Professional Documents

Culture Documents

STRP82 18 26 02 2021

STRP82 18 26 02 2021

Uploaded by

Aditya MaheshwariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

STRP82 18 26 02 2021

STRP82 18 26 02 2021

Uploaded by

Aditya MaheshwariCopyright:

Available Formats

1

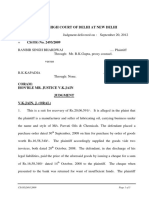

IN THE HIGH COURT OF KARNATAKA AT BENGALURU

DATED THIS THE 26TH DAY OF FEBRUARY, 2021

PRESENT

THE HON’BLE MR. JUSTICE SATISH CHANDRA SHARMA

AND

THE HON’BLE MR. JUSTICE V. SRISHANANDA

STRP NO. 82/2018

BETWEEN:

THE STATE OF KARNATAKA

REPRESENTED BY THE SECRETARY

FINANCE DEPARTMENT

VIDHANA SOUDHA

BENGALURU-560001.

...PETITIONER

(BY SRI VIKRAM HUILGOL, AGA.)

AND:

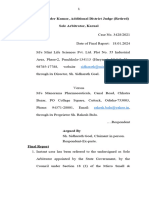

M/S TALLAM APPARELS

NO.34, KALIDASA ROAD

GANDHINAGAR

BANGALORE-560009

... RESPONDENT

(BY SMT. VEENA J. KAMATH, ADV.)

THIS STRP IS FILED UNDER SEC. 65(1) OF THE

KARNATAKA VALUE ADDED TAX ACT, 2003 AGAINST THE

JUDGMENT DATED 21.8.2017 PASSED IN STA NO.3/2016 ON

THE FILE OF THE KARNATAKA APPELLATE TRIBUNAL AT

BENGALURU, ALLOWING THE APPEAL SETTING ASIDE THE

ORDER DATED 30.10.2015 PASSED IN VAT AP NO.984 TO

989/14-15 ON THE FILE OF THE JOINT COMMISSIONER OF

2

COMMERCIAL TAXES (APPEALS) SHANTHINAGAR,

BENGALURU, DISMISSING THE APPEAL AND UPHOLDING

THE RE-ASSESSMENT AND PENALTY ORDER DATED

26.12.2014 PASSED IN NO.218341824 UNDER THE KVAT

ACT, 2003 BY THE DEPUTY COMMISSIONER OF COMMERCIAL

TAXES (AUDIT-1.7) DVO-1, YESHWANTHPURA, BENGALURU-

560 022, FOR THE TAX PERIOD SEPTEMBER 2012 TO MARCH

2013.

THIS STRP HAVING BEEN HEARD AND RESERVED FOR

ORDERS ON 18.2.2021, COMING ON FOR PRONOUNCEMENT

OF ORDER, THIS DAY, V. SRISHANANDA. J., DELIVERED

THE FOLLOWING:

JUDGMENT

State has filed this Revision Petition questioning the

validity of the order passed in STA No.3/2016 dated

21.08.2017 on the file of Karnataka Appellate Tribunal,

Bengaluru [hereinafter referred to 'the KAT' for short].

2. Brief facts which are necessary for disposal of

this revision petition are as under:

M/s. Tallam Apparels (hereinafter referred to as

‘assessee’ for short) is a dealer registered under the

Karnataka Value Added Tax Act, 2003 (hereinafter referred

to as ‘the Act’ for short) having TIN No.29850733495

engaged in sales of textile and readymade garments from the

3

registered dealers within the State and sold by charging tax

to the buyers, by issuing tax invoices as per Section 29 of

the KVAT Act and Rules. In spite of discharge of burden

cast under the statute the audit authority passed an order

dated 26.12.2014 under Section 39(1) of the Act, rejecting

the input tax credit claimed by the appellant. The appellant

aggrieved by the order of the Assistant Commissioner of

Commercial Taxes Audit, Bengaluru (hereinafter referred to

as ‘the AA’ for short) has audited the books of accounts and

rejected the returns filed by assigning reasons. The

appellant being aggrieved by the order of the AA, challenged

the same before the Joint Commissioner of Commercial

Taxes (Appeals)-1, Shanthinagar, Bengaluru (hereinafter

referred to as 'the FAA' for short) in KVAT Application

Nos.984-989/14-15 on several grounds. The FAA dismissed

the appeal of the assessee.

