Professional Documents

Culture Documents

Company Cap Table

Company Cap Table

Uploaded by

shon_dellingerCopyright:

Available Formats

You might also like

- Walter Piston, Mark DeVoto - Harmony 5th Ed Book 1 (Edited)Document216 pagesWalter Piston, Mark DeVoto - Harmony 5th Ed Book 1 (Edited)saghiNo ratings yet

- STEM Pitch DeckDocument19 pagesSTEM Pitch Deckgazitua.79No ratings yet

- Valuation and Dilution CalculatorDocument14 pagesValuation and Dilution CalculatorNguyễn Đức AnhNo ratings yet

- Founders Pocket Guide Cap TableDocument10 pagesFounders Pocket Guide Cap TableVenkatesh Mahalingam100% (1)

- Initial Cap Table Sample For Early Stage StartupDocument1 pageInitial Cap Table Sample For Early Stage StartupjamesfjensenNo ratings yet

- Startup India Seed Fund Scheme: Startup Sample Pitch DeckDocument13 pagesStartup India Seed Fund Scheme: Startup Sample Pitch DeckSimran KhuranaNo ratings yet

- Startup Business Planning: 5 Steps To Success: Why Start With A Financial Modelling?Document35 pagesStartup Business Planning: 5 Steps To Success: Why Start With A Financial Modelling?Bruno Magro100% (1)

- Table 13.4 Valuation Template 9Document8 pagesTable 13.4 Valuation Template 9Hunkar IvgenNo ratings yet

- Behaviour Modification TechniquesDocument42 pagesBehaviour Modification Techniquesdr parveen bathla100% (1)

- TOEFL ExamDocument8 pagesTOEFL ExamAnkit100% (2)

- Basic CapTable - No Valuation CapDocument6 pagesBasic CapTable - No Valuation CapsonkarmanishNo ratings yet

- Waterfall Analysis - 1X Liquidation PreferenceDocument9 pagesWaterfall Analysis - 1X Liquidation PreferenceMonish KartheekNo ratings yet

- IRR Financial ModelDocument110 pagesIRR Financial ModelericNo ratings yet

- Cap Table ModelDocument13 pagesCap Table Modelmq222No ratings yet

- Sample Cap TableDocument1 pageSample Cap TablenewyuppieNo ratings yet

- Misc Inputs and Outputs: Total Series A $500,000 1,503,759 11.11%Document7 pagesMisc Inputs and Outputs: Total Series A $500,000 1,503,759 11.11%Ray AlexanderNo ratings yet

- Dilution Calculator Cap Table ModelDocument4 pagesDilution Calculator Cap Table ModelMichel KropfNo ratings yet

- Value MergerDocument15 pagesValue Mergersnfrh21No ratings yet

- Company Name Share Register ExampleDocument9 pagesCompany Name Share Register ExampleNikhil KulkarniNo ratings yet

- Cap Table ExerciseDocument27 pagesCap Table ExerciseJOSEPH CAI100% (1)

- Cap TableDocument1 pageCap TabledarescribdNo ratings yet

- Sahay Management Consultancy Company Profile 2.0 PDFDocument30 pagesSahay Management Consultancy Company Profile 2.0 PDFDipesh DayamaNo ratings yet

- Startup M.A.T.T Sheet v5Document30 pagesStartup M.A.T.T Sheet v5HASNAIN JANNo ratings yet

- EV Equity Value ModelDocument6 pagesEV Equity Value Modelkirihara95No ratings yet

- Private Equity, LBO & Hedge Funds (Bocconi University)Document14 pagesPrivate Equity, LBO & Hedge Funds (Bocconi University)ah02618No ratings yet

- My Patent Valuation Tool 3Document6 pagesMy Patent Valuation Tool 3BobbyNicholsNo ratings yet

- Investment Memo Template by Niklas JansenDocument6 pagesInvestment Memo Template by Niklas JansenAbri VincentNo ratings yet

- Climate Fintech App Pitch Deck by SlidesgoDocument41 pagesClimate Fintech App Pitch Deck by SlidesgoAli AndraNo ratings yet

- Anti-Dilution CalculationsDocument1 pageAnti-Dilution CalculationsHugo PereiraNo ratings yet

- Template BP AnglaisDocument30 pagesTemplate BP AnglaisAmalle BediarNo ratings yet

