet

- Polycab22 3Document2 pagesPolycab22 3Velu SNo ratings yet

- Case 1: Less: Reinvestment at 20%Document4 pagesCase 1: Less: Reinvestment at 20%Vinay JajuNo ratings yet

- 0497427936124Document18 pages0497427936124Saleh AlgdaryNo ratings yet

- ExcelDocument2 pagesExceloaziz66No ratings yet

- LT Power Cables - Aluminium Conductor: Havells BrandDocument20 pagesLT Power Cables - Aluminium Conductor: Havells BrandVimal SinghNo ratings yet

- Catalogue ProfilDocument104 pagesCatalogue ProfilTuyết MinhNo ratings yet

- BA Excel Practice Note 3Document7 pagesBA Excel Practice Note 3biswajitsau891No ratings yet

- Group 1 - Hannson CasestudyDocument16 pagesGroup 1 - Hannson Casestudyamanraj21No ratings yet

- Revenue ProjectionDocument17 pagesRevenue ProjectionKriti AhujaNo ratings yet

- What IF 234565weqwdsxvDocument12 pagesWhat IF 234565weqwdsxvOmer CrestianiNo ratings yet

- Antropometri Projectti21fDocument27 pagesAntropometri Projectti21fFalahal MajidNo ratings yet

- Production Function Production Production FunctionDocument3 pagesProduction Function Production Production FunctionJahirul Islam Khondoker ShuvoNo ratings yet

- Bep AnalysisDocument3 pagesBep AnalysispradeepNo ratings yet

- Datasheet - 2020-12-02T111847.547Document1 pageDatasheet - 2020-12-02T111847.547Omar GuillenNo ratings yet

- SCM AbcDocument2 pagesSCM Abcjana.nel345No ratings yet

- Group 2 EconomicDocument14 pagesGroup 2 EconomicCourage ChigerweNo ratings yet

- Ws9 Soln FinalDocument14 pagesWs9 Soln FinaltwofortheNo ratings yet

- Table of Section Properties For IPE, HEA, HEB, HEM Profiles - Eurocode 3Document22 pagesTable of Section Properties For IPE, HEA, HEB, HEM Profiles - Eurocode 3Daniel OkereNo ratings yet

- 2Document4 pages2SiddharthNo ratings yet

- 2Document4 pages2SiddharthNo ratings yet

- A 2 3 4 3 B 4 7 10 7 C 5 6 9 6.33 D 6 7 16 8.33 e 7 9 10 8.83 F 4 5 6 5 G 3 6 10 6.17 H 2 4 7 4.17 I 2 2 2 2 J 3 4 14 5.5 K 2 3 4 3Document4 pagesA 2 3 4 3 B 4 7 10 7 C 5 6 9 6.33 D 6 7 16 8.33 e 7 9 10 8.83 F 4 5 6 5 G 3 6 10 6.17 H 2 4 7 4.17 I 2 2 2 2 J 3 4 14 5.5 K 2 3 4 3SiddharthNo ratings yet

- Geometry Sectional Area Bending: H (MM) B (MM) T (MM) T (MM) H (MM) R (MM) D (MM) K (MM) A (CM) I (CM) I (CM) I (CM)Document8 pagesGeometry Sectional Area Bending: H (MM) B (MM) T (MM) T (MM) H (MM) R (MM) D (MM) K (MM) A (CM) I (CM) I (CM) I (CM)erald hasanajNo ratings yet

- Project No 1 DCF 2 DCF 3 DCF 4 DCF 5 Initial Investment: Exhibit 1 Project Free Cash Flows (Dollars in Thousands)Document5 pagesProject No 1 DCF 2 DCF 3 DCF 4 DCF 5 Initial Investment: Exhibit 1 Project Free Cash Flows (Dollars in Thousands)jk kumarNo ratings yet

- Havells India Limited: LT Power Cables - Aluminium ConductorDocument5 pagesHavells India Limited: LT Power Cables - Aluminium Conductornaresh singlaNo ratings yet

- Torrex Cable Price List July 2022Document2 pagesTorrex Cable Price List July 2022getztarunNo ratings yet

