Professional Documents

Culture Documents

Advanced Accounting - Dayag 2015 - Chapter 11 - MC (B)

Advanced Accounting - Dayag 2015 - Chapter 11 - MC (B)

Uploaded by

John Carlos Doringo0 ratings0% found this document useful (0 votes)

36 views1 pageThis document contains multiple choice questions and answers from Chapter 11 of an accounting textbook. It also includes an example of calculating the net income for a company, L Inc., from its investment in a joint operation based on the revenue, expenses, and unrealized gains allocated to L Inc.'s ownership percentage. Finally, it presents a manufacturing company's balance sheet as of December 31, 20X4 showing assets, liabilities, and equity.

Original Description:

Advanced Accounting - Dayag 2015 - Chapter 11 - MC (B)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains multiple choice questions and answers from Chapter 11 of an accounting textbook. It also includes an example of calculating the net income for a company, L Inc., from its investment in a joint operation based on the revenue, expenses, and unrealized gains allocated to L Inc.'s ownership percentage. Finally, it presents a manufacturing company's balance sheet as of December 31, 20X4 showing assets, liabilities, and equity.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

36 views1 pageAdvanced Accounting - Dayag 2015 - Chapter 11 - MC (B)

Advanced Accounting - Dayag 2015 - Chapter 11 - MC (B)

Uploaded by

John Carlos DoringoThis document contains multiple choice questions and answers from Chapter 11 of an accounting textbook. It also includes an example of calculating the net income for a company, L Inc., from its investment in a joint operation based on the revenue, expenses, and unrealized gains allocated to L Inc.'s ownership percentage. Finally, it presents a manufacturing company's balance sheet as of December 31, 20X4 showing assets, liabilities, and equity.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Chapter 11

Multiple Choice Problems

7. c

• The unrealized gain is a contra account to the pipeline account; it should not be reported as a deferred gain on the liability

side of the balance sheet. When L Inc., prepares a balance sheet, the unrealized gain will be offset against the pipeline such

that the pipeline’s net cost is P19,404,000 (P21,000,000 – {P1,680,000 – P84,000})). As the net cost of the pipeline is being

amortized, the unrealized gain account is also being amortized. In effect, the unrealized gain is being brought into income

over the life of the pipeline. As the pipeline is being used to generate revenue on transactions with outsiders, the operator’s

own share of the unrealized gain is being recognized in net income. This is similar to what happened in Chapter 18

(Intercompany Sales of Property and Equipment) of Volume II, when the unrealized profits from an intercompany sale of a

depreciable asset were realized over the life of the depreciable asset.

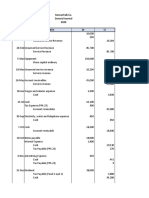

Incidentally, the share of L Inc. in net income of the joint operation would be as follows:

Revenue (30% x P23,100,000). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . P 6,930,000

Less: Operating expenses (30% x P14,000,000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,200,000

Amortization expense: P70,000,000 x 30% = P21,000,000 / 20 years. . . . . . . . . . . 1,050,000

Add: Gain on steel pipes [70%* x (P21,000,000 – P15,400,000)] . . . . . . . . . . . . . . . . . 3,920,000

Realized gain – amortization**(P1,680,000/20 years). . . . . . . . . . . . . . . . . . . . . . . _____84,000

Net Income of L. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . P 5,684,000

* PFRS 11 states that: “When an entity enters into a transaction with a joint operation in which it is a joint operator, such as a sale or contribution of assets, it

is conducting the transaction with the other parties to the joint operation and, as such, the joint operator shall recognize gains and losses resulting from such

a transaction only to the *extent of the other parties’ interests in the joint operation.”

