Professional Documents

Culture Documents

1.hilado v. CIR, 100 Phil 288

1.hilado v. CIR, 100 Phil 288

Uploaded by

Jo DevisCopyright:

Available Formats

You might also like

- Payslip Nov - Sailu1Document2 pagesPayslip Nov - Sailu1Christine Hall0% (1)

- Tan V Del Rosario DigestDocument2 pagesTan V Del Rosario DigestJA Quibz100% (1)

- Agreement For Providing Permanent Alternate Accommodation To The Tenant On Ownership Basis in Lieu of Tenanted Premises by A DeveloperDocument8 pagesAgreement For Providing Permanent Alternate Accommodation To The Tenant On Ownership Basis in Lieu of Tenanted Premises by A DeveloperSiddharth ShahNo ratings yet

- Case Digest Cir vs. BoacDocument1 pageCase Digest Cir vs. BoacAnn SC100% (5)

- Mactan Cebu International Airport Authority v. MarcosDocument2 pagesMactan Cebu International Airport Authority v. MarcosKabataan Party-List100% (5)

- Consti2Digest - Sison Vs Ancheta, 130 SCRA 654, 1984Document3 pagesConsti2Digest - Sison Vs Ancheta, 130 SCRA 654, 1984Lu CasNo ratings yet

- Manila International Airport Authority vs. City of PasayDocument3 pagesManila International Airport Authority vs. City of Pasayasg_jing100% (3)

- Philex Mining Vs Cir DigestDocument3 pagesPhilex Mining Vs Cir DigestRyan Acosta100% (2)

- CIR V CA, CTA, YMCADocument2 pagesCIR V CA, CTA, YMCAChil Belgira100% (3)

- CIR v. Algue, Inc., G.R. No. L-28896Document1 pageCIR v. Algue, Inc., G.R. No. L-28896fay garneth buscato100% (2)

- Hilado vs. CIRDocument2 pagesHilado vs. CIRAlan Gultia100% (2)

- Roxas v. CTADocument2 pagesRoxas v. CTAJf ManejaNo ratings yet

- Republic v. Mambulao Lumber Co.Document2 pagesRepublic v. Mambulao Lumber Co.Joni Aquino50% (2)

- LORENZO Vs POSADAS G.R. No. L-43082 June 18, 1937Document3 pagesLORENZO Vs POSADAS G.R. No. L-43082 June 18, 1937Francise Mae Montilla Mordeno100% (3)

- Manila Gas Corporation v. The Collector of Internal RevenueDocument1 pageManila Gas Corporation v. The Collector of Internal RevenueRNicolo Ballesteros100% (1)

- G.R. No. 109289 October 3, 1994 TAN V. DEL ROSARIO FACTS FactsDocument1 pageG.R. No. 109289 October 3, 1994 TAN V. DEL ROSARIO FACTS FactsGeorginaNo ratings yet

- Paseo Realty & Dev. Corp. vs. CA, CTA, and CIR Case DigestDocument2 pagesPaseo Realty & Dev. Corp. vs. CA, CTA, and CIR Case DigestReniel Eda100% (2)

- Chamber of Real Estate and Builders' Assoc. Vs Hon. Exec. Sec. Alberto RomuloDocument2 pagesChamber of Real Estate and Builders' Assoc. Vs Hon. Exec. Sec. Alberto RomuloRhea Mae Lasay-Sumpiao100% (1)

- Republic V Mambulao Lumber Company, Et Al GR No L-17725, February 28, 1962Document1 pageRepublic V Mambulao Lumber Company, Et Al GR No L-17725, February 28, 1962franzadonNo ratings yet

- Cervantes Vs Auditor General, 91 SCRA 359 Case Digest (Administrative Law)Document1 pageCervantes Vs Auditor General, 91 SCRA 359 Case Digest (Administrative Law)AizaFerrerEbina100% (3)

- G.R. No. L-19842 December 26, 1969 REPUBLIC OF THE PHILIPPINES, Plaintiff-Appellee, CENTRAL AZUCARERA DEL DANAO, Defendant-Appellant. FactsDocument8 pagesG.R. No. L-19842 December 26, 1969 REPUBLIC OF THE PHILIPPINES, Plaintiff-Appellee, CENTRAL AZUCARERA DEL DANAO, Defendant-Appellant. FactstwIzNo ratings yet

- PAL v. Edu DigestDocument1 pagePAL v. Edu Digestpinkblush717100% (1)

- 5 Chavez Vs Ongpin - DigestDocument2 pages5 Chavez Vs Ongpin - DigestGilbert Mendoza100% (5)

- Philex Mining Corporation vs. CIRDocument3 pagesPhilex Mining Corporation vs. CIRRobNo ratings yet

- Phil Guaranty V CIR DigestDocument2 pagesPhil Guaranty V CIR DigestMaria Reylan Garcia100% (2)

- CITY OF BAGUIO V. FORTUNATO DE LEON, 25 SCRA 938 - PUBLIC PURPOSE - EQUAL PROTECTION - DigestDocument1 pageCITY OF BAGUIO V. FORTUNATO DE LEON, 25 SCRA 938 - PUBLIC PURPOSE - EQUAL PROTECTION - DigestKate GaroNo ratings yet

- Tax Case Digest: PB Com V. CIR (1999) : G.R. No. 112024Document2 pagesTax Case Digest: PB Com V. CIR (1999) : G.R. No. 112024RexNo ratings yet

- Hilado vs. CIRDocument1 pageHilado vs. CIRAlan GultiaNo ratings yet

- Tan v. Del Rosario DigestDocument2 pagesTan v. Del Rosario DigestDGDelfin100% (2)

- Lorenzo v. Posadas Case DigestDocument2 pagesLorenzo v. Posadas Case DigestPatrick Anthony Llasus-NafarreteNo ratings yet

- Reyes v. AlmanzorDocument5 pagesReyes v. AlmanzorPatricia BautistaNo ratings yet

- Commissioner of Internal Revenue Vs Isabela Cultural CorporationDocument2 pagesCommissioner of Internal Revenue Vs Isabela Cultural CorporationKim Lorenzo Calatrava100% (4)

- CIR v. CADocument2 pagesCIR v. CAKristina Karen100% (1)

- Caltex v. COA DigestDocument2 pagesCaltex v. COA Digestpinkblush717100% (1)

- J. CASANOVAS Vs JNO. S. HORD 8 Phil 125 Case DigestDocument1 pageJ. CASANOVAS Vs JNO. S. HORD 8 Phil 125 Case DigestzanjknightNo ratings yet

- Diaz Vs Secretary of FinanceDocument3 pagesDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- CIR vs. Yutivo and Sons (G.R. No. L-13203 January 28, 1961) - H DIGESTDocument2 pagesCIR vs. Yutivo and Sons (G.R. No. L-13203 January 28, 1961) - H DIGESTHarleneNo ratings yet

- Roxas v. RaffertyDocument2 pagesRoxas v. RaffertySophiaFrancescaEspinosaNo ratings yet

- G.R. No. L-53961Document1 pageG.R. No. L-53961Jannie Ann DayandayanNo ratings yet

- American Mail Line V City of BasilanDocument1 pageAmerican Mail Line V City of BasilanDenise Lim0% (1)

- TAX-Villanueva vs. City of IloiloDocument2 pagesTAX-Villanueva vs. City of IloiloJoesil Dianne67% (3)

- Paseo Realty & Development Corporation vs. Court of AppealsDocument12 pagesPaseo Realty & Development Corporation vs. Court of AppealsMp CasNo ratings yet

- Collector v. UstDocument2 pagesCollector v. UstEynab PerezNo ratings yet

- National Development Company Vs CIRDocument7 pagesNational Development Company Vs CIRIvy ZaldarriagaNo ratings yet

- CIR V Marubeni CorpDocument2 pagesCIR V Marubeni CorpJaz Sumalinog75% (8)

- Silkair vs. CirDocument2 pagesSilkair vs. CirKath Leen100% (1)

- Basilan Estates Vs CIRDocument2 pagesBasilan Estates Vs CIRKim Lorenzo Calatrava100% (1)

- Bpi V Cir DigestDocument3 pagesBpi V Cir DigestkathrynmaydevezaNo ratings yet

- Caltex Philippines V CoaDocument1 pageCaltex Philippines V CoaJL A H-Dimaculangan100% (3)

- Phil. Guaranty Co. v. CIRDocument2 pagesPhil. Guaranty Co. v. CIRIshNo ratings yet

- PAL Vs EDUDocument2 pagesPAL Vs EDUCamille Benjamin RemorozaNo ratings yet

- Victorias Milling V Municipality of Victorias DigestDocument1 pageVictorias Milling V Municipality of Victorias Digestgel94100% (2)

- Esso Standard Eastern, Inc Vs CirDocument2 pagesEsso Standard Eastern, Inc Vs CirCeresjudicata100% (1)

- Procter & Gamble V Municipality of JagnaDocument2 pagesProcter & Gamble V Municipality of JagnaJackie Canlas100% (3)

- Serafica v. City Treasurer of OrmocDocument1 pageSerafica v. City Treasurer of OrmocEarl LarroderNo ratings yet

