Professional Documents

Culture Documents

Accounting For Joint Product Costs

Accounting For Joint Product Costs

Uploaded by

Erwin Labayog Medina0 ratings0% found this document useful (0 votes)

17 views3 pagesCost Accounting

Original Title

Accounting for Joint Product Costs-converted

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCost Accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

17 views3 pagesAccounting For Joint Product Costs

Accounting For Joint Product Costs

Uploaded by

Erwin Labayog MedinaCost Accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 3

Il. Accounting for Joint Product Costs . Loaming Objective #2

‘A. Introduction

1. Joint cost allocations must be done for financial reporting purposes: to value inven-

tory and to determine income. An allocation method must be found, though arbitrary,

to allocate the joint costs as reasonably as possible.

2. The joint cost allocation approaches include the following:

a. Benefits-received approaches, which include the following methods:

= Physical units method

= Weighted average method

b. Allocation based on the relative market value, using the following methods:

= Sales-value-at-split-off method

= Net realizable value method

™ Constant gross margin percentage method

| Sales-to-production-ratio method

B. Benefits-Received Approaches

1. Physical Units Method

‘a. Under the physical units method, units of physical output, such as heat con-

tent, volume, or weight, that measure the benefits received are used to distribute

a. The constant gross margin percentage method allocates joint costs such

that the gross margin percentage is the same for each product.

b. This method assumes that the further processing yields an identical profit per-

centage across all products.

©. Using the constant gross margin percentage method, the joint cost allocation

steps include the following calculations:

(Total revenue -Total costs)

Grand in percentage =

ee Total revenue

Joint product gross margin = Market price * Grand gross margin

Joint cost allocated to product = Market value ~ Gross margin ~ Separable

costs

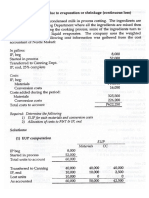

4, Sales-to-Production Ratio

a. The sales-to-production-ratio method allocates joint costs in accordance with

a weighting factor that compares the percentage of sales with the percentage

of production,

b. In this method, the products that sell the most are allocated a larger share of

the joint cost of current production.

©. Using the sales-to-production-ratio method, the joint cost allocation steps in-

clude:

(1) Compute the percentage of total sales based on the joint product ur

sold,

(2) Compute the percentage of total production based on the joint product

units produced.

(3) Compute the sales-to-production ratio of the joint product.

Percentage of total sales

Sales-to-prodiuction rato = percentage of production

(4) Use the sales-to-production ratio to allocate joint cost.

5. The limitations of allocation based on relative market value include the following)

= All methods are based on price. If price is used to determine cost, then those

costs cannot be used to determine price. The decision would be circular.

'™ Changes in relative market prices will cause changes in the costs allocated

to the product, even when there has been no change in total costs or the

method of production.

'& Using allocation based on relative market value produces the same margin

per dollar of allocated cost. This could be misleading to management if the im-

pression is created that all products are equally profitable.

joint costs. This method allocates to each joint product the same proportion of

joint costs as the underlying proportion of units,

™ Example: Manufacturers of forest products use the physical units

method to apply the average conversion cost to all finished products, re-

gardless of their type, grade, or market value.

b. Disadvantages of the physical units method include the following:

It ignores the fact that not all costs are directly related to physical

quantities.

= It may result in incorrect managerial decisions because high profit

may be reflected from the sale of high-grade products, with low profit or

losses reflected from the sale of low-grade products.

2. Weighted Average Method

The weighted average method uses the weight factors to include such diverse el-

ements as amount of material used, difficulty to manufacture, time consumed, dif-

ference in type of labor used, and size of unit.

Weighted physical units = Number of units * Weight factor

Example: The canning industry uses weight factors to distinguish between

can sizes or quality of product. The weighted average method allocates relative-

ly more of the joint cost to the high-grade products because they represent more

desirable and profitable products.

Allocation Based on Relative Market Value

‘The methods in this approach try to assign costs based on the product's ability to ab-

sorb joint costs, They are based on the assumption that the joint costs would not be

inourred unless the products yield enough revenues to cover all costs plus a reason-

able profit.