** Sales price of P21,000,000 – P15,400,000, cost of steel pipes = P5,600,000 x 30% = P1,680,000

8. b

9. b

Cash

Work-in-Process

Contribution – XX 252,000 84,000 Machinery and equipment

Labor 120,960 302,400 to Finished Goods

Contribution – YY 252,000 117,600 Labor

Materials 80,640

Bank loan 84,000 16,800 Machinery and equipment

Factory Overhead – heat, etc. 218,400

70,560 Accounts payable

Factory Overhead– depreciation 13,440

218,400 Factory overhead control

Balance, 12/31/x4 131,040

Balance, 12/31/x4 80,640

10. c

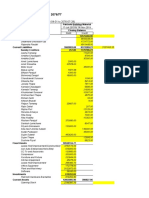

December 31, 20x4

Assets

Current Assets

Cash P 80,640

Finished goods inventory 33,600

Work-in-Process inventory 131,040

Materials inventory 28,560

Total current assets P 273,840

Non-current Assets

Equipment P 134,400

Less: Accumulated depreciation 13,440 120,960

Total Assets P394,800

Liabilities and Net Assets

Current Liabilities

Accrued payroll P 3,360

Accounts payable 38,640 P 42,000

Non-current Liabilities

Bank loan payable P 84,000

Loan payable – machinery and equipment 33,600 __117,600

Total Liabilities P 159,600

Net Assets _235,200

Total Liabilities and Net Assets P 394,800

You might also like

- Slidebean Financial Model Template - Free v2.1 (Copy - Download To Edit)Document268 pagesSlidebean Financial Model Template - Free v2.1 (Copy - Download To Edit)Suvas Jesrani50% (2)

- Reviewer Midterm Accounting Exercises in Financial and Accouting ReportingDocument20 pagesReviewer Midterm Accounting Exercises in Financial and Accouting ReportingFiel Marie SateraNo ratings yet

- AIS Chapter 1 Question and Answer (Set B)Document2 pagesAIS Chapter 1 Question and Answer (Set B)John Carlos Doringo100% (2)

- Solution AP Test Bank 2Document9 pagesSolution AP Test Bank 2imaNo ratings yet

- (Set D) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set D) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- Problems Chapter 7-1: RequiredDocument16 pagesProblems Chapter 7-1: RequiredTanyelle Louv0% (1)

- 105 PrelimDocument10 pages105 PrelimEly DoNo ratings yet

- Pengantar Akuntansi WarrenDocument88 pagesPengantar Akuntansi WarrenCellisaNo ratings yet

- Chapter 3 ExaminationDocument4 pagesChapter 3 ExaminationSurameto HariyadiNo ratings yet

- Chapter 4 - Fundamentals of Corporate Finance 9th Edition - Test BankDocument26 pagesChapter 4 - Fundamentals of Corporate Finance 9th Edition - Test BankKellyGibbons100% (2)

- Ch22 Accounting Changes and Error AnalysisDocument31 pagesCh22 Accounting Changes and Error AnalysisknapenaveNo ratings yet

- Multiple Choice Problems 9Document15 pagesMultiple Choice Problems 9Dieter LudwigNo ratings yet

- Part 2 Joint Arrangements Class Consultation PDFDocument6 pagesPart 2 Joint Arrangements Class Consultation PDFidk520055No ratings yet

- Budgeted Income Statement and Balance SheetDocument5 pagesBudgeted Income Statement and Balance SheetNeil De LeonNo ratings yet

- Microsoft Word - Unit 2 Understanding Statement of Financial PositionDocument17 pagesMicrosoft Word - Unit 2 Understanding Statement of Financial PositionKamille C. CerenoNo ratings yet

- Act 3602. Chapter 3. Prob.3-39 HomeworkDocument3 pagesAct 3602. Chapter 3. Prob.3-39 HomeworkphanupongnineNo ratings yet

- Sample Problems Part FormDocument4 pagesSample Problems Part FormkenivanabejuelaNo ratings yet

- The Master Budget HandoutsDocument4 pagesThe Master Budget Handoutscherein6soriano6paelNo ratings yet

- Additional Cash Flow ProblemsDocument3 pagesAdditional Cash Flow ProblemsChelle HullezaNo ratings yet