- Havells Cables Pricelist 01.05.2018 PDFDocument5 pagesHavells Cables Pricelist 01.05.2018 PDFjuga2013No ratings yet

- CBR TestDocument3 pagesCBR TestAshutosh SharmaNo ratings yet

- SI Summary Revenue April 2020 Date Voice Billable SMS Billable GPRS Billable SubscriptionsDocument95 pagesSI Summary Revenue April 2020 Date Voice Billable SMS Billable GPRS Billable SubscriptionsFred SiriuraoNo ratings yet

- 627 Mekflu ComparativeDocument8 pages627 Mekflu ComparativeAisya DewiNo ratings yet

- Quiz 2 TableDocument5 pagesQuiz 2 TableSathish BNo ratings yet

- Polycab Wires Latest Price ListDocument1 pagePolycab Wires Latest Price Listandcha.exe100% (1)

- Unit Weight (KG) : Standard 1/2" Coil Weight Fan Weight List Motor and Gearing WeightDocument1 pageUnit Weight (KG) : Standard 1/2" Coil Weight Fan Weight List Motor and Gearing WeightJosephRusselVizmanosNo ratings yet

- Unit Weight (KG) : Standard 1/2" Coil Weight Fan Weight List Motor and Gearing WeightDocument1 pageUnit Weight (KG) : Standard 1/2" Coil Weight Fan Weight List Motor and Gearing WeightJosephRusselVizmanosNo ratings yet

- Perfiles IPE EntregableDocument19 pagesPerfiles IPE EntregableJazmín NopeNo ratings yet

- Approximate Weights (LBS.) For 90° and 45° Elbows and 180° Long Radius ReturnsDocument28 pagesApproximate Weights (LBS.) For 90° and 45° Elbows and 180° Long Radius ReturnsGabriel Alvarez RojasNo ratings yet

- Final Year Design Lectures - Feb/Mar 2019: List of AttachmentsDocument12 pagesFinal Year Design Lectures - Feb/Mar 2019: List of AttachmentsMuzammil IqbalNo ratings yet

- British Steel European Sections Product RangeDocument9 pagesBritish Steel European Sections Product Rangemdakhan679No ratings yet

- Suporte Tanques HecpollDocument1 pageSuporte Tanques HecpollFrederico Vicente MativaneNo ratings yet

- The Supreme Industries LTD.: Size Plain PipesDocument1 pageThe Supreme Industries LTD.: Size Plain PipesPrasanth Pawar NNo ratings yet

- LP Gloster Pricelist Aug14 PDFDocument5 pagesLP Gloster Pricelist Aug14 PDFvjtheeeNo ratings yet

- Bacia de CamposDocument7 pagesBacia de CampospoisonboxNo ratings yet

- Polycab Low Tension PVC Cable Pricelist 2017 NovDocument2 pagesPolycab Low Tension PVC Cable Pricelist 2017 NovAEE MHCH Sub Div 1stNo ratings yet

- Polycab HT LT Armoured CablesDocument7 pagesPolycab HT LT Armoured Cablesst_calvoNo ratings yet

- Order Size Number of Order Number of Drum Cumulatif Number Cumulatif Demand 1 2 3 4 5 6 8 9 10 12 15 16 20 24 36 48Document3 pagesOrder Size Number of Order Number of Drum Cumulatif Number Cumulatif Demand 1 2 3 4 5 6 8 9 10 12 15 16 20 24 36 48Maria Kartini Rise SitungkirNo ratings yet

- Du Pont FlexDocument12 pagesDu Pont Flexhayagreevan vNo ratings yet

- 2250 Heavy Lift Wire Rope Specifications 8025 ADocument3 pages2250 Heavy Lift Wire Rope Specifications 8025 AAmpera marzelaNo ratings yet

