Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

16 viewsQuestions For Review Chap 12

Questions For Review Chap 12

Uploaded by

Hailee Hayesinternational business

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

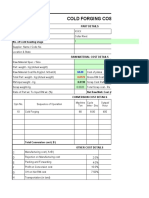

- 94.cold Forging Cost Estimation SheetDocument5 pages94.cold Forging Cost Estimation SheetVenkateswaran venkateswaranNo ratings yet

- Midterm TestDocument2 pagesMidterm TestHailee HayesNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Adoption of Big Data For Last Mile Optimization: The Case of DHLDocument2 pagesAdoption of Big Data For Last Mile Optimization: The Case of DHLHailee HayesNo ratings yet

- TAX-501 (Excise Taxes)Document6 pagesTAX-501 (Excise Taxes)Ryan AllanicNo ratings yet

- JCB Case StudyDocument9 pagesJCB Case StudyPanma PatelNo ratings yet

- Sample SpaDocument2 pagesSample SpaLays Rds50% (6)

- Brand EquityDocument6 pagesBrand EquityHailee HayesNo ratings yet

- Accounting System in SpainDocument5 pagesAccounting System in SpainHailee HayesNo ratings yet

- Questions 13. What Is The Most Important Use of The Statement of The International Investment Position of A Nation?Document2 pagesQuestions 13. What Is The Most Important Use of The Statement of The International Investment Position of A Nation?Hailee HayesNo ratings yet

- Table 2. U.S. International Trade in Goods-: ContinuesDocument5 pagesTable 2. U.S. International Trade in Goods-: ContinuesHailee HayesNo ratings yet

- Analysis of Corporate Strategy of ZaraDocument14 pagesAnalysis of Corporate Strategy of ZaraHailee HayesNo ratings yet

- Of Which: Seasonal Adjustment DiscrepancyDocument6 pagesOf Which: Seasonal Adjustment DiscrepancyHailee HayesNo ratings yet

- Homework: I. Questions For ReviewDocument16 pagesHomework: I. Questions For ReviewHailee HayesNo ratings yet

- Homework: I. Questions For ReviewDocument12 pagesHomework: I. Questions For ReviewHailee HayesNo ratings yet

- Amazon's Alexa Spaghetti StrategyDocument10 pagesAmazon's Alexa Spaghetti StrategyShubham SinghNo ratings yet

- Ratio Analysis of Coca ColaDocument16 pagesRatio Analysis of Coca ColaAlwina100% (1)

- Motor Insurance Certificate 2Document1 pageMotor Insurance Certificate 2Abel SilvaNo ratings yet

- Ebf - Part 1 + 2Document36 pagesEbf - Part 1 + 2Phạm HằngNo ratings yet

- Project On Tata MotorsDocument15 pagesProject On Tata Motorsayush kumar singh95% (37)

- Chapter 2 Part 3: Financial Planning and Forecasting Financial StatementsDocument10 pagesChapter 2 Part 3: Financial Planning and Forecasting Financial StatementsshafNo ratings yet

- Pdc8 Checklist StatusDocument1 pagePdc8 Checklist StatusNusaibah YusofNo ratings yet

- CIR v. V.Y. Domingo JewellersDocument2 pagesCIR v. V.Y. Domingo JewellersBananaNo ratings yet

- IEM Bulletin October 2016Document52 pagesIEM Bulletin October 2016Zero123No ratings yet

- DPR Selwa 02.07.2020Document22 pagesDPR Selwa 02.07.2020ravibelavadiNo ratings yet

- State Bank of India - Parivartan: Case StudyDocument4 pagesState Bank of India - Parivartan: Case StudyKunal BagdeNo ratings yet

- Study On Advertising Agency and Tourism Industry in NepalDocument5 pagesStudy On Advertising Agency and Tourism Industry in NepalSocial Science Journal for Advanced ResearchNo ratings yet

- Industrial VisitDocument8 pagesIndustrial VisitmarySibiliaNo ratings yet

- Agriculture and Forestry NotesDocument89 pagesAgriculture and Forestry NotesWaqasNo ratings yet

- Supermom Indonesia Credential DeckDocument24 pagesSupermom Indonesia Credential DeckAstri WardhaniNo ratings yet

- 10 Manila Electric V City Assessor and Treasurer of LucenaDocument2 pages10 Manila Electric V City Assessor and Treasurer of LucenapdasilvaNo ratings yet