- Balance Sheet QUESTIONANSWERDocument19 pagesBalance Sheet QUESTIONANSWERJoyce Ann Agdippa BarcelonaNo ratings yet

- Koreantalk Co. General Journal 2020 Date Description DR CRDocument5 pagesKoreantalk Co. General Journal 2020 Date Description DR CRCarat ForeverNo ratings yet

- Fundamentals of Accountancy Business and Management PPPDocument88 pagesFundamentals of Accountancy Business and Management PPPJanelle Dela Cruz100% (1)

- Joint ArrangementsDocument3 pagesJoint ArrangementsCha EsguerraNo ratings yet

- ANSWER KEY - CHARLOTTE SERVICES - Classification of Account and Balances of The AccountsDocument11 pagesANSWER KEY - CHARLOTTE SERVICES - Classification of Account and Balances of The AccountsAnne MiguelNo ratings yet

- Answer (Question) MODULE 4 - Quiz 2Document2 pagesAnswer (Question) MODULE 4 - Quiz 2kakaoNo ratings yet

- Financial Management Master Budget ExerciseDocument10 pagesFinancial Management Master Budget ExerciseJerickho JNo ratings yet

- Joint ArrangementDocument3 pagesJoint ArrangementAlliah Mae AcostaNo ratings yet

- Bus Com 12Document3 pagesBus Com 12Chabelita MijaresNo ratings yet

- Bucom 2Document3 pagesBucom 2dmangiginNo ratings yet

- Far - BS - Is - Rak N' KollDocument4 pagesFar - BS - Is - Rak N' Kollshe kioraNo ratings yet

- Manajemen Keuangan Laporan Keuangan Dan Analisi RasioDocument8 pagesManajemen Keuangan Laporan Keuangan Dan Analisi RasioDeslia AnggraeniNo ratings yet

- Chapter 4 - Statement of Financial PositionDocument15 pagesChapter 4 - Statement of Financial PositionHan Yee YeoNo ratings yet

- Quiz 1.1Document2 pagesQuiz 1.1Annalie Cono0% (1)

- Examen ANA FIN 2019+CORDocument6 pagesExamen ANA FIN 2019+CORfadali amineNo ratings yet

- Eco Assignment by Allan SmithDocument4 pagesEco Assignment by Allan SmithUmar AshrafNo ratings yet

- 3 - Cash Flow Statement - Indirect Method - QuestionsDocument3 pages3 - Cash Flow Statement - Indirect Method - Questionsmikheal beyber100% (1)

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- Tugas CompletingDocument6 pagesTugas CompletingWidad NadiaNo ratings yet

- Manajemen Keuangan Laporan Keuangan Dan Analisi RasioDocument8 pagesManajemen Keuangan Laporan Keuangan Dan Analisi RasioDeslia AnggraeniNo ratings yet

- Tutorial 3Document14 pagesTutorial 3NURSUHAILI IZZATI ABU BAKARNo ratings yet

- This Study Resource Was: Problem 21-6A (Part Level Submission)Document3 pagesThis Study Resource Was: Problem 21-6A (Part Level Submission)Jalaj GuptaNo ratings yet

- Activity-13 GreenDocument3 pagesActivity-13 GreenLaura KissNo ratings yet

- Sessions 8 - 9 - BS - SentDocument11 pagesSessions 8 - 9 - BS - SentAjay DesaleNo ratings yet

- ITA Exam FolderDocument33 pagesITA Exam Folderahmadrana142006No ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Lesson Title: Business Combination (Part 1) : Learning Targets: MDocument4 pagesLesson Title: Business Combination (Part 1) : Learning Targets: MjhammyNo ratings yet

- Tutorial 7 QADocument4 pagesTutorial 7 QAJin HueyNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- Task 2. Ban Gay and Ban Trai's Partnership: Statements of Changes in Partners' CapitalDocument11 pagesTask 2. Ban Gay and Ban Trai's Partnership: Statements of Changes in Partners' CapitalHuyen VuNo ratings yet

