Professional Documents

Culture Documents

Ed Ms Download

Ed Ms Download

Uploaded by

Kevin WhitteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ed Ms Download

Ed Ms Download

Uploaded by

Kevin WhitteCopyright:

Available Formats

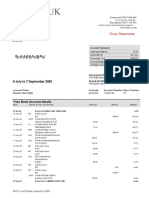

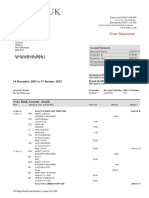

Contact tel 03457 60 60 60

see reverse for call times

Text phone 03457 125 563

used by deaf or speech impaired customers

www.hsbc.co.uk

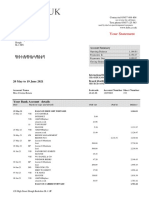

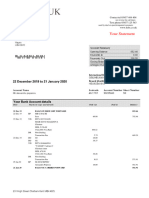

Your Statement

Mr John Martin Pim

15 Redford Meadow

Kingsbridge

Devon

TQ7 1SH Account Summary

Ope ning Balance 9.67 D

Paym e nts In 150.50

Paym e nts Out 155.50

Clos ing Balance 14.67 D

.

International Bank Account Number

GB74HBUK40261081517104

2 March to 1 April 2021 Branch Identifier Code

HBUKGB4136F

Acco unt Nam e S o rtcode Acco unt Num ber S he e t Num be r

Mr John Martin Pim Business Account 40-26-10 81517104 63

Your Business Current Account details

Date Pay m e nt t y p e and de t ails Paid o ut Paid in Balance

A

01 Mar 21 BALANCE BROUGHT FORWARD . 9.67 D

08 Mar 21 DD SSE SOUTHERN ELEC 72.00

CR REVERSAL OF 08-03

SSE SOUTHERN ELEC 72.00

DR CHARGE

RECALL S/0-D/D 2.50 12.17 D

22 Mar 21 DD SSE SOUTHERN ELEC 72.00

CR REVERSAL OF 22-03

SSE SOUTHERN ELEC 72.00

CR REFUND OF CHARGES 6.50

DR TOTAL CHARGES

TO 28FEB2021 6.50

DR CHARGE

RECALL S/0-D/D 2.50 14.67 D

01 Apr 21 BALANCE CARRIED FORWARD 14.67 D

Info rmatio n abo ut the Financial S e rvice s Co mpe ns atio n Sche m e

Your deposit is eligible for protection under the Financial Services Compensation Scheme (FSCS). For further information

about the compensation provided by the FSCS, refer to the FSCS website at www.FSCS.org.uk, call into your nearest branch

or call your telephone banking service. Further details can be found on the FSCS Information Sheet and Exclusions List

which is available on our website (www.hsbc.co.uk).

32 Fore Street Kingsbridge Devon TQ7 1PB

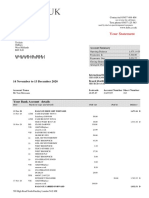

Contact tel 03457 60 60 60

see reverse for call times

Text phone 03457 125 563

used by deaf or speech impaired customers

www.hsbc.co.uk

2 March to 1 April 2021

Your Statement

Acco unt Nam e S ortco de Acco unt Num ber S he e t Num be r

Mr John Martin Pim Business Account 40-26-10 81517104 64

AER EAR

Cre dit Inte re s t Rate s balance variable De bit Inte re s t Rate s b alance variable

Cre dit inte re s t is not paid De bit inte re s t 21.34%

32 Fore Street Kingsbridge Devon TQ7 1PB

Interest Details of the current VISA Payment Scheme Exchange Rates

Credit Interest is calculated daily on the cleared credit can be obtained from the card support section of hsbc.co.uk

balance and is paid monthly if applicable (this is not paid on all (UK customers) or ciiom.hsbc.com (Channel Islands and Isle

accounts, eg, Basic Bank Account, Bank Account and HSBC of Man customers) or by calling us on the usual numbers.

Advance). For personal current accounts (excluding Premier We will deduct the payment from your account once we

and Jade by HSBC Premier) overdraft interest is only charged receive details of the payment from the card scheme, at the

on arranged overdrawn balances. Debit interest is calculated latest, the next working day.

daily on the cleared debit balance of your account, it accrues For cash machine withdrawals in a currency other than

during your charging cycle (usually monthly) and is deducted sterling we will charge a Non Sterling Cash Fee of 2%

from your account following the end of your charging cycle. (minimum £1.75, maximum £5). This fee applies to all cash

Effective from 1 August 2017 machines outside the UK, Channel islands and the Isle of Man

Monthly cap on unarranged overdraft charges and to cash machines in the UK, Channel Islands and Isle of

1. Each current account will set a monthly maximum Man if we convert the withdrawal to Sterling for you. HSBC

charge for: Advance customers are exempt from this fee.

(a) going overdrawn when you have not arranged an Some cash machine operators may apply a direct charge for

overdraft; or withdrawals from their cash machines and this will be advised

(b) going over/past your arranged overdraft limit (if you on screen at the time of withdrawal.

have one). Recurring Transaction

2. This cap covers any: A recurring transaction, sometimes called a continuous

payment authority, is a series of payments collected with

(a) interest and fees for going over/past your arranged

your agreement from your card by a retailer or supplier (for

overdraft limit;

example, insurance cover). This is an agreement between

(b) fees for each payment your bank allows despite lack you and the retailer. The Direct Debit Guarantee does not

of funds; and cover these transactions. If you wish to cancel a recurring

(c) fees for each payment your bank refuses due to lack transaction you can do this with the retailer or us. We can

of funds. cancel the payment, however contacting the retailer allows

The monthly cap on unarranged overdraft charges for you to also deal with the agreement you have with them

the Bank Account, Current Account, Home Management and you can make other arrangements for the payment or

Account, HSBC Advance Bank Account and Graduate Bank cancellation of the goods or services. If you cancel with

Account is £80. the retailer, we recommend you keep evidence of the

cancellation. Once you have cancelled with the retailer or us,

The monthly cap on unarranged overdraft charges is not

if the retailer does try to collect any future payments under

applicable to Bank Account Pay Monthly, Basic Bank

the recurring transaction agreement, we will treat these as

Account, Student Bank Account, Amanah Bank Account

unauthorised. If we miss any of the cancelled transactions,

and MyAccount as these accounts do not incur unarranged

please contact us.

overdraft charges.

The following references apply to all customers

The introduction of the Monthly Maximum Charge will not

affect any charging period that ended prior to 1st August 2017. Dispute resolution

Any notification of charges that are generated on or after If you have a problem with your agreement, please try

1st August 2017 will incorporate the new Monthly Maximum to resolve it with us in the first instance. If you are not

Charge cap. happy with the way in which we handled your complaint

or the result, you may be able to complain to the Financial

The following references regarding debit cards only

Ombudsman Service. If you do not take up your problem

apply to personal customers, commercial customers

with us first you will not be entitled to complain to the

please refer to your terms and conditions.

Ombudsman. We can provide details of how to contact the

Your debit card Ombudsman.

When you use your card abroad, your statement will show

The Financial Ombudsman Service does not apply to

where the transaction took place, the amount spent in local

customers of our branches in the Channel Islands and Isle of

currency and the amount converted into sterling. We also

Man, but you could be entitled to refer your complaint to the

monitor transactions to protect you against your card being

Channel Islands Financial Ombudsman in Jersey or Guernsey

used fraudulently.

or the Financial Services Ombudsman Scheme in the Isle of

Unless you agree that the currency conversion is done at the Man. Please contact your branch for further details.

point of sale or withdrawal and agree the rate at that time, for

Telephone Banking Service

example with the shopkeeper or on the self-service machine

Customer representatives are available from 8am – 10pm

screen, the exchange rate that applies to any non-sterling

everyday and 24 hours a day for HSBC Advance customers.

debit card payments (including cash withdrawals) is the VISA

Calls may be monitored or recorded for quality purposes.

Payment Scheme Exchange Rate applying on the day the

Alternatively for all your banking needs go to hsbc.co.uk

conversion is made.