- Bbe A1Document16 pagesBbe A1NaNóngNảyNo ratings yet

- b2b Files Apr'23-Sep'23Document136 pagesb2b Files Apr'23-Sep'23arun.s201186No ratings yet

- SCM 16 Transportation Management - Part-2Document11 pagesSCM 16 Transportation Management - Part-2swagat mohapatra100% (1)

- The Importance of SEO in Digital MarketingDocument7 pagesThe Importance of SEO in Digital MarketingSamriNo ratings yet

- Op No 13 - Understanding The Filipino Green ConsumerDocument40 pagesOp No 13 - Understanding The Filipino Green Consumermilrosebatilo2012No ratings yet

- Tds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary ComplianceDocument1 pageTds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary ComplianceArvind Kumar GuptaNo ratings yet

- Fmda GST RCDocument3 pagesFmda GST RCDipankar BarmanNo ratings yet

- Customer Name Card Account No MR Chandrashekar K 4375 XXXX XXXX 6003Document5 pagesCustomer Name Card Account No MR Chandrashekar K 4375 XXXX XXXX 6003Chandrashekar KNo ratings yet

- UntitledDocument10 pagesUntitledAlyssa Jane MertoNo ratings yet

- Unit 2 Instrumental Method of AnalysisDocument50 pagesUnit 2 Instrumental Method of AnalysisMeghaa.DNo ratings yet

Questions For Review Chap 12

Questions For Review Chap 12

Uploaded by

Hailee Hayes0 ratings0% found this document useful (0 votes)

16 views2 pagesinternational business

Original Title

Questions for Review Chap 12

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentinternational business

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

16 views2 pagesQuestions For Review Chap 12

Questions For Review Chap 12

Uploaded by

Hailee Hayesinternational business

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Questions for review

1. In what sense are international flows of productive resources a substitute for

international commodity trade?

Besides commodity trade, there is an international movement of resources as

well. Thus, labour, capital and technology move across national boundaries.

International trade and movement of productive resources from one country to

the other are regarded as substitutes for one another.

A country like the United States, which is capital abundant and labour scarce,

can export capital-intensive commodities or capital, and import labour intensive

commodities or allow immigration of workers from countries, which are abundant

in labour.

Movement of productive resources from places of plenty and low compensation

to places of scarcities and high compensation is beneficial for all.

However, international trade and movement of factors have different economic

effects on the nations involved.

2. What is meant by portfolio investments? Through what institutions do they

usually take place?

A portfolio investment is ownership of a stock, bond, or other financial asset with

the expectation that it will earn a return or grow in value over time, or both. It

entails passive or hands-off ownership of assets as opposed to direct investment,

which would involve an active management role.

The portfolio investment is done through financial institutions like banks and

investment funds. Portfolio investments are held directly by an investor or

managed by financial professionals. In economics, foreign portfolio investment

is the entry of funds into a country where foreigners deposit money in a country's

bank or make purchases in the country's stock and bond markets, sometimes for

speculation.

3. What is meant by direct investments? By what organizations are they usually

undertaken internationally?

Direct investment is more commonly referred to as foreign direct

investment (FDI). FDI refers to an investment in a foreign business enterprise

designed to acquire a controlling interest in the enterprise. The direct investment

provides capital funding in exchange for an equity interest without the purchase

of regular shares of a company’s stock.

Direct investment is done to start a subsidiary or take over another firm by

purchasing a major share of the stock. Multinational companies do direct

investment, which are engaged in manufacturing or provision of services. Thus,

direct investment is an important channel for international private flow of funds.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 94.cold Forging Cost Estimation SheetDocument5 pages94.cold Forging Cost Estimation SheetVenkateswaran venkateswaranNo ratings yet

- Midterm TestDocument2 pagesMidterm TestHailee HayesNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Adoption of Big Data For Last Mile Optimization: The Case of DHLDocument2 pagesAdoption of Big Data For Last Mile Optimization: The Case of DHLHailee HayesNo ratings yet

- TAX-501 (Excise Taxes)Document6 pagesTAX-501 (Excise Taxes)Ryan AllanicNo ratings yet

- JCB Case StudyDocument9 pagesJCB Case StudyPanma PatelNo ratings yet

- Sample SpaDocument2 pagesSample SpaLays Rds50% (6)

- Brand EquityDocument6 pagesBrand EquityHailee HayesNo ratings yet

- Accounting System in SpainDocument5 pagesAccounting System in SpainHailee HayesNo ratings yet

