Professional Documents

Culture Documents

Lecture Note 6

Lecture Note 6

Uploaded by

Mighty SinghCopyright:

Available Formats

You might also like

- The Practically Cheating Statistics Handbook, The Sequel! (2nd Edition)From EverandThe Practically Cheating Statistics Handbook, The Sequel! (2nd Edition)Rating: 4.5 out of 5 stars4.5/5 (3)

- A Short Lesson On R and R-MultipleDocument13 pagesA Short Lesson On R and R-MultipleAbhiroopGupta100% (2)

- This is The Statistics Handbook your Professor Doesn't Want you to See. So Easy, it's Practically Cheating...From EverandThis is The Statistics Handbook your Professor Doesn't Want you to See. So Easy, it's Practically Cheating...Rating: 4.5 out of 5 stars4.5/5 (6)

- Introduction To Data Mining Using OrangeDocument72 pagesIntroduction To Data Mining Using OrangeMighty SinghNo ratings yet

- Mistakes Are The Downfall of Most TradersDocument10 pagesMistakes Are The Downfall of Most TradersJaoNo ratings yet

- Kay Sunderland: Making The Grade at Attain Learning: Name: Dheeraj Sarda Roll No.: P40065 Section: BDocument1 pageKay Sunderland: Making The Grade at Attain Learning: Name: Dheeraj Sarda Roll No.: P40065 Section: BMighty SinghNo ratings yet

- Facebook 2013 Annual Report 10-KDocument103 pagesFacebook 2013 Annual Report 10-KEricNo ratings yet

- Model Evaluation TechniquesDocument20 pagesModel Evaluation TechniquesZeeshan TariqNo ratings yet

- 09 - ML-Model EvaluationDocument33 pages09 - ML-Model EvaluationNguyễn Tấn KhangNo ratings yet

- ML MetricsDocument9 pagesML Metricszpddf9hqx5No ratings yet

- Evaluation Metrics:: Confusion MatrixDocument7 pagesEvaluation Metrics:: Confusion MatrixNithya PrasathNo ratings yet

- Hands On Machine Learning 3 EditionDocument31 pagesHands On Machine Learning 3 EditionsaharabdoumaNo ratings yet

- Accuracy, Precision, Recall & F1 Score Interpretation of Performance MeasuresDocument5 pagesAccuracy, Precision, Recall & F1 Score Interpretation of Performance MeasuresFriday JonesNo ratings yet

- CS305 Exercise 5: Task 1: Comparing Machine Learning AlgorithmsDocument7 pagesCS305 Exercise 5: Task 1: Comparing Machine Learning Algorithmsramgoog71No ratings yet

- Roc and Auc: Receiver Operating CharacteristicDocument4 pagesRoc and Auc: Receiver Operating CharacteristicJoe1No ratings yet

- Confusion Matrix Machine LearningDocument9 pagesConfusion Matrix Machine Learningyordanos birhanuNo ratings yet

- International Institute of Trading MasteryDocument2 pagesInternational Institute of Trading MasteryEttore TruccoNo ratings yet

- Article Forex TradeDocument4 pagesArticle Forex TradeVinh TinNo ratings yet

- Classification Accuracy Logarithmic Loss Confusion Matrix Area Under Curve F1 Score Mean Absolute ErrorDocument9 pagesClassification Accuracy Logarithmic Loss Confusion Matrix Area Under Curve F1 Score Mean Absolute ErrorHarpreet Singh BaggaNo ratings yet

- جلسه 13Document76 pagesجلسه 13Mohammd Ehsan EsfahaniNo ratings yet

- Risk ManagementDocument8 pagesRisk ManagementPeniel Crystal100% (1)

- Credit Card Fraud DetectionDocument16 pagesCredit Card Fraud DetectionAbhinav RahateNo ratings yet

- Data Science Interview Q's - VDocument17 pagesData Science Interview Q's - VRajaNo ratings yet

- Exercise 5Document8 pagesExercise 5Aura LòpezNo ratings yet

- Gain Probability IndexDocument11 pagesGain Probability IndexZen TraderNo ratings yet

- Numerical MethodDocument9 pagesNumerical MethodArpita BiswasNo ratings yet

- AI & ML NotesDocument22 pagesAI & ML Noteskarthik singaraoNo ratings yet

- F1 Score Vs ROC AUC Vs Accuracy Vs PR AUC Which Evaluation Metric Should You Choose - Neptune - AiDocument1 pageF1 Score Vs ROC AUC Vs Accuracy Vs PR AUC Which Evaluation Metric Should You Choose - Neptune - Aicool_spNo ratings yet

- Auc Roc Curve Machine LearningDocument12 pagesAuc Roc Curve Machine LearningMilan NaikNo ratings yet

- Accuracy Precision and RecallDocument21 pagesAccuracy Precision and RecallWajahat Ali085No ratings yet

- Machine Learning Project Report (Group 3) Shahbaz KhanDocument11 pagesMachine Learning Project Report (Group 3) Shahbaz KhanShahbaz khanNo ratings yet

- 5 ROC CurveDocument2 pages5 ROC CurveArchanaNo ratings yet

- Evaluation Metrics-MLDocument16 pagesEvaluation Metrics-MLiemct23No ratings yet

- Project Data Mining1Document83 pagesProject Data Mining1harish kumarNo ratings yet

- Module 7 - Evaluation MeasuresDocument27 pagesModule 7 - Evaluation MeasuresAathmika VijayNo ratings yet

- ML Interview QuesDocument12 pagesML Interview QuesAkhil ShrivastavNo ratings yet

- Risk Management - LeviathanDocument9 pagesRisk Management - LeviathanPloutos IbnLasion100% (2)

- System Performance Evaluation: Extracted From Chapter 15 of "Cybernetic Analysis For Stocks and Futures", John WileyDocument1 pageSystem Performance Evaluation: Extracted From Chapter 15 of "Cybernetic Analysis For Stocks and Futures", John WileyTraderCat SolarisNo ratings yet

- Zscore 4Document6 pagesZscore 4ata ur rahmanNo ratings yet

- 10 Techniques To Deal With Class Imbalance in Machine LearningDocument10 pages10 Techniques To Deal With Class Imbalance in Machine LearningCHLIAH HANANENo ratings yet

- Casino MathDocument89 pagesCasino MathAngela Brown100% (2)

- Day 9 of 100 Data Science Interview Questions Series!!Document4 pagesDay 9 of 100 Data Science Interview Questions Series!!SilgaNo ratings yet

- ML-Lecture-12 (Evaluation Metrics For Classification)Document15 pagesML-Lecture-12 (Evaluation Metrics For Classification)Md Fazle RabbyNo ratings yet

- How To Use The Reward Risk Ratio Like A ProfessionalDocument11 pagesHow To Use The Reward Risk Ratio Like A Professionaldiogonbig100% (4)

- Accuracy, Precision, Recall or F1Document5 pagesAccuracy, Precision, Recall or F1nathanlgrossmanNo ratings yet

- Evaluation NotesDocument12 pagesEvaluation NotesPooja AnandNo ratings yet

- Model Evaluation - IIDocument12 pagesModel Evaluation - IIJayod RajapakshaNo ratings yet

- Testing ReportDocument10 pagesTesting ReportEnrique BlancoNo ratings yet

- Money ManagementDocument5 pagesMoney ManagementCcy Choon Yuan100% (1)

- Machine Learning Interview Questions & Answers PDFDocument18 pagesMachine Learning Interview Questions & Answers PDFhsgmysore38No ratings yet

- BOP AssignmentDocument9 pagesBOP AssignmentSaurav PrakashNo ratings yet

- The Power of Risk Reward, What To Expect From Supply and DemandDocument5 pagesThe Power of Risk Reward, What To Expect From Supply and DemandCharisNo ratings yet

- Risk Reward RatioDocument2 pagesRisk Reward RatioEttore TruccoNo ratings yet

- If Statements: 1 A Simple ExampleDocument5 pagesIf Statements: 1 A Simple ExampleMatius KelvinNo ratings yet

- Ratio: InputDocument2 pagesRatio: InputHello misterNo ratings yet

- Lab ReportDocument11 pagesLab ReportNicolae BarbaNo ratings yet

- Python Machine AnalysisDocument453 pagesPython Machine AnalysisSuresh Anand MNo ratings yet

- Confusion Matrix - Unit 2Document50 pagesConfusion Matrix - Unit 2Vaishnavi KorgaonkarNo ratings yet

- Advanced RegressionDocument13 pagesAdvanced RegressionDaniel N Sherine FooNo ratings yet

- 9_Session 9- Visualizing Model Performance, Evidence and ProbabilitiesDocument37 pages9_Session 9- Visualizing Model Performance, Evidence and ProbabilitiesMuhammad Yazid Al-KaafiNo ratings yet

- EvaluationQuestions Class 10 AiDocument6 pagesEvaluationQuestions Class 10 AikritavearnNo ratings yet

- Lecture 2 Classifier Performance MetricsDocument60 pagesLecture 2 Classifier Performance Metricsiamboss086No ratings yet

- Solutions4 301Document5 pagesSolutions4 301Glory OlalereNo ratings yet

- 5 Sources of Power and InfluenceDocument2 pages5 Sources of Power and InfluenceMighty SinghNo ratings yet

- Performance Trusted SupplierDocument3 pagesPerformance Trusted SupplierMighty SinghNo ratings yet

- 6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Document21 pages6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Mighty SinghNo ratings yet

- 8 - GST-8-EXAMPLES - Email BEFORE The SessionDocument2 pages8 - GST-8-EXAMPLES - Email BEFORE The SessionMighty SinghNo ratings yet

- Data Mining Techniques (DMT) by Kushal Anjaria Session-2: Tid ItemsDocument4 pagesData Mining Techniques (DMT) by Kushal Anjaria Session-2: Tid ItemsMighty SinghNo ratings yet

- Value Lies in The Belief of The Investor Prof. R. RamaseshanDocument5 pagesValue Lies in The Belief of The Investor Prof. R. RamaseshanMighty SinghNo ratings yet

- DMT Session-3 by Kushal Anjaria: Goal: Previously Unseen Records Should Be Assigned A Class As Accurately As PossibleDocument2 pagesDMT Session-3 by Kushal Anjaria: Goal: Previously Unseen Records Should Be Assigned A Class As Accurately As PossibleMighty SinghNo ratings yet

- Data Mining Techniques (DMT) by Kushal Anjaria Session-1 (Lecture Note)Document2 pagesData Mining Techniques (DMT) by Kushal Anjaria Session-1 (Lecture Note)Mighty SinghNo ratings yet

- Lecture Note Session5Document1 pageLecture Note Session5Mighty SinghNo ratings yet

- Orange3 Data Mining Library Using PythonDocument102 pagesOrange3 Data Mining Library Using PythonMighty Singh0% (1)

- DRW Technology Situational AnalysisDocument2 pagesDRW Technology Situational AnalysisMighty SinghNo ratings yet

- Vulcan Gantt Scheduler TutorialDocument44 pagesVulcan Gantt Scheduler Tutorialroldan2011No ratings yet

- ML 1510Document122 pagesML 1510nelutuanv-1No ratings yet

- स्वामी चरित्र सारामृत PDFDocument20 pagesस्वामी चरित्र सारामृत PDFShobhan AmbolkarNo ratings yet

- EMSO: A New Environment For Modelling, Simulation and OptimisationDocument7 pagesEMSO: A New Environment For Modelling, Simulation and OptimisationMarvin Martins Dos SantosNo ratings yet

- A Self-Biased High Performance Folded Cascode Op-Amp: of ofDocument6 pagesA Self-Biased High Performance Folded Cascode Op-Amp: of ofBodhayan PrasadNo ratings yet

- HP LaserJet Enterprise 700 Color MFP M775 SeriesDocument4 pagesHP LaserJet Enterprise 700 Color MFP M775 Seriesalioudarren@gmail.comNo ratings yet

- Anr 1.1.07.0032 (11070032) 0Document10 pagesAnr 1.1.07.0032 (11070032) 0jaelmelicioNo ratings yet

- Quarter 2 Summative Test Mapeh 6 Sy. 2020-2021Document29 pagesQuarter 2 Summative Test Mapeh 6 Sy. 2020-2021Rinen DebbieNo ratings yet

- Numerical SolutionDocument2 pagesNumerical SolutionAicelleNo ratings yet

- Moving To All-IP Network: Challenges & Solutions: Prashant Shukla Sr. Solutions Architect ECI Telecom March 2012Document25 pagesMoving To All-IP Network: Challenges & Solutions: Prashant Shukla Sr. Solutions Architect ECI Telecom March 2012Beny D SetyawanNo ratings yet

- Part 2Document37 pagesPart 2remino1No ratings yet

- SND 501Document1 pageSND 501nk1969No ratings yet

- Pratiyogita DarpanDocument2 pagesPratiyogita DarpanPavithra SivarajaNo ratings yet

- Sai Vatsavai-Survey-PaperDocument13 pagesSai Vatsavai-Survey-PapertamernadeemNo ratings yet

- VCF NuDocument7 pagesVCF NuJohn GreenNo ratings yet

- 4.1.4 Packet Tracer - ACL Demonstration - ILMDocument3 pages4.1.4 Packet Tracer - ACL Demonstration - ILMlizardohilarioNo ratings yet

- A Multiple Access Protocol For Multimedia Transmission Over Wireless NetworksDocument17 pagesA Multiple Access Protocol For Multimedia Transmission Over Wireless NetworksAIRCC - IJCNCNo ratings yet

- Chapter Three: System Development Life Cycle (SDLC)Document10 pagesChapter Three: System Development Life Cycle (SDLC)Gemechis Lema100% (1)

- Oracle Erp Cloud Implementation Leading Practices WPDocument35 pagesOracle Erp Cloud Implementation Leading Practices WPMiguel Felicio100% (1)

- Peripheral DevicesDocument2 pagesPeripheral Deviceschanty chantyNo ratings yet

- DroneDocument4 pagesDroneheni16belayNo ratings yet

- Feedback and Control System Chapter 1. Introduction To Control SystemDocument9 pagesFeedback and Control System Chapter 1. Introduction To Control SystemJefferson BaptistaNo ratings yet

- 3180 Oximeter: Service ManualDocument30 pages3180 Oximeter: Service Manualalexis jonathanNo ratings yet

- Electronic and Mobile Commerce: Ralph M. Stair - George W. ReynoldsDocument67 pagesElectronic and Mobile Commerce: Ralph M. Stair - George W. ReynoldsClaudia BassonNo ratings yet

- Destructive and Non-Destructive - QuizDocument15 pagesDestructive and Non-Destructive - QuizDiangelia ArtagameNo ratings yet

- Ebook Design For Thermal Key Requirements Qualcomm Technologies Inc Online PDF All ChapterDocument49 pagesEbook Design For Thermal Key Requirements Qualcomm Technologies Inc Online PDF All Chaptercynthia.guerrant485100% (8)

- Chapter 3 - InputDocument32 pagesChapter 3 - InputNur Amira NadiaNo ratings yet

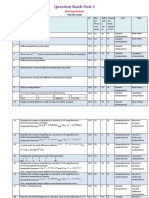

- Question Bank-Unit 2: MATH 2300Document8 pagesQuestion Bank-Unit 2: MATH 2300ROHAN TRIVEDI 20SCSE1180013No ratings yet

- Introduction To Excel - 2022Document44 pagesIntroduction To Excel - 2022Frankie Asido100% (1)

Lecture Note 6

Lecture Note 6

Uploaded by

Mighty SinghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture Note 6

Lecture Note 6

Uploaded by

Mighty SinghCopyright:

Available Formats

DMT

Session-6

By Kushal Anjaria

Next, we will see how to compare multiple classifier?

Your boss asked you to build a fraud detection

classifier, so you’ve created one.

The output of your fraud detection model is the

probability [0.0–1.0] that a transaction is fraudulent. If

this probability is below 0.5, you classify the

transaction as non-fraudulent; otherwise, you classify

the transaction as fraudulent.

While 97% accuracy may seem excellent at first glance,

To evaluate the performance of your model, you you’ve soon realized the catch: your boss asked you to

collect 10,000 manually classified transactions, with build a fraud detection classifier, and with the always-

300 fraudulent transaction and 9,700 non-fraudulent return-non-fraudulent classifier you will miss all the

transactions. You run your classifier on every fraudulent transactions. You learned the hard-way that

transaction, predict the class label (fraudulent or non- accuracy can be misleading and that for problems like

fraudulent) and summarise the results in the following this, additional measures are required to evaluate your

confusion matrix: classifier.

You start by asking yourself what percent of the

positive (fraudulent) cases did you catch? You go back

to the confusion matrix and divide the True Positive

(TP — blue oval) by the overall number of true

fraudulent transactions (red rectangle)

A True Positive (TP=100) is an outcome where the model

correctly predicts the positive (fraudulent) class.

Similarly, a True Negative (TN=9,000) is an outcome

where the model correctly predicts the negative (non-

fraudulent) class.

A False Positive (FP=700) is an outcome where the model

incorrectly predicts the positive (fraudulent) class. And a So, the classier caught 33.3% of the fraudulent

False Negative (FN=200) is an outcome where the model transactions.

incorrectly predicts the negative (non-fraudulent) class. Next, you ask yourself what percent of positive

Asking yourself what percent of your predictions were (fraudulent) predictions were correct? You go back to

correct, you calculate the accuracy: the confusion matrix and divide the True Positive (TP

— blue oval) by the overall number of predicted

fraudulent transactions (red rectangle)

Wow, 91% accuracy! Just before sharing the great news

with your boss, you notice that out of the 300 fraudulent

transactions, only 100 fraudulent transactions are

classified correctly. Your classifier missed 200 out of the

300 fraudulent transactions!

Your colleague, hardly hiding her simile, suggests a

“better” classifier. Her classifier predicts every

transaction as non-fraudulent (negative), with a

staggering 97% accuracy!

So now you know that when your classifier predicts transactions, and the last column (Fraudulent Prob) is

that a transaction is fraudulent, only 12.5% of the the probability that the transaction is fraudulent:

time your classifier is correct.