The relative market value approach of allocation is better than the physical units ap-

proach if (1) the physical mix of output can be altered by incurring more (or less) total

joint costs, and (2) this alteration produces more (or less) total market value.

1. Sales-Value-at-Split-Off Method

a. The sales-value-at-split-off method allocates joint cost based on each prod-

Uct’s proportionate share of market or sales value at the spli-off point.

b. In this method, the higher the market value, the greater the joint cost assigned

to the product.

2. Net Realizable Value Method

a. The net realizable value method allocates joint costs based on hypothetical

sales values because there may not be a ready market for the product at the

split-off point.

b. This method is particularly useful when one or more products cannot be sold at

the split-off point but must be processed further.

Hypothetical sales value =

Market price — Further processing costs after split-off point

3. Constant Gross Margin Percentage Method

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Accounting For By-ProductsDocument2 pagesAccounting For By-ProductsErwin Labayog MedinaNo ratings yet

- Illustration Lost Units Due To Evaporation or Shrinkage (Continuous Loss) 23Document2 pagesIllustration Lost Units Due To Evaporation or Shrinkage (Continuous Loss) 23Erwin Labayog Medina50% (2)

- General Characteristics of Joint ProductionDocument2 pagesGeneral Characteristics of Joint ProductionErwin Labayog MedinaNo ratings yet

- Effects of Joint Product Cost On Cost Control and Decision MakingDocument2 pagesEffects of Joint Product Cost On Cost Control and Decision MakingErwin Labayog MedinaNo ratings yet

- Blaw 1-Part 1Document46 pagesBlaw 1-Part 1Erwin Labayog MedinaNo ratings yet

- ARTICLES 1179-1230: Kinds OF Legal ObligationsDocument8 pagesARTICLES 1179-1230: Kinds OF Legal ObligationsErwin Labayog MedinaNo ratings yet

- Circumstances Affecting ObligationsDocument7 pagesCircumstances Affecting ObligationsErwin Labayog MedinaNo ratings yet

- Guidelines For The 2005 Renewal of LicenseDocument5 pagesGuidelines For The 2005 Renewal of LicenseErwin Labayog MedinaNo ratings yet

- Registration Requirements (Investment Houses)Document2 pagesRegistration Requirements (Investment Houses)Erwin Labayog MedinaNo ratings yet

- Chapter 24 Acctg. For Derivatives & Hedging Transactions - Part 1Document24 pagesChapter 24 Acctg. For Derivatives & Hedging Transactions - Part 1Erwin Labayog MedinaNo ratings yet

- EDP Auditing MidtermDocument5 pagesEDP Auditing MidtermErwin Labayog MedinaNo ratings yet

- EDP Auditing SemiFinalDocument4 pagesEDP Auditing SemiFinalErwin Labayog MedinaNo ratings yet

- Chapter 22 - Financial Reporing in Hyperinflationary EconomiesDocument19 pagesChapter 22 - Financial Reporing in Hyperinflationary EconomiesErwin Labayog MedinaNo ratings yet

- General de Jesus CollegeDocument16 pagesGeneral de Jesus CollegeErwin Labayog MedinaNo ratings yet

- Chapter 20 Consolidated FS - Part 4Document6 pagesChapter 20 Consolidated FS - Part 4Erwin Labayog MedinaNo ratings yet

- Chapter 19 Consolidated FS - Part 3Document9 pagesChapter 19 Consolidated FS - Part 3Erwin Labayog MedinaNo ratings yet

- Chapter 21 Separate FSDocument8 pagesChapter 21 Separate FSErwin Labayog MedinaNo ratings yet

- Chapter 15 Business Combinations - Part 2Document10 pagesChapter 15 Business Combinations - Part 2Erwin Labayog Medina100% (2)

- Chapter 16 Business Combinations - Part 3Document11 pagesChapter 16 Business Combinations - Part 3Erwin Labayog MedinaNo ratings yet

- Chapter 18 Consolidated FS - Part 2Document13 pagesChapter 18 Consolidated FS - Part 2Erwin Labayog MedinaNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument12 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Chapter 17 Consolidated FS - Part 1Document29 pagesChapter 17 Consolidated FS - Part 1Erwin Labayog Medina100% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument13 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet