Professional Documents

Culture Documents

Problem Set 8.3

Problem Set 8.3

Uploaded by

sumit jhaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem Set 8.3

Problem Set 8.3

Uploaded by

sumit jhaCopyright:

Available Formats

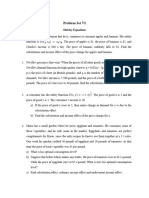

PROBLEM SET 8.

3 – ON TACIT COLLUSION

Reconsider Question 1 in Problem Set 7.2, where two whole-sellers, B and G, supply rice (of

identical quality) to a whole-sale rice market every day. Take as given all data about the

game from Question 1 in Problem Set 7.2, and consider the case: F = 0, uB = 30, and uG = 36.

In contrast to Question 1 in Problem Set 7.2, suppose (more realistically) that every morning,

the sellers simultaneously determine their supplies for the day. So day after day, individual

firm supplies can be changed based on what has happened in previous days. This goes on

forever, and consequently, the whole-sellers realize that they are playing an infinitely

repeated game against each other. The daily interest rate is , and there is no inflation.

Suppose that the two firms want to tacitly sustain the following collusive outcome: “seller B

supplies 10 quintals of rice every day, and seller G supplies 4 quintals of rice every day”, by

using the threat of ‘perpetual one-shot Nash reversion’.

Determine the ‘two collusion constraints’ that the two (asymmetric) whole-sellers face. For

what values of – the daily market interest rate – will both the collusion constraints be

satisfied?

You might also like

- 2223 Level N AP Microeconomics Course QuestionsDocument21 pages2223 Level N AP Microeconomics Course Questionslayan100% (1)

- Economics For Everyone: Problem Set 2Document4 pagesEconomics For Everyone: Problem Set 2kogea2No ratings yet

- ME Problem Set-1 (2019)Document2 pagesME Problem Set-1 (2019)pikuNo ratings yet

- Exam1 FIN 4750Document1 pageExam1 FIN 4750jaykahNo ratings yet

- Deakin Business Administration Economics UnitDocument18 pagesDeakin Business Administration Economics UnitYasiru MahindaratneNo ratings yet

- ME Problem Set-3-2017 BatchDocument6 pagesME Problem Set-3-2017 BatchsrivastavavishistNo ratings yet

- Choice, Utility, DemandDocument4 pagesChoice, Utility, DemandMohit RakyanNo ratings yet

- P S 7.1 - O G T: Numerical ProblemsDocument1 pageP S 7.1 - O G T: Numerical Problemssumit jhaNo ratings yet

- BMIK Mock Exam - 20231228Document6 pagesBMIK Mock Exam - 2023122810622006No ratings yet

- Problem2 PDFDocument7 pagesProblem2 PDFLucas PiroulusNo ratings yet

- Modules 1&2Document6 pagesModules 1&2Prateek BabbewalaNo ratings yet

- Mid-Sem Exam SampleDocument5 pagesMid-Sem Exam SampleMinh NgọcNo ratings yet

- Practice QuestionDocument10 pagesPractice QuestionRajeev SinghNo ratings yet

- PS 4Document3 pagesPS 4emmaNo ratings yet

- Micro Problems GDocument24 pagesMicro Problems GBingzhi ZhaoNo ratings yet

- Problem Set V: EC 246: Decisions & GamesDocument3 pagesProblem Set V: EC 246: Decisions & GamesParmesh GuptaNo ratings yet

- Micro2 Homw6 Post AY2020 21 T1Document2 pagesMicro2 Homw6 Post AY2020 21 T1TAN CHUN LIN BOBBY DOWNo ratings yet

- Mid-Sem Exam SampleDocument4 pagesMid-Sem Exam Samplephuong linh nguyenNo ratings yet

- ECO101 Solved Problems Games and OligopolyDocument4 pagesECO101 Solved Problems Games and OligopolyRitesh SinghNo ratings yet

- Mock Exam 1Document12 pagesMock Exam 110622006No ratings yet

- Problem Set 3 (2022)Document1 pageProblem Set 3 (2022)AnneNo ratings yet

- Assignment 1: Ecn 217: Mathematical Economics-2 6/1/2021Document2 pagesAssignment 1: Ecn 217: Mathematical Economics-2 6/1/2021AtiquzzamanNo ratings yet

- HW4Monopoly, Game TheoryDocument3 pagesHW4Monopoly, Game TheoryShivani GuptaNo ratings yet

- Demand - CH 2 - QnaDocument110 pagesDemand - CH 2 - QnaShanaya SinghNo ratings yet

- Microeconomics ExercisesDocument11 pagesMicroeconomics ExercisesMiguel SantanaNo ratings yet

- Pset 1Document4 pagesPset 1befn35No ratings yet

- Reviewer CH 4 & 5Document10 pagesReviewer CH 4 & 5Green StoneNo ratings yet

- Problem Set #2 - The Gains From Trade: This Document Contains 7 PagesDocument4 pagesProblem Set #2 - The Gains From Trade: This Document Contains 7 PagesJBNo ratings yet