- Philippine Acetylene Co. Inc vs. CirDocument2 pagesPhilippine Acetylene Co. Inc vs. Cirbrendamanganaan100% (1)

- Progressive Development Corporation v. Quezon CityDocument1 pageProgressive Development Corporation v. Quezon Cityfranzadon100% (1)

- CIR vs. ST Lukes DigestDocument2 pagesCIR vs. ST Lukes DigestKath Leen100% (4)

- Hilado vs. CIRDocument3 pagesHilado vs. CIRadeleNo ratings yet

- Tax Part 1Document23 pagesTax Part 1Christian James ChuNo ratings yet

- Hilado v. CIR, G.R. No. L-9408 (October 31, 1956)Document6 pagesHilado v. CIR, G.R. No. L-9408 (October 31, 1956)Lou AquinoNo ratings yet

- 07 - Interpretative RulesDocument13 pages07 - Interpretative RulesFe A. BartolomeNo ratings yet

- Manila Race Horse Trainers AssociationDocument1 pageManila Race Horse Trainers AssociationJo Devis100% (1)

- Suroza v. HonradoDocument2 pagesSuroza v. HonradoJo DevisNo ratings yet

- Nera vs. RimandoDocument1 pageNera vs. RimandoJo DevisNo ratings yet

- Collector v. Yuseco, 3 SCRA 313Document1 pageCollector v. Yuseco, 3 SCRA 313Jo DevisNo ratings yet

- Cir vs. Pineda, 21 Scra 105 PDFDocument1 pageCir vs. Pineda, 21 Scra 105 PDFJo DevisNo ratings yet

- Paseo Realty and Dev't. Corp. v. CA, 309 SCRA 402Document2 pagesPaseo Realty and Dev't. Corp. v. CA, 309 SCRA 402Jo DevisNo ratings yet

- TUZON v. COURT OF APPEALSDocument1 pageTUZON v. COURT OF APPEALSJo DevisNo ratings yet

- Cir vs. Pineda, 21 Scra 105 PDFDocument1 pageCir vs. Pineda, 21 Scra 105 PDFJo DevisNo ratings yet

- CIR Vs CADocument2 pagesCIR Vs CAJo DevisNo ratings yet

- 42.gaston vs. Republic Planter's Bank 158 Scra 626Document1 page42.gaston vs. Republic Planter's Bank 158 Scra 626Jo DevisNo ratings yet

- CIR v. Algue, Inc.Document1 pageCIR v. Algue, Inc.Jo DevisNo ratings yet

- Gerochi Vs DOEDocument1 pageGerochi Vs DOEJo DevisNo ratings yet

- Estela and CrisostomoDocument4 pagesEstela and CrisostomoJo DevisNo ratings yet

- Cir vs. Pineda, 21 Scra 105Document1 pageCir vs. Pineda, 21 Scra 105Jo DevisNo ratings yet

- Motion For Reconsideration Is DeniedDocument2 pagesMotion For Reconsideration Is DeniedJo DevisNo ratings yet

- G.R. No. 159796Document13 pagesG.R. No. 159796Jo DevisNo ratings yet

- G.R. No. 108358Document4 pagesG.R. No. 108358Jo DevisNo ratings yet

- G.R. No. L-19707Document6 pagesG.R. No. L-19707Jo DevisNo ratings yet

- Chapter 13Document11 pagesChapter 13Avox EverdeenNo ratings yet

- Jonathan Mutukwa Second ReportDocument40 pagesJonathan Mutukwa Second ReportRUVARASHE TENDAYINo ratings yet

- Mactan-Cebu International Airport Authority (MCIAA) vs. City of Lapu-Lapu, 757 SCRA 323, June 15, 2015Document65 pagesMactan-Cebu International Airport Authority (MCIAA) vs. City of Lapu-Lapu, 757 SCRA 323, June 15, 2015Jane BandojaNo ratings yet

- Annexure I - Vinay SharmaDocument1 pageAnnexure I - Vinay SharmaVinay SharmaNo ratings yet

- Analysis of Mutual Fund: Stock Vs Mutual FundsDocument2 pagesAnalysis of Mutual Fund: Stock Vs Mutual FundsSamyu MemoriesNo ratings yet

- ShehnaiDocument17 pagesShehnaiArpit PandeyNo ratings yet

- Jun 2023 110874Document1 pageJun 2023 110874augus1982No ratings yet

- Coca Cola Co Balance SheetDocument2 pagesCoca Cola Co Balance SheetDevender SinghNo ratings yet