F1 Score combines Recall and Precision to one

performance metric. F1 Score is the weighted

average of Precision and Recall. Therefore, this score

takes both false positives and false negatives into

account. F1 is usually more useful than Accuracy,

especially if you have an uneven class distribution.

Finally, you ask yourself what percent of negative

(non-fraudulent) predictions were incorrect? You go

back to the confusion matrix and divide the False

The confusion matrix for the Threshold=1.0 case:

Positive (FP — blue oval) by the overall number of

true non-fraudulent transactions (red rectangle)

The ROC curve is created by plotting the True Positive

Pate (TPR) against the False Positive Rate (FPR) at

various threshold settings, so you calculate both:

7.2% of the non-fraudulent transactions were You summarize it in the following table:

classified incorrectly as fraudulent transactions.

ROC (Receiver Operating Characteristics)

You soon learn that you must examine both Precision Now you can finally plot the first point on your ROC

and Recall. Unfortunately, Precision and Recall are graph! A random guess would give a point along the

often in tension. That is, improving Precision typically dotted diagonal line (the so-called line of no-

reduces Recall and vice versa. discrimination) from the left bottom to the top right

The overall performance of a classifier, summarized corners. You continue and plot the True Positive Pate

over all possible thresholds, is given by the Receiver (TPR) against the False Positive Rate (FPR) at various

Operating Characteristics (ROC) curve. The name threshold settings. The ROC can be designed as

“ROC” is historical and comes from communications follows:

theory. ROC Curves are used to see how well your

classifier can separate positive and negative

examples and to identify the best threshold for

separating them.

To be able to use the ROC curve, your classifier should

be able to rank examples such that the ones with

higher rank are more likely to be positive

(fraudulent). As an example, Logistic Regression

outputs probabilities, which is a score that you can

use for ranking.

You train a new model and you use it to predict the

outcome of 10 new test transactions, summarizing

the result in the following table: the values of the

middle column (True Label) are either zero (0) for

non-fraudulent transactions or one (1) for fraudulent AUC (Area Under the Curve)

The model performance is determined by looking at

the area under the ROC curve (or AUC). An excellent

model has AUC near to the 1.0, which means it has a

good measure of separability. For your model, the

AUC is the combined are of the blue, green and

purple rectangles, so the AUC = 0.4 x 0.6 + 0.2 x 0.8 +

0.4 x 1.0 = 0.80.

Conclusion

• Accuracy will not always be the metric.

• Precision and recall are often in tension. That jIf age is >40, income is low, student status is yes,

is, improving precision typically reduces credit_rating is fair then whether that person will buy

recall and vice versa. computer or not. Identify the class.

• AUC-ROC curve is one of the most commonly

used metrics to evaluate the performance of

machine learning algorithms.

• ROC Curves summarize the trade-off

between the true positive rate and false

positive rate for a predictive model using

different probability thresholds.

• The ROC curve can be used to choose the

best operating point.

Example of Bayes Classifier

You might also like

- The Practically Cheating Statistics Handbook, The Sequel! (2nd Edition)From EverandThe Practically Cheating Statistics Handbook, The Sequel! (2nd Edition)Rating: 4.5 out of 5 stars4.5/5 (3)

- A Short Lesson On R and R-MultipleDocument13 pagesA Short Lesson On R and R-MultipleAbhiroopGupta100% (2)

- This is The Statistics Handbook your Professor Doesn't Want you to See. So Easy, it's Practically Cheating...From EverandThis is The Statistics Handbook your Professor Doesn't Want you to See. So Easy, it's Practically Cheating...Rating: 4.5 out of 5 stars4.5/5 (6)

- Introduction To Data Mining Using OrangeDocument72 pagesIntroduction To Data Mining Using OrangeMighty SinghNo ratings yet

- Mistakes Are The Downfall of Most TradersDocument10 pagesMistakes Are The Downfall of Most TradersJaoNo ratings yet

- Kay Sunderland: Making The Grade at Attain Learning: Name: Dheeraj Sarda Roll No.: P40065 Section: BDocument1 pageKay Sunderland: Making The Grade at Attain Learning: Name: Dheeraj Sarda Roll No.: P40065 Section: BMighty SinghNo ratings yet

- Facebook 2013 Annual Report 10-KDocument103 pagesFacebook 2013 Annual Report 10-KEricNo ratings yet

- Model Evaluation TechniquesDocument20 pagesModel Evaluation TechniquesZeeshan TariqNo ratings yet

- 09 - ML-Model EvaluationDocument33 pages09 - ML-Model EvaluationNguyễn Tấn KhangNo ratings yet

