Professional Documents

Culture Documents

Life Insurance: A Non Linked Non Participating Individual Life Savings Insurance Plan

Life Insurance: A Non Linked Non Participating Individual Life Savings Insurance Plan

Uploaded by

nita davidOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Life Insurance: A Non Linked Non Participating Individual Life Savings Insurance Plan

Life Insurance: A Non Linked Non Participating Individual Life Savings Insurance Plan

Uploaded by

nita davidCopyright:

Available Formats

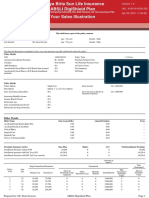

Aditya Birla Sun Life Insurance Version 1.

ABSLI DigiShield Plan UID : 21940002001S01

A Non Linked Non Participating Individual Life Savings Insurance Plan

Apr 09, 2021 11:02:01

Your Sales Illustration

LIFE INSURANCE

Aditya Birla Sun Life Insurance Company Limited

This shall form a part of the policy contract

Proposer Mr. Shyam Mithiya Age : 37 years Gender : Male

Life Insured Mr. Shyam Mithiya Age : 37 years Gender : Male

This benefit illustration is intended to show year wise premiums payable and benefits under the policy:

Policy Details

UIN : 109N108V05 Policy Term : 48 Years

Amount of Installment Premium : Rs. 73,100 Premium Payment Term : 23 Years

Category : Non-Smoker ACI Premium Payment Term : NA

ABG Employee : No ACI Cover Term : NA

Accelerated Critical Illness (ACI) Beneft Sum Assured : NA Pay Frequency : Yearly

Accelerated Critical Illness (ACI) Benefit Installment : NA GST Rate : 4.5%

premium

Policy Details

Policy Option : Single Life Sum Assured : Rs. 10,000,000

Plan Option : Option 9 - Level Cover with Survival

Benefit

Sum Assured Escalation Rate : NA Sum Assured on Death (at : Rs. 10,000,000

inception of policy)

Increasing Monthly Income : NA

Income Benefit Period : NA

Retirement Age : NA

Sum Assured Reduction Factor : NA

Enhanced Life Stage Protection : No

Rider Details

Rider Name Sum Assured(Rs.) Annual Premium Term

Accidental Death Benefit Rider Plus 0.00 0.00 --

Accidental Death & Disability 0.00 0.00 --

Critical Illness 0.00 0.00 --

Surgical Care 0.00 0.00 --

Hospital Care 0.00 0.00 --

Waiver of Premium Rider 0.00 0.00 --

Premium Summary (in Rs.) Base Plan Riders ACI Total Installment Premium

Installment Premium without GST 73,100 0 0 73,100

Installment premium with First Year GST 76,389.5 0 0 76,389.5

Installment Premium with GST 2nd Year onwards 74,744.75 0 0 74,744.75

(Amount in

rupees)