(UK customers) or ciiom.hsbc.com (Channel Islands and

For non-Sterling (foreign currency) transactions we will charge Isle of Man customers).

a fee of 2.75% of the amount of the transaction. This fee will

Disabled Customers

be shown as a separate line on your statement as a ‘Non-

We offer a number of services such as statements in

Sterling Transaction Fee’.

Braille or large print. Please contact us to let us know

how we can serve you better.

HSBC UK Bank plc Lost and stolen cards

Registered in England and Wales with registration number 09928412

Registered office: 1 Centenary Square, Birmingham B1 1HQ, If any of your cards issued by us are lost or stolen please call

United Kingdom our 24-hour service immediately on 03456 007 010 or if you

RFB1898 MCP50300 07/18 © HSBC Group 2018 are calling from abroad, please call us on 44 1442 422 929.

You might also like

- Statement 20150506Document6 pagesStatement 20150506Anastasia Sandu100% (2)

- Bank of Ireland 1 PDFDocument2 pagesBank of Ireland 1 PDFpaulius50% (2)

- 2021 07 24 - Statement 1.pdf PDF ExpertDocument2 pages2021 07 24 - Statement 1.pdf PDF ExpertMiki CristinaNo ratings yet

- Business Bank Statement Lloyds Bank Bank - 231213 - 200928Document2 pagesBusiness Bank Statement Lloyds Bank Bank - 231213 - 200928snelu1178100% (1)

- Statement 30-DEC-22 AC 50882755 01045142 PDFDocument5 pagesStatement 30-DEC-22 AC 50882755 01045142 PDFferuzbekNo ratings yet

- Statement 27-DEC-19 AC 50127558 - 1 PDFDocument4 pagesStatement 27-DEC-19 AC 50127558 - 1 PDFEbuka Oye80% (5)

- Statement 21-NOV-22 AC 03013375 23042820Document3 pagesStatement 21-NOV-22 AC 03013375 23042820Vitor BinghamNo ratings yet

- Statement: Select AccountDocument5 pagesStatement: Select AccountPamela Dickinson0% (1)

- Business Account Statement: MR John Doe 20 Sherwood ST, London W1F 7edDocument5 pagesBusiness Account Statement: MR John Doe 20 Sherwood ST, London W1F 7edOmar BouayadNo ratings yet

- UK Natwest Statement - 2 - 3Document2 pagesUK Natwest Statement - 2 - 3shahid2opu33% (3)

- Statement 10123 16046773 18 12 2021 18 01 2022Document1 pageStatement 10123 16046773 18 12 2021 18 01 2022louisa zhangNo ratings yet

- HSBC IrelandDocument2 pagesHSBC Irelandshahid2opu100% (1)

- Your Statement: 20 May To 19 June 2021Document3 pagesYour Statement: 20 May To 19 June 2021Cristina Rotaru100% (1)

- Statement 03feb2021Document2 pagesStatement 03feb2021marin josanNo ratings yet

- Statement 2023 1Document5 pagesStatement 2023 1ArmaanNo ratings yet

- Statement: Branch Details Your Current Details Period 2020 To 202Document6 pagesStatement: Branch Details Your Current Details Period 2020 To 202xxalias100% (1)

- 2019 07 02 - Statement PDFDocument9 pages2019 07 02 - Statement PDFGabriel LitaNo ratings yet

- Statement 20150506Document6 pagesStatement 20150506saeed shamiNo ratings yet

- Statement: Select AccountDocument22 pagesStatement: Select Accountmike brienNo ratings yet

- Statement: Foundation AccountDocument12 pagesStatement: Foundation AccountJN Adingra0% (1)

- Personal Account Statement: Amir AtangDocument2 pagesPersonal Account Statement: Amir AtangAserNo ratings yet

- Statement 31-JUL-20 AC 33211541Document6 pagesStatement 31-JUL-20 AC 33211541meu pau67% (3)

- Statement: Business Current AccountDocument1 pageStatement: Business Current AccountGrace HillNo ratings yet

- 2022 06 04 - StatementDocument5 pages2022 06 04 - Statementmaria1983-2014100% (1)

- 2020 12 13 - StatementDocument7 pages2020 12 13 - StatementToni MirosanuNo ratings yet