- ML MetricsDocument9 pagesML Metricszpddf9hqx5No ratings yet

- Evaluation Metrics:: Confusion MatrixDocument7 pagesEvaluation Metrics:: Confusion MatrixNithya PrasathNo ratings yet

- Hands On Machine Learning 3 EditionDocument31 pagesHands On Machine Learning 3 EditionsaharabdoumaNo ratings yet

- Accuracy, Precision, Recall & F1 Score Interpretation of Performance MeasuresDocument5 pagesAccuracy, Precision, Recall & F1 Score Interpretation of Performance MeasuresFriday JonesNo ratings yet

- CS305 Exercise 5: Task 1: Comparing Machine Learning AlgorithmsDocument7 pagesCS305 Exercise 5: Task 1: Comparing Machine Learning Algorithmsramgoog71No ratings yet

- Roc and Auc: Receiver Operating CharacteristicDocument4 pagesRoc and Auc: Receiver Operating CharacteristicJoe1No ratings yet

- Confusion Matrix Machine LearningDocument9 pagesConfusion Matrix Machine Learningyordanos birhanuNo ratings yet

- International Institute of Trading MasteryDocument2 pagesInternational Institute of Trading MasteryEttore TruccoNo ratings yet

- Article Forex TradeDocument4 pagesArticle Forex TradeVinh TinNo ratings yet

- Classification Accuracy Logarithmic Loss Confusion Matrix Area Under Curve F1 Score Mean Absolute ErrorDocument9 pagesClassification Accuracy Logarithmic Loss Confusion Matrix Area Under Curve F1 Score Mean Absolute ErrorHarpreet Singh BaggaNo ratings yet

- جلسه 13Document76 pagesجلسه 13Mohammd Ehsan EsfahaniNo ratings yet

- Risk ManagementDocument8 pagesRisk ManagementPeniel Crystal100% (1)

- Credit Card Fraud DetectionDocument16 pagesCredit Card Fraud DetectionAbhinav RahateNo ratings yet

- Data Science Interview Q's - VDocument17 pagesData Science Interview Q's - VRajaNo ratings yet

- Exercise 5Document8 pagesExercise 5Aura LòpezNo ratings yet

- Gain Probability IndexDocument11 pagesGain Probability IndexZen TraderNo ratings yet

- Numerical MethodDocument9 pagesNumerical MethodArpita BiswasNo ratings yet

- AI & ML NotesDocument22 pagesAI & ML Noteskarthik singaraoNo ratings yet

- F1 Score Vs ROC AUC Vs Accuracy Vs PR AUC Which Evaluation Metric Should You Choose - Neptune - AiDocument1 pageF1 Score Vs ROC AUC Vs Accuracy Vs PR AUC Which Evaluation Metric Should You Choose - Neptune - Aicool_spNo ratings yet

- Auc Roc Curve Machine LearningDocument12 pagesAuc Roc Curve Machine LearningMilan NaikNo ratings yet

- Accuracy Precision and RecallDocument21 pagesAccuracy Precision and RecallWajahat Ali085No ratings yet

- Machine Learning Project Report (Group 3) Shahbaz KhanDocument11 pagesMachine Learning Project Report (Group 3) Shahbaz KhanShahbaz khanNo ratings yet

- 5 ROC CurveDocument2 pages5 ROC CurveArchanaNo ratings yet

- Evaluation Metrics-MLDocument16 pagesEvaluation Metrics-MLiemct23No ratings yet

- Project Data Mining1Document83 pagesProject Data Mining1harish kumarNo ratings yet

- Module 7 - Evaluation MeasuresDocument27 pagesModule 7 - Evaluation MeasuresAathmika VijayNo ratings yet

- ML Interview QuesDocument12 pagesML Interview QuesAkhil ShrivastavNo ratings yet

- Risk Management - LeviathanDocument9 pagesRisk Management - LeviathanPloutos IbnLasion100% (2)

- System Performance Evaluation: Extracted From Chapter 15 of "Cybernetic Analysis For Stocks and Futures", John WileyDocument1 pageSystem Performance Evaluation: Extracted From Chapter 15 of "Cybernetic Analysis For Stocks and Futures", John WileyTraderCat SolarisNo ratings yet

- Zscore 4Document6 pagesZscore 4ata ur rahmanNo ratings yet

- 10 Techniques To Deal With Class Imbalance in Machine LearningDocument10 pages10 Techniques To Deal With Class Imbalance in Machine LearningCHLIAH HANANENo ratings yet

- Casino MathDocument89 pagesCasino MathAngela Brown100% (2)

