Professional Documents

Culture Documents

Krishi Current Account (CAKRI) - Schedule of Charges (

Krishi Current Account (CAKRI) - Schedule of Charges (

Uploaded by

BokulCopyright:

Available Formats

You might also like

- Halifax Print Friendly Statement PDFDocument2 pagesHalifax Print Friendly Statement PDFBokulNo ratings yet

- Balance Certificate of DBBLDocument1 pageBalance Certificate of DBBLBokul100% (1)

- NEW - Onehub EGobyerno Company Enrollment Form 12272017Document3 pagesNEW - Onehub EGobyerno Company Enrollment Form 12272017Elya Abillon100% (1)

- Statement 20150506Document6 pagesStatement 20150506saeed shamiNo ratings yet

- Death Certificate: Shaheed Monsur Ali Medical College HospitalDocument3 pagesDeath Certificate: Shaheed Monsur Ali Medical College HospitalBokul80% (5)

- Module 16 - Cash and Cash EquivalentsDocument7 pagesModule 16 - Cash and Cash EquivalentsLuiNo ratings yet

- AP Macroeconomics Review Sheet 2013Document7 pagesAP Macroeconomics Review Sheet 2013Crystal Farmer100% (4)

- family-360-banking-socs-01Document17 pagesfamily-360-banking-socs-01rahul2621991No ratings yet

- Privilege Banking SocDocument11 pagesPrivilege Banking Socmish.rithreddy78No ratings yet

- Fees and Charges To Other Users (Updated As On March 31, 2019) SR No Service Offered Charges/fees (Amount) Rupees UserDocument3 pagesFees and Charges To Other Users (Updated As On March 31, 2019) SR No Service Offered Charges/fees (Amount) Rupees UserAasthaNo ratings yet

- Saving SheetDocument6 pagesSaving Sheetiihm19dl148rohitNo ratings yet

- Sba 2 0 Ivy PDFDocument2 pagesSba 2 0 Ivy PDFChandan SahNo ratings yet

- Sbprime - Bde'sDocument16 pagesSbprime - Bde'sParteek JangraNo ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDocument1 pageCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanNo ratings yet

- Branch)Document3 pagesBranch)Jeyavel NagarajanNo ratings yet

- Cash Transaction Charges For Savings Account HoldersDocument6 pagesCash Transaction Charges For Savings Account HoldersMaheshkumar AmulaNo ratings yet

- Start Up Current Account 2022Document3 pagesStart Up Current Account 2022majhi.deepashreeNo ratings yet

- Broking Idirect Linked Savings AccountDocument7 pagesBroking Idirect Linked Savings Accounttrue chartNo ratings yet

- Annexure2 PDFDocument2 pagesAnnexure2 PDFMukeshNo ratings yet

- Privilege Banking SocDocument3 pagesPrivilege Banking SocBAMS Marine Services Pvt. Ltd.No ratings yet

- Regular Salary AccountDocument3 pagesRegular Salary AccountPrashant KumarNo ratings yet

- Nri Schedule of ChargesDocument4 pagesNri Schedule of ChargesRishiNo ratings yet

- Advantage Woman Savings AccountDocument7 pagesAdvantage Woman Savings Accounthimanshi.himanshi.chaudharyNo ratings yet

- ECS ChargesDocument14 pagesECS ChargesgnanaNo ratings yet

- 811 - Kotak Mahindra BankDocument5 pages811 - Kotak Mahindra BankVivek EadaraNo ratings yet

- Chartered Accountant 2 0Document3 pagesChartered Accountant 2 0RkNo ratings yet

- DownloadDocument2 pagesDownloadGazzu GazaliNo ratings yet

- Flexi Cash Current AccountDocument4 pagesFlexi Cash Current Accountkanetiya6556No ratings yet

- Schedule of Charges For Nri PriorityDocument4 pagesSchedule of Charges For Nri PriorityAnnuRawatNo ratings yet

- HDFC Vs IciciDocument10 pagesHDFC Vs IciciRahulNo ratings yet

- Common Service ChargesDocument3 pagesCommon Service ChargesatharvxunoNo ratings yet

- Parameter Au Samriddhi Current AccountDocument2 pagesParameter Au Samriddhi Current Accounthiteshmohakar15No ratings yet

- Shubhaarambh SocDocument2 pagesShubhaarambh SocCrAzY PuLkiTNo ratings yet

- Service ChargesDocument64 pagesService ChargesAmrutaNo ratings yet

- Schedule of Charges Unity Classic Saving AcDocument4 pagesSchedule of Charges Unity Classic Saving Acpunitrai28111No ratings yet

- New Dgtca SocDocument2 pagesNew Dgtca SocchintankantariaNo ratings yet

- Regular Salary Account Service ChargesDocument2 pagesRegular Salary Account Service ChargesGunde Hari BabuNo ratings yet

- Cash Current AccountDocument4 pagesCash Current Accountmajhi.deepashreeNo ratings yet

- IDBI Trade Current Account 2022Document4 pagesIDBI Trade Current Account 2022majhi.deepashreeNo ratings yet

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Document2 pagesMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNo ratings yet

- New StartupDocument2 pagesNew StartupAmey ChavanNo ratings yet

- IDBI Royale Plus Account Sep 01 2018Document2 pagesIDBI Royale Plus Account Sep 01 2018Sumit KumarNo ratings yet

- Axis Bank Service ChargesDocument4 pagesAxis Bank Service ChargesRanjith MeelaNo ratings yet

- Notice To SB CA OD Account Customer Annexure IIIDocument4 pagesNotice To SB CA OD Account Customer Annexure IIIratnesh singhNo ratings yet

- From Kotak WebsiteDocument20 pagesFrom Kotak WebsiteHimadri Shekhar VermaNo ratings yet

- Roaming Current Account 1Document5 pagesRoaming Current Account 1raviNo ratings yet

- Schedule of Charges For Nri Accounts PrimeDocument4 pagesSchedule of Charges For Nri Accounts PrimeSonam SharmaNo ratings yet

- Selfe Savings SOC December 2022Document2 pagesSelfe Savings SOC December 2022naresh kumarNo ratings yet

- ROC FeesDocument1 pageROC FeesGourav MaheshwariNo ratings yet

- Key Fact DocumentDocument2 pagesKey Fact DocumentJagiNo ratings yet

- One Globe Trade AccountDocument5 pagesOne Globe Trade AccountKhushi VarshneyNo ratings yet

- Schedule of Charges - Retail (India)Document2 pagesSchedule of Charges - Retail (India)John PeterNo ratings yet

- Schedule of Charges Edge Business 1st Feb 20 PDFDocument2 pagesSchedule of Charges Edge Business 1st Feb 20 PDFRavie S DhamaNo ratings yet

- New Start Up Account SocDocument1 pageNew Start Up Account SocMoorthi VNo ratings yet

- 9114 Accts-SERVICE CHARGhjgjgnj)Document5 pages9114 Accts-SERVICE CHARGhjgjgnj)Girish KumarNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accountnirvana8791No ratings yet

- GSFC Kotak811 Apr17Document1 pageGSFC Kotak811 Apr17karthip08No ratings yet

- ANNEXURE B - Fees and Charges To Issuers (Updated As On March 31, 2019) Sr. No. Service Offered Charges/fees (Amount) RupeesDocument4 pagesANNEXURE B - Fees and Charges To Issuers (Updated As On March 31, 2019) Sr. No. Service Offered Charges/fees (Amount) Rupeesrsaxena_MITNo ratings yet

- Service Charges Annexure-A Revised 18-7-11Document28 pagesService Charges Annexure-A Revised 18-7-11Dhaliwal JassieNo ratings yet

- Preferred AccountDocument2 pagesPreferred AccountaurummaangxinchenNo ratings yet

- Soc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFDocument2 pagesSoc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFJella RamakrishnaNo ratings yet

- Comparison of Standard Chartered Bank With Citibank and HSBCDocument5 pagesComparison of Standard Chartered Bank With Citibank and HSBCarpit_tNo ratings yet

- AnnexA-SoC Comfort01062014Document4 pagesAnnexA-SoC Comfort01062014satyabrataNo ratings yet

- Shubhaarambh Soc PDFDocument1 pageShubhaarambh Soc PDFSanjayNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- The Madhya Pradesh Sahakari Krishi Aur Vikas Bank Adhiniyam, 1999Document25 pagesThe Madhya Pradesh Sahakari Krishi Aur Vikas Bank Adhiniyam, 1999BokulNo ratings yet

- Bangladesh Krishi Bank Order, 1973Document23 pagesBangladesh Krishi Bank Order, 1973BokulNo ratings yet

- Routing No: Swift Code:: 020120436 AbblbddhDocument3 pagesRouting No: Swift Code:: 020120436 AbblbddhBokul0% (1)