3. Being not satisfied with the order passed by the FAA

dated 30.10.2015, the assessee preferred an appeal before

the Karnataka Appellate Tribunal. Before the Karnataka

Appellate Tribunal, parties were heard and the Karnataka

4

Appellate Tribunal by the impugned judgment allowed the

appeal of the assessee and set aside the order passed by the

FAA and AA dated 30.10.2015 and 21.08.2017. The State is

in appeal against the order of the Karnataka Appellate

Tribunal in this revision petition.

4. Learned Government Advocate contended that the

Tribunal grossly erred in setting aside the order passed by

the FAA and the AA. He further emphasize that the scheme

of KVAT Act is such that only tax that has been collected and

discharged by a selling dealer is eligible to be availed as

input tax credit by the purchasing dealer and the Tribunal

failed to appreciate the salient features in the scheme of

KVAT Act while passing the impugned order. He further

contended that the Tribunal grossly erred in considering the

provisions of Section 70(1) of the KVAT Act, which clearly

states that the burden of proving any claim as to deduction

of input tax shall lie on the dealer and in the instant case, the

assessee failed to prove that M/s.Taksons, M/s.Jasky

Exporters Pvt.Ltd., and M/s. Venus Printers are not a bogus

dealer and the purchases effected in the said entity was

5

genuine purchase. He also contended that the Tribunal erred

in not properly appreciating the scope and ambit of Section

70 of the Act and thus, sought for allowing the Revision

Petition.

5. He further contended that whether the assessee

was entitled for input tax rebate was not at all properly

discussed by the Karnataka Appellate Tribunal while passing

the impugned order having regard to the materials available

on record especially in the form of inspection report and thus

sought for allowing the Revision Petition.

6. In support of his contention, learned Government

Advocate relied on the judgment reported in (1) 2011 (71)

KLJ 10 (DB) in the case of Microqual Techno Pvt. Ltd.,

Vs. Additional Commissioner of Commercial Taxes and

(2) 2012 (73) KLJ 450 (DB) in the case of Packwell

Industries Vs. State of Karnataka and submitted that the

order of the Karnataka Appellate Tribunal deserves to be set

aside and thus, sought for allowing the Revision Petition.

6

7. Per contra, Smt. Veena J. Kamath, learned counsel

representing the assessee supported the impugned order by

submitting that when once the purchase is made by the

assessee with proper documentation, the assessee can

always claim the input tax based on the value mentioned in

the invoice and whether his dealer has paid the tax or not is

none of the concern of the assessee and therefore, sought for

dismissing the Revision Petition.

8. She further contended that in the instant case,

assessee has established that in put tax mentioned in the

invoices is claimed by the assessee is repaid and emphasizes

that the invoice itself contain the details of account payee

cheque through which the payment has been made to the

above concerns whereby, the assessee discharged the

burden cast on it as contemplated under Section 71 of the

Act and therefore, the orders passed by the authorities were

incorrect orders. The Karnataka Appellate Tribunal

appreciated these aspects of the matter in its proper

perspective in the impugned order and thus sought for

dismissal of the Revision Petition.

7

9. We have given our anxious consideration to the

rival contentions and perused the materials on record.

10. The relevant provisions of Sections 3, 70 and

77(2) of the Act which are necessary for disposal of this

Revision Petition are culled out hereunder:

"3. Levy of tax.- (1) The tax shall be

levied on every sale of goods in the State by a

registered dealer or a dealer liable to be

registered, in accordance with the provisions of

this Act.