- Soal MicroeconomyDocument2 pagesSoal MicroeconomyDavid WijayaNo ratings yet

- 206 HW6 BneDocument9 pages206 HW6 Bneamit_singhal_110% (1)

- Econ 102 S 07 FXDocument11 pagesEcon 102 S 07 FXhyung_jipmNo ratings yet

- Microeconomic Principles SPRING 2001 MIDTERM ONE - AnswersDocument13 pagesMicroeconomic Principles SPRING 2001 MIDTERM ONE - AnswersirsaNo ratings yet

- Problem Set OligopolyDocument3 pagesProblem Set Oligopolyasmitamittal1998No ratings yet

- Exam1 SolutionDocument12 pagesExam1 SolutionEmmelynNo ratings yet

- Mock 1Document4 pagesMock 110622006No ratings yet

- PS6 2Document3 pagesPS6 2doanquynhnth1019No ratings yet

- Tugas 2 or 2 SLP, PDP, Game TheoryDocument2 pagesTugas 2 or 2 SLP, PDP, Game TheoryVeronika Dwika AndhitaNo ratings yet

- Final Exam May 2022Document3 pagesFinal Exam May 2022Sheikh Sahil MobinNo ratings yet

- EC2066 Commentary 2008 - ZBDocument27 pagesEC2066 Commentary 2008 - ZBtabonemoira88No ratings yet

- EC203 - Problem Set 2 - KopyaDocument3 pagesEC203 - Problem Set 2 - KopyaKyle MckinseyNo ratings yet

- Worksheet 3-Indifference CurveDocument1 pageWorksheet 3-Indifference CurvearushiNo ratings yet

- Extra Practice QuestionsDocument7 pagesExtra Practice QuestionsBobNo ratings yet

- ECON 201 Practice Test 2 (Chapter 5, 6 and 21)Document9 pagesECON 201 Practice Test 2 (Chapter 5, 6 and 21)Meghna N MenonNo ratings yet

- EC203 - Problem Set 2Document3 pagesEC203 - Problem Set 2Yiğit KocamanNo ratings yet

- ps06 1291621965Document5 pagesps06 1291621965daler12345No ratings yet

- Unit 2. Elasticity and Its Application: (Please Do Not Write Anything On This Question Sheet!)Document1 pageUnit 2. Elasticity and Its Application: (Please Do Not Write Anything On This Question Sheet!)Miguel CarvalhoNo ratings yet

- 201 Final Winter 2011 v1 AnswersDocument11 pages201 Final Winter 2011 v1 AnswersJonathan Ruiz100% (2)

- Model A: Damietta University Faculty of Commerce Department of Economics 2 Semester Final Exam 2020/ 2021Document6 pagesModel A: Damietta University Faculty of Commerce Department of Economics 2 Semester Final Exam 2020/ 2021Testo PartNo ratings yet

- BECO110-Assignment1-2012 10 05Document4 pagesBECO110-Assignment1-2012 10 05Price100% (2)

- Frontier EquationDocument6 pagesFrontier EquationPriyanka BharadwajNo ratings yet

- HWK - 6Document3 pagesHWK - 6Karen Nicole Lopez0% (1)

- 11 NewDocument30 pages11 Newnada abdelrahmanNo ratings yet

- Game Theory Exam QuestionsDocument13 pagesGame Theory Exam QuestionsPaulNo ratings yet

- Problems Repeated and Bayesian Game PDFDocument6 pagesProblems Repeated and Bayesian Game PDFvictorginer8No ratings yet

- Practice QuestionsDocument1 pagePractice QuestionsAnjali YadavNo ratings yet

- Chapter 20 - Consumer ChoiceDocument13 pagesChapter 20 - Consumer ChoicerashiNo ratings yet

- Additional Q Ch3 and Ch10Document14 pagesAdditional Q Ch3 and Ch10wellingtonNo ratings yet

- Algebra Readiness Chapter 03 Worksheet # 1 II Partial: Multiple ChoiceDocument2 pagesAlgebra Readiness Chapter 03 Worksheet # 1 II Partial: Multiple ChoiceFernando MiguelNo ratings yet

- Exercise Sheet 3Document1 pageExercise Sheet 3Khadija RaffatNo ratings yet

- AP Econ Practice Prob Mod 8 and 9Document10 pagesAP Econ Practice Prob Mod 8 and 9A FNo ratings yet

- IIM Calcutta Job DescriptionDocument2 pagesIIM Calcutta Job Descriptionsumit jhaNo ratings yet

- Problem Set 8.1Document2 pagesProblem Set 8.1sumit jhaNo ratings yet

- Problem Set 7.2Document2 pagesProblem Set 7.2sumit jhaNo ratings yet

- Problem Set 6Document2 pagesProblem Set 6sumit jhaNo ratings yet