- Founding Seed: Total 100% 100 100% 118 $ 95,238 Cumulative Stake Per InvestorDocument2 pagesFounding Seed: Total 100% 100 100% 118 $ 95,238 Cumulative Stake Per InvestorArturo Alejandro Rochefort RojasNo ratings yet

- First Round Capital Slide Deck PDFDocument10 pagesFirst Round Capital Slide Deck PDFEmily StanfordNo ratings yet

- Lee Chee How 21wbd08408 IndvassignmentDocument19 pagesLee Chee How 21wbd08408 Indvassignmentho cheeNo ratings yet

- First Round Capital Original Pitch DeckDocument10 pagesFirst Round Capital Original Pitch DeckFirst Round CapitalNo ratings yet

- Airtel Brand ValuationDocument21 pagesAirtel Brand ValuationPratik Gupta100% (1)

- CB Insights - What Is Venture CapitalDocument37 pagesCB Insights - What Is Venture CapitalEnrico RecchiNo ratings yet

- Bill Snow Financial Model 2004-03-09Document35 pagesBill Snow Financial Model 2004-03-09nsadnanNo ratings yet

- Valuation of A Tech Start'up in PractiseDocument15 pagesValuation of A Tech Start'up in PractiseTarek MghNo ratings yet

- Startup Funding: Entrepreneurship and StartupsDocument95 pagesStartup Funding: Entrepreneurship and StartupsAhmed Hadad0% (1)

- Canara Robeco Infrastructure: Monthly Portfolio Statement As On August 31, 2020Document69 pagesCanara Robeco Infrastructure: Monthly Portfolio Statement As On August 31, 2020sanjeev kalraNo ratings yet

- Term Sheet NegotiationsDocument26 pagesTerm Sheet NegotiationsRussellNo ratings yet

- JAT IPO - Teaser - June2021Document10 pagesJAT IPO - Teaser - June2021cpasl123No ratings yet

- IPO PresentationDocument17 pagesIPO Presentationapi-3705645No ratings yet

- Chapter 16.1 Due Diligence, Investigation and Forensic AuditDocument13 pagesChapter 16.1 Due Diligence, Investigation and Forensic AuditJagrit Oberoi0% (1)

- Methods of IPODocument5 pagesMethods of IPOMESRETNo ratings yet

- Startup FinanceDocument360 pagesStartup FinanceJohnny Bravo100% (1)

- BasketftpDocument11 pagesBasketftpUrooj TabaniNo ratings yet

- Mergers SPAC ELearnDocument3 pagesMergers SPAC ELearnOwen ChanNo ratings yet

- Competitive Profile Matrix TemplateDocument3 pagesCompetitive Profile Matrix Templateعبدالرحمن القطاونةNo ratings yet

- Must-Have Slides For A Venture Capital PowerPoint Pitch DeckDocument1 pageMust-Have Slides For A Venture Capital PowerPoint Pitch DeckStartup Tool KitNo ratings yet

- Feedme - Pitch DeckDocument14 pagesFeedme - Pitch DeckArun KumarNo ratings yet

- My Patent Valuation Tool 3Document6 pagesMy Patent Valuation Tool 3nsadnanNo ratings yet

- Corgentum Private Equity Operational Due Diligence Trends StudyDocument9 pagesCorgentum Private Equity Operational Due Diligence Trends StudyMEGNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument5 pagesThe Discounted Free Cash Flow Model For A Complete BusinessSanket DubeyNo ratings yet

- Corporate Restructuring in India-Need of The Hour:: Health NetDocument21 pagesCorporate Restructuring in India-Need of The Hour:: Health NetKavitha PichandiNo ratings yet

- Colgate Company Analysis ReportDocument16 pagesColgate Company Analysis ReportAmmar KanchwalaNo ratings yet

- Val PacketDocument157 pagesVal PacketKumar PrashantNo ratings yet

- Investor Pitch Deck TemplateDocument17 pagesInvestor Pitch Deck TemplateskNo ratings yet

- Financial ModelDocument6 pagesFinancial ModelGarvit JainNo ratings yet

- Abu Dhabi Toursim DocumentsDocument25 pagesAbu Dhabi Toursim DocumentsAdventure EmiratesNo ratings yet

- VC Cap Table ExampleDocument5 pagesVC Cap Table Examplesaurish.kpoorNo ratings yet

- Company Valuation Series A: Cap Table TemplateDocument2 pagesCompany Valuation Series A: Cap Table TemplateGolamMostafaNo ratings yet

- Dario Mnordan ComDocument1 pageDario Mnordan ComSteve MedhurstNo ratings yet

- Indo Global College of Architecture, Abhipur: Sector: 33-A, Noida, Uttar PradeshDocument86 pagesIndo Global College of Architecture, Abhipur: Sector: 33-A, Noida, Uttar PradeshPrarthana GhoshNo ratings yet

- Etchells Tuning SequenceDocument2 pagesEtchells Tuning SequencegsolomonsNo ratings yet

- Rose of BethlehemDocument2 pagesRose of BethlehemjumbowoodsNo ratings yet

- Design Methods in Engineering and Product DesignDocument1 pageDesign Methods in Engineering and Product DesignjcetmechanicalNo ratings yet

- SR - Q1 2021 Cattle Situation ReportDocument6 pagesSR - Q1 2021 Cattle Situation ReportPhilip Blair OngNo ratings yet

- Percentages PracticeDocument8 pagesPercentages PracticeChikanma OkoisorNo ratings yet

- IT Service Management Certification RoadmapDocument4 pagesIT Service Management Certification RoadmapLeandro Ostertag de MeloNo ratings yet

- Acs880 PDFDocument88 pagesAcs880 PDFlollollol1515615df4gNo ratings yet

- Bhayu H. 349655122Document16 pagesBhayu H. 349655122Green Sustain EnergyNo ratings yet

- Sinach LyricsDocument8 pagesSinach LyricsMichael EinsteinNo ratings yet

- Garrett PD 65001 User ManualDocument4 pagesGarrett PD 65001 User ManualFelipe MejiasNo ratings yet

- Survey For CAS Teambuilding 2022Document4 pagesSurvey For CAS Teambuilding 2022JayronNo ratings yet

- Salatin Sept03Document4 pagesSalatin Sept03api-3733859No ratings yet

- Tall Grass Mob StockingDocument4 pagesTall Grass Mob StockingJD_pdfNo ratings yet

- Purposive Communication: Module 1: Communication Process, Principles and EthicsDocument11 pagesPurposive Communication: Module 1: Communication Process, Principles and EthicsJan Jerwin PobleteNo ratings yet

- Application Form / Checklist : Department of Fire & Rescue Services, Government of KeralaDocument37 pagesApplication Form / Checklist : Department of Fire & Rescue Services, Government of KeralaStew884No ratings yet

- Q3 Mil Rev 1 PDFDocument12 pagesQ3 Mil Rev 1 PDFCharlie jamesNo ratings yet

- Core Values Module PaoloDocument9 pagesCore Values Module PaoloLala BoraNo ratings yet

- Materi Tanggapan Tulisan Insan CSR Olah Karsa 2023Document18 pagesMateri Tanggapan Tulisan Insan CSR Olah Karsa 2023yantoNo ratings yet

- RankingDocument11 pagesRankingZerlene RuchandaniNo ratings yet

- American Airlines VS Ca 327 Scra 482 PDFDocument4 pagesAmerican Airlines VS Ca 327 Scra 482 PDFGwen Alistaer CanaleNo ratings yet

- Novum Organum, Book II & Parasceve (OFB XI)Document138 pagesNovum Organum, Book II & Parasceve (OFB XI)Elodie CassanNo ratings yet

- 1ghadjzftewifvsmn PDFDocument282 pages1ghadjzftewifvsmn PDFAlex MingNo ratings yet

- Merlina Santi. British and American Drama. The Assignment-DikonversiDocument17 pagesMerlina Santi. British and American Drama. The Assignment-DikonversiMerlin SantiNo ratings yet

- 2013-14 Victoria Government ICT StrategyDocument28 pages2013-14 Victoria Government ICT StrategyJuha SaarinenNo ratings yet

- Scripts Emcee - For MergeDocument8 pagesScripts Emcee - For MergeANDREANA BEATRIZ GAURINONo ratings yet

- Can't Help Falling in Love (Tenor Sax)Document1 pageCan't Help Falling in Love (Tenor Sax)AnardinoNo ratings yet

Company Cap Table

Company Cap Table

Uploaded by

shon_dellingerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Cap Table

Company Cap Table

Uploaded by

shon_dellingerCopyright:

Available Formats

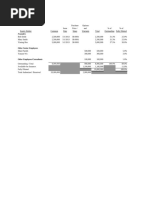

Company Capitalization Table Template

Share/Option Holder Preferred Invested Common Options Warrants Fully Diluted Percent

Founder Stock

$45,000 @ $0.01 and $0.05

Founder/CEO Name 0 $10,000 1,000,000 1,000,000 0 2,000,000 6.78%

Co-Founder/CTO Name 0 $10,000 1,000,000 1,000,000 0 2,000,000 6.78%

Investor/Advisor Name 0 $25,000 500,000 500,000 0 1,000,000 3.39%

Series A Preferred

$500,000 @ $0.10/share

Board/Investor Name 1,000,000 $100,000 0 0 200,000 1,200,000 4.07%

Board/Investor Name 1,000,000 $100,000 0 0 200,000 1,200,000 4.07%

Investor Name 500,000 $50,000 0 0 100,000 600,000 2.03%

Investor Name 500,000 $50,000 0 0 100,000 600,000 2.03%

Investor Name 500,000 $50,000 0 0 100,000 600,000 2.03%

Investor Name 500,000 $50,000 0 0 100,000 600,000 2.03%

Investor Name 500,000 $50,000 0 0 100,000 600,000 2.03%

Investor Name 500,000 $50,000 0 0 100,000 600,000 2.03%

Series B Preferred

$3,000,000 @ $0.50/share

Board/Investor Name 2,000,000 $1,000,000 0 0 0 2,000,000 6.78%

Board/Investor Name 2,000,000 $1,000,000 0 0 0 2,000,000 6.78%

Investor Name 1,000,000 $500,000 0 0 0 1,000,000 3.39%

Board/Investor Name 500,000 $250,000 0 0 0 500,000 1.69%

Investor Name 300,000 $150,000 0 0 0 300,000 1.02%

Investor Name 200,000 $100,000 0 0 0 200,000 0.68%

Series C Preferred

$10,000,000 @ $1.00/share

Investor Name 3,000,000 $3,000,000 0 0 0 3,000,000 10.17%

Investor Name 3,000,000 $3,000,000 0 0 0 3,000,000 10.17%

Investor Name 2,000,000 $2,000,000 0 0 0 2,000,000 6.78%

Investor Name 1,000,000 $1,000,000 0 0 0 1,000,000 3.39%

Investor Name 1,000,000 $1,000,000 0 0 0 1,000,000 3.39%

Board/Advisor/Employee/Contractor Options

Title Name 0 $0 0 250,000 0 250,000 0.85%

Title Name 0 $0 0 250,000 0 250,000 0.85%

Title Name 0 $0 0 100,000 0 100,000 0.34%

Title Name 0 $0 0 100,000 0 100,000 0.34%

Title Name 0 $0 0 100,000 0 100,000 0.34%

Title Name 0 $0 0 75,000 0 75,000 0.25%

Title Name 0 $0 0 75,000 0 75,000 0.25%

Title Name 0 $0 0 75,000 0 75,000 0.25%

Title Name 0 $0 0 50,000 0 50,000 0.17%

Title Name 0 $0 0 50,000 0 50,000 0.17%

Title Name 0 $0 0 50,000 0 50,000 0.17%

Title Name 0 $0 0 50,000 0 50,000 0.17%

Title Name 0 $0 0 50,000 0 50,000 0.17%

Title Name 0 $0 0 50,000 0 50,000 0.17%

Title Name 0 $0 0 50,000 0 50,000 0.17%

Title Name 0 $0 0 25,000 0 25,000 0.08%

Title Name 0 $0 0 25,000 0 25,000 0.08%

Title Name 0 $0 0 25,000 0 25,000 0.08%

Title Name 0 $0 0 25,000 0 25,000 0.08%

Title Name 0 $0 0 25,000 0 25,000 0.08%

Reserve Option Pool Future Employees 0 $0 0 1,000,000 0 1,000,000 3.39%

0.00%

TOTALS 21,000,000 $13,545,000 2,500,000 5,000,000 1,000,000 29,500,000 100.00%

INITIAL CAPITALIZATION, FOUNDER'S ROUND

Two founders come together to form a company. They each invest $10,000 at $0.01 per share and get 1,000,000 shares each. They also issue themselves each 1,000,000

options as upside, for their work and contributions to the business. The founders entice a friend to invest $25,000. The friend is a passive investor and is not contributing

sweat equity or intellectual property. He pays $0.05 for his shares and gets 500,000 options for his risk. At this point, the founders each have 40% of the company and the

investor has 20%.

Share/Option Holder Preferred Invested Common Options Warrants Fully Diluted

Founder Stock

$45,000 @ $0.01 and $0.05

Founder/CEO Name 0 $10,000 1,000,000 1,000,000 0 2,000,000

Co-Founder/CTO Name 0 $10,000 1,000,000 1,000,000 0 2,000,000

Investor/Advisor Name 0 $25,000 500,000 500,000 0 1,000,000

TOTALS 0 $45,000 2,500,000 2,500,000 0 5,000,000

THE FIRST OUTSIDE INVESTOR ROUND

The founders are successful in developing and prototyping the product. They are getting traction in the market. They entice some angel investors to invest $500,000 at

$0.10 per share for preferred stock. The investment is high risk because the company, while promising, is not making money and has much to accomplish to become a

viable business. The angel investors are also granted warrants to sweeten the deal and increase their upside. The investors get about half the company, making the

valuation of the company at approx $1M. The board also decides to reserve 1.2M shares in the form of options, post investment, for additional grants to the founders and to

attract new hires. At this point, the founders have given up half the company (unless they were one of the preferred investors). The founders have an opportunity to

increase their percentage from the option pool, based on performance.

Previous Cap 0 $45,000 2,500,000.00 2,500,000 0 5,000,000

$500,000 @ $0.10/share

Board/Investor Name 1,000,000 $100,000 0 0 200,000 1,200,000

Board/Investor Name 1,000,000 $100,000 0 0 200,000 1,200,000

Investor Name 500,000 $50,000 0 0 100,000 600,000

Investor Name 500,000 $50,000 0 0 100,000 600,000

Investor Name 500,000 $50,000 0 0 100,000 600,000

Investor Name 500,000 $50,000 0 0 100,000 600,000

Investor Name 500,000 $50,000 0 0 100,000 600,000

Investor Name 500,000 $50,000 0 0 100,000 600,000

Employee Option Pool Future Hires/Advisors 0 $0 0 1,200,000 0 1,200,000

TOTALS 5,000,000 $545,000 2,500,000 3,700,000 1,000,000 12,200,000

THE SECOND OUTSIDE INVESTOR ROUND

The company achieves its goals and attracts a VC to lead a Series B round for $3M at $0.50 per share. The new investors get about one third of the company, making the

valuation around $10 million.

Previous Cap 5,000,000 $545,000 2,500,000 3,700,000 1,000,000 12,200,000

$3,000,000 @ $0.50/share

Board/Investor Name 2,000,000 $1,000,000 0 0 0 2,000,000

Board/Investor Name 2,000,000 $1,000,000 0 0 0 2,000,000

Investor Name 1,000,000 $500,000 0 0 0 1,000,000

Board/Investor Name 500,000 $250,000 0 0 0 500,000

Investor Name 300,000 $150,000 0 0 0 300,000

Investor Name 200,000 $100,000 0 0 0 200,000

TOTALS 11,000,000 $3,545,000 2,500,000 3,700,000 1,000,000 18,200,000

THE THIRD OUTSIDE INVESTOR ROUND

The company achieves its goals and the investors collectively invest another $10M at $1.00 per share in a Series C round. The post money valuation is approximately $30

million. The board also approves another 1,300,000 shares for founder, employee, board and advisor stock options.