- TravianDocument102 pagesTravianJacky QwertyNo ratings yet

- Data OperationsDocument80 pagesData OperationsKosana MiniswarNo ratings yet

- Excel Exercise 3.3Document2 pagesExcel Exercise 3.3andreNo ratings yet

- Multi-Party and Multi-Contract Arbitration in the Construction IndustryFrom EverandMulti-Party and Multi-Contract Arbitration in the Construction IndustryNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- 2071-File Utama Naskah-8155-1-10-20211212Document14 pages2071-File Utama Naskah-8155-1-10-20211212Achmad ArdanuNo ratings yet

- Using Two Measures of RiskDocument2 pagesUsing Two Measures of RiskAchmad ArdanuNo ratings yet

- Return and Risk From All Investment DecisionsDocument4 pagesReturn and Risk From All Investment DecisionsAchmad ArdanuNo ratings yet

- Categorizing Financial AssetsDocument3 pagesCategorizing Financial AssetsAchmad ArdanuNo ratings yet

- PR 2-2 A Group 1Document8 pagesPR 2-2 A Group 1Achmad ArdanuNo ratings yet

- Hipotesis Perataan LabaDocument7 pagesHipotesis Perataan LabaAchmad ArdanuNo ratings yet

- Name:Achmad Ardanu NIM:20080694029 Kelas:2020IDocument6 pagesName:Achmad Ardanu NIM:20080694029 Kelas:2020IAchmad ArdanuNo ratings yet

- PR 6-1A Group 1Document3 pagesPR 6-1A Group 1Achmad ArdanuNo ratings yet

- Group 1 - PR 7-2B - PR 7-3B - Meet 12Document14 pagesGroup 1 - PR 7-2B - PR 7-3B - Meet 12Achmad ArdanuNo ratings yet

- Achmad Ardanu - Petty Cash-ReconciliationDocument8 pagesAchmad Ardanu - Petty Cash-ReconciliationAchmad ArdanuNo ratings yet

- Achmad Ardanu 20080694029 Chapter5Document13 pagesAchmad Ardanu 20080694029 Chapter5Achmad ArdanuNo ratings yet

- IFRS Rules On Inventory Counting Process & Depreciation CalculationDocument32 pagesIFRS Rules On Inventory Counting Process & Depreciation Calculationarifinsabid59No ratings yet

- Accounting For InventoryDocument10 pagesAccounting For InventoryHafidzi DerahmanNo ratings yet

- Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 6 PDFDocument68 pagesTest Bank Cost Accounting 6e by Raiborn and Kinney Chapter 6 PDFNerissa Bangui0% (1)

- Quiz PASDocument3 pagesQuiz PASZoey Alvin EstarejaNo ratings yet

- Chapter 6 Lecture H-9Document8 pagesChapter 6 Lecture H-9ryanhuNo ratings yet

- Nios Accountancy Full BookDocument300 pagesNios Accountancy Full BookVivek Ratan100% (1)

- UKAM1033 Course PlanDocument10 pagesUKAM1033 Course PlanRhinndhi SakthyvelNo ratings yet

- P WC Inventory 1221Document49 pagesP WC Inventory 1221Roj TodiSoaNo ratings yet

- Ch28 Tool KitADocument7 pagesCh28 Tool KitARoy HemenwayNo ratings yet

- Taxation of Individuals and Business Entities 2017 8th Edition Spilker Solutions ManualDocument10 pagesTaxation of Individuals and Business Entities 2017 8th Edition Spilker Solutions Manualloanmaiyu28p7100% (26)

- Comparing Compact Storage SystemsDocument3 pagesComparing Compact Storage SystemsFelipe Sánchez PlazaNo ratings yet

- Pas 2Document4 pagesPas 2Cristine Jane Granaderos OppusNo ratings yet

- Journal of Business and Management Studies (JBMS) : STI COLLEGE - Lucena City, Quezon, PhilippinesDocument10 pagesJournal of Business and Management Studies (JBMS) : STI COLLEGE - Lucena City, Quezon, PhilippinesKira AckermanNo ratings yet

- Ruth Assignment On Financial and Managerial Accounting (Hallmark College)Document7 pagesRuth Assignment On Financial and Managerial Accounting (Hallmark College)kal4evr19No ratings yet

- Cost and Management AccountingDocument84 pagesCost and Management AccountingMuskan NarulaNo ratings yet