Non

Single/Annualized Premium* Guaranteed Guaranteed

Policy Attn Min

Year Age Survival Special

Other Maturity Guaranteed

During Year Cumulative Benefits/Loyalty Death Benefit Surrender

Benefits(if any) Benefit Surrender

Additions Value

Value

1 37 73,100 73,100 0 0 0 10,000,000 0 0

2 38 73,100 146,200 0 0 0 10,000,000 43,860 8,000

3 39 73,100 219,300 0 0 0 10,000,000 76,755 12,000

4 40 73,100 292,400 0 0 0 10,000,000 146,200 18,000

5 41 73,100 365,500 0 0 0 10,000,000 182,750 24,000

Prepared for: Mr. Shyam Mithiya ABSLI Digishield Plan Page 1

Aditya Birla Sun Life Insurance Version 1.2

ABSLI DigiShield Plan UID : 21940002001S01

A Non Linked Non Participating Individual Life Savings Insurance Plan

Apr 09, 2021 11:02:01

Your Sales Illustration

LIFE INSURANCE

Aditya Birla Sun Life Insurance Company Limited

6 42 73,100 438,600 0 0 0 10,000,000 219,300 31,000

7 43 73,100 511,700 0 0 0 10,000,000 255,850 39,000

8 44 73,100 584,800 0 0 0 10,000,000 298,248 48,000

9 45 73,100 657,900 0 0 0 10,000,000 342,108 59,000

10 46 73,100 731,000 0 0 0 10,000,000 387,430 71,000

11 47 73,100 804,100 0 0 0 10,000,000 434,214 85,000

12 48 73,100 877,200 0 0 0 10,000,000 482,460 100,000

13 49 73,100 950,300 0 0 0 10,000,000 532,168 117,000

14 50 73,100 1,023,400 0 0 0 10,000,000 583,338 137,000

15 51 73,100 1,096,500 0 0 0 10,000,000 635,970 158,000

16 52 73,100 1,169,600 0 0 0 10,000,000 690,064 183,000

17 53 73,100 1,242,700 0 0 0 10,000,000 745,620 210,000

18 54 73,100 1,315,800 0 0 0 10,000,000 802,638 241,000

19 55 73,100 1,388,900 0 0 0 10,000,000 861,118 276,000

20 56 73,100 1,462,000 0 0 0 10,000,000 921,060 314,000

21 57 73,100 1,535,100 0 0 0 10,000,000 982,464 357,000

22 58 73,100 1,608,200 0 0 0 10,000,000 1,045,330 405,000

23 59 73,100 1,681,300 0 0 0 10,000,000 1,109,658 459,000

24 60 0 1,681,300 144,000 0 0 9,868,000 982,471 477,000

25 61 0 1,681,300 144,000 0 0 9,724,000 855,284 494,000

26 62 0 1,681,300 144,000 0 0 9,580,000 728,097 512,000

27 63 0 1,681,300 144,000 0 0 9,436,000 600,910 529,000

28 64 0 1,681,300 144,000 0 0 9,292,000 456,910 545,000

29 65 0 1,681,300 144,000 0 0 9,148,000 329,723 561,000

30 66 0 1,681,300 144,000 0 0 9,004,000 202,536 575,000

31 67 0 1,681,300 144,000 0 0 8,860,000 75,349 588,000

32 68 0 1,681,300 144,000 0 0 8,716,000 0 599,000

33 69 0 1,681,300 144,000 0 0 8,572,000 0 608,000

34 70 0 1,681,300 144,000 0 0 8,428,000 0 614,000

35 71 0 1,681,300 144,000 0 0 8,284,000 0 617,000

36 72 0 1,681,300 144,000 0 0 8,140,000 0 617,000

37 73 0 1,681,300 144,000 0 0 7,996,000 0 612,000

38 74 0 1,681,300 144,000 0 0 7,852,000 0 602,000

39 75 0 1,681,300 144,000 0 0 7,708,000 0 587,000

40 76 0 1,681,300 144,000 0 0 7,564,000 0 564,000

41 77 0 1,681,300 144,000 0 0 7,420,000 0 535,000

42 78 0 1,681,300 144,000 0 0 7,276,000 0 496,000

43 79 0 1,681,300 144,000 0 0 7,132,000 0 447,000

44 80 0 1,681,300 144,000 0 0 6,988,000 0 388,000

45 81 0 1,681,300 144,000 0 0 6,844,000 0 315,000

46 82 0 1,681,300 144,000 0 0 6,700,000 0 227,000

47 83 0 1,681,300 144,000 0 0 6,556,000 0 123,000

48 84 0 1,681,300 144,000 0 0 6,412,000 0 0

Notes: Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, ACI premium, if any, the premiums paid towards the riders, if any and

Goods & Service Tax (if any).

Terminal Illness Benefit

On diagnosis of Terminal Illness while the policy is in force, 50% of the applicable Sum Assured on Death subject to maximum of Rs. 2 Crore, shall be paid in lump sum as

Terminal Illness Benefit. On subsequent death of the Life Insured during the policy term, the Sum Assured on Death shall be reduced by the amount of Terminal Illness

Benefit already paid. TI Benefit is available with all Plan options.

Accelerated Critical Illness Benefit (ACI)

On diagnosis of Critical Illness while the policy is in force,provided the policy holder has opted for the same at policy inception, the chosen ACI Sum Assured shall be paid in

lump sum as Accelerated Critical Illness Benefit. On subsequent death of the Life Insured during the policy term, the Sum Assured on Death shall be reduced by the amount of

Accelerated Critical Illness Benefit already paid. ACI benefit is available with all Plan Options.