- Day 9 of 100 Data Science Interview Questions Series!!Document4 pagesDay 9 of 100 Data Science Interview Questions Series!!SilgaNo ratings yet

- ML-Lecture-12 (Evaluation Metrics For Classification)Document15 pagesML-Lecture-12 (Evaluation Metrics For Classification)Md Fazle RabbyNo ratings yet

- How To Use The Reward Risk Ratio Like A ProfessionalDocument11 pagesHow To Use The Reward Risk Ratio Like A Professionaldiogonbig100% (4)

- Accuracy, Precision, Recall or F1Document5 pagesAccuracy, Precision, Recall or F1nathanlgrossmanNo ratings yet

- Evaluation NotesDocument12 pagesEvaluation NotesPooja AnandNo ratings yet

- Model Evaluation - IIDocument12 pagesModel Evaluation - IIJayod RajapakshaNo ratings yet

- Testing ReportDocument10 pagesTesting ReportEnrique BlancoNo ratings yet

- Money ManagementDocument5 pagesMoney ManagementCcy Choon Yuan100% (1)

- Machine Learning Interview Questions & Answers PDFDocument18 pagesMachine Learning Interview Questions & Answers PDFhsgmysore38No ratings yet

- BOP AssignmentDocument9 pagesBOP AssignmentSaurav PrakashNo ratings yet

- The Power of Risk Reward, What To Expect From Supply and DemandDocument5 pagesThe Power of Risk Reward, What To Expect From Supply and DemandCharisNo ratings yet

- Risk Reward RatioDocument2 pagesRisk Reward RatioEttore TruccoNo ratings yet

- If Statements: 1 A Simple ExampleDocument5 pagesIf Statements: 1 A Simple ExampleMatius KelvinNo ratings yet

- Ratio: InputDocument2 pagesRatio: InputHello misterNo ratings yet

- Lab ReportDocument11 pagesLab ReportNicolae BarbaNo ratings yet

- Python Machine AnalysisDocument453 pagesPython Machine AnalysisSuresh Anand MNo ratings yet

- Confusion Matrix - Unit 2Document50 pagesConfusion Matrix - Unit 2Vaishnavi KorgaonkarNo ratings yet

- Advanced RegressionDocument13 pagesAdvanced RegressionDaniel N Sherine FooNo ratings yet

- 9_Session 9- Visualizing Model Performance, Evidence and ProbabilitiesDocument37 pages9_Session 9- Visualizing Model Performance, Evidence and ProbabilitiesMuhammad Yazid Al-KaafiNo ratings yet

- EvaluationQuestions Class 10 AiDocument6 pagesEvaluationQuestions Class 10 AikritavearnNo ratings yet

- Lecture 2 Classifier Performance MetricsDocument60 pagesLecture 2 Classifier Performance Metricsiamboss086No ratings yet

- Solutions4 301Document5 pagesSolutions4 301Glory OlalereNo ratings yet

- 5 Sources of Power and InfluenceDocument2 pages5 Sources of Power and InfluenceMighty SinghNo ratings yet

- Performance Trusted SupplierDocument3 pagesPerformance Trusted SupplierMighty SinghNo ratings yet

- 6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Document21 pages6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Mighty SinghNo ratings yet

- 8 - GST-8-EXAMPLES - Email BEFORE The SessionDocument2 pages8 - GST-8-EXAMPLES - Email BEFORE The SessionMighty SinghNo ratings yet

- Data Mining Techniques (DMT) by Kushal Anjaria Session-2: Tid ItemsDocument4 pagesData Mining Techniques (DMT) by Kushal Anjaria Session-2: Tid ItemsMighty SinghNo ratings yet

- Value Lies in The Belief of The Investor Prof. R. RamaseshanDocument5 pagesValue Lies in The Belief of The Investor Prof. R. RamaseshanMighty SinghNo ratings yet

- DMT Session-3 by Kushal Anjaria: Goal: Previously Unseen Records Should Be Assigned A Class As Accurately As PossibleDocument2 pagesDMT Session-3 by Kushal Anjaria: Goal: Previously Unseen Records Should Be Assigned A Class As Accurately As PossibleMighty SinghNo ratings yet

- Data Mining Techniques (DMT) by Kushal Anjaria Session-1 (Lecture Note)Document2 pagesData Mining Techniques (DMT) by Kushal Anjaria Session-1 (Lecture Note)Mighty SinghNo ratings yet

- Lecture Note Session5Document1 pageLecture Note Session5Mighty SinghNo ratings yet

- Orange3 Data Mining Library Using PythonDocument102 pagesOrange3 Data Mining Library Using PythonMighty Singh0% (1)