- Internship Report: Nusrat Hafiz Lecturer, Brac Business SchoolDocument45 pagesInternship Report: Nusrat Hafiz Lecturer, Brac Business SchoolBokulNo ratings yet

- Basel III 2018Document14 pagesBasel III 2018BokulNo ratings yet

- Instruction: Telegraphic TransferDocument4 pagesInstruction: Telegraphic TransferBokulNo ratings yet

- Divergent Vaccine Rollout Leading To Asymmetric Risk: DailyDocument4 pagesDivergent Vaccine Rollout Leading To Asymmetric Risk: DailyBokulNo ratings yet

- Pra Decision Notice CitigroupDocument44 pagesPra Decision Notice CitigroupBokulNo ratings yet

- In The High Court of Justice Business and Property Court Companies Court (CHD)Document37 pagesIn The High Court of Justice Business and Property Court Companies Court (CHD)BokulNo ratings yet

- Doctor Prescription PadDocument1 pageDoctor Prescription PadBokulNo ratings yet

- A Case Study and Analysis of VFM Campaign Through Out of Home Advertising of Airtel Bangladesh LimitedDocument27 pagesA Case Study and Analysis of VFM Campaign Through Out of Home Advertising of Airtel Bangladesh LimitedBokulNo ratings yet

- Customer Application Form (CAF) : PC Care Airway Infratel Private LimitedDocument9 pagesCustomer Application Form (CAF) : PC Care Airway Infratel Private LimitedBokulNo ratings yet

- Cityam 2012-05-04..Document48 pagesCityam 2012-05-04..City A.M.No ratings yet

- Inflation in IndiaDocument55 pagesInflation in Indiakrishnakeerthana142081100% (2)

- Fee Structure GSS JANUARY 2021 SEMESTERDocument1 pageFee Structure GSS JANUARY 2021 SEMESTERAllanNo ratings yet

- My Ideal Job BankerDocument4 pagesMy Ideal Job BankerAnne MaryNo ratings yet

- Mrs. Bectors Food Specialities LimitedDocument8 pagesMrs. Bectors Food Specialities Limitedkrushna.maneNo ratings yet

- Staff OD Application Format-Process-DocumentsDocument9 pagesStaff OD Application Format-Process-DocumentsSonu YadavNo ratings yet

- SOP BESCOM Manual - 231008 - 124602Document37 pagesSOP BESCOM Manual - 231008 - 124602Geogy GeorgeNo ratings yet

- 04 Task Performance 1Document4 pages04 Task Performance 1Camille MadlangbayanNo ratings yet

- Saudi LawsDocument10 pagesSaudi LawsfahadzekliasmNo ratings yet

- Compensation Strategies and Practices in The Banking Sector of Bangladesh: A Comparative StudyDocument27 pagesCompensation Strategies and Practices in The Banking Sector of Bangladesh: A Comparative StudyMontasir Rossi100% (1)

- Islamic Capital MarketDocument42 pagesIslamic Capital MarketTee Soon HuatNo ratings yet

- LOR PPP - Investment - Ven SBLC - Dragon Destiny 020223Document5 pagesLOR PPP - Investment - Ven SBLC - Dragon Destiny 020223EM CRNo ratings yet

- Slide On Advertisement of BankDocument20 pagesSlide On Advertisement of Bankrayhan Kobir PervezNo ratings yet

- Assignment No. 2 - Cash and Cash EquivalentsDocument1 pageAssignment No. 2 - Cash and Cash EquivalentsAngel MarieNo ratings yet

- No Demand W11Document6 pagesNo Demand W11Guru charan ReddyNo ratings yet

- Final Test Deposit - MurabahahDocument13 pagesFinal Test Deposit - MurabahahNor SyahidahNo ratings yet

- Fabm Ii - Bank ReconciliationDocument41 pagesFabm Ii - Bank ReconciliationAvril OlivarezNo ratings yet

- Welcome Letter 111306743Document6 pagesWelcome Letter 111306743Tabe alamNo ratings yet

- AISDocument2 pagesAISMichelle BabaNo ratings yet

- Buczek Law Memo - International Bill of Exchahnge & HJR192 73-10 & 48Document14 pagesBuczek Law Memo - International Bill of Exchahnge & HJR192 73-10 & 48Bob HurtNo ratings yet

- "A Study of Agriculture Loan" Vividh Karyakari Seva Sahkari Society Ltd. DingoreDocument34 pages"A Study of Agriculture Loan" Vividh Karyakari Seva Sahkari Society Ltd. Dingorespiritual pfiNo ratings yet