- Lkas 2 InventoriesDocument12 pagesLkas 2 InventoriesW V C JAYAMININo ratings yet

- CH 08Document52 pagesCH 08kareem_batista20860% (5)

- CFA QuestionsDocument42 pagesCFA Questionspuntanalyst100% (2)

- Financial Statement Analysis Professor Julian Yeo: 1 You May Only Share These Materials With Current Term StudentsDocument32 pagesFinancial Statement Analysis Professor Julian Yeo: 1 You May Only Share These Materials With Current Term StudentsHE HUNo ratings yet

- MGT401 Solved Online Quizzes - WWW - Vuattach.ningDocument6 pagesMGT401 Solved Online Quizzes - WWW - Vuattach.ningAwais ChoudaryNo ratings yet

- CH 08Document22 pagesCH 08Abdalelah FrarjehNo ratings yet

- Comprehensive Problem 1Document5 pagesComprehensive Problem 1Coke Aidenry SaludoNo ratings yet

- Chapter 11 - Monthly Physical Inventory and Monthly Food Cost CalculationsDocument28 pagesChapter 11 - Monthly Physical Inventory and Monthly Food Cost CalculationsJc 210% (1)

- 681 Questions + Answers: Cfa ExamDocument256 pages681 Questions + Answers: Cfa ExamAbdullah MantawyNo ratings yet

- ABC and FifoDocument4 pagesABC and FifosninaricaNo ratings yet

A. Fifo Gross Profit Ending Inventory

A. Fifo Gross Profit Ending Inventory

Uploaded by

Achmad Ardanu0 ratings0% found this document useful (0 votes)

16 views5 pagesThe document compares three inventory costing methods - FIFO, LIFO, and weighted average - by showing the calculation of gross profit and ending inventory for each method. [LIFO results in the lowest ending inventory balance and gross profit compared to FIFO and weighted average]. Under LIFO, the company would report a lower net income and pay less in taxes for the current year.

Original Description:

Original Title

Tugas akpeng

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document compares three inventory costing methods - FIFO, LIFO, and weighted average - by showing the calculation of gross profit and ending inventory for each method. [LIFO results in the lowest ending inventory balance and gross profit compared to FIFO and weighted average]. Under LIFO, the company would report a lower net income and pay less in taxes for the current year.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

16 views5 pagesA. Fifo Gross Profit Ending Inventory

A. Fifo Gross Profit Ending Inventory

Uploaded by

Achmad ArdanuThe document compares three inventory costing methods - FIFO, LIFO, and weighted average - by showing the calculation of gross profit and ending inventory for each method. [LIFO results in the lowest ending inventory balance and gross profit compared to FIFO and weighted average]. Under LIFO, the company would report a lower net income and pay less in taxes for the current year.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 5

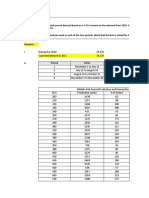

a.

FIFO

Gross Profit Ending Inventory

$75 - $40 = $35 $42 + $44 = $ 86

b.LIFO

Gross Profit Ending Inventory

$75 - $44 = $31 $40 + $42 = $ 82

c.Weighted Average Cost

Gross Profit Ending Inventory

$75 - $42 = $33 $42 + $42 = $ 84

a. FIFO

Inventory Cost

Quantity Unit Cost Total Cost

23 162 3.726

Total $3,726

b. LIFO

Inventory Cost

Quantity Unit Cost Total Cost

23 135 3.105

Total $3,105

c. Weighted Average Cost

Inventory Cost

Quantity Unit Cost Total Cost

23 150 3450

Total $3,450

Average Cost = $13.500 : 90 Unit = $150

1. FIFO

Model Quantity Unit Cost Total Cost

A10 4 76 304

2 70 140

B15 6 184 1104

2 170 340

E60 5 70 350

G83 9 259 2331

J34 15 270 4050

M90 3 130 390

2 128 256

Q70 7 180 1260

1 175 175

Total $10700

2. LIFO

Model Quantity Unit Cost Total Cost

A10 4 64 256

2 70 140

B15 8 176 1408

E60 3 75 225

2 65 130

G83 7 242 1694

2 250 500

J34 12 240 2880

3 246 738

M90 2 108 216

2 110 220

1 128 128

Q70 5 160 800

3 170 510

Total $9845

3. Weighted Average Cost

Model Quantity Unit Cost Total Cost

A10 6 70 420

B15 8 174 1392

E60 5 69 345

G83 9 253 2277

J34 15 258 3870

M90 5 121 605

Q70 8 172 1376

Total $10285

4.