Prepared for: Mr. Shyam Mithiya ABSLI Digishield Plan Page 2

Aditya Birla Sun Life Insurance Version 1.2

ABSLI DigiShield Plan UID : 21940002001S01

A Non Linked Non Participating Individual Life Savings Insurance Plan

Apr 09, 2021 11:02:01

Your Sales Illustration

LIFE INSURANCE

Aditya Birla Sun Life Insurance Company Limited

Sum Assured on Death is highest of

• 11 times of the Annualised premium for all ages; or

• 105% of all the Total Premiums paid as on the date of death; or

• Absolute amount assured to be paid on death

I, ............................, have explained the premiums and benefits under the policy I, ............................, having received the information with respect to the above,

fully to the prospect/policyholder. have understood the above statement before entering into the contract.

Place :

Date : 9/4/2021 Date : 9/4/2021

___________________________________ ______________________________

Signature of Agent/Intermediary/ Official Signature of Prospect/Policyholder:

For further details please refer to the product brochure

Aditya Birla Sun Life Insurance Company Limited Reg. No. 109

Prepared for: Mr. Shyam Mithiya ABSLI Digishield Plan Page 3

You might also like

- Life Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance PlanDocument3 pagesLife Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance Plannita davidNo ratings yet

- Life Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance PlanDocument3 pagesLife Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance PlanPavan Kumar TripurariNo ratings yet

- Shankar M Lifeshield 16197 1628753881844Document3 pagesShankar M Lifeshield 16197 1628753881844mohammed hussainNo ratings yet

- Sales Illustration - 008844614 - 153947Document3 pagesSales Illustration - 008844614 - 153947gaurav sharmaNo ratings yet

- Xyz Abslinishchitaayush 24153 1678626707467Document3 pagesXyz Abslinishchitaayush 24153 1678626707467LISHA AVTANINo ratings yet

- Null 15Document5 pagesNull 15Rajat PradhanNo ratings yet

- Kavyansh Khosla Abslinishchitaayush 72995 1710327512997Document3 pagesKavyansh Khosla Abslinishchitaayush 72995 1710327512997gaurav sharmaNo ratings yet

- Investor Abslinishchitaayush 04585 1687152283310Document3 pagesInvestor Abslinishchitaayush 04585 1687152283310Prabhat GuptaNo ratings yet

- Illustration - 2023-11-09T154448.741Document2 pagesIllustration - 2023-11-09T154448.741raamshankar11No ratings yet

- BSH NSH AssuredSavings Illustration 15.02.2024 14.32.31Document2 pagesBSH NSH AssuredSavings Illustration 15.02.2024 14.32.31gaurav sharmaNo ratings yet

- Illustration - 2022-08-31T122344.433Document3 pagesIllustration - 2022-08-31T122344.433Soumen BeraNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- Ab S AssuredSavings Illustration 13.02.2024 10.21.02Document3 pagesAb S AssuredSavings Illustration 13.02.2024 10.21.02gaurav sharmaNo ratings yet

- Illustration - 2023-11-09T153903.144Document2 pagesIllustration - 2023-11-09T153903.144raamshankar11No ratings yet

- Sukhwinder Fortuneelite 24527 1671441783110Document6 pagesSukhwinder Fortuneelite 24527 1671441783110Harish SharmaNo ratings yet

- Illustration Qbbpi722hqyhtDocument3 pagesIllustration Qbbpi722hqyhtMaruti KambleNo ratings yet

- IllustrationDocument2 pagesIllustrationAkash ChauhanNo ratings yet

- Illustration - 2022-08-31T152151.383Document3 pagesIllustration - 2022-08-31T152151.383Soumen BeraNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- Illustration - 2022-08-31T155028.397Document3 pagesIllustration - 2022-08-31T155028.397Soumen BeraNo ratings yet

- 15 Pay 1cr Cover Till 70Document5 pages15 Pay 1cr Cover Till 70venkyNo ratings yet

- Illustr NewDocument2 pagesIllustr NewHar DonNo ratings yet

- IllustrationDocument2 pagesIllustrationRanjit PanigrahiNo ratings yet

- Illustration - 2024-01-09T142300.554Document2 pagesIllustration - 2024-01-09T142300.554Rohit yadavNo ratings yet

- Illustration - 2023-10-14T171945.641Document2 pagesIllustration - 2023-10-14T171945.641abinashsekharmishra1No ratings yet

- Illustration Qbyuu7muxf1cvDocument3 pagesIllustration Qbyuu7muxf1cvajayNo ratings yet