- Preparation of Financial StatementsDocument10 pagesPreparation of Financial StatementspolymeianNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- Business Combination - GROUP 1Document4 pagesBusiness Combination - GROUP 1Ejoyce KimNo ratings yet

- Evening Co. Statement of Financial Position As of December 31, 20x1 AssetsDocument4 pagesEvening Co. Statement of Financial Position As of December 31, 20x1 AssetsKatherine Cachapero Cachapero100% (1)

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- Presentation of Properly Classified FSDocument9 pagesPresentation of Properly Classified FSpapa1No ratings yet

- đề thi F7Document10 pagesđề thi F7Hoàng Yến LêNo ratings yet

- Ia Assignment 3Document3 pagesIa Assignment 3Resty VillaroelNo ratings yet

- Repaso T.6 SolucionDocument5 pagesRepaso T.6 Solucionjorge grau lopezNo ratings yet

- J. Jarvis Trial Balance As at 31 December 2010Document3 pagesJ. Jarvis Trial Balance As at 31 December 2010Ahmad HaqqyNo ratings yet

- Auditing Problem Test Bank 1Document15 pagesAuditing Problem Test Bank 1Jayson CerradoNo ratings yet

- 1 Supplementary Materials Solutions Topic 1 2Document15 pages1 Supplementary Materials Solutions Topic 1 2lixinshi59No ratings yet

- Chapter 11advanced AccountingDocument12 pagesChapter 11advanced AccountingKarina Barretto AgnesNo ratings yet

- f2 Financial Accounting August 2015Document18 pagesf2 Financial Accounting August 2015Saddam HusseinNo ratings yet

- MSC F & A Test One SolutionDocument7 pagesMSC F & A Test One Solutionsebastian mlingwaNo ratings yet

- Galman v. Pamaran, 138 SCRA 294Document72 pagesGalman v. Pamaran, 138 SCRA 294John Carlos DoringoNo ratings yet

- Beltran v. Samson, 53 Phil. 570Document5 pagesBeltran v. Samson, 53 Phil. 570John Carlos DoringoNo ratings yet

- AIS Chapter 1 Question and Answer (Set E)Document3 pagesAIS Chapter 1 Question and Answer (Set E)John Carlos DoringoNo ratings yet

- AIS Chapter 1 Question and Answer (Set D)Document4 pagesAIS Chapter 1 Question and Answer (Set D)John Carlos DoringoNo ratings yet

- AIS Chapter 1 Question and Answer (Set C)Document2 pagesAIS Chapter 1 Question and Answer (Set C)John Carlos Doringo100% (1)

- AIS Multiple Choice Question and Answer (Chapter 2 - Set F)Document2 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set F)John Carlos Doringo100% (1)

- AIS Multiple Choice Question and Answer (Chapter 2 - Set D)Document2 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set D)John Carlos Doringo100% (1)

- AIS Multiple Choice Question and Answer (Chapter 2 - Set B)Document2 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set B)John Carlos Doringo67% (3)

- AIS Multiple Choice Question and Answer (Chapter 2 - Set E)Document3 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set E)John Carlos DoringoNo ratings yet

- Set D (MC), Question and Answers Chapter 20 - BudgetingDocument4 pagesSet D (MC), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNo ratings yet

- (Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- Set D (True or False), Question and Answers Chapter 20 - BudgetingDocument2 pagesSet D (True or False), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNo ratings yet

- Advanced Accounting - Dayag 2015 - Chapter 8 - Problems IXDocument2 pagesAdvanced Accounting - Dayag 2015 - Chapter 8 - Problems IXJohn Carlos DoringoNo ratings yet

- Set E (MC), Question and Answers Chapter 20 - BudgetingDocument3 pagesSet E (MC), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNo ratings yet

- Set B Multiple Choice, Chapter 24 - Capital Investment AnalysisDocument2 pagesSet B Multiple Choice, Chapter 24 - Capital Investment AnalysisJohn Carlos DoringoNo ratings yet

