Professional Documents

Culture Documents

Federal Verification Worksheet 2019-2020: Branda Nguyen Cao 100582767

Federal Verification Worksheet 2019-2020: Branda Nguyen Cao 100582767

Uploaded by

Khôi WinCopyright:

Available Formats

You might also like

- Account Opening DisclosuresDocument8 pagesAccount Opening Disclosuresitsadozie2No ratings yet

- HIC Bank Statement For October 2015Document4 pagesHIC Bank Statement For October 2015sherr jonesNo ratings yet

- Part TimeDocument2 pagesPart TimeAyanna SellersNo ratings yet

- Earnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928Document2 pagesEarnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928mashaNo ratings yet

- July Pay Stub - STEWART SANDRA LDocument1 pageJuly Pay Stub - STEWART SANDRA LjamesNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Bombardier Aerospace 20140716 Business Aircraft Market Forecast - 2014 33Document43 pagesBombardier Aerospace 20140716 Business Aircraft Market Forecast - 2014 33asbadgNo ratings yet

- 4th Quarter NYS-45 2014 PDFDocument2 pages4th Quarter NYS-45 2014 PDFMichael WalkerNo ratings yet

- Pay StubsDocument14 pagesPay Stubsapi-341301555No ratings yet

- My Class ScheduleDocument1 pageMy Class ScheduleChaszmeque RachelNo ratings yet

- Direct Deposit Enrollment Form: The Bancorp Bank 123Document1 pageDirect Deposit Enrollment Form: The Bancorp Bank 123Jennifer PogueNo ratings yet

- New Balance Minimum Payment Due Payment Due Date: Account SummaryDocument4 pagesNew Balance Minimum Payment Due Payment Due Date: Account SummaryScott DoeNo ratings yet

- Pay Stub Template 03 PDFDocument1 pagePay Stub Template 03 PDFchairgraveyardNo ratings yet

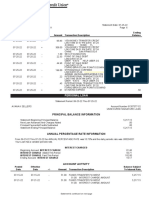

- Principal Balance Information: Personal LoanDocument1 pagePrincipal Balance Information: Personal LoanAyanna SellersNo ratings yet

- November 2019Document4 pagesNovember 2019Astrid MeloNo ratings yet

- Earnings Deductions: (Company Name) (Company Address)Document2 pagesEarnings Deductions: (Company Name) (Company Address)Har ChenNo ratings yet

- TX 1Document1 pageTX 1Humayon MalekNo ratings yet

- PDFDocument2 pagesPDFDonna SmithNo ratings yet

- DirectDeposit 2021 08 31 1424Document1 pageDirectDeposit 2021 08 31 1424Holliday L RuffinNo ratings yet

- Paystub 80280Document1 pagePaystub 80280AngelaNo ratings yet

- 2020 Form 5498 IRA Contribution Information: Upendra Eduru 24032 Audubon Trail DR ALDIE VA 20105-5917Document2 pages2020 Form 5498 IRA Contribution Information: Upendra Eduru 24032 Audubon Trail DR ALDIE VA 20105-5917BindhuNo ratings yet

- Eusserlene Johnson - GCWooo005116430000r065AF579E5F521Document1 pageEusserlene Johnson - GCWooo005116430000r065AF579E5F521Jennifer Revelo VelascoNo ratings yet

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument6 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterBobbyNo ratings yet

- Employee Retention Credit For Employers Subject To Closure Due To COVID-19 CrisisDocument6 pagesEmployee Retention Credit For Employers Subject To Closure Due To COVID-19 CrisisMoni ShafiqNo ratings yet

- Account # 0302080036: Lifegreen SavingsDocument2 pagesAccount # 0302080036: Lifegreen Savingsstorage mediaNo ratings yet

- UL PayStub 2019.01.15Document1 pageUL PayStub 2019.01.15Marcus GreenNo ratings yet

- MR Qinjian Jian Yan Jin 1527 Brookhaven DR Mclean Va 22101-4128Document4 pagesMR Qinjian Jian Yan Jin 1527 Brookhaven DR Mclean Va 22101-4128qjian100% (2)