- Commissioner of Internal Revenue vs. Deutsche Knowledge Services, Pte. LTD., 807 SCRA 90, November 07, 2016Document12 pagesCommissioner of Internal Revenue vs. Deutsche Knowledge Services, Pte. LTD., 807 SCRA 90, November 07, 2016Vida MarieNo ratings yet

- Construction Equipment Management and Analysis of Multi-Storied Building Phase-IDocument77 pagesConstruction Equipment Management and Analysis of Multi-Storied Building Phase-Iyared admassuNo ratings yet

- Social Cost Benefit AnalysisDocument7 pagesSocial Cost Benefit AnalysislovleshrubyNo ratings yet

- CMS Renewables Guide 2020Document170 pagesCMS Renewables Guide 2020Szymon StrzelczykNo ratings yet

- ADIT Prospectus 2018Document40 pagesADIT Prospectus 2018Alan HgNo ratings yet

- Quiz 1 PrelimDocument2 pagesQuiz 1 PrelimMicaella DanoNo ratings yet

- Instructions FOR: Small Estate AffidavitDocument17 pagesInstructions FOR: Small Estate AffidavitJohn29999No ratings yet

- Animation Auction 58Document256 pagesAnimation Auction 58Valter SchuelerNo ratings yet

- Athens Views Issue No 3Document31 pagesAthens Views Issue No 3Misyrlena EgkolfopoulouNo ratings yet

- Unit Cost Analysis.2019Document1 pageUnit Cost Analysis.2019Edwin Tapit JrNo ratings yet

- United Leasing Company LimitedDocument46 pagesUnited Leasing Company LimitedTanjina RahmanNo ratings yet

- PAk Suzuki Motors PresentationDocument41 pagesPAk Suzuki Motors PresentationAZAM WAQASNo ratings yet

- InvoiceDocument1 pageInvoiceRamanjaneya ReddyNo ratings yet

- Denim JeansDocument21 pagesDenim JeansFăÍż SăįYąð100% (1)

- PGBP - May 2024 & June 2024Document10 pagesPGBP - May 2024 & June 2024shauryaaaaa22kNo ratings yet

- 06 11 Merger Model Quiz Questions Advanced PDFDocument17 pages06 11 Merger Model Quiz Questions Advanced PDFVarun AgarwalNo ratings yet

- Lesson 1 Financial Objectves of The Different Types of OrganizationsDocument41 pagesLesson 1 Financial Objectves of The Different Types of OrganizationsKissel Jade Barsalote SarnoNo ratings yet

- BY: Ynigesu Minchil Felekech Gizawu Selam Tesfaye Yohanis Petiros Ashenafi AshagrieDocument6 pagesBY: Ynigesu Minchil Felekech Gizawu Selam Tesfaye Yohanis Petiros Ashenafi AshagrieASHENAFI ASHAGRIENo ratings yet

- Two Centuries of TariffsDocument146 pagesTwo Centuries of TariffsStephen LoiaconiNo ratings yet

- Taxation XIDocument179 pagesTaxation XIAleti NithishNo ratings yet

1.hilado v. CIR, 100 Phil 288

1.hilado v. CIR, 100 Phil 288

Uploaded by

Jo DevisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1.hilado v. CIR, 100 Phil 288

1.hilado v. CIR, 100 Phil 288

Uploaded by

Jo DevisCopyright:

Available Formats

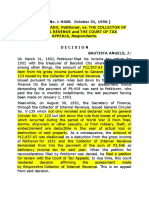

1. Hilado v.

CIR, 100 Phil 288

Topic: Nature of Internal Revenue Law

Facts:

Emilio Hilado filed for his 1951 Income Tax Return on March 31, 2020 with the treasurer of Bacolod City.

He claimed, among other things, the deduction of P 12,831.65 from his gross income pursuant to General

Circular No. V-123 issued by the Collector of Internal Revenue. However, on August 30,1962, the

Secretary of Finance, through the Collector issued General Circular No. V-139 which revoked and

declared General Circular V-123 void. It also laid down the rule that losses of property which occurred

during the period of World War II from fires, storms, shipwreck or other casualty, or from robbery or

theft or embezzlement are deductible in the year of actual loss or destruction of said property. As a

consequence, the amount of P12,837.65 was disallowed as a deduction from the gross income

of Petitioner for 1951 and the Collector of Internal Revenue demanded from him the payment of the sum

of P3,546 as deficiency income tax for said year.

Issue:

1. Whether Hilado contention that during the war and as consequence of enemy occupation “there

was no taxable year” within the meaning of our internal revenue laws because during that period

they were unenforceable is valid.

2. Whether the General Circular No. V-139 cannot be given retroactive effect

Ruling:

1. No, the Court ruled that this is without merit . It is well known that our internal revenue laws

are not political in nature and as such were continued in force during the period of enemy

occupation and in effect were actually enforced by the occupation government. As a matter of

fact, income tax returns were filed during that period and income tax payment were effected and

considered valid and legal. Such tax laws are deemed to be the laws of the occupied territory and

not of the occupying enemy.

“Furthermore, it is a legal maxim, that excepting that of a political nature, ‘Law once established

continues until changed by some competent legislative power. It is not changed merely by

change of sovereignty.’ (Joseph H. Beale, Cases on Conflict of Laws, III, Summary section 9,

citing Commonwealth vs. Chapman, 13 Met., 68.) As the same author says, in his Treatise on the

Conflict of Laws (Cambridge, 1916, section 131):c ‘There can be no break or interregnum in law.

From the time the law comes into existence with the first-felt corporateness of a primitive people

it must last until the final disappearance of human society. Once created, it persists until a

change takes place, and when changed it continues in such changed condition until the next

change and so forever. Conquest or colonization is impotent to bring law to an end; inspite of

change of constitution, the law continues unchanged until the new sovereign by legislative act

creates a change.’“(Co Kim Chan vs. Valdes Tan Keh and Dizon, 75 Phil., 113, 142-143.)

2. No. It can suffice to say that General Circular No. V-123, cannot give rise to a vested right that

can be invoked by a taxpayer. The reason is obvious: a vested right cannot spring from a wrong

interpretation. “It seems too clear for serious argument that an administrative officer cannot

change a law enacted by Congress. A regulation that is merely an interpretation of the statute

when once determined to have been erroneous becomes nullity. An erroneous construction of the

law by the Treasury Department or the collector of internal revenue does not preclude or estop

the government from collecting a tax which is legally due.” (Ben Stocker, et al., 12 B. T. A., 1351.)

“Art. 2254. — No vested or acquired right can arise from acts or omissions which are against the law or

which infringe upon the rights of others.” (Article 2254, New Civil Code.)

You might also like

- Payslip Nov - Sailu1Document2 pagesPayslip Nov - Sailu1Christine Hall0% (1)

- Tan V Del Rosario DigestDocument2 pagesTan V Del Rosario DigestJA Quibz100% (1)

- Agreement For Providing Permanent Alternate Accommodation To The Tenant On Ownership Basis in Lieu of Tenanted Premises by A DeveloperDocument8 pagesAgreement For Providing Permanent Alternate Accommodation To The Tenant On Ownership Basis in Lieu of Tenanted Premises by A DeveloperSiddharth ShahNo ratings yet

- Case Digest Cir vs. BoacDocument1 pageCase Digest Cir vs. BoacAnn SC100% (5)

- Mactan Cebu International Airport Authority v. MarcosDocument2 pagesMactan Cebu International Airport Authority v. MarcosKabataan Party-List100% (5)

- Consti2Digest - Sison Vs Ancheta, 130 SCRA 654, 1984Document3 pagesConsti2Digest - Sison Vs Ancheta, 130 SCRA 654, 1984Lu CasNo ratings yet

- Manila International Airport Authority vs. City of PasayDocument3 pagesManila International Airport Authority vs. City of Pasayasg_jing100% (3)

- Philex Mining Vs Cir DigestDocument3 pagesPhilex Mining Vs Cir DigestRyan Acosta100% (2)

- CIR V CA, CTA, YMCADocument2 pagesCIR V CA, CTA, YMCAChil Belgira100% (3)

- CIR v. Algue, Inc., G.R. No. L-28896Document1 pageCIR v. Algue, Inc., G.R. No. L-28896fay garneth buscato100% (2)

- Hilado vs. CIRDocument2 pagesHilado vs. CIRAlan Gultia100% (2)

- Roxas v. CTADocument2 pagesRoxas v. CTAJf ManejaNo ratings yet

- Republic v. Mambulao Lumber Co.Document2 pagesRepublic v. Mambulao Lumber Co.Joni Aquino50% (2)

- LORENZO Vs POSADAS G.R. No. L-43082 June 18, 1937Document3 pagesLORENZO Vs POSADAS G.R. No. L-43082 June 18, 1937Francise Mae Montilla Mordeno100% (3)

- Manila Gas Corporation v. The Collector of Internal RevenueDocument1 pageManila Gas Corporation v. The Collector of Internal RevenueRNicolo Ballesteros100% (1)

- G.R. No. 109289 October 3, 1994 TAN V. DEL ROSARIO FACTS FactsDocument1 pageG.R. No. 109289 October 3, 1994 TAN V. DEL ROSARIO FACTS FactsGeorginaNo ratings yet

- Paseo Realty & Dev. Corp. vs. CA, CTA, and CIR Case DigestDocument2 pagesPaseo Realty & Dev. Corp. vs. CA, CTA, and CIR Case DigestReniel Eda100% (2)

- Chamber of Real Estate and Builders' Assoc. Vs Hon. Exec. Sec. Alberto RomuloDocument2 pagesChamber of Real Estate and Builders' Assoc. Vs Hon. Exec. Sec. Alberto RomuloRhea Mae Lasay-Sumpiao100% (1)

- Republic V Mambulao Lumber Company, Et Al GR No L-17725, February 28, 1962Document1 pageRepublic V Mambulao Lumber Company, Et Al GR No L-17725, February 28, 1962franzadonNo ratings yet

- Cervantes Vs Auditor General, 91 SCRA 359 Case Digest (Administrative Law)Document1 pageCervantes Vs Auditor General, 91 SCRA 359 Case Digest (Administrative Law)AizaFerrerEbina100% (3)

- G.R. No. L-19842 December 26, 1969 REPUBLIC OF THE PHILIPPINES, Plaintiff-Appellee, CENTRAL AZUCARERA DEL DANAO, Defendant-Appellant. FactsDocument8 pagesG.R. No. L-19842 December 26, 1969 REPUBLIC OF THE PHILIPPINES, Plaintiff-Appellee, CENTRAL AZUCARERA DEL DANAO, Defendant-Appellant. FactstwIzNo ratings yet

- PAL v. Edu DigestDocument1 pagePAL v. Edu Digestpinkblush717100% (1)

- 5 Chavez Vs Ongpin - DigestDocument2 pages5 Chavez Vs Ongpin - DigestGilbert Mendoza100% (5)

- Philex Mining Corporation vs. CIRDocument3 pagesPhilex Mining Corporation vs. CIRRobNo ratings yet

- Phil Guaranty V CIR DigestDocument2 pagesPhil Guaranty V CIR DigestMaria Reylan Garcia100% (2)

- CITY OF BAGUIO V. FORTUNATO DE LEON, 25 SCRA 938 - PUBLIC PURPOSE - EQUAL PROTECTION - DigestDocument1 pageCITY OF BAGUIO V. FORTUNATO DE LEON, 25 SCRA 938 - PUBLIC PURPOSE - EQUAL PROTECTION - DigestKate GaroNo ratings yet

- Tax Case Digest: PB Com V. CIR (1999) : G.R. No. 112024Document2 pagesTax Case Digest: PB Com V. CIR (1999) : G.R. No. 112024RexNo ratings yet

- Hilado vs. CIRDocument1 pageHilado vs. CIRAlan GultiaNo ratings yet

- Tan v. Del Rosario DigestDocument2 pagesTan v. Del Rosario DigestDGDelfin100% (2)

- Lorenzo v. Posadas Case DigestDocument2 pagesLorenzo v. Posadas Case DigestPatrick Anthony Llasus-NafarreteNo ratings yet

- Reyes v. AlmanzorDocument5 pagesReyes v. AlmanzorPatricia BautistaNo ratings yet

- Commissioner of Internal Revenue Vs Isabela Cultural CorporationDocument2 pagesCommissioner of Internal Revenue Vs Isabela Cultural CorporationKim Lorenzo Calatrava100% (4)

- CIR v. CADocument2 pagesCIR v. CAKristina Karen100% (1)

- Caltex v. COA DigestDocument2 pagesCaltex v. COA Digestpinkblush717100% (1)

- J. CASANOVAS Vs JNO. S. HORD 8 Phil 125 Case DigestDocument1 pageJ. CASANOVAS Vs JNO. S. HORD 8 Phil 125 Case DigestzanjknightNo ratings yet

- Diaz Vs Secretary of FinanceDocument3 pagesDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- CIR vs. Yutivo and Sons (G.R. No. L-13203 January 28, 1961) - H DIGESTDocument2 pagesCIR vs. Yutivo and Sons (G.R. No. L-13203 January 28, 1961) - H DIGESTHarleneNo ratings yet

- Roxas v. RaffertyDocument2 pagesRoxas v. RaffertySophiaFrancescaEspinosaNo ratings yet

- G.R. No. L-53961Document1 pageG.R. No. L-53961Jannie Ann DayandayanNo ratings yet

- American Mail Line V City of BasilanDocument1 pageAmerican Mail Line V City of BasilanDenise Lim0% (1)

- TAX-Villanueva vs. City of IloiloDocument2 pagesTAX-Villanueva vs. City of IloiloJoesil Dianne67% (3)

- Paseo Realty & Development Corporation vs. Court of AppealsDocument12 pagesPaseo Realty & Development Corporation vs. Court of AppealsMp CasNo ratings yet

- Collector v. UstDocument2 pagesCollector v. UstEynab PerezNo ratings yet

- National Development Company Vs CIRDocument7 pagesNational Development Company Vs CIRIvy ZaldarriagaNo ratings yet

- CIR V Marubeni CorpDocument2 pagesCIR V Marubeni CorpJaz Sumalinog75% (8)

- Silkair vs. CirDocument2 pagesSilkair vs. CirKath Leen100% (1)

- Basilan Estates Vs CIRDocument2 pagesBasilan Estates Vs CIRKim Lorenzo Calatrava100% (1)

- Bpi V Cir DigestDocument3 pagesBpi V Cir DigestkathrynmaydevezaNo ratings yet

- Caltex Philippines V CoaDocument1 pageCaltex Philippines V CoaJL A H-Dimaculangan100% (3)

- Phil. Guaranty Co. v. CIRDocument2 pagesPhil. Guaranty Co. v. CIRIshNo ratings yet

- PAL Vs EDUDocument2 pagesPAL Vs EDUCamille Benjamin RemorozaNo ratings yet

- Victorias Milling V Municipality of Victorias DigestDocument1 pageVictorias Milling V Municipality of Victorias Digestgel94100% (2)

- Esso Standard Eastern, Inc Vs CirDocument2 pagesEsso Standard Eastern, Inc Vs CirCeresjudicata100% (1)

- Procter & Gamble V Municipality of JagnaDocument2 pagesProcter & Gamble V Municipality of JagnaJackie Canlas100% (3)

- Serafica v. City Treasurer of OrmocDocument1 pageSerafica v. City Treasurer of OrmocEarl LarroderNo ratings yet

- Philippine Acetylene Co. Inc vs. CirDocument2 pagesPhilippine Acetylene Co. Inc vs. Cirbrendamanganaan100% (1)

- Progressive Development Corporation v. Quezon CityDocument1 pageProgressive Development Corporation v. Quezon Cityfranzadon100% (1)

- CIR vs. ST Lukes DigestDocument2 pagesCIR vs. ST Lukes DigestKath Leen100% (4)

- Hilado vs. CIRDocument3 pagesHilado vs. CIRadeleNo ratings yet

- Tax Part 1Document23 pagesTax Part 1Christian James ChuNo ratings yet

- Hilado v. CIR, G.R. No. L-9408 (October 31, 1956)Document6 pagesHilado v. CIR, G.R. No. L-9408 (October 31, 1956)Lou AquinoNo ratings yet

- 07 - Interpretative RulesDocument13 pages07 - Interpretative RulesFe A. BartolomeNo ratings yet

- Manila Race Horse Trainers AssociationDocument1 pageManila Race Horse Trainers AssociationJo Devis100% (1)

- Suroza v. HonradoDocument2 pagesSuroza v. HonradoJo DevisNo ratings yet

- Nera vs. RimandoDocument1 pageNera vs. RimandoJo DevisNo ratings yet

- Collector v. Yuseco, 3 SCRA 313Document1 pageCollector v. Yuseco, 3 SCRA 313Jo DevisNo ratings yet

- Cir vs. Pineda, 21 Scra 105 PDFDocument1 pageCir vs. Pineda, 21 Scra 105 PDFJo DevisNo ratings yet

- Paseo Realty and Dev't. Corp. v. CA, 309 SCRA 402Document2 pagesPaseo Realty and Dev't. Corp. v. CA, 309 SCRA 402Jo DevisNo ratings yet

- TUZON v. COURT OF APPEALSDocument1 pageTUZON v. COURT OF APPEALSJo DevisNo ratings yet

- Cir vs. Pineda, 21 Scra 105 PDFDocument1 pageCir vs. Pineda, 21 Scra 105 PDFJo DevisNo ratings yet

- CIR Vs CADocument2 pagesCIR Vs CAJo DevisNo ratings yet

- 42.gaston vs. Republic Planter's Bank 158 Scra 626Document1 page42.gaston vs. Republic Planter's Bank 158 Scra 626Jo DevisNo ratings yet

- CIR v. Algue, Inc.Document1 pageCIR v. Algue, Inc.Jo DevisNo ratings yet

- Gerochi Vs DOEDocument1 pageGerochi Vs DOEJo DevisNo ratings yet

- Estela and CrisostomoDocument4 pagesEstela and CrisostomoJo DevisNo ratings yet

- Cir vs. Pineda, 21 Scra 105Document1 pageCir vs. Pineda, 21 Scra 105Jo DevisNo ratings yet