(2) The tax shall also be levied, and paid by

every registered dealer or a dealer liable to be

registered, on the sale of taxable goods to him, for

use in the course of his business ,by a person who

is not registered under this Act.

70. Burden of proof.- (1) For the purposes

of payment or assessment of tax or any claim to

input tax under this Act, the burden of proving that

any transaction of a dealer is not liable to tax, or

any claim to deduction of input tax is correct, shall

lie on such dealer.

8

(2) Where a dealer knowingly issues or

produces a false tax invoice, credit or debit note,

declaration, certificate or other document with a

view to support or make any claim that a

transaction of sale or purchase effected by him or

any other dealer, is not liable to be taxed, or liable

to tax at a lower rate, or that a deduction of input

tax is available, the prescribed authority shall, on

detecting such issue or production, direct the

dealer issuing or producing such document to pay

as penalty;

(a) in the case of first such detection, three

times the tax due in respect of such transaction or

claim; and

(b) in the case of second or subsequent

detection, five times the tax due in respect of such

transaction or claim.

(3) Before issuing any direction for the

payment of the penalty under this Section, the

prescribed authority shall give to the dealer the

opportunity of showing cause in writing against the

imposition of such penalty.

77. Penalties relating to seals, electronic

tax registers and to unaccounted stocks.-

(1) …..

9

(2) Any persons or dealer who is found to be

in possession of unaccounted stocks of any taxable

goods under the provisions of clause (j) of sub-

section (1) of Section 52, after being given in

opportunity of showing cause in writing against the

imposition of a penalty, shall be liable to a penalty,

which shall not be less than the amount of tax

leviable or one thousand rupees whichever is

higher but which shall not exceed double the

amount of tax or five thousand rupees whichever is

higher."

11. In the case on hand, there is no dispute that the

assessee produced the true copies of communication

certificate, turnover analysis of M/s. Tallam Apparels for the

year 2012-13. It is not in dispute that M/s. Tallam Apparels

was registered dealer bearing Tin No.29850733495.

12. From perusal of these documents, it can safely be

concluded that the transaction is not a bogus transaction or

make believe transaction. Since M/s. Tallam Apparels is not a

bogus dealer, as is evident from the documents produced by

the assessee, dis-allowing of input tax is incorrect. There

cannot be any dispute, that burden is cast on the assessee to

10

establish the transaction to lay a claim for deduction of input

tax by production of necessary documents. This Court is of

the considered opinion that the assessee has discharged this

burden by placing necessary documents referred to supra.

The details of the account payee cheques mentioned in the

invoice itself demonstrates that the amount is transferred

from the assessee to the dealer through the Bank which fact

establishes that the transaction is not a bogus transaction.

13. In the case on hand, if M/s. Tallam Apparels has

not remitted the tax to the Department, for which assessee

cannot be penalized. Therefore, we do not find any

justification in interfering with the order of the Karnataka

Appellate Tribunal.

14. Under the scheme of the Act, there is no power

vested in the authority to proceed against the assessee for

non-remittance of tax by his purchaser. This aspect of the

matter has been rightly considered by the Karnataka

Appellate Tribunal in the right perspective. Therefore, we do

not find any infirmity in the impugned order recording a

finding that the AA and the FAA were wrong in disallowing

11

the input tax credit in favour of the assessee for the

purchases made from M/s. Tallam Apparrels.

15. In view of the foregoing discussion, no case is

made out to interfere with the well reasoned order of the

Karnataka Appellate Tribunal.

Accordingly, the Sales Tax Revision Petition is

dismissed.

Sd/-

JUDGE

Sd/-

JUDGE

PL*

You might also like

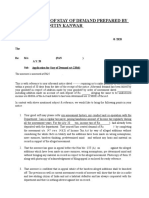

- DRAFT Stay of Demand by CA NITIN KANWARDocument13 pagesDRAFT Stay of Demand by CA NITIN KANWARAmandeep Vats91% (11)

- Sarah Joseph - Melissa Castan - The International Covenant On Civil and Political Rights - Cases, Materials, and Commentary-Oxford University Press (UK) (2013)Document1,042 pagesSarah Joseph - Melissa Castan - The International Covenant On Civil and Political Rights - Cases, Materials, and Commentary-Oxford University Press (UK) (2013)Aditya MaheshwariNo ratings yet

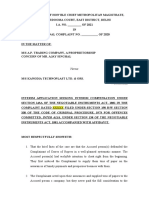

- Interim Application Under Section 143ADocument9 pagesInterim Application Under Section 143AKartik Sabharwal92% (12)

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Evidence Syllabus - Judge Rowena TanDocument8 pagesEvidence Syllabus - Judge Rowena TanTJ Paula Tapales JornacionNo ratings yet

- Presentation Evidence 2Document7 pagesPresentation Evidence 2Izzat IrfanNo ratings yet

- 187 State of Karnataka V Ecom Gill Coffee Trading PVT LTD 13 Mar 2023 463904Document7 pages187 State of Karnataka V Ecom Gill Coffee Trading PVT LTD 13 Mar 2023 463904Nithyananda N LNo ratings yet

- SC ECom Gill Sec 70 KVATDocument20 pagesSC ECom Gill Sec 70 KVATGVKNo ratings yet

- Doc-20231022-Wa0005 231022 090138Document9 pagesDoc-20231022-Wa0005 231022 090138kumarhealthcare2000No ratings yet

- Input Tax Credit Cannot Be Denied To Purchaser Merely Because Seller Didnt Record Transaction in GSTR-2A Form - Kerala High CourtDocument9 pagesInput Tax Credit Cannot Be Denied To Purchaser Merely Because Seller Didnt Record Transaction in GSTR-2A Form - Kerala High CourtdeepakasopaNo ratings yet

- Article On Madhav SteelDocument5 pagesArticle On Madhav SteelAbhay DesaiNo ratings yet

- JudgementbyjdateDocument27 pagesJudgementbyjdateBasanta Kumar SahooNo ratings yet

- IGST Refund Claim Cannot Be Withheld When ITC Towards Purchase From Risky Supplier Had Already Been Reversed - Taxguru - inDocument6 pagesIGST Refund Claim Cannot Be Withheld When ITC Towards Purchase From Risky Supplier Had Already Been Reversed - Taxguru - inIrfan ShaikhNo ratings yet

- SM DigestDocument4 pagesSM Digestapril75No ratings yet

- Republic of The Philippines CT A Eb No. 2009Document12 pagesRepublic of The Philippines CT A Eb No. 2009Sheryllyne NacarioNo ratings yet

- (2010) 328 ITR 169 (Punjab & Haryana) (19-08-2009) Commissioner of Income-Tax vs. Mandeep SinghDocument2 pages(2010) 328 ITR 169 (Punjab & Haryana) (19-08-2009) Commissioner of Income-Tax vs. Mandeep SinghkalravNo ratings yet

- In Re Senco Gold LTD GST AAR West BangalDocument4 pagesIn Re Senco Gold LTD GST AAR West Bangalkinnar2013No ratings yet

- Messrs Shree Renuka Sugars Ltd. Versus State of GujaratDocument12 pagesMessrs Shree Renuka Sugars Ltd. Versus State of Gujaratrizwanipooja89No ratings yet

- Authority TaxDocument4 pagesAuthority TaxabelgichanaNo ratings yet

- 2020 P T D Trib 614Document8 pages2020 P T D Trib 614haseeb AhsanNo ratings yet

- Civ 1 Rev CasesDocument11 pagesCiv 1 Rev CasesJulian Paul CachoNo ratings yet

- Shree Durga Rice Mill Vs State of Bihar - AspxDocument18 pagesShree Durga Rice Mill Vs State of Bihar - AspxanillegalmailsNo ratings yet