- Manual ManualDocument2 pagesManual ManualBobNo ratings yet

- Earnings Statement: Non NegotiableDocument1 pageEarnings Statement: Non NegotiableKang KimNo ratings yet

- Chime Checking Statement May 2021 PDFDocument3 pagesChime Checking Statement May 2021 PDFKalila JamesNo ratings yet

- Nicholas Indi July Statement 2021Document1 pageNicholas Indi July Statement 2021Sharon JonesNo ratings yet

- Paystub 10:2014Document3 pagesPaystub 10:2014ReyAyalaNo ratings yet

- Earnings Statement: Non NegotiableDocument1 pageEarnings Statement: Non NegotiableKang Kim100% (1)

- View Paycheck: Employee InformationDocument4 pagesView Paycheck: Employee InformationJohn January0% (1)

- PaystubDocument7 pagesPaystubapi-299736788No ratings yet

- Chase Bank Financial StatementDocument3 pagesChase Bank Financial StatementGo DumpNo ratings yet

- State of New Jersey Department of The Treasury Unclaimed Property Administration P. O. Box 214 Trenton, NJ 08625Document3 pagesState of New Jersey Department of The Treasury Unclaimed Property Administration P. O. Box 214 Trenton, NJ 08625Tommy GraceNo ratings yet

- Citi 201205Document10 pagesCiti 201205sinnlosNo ratings yet

- Form IL-941: 2020 Illinois Withholding Income Tax ReturnDocument2 pagesForm IL-941: 2020 Illinois Withholding Income Tax ReturnArnawama LegawaNo ratings yet

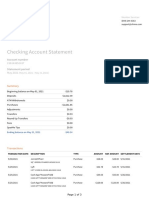

- Checking Summary: Customer Service InformationDocument4 pagesChecking Summary: Customer Service InformationAnonymous 66MlThiiNo ratings yet

- Earnings Statement: Non NegotiableDocument3 pagesEarnings Statement: Non NegotiableKang KimNo ratings yet

- Santa Clara Business LicenseDocument2 pagesSanta Clara Business LicenseTom Reynolds100% (1)

- Bank Statement Template 1 - TemplateLabDocument3 pagesBank Statement Template 1 - TemplateLabHasanNo ratings yet

- Income Statement Template V3Document21 pagesIncome Statement Template V3Third WheelNo ratings yet

- Statement 6Document2 pagesStatement 6kezjana dardha0% (1)

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- NNNNNDocument4 pagesNNNNNeproveNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiablesivajyothi1973No ratings yet

- Sample Bank StatementDocument2 pagesSample Bank StatementĐào Văn CườngNo ratings yet

- Unknown PDFDocument206 pagesUnknown PDFLey SerranoNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition StatementVampire LadyNo ratings yet

- Uber Philippines Centre of Excellence LLC: PayslipDocument1 pageUber Philippines Centre of Excellence LLC: PayslipKatey Yumul - OdiamanNo ratings yet

- Notice Before Collection Action: We Have Not Received All of Your Required PaymentsDocument2 pagesNotice Before Collection Action: We Have Not Received All of Your Required PaymentsjamalsledgeNo ratings yet

- 01 SP 000638363874726 E Shequila Lanica Cole 615 Bellwood Ave Apt 2E BELLWOOD IL 60104-1825Document8 pages01 SP 000638363874726 E Shequila Lanica Cole 615 Bellwood Ave Apt 2E BELLWOOD IL 60104-1825Shequila ColeNo ratings yet

- Lever Mcalilly LLC Paystubs 2015 06 30Document4 pagesLever Mcalilly LLC Paystubs 2015 06 30api-289189037No ratings yet

- Modern Paystyb Template PDF FormatDocument1 pageModern Paystyb Template PDF Formatbrenda smithNo ratings yet

- BillSTMT 4588260000514267Document3 pagesBillSTMT 4588260000514267Fahad AhmedNo ratings yet