Previous Cap 11,000,000 $3,545,000 2,500,000 3,700,000 1,000,000 18,200,000

$10,000,000 @ $1.00/share

Investor Name 3,000,000 $3,000,000 0 0 0 3,000,000

Investor Name 3,000,000 $3,000,000 0 0 0 3,000,000

Investor Name 2,000,000 $2,000,000 0 0 0 2,000,000

Investor Name 1,000,000 $1,000,000 0 0 0 1,000,000

Investor Name 1,000,000 $1,000,000 0 0 0 1,000,000

Employee Option Pool Future Hires/Advisors 0 $0 0 1,300,000 0 1,300,000

TOTALS 21,000,000 $13,545,000 2,500,000 5,000,000 1,000,000 29,500,000

o issue themselves each 1,000,000

e investor and is not contributing

have 40% of the company and the

Percent

40.00%

40.00%

20.00%

100.00%

investors to invest $500,000 at

uch to accomplish to become a

alf the company, making the

tional grants to the founders and to

ders have an opportunity to

41.0%

9.84%

9.84%

4.92%

4.92%

4.92%

4.92%

4.92%

4.92%

9.84%

100.00%

third of the company, making the

67.03%

10.99%

10.99%

5.49%

2.75%

1.65%

1.10%

100.00%

ney valuation is approximately $30

61.69%

10.17%

10.17%

6.78%

3.39%

3.39%

4.41%

100.00%

You might also like

- Walter Piston, Mark DeVoto - Harmony 5th Ed Book 1 (Edited)Document216 pagesWalter Piston, Mark DeVoto - Harmony 5th Ed Book 1 (Edited)saghiNo ratings yet

- STEM Pitch DeckDocument19 pagesSTEM Pitch Deckgazitua.79No ratings yet

- Valuation and Dilution CalculatorDocument14 pagesValuation and Dilution CalculatorNguyễn Đức AnhNo ratings yet

- Founders Pocket Guide Cap TableDocument10 pagesFounders Pocket Guide Cap TableVenkatesh Mahalingam100% (1)

- Initial Cap Table Sample For Early Stage StartupDocument1 pageInitial Cap Table Sample For Early Stage StartupjamesfjensenNo ratings yet

- Startup India Seed Fund Scheme: Startup Sample Pitch DeckDocument13 pagesStartup India Seed Fund Scheme: Startup Sample Pitch DeckSimran KhuranaNo ratings yet

- Startup Business Planning: 5 Steps To Success: Why Start With A Financial Modelling?Document35 pagesStartup Business Planning: 5 Steps To Success: Why Start With A Financial Modelling?Bruno Magro100% (1)

- Table 13.4 Valuation Template 9Document8 pagesTable 13.4 Valuation Template 9Hunkar IvgenNo ratings yet

- Behaviour Modification TechniquesDocument42 pagesBehaviour Modification Techniquesdr parveen bathla100% (1)

- TOEFL ExamDocument8 pagesTOEFL ExamAnkit100% (2)

- Basic CapTable - No Valuation CapDocument6 pagesBasic CapTable - No Valuation CapsonkarmanishNo ratings yet

- Waterfall Analysis - 1X Liquidation PreferenceDocument9 pagesWaterfall Analysis - 1X Liquidation PreferenceMonish KartheekNo ratings yet

- IRR Financial ModelDocument110 pagesIRR Financial ModelericNo ratings yet

- Cap Table ModelDocument13 pagesCap Table Modelmq222No ratings yet

- Sample Cap TableDocument1 pageSample Cap TablenewyuppieNo ratings yet

- Misc Inputs and Outputs: Total Series A $500,000 1,503,759 11.11%Document7 pagesMisc Inputs and Outputs: Total Series A $500,000 1,503,759 11.11%Ray AlexanderNo ratings yet

- Dilution Calculator Cap Table ModelDocument4 pagesDilution Calculator Cap Table ModelMichel KropfNo ratings yet

- Value MergerDocument15 pagesValue Mergersnfrh21No ratings yet

- Company Name Share Register ExampleDocument9 pagesCompany Name Share Register ExampleNikhil KulkarniNo ratings yet

- Cap Table ExerciseDocument27 pagesCap Table ExerciseJOSEPH CAI100% (1)

- Cap TableDocument1 pageCap TabledarescribdNo ratings yet

- Sahay Management Consultancy Company Profile 2.0 PDFDocument30 pagesSahay Management Consultancy Company Profile 2.0 PDFDipesh DayamaNo ratings yet

- Startup M.A.T.T Sheet v5Document30 pagesStartup M.A.T.T Sheet v5HASNAIN JANNo ratings yet

- EV Equity Value ModelDocument6 pagesEV Equity Value Modelkirihara95No ratings yet

- Private Equity, LBO & Hedge Funds (Bocconi University)Document14 pagesPrivate Equity, LBO & Hedge Funds (Bocconi University)ah02618No ratings yet

- My Patent Valuation Tool 3Document6 pagesMy Patent Valuation Tool 3BobbyNicholsNo ratings yet

- Investment Memo Template by Niklas JansenDocument6 pagesInvestment Memo Template by Niklas JansenAbri VincentNo ratings yet

- Climate Fintech App Pitch Deck by SlidesgoDocument41 pagesClimate Fintech App Pitch Deck by SlidesgoAli AndraNo ratings yet