- Illustration Qbbphn08e5mlqDocument4 pagesIllustration Qbbphn08e5mlqMaruti KambleNo ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- CalculationDocument5 pagesCalculationSaurabh GoreNo ratings yet

- Illustration - 2022-11-04T161802.609Document3 pagesIllustration - 2022-11-04T161802.609BLOODY ASHHERNo ratings yet

- Benefit IllustrationDocument2 pagesBenefit IllustrationusefulNo ratings yet

- Hdfc-Illustration - 2022-09-09T113844.627Document3 pagesHdfc-Illustration - 2022-09-09T113844.627srinivasangsrinivasaNo ratings yet

- IllustrationDocument2 pagesIllustrationTushar ChaudhariNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument4 pagesIllustrationvinaagrwalNo ratings yet

- Sanchay Plus Policy DocumentDocument2 pagesSanchay Plus Policy DocumentM V N V PrasadNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Illustration - 2022-08-31T155906.546Document3 pagesIllustration - 2022-08-31T155906.546Soumen BeraNo ratings yet

- VISHAL PURI SalariedSurakshaUlipPlan Illustration 12.06.2024 15.47.34Document5 pagesVISHAL PURI SalariedSurakshaUlipPlan Illustration 12.06.2024 15.47.34gaurav sharmaNo ratings yet

- KFD New06012024143830079 T51Document5 pagesKFD New06012024143830079 T51Mayur NagdiveNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- HDFC Life Guaranteed Income Insurance ( 8 - 16 )Document2 pagesHDFC Life Guaranteed Income Insurance ( 8 - 16 )AbhishekNo ratings yet

- Exide Life Assured Gain Plus-Wed Jun 29 10 - 00 - 09 IST 2022Document3 pagesExide Life Assured Gain Plus-Wed Jun 29 10 - 00 - 09 IST 2022lakshmee262No ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- Illustration - 2023-12-09T151835.539Document2 pagesIllustration - 2023-12-09T151835.539sebinsbstn93No ratings yet

- Dummy Please IgnoreDocument4 pagesDummy Please IgnoreShivam SoniNo ratings yet

- Exide Life Guaranteed Income Insurance Plan1633941626957Document2 pagesExide Life Guaranteed Income Insurance Plan1633941626957Prashant PrinceNo ratings yet

- Illustration 3Document2 pagesIllustration 3Satyaki DuttaNo ratings yet

- Illustration How ToDocument2 pagesIllustration How Toakash agarwalNo ratings yet

- Illustration - 2022-08-31T122247.414Document3 pagesIllustration - 2022-08-31T122247.414Soumen BeraNo ratings yet

- Poonam Lal Wealthaspire 02393 1700292992900Document9 pagesPoonam Lal Wealthaspire 02393 1700292992900gaurav sharmaNo ratings yet

- IllustrationDocument2 pagesIllustrationshaan.sangram190No ratings yet

- IllustrationDocument3 pagesIllustrationBLOODY ASHHERNo ratings yet

- IllustrationDocument3 pagesIllustrationsonuNo ratings yet

- Income + Lump Sum Term Plan (Regular Pay, Cover Till The Age of 75)Document5 pagesIncome + Lump Sum Term Plan (Regular Pay, Cover Till The Age of 75)Ranjit ReddyNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Due Amount: We're ListeningDocument2 pagesDue Amount: We're Listeningnita davidNo ratings yet

- The Covid19 Vaccines: All You Need To Know AboutDocument14 pagesThe Covid19 Vaccines: All You Need To Know Aboutnita davidNo ratings yet

- Life Insurance: This Shall Form A Part of The Policy ContractDocument2 pagesLife Insurance: This Shall Form A Part of The Policy Contractnita davidNo ratings yet

- Life Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance PlanDocument3 pagesLife Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance Plannita davidNo ratings yet

- Group 1: Members: - Sujeet Pandey (Group Leader) - Rahul Kumar Gupta - Daya Jaiswal - Nita DavidDocument66 pagesGroup 1: Members: - Sujeet Pandey (Group Leader) - Rahul Kumar Gupta - Daya Jaiswal - Nita Davidnita davidNo ratings yet

- Shopping Mall Culture in IndiaDocument11 pagesShopping Mall Culture in Indianita davidNo ratings yet