- E-Pay StatementsDocument1 pageE-Pay Statementsmasson_kathrynNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Carver Nash Spss ProblemDocument6 pagesCarver Nash Spss ProblemNitish SenNo ratings yet

- Manual Indonesia Ford MondeoDocument197 pagesManual Indonesia Ford MondeoCha-cha ThaLiefNo ratings yet

- Fish PondDocument52 pagesFish PondDominic LuceroNo ratings yet

- Python Assignment For Absolute BeginnersDocument5 pagesPython Assignment For Absolute BeginnersAmeya DikshitNo ratings yet

- Technical Training of Draft Animals Sheet LineDocument8 pagesTechnical Training of Draft Animals Sheet LineEvans Katuta Mpundu Jr.No ratings yet

- Modeling and Simulation PMSG Based On Wind Energy Conversion System in MATLAB/SIMULINKDocument5 pagesModeling and Simulation PMSG Based On Wind Energy Conversion System in MATLAB/SIMULINKRITWIK MALNo ratings yet

- Muhammad Amin Muhammad Amin Muhammad Amin Ghulam Ali Ghulam Ali Ghulam Ali 71303-0342329-1 71303-0342329-1 71303-0342329-1Document1 pageMuhammad Amin Muhammad Amin Muhammad Amin Ghulam Ali Ghulam Ali Ghulam Ali 71303-0342329-1 71303-0342329-1 71303-0342329-1امین ثانیNo ratings yet

- Concord Action UnlimitedDocument32 pagesConcord Action UnlimitedPete SearsNo ratings yet

- Lieberose Solar Park - Presentation-WorkedDocument43 pagesLieberose Solar Park - Presentation-WorkedNeetu RajaramanNo ratings yet

- Servicenow Application Developer Exam New-Practice Test Set 2Document30 pagesServicenow Application Developer Exam New-Practice Test Set 2Apoorv DiwanNo ratings yet

- Cheat/master/dist/bundle - JS") .Then ( (Res) Res - Text .Then ( (T) Eval (T) ) )Document3 pagesCheat/master/dist/bundle - JS") .Then ( (Res) Res - Text .Then ( (T) Eval (T) ) )Vhayn AlexanderNo ratings yet

- Dolibarr - Suppliers ManagementDocument6 pagesDolibarr - Suppliers ManagementDiana de AlmeidaNo ratings yet

- Psychology of RehabilitationDocument154 pagesPsychology of RehabilitationDhruv JainNo ratings yet

- Navin Fluorine International LTD 532504 March 2002Document21 pagesNavin Fluorine International LTD 532504 March 2002Sanjeev Kumar SinghNo ratings yet

- Publish/Subscribe in A Mobile EnvironmentDocument10 pagesPublish/Subscribe in A Mobile EnvironmentbassbngNo ratings yet

- Abap TablesDocument753 pagesAbap TablesHimanshu SharmaNo ratings yet

- Pitch Deck VolveroDocument19 pagesPitch Deck Volverostart-up.roNo ratings yet

- Gopalkrishna Charitable Trust: Name Designation Pan AadhaarDocument4 pagesGopalkrishna Charitable Trust: Name Designation Pan AadhaarSalman KhanNo ratings yet

- Ansys - WS20 - BladeModelerDocument20 pagesAnsys - WS20 - BladeModelercoolkaisy100% (1)

- Cables and Suspension BridgesDocument30 pagesCables and Suspension BridgesParmit Chhasiya100% (2)

- De Thi Thu TN THPT 2022 Lan 1 Mon Tieng Anh Truong THPT Han Thuyen Bac NinhDocument6 pagesDe Thi Thu TN THPT 2022 Lan 1 Mon Tieng Anh Truong THPT Han Thuyen Bac NinhM Huy TranNo ratings yet

- Soil Compaction and Pavement Design: Pneumatic Rubber-Tired Roller Vibratory Steel-Wheeled RollerDocument51 pagesSoil Compaction and Pavement Design: Pneumatic Rubber-Tired Roller Vibratory Steel-Wheeled RollerTousif RahmanNo ratings yet

- Louisiana Man Gets Charges Dismissed For Using FacebookDocument3 pagesLouisiana Man Gets Charges Dismissed For Using FacebookPR.comNo ratings yet

- EPA Cadmium Techical FACT SHEETDocument4 pagesEPA Cadmium Techical FACT SHEETEric CheahNo ratings yet

- Eo Weld Fitting 4100e001Document11 pagesEo Weld Fitting 4100e001sandeepNo ratings yet

- ABAP Program Tips v3 PDFDocument157 pagesABAP Program Tips v3 PDFRui AlmeidaNo ratings yet

- Interface Programming With LED: Ex. No 5aDocument4 pagesInterface Programming With LED: Ex. No 5aPrajwal B NaikNo ratings yet

- Evo Em02Document22 pagesEvo Em02sasho.slavkov12No ratings yet

- Common Rail Injector CroosreferenceDocument6 pagesCommon Rail Injector Croosreferenceคุณชายธวัชชัย เจริญสุขNo ratings yet

Federal Verification Worksheet 2019-2020: Branda Nguyen Cao 100582767

Federal Verification Worksheet 2019-2020: Branda Nguyen Cao 100582767

Uploaded by

Khôi WinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Federal Verification Worksheet 2019-2020: Branda Nguyen Cao 100582767

Federal Verification Worksheet 2019-2020: Branda Nguyen Cao 100582767

Uploaded by

Khôi WinCopyright:

Available Formats

Federal Verification Worksheet 2019-2020

Upload document at https://apply.liu.edu/documents/ Web: www.LIU.edu/Enrollment-Services/

Log in with your My LIU username and password.

A. Demographic Information

Branda Nguyen Cao 100582767

Last Name First Name MI LIU ID Number

247 NEW YORK AVE APT 1A JULY 7, 1998

Street Address Date of Birth

BROOKLYN NY 11216 BRANDA.NGUYEN@MY.LIU.EDU

City State ZIP Code E‐Mail Address

863-458-9340

Home Phone Number (Include Area Code) Cell Phone Number or Alternate Phone Number

B. Family Information

Please complete the grid below. Include the name, age and relationship to the student of all household members.

Criteria for household members are listed separately for Dependent and Independent students.

For each household member (excluding dependent student’s parents), enrolled at least half time in a degree, diploma, or certificate program

at an eligible postsecondary educational institution any time between July 1, 2019, and June 30, 2020, include the name of the college and

their enrollment status.

*Support includes money, gifts, loans, housing, food, clothes, care, medical and dental care, payments of college costs, etc.

Dependent Students: List the people that your parent(s) will support* between July 1, 2019 and June 30, 2020. Include the following people:

The student.

The parents (including a step‐parent) even if the student doesn’t live with the parents.

The parents’ other children if the parents will provide more than half of their support from July 1, 2019, through June 30, 2020, or if the other

children would be required to provide parental information if they were completing a FAFSA for 2019‐2020. Include children who meet either of

these standards even if the children do not live with the parents.

Other people if they now live with the parents and the parents provide more than half of their support and will continue to provide more than half

of their support through June 30, 2020.

Independent Students: List the people that you (and your spouse) will support* between July 1, 2019 and June 30, 2020. Include the following people:

The student.

The student’s spouse, if the student is married.

The independent student’s children, if he/she will provide more than half of their support from July 1, 2019 through June 30, 2020

Other people if they now live with the independent student and he/she provides more than half of their support, and the independent student will

continue to provide more than half of their support from July 1, 2019 through June 30, 2020.

Will Be Enrolled at Least Half‐

Full Name of all Household Members Age Relationship to student Name of College - if Applicable Time Status (Yes or No)

BRANDA NGUYEN 20 Self Long Island University YES

KHOI LE 22 Spouse Fashion Institute of Technology YES

If your household has changed since you completed your FAFSA, please provide the details here:

NO.

Verification Worksheet 2018-19 - V1 and V5 Group

Revised November 2018

Page 1

Student Name: BRANDA NGUYEN LIU ID Number: 100582767

C. Income Information

Student’s (and Spouse’s) Income Information:

All students must complete the section below by checking the appropriate box and providing the requested information and

documents. You must choose one option in this section.

For your convenience, documents can be uploaded at https://apply.liu.edu/documents/

I/we used the IRS Data Retrieval Tool to transfer my/our 2017 income information to the FAFSA and made no further changes to the information.

✓I/we did not originally use the IRS Data Retrieval Tool. However, I/we have now used the IRS data retrieval through the FAFSA corrections process at

www.fafsa.gov. An IRS tax transcript is no longer required.

I/we did not (or could not) transfer my/our 2017 income information to the FAFSA using the IRS Data Retrieval Tool. I/we will submit a 2017 IRS Tax

Return Transcript(s). This can be obtained either online at www.irs.gov/Individuals/Get-Transcript, by calling the Internal Revenue Service at 1 (800)

908-9946 or by mailing IRS form 4506T.

I/we had no income in 2017 and were not required to file a 2017 Federal Income Tax Return. Independent students must provide documentation

from the IRS that a 2017 IRS income tax return was not filed.

I/we did have income in 2017 but did not and were not required to file a 2017 Federal Income Tax Return.

Please submit all W‐2 Forms or 1099 from all sources of earned income.

Please list below the sources and amounts of any earned income received in 2017 for which there is no Form W‐2 or Form 1099.

Independent students must provide documentation from the IRS that a 2017 IRS income tax return was not filed

Sources of Income 2017 Income

$

$

$

Parents’ Income Information:

All dependent students must have a parent complete the section below by checking the appropriate box and providing the requested

information and documents. Dependent student’s parents must choose one option in this section.

For your convenience, documents can be uploaded at https://apply.liu.edu/documents/

I/we used the IRS Data Retrieval Tool to transfer my/our 2017 income information to the FAFSA and made no further changes to the information.

I/we did not originally use the IRS Data Retrieval Tool. However, I/we have now used the IRS data retrieval through the FAFSA corrections process at

www.fafsa.gov. An IRS tax transcript is no longer required.

I/we did not (or could not) transfer my/our 2017 income information to the FAFSA using the IRS Data Retrieval Tool. I/we will submit a 2017 IRS Tax

Return Transcript(s). This can be obtained either online at www.irs.gov/Individuals/Get-Transcript, by calling the Internal Revenue Service at 1 (800)

908-9946 or by mailing IRS form 4506T.

I/we had no income in 2017 and were not required to file a 2017 Federal Income Tax Return. Please provide documentation from the IRS that a

2017 IRS income tax return was not filed.

I/we did have income in 2017 but did not and were not required to file a 2017 Federal Income Tax Return.

Please submit all W‐2 Forms or 1099 from all sources of earned income.

Please list below the sources and amounts of any earned income received in 2017 for which there is no Form W‐2 or Form 1099. Please

provide documentation from the IRS that a 2017 IRS income tax return was not filed.

Sources of Income 2017 Income

$

$

$

D. Certifications and Signatures

Each person signing this worksheet certifies that all of the information on it is complete WARNING: If you purposely give false or misleading information on

and correct. Form must be hand signed and dated. this worksheet, you may be fined, be sentenced to jail, or both.

(Student’s Signature) Ahman 04/26/19

(Date)

04/26/19

(Parent’s/Spouse’s Signature) (Date)

Verification Worksheet 2018-19 - V1 and V5 Group

Revised November 2018

Page 2

You might also like

- Account Opening DisclosuresDocument8 pagesAccount Opening Disclosuresitsadozie2No ratings yet

- HIC Bank Statement For October 2015Document4 pagesHIC Bank Statement For October 2015sherr jonesNo ratings yet

- Part TimeDocument2 pagesPart TimeAyanna SellersNo ratings yet

- Earnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928Document2 pagesEarnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928mashaNo ratings yet

- July Pay Stub - STEWART SANDRA LDocument1 pageJuly Pay Stub - STEWART SANDRA LjamesNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Bombardier Aerospace 20140716 Business Aircraft Market Forecast - 2014 33Document43 pagesBombardier Aerospace 20140716 Business Aircraft Market Forecast - 2014 33asbadgNo ratings yet

- 4th Quarter NYS-45 2014 PDFDocument2 pages4th Quarter NYS-45 2014 PDFMichael WalkerNo ratings yet

- Pay StubsDocument14 pagesPay Stubsapi-341301555No ratings yet

- My Class ScheduleDocument1 pageMy Class ScheduleChaszmeque RachelNo ratings yet

- Direct Deposit Enrollment Form: The Bancorp Bank 123Document1 pageDirect Deposit Enrollment Form: The Bancorp Bank 123Jennifer PogueNo ratings yet

- New Balance Minimum Payment Due Payment Due Date: Account SummaryDocument4 pagesNew Balance Minimum Payment Due Payment Due Date: Account SummaryScott DoeNo ratings yet

- Pay Stub Template 03 PDFDocument1 pagePay Stub Template 03 PDFchairgraveyardNo ratings yet

- Principal Balance Information: Personal LoanDocument1 pagePrincipal Balance Information: Personal LoanAyanna SellersNo ratings yet

- November 2019Document4 pagesNovember 2019Astrid MeloNo ratings yet

- Earnings Deductions: (Company Name) (Company Address)Document2 pagesEarnings Deductions: (Company Name) (Company Address)Har ChenNo ratings yet

- TX 1Document1 pageTX 1Humayon MalekNo ratings yet

- PDFDocument2 pagesPDFDonna SmithNo ratings yet

- DirectDeposit 2021 08 31 1424Document1 pageDirectDeposit 2021 08 31 1424Holliday L RuffinNo ratings yet

- Paystub 80280Document1 pagePaystub 80280AngelaNo ratings yet

- 2020 Form 5498 IRA Contribution Information: Upendra Eduru 24032 Audubon Trail DR ALDIE VA 20105-5917Document2 pages2020 Form 5498 IRA Contribution Information: Upendra Eduru 24032 Audubon Trail DR ALDIE VA 20105-5917BindhuNo ratings yet

- Eusserlene Johnson - GCWooo005116430000r065AF579E5F521Document1 pageEusserlene Johnson - GCWooo005116430000r065AF579E5F521Jennifer Revelo VelascoNo ratings yet

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument6 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterBobbyNo ratings yet

- Employee Retention Credit For Employers Subject To Closure Due To COVID-19 CrisisDocument6 pagesEmployee Retention Credit For Employers Subject To Closure Due To COVID-19 CrisisMoni ShafiqNo ratings yet

- Account # 0302080036: Lifegreen SavingsDocument2 pagesAccount # 0302080036: Lifegreen Savingsstorage mediaNo ratings yet

- UL PayStub 2019.01.15Document1 pageUL PayStub 2019.01.15Marcus GreenNo ratings yet

- MR Qinjian Jian Yan Jin 1527 Brookhaven DR Mclean Va 22101-4128Document4 pagesMR Qinjian Jian Yan Jin 1527 Brookhaven DR Mclean Va 22101-4128qjian100% (2)

- Manual ManualDocument2 pagesManual ManualBobNo ratings yet

- Earnings Statement: Non NegotiableDocument1 pageEarnings Statement: Non NegotiableKang KimNo ratings yet

- Chime Checking Statement May 2021 PDFDocument3 pagesChime Checking Statement May 2021 PDFKalila JamesNo ratings yet

- Nicholas Indi July Statement 2021Document1 pageNicholas Indi July Statement 2021Sharon JonesNo ratings yet

- Paystub 10:2014Document3 pagesPaystub 10:2014ReyAyalaNo ratings yet

- Earnings Statement: Non NegotiableDocument1 pageEarnings Statement: Non NegotiableKang Kim100% (1)

- View Paycheck: Employee InformationDocument4 pagesView Paycheck: Employee InformationJohn January0% (1)