- DRW Technology Situational AnalysisDocument2 pagesDRW Technology Situational AnalysisMighty SinghNo ratings yet

- Vulcan Gantt Scheduler TutorialDocument44 pagesVulcan Gantt Scheduler Tutorialroldan2011No ratings yet

- ML 1510Document122 pagesML 1510nelutuanv-1No ratings yet

- स्वामी चरित्र सारामृत PDFDocument20 pagesस्वामी चरित्र सारामृत PDFShobhan AmbolkarNo ratings yet

- EMSO: A New Environment For Modelling, Simulation and OptimisationDocument7 pagesEMSO: A New Environment For Modelling, Simulation and OptimisationMarvin Martins Dos SantosNo ratings yet

- A Self-Biased High Performance Folded Cascode Op-Amp: of ofDocument6 pagesA Self-Biased High Performance Folded Cascode Op-Amp: of ofBodhayan PrasadNo ratings yet

- HP LaserJet Enterprise 700 Color MFP M775 SeriesDocument4 pagesHP LaserJet Enterprise 700 Color MFP M775 Seriesalioudarren@gmail.comNo ratings yet

- Anr 1.1.07.0032 (11070032) 0Document10 pagesAnr 1.1.07.0032 (11070032) 0jaelmelicioNo ratings yet

- Quarter 2 Summative Test Mapeh 6 Sy. 2020-2021Document29 pagesQuarter 2 Summative Test Mapeh 6 Sy. 2020-2021Rinen DebbieNo ratings yet

- Numerical SolutionDocument2 pagesNumerical SolutionAicelleNo ratings yet

- Moving To All-IP Network: Challenges & Solutions: Prashant Shukla Sr. Solutions Architect ECI Telecom March 2012Document25 pagesMoving To All-IP Network: Challenges & Solutions: Prashant Shukla Sr. Solutions Architect ECI Telecom March 2012Beny D SetyawanNo ratings yet

- Part 2Document37 pagesPart 2remino1No ratings yet

- SND 501Document1 pageSND 501nk1969No ratings yet

- Pratiyogita DarpanDocument2 pagesPratiyogita DarpanPavithra SivarajaNo ratings yet

- Sai Vatsavai-Survey-PaperDocument13 pagesSai Vatsavai-Survey-PapertamernadeemNo ratings yet

- VCF NuDocument7 pagesVCF NuJohn GreenNo ratings yet

- 4.1.4 Packet Tracer - ACL Demonstration - ILMDocument3 pages4.1.4 Packet Tracer - ACL Demonstration - ILMlizardohilarioNo ratings yet

- A Multiple Access Protocol For Multimedia Transmission Over Wireless NetworksDocument17 pagesA Multiple Access Protocol For Multimedia Transmission Over Wireless NetworksAIRCC - IJCNCNo ratings yet

- Chapter Three: System Development Life Cycle (SDLC)Document10 pagesChapter Three: System Development Life Cycle (SDLC)Gemechis Lema100% (1)

- Oracle Erp Cloud Implementation Leading Practices WPDocument35 pagesOracle Erp Cloud Implementation Leading Practices WPMiguel Felicio100% (1)

- Peripheral DevicesDocument2 pagesPeripheral Deviceschanty chantyNo ratings yet

- DroneDocument4 pagesDroneheni16belayNo ratings yet

- Feedback and Control System Chapter 1. Introduction To Control SystemDocument9 pagesFeedback and Control System Chapter 1. Introduction To Control SystemJefferson BaptistaNo ratings yet

- 3180 Oximeter: Service ManualDocument30 pages3180 Oximeter: Service Manualalexis jonathanNo ratings yet

- Electronic and Mobile Commerce: Ralph M. Stair - George W. ReynoldsDocument67 pagesElectronic and Mobile Commerce: Ralph M. Stair - George W. ReynoldsClaudia BassonNo ratings yet

- Destructive and Non-Destructive - QuizDocument15 pagesDestructive and Non-Destructive - QuizDiangelia ArtagameNo ratings yet

- Ebook Design For Thermal Key Requirements Qualcomm Technologies Inc Online PDF All ChapterDocument49 pagesEbook Design For Thermal Key Requirements Qualcomm Technologies Inc Online PDF All Chaptercynthia.guerrant485100% (8)

- Chapter 3 - InputDocument32 pagesChapter 3 - InputNur Amira NadiaNo ratings yet

- Question Bank-Unit 2: MATH 2300Document8 pagesQuestion Bank-Unit 2: MATH 2300ROHAN TRIVEDI 20SCSE1180013No ratings yet

- Introduction To Excel - 2022Document44 pagesIntroduction To Excel - 2022Frankie Asido100% (1)