- Anti-Dilution CalculationsDocument1 pageAnti-Dilution CalculationsHugo PereiraNo ratings yet

- Template BP AnglaisDocument30 pagesTemplate BP AnglaisAmalle BediarNo ratings yet

- Founding Seed: Total 100% 100 100% 118 $ 95,238 Cumulative Stake Per InvestorDocument2 pagesFounding Seed: Total 100% 100 100% 118 $ 95,238 Cumulative Stake Per InvestorArturo Alejandro Rochefort RojasNo ratings yet

- First Round Capital Slide Deck PDFDocument10 pagesFirst Round Capital Slide Deck PDFEmily StanfordNo ratings yet

- Lee Chee How 21wbd08408 IndvassignmentDocument19 pagesLee Chee How 21wbd08408 Indvassignmentho cheeNo ratings yet

- First Round Capital Original Pitch DeckDocument10 pagesFirst Round Capital Original Pitch DeckFirst Round CapitalNo ratings yet

- Airtel Brand ValuationDocument21 pagesAirtel Brand ValuationPratik Gupta100% (1)

- CB Insights - What Is Venture CapitalDocument37 pagesCB Insights - What Is Venture CapitalEnrico RecchiNo ratings yet

- Bill Snow Financial Model 2004-03-09Document35 pagesBill Snow Financial Model 2004-03-09nsadnanNo ratings yet

- Valuation of A Tech Start'up in PractiseDocument15 pagesValuation of A Tech Start'up in PractiseTarek MghNo ratings yet

- Startup Funding: Entrepreneurship and StartupsDocument95 pagesStartup Funding: Entrepreneurship and StartupsAhmed Hadad0% (1)

- Canara Robeco Infrastructure: Monthly Portfolio Statement As On August 31, 2020Document69 pagesCanara Robeco Infrastructure: Monthly Portfolio Statement As On August 31, 2020sanjeev kalraNo ratings yet

- Term Sheet NegotiationsDocument26 pagesTerm Sheet NegotiationsRussellNo ratings yet

- JAT IPO - Teaser - June2021Document10 pagesJAT IPO - Teaser - June2021cpasl123No ratings yet

- IPO PresentationDocument17 pagesIPO Presentationapi-3705645No ratings yet

- Chapter 16.1 Due Diligence, Investigation and Forensic AuditDocument13 pagesChapter 16.1 Due Diligence, Investigation and Forensic AuditJagrit Oberoi0% (1)

- Methods of IPODocument5 pagesMethods of IPOMESRETNo ratings yet

- Startup FinanceDocument360 pagesStartup FinanceJohnny Bravo100% (1)

- BasketftpDocument11 pagesBasketftpUrooj TabaniNo ratings yet

- Mergers SPAC ELearnDocument3 pagesMergers SPAC ELearnOwen ChanNo ratings yet

- Competitive Profile Matrix TemplateDocument3 pagesCompetitive Profile Matrix Templateعبدالرحمن القطاونةNo ratings yet

- Must-Have Slides For A Venture Capital PowerPoint Pitch DeckDocument1 pageMust-Have Slides For A Venture Capital PowerPoint Pitch DeckStartup Tool KitNo ratings yet

- Feedme - Pitch DeckDocument14 pagesFeedme - Pitch DeckArun KumarNo ratings yet

- My Patent Valuation Tool 3Document6 pagesMy Patent Valuation Tool 3nsadnanNo ratings yet

- Corgentum Private Equity Operational Due Diligence Trends StudyDocument9 pagesCorgentum Private Equity Operational Due Diligence Trends StudyMEGNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument5 pagesThe Discounted Free Cash Flow Model For A Complete BusinessSanket DubeyNo ratings yet

- Corporate Restructuring in India-Need of The Hour:: Health NetDocument21 pagesCorporate Restructuring in India-Need of The Hour:: Health NetKavitha PichandiNo ratings yet

- Colgate Company Analysis ReportDocument16 pagesColgate Company Analysis ReportAmmar KanchwalaNo ratings yet

- Val PacketDocument157 pagesVal PacketKumar PrashantNo ratings yet

- Investor Pitch Deck TemplateDocument17 pagesInvestor Pitch Deck TemplateskNo ratings yet

- Financial ModelDocument6 pagesFinancial ModelGarvit JainNo ratings yet

- Abu Dhabi Toursim DocumentsDocument25 pagesAbu Dhabi Toursim DocumentsAdventure EmiratesNo ratings yet