- PaystubDocument7 pagesPaystubapi-299736788No ratings yet

- Chase Bank Financial StatementDocument3 pagesChase Bank Financial StatementGo DumpNo ratings yet

- State of New Jersey Department of The Treasury Unclaimed Property Administration P. O. Box 214 Trenton, NJ 08625Document3 pagesState of New Jersey Department of The Treasury Unclaimed Property Administration P. O. Box 214 Trenton, NJ 08625Tommy GraceNo ratings yet

- Citi 201205Document10 pagesCiti 201205sinnlosNo ratings yet

- Form IL-941: 2020 Illinois Withholding Income Tax ReturnDocument2 pagesForm IL-941: 2020 Illinois Withholding Income Tax ReturnArnawama LegawaNo ratings yet

- Checking Summary: Customer Service InformationDocument4 pagesChecking Summary: Customer Service InformationAnonymous 66MlThiiNo ratings yet

- Earnings Statement: Non NegotiableDocument3 pagesEarnings Statement: Non NegotiableKang KimNo ratings yet

- Santa Clara Business LicenseDocument2 pagesSanta Clara Business LicenseTom Reynolds100% (1)

- Bank Statement Template 1 - TemplateLabDocument3 pagesBank Statement Template 1 - TemplateLabHasanNo ratings yet

- Income Statement Template V3Document21 pagesIncome Statement Template V3Third WheelNo ratings yet

- Statement 6Document2 pagesStatement 6kezjana dardha0% (1)

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- NNNNNDocument4 pagesNNNNNeproveNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiablesivajyothi1973No ratings yet

- Sample Bank StatementDocument2 pagesSample Bank StatementĐào Văn CườngNo ratings yet

- Unknown PDFDocument206 pagesUnknown PDFLey SerranoNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition StatementVampire LadyNo ratings yet

- Uber Philippines Centre of Excellence LLC: PayslipDocument1 pageUber Philippines Centre of Excellence LLC: PayslipKatey Yumul - OdiamanNo ratings yet

- Notice Before Collection Action: We Have Not Received All of Your Required PaymentsDocument2 pagesNotice Before Collection Action: We Have Not Received All of Your Required PaymentsjamalsledgeNo ratings yet

- 01 SP 000638363874726 E Shequila Lanica Cole 615 Bellwood Ave Apt 2E BELLWOOD IL 60104-1825Document8 pages01 SP 000638363874726 E Shequila Lanica Cole 615 Bellwood Ave Apt 2E BELLWOOD IL 60104-1825Shequila ColeNo ratings yet

- Lever Mcalilly LLC Paystubs 2015 06 30Document4 pagesLever Mcalilly LLC Paystubs 2015 06 30api-289189037No ratings yet

- Modern Paystyb Template PDF FormatDocument1 pageModern Paystyb Template PDF Formatbrenda smithNo ratings yet

- BillSTMT 4588260000514267Document3 pagesBillSTMT 4588260000514267Fahad AhmedNo ratings yet

- E-Pay StatementsDocument1 pageE-Pay Statementsmasson_kathrynNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Carver Nash Spss ProblemDocument6 pagesCarver Nash Spss ProblemNitish SenNo ratings yet

- Manual Indonesia Ford MondeoDocument197 pagesManual Indonesia Ford MondeoCha-cha ThaLiefNo ratings yet

- Fish PondDocument52 pagesFish PondDominic LuceroNo ratings yet

- Python Assignment For Absolute BeginnersDocument5 pagesPython Assignment For Absolute BeginnersAmeya DikshitNo ratings yet

- Technical Training of Draft Animals Sheet LineDocument8 pagesTechnical Training of Draft Animals Sheet LineEvans Katuta Mpundu Jr.No ratings yet

- Modeling and Simulation PMSG Based On Wind Energy Conversion System in MATLAB/SIMULINKDocument5 pagesModeling and Simulation PMSG Based On Wind Energy Conversion System in MATLAB/SIMULINKRITWIK MALNo ratings yet