- Motion For Reconsideration Is DeniedDocument2 pagesMotion For Reconsideration Is DeniedJo DevisNo ratings yet

- G.R. No. 159796Document13 pagesG.R. No. 159796Jo DevisNo ratings yet

- G.R. No. 108358Document4 pagesG.R. No. 108358Jo DevisNo ratings yet

- G.R. No. L-19707Document6 pagesG.R. No. L-19707Jo DevisNo ratings yet

- Chapter 13Document11 pagesChapter 13Avox EverdeenNo ratings yet

- Jonathan Mutukwa Second ReportDocument40 pagesJonathan Mutukwa Second ReportRUVARASHE TENDAYINo ratings yet

- Mactan-Cebu International Airport Authority (MCIAA) vs. City of Lapu-Lapu, 757 SCRA 323, June 15, 2015Document65 pagesMactan-Cebu International Airport Authority (MCIAA) vs. City of Lapu-Lapu, 757 SCRA 323, June 15, 2015Jane BandojaNo ratings yet

- Annexure I - Vinay SharmaDocument1 pageAnnexure I - Vinay SharmaVinay SharmaNo ratings yet

- Analysis of Mutual Fund: Stock Vs Mutual FundsDocument2 pagesAnalysis of Mutual Fund: Stock Vs Mutual FundsSamyu MemoriesNo ratings yet

- ShehnaiDocument17 pagesShehnaiArpit PandeyNo ratings yet

- Jun 2023 110874Document1 pageJun 2023 110874augus1982No ratings yet

- Coca Cola Co Balance SheetDocument2 pagesCoca Cola Co Balance SheetDevender SinghNo ratings yet

- Commissioner of Internal Revenue vs. Deutsche Knowledge Services, Pte. LTD., 807 SCRA 90, November 07, 2016Document12 pagesCommissioner of Internal Revenue vs. Deutsche Knowledge Services, Pte. LTD., 807 SCRA 90, November 07, 2016Vida MarieNo ratings yet

- Construction Equipment Management and Analysis of Multi-Storied Building Phase-IDocument77 pagesConstruction Equipment Management and Analysis of Multi-Storied Building Phase-Iyared admassuNo ratings yet

- Social Cost Benefit AnalysisDocument7 pagesSocial Cost Benefit AnalysislovleshrubyNo ratings yet

- CMS Renewables Guide 2020Document170 pagesCMS Renewables Guide 2020Szymon StrzelczykNo ratings yet

- ADIT Prospectus 2018Document40 pagesADIT Prospectus 2018Alan HgNo ratings yet

- Quiz 1 PrelimDocument2 pagesQuiz 1 PrelimMicaella DanoNo ratings yet

- Instructions FOR: Small Estate AffidavitDocument17 pagesInstructions FOR: Small Estate AffidavitJohn29999No ratings yet

- Animation Auction 58Document256 pagesAnimation Auction 58Valter SchuelerNo ratings yet

- Athens Views Issue No 3Document31 pagesAthens Views Issue No 3Misyrlena EgkolfopoulouNo ratings yet

- Unit Cost Analysis.2019Document1 pageUnit Cost Analysis.2019Edwin Tapit JrNo ratings yet

- United Leasing Company LimitedDocument46 pagesUnited Leasing Company LimitedTanjina RahmanNo ratings yet

- PAk Suzuki Motors PresentationDocument41 pagesPAk Suzuki Motors PresentationAZAM WAQASNo ratings yet

- InvoiceDocument1 pageInvoiceRamanjaneya ReddyNo ratings yet

- Denim JeansDocument21 pagesDenim JeansFăÍż SăįYąð100% (1)

- PGBP - May 2024 & June 2024Document10 pagesPGBP - May 2024 & June 2024shauryaaaaa22kNo ratings yet

- 06 11 Merger Model Quiz Questions Advanced PDFDocument17 pages06 11 Merger Model Quiz Questions Advanced PDFVarun AgarwalNo ratings yet

- Lesson 1 Financial Objectves of The Different Types of OrganizationsDocument41 pagesLesson 1 Financial Objectves of The Different Types of OrganizationsKissel Jade Barsalote SarnoNo ratings yet

- BY: Ynigesu Minchil Felekech Gizawu Selam Tesfaye Yohanis Petiros Ashenafi AshagrieDocument6 pagesBY: Ynigesu Minchil Felekech Gizawu Selam Tesfaye Yohanis Petiros Ashenafi AshagrieASHENAFI ASHAGRIENo ratings yet

- Two Centuries of TariffsDocument146 pagesTwo Centuries of TariffsStephen LoiaconiNo ratings yet

- Taxation XIDocument179 pagesTaxation XIAleti NithishNo ratings yet