- Atlas V CIRDocument5 pagesAtlas V CIRAgnes FranciscoNo ratings yet

- GDT V Comptroller of GST 2021 SGGSTDocument35 pagesGDT V Comptroller of GST 2021 SGGSTKW LeonNo ratings yet

- Prulife Vs CirDocument12 pagesPrulife Vs CirERWINLAV2000No ratings yet

- Maruti Suzuki India LTD 0Document97 pagesMaruti Suzuki India LTD 0AMAN KUMAR 20213009No ratings yet

- Supreme Court of India Page 1 of 6Document6 pagesSupreme Court of India Page 1 of 6amitk96270No ratings yet

- Shadow Judg. Rishabh Munjal PRN 3039 Div D 2018-23Document7 pagesShadow Judg. Rishabh Munjal PRN 3039 Div D 2018-23rishabhNo ratings yet

- Republic of The Philippines: Supreme CourtDocument12 pagesRepublic of The Philippines: Supreme Courtlen_dy010487No ratings yet

- CIT-Vs-NCR-Corporation-Pvt.-Ltd.-Karnataka-High-Court - ATMs Are ComputerDocument15 pagesCIT-Vs-NCR-Corporation-Pvt.-Ltd.-Karnataka-High-Court - ATMs Are ComputerSoftdynamiteNo ratings yet

- In The High Court of Delhi at New DelhiDocument5 pagesIn The High Court of Delhi at New DelhiMayank DwivediNo ratings yet

- Allied Banking Corp Vs CIRDocument15 pagesAllied Banking Corp Vs CIRLeslie LernerNo ratings yet

- Case No. 3428 of 2021Document7 pagesCase No. 3428 of 2021puneet1876No ratings yet

- No Itc Reversal Demand W o Investigating Supplier DB Calhc 1690968957Document10 pagesNo Itc Reversal Demand W o Investigating Supplier DB Calhc 1690968957Dhanashree Prasanna Phadke ValanjooNo ratings yet

- Del Itat On 120 - 124 - 127 - Additional Cit Is Not AoDocument36 pagesDel Itat On 120 - 124 - 127 - Additional Cit Is Not Aohvdatar8898No ratings yet

- Jwalamala JewellersDocument9 pagesJwalamala Jewellersbharath289No ratings yet

- Factual Antecedents: Custom SearchDocument9 pagesFactual Antecedents: Custom SearchJerome CasasNo ratings yet

- Kalyan Jewellers AAAR PDFDocument4 pagesKalyan Jewellers AAAR PDFprathamesh bhatkarNo ratings yet

- Anheuser Busch Inbev India LTD Vs CCTDocument5 pagesAnheuser Busch Inbev India LTD Vs CCTAsma HussainNo ratings yet

- Court of Tax Appeal: Chairperson, andDocument25 pagesCourt of Tax Appeal: Chairperson, andYna YnaNo ratings yet

- Gulf Oil LubricantsDocument3 pagesGulf Oil Lubricantsmdfaizan.alamNo ratings yet

- Tax Appeal: 20'" & 29th October, 2021Document18 pagesTax Appeal: 20'" & 29th October, 2021WalterNo ratings yet

- CIR Vs PAL - ConstructionDocument8 pagesCIR Vs PAL - ConstructionEvan NervezaNo ratings yet

- VAT ApppealDocument7 pagesVAT ApppealhhhhhhhuuuuuyyuyyyyyNo ratings yet

- RemediesDocument36 pagesRemediesDaryll Gayle AsuncionNo ratings yet

- Capital GainDocument10 pagesCapital GainSunny MittalNo ratings yet

- Coon of Tax Appeals: Second DivisionDocument12 pagesCoon of Tax Appeals: Second DivisionGeorge HabaconNo ratings yet

- ITC Cannot Be Denied Solely Due To GSTR 2A & 3B Discrepancies - Kerala HC - Taxguru - inDocument2 pagesITC Cannot Be Denied Solely Due To GSTR 2A & 3B Discrepancies - Kerala HC - Taxguru - inRiya Shankar SharmaNo ratings yet