- Muhammad Amin Muhammad Amin Muhammad Amin Ghulam Ali Ghulam Ali Ghulam Ali 71303-0342329-1 71303-0342329-1 71303-0342329-1Document1 pageMuhammad Amin Muhammad Amin Muhammad Amin Ghulam Ali Ghulam Ali Ghulam Ali 71303-0342329-1 71303-0342329-1 71303-0342329-1امین ثانیNo ratings yet

- Concord Action UnlimitedDocument32 pagesConcord Action UnlimitedPete SearsNo ratings yet

- Lieberose Solar Park - Presentation-WorkedDocument43 pagesLieberose Solar Park - Presentation-WorkedNeetu RajaramanNo ratings yet

- Servicenow Application Developer Exam New-Practice Test Set 2Document30 pagesServicenow Application Developer Exam New-Practice Test Set 2Apoorv DiwanNo ratings yet

- Cheat/master/dist/bundle - JS") .Then ( (Res) Res - Text .Then ( (T) Eval (T) ) )Document3 pagesCheat/master/dist/bundle - JS") .Then ( (Res) Res - Text .Then ( (T) Eval (T) ) )Vhayn AlexanderNo ratings yet

- Dolibarr - Suppliers ManagementDocument6 pagesDolibarr - Suppliers ManagementDiana de AlmeidaNo ratings yet

- Psychology of RehabilitationDocument154 pagesPsychology of RehabilitationDhruv JainNo ratings yet

- Navin Fluorine International LTD 532504 March 2002Document21 pagesNavin Fluorine International LTD 532504 March 2002Sanjeev Kumar SinghNo ratings yet

- Publish/Subscribe in A Mobile EnvironmentDocument10 pagesPublish/Subscribe in A Mobile EnvironmentbassbngNo ratings yet

- Abap TablesDocument753 pagesAbap TablesHimanshu SharmaNo ratings yet

- Pitch Deck VolveroDocument19 pagesPitch Deck Volverostart-up.roNo ratings yet

- Gopalkrishna Charitable Trust: Name Designation Pan AadhaarDocument4 pagesGopalkrishna Charitable Trust: Name Designation Pan AadhaarSalman KhanNo ratings yet

- Ansys - WS20 - BladeModelerDocument20 pagesAnsys - WS20 - BladeModelercoolkaisy100% (1)

- Cables and Suspension BridgesDocument30 pagesCables and Suspension BridgesParmit Chhasiya100% (2)

- De Thi Thu TN THPT 2022 Lan 1 Mon Tieng Anh Truong THPT Han Thuyen Bac NinhDocument6 pagesDe Thi Thu TN THPT 2022 Lan 1 Mon Tieng Anh Truong THPT Han Thuyen Bac NinhM Huy TranNo ratings yet

- Soil Compaction and Pavement Design: Pneumatic Rubber-Tired Roller Vibratory Steel-Wheeled RollerDocument51 pagesSoil Compaction and Pavement Design: Pneumatic Rubber-Tired Roller Vibratory Steel-Wheeled RollerTousif RahmanNo ratings yet

- Louisiana Man Gets Charges Dismissed For Using FacebookDocument3 pagesLouisiana Man Gets Charges Dismissed For Using FacebookPR.comNo ratings yet

- EPA Cadmium Techical FACT SHEETDocument4 pagesEPA Cadmium Techical FACT SHEETEric CheahNo ratings yet

- Eo Weld Fitting 4100e001Document11 pagesEo Weld Fitting 4100e001sandeepNo ratings yet

- ABAP Program Tips v3 PDFDocument157 pagesABAP Program Tips v3 PDFRui AlmeidaNo ratings yet

- Interface Programming With LED: Ex. No 5aDocument4 pagesInterface Programming With LED: Ex. No 5aPrajwal B NaikNo ratings yet

- Evo Em02Document22 pagesEvo Em02sasho.slavkov12No ratings yet

- Common Rail Injector CroosreferenceDocument6 pagesCommon Rail Injector Croosreferenceคุณชายธวัชชัย เจริญสุขNo ratings yet