- Fiac6212ea c19 WusDocument12 pagesFiac6212ea c19 WusarronyeagarNo ratings yet

- Fintech Industry in India:Future of Financial Services: Report Summary IvDocument2 pagesFintech Industry in India:Future of Financial Services: Report Summary IvHEMANG PAREEKNo ratings yet

- 019 Redacted Affidavit of Adam Edward Grimley Sworn 8 December 2020Document53 pages019 Redacted Affidavit of Adam Edward Grimley Sworn 8 December 2020AlexNo ratings yet

- Finance & StrategyDocument36 pagesFinance & StrategySirsanath Banerjee100% (1)

- Grameen Bank, Bangladesh: Background DescriptionDocument3 pagesGrameen Bank, Bangladesh: Background DescriptionAnkit VermaNo ratings yet

Krishi Current Account (CAKRI) - Schedule of Charges (

Krishi Current Account (CAKRI) - Schedule of Charges (

Uploaded by

BokulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Krishi Current Account (CAKRI) - Schedule of Charges (

Krishi Current Account (CAKRI) - Schedule of Charges (

Uploaded by

BokulCopyright:

Available Formats

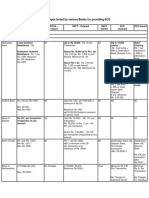

AXIS BANK - TRANSACTION BANKING

Krishi Current Account (CAKRI)- Schedule of Charges (w.e.f. - 25.05.09)

Rs. 10,000 for Urban centres;

HAB Half Yearly Average Balance Rs. 5,000 for Semi-Urban centres;

Rs. 2,500 for Rural centres

Home Branch

Free Limit Rs. 6 lacs / Half-year

Charges above free limit Above Rs. 6 lacs & upto Rs. 2.5 cr. per Half-year - Rs. 3.00 / 1000;

Above Rs. 2.5 cr. & upto Rs. 10 cr. per Half-year - Rs. 5.00 / 1000;

Greater than Rs. 10 cr. per Half-year - Rs. 8.00 / 1000

Transaction Charges Free upto 150 transactions per Half-year;

Above free limit Rs. 50 per transaction

DEPOSITS

Interbranch (Intercity & Intracity)

Charges Upto Rs. 2.5 cr. per Half-year - Rs. 4.50 / 1000;

CASH TRANSACTIONS**

Above Rs. 2.5 cr. & upto Rs. 10 cr. per Half-year - Rs. 6.00 / 1000;

Greater than Rs. 10 cr. per Half-year - Rs. 9.00 / 1000

Upfront Charge Rs. 100 per transaction (At the time of deposit)

Maximum Daily Limits for Interbranch Deposits Rs. 50,000 per Transaction

(Intercity & Intracity)

Out of the above Maximum Limits for Third Party Deposits Rs. 50,000 per Transaction

(Intracity & Intercity)

Home Branch

Transaction Charges Free upto 300 transactions per Half-year;

WITHDRAWALS

Above free limit Rs. 25 per transaction

Interbranch (Intercity & Intracity)

Ad Valorem Charges Rs. 2.00 / 1000; Maximum withdrawal limit Rs. 1 Lac per day

Transaction Charges Rs. 25 per transaction

Of the above Maximum Daily Limit for Third Party Interbranch Rs. 50,000

Withdrawals

Pay orders

DEMAND DRAFTS & PAY ORDERS

Free Limit Nil

Ad Valorem Charges Rs. 1.00 / 1000

Transaction Charges Rs. 50 per PO

Demand Drafts (Payable at Axis Bank Locations)

Free Limit Nil

Ad Valorem Charges Rs. 1.50 / 1000

Transaction Charges Rs. 50 per DD

Demand Drafts (Payable at Correspondent Bank Rs. 2.50 / 1000; Minimum Rs. 25 per DD

Locations under Desk Drawing arrangement)

Demand Drafts purchased from Other banks Actual + Rs. 0.50 / 1000; Minimum Rs. 50 per DD

Cheques Deposited at any branch in the same city for local Free

clearing

CHEQUE TRANSACTIONS

Cheques paid at Non-Home Branch location and Cheques

Deposited at any Axis Bank branch / ATM outside Home city

Location for Local Clearing #

Ad Valorem Charges Rs. 1.50 / 1000

Transaction Charges Rs. 25 per cheque

Cheques Deposited at any Axis Bank branch for outstation Upto Rs. 10,000 - Rs. 50 per instrument;

collection # Rs. 10,000 to Rs. 1 lac - Rs. 100 per instrument;

Above Rs. 1 lac - Rs. 150 per instrument

(Charges inclusive of postage)

Fund Transfer #

TRANSACTIONS

(Intercity between Axis Bank accounts)

TRANSFER

Ad Valorem Charges Free

Transaction Charges Rs. 25 per transfer

NEFT outside Axis Bank FREE

TRANSACTIONS

NEFT & RTGS

RTGS outside Axis Bank FREE

Clearing Cheque Return

Cheque Issued by the customer Rs. 350 / cheque for first 2 cheques;

Rs. 450 / cheque for 3rd cheque to 5th cheque;

Rs. 750 / cheque 6th cheque onwards

Cheque Deposited by the customer for Local Collection Rs. 125 / cheque

Cheque Deposited by the customer for Outstation Collection 50% of OSC commission

Minimum Rs. 50 / cheque + Other bank charges

Chequebook Upto 50 leaves per month - Rs. 2 / leaf;

(First 25 cheque leaves free) From 51 to 250 leaves per month - Rs. 5 / leaf;

Above 250 leaves per month - Rs. 8 / leaf

Business Classic Debit Card

Issue charges Rs. 150 per card

Annual Charge Rs. 150 per card

Business Platinum Debit Card

Issue charges Rs. 500 per card

Annual Charge Rs. 500 per card

OTHER SERVICES

Account Statement

Monthly by post Free

Daily / Weekly by e-mail Free

Adhoc Statement from any branch Rs. 100 per statement

Mobile Alerts

Daily Alerts on Day End Balance Rs. 10 per month / Registration

Alerts for transactions above Rs. 10,000 / Rs. 25 per month / Registration

Cheque Return instances

Both Rs. 35 per month / Registration

Stop Payment

Per instrument Rs. 100

Per series Rs. 250

Non-Maintenance Charges Semi Urban centres - (HAB less than Rs. 5000)- Rs. 1800;

Rural centres - (HAB less than Rs. 2,500)- Rs. 1500;

Metro & Urban centres -

(HAB less than Rs. 10,000)- Rs. 1500;

(HAB less than Rs. 5,000)- Rs. 1800

Account closure charges

Less than 6 months old Rs. 500

More than 6 months old Rs. 250

Scheme Code Conversion Charges^ Rs. 150 per instance

All the above terms are subject to change without any prior notice.

All the above service charges will attract service tax as applicable.

The charge cycle period shall be 01st of the month to the last day of the 06th month. For eg: 01st October to 31st March.

Half-year periods are : October to March and April to September.

# Conditions apply: Subject to 48 hours notice and Bank's confirmations for transaction exceeding Rs. 1 cr. a day where the destination

REMARKS

branch is a Non-RBI centre. (RBI centres are: Mumbai, Chennai, Kolkata, New Delhi, Ahmedabad, Hyderabad, Jaipur, Kanpur, Nagpur,

Trivandrum, Bhubaneshwar, Chandigarh, Bangalore, Guwahati, Bhopal & Patna)

** For all cash Transaction of Rs. 10 lacs and above on a single day would require prior intimation and approval of the Branch atleast one

working day in advance.

The monthly charges applicable in a current account will be based on the scheme code of that account in the previous month.

^ Scheme Code Conversion Charge of Rs. 150 per instance shall be charged to all current account holders for opting different scheme

code from the existing one.

Physical statements will not be sent for the current account where there are no transactions consecutively for 6 months

REBATE

Half Yearly Average Balance maintained Rebate of charges

Less than Rs. 25,000 NIL

Greater than or Equal to Rs. 25,000 but less than Rs. 1,00,000 25%

Greater than Rs. 1,00,000 50%

I / We have chosen to open a Current Account Krishi with Axis Bank with the Minimum Half yearly Average Balance requirement of Rs. 10,000 (Rs. 5,000

for Semi-urban branches & Rs. 2,500 for Rural branches) and have understood the facilities and charges applicable to the said product.

Signature of the client with stamp

Charges effective from 01st Aug, 2016

You might also like

- Halifax Print Friendly Statement PDFDocument2 pagesHalifax Print Friendly Statement PDFBokulNo ratings yet

- Balance Certificate of DBBLDocument1 pageBalance Certificate of DBBLBokul100% (1)

- NEW - Onehub EGobyerno Company Enrollment Form 12272017Document3 pagesNEW - Onehub EGobyerno Company Enrollment Form 12272017Elya Abillon100% (1)

- Statement 20150506Document6 pagesStatement 20150506saeed shamiNo ratings yet

- Death Certificate: Shaheed Monsur Ali Medical College HospitalDocument3 pagesDeath Certificate: Shaheed Monsur Ali Medical College HospitalBokul80% (5)

- Module 16 - Cash and Cash EquivalentsDocument7 pagesModule 16 - Cash and Cash EquivalentsLuiNo ratings yet

- AP Macroeconomics Review Sheet 2013Document7 pagesAP Macroeconomics Review Sheet 2013Crystal Farmer100% (4)

- family-360-banking-socs-01Document17 pagesfamily-360-banking-socs-01rahul2621991No ratings yet

- Privilege Banking SocDocument11 pagesPrivilege Banking Socmish.rithreddy78No ratings yet

- Fees and Charges To Other Users (Updated As On March 31, 2019) SR No Service Offered Charges/fees (Amount) Rupees UserDocument3 pagesFees and Charges To Other Users (Updated As On March 31, 2019) SR No Service Offered Charges/fees (Amount) Rupees UserAasthaNo ratings yet

- Saving SheetDocument6 pagesSaving Sheetiihm19dl148rohitNo ratings yet

- Sba 2 0 Ivy PDFDocument2 pagesSba 2 0 Ivy PDFChandan SahNo ratings yet

- Sbprime - Bde'sDocument16 pagesSbprime - Bde'sParteek JangraNo ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDocument1 pageCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanNo ratings yet

- Branch)Document3 pagesBranch)Jeyavel NagarajanNo ratings yet

- Cash Transaction Charges For Savings Account HoldersDocument6 pagesCash Transaction Charges For Savings Account HoldersMaheshkumar AmulaNo ratings yet

- Start Up Current Account 2022Document3 pagesStart Up Current Account 2022majhi.deepashreeNo ratings yet

- Broking Idirect Linked Savings AccountDocument7 pagesBroking Idirect Linked Savings Accounttrue chartNo ratings yet

- Annexure2 PDFDocument2 pagesAnnexure2 PDFMukeshNo ratings yet

- Privilege Banking SocDocument3 pagesPrivilege Banking SocBAMS Marine Services Pvt. Ltd.No ratings yet

- Regular Salary AccountDocument3 pagesRegular Salary AccountPrashant KumarNo ratings yet

- Nri Schedule of ChargesDocument4 pagesNri Schedule of ChargesRishiNo ratings yet

- Advantage Woman Savings AccountDocument7 pagesAdvantage Woman Savings Accounthimanshi.himanshi.chaudharyNo ratings yet

- ECS ChargesDocument14 pagesECS ChargesgnanaNo ratings yet

- 811 - Kotak Mahindra BankDocument5 pages811 - Kotak Mahindra BankVivek EadaraNo ratings yet

- Chartered Accountant 2 0Document3 pagesChartered Accountant 2 0RkNo ratings yet

- DownloadDocument2 pagesDownloadGazzu GazaliNo ratings yet

- Flexi Cash Current AccountDocument4 pagesFlexi Cash Current Accountkanetiya6556No ratings yet

- Schedule of Charges For Nri PriorityDocument4 pagesSchedule of Charges For Nri PriorityAnnuRawatNo ratings yet

- HDFC Vs IciciDocument10 pagesHDFC Vs IciciRahulNo ratings yet

- Common Service ChargesDocument3 pagesCommon Service ChargesatharvxunoNo ratings yet

- Parameter Au Samriddhi Current AccountDocument2 pagesParameter Au Samriddhi Current Accounthiteshmohakar15No ratings yet

- Shubhaarambh SocDocument2 pagesShubhaarambh SocCrAzY PuLkiTNo ratings yet

- Service ChargesDocument64 pagesService ChargesAmrutaNo ratings yet

- Schedule of Charges Unity Classic Saving AcDocument4 pagesSchedule of Charges Unity Classic Saving Acpunitrai28111No ratings yet

- New Dgtca SocDocument2 pagesNew Dgtca SocchintankantariaNo ratings yet

- Regular Salary Account Service ChargesDocument2 pagesRegular Salary Account Service ChargesGunde Hari BabuNo ratings yet

- Cash Current AccountDocument4 pagesCash Current Accountmajhi.deepashreeNo ratings yet

- IDBI Trade Current Account 2022Document4 pagesIDBI Trade Current Account 2022majhi.deepashreeNo ratings yet

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Document2 pagesMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNo ratings yet

- New StartupDocument2 pagesNew StartupAmey ChavanNo ratings yet

- IDBI Royale Plus Account Sep 01 2018Document2 pagesIDBI Royale Plus Account Sep 01 2018Sumit KumarNo ratings yet