- CIR v. Benguet Corp.Document1 pageCIR v. Benguet Corp.Chou TakahiroNo ratings yet

- Infiniti Wholesale Limited Vs The Assistant Commissioner (CT) On 6 November, 2014Document7 pagesInfiniti Wholesale Limited Vs The Assistant Commissioner (CT) On 6 November, 2014Ashok SharmaNo ratings yet

- Can GST Scrutiny Be There After Audit 1705059483Document5 pagesCan GST Scrutiny Be There After Audit 1705059483RajatNo ratings yet

- GST Weekly Update - 10-2023-24Document4 pagesGST Weekly Update - 10-2023-24Ayush JhaNo ratings yet

- Pim Application FormatDocument6 pagesPim Application Formatseshadrimn seshadrimnNo ratings yet

- 10 - CIR v. Yusen Logistics Center, Inc.Document3 pages10 - CIR v. Yusen Logistics Center, Inc.Carlota VillaromanNo ratings yet

- Tax 2 CasesDocument33 pagesTax 2 CasessalpanditaNo ratings yet

- CIT ACIT Vs Karnataka Vikas Grameen Bank Karnataka High CourtDocument25 pagesCIT ACIT Vs Karnataka Vikas Grameen Bank Karnataka High Courtbq6bj9crmxNo ratings yet

- Cir vs. Aichi Forging G.R. No. 184823Document14 pagesCir vs. Aichi Forging G.R. No. 184823Eiv AfirudesNo ratings yet

- Letter Template-1Document21 pagesLetter Template-1QwertyNo ratings yet

- G.R. No. 175097 Allied Banking Corporation, Petitioner, vs. Commissioner of Internal Revenue, Respondent. Del Castillo, J.Document2 pagesG.R. No. 175097 Allied Banking Corporation, Petitioner, vs. Commissioner of Internal Revenue, Respondent. Del Castillo, J.thelionleo1No ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Consumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintFrom EverandConsumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintNo ratings yet

- Love-Jihad' Protection of Religious Proximity: An Indian SituationDocument22 pagesLove-Jihad' Protection of Religious Proximity: An Indian SituationAditya MaheshwariNo ratings yet

- CPC Ca-IiDocument4 pagesCPC Ca-IiAditya MaheshwariNo ratings yet

- Hindu Women, Muslim Men: Love Jihad and Conversions: Economic and Political Weekly December 2009Document4 pagesHindu Women, Muslim Men: Love Jihad and Conversions: Economic and Political Weekly December 2009Aditya MaheshwariNo ratings yet

- Article Writing Competition - BROCHUREDocument3 pagesArticle Writing Competition - BROCHUREAditya MaheshwariNo ratings yet

- Chambers Cheque Bounce U/s 138Document3 pagesChambers Cheque Bounce U/s 138Aditya MaheshwariNo ratings yet

- The Legum Wire: Connecting CornersDocument7 pagesThe Legum Wire: Connecting CornersAditya MaheshwariNo ratings yet

- N L U, J: Ational AW Niversity OdhpurDocument6 pagesN L U, J: Ational AW Niversity OdhpurAditya MaheshwariNo ratings yet

- ADMIN CASES DigestDocument4 pagesADMIN CASES DigestAnonymous 2NtRRpNo ratings yet

- How To FOIA: A CCR FOIA Request Resource GuideDocument16 pagesHow To FOIA: A CCR FOIA Request Resource GuideJonathan Hall100% (6)

- FELS Energy, Inc. vs. Province of Batangas (G.R. No. 168557)Document23 pagesFELS Energy, Inc. vs. Province of Batangas (G.R. No. 168557)aitoomuchtvNo ratings yet

- Pre Trial Brief ProsecutionDocument3 pagesPre Trial Brief ProsecutionLawrence Ȼaballo BiolNo ratings yet