During periods of rising prices, the LIFO method will result in a lower cost of inventory, a greater amount of cost of

merchandise sold, and a lesser amount of net income than the other two methods. For Dymac Appliances, the LIFO

method would be preferred for the current year, since it would result in a lesser amount of income tax.

You might also like

- Athletic KnitDocument31 pagesAthletic KnitNish A0% (1)

- Sr. No Name Roll No Programme: Case Analysis Section 2 Toffee Inc. Course: Operations Management (Tod 221)Document6 pagesSr. No Name Roll No Programme: Case Analysis Section 2 Toffee Inc. Course: Operations Management (Tod 221)Harshvardhan Jadwani0% (1)

- Lupin's Foray Into Japan - SolutionDocument14 pagesLupin's Foray Into Japan - Solutionvardhan100% (1)

- Volume 2 India Ver 141005 PDFDocument222 pagesVolume 2 India Ver 141005 PDFLittin Thankachan82% (17)

- Treasure Trophy CompanyDocument12 pagesTreasure Trophy CompanyArslan ShaikhNo ratings yet

- Boston Beer ExcelDocument6 pagesBoston Beer ExcelNarinderNo ratings yet

- 2009 CFA Level 1 Mock Exam MorningDocument38 pages2009 CFA Level 1 Mock Exam MorningForrest100% (1)

- Inventory ValuationDocument4 pagesInventory ValuationFyaj RohanNo ratings yet

- Exercises For Final PDFDocument11 pagesExercises For Final PDFThanh HằngNo ratings yet

- A2 Recognition, Measurement, Valuation, and Disclosure PDFDocument7 pagesA2 Recognition, Measurement, Valuation, and Disclosure PDFbernard cruzNo ratings yet

- PV & Thermal Payback Calculator Jan 12 v1Document2 pagesPV & Thermal Payback Calculator Jan 12 v1andriaorgNo ratings yet

- PDC Pricelist 15-03-2022Document12 pagesPDC Pricelist 15-03-2022anirban 007No ratings yet

- Data Produksi Minyak Mentah 3 4 5Document10 pagesData Produksi Minyak Mentah 3 4 5Irsalina NHNo ratings yet

- Polycab22 3Document2 pagesPolycab22 3Velu SNo ratings yet

- Case 1: Less: Reinvestment at 20%Document4 pagesCase 1: Less: Reinvestment at 20%Vinay JajuNo ratings yet

- 0497427936124Document18 pages0497427936124Saleh AlgdaryNo ratings yet

- ExcelDocument2 pagesExceloaziz66No ratings yet

- LT Power Cables - Aluminium Conductor: Havells BrandDocument20 pagesLT Power Cables - Aluminium Conductor: Havells BrandVimal SinghNo ratings yet

- Catalogue ProfilDocument104 pagesCatalogue ProfilTuyết MinhNo ratings yet

- BA Excel Practice Note 3Document7 pagesBA Excel Practice Note 3biswajitsau891No ratings yet

- Group 1 - Hannson CasestudyDocument16 pagesGroup 1 - Hannson Casestudyamanraj21No ratings yet

- Revenue ProjectionDocument17 pagesRevenue ProjectionKriti AhujaNo ratings yet

- What IF 234565weqwdsxvDocument12 pagesWhat IF 234565weqwdsxvOmer CrestianiNo ratings yet

- Antropometri Projectti21fDocument27 pagesAntropometri Projectti21fFalahal MajidNo ratings yet

- Production Function Production Production FunctionDocument3 pagesProduction Function Production Production FunctionJahirul Islam Khondoker ShuvoNo ratings yet