- Axis Bank Service ChargesDocument4 pagesAxis Bank Service ChargesRanjith MeelaNo ratings yet

- Notice To SB CA OD Account Customer Annexure IIIDocument4 pagesNotice To SB CA OD Account Customer Annexure IIIratnesh singhNo ratings yet

- From Kotak WebsiteDocument20 pagesFrom Kotak WebsiteHimadri Shekhar VermaNo ratings yet

- Roaming Current Account 1Document5 pagesRoaming Current Account 1raviNo ratings yet

- Schedule of Charges For Nri Accounts PrimeDocument4 pagesSchedule of Charges For Nri Accounts PrimeSonam SharmaNo ratings yet

- Selfe Savings SOC December 2022Document2 pagesSelfe Savings SOC December 2022naresh kumarNo ratings yet

- ROC FeesDocument1 pageROC FeesGourav MaheshwariNo ratings yet

- Key Fact DocumentDocument2 pagesKey Fact DocumentJagiNo ratings yet

- One Globe Trade AccountDocument5 pagesOne Globe Trade AccountKhushi VarshneyNo ratings yet

- Schedule of Charges - Retail (India)Document2 pagesSchedule of Charges - Retail (India)John PeterNo ratings yet

- Schedule of Charges Edge Business 1st Feb 20 PDFDocument2 pagesSchedule of Charges Edge Business 1st Feb 20 PDFRavie S DhamaNo ratings yet

- New Start Up Account SocDocument1 pageNew Start Up Account SocMoorthi VNo ratings yet

- 9114 Accts-SERVICE CHARGhjgjgnj)Document5 pages9114 Accts-SERVICE CHARGhjgjgnj)Girish KumarNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accountnirvana8791No ratings yet

- GSFC Kotak811 Apr17Document1 pageGSFC Kotak811 Apr17karthip08No ratings yet

- ANNEXURE B - Fees and Charges To Issuers (Updated As On March 31, 2019) Sr. No. Service Offered Charges/fees (Amount) RupeesDocument4 pagesANNEXURE B - Fees and Charges To Issuers (Updated As On March 31, 2019) Sr. No. Service Offered Charges/fees (Amount) Rupeesrsaxena_MITNo ratings yet

- Service Charges Annexure-A Revised 18-7-11Document28 pagesService Charges Annexure-A Revised 18-7-11Dhaliwal JassieNo ratings yet

- Preferred AccountDocument2 pagesPreferred AccountaurummaangxinchenNo ratings yet

- Soc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFDocument2 pagesSoc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFJella RamakrishnaNo ratings yet

- Comparison of Standard Chartered Bank With Citibank and HSBCDocument5 pagesComparison of Standard Chartered Bank With Citibank and HSBCarpit_tNo ratings yet

- AnnexA-SoC Comfort01062014Document4 pagesAnnexA-SoC Comfort01062014satyabrataNo ratings yet

- Shubhaarambh Soc PDFDocument1 pageShubhaarambh Soc PDFSanjayNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- The Madhya Pradesh Sahakari Krishi Aur Vikas Bank Adhiniyam, 1999Document25 pagesThe Madhya Pradesh Sahakari Krishi Aur Vikas Bank Adhiniyam, 1999BokulNo ratings yet

- Bangladesh Krishi Bank Order, 1973Document23 pagesBangladesh Krishi Bank Order, 1973BokulNo ratings yet

- Routing No: Swift Code:: 020120436 AbblbddhDocument3 pagesRouting No: Swift Code:: 020120436 AbblbddhBokul0% (1)

- Internship Report: Nusrat Hafiz Lecturer, Brac Business SchoolDocument45 pagesInternship Report: Nusrat Hafiz Lecturer, Brac Business SchoolBokulNo ratings yet

- Basel III 2018Document14 pagesBasel III 2018BokulNo ratings yet

- Instruction: Telegraphic TransferDocument4 pagesInstruction: Telegraphic TransferBokulNo ratings yet

- Divergent Vaccine Rollout Leading To Asymmetric Risk: DailyDocument4 pagesDivergent Vaccine Rollout Leading To Asymmetric Risk: DailyBokulNo ratings yet

- Pra Decision Notice CitigroupDocument44 pagesPra Decision Notice CitigroupBokulNo ratings yet

- In The High Court of Justice Business and Property Court Companies Court (CHD)Document37 pagesIn The High Court of Justice Business and Property Court Companies Court (CHD)BokulNo ratings yet