- Baluyut V PanoDocument1 pageBaluyut V PanoMarilou AgustinNo ratings yet

- Elegalix - Allahabad High Court Judgment Information System: (Judgment/Order in Text Format)Document2 pagesElegalix - Allahabad High Court Judgment Information System: (Judgment/Order in Text Format)arvindNo ratings yet

- Public Security OrdinanceDocument17 pagesPublic Security OrdinanceNews CutterNo ratings yet

- FERNANDO A. FROILAN, Plaintiff-Appellee, PAN ORIENTAL SHIPPING CO., Defendant-Appellant, REPUBLIC OF THE PHILIPPINES, Intervenor-Appellee. FactsDocument2 pagesFERNANDO A. FROILAN, Plaintiff-Appellee, PAN ORIENTAL SHIPPING CO., Defendant-Appellant, REPUBLIC OF THE PHILIPPINES, Intervenor-Appellee. FactsGellian eve OngNo ratings yet

- Can We Really Limit Liability - Al Tamimi & CompanyDocument3 pagesCan We Really Limit Liability - Al Tamimi & CompanysagaicaNo ratings yet

- Introduction To Land Law Term Paper of ShawonDocument34 pagesIntroduction To Land Law Term Paper of ShawonArifur Rahman ShawonNo ratings yet

- de Bogacki Vs InsertoDocument2 pagesde Bogacki Vs InsertoAnn Margaret G. GomezNo ratings yet

- 3 People Vs GarciaDocument23 pages3 People Vs GarciaPatrisha AlmasaNo ratings yet

- Motion of ReceiverDocument140 pagesMotion of ReceiverLocal12WKRC0% (1)

- Uy Vs CA, GR #109557, November 29, 2000Document3 pagesUy Vs CA, GR #109557, November 29, 2000Loren Delos SantosNo ratings yet

- FS4 NotesDocument6 pagesFS4 NotesSword SaintNo ratings yet

- Oblicon - 113. Bognot v. Rri Lending, G.R. No. 180144, Sept. 24, 2014Document4 pagesOblicon - 113. Bognot v. Rri Lending, G.R. No. 180144, Sept. 24, 2014Abdullah JulkanainNo ratings yet

- 4 Gaanan Vs IAC - CDDocument1 page4 Gaanan Vs IAC - CDJeah N MelocotonesNo ratings yet

- Sunit Vs OSM MaritimeDocument2 pagesSunit Vs OSM MaritimeKier ArqueNo ratings yet

- Gabriel Yap vs. Letecia SiaoDocument10 pagesGabriel Yap vs. Letecia SiaoCarol TerradoNo ratings yet

- Judiciary FinalDocument16 pagesJudiciary Finalharsh daveNo ratings yet

- Stitt LawsuitDocument33 pagesStitt LawsuitKFORNo ratings yet

- Narendra Vallabhbhai Patel-Consent Quashing With Complainant AffidavitDocument17 pagesNarendra Vallabhbhai Patel-Consent Quashing With Complainant AffidavitYash MohtaNo ratings yet

- Dangwa Transportation Co., Inc. vs. Court of AppealsDocument2 pagesDangwa Transportation Co., Inc. vs. Court of AppealsAlmer TinapayNo ratings yet

- Eleventh Circuit Powell LetterDocument1 pageEleventh Circuit Powell LetterLaw&CrimeNo ratings yet

- LAWSUIT: Franz v. Oxford Community School DistrictDocument46 pagesLAWSUIT: Franz v. Oxford Community School DistrictJillian SmithNo ratings yet

- Private International LawDocument11 pagesPrivate International Lawanne leeNo ratings yet

- 1) Go VS SunbanunDocument17 pages1) Go VS Sunbanunjed_sindaNo ratings yet

- Screenshot 2023-05-18 at 1.23.55 PMDocument31 pagesScreenshot 2023-05-18 at 1.23.55 PMsabNo ratings yet