- HSBC Advance: Your StatementDocument2 pagesHSBC Advance: Your StatementWaifubot 2.1No ratings yet

- Current Account Statement - 14012021Document3 pagesCurrent Account Statement - 14012021Vassilios VarotsisNo ratings yet

- 2020 May StatementDocument1 page2020 May StatementPOPESCU BERTHA-ANDREEANo ratings yet

- Current Account 29 August 2020 To 29 September 2020Document5 pagesCurrent Account 29 August 2020 To 29 September 2020James CocksNo ratings yet

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

- Statement: Branch Details Your Current Details Period 10 May 2019 To 10 June 2019Document2 pagesStatement: Branch Details Your Current Details Period 10 May 2019 To 10 June 2019Ali RAZANo ratings yet

- Statement: Branch Details Your Current Details PeriodDocument2 pagesStatement: Branch Details Your Current Details Periodxxalias100% (2)

- Statements PDFDocument6 pagesStatements PDFEdi ȘtefanNo ratings yet

- August 16Document2 pagesAugust 16Anonymous x2GK332No ratings yet

- Statement 31-MAR-20 AC 33211541Document7 pagesStatement 31-MAR-20 AC 33211541meu pau100% (1)

- Natwest Uk (Sample 2) - 2Document2 pagesNatwest Uk (Sample 2) - 2shahid2opuNo ratings yet

- Statement: Your Current Details Branch Details Period 28 Dec 2019 To 27 Jan 2020Document1 pageStatement: Your Current Details Branch Details Period 28 Dec 2019 To 27 Jan 2020Ali RAZANo ratings yet

- Demographic: ExampleDocument5 pagesDemographic: ExampleDevojit BoraNo ratings yet

- ACCA P5 Exam Questions AnalysisDocument7 pagesACCA P5 Exam Questions AnalysisUnikNo ratings yet

- Statment PDFDocument1 pageStatment PDFAnonymous oPpOqo100% (1)

- Statement Date 13 Feb 2018Document4 pagesStatement Date 13 Feb 2018tom arthur0% (1)

- Dec JanDocument6 pagesDec Janmadhujayan100% (1)

- Your Barclays Bank Account StatementDocument4 pagesYour Barclays Bank Account StatementAli RAZA100% (1)

- Statement 517057 86377450 17 04 2021 17 06 2021Document6 pagesStatement 517057 86377450 17 04 2021 17 06 2021Yeaze100% (1)

- DR Dewi Mutangiri: February 2003Document3 pagesDR Dewi Mutangiri: February 2003pastorlmutangiriNo ratings yet

- Clydesdale Bank Nov20 Lukasik UkDocument1 pageClydesdale Bank Nov20 Lukasik Ukjulien feuillet100% (1)

- Statement 600606 35438479 2 11 2022 1 12 2022Document1 pageStatement 600606 35438479 2 11 2022 1 12 2022Orhan DagdelenNo ratings yet

- 3rd Jan - 2nd FebDocument4 pages3rd Jan - 2nd FebPrajakta JoshiNo ratings yet

- Statement 17-NOV-21 AC 13295052 19041745Document4 pagesStatement 17-NOV-21 AC 13295052 19041745zihan linNo ratings yet

- UK Nationwide Bank StatementDocument5 pagesUK Nationwide Bank Statementayoubarade1No ratings yet

- DemoDocument3 pagesDemoEngr Muhammad Khaliq UtroriNo ratings yet

- BarclaysDocument5 pagesBarclaysmandy100% (1)

- BStatement 20101029 (1) BDocument7 pagesBStatement 20101029 (1) Banon_519122No ratings yet

- Kangqi PDFDocument4 pagesKangqi PDFle lanNo ratings yet

- Your Young Persons Account StatementDocument2 pagesYour Young Persons Account Statementabdi100% (1)

- Current Account 19 January 2021 To 18 February 2021Document4 pagesCurrent Account 19 January 2021 To 18 February 2021Ghulam GhousNo ratings yet

- March 2019Document4 pagesMarch 2019sagar manghwaniNo ratings yet

- Halifax - Print Friendly Statement PDFDocument1 pageHalifax - Print Friendly Statement PDFAnonymous Pa3LMMgNo ratings yet