- Doctor Prescription PadDocument1 pageDoctor Prescription PadBokulNo ratings yet

- A Case Study and Analysis of VFM Campaign Through Out of Home Advertising of Airtel Bangladesh LimitedDocument27 pagesA Case Study and Analysis of VFM Campaign Through Out of Home Advertising of Airtel Bangladesh LimitedBokulNo ratings yet

- Customer Application Form (CAF) : PC Care Airway Infratel Private LimitedDocument9 pagesCustomer Application Form (CAF) : PC Care Airway Infratel Private LimitedBokulNo ratings yet

- Cityam 2012-05-04..Document48 pagesCityam 2012-05-04..City A.M.No ratings yet

- Inflation in IndiaDocument55 pagesInflation in Indiakrishnakeerthana142081100% (2)

- Fee Structure GSS JANUARY 2021 SEMESTERDocument1 pageFee Structure GSS JANUARY 2021 SEMESTERAllanNo ratings yet

- My Ideal Job BankerDocument4 pagesMy Ideal Job BankerAnne MaryNo ratings yet

- Mrs. Bectors Food Specialities LimitedDocument8 pagesMrs. Bectors Food Specialities Limitedkrushna.maneNo ratings yet

- Staff OD Application Format-Process-DocumentsDocument9 pagesStaff OD Application Format-Process-DocumentsSonu YadavNo ratings yet

- SOP BESCOM Manual - 231008 - 124602Document37 pagesSOP BESCOM Manual - 231008 - 124602Geogy GeorgeNo ratings yet

- 04 Task Performance 1Document4 pages04 Task Performance 1Camille MadlangbayanNo ratings yet

- Saudi LawsDocument10 pagesSaudi LawsfahadzekliasmNo ratings yet

- Compensation Strategies and Practices in The Banking Sector of Bangladesh: A Comparative StudyDocument27 pagesCompensation Strategies and Practices in The Banking Sector of Bangladesh: A Comparative StudyMontasir Rossi100% (1)

- Islamic Capital MarketDocument42 pagesIslamic Capital MarketTee Soon HuatNo ratings yet

- LOR PPP - Investment - Ven SBLC - Dragon Destiny 020223Document5 pagesLOR PPP - Investment - Ven SBLC - Dragon Destiny 020223EM CRNo ratings yet

- Slide On Advertisement of BankDocument20 pagesSlide On Advertisement of Bankrayhan Kobir PervezNo ratings yet

- Assignment No. 2 - Cash and Cash EquivalentsDocument1 pageAssignment No. 2 - Cash and Cash EquivalentsAngel MarieNo ratings yet

- No Demand W11Document6 pagesNo Demand W11Guru charan ReddyNo ratings yet

- Final Test Deposit - MurabahahDocument13 pagesFinal Test Deposit - MurabahahNor SyahidahNo ratings yet

- Fabm Ii - Bank ReconciliationDocument41 pagesFabm Ii - Bank ReconciliationAvril OlivarezNo ratings yet

- Welcome Letter 111306743Document6 pagesWelcome Letter 111306743Tabe alamNo ratings yet

- AISDocument2 pagesAISMichelle BabaNo ratings yet

- Buczek Law Memo - International Bill of Exchahnge & HJR192 73-10 & 48Document14 pagesBuczek Law Memo - International Bill of Exchahnge & HJR192 73-10 & 48Bob HurtNo ratings yet

- "A Study of Agriculture Loan" Vividh Karyakari Seva Sahkari Society Ltd. DingoreDocument34 pages"A Study of Agriculture Loan" Vividh Karyakari Seva Sahkari Society Ltd. Dingorespiritual pfiNo ratings yet

- Fiac6212ea c19 WusDocument12 pagesFiac6212ea c19 WusarronyeagarNo ratings yet

- Fintech Industry in India:Future of Financial Services: Report Summary IvDocument2 pagesFintech Industry in India:Future of Financial Services: Report Summary IvHEMANG PAREEKNo ratings yet

- 019 Redacted Affidavit of Adam Edward Grimley Sworn 8 December 2020Document53 pages019 Redacted Affidavit of Adam Edward Grimley Sworn 8 December 2020AlexNo ratings yet

- Finance & StrategyDocument36 pagesFinance & StrategySirsanath Banerjee100% (1)

- Grameen Bank, Bangladesh: Background DescriptionDocument3 pagesGrameen Bank, Bangladesh: Background DescriptionAnkit VermaNo ratings yet