- (Set F) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument4 pages(Set F) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- (Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- Perpetual vs. Periodic Inventory System Journal EntriesDocument12 pagesPerpetual vs. Periodic Inventory System Journal EntriesMutia SefriliaNo ratings yet

- Financial Management Theory and Practice 15th Edition Brigham Solutions ManualDocument36 pagesFinancial Management Theory and Practice 15th Edition Brigham Solutions Manualrappelpotherueo100% (35)

- Furniture Business PlanDocument23 pagesFurniture Business Planjunaidjavaid99100% (2)

- Partner DissolutionDocument12 pagesPartner DissolutionFionna Rei DeGaliciaNo ratings yet

- Final Accounts:: Definition and ExplanationDocument22 pagesFinal Accounts:: Definition and ExplanationAmith LaddaNo ratings yet

- Annual ReportDocument8 pagesAnnual Reportauni fildzahNo ratings yet

- DepreciationDocument19 pagesDepreciationSuleiman BaruniNo ratings yet

- Palchoki Building Material 2076/77 Trial Balance: 17-Jul-2019 To 14-Nov-2019 (2076-04-01 To 2076-07-28)Document19 pagesPalchoki Building Material 2076/77 Trial Balance: 17-Jul-2019 To 14-Nov-2019 (2076-04-01 To 2076-07-28)SworajNo ratings yet

- V Imp Questions For Exams For Selected ChaptersDocument132 pagesV Imp Questions For Exams For Selected ChaptersNkume Irene100% (1)

- Beauty Parlour FinalDocument16 pagesBeauty Parlour FinalAbdul Hakim ShaikhNo ratings yet

- Format of Statement of Profit & Loss and Balance SheetDocument2 pagesFormat of Statement of Profit & Loss and Balance SheetShalak JoshiNo ratings yet

- Vijay Malik Template v2Document38 pagesVijay Malik Template v2KiranNo ratings yet

- Blue Bill Corp Module 6 Assignment-1cxlc8byxz6r5 - 1euusngisn9vlDocument4 pagesBlue Bill Corp Module 6 Assignment-1cxlc8byxz6r5 - 1euusngisn9vlKimberley WrightNo ratings yet

- Purefoods Financial Statements 2018-2021Document8 pagesPurefoods Financial Statements 2018-2021Kyle Denise Castillo VelascoNo ratings yet

- Notes - Conso FS (Subsequent To Acquisition Date)Document35 pagesNotes - Conso FS (Subsequent To Acquisition Date)Joana TrinidadNo ratings yet

- Additional Questions 3Document4 pagesAdditional Questions 3Shyam SoniNo ratings yet

- Ppe - WorksheetDocument7 pagesPpe - Worksheetbereket nigussieNo ratings yet

- Effects of Business Combinations On The Competitive EnvironmentDocument22 pagesEffects of Business Combinations On The Competitive EnvironmentSophia Marie MoratoNo ratings yet

- Assignment 2Document7 pagesAssignment 2Zack NottageNo ratings yet

- Financial Statement 2162Document126 pagesFinancial Statement 2162YOLA DWI YULANDARINo ratings yet

- Accounting Assignment BudgetDocument21 pagesAccounting Assignment BudgetLadan FotoohiNo ratings yet

- Cash Ar NRDocument76 pagesCash Ar NRPeter PiperNo ratings yet

- Practice Sets 3 & 4: Accounting For PartnershipDocument4 pagesPractice Sets 3 & 4: Accounting For PartnershipRey Joyce AbuelNo ratings yet

- The Cheat Sheet: Workpaper References Standards Tickmarks Area Description TickmarkDocument2 pagesThe Cheat Sheet: Workpaper References Standards Tickmarks Area Description TickmarkDave LaRosaNo ratings yet

- MODUL PRAKTIKUM 03 ModifikasiDocument4 pagesMODUL PRAKTIKUM 03 ModifikasiSlamet Riyadi123No ratings yet