- 2024 01 19 - StatementDocument2 pages2024 01 19 - StatementjanmejaychhetriNo ratings yet

- 2022 01 13 - StatementDocument8 pages2022 01 13 - StatementToni MirosanuNo ratings yet

- 2020 01 21 - StatementDocument3 pages2020 01 21 - Statementpd9d2wtnbhNo ratings yet

- 2024 01 26 - StatementDocument2 pages2024 01 26 - StatementDaia SorinNo ratings yet

- Florence TENANT LETTER - Harrigan - July 6 - 21 2012Document4 pagesFlorence TENANT LETTER - Harrigan - July 6 - 21 2012Richard HarriganNo ratings yet

- Turnaroung - HMDocument16 pagesTurnaroung - HMraviNo ratings yet

- Theories and Models in BusinessDocument4 pagesTheories and Models in BusinesspmthogoNo ratings yet

- MHE DemagDocument16 pagesMHE DemagGage Floyd BitayoNo ratings yet

- LEC 2 - INTRO - HR MGRDocument19 pagesLEC 2 - INTRO - HR MGRleo max arceoNo ratings yet

- Factorytalk View Se FaqDocument5 pagesFactorytalk View Se FaqmihacraciunNo ratings yet

- Reading Economic BubblesDocument35 pagesReading Economic BubblesDAVID WATTERSONNo ratings yet

- Payment Request FormDocument1 pagePayment Request FormYosef Yonathan TaminNo ratings yet

- New GL Migration TipsDocument3 pagesNew GL Migration Tipsgirija_krNo ratings yet

- Synopsis 1Document11 pagesSynopsis 1rani adhauNo ratings yet

- Payment Invoice: GSTN Number:06AAHCP1178L1Z4 SAC Code:998551Document2 pagesPayment Invoice: GSTN Number:06AAHCP1178L1Z4 SAC Code:998551pinakin4uNo ratings yet

- Abando Vs LozadaDocument3 pagesAbando Vs LozadaMacy YbanezNo ratings yet

- 1 - Formation of ContractDocument4 pages1 - Formation of ContractBeren RumbleNo ratings yet

- Assignment On Private Company Vs Public Company in eDocument5 pagesAssignment On Private Company Vs Public Company in eSaravanagsNo ratings yet

- The IS - LM CurveDocument28 pagesThe IS - LM CurveVikku AgarwalNo ratings yet

- Celestino Co. v. CIRDocument1 pageCelestino Co. v. CIRmmgvNo ratings yet

- ACC chapter 1Document17 pagesACC chapter 1ptbhan2504No ratings yet

- Marketing CommunicationDocument4 pagesMarketing CommunicationNicholas TeoNo ratings yet

- Nike Accuses For Child LabourDocument14 pagesNike Accuses For Child LabourDilas Zooni Meraj100% (1)

- Non Profitable Organs at IonDocument12 pagesNon Profitable Organs at IonAMIN BUHARI ABDUL KHADERNo ratings yet

- Financial Feasibility StudyDocument316 pagesFinancial Feasibility Studyronavanessa0% (1)

- Rals - CV. NURISSAH INDOMAKMUR - JKT2580948 - 5466154901Document2 pagesRals - CV. NURISSAH INDOMAKMUR - JKT2580948 - 5466154901Fitri FitrianahNo ratings yet

- RTHD L3gxiktDocument2 pagesRTHD L3gxiktRobin RahmanNo ratings yet

- The Home Insurance Company V Eastern Shipping Lanes (Statcon Digest)Document3 pagesThe Home Insurance Company V Eastern Shipping Lanes (Statcon Digest)Angelique Porta100% (1)

- Chapter 14Document49 pagesChapter 14Ram SskNo ratings yet

- The Impact of Promotional Tools On Consumer Buying Behavior: A Study From PakistanDocument13 pagesThe Impact of Promotional Tools On Consumer Buying Behavior: A Study From PakistanHà HàNo ratings yet

- Vendor EvaluationDocument30 pagesVendor EvaluationJay Ramchandani100% (3)

- Crisis ManagementDocument2 pagesCrisis ManagementMars CervantesNo ratings yet