- Questions 13. What Is The Most Important Use of The Statement of The International Investment Position of A Nation?Document2 pagesQuestions 13. What Is The Most Important Use of The Statement of The International Investment Position of A Nation?Hailee HayesNo ratings yet

- Table 2. U.S. International Trade in Goods-: ContinuesDocument5 pagesTable 2. U.S. International Trade in Goods-: ContinuesHailee HayesNo ratings yet

- Analysis of Corporate Strategy of ZaraDocument14 pagesAnalysis of Corporate Strategy of ZaraHailee HayesNo ratings yet

- Of Which: Seasonal Adjustment DiscrepancyDocument6 pagesOf Which: Seasonal Adjustment DiscrepancyHailee HayesNo ratings yet

- Homework: I. Questions For ReviewDocument16 pagesHomework: I. Questions For ReviewHailee HayesNo ratings yet

- Homework: I. Questions For ReviewDocument12 pagesHomework: I. Questions For ReviewHailee HayesNo ratings yet

- Amazon's Alexa Spaghetti StrategyDocument10 pagesAmazon's Alexa Spaghetti StrategyShubham SinghNo ratings yet

- Ratio Analysis of Coca ColaDocument16 pagesRatio Analysis of Coca ColaAlwina100% (1)

- Motor Insurance Certificate 2Document1 pageMotor Insurance Certificate 2Abel SilvaNo ratings yet

- Ebf - Part 1 + 2Document36 pagesEbf - Part 1 + 2Phạm HằngNo ratings yet

- Project On Tata MotorsDocument15 pagesProject On Tata Motorsayush kumar singh95% (37)

- Chapter 2 Part 3: Financial Planning and Forecasting Financial StatementsDocument10 pagesChapter 2 Part 3: Financial Planning and Forecasting Financial StatementsshafNo ratings yet

- Pdc8 Checklist StatusDocument1 pagePdc8 Checklist StatusNusaibah YusofNo ratings yet

- CIR v. V.Y. Domingo JewellersDocument2 pagesCIR v. V.Y. Domingo JewellersBananaNo ratings yet

- IEM Bulletin October 2016Document52 pagesIEM Bulletin October 2016Zero123No ratings yet

- DPR Selwa 02.07.2020Document22 pagesDPR Selwa 02.07.2020ravibelavadiNo ratings yet

- State Bank of India - Parivartan: Case StudyDocument4 pagesState Bank of India - Parivartan: Case StudyKunal BagdeNo ratings yet

- Study On Advertising Agency and Tourism Industry in NepalDocument5 pagesStudy On Advertising Agency and Tourism Industry in NepalSocial Science Journal for Advanced ResearchNo ratings yet

- Industrial VisitDocument8 pagesIndustrial VisitmarySibiliaNo ratings yet

- Agriculture and Forestry NotesDocument89 pagesAgriculture and Forestry NotesWaqasNo ratings yet

- Supermom Indonesia Credential DeckDocument24 pagesSupermom Indonesia Credential DeckAstri WardhaniNo ratings yet

- 10 Manila Electric V City Assessor and Treasurer of LucenaDocument2 pages10 Manila Electric V City Assessor and Treasurer of LucenapdasilvaNo ratings yet

- Bbe A1Document16 pagesBbe A1NaNóngNảyNo ratings yet

- b2b Files Apr'23-Sep'23Document136 pagesb2b Files Apr'23-Sep'23arun.s201186No ratings yet

- SCM 16 Transportation Management - Part-2Document11 pagesSCM 16 Transportation Management - Part-2swagat mohapatra100% (1)

- The Importance of SEO in Digital MarketingDocument7 pagesThe Importance of SEO in Digital MarketingSamriNo ratings yet

- Op No 13 - Understanding The Filipino Green ConsumerDocument40 pagesOp No 13 - Understanding The Filipino Green Consumermilrosebatilo2012No ratings yet

- Tds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary ComplianceDocument1 pageTds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary ComplianceArvind Kumar GuptaNo ratings yet

- Fmda GST RCDocument3 pagesFmda GST RCDipankar BarmanNo ratings yet

- Customer Name Card Account No MR Chandrashekar K 4375 XXXX XXXX 6003Document5 pagesCustomer Name Card Account No MR Chandrashekar K 4375 XXXX XXXX 6003Chandrashekar KNo ratings yet

- UntitledDocument10 pagesUntitledAlyssa Jane MertoNo ratings yet

- Unit 2 Instrumental Method of AnalysisDocument50 pagesUnit 2 Instrumental Method of AnalysisMeghaa.DNo ratings yet