- VC Cap Table ExampleDocument5 pagesVC Cap Table Examplesaurish.kpoorNo ratings yet

- Company Valuation Series A: Cap Table TemplateDocument2 pagesCompany Valuation Series A: Cap Table TemplateGolamMostafaNo ratings yet

- Dario Mnordan ComDocument1 pageDario Mnordan ComSteve MedhurstNo ratings yet

- Indo Global College of Architecture, Abhipur: Sector: 33-A, Noida, Uttar PradeshDocument86 pagesIndo Global College of Architecture, Abhipur: Sector: 33-A, Noida, Uttar PradeshPrarthana GhoshNo ratings yet

- Etchells Tuning SequenceDocument2 pagesEtchells Tuning SequencegsolomonsNo ratings yet

- Rose of BethlehemDocument2 pagesRose of BethlehemjumbowoodsNo ratings yet

- Design Methods in Engineering and Product DesignDocument1 pageDesign Methods in Engineering and Product DesignjcetmechanicalNo ratings yet

- SR - Q1 2021 Cattle Situation ReportDocument6 pagesSR - Q1 2021 Cattle Situation ReportPhilip Blair OngNo ratings yet

- Percentages PracticeDocument8 pagesPercentages PracticeChikanma OkoisorNo ratings yet

- IT Service Management Certification RoadmapDocument4 pagesIT Service Management Certification RoadmapLeandro Ostertag de MeloNo ratings yet

- Acs880 PDFDocument88 pagesAcs880 PDFlollollol1515615df4gNo ratings yet

- Bhayu H. 349655122Document16 pagesBhayu H. 349655122Green Sustain EnergyNo ratings yet

- Sinach LyricsDocument8 pagesSinach LyricsMichael EinsteinNo ratings yet

- Garrett PD 65001 User ManualDocument4 pagesGarrett PD 65001 User ManualFelipe MejiasNo ratings yet

- Survey For CAS Teambuilding 2022Document4 pagesSurvey For CAS Teambuilding 2022JayronNo ratings yet

- Salatin Sept03Document4 pagesSalatin Sept03api-3733859No ratings yet

- Tall Grass Mob StockingDocument4 pagesTall Grass Mob StockingJD_pdfNo ratings yet

- Purposive Communication: Module 1: Communication Process, Principles and EthicsDocument11 pagesPurposive Communication: Module 1: Communication Process, Principles and EthicsJan Jerwin PobleteNo ratings yet

- Application Form / Checklist : Department of Fire & Rescue Services, Government of KeralaDocument37 pagesApplication Form / Checklist : Department of Fire & Rescue Services, Government of KeralaStew884No ratings yet

- Q3 Mil Rev 1 PDFDocument12 pagesQ3 Mil Rev 1 PDFCharlie jamesNo ratings yet

- Core Values Module PaoloDocument9 pagesCore Values Module PaoloLala BoraNo ratings yet

- Materi Tanggapan Tulisan Insan CSR Olah Karsa 2023Document18 pagesMateri Tanggapan Tulisan Insan CSR Olah Karsa 2023yantoNo ratings yet

- RankingDocument11 pagesRankingZerlene RuchandaniNo ratings yet

- American Airlines VS Ca 327 Scra 482 PDFDocument4 pagesAmerican Airlines VS Ca 327 Scra 482 PDFGwen Alistaer CanaleNo ratings yet

- Novum Organum, Book II & Parasceve (OFB XI)Document138 pagesNovum Organum, Book II & Parasceve (OFB XI)Elodie CassanNo ratings yet

- 1ghadjzftewifvsmn PDFDocument282 pages1ghadjzftewifvsmn PDFAlex MingNo ratings yet

- Merlina Santi. British and American Drama. The Assignment-DikonversiDocument17 pagesMerlina Santi. British and American Drama. The Assignment-DikonversiMerlin SantiNo ratings yet

- 2013-14 Victoria Government ICT StrategyDocument28 pages2013-14 Victoria Government ICT StrategyJuha SaarinenNo ratings yet

- Scripts Emcee - For MergeDocument8 pagesScripts Emcee - For MergeANDREANA BEATRIZ GAURINONo ratings yet

- Can't Help Falling in Love (Tenor Sax)Document1 pageCan't Help Falling in Love (Tenor Sax)AnardinoNo ratings yet