- Letter of Intent FinancierDocument2 pagesLetter of Intent Financiernita davidNo ratings yet

- Group 5Document14 pagesGroup 5Kearn CercadoNo ratings yet

- Lesson 10 Intercompany Transactions Exercise 2 - Suggested AnswersDocument18 pagesLesson 10 Intercompany Transactions Exercise 2 - Suggested AnswersjvNo ratings yet

- (Microsoft Dynamics Navision Technical Consultant) : Building, and MS Power BIDocument8 pages(Microsoft Dynamics Navision Technical Consultant) : Building, and MS Power BIHR Recruiter100% (1)

- Political Economy - A Beginner's CourseDocument232 pagesPolitical Economy - A Beginner's CourseFelipe RodriguesNo ratings yet

- AP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSDocument40 pagesAP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSBebie Joy Urbano100% (1)

- 370icap 13 10 2021Document3 pages370icap 13 10 2021Boniface BaleleNo ratings yet

- B0701C PDF EngDocument5 pagesB0701C PDF EngRohit PanditNo ratings yet

- RA 7652 Investors Lease ActDocument3 pagesRA 7652 Investors Lease ActPatrick Rommel PajarinNo ratings yet

- Aim Methodology Activities and DocumentsDocument7 pagesAim Methodology Activities and DocumentsKiran NambariNo ratings yet

- Abdul Qadeer Arshad-ACCADocument3 pagesAbdul Qadeer Arshad-ACCANasir AhmedNo ratings yet

- H.j.heinz M & A Kel848-PDF-Eng - UnlockedDocument25 pagesH.j.heinz M & A Kel848-PDF-Eng - UnlockedHasanNo ratings yet

- Boc Aviation Glossary of TermsDocument3 pagesBoc Aviation Glossary of TermsRajendra KumarNo ratings yet

- Samahan NG Optometrists Sa Pilipinas v. AcebeoDocument2 pagesSamahan NG Optometrists Sa Pilipinas v. AcebeoIvee OngNo ratings yet

- CavinKares Indica Easy T6 PDFDocument12 pagesCavinKares Indica Easy T6 PDFriya agrawallaNo ratings yet

- G20 DIA SUMMIT 2023 Exhibitor Directory v3Document129 pagesG20 DIA SUMMIT 2023 Exhibitor Directory v3akhiltejaNo ratings yet

- Unit 5 Market SegmentationDocument23 pagesUnit 5 Market SegmentationUyen ThuNo ratings yet

- OpenText Data Archiving For SAP Solutions Product OverviewDocument2 pagesOpenText Data Archiving For SAP Solutions Product OverviewChakravarthy Vedula VSSSNo ratings yet

- Intermediate Accounting 3 Valix Chapter 12 ProblemsDocument9 pagesIntermediate Accounting 3 Valix Chapter 12 ProblemsAlicia Summer100% (1)

- Submission of Requirements For Appointment For ReclassificationDocument3 pagesSubmission of Requirements For Appointment For ReclassificationSibs Academic ServicesNo ratings yet

- Storage Handling & TransportationDocument4 pagesStorage Handling & TransportationAzzeddine GundNo ratings yet

- Griffiths CaseDocument13 pagesGriffiths CaseMERCY LAWNo ratings yet

- V SRMT 2Document10 pagesV SRMT 2Aeshvery RajouraNo ratings yet

- Store Procedure OFILAMDocument60 pagesStore Procedure OFILAMCarbin VinojiNo ratings yet

- Companies and Business Booklet 2021Document65 pagesCompanies and Business Booklet 2021Benjamin BandaNo ratings yet

- Sovereign BookDocument35 pagesSovereign BookJoe JoeNo ratings yet

- Ground Handling in AsiaDocument34 pagesGround Handling in AsiaBảo ĐứcNo ratings yet

- Tna Confectionery Brochure (EN)Document3 pagesTna Confectionery Brochure (EN)Bindu PanickerNo ratings yet

- Historical PerspectivesDocument307 pagesHistorical PerspectivesBilderCenterNo ratings yet

- Invoice 43904700Document1 pageInvoice 43904700Sandra IvanovićNo ratings yet

- Account Statement: Account Details Customer DetailsDocument4 pagesAccount Statement: Account Details Customer DetailsIJeoma KellyNo ratings yet