- Bep AnalysisDocument3 pagesBep AnalysispradeepNo ratings yet

- Datasheet - 2020-12-02T111847.547Document1 pageDatasheet - 2020-12-02T111847.547Omar GuillenNo ratings yet

- SCM AbcDocument2 pagesSCM Abcjana.nel345No ratings yet

- Group 2 EconomicDocument14 pagesGroup 2 EconomicCourage ChigerweNo ratings yet

- Ws9 Soln FinalDocument14 pagesWs9 Soln FinaltwofortheNo ratings yet

- Table of Section Properties For IPE, HEA, HEB, HEM Profiles - Eurocode 3Document22 pagesTable of Section Properties For IPE, HEA, HEB, HEM Profiles - Eurocode 3Daniel OkereNo ratings yet

- 2Document4 pages2SiddharthNo ratings yet

- 2Document4 pages2SiddharthNo ratings yet

- A 2 3 4 3 B 4 7 10 7 C 5 6 9 6.33 D 6 7 16 8.33 e 7 9 10 8.83 F 4 5 6 5 G 3 6 10 6.17 H 2 4 7 4.17 I 2 2 2 2 J 3 4 14 5.5 K 2 3 4 3Document4 pagesA 2 3 4 3 B 4 7 10 7 C 5 6 9 6.33 D 6 7 16 8.33 e 7 9 10 8.83 F 4 5 6 5 G 3 6 10 6.17 H 2 4 7 4.17 I 2 2 2 2 J 3 4 14 5.5 K 2 3 4 3SiddharthNo ratings yet

- Geometry Sectional Area Bending: H (MM) B (MM) T (MM) T (MM) H (MM) R (MM) D (MM) K (MM) A (CM) I (CM) I (CM) I (CM)Document8 pagesGeometry Sectional Area Bending: H (MM) B (MM) T (MM) T (MM) H (MM) R (MM) D (MM) K (MM) A (CM) I (CM) I (CM) I (CM)erald hasanajNo ratings yet

- Project No 1 DCF 2 DCF 3 DCF 4 DCF 5 Initial Investment: Exhibit 1 Project Free Cash Flows (Dollars in Thousands)Document5 pagesProject No 1 DCF 2 DCF 3 DCF 4 DCF 5 Initial Investment: Exhibit 1 Project Free Cash Flows (Dollars in Thousands)jk kumarNo ratings yet

- Havells India Limited: LT Power Cables - Aluminium ConductorDocument5 pagesHavells India Limited: LT Power Cables - Aluminium Conductornaresh singlaNo ratings yet

- Torrex Cable Price List July 2022Document2 pagesTorrex Cable Price List July 2022getztarunNo ratings yet

- Havells Cables Pricelist 01.05.2018 PDFDocument5 pagesHavells Cables Pricelist 01.05.2018 PDFjuga2013No ratings yet

- CBR TestDocument3 pagesCBR TestAshutosh SharmaNo ratings yet

- SI Summary Revenue April 2020 Date Voice Billable SMS Billable GPRS Billable SubscriptionsDocument95 pagesSI Summary Revenue April 2020 Date Voice Billable SMS Billable GPRS Billable SubscriptionsFred SiriuraoNo ratings yet

- 627 Mekflu ComparativeDocument8 pages627 Mekflu ComparativeAisya DewiNo ratings yet

- Quiz 2 TableDocument5 pagesQuiz 2 TableSathish BNo ratings yet

- Polycab Wires Latest Price ListDocument1 pagePolycab Wires Latest Price Listandcha.exe100% (1)

- Unit Weight (KG) : Standard 1/2" Coil Weight Fan Weight List Motor and Gearing WeightDocument1 pageUnit Weight (KG) : Standard 1/2" Coil Weight Fan Weight List Motor and Gearing WeightJosephRusselVizmanosNo ratings yet

- Unit Weight (KG) : Standard 1/2" Coil Weight Fan Weight List Motor and Gearing WeightDocument1 pageUnit Weight (KG) : Standard 1/2" Coil Weight Fan Weight List Motor and Gearing WeightJosephRusselVizmanosNo ratings yet

- Perfiles IPE EntregableDocument19 pagesPerfiles IPE EntregableJazmín NopeNo ratings yet

- Approximate Weights (LBS.) For 90° and 45° Elbows and 180° Long Radius ReturnsDocument28 pagesApproximate Weights (LBS.) For 90° and 45° Elbows and 180° Long Radius ReturnsGabriel Alvarez RojasNo ratings yet

- Final Year Design Lectures - Feb/Mar 2019: List of AttachmentsDocument12 pagesFinal Year Design Lectures - Feb/Mar 2019: List of AttachmentsMuzammil IqbalNo ratings yet

- British Steel European Sections Product RangeDocument9 pagesBritish Steel European Sections Product Rangemdakhan679No ratings yet

- Suporte Tanques HecpollDocument1 pageSuporte Tanques HecpollFrederico Vicente MativaneNo ratings yet

- The Supreme Industries LTD.: Size Plain PipesDocument1 pageThe Supreme Industries LTD.: Size Plain PipesPrasanth Pawar NNo ratings yet

- LP Gloster Pricelist Aug14 PDFDocument5 pagesLP Gloster Pricelist Aug14 PDFvjtheeeNo ratings yet

- Bacia de CamposDocument7 pagesBacia de CampospoisonboxNo ratings yet

- Polycab Low Tension PVC Cable Pricelist 2017 NovDocument2 pagesPolycab Low Tension PVC Cable Pricelist 2017 NovAEE MHCH Sub Div 1stNo ratings yet

- Polycab HT LT Armoured CablesDocument7 pagesPolycab HT LT Armoured Cablesst_calvoNo ratings yet

- Order Size Number of Order Number of Drum Cumulatif Number Cumulatif Demand 1 2 3 4 5 6 8 9 10 12 15 16 20 24 36 48Document3 pagesOrder Size Number of Order Number of Drum Cumulatif Number Cumulatif Demand 1 2 3 4 5 6 8 9 10 12 15 16 20 24 36 48Maria Kartini Rise SitungkirNo ratings yet

- Du Pont FlexDocument12 pagesDu Pont Flexhayagreevan vNo ratings yet

- 2250 Heavy Lift Wire Rope Specifications 8025 ADocument3 pages2250 Heavy Lift Wire Rope Specifications 8025 AAmpera marzelaNo ratings yet

- TravianDocument102 pagesTravianJacky QwertyNo ratings yet

- Data OperationsDocument80 pagesData OperationsKosana MiniswarNo ratings yet

- Excel Exercise 3.3Document2 pagesExcel Exercise 3.3andreNo ratings yet

- Multi-Party and Multi-Contract Arbitration in the Construction IndustryFrom EverandMulti-Party and Multi-Contract Arbitration in the Construction IndustryNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- 2071-File Utama Naskah-8155-1-10-20211212Document14 pages2071-File Utama Naskah-8155-1-10-20211212Achmad ArdanuNo ratings yet

- Using Two Measures of RiskDocument2 pagesUsing Two Measures of RiskAchmad ArdanuNo ratings yet

- Return and Risk From All Investment DecisionsDocument4 pagesReturn and Risk From All Investment DecisionsAchmad ArdanuNo ratings yet

- Categorizing Financial AssetsDocument3 pagesCategorizing Financial AssetsAchmad ArdanuNo ratings yet

- PR 2-2 A Group 1Document8 pagesPR 2-2 A Group 1Achmad ArdanuNo ratings yet

- Hipotesis Perataan LabaDocument7 pagesHipotesis Perataan LabaAchmad ArdanuNo ratings yet

- Name:Achmad Ardanu NIM:20080694029 Kelas:2020IDocument6 pagesName:Achmad Ardanu NIM:20080694029 Kelas:2020IAchmad ArdanuNo ratings yet

- PR 6-1A Group 1Document3 pagesPR 6-1A Group 1Achmad ArdanuNo ratings yet

- Group 1 - PR 7-2B - PR 7-3B - Meet 12Document14 pagesGroup 1 - PR 7-2B - PR 7-3B - Meet 12Achmad ArdanuNo ratings yet

- Achmad Ardanu - Petty Cash-ReconciliationDocument8 pagesAchmad Ardanu - Petty Cash-ReconciliationAchmad ArdanuNo ratings yet

- Achmad Ardanu 20080694029 Chapter5Document13 pagesAchmad Ardanu 20080694029 Chapter5Achmad ArdanuNo ratings yet

- IFRS Rules On Inventory Counting Process & Depreciation CalculationDocument32 pagesIFRS Rules On Inventory Counting Process & Depreciation Calculationarifinsabid59No ratings yet

- Accounting For InventoryDocument10 pagesAccounting For InventoryHafidzi DerahmanNo ratings yet

- Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 6 PDFDocument68 pagesTest Bank Cost Accounting 6e by Raiborn and Kinney Chapter 6 PDFNerissa Bangui0% (1)

- Quiz PASDocument3 pagesQuiz PASZoey Alvin EstarejaNo ratings yet

- Chapter 6 Lecture H-9Document8 pagesChapter 6 Lecture H-9ryanhuNo ratings yet

- Nios Accountancy Full BookDocument300 pagesNios Accountancy Full BookVivek Ratan100% (1)

- UKAM1033 Course PlanDocument10 pagesUKAM1033 Course PlanRhinndhi SakthyvelNo ratings yet

- P WC Inventory 1221Document49 pagesP WC Inventory 1221Roj TodiSoaNo ratings yet

- Ch28 Tool KitADocument7 pagesCh28 Tool KitARoy HemenwayNo ratings yet

- Taxation of Individuals and Business Entities 2017 8th Edition Spilker Solutions ManualDocument10 pagesTaxation of Individuals and Business Entities 2017 8th Edition Spilker Solutions Manualloanmaiyu28p7100% (26)

- Comparing Compact Storage SystemsDocument3 pagesComparing Compact Storage SystemsFelipe Sánchez PlazaNo ratings yet

- Pas 2Document4 pagesPas 2Cristine Jane Granaderos OppusNo ratings yet

- Journal of Business and Management Studies (JBMS) : STI COLLEGE - Lucena City, Quezon, PhilippinesDocument10 pagesJournal of Business and Management Studies (JBMS) : STI COLLEGE - Lucena City, Quezon, PhilippinesKira AckermanNo ratings yet

- Ruth Assignment On Financial and Managerial Accounting (Hallmark College)Document7 pagesRuth Assignment On Financial and Managerial Accounting (Hallmark College)kal4evr19No ratings yet

- Cost and Management AccountingDocument84 pagesCost and Management AccountingMuskan NarulaNo ratings yet

- Lkas 2 InventoriesDocument12 pagesLkas 2 InventoriesW V C JAYAMININo ratings yet

- CH 08Document52 pagesCH 08kareem_batista20860% (5)

- CFA QuestionsDocument42 pagesCFA Questionspuntanalyst100% (2)

- Financial Statement Analysis Professor Julian Yeo: 1 You May Only Share These Materials With Current Term StudentsDocument32 pagesFinancial Statement Analysis Professor Julian Yeo: 1 You May Only Share These Materials With Current Term StudentsHE HUNo ratings yet

- MGT401 Solved Online Quizzes - WWW - Vuattach.ningDocument6 pagesMGT401 Solved Online Quizzes - WWW - Vuattach.ningAwais ChoudaryNo ratings yet

- CH 08Document22 pagesCH 08Abdalelah FrarjehNo ratings yet

- Comprehensive Problem 1Document5 pagesComprehensive Problem 1Coke Aidenry SaludoNo ratings yet

- Chapter 11 - Monthly Physical Inventory and Monthly Food Cost CalculationsDocument28 pagesChapter 11 - Monthly Physical Inventory and Monthly Food Cost CalculationsJc 210% (1)

- 681 Questions + Answers: Cfa ExamDocument256 pages681 Questions + Answers: Cfa ExamAbdullah MantawyNo ratings yet

- ABC and FifoDocument4 pagesABC and FifosninaricaNo ratings yet