Professional Documents

Culture Documents

Sarda Energy MLR Sec 13-01-11

Sarda Energy MLR Sec 13-01-11

Uploaded by

sameeranadeCopyright:

Available Formats

You might also like

- Tejpal Sheth - Business Law-Pearson India (2017) PDFDocument649 pagesTejpal Sheth - Business Law-Pearson India (2017) PDFAhsan Raza67% (6)

- Ac Sur-004Document80 pagesAc Sur-004AO BeltranNo ratings yet

- Tata Steel - Value Chain AnalysisDocument11 pagesTata Steel - Value Chain AnalysisKiranNo ratings yet

- Report Business Plan Iron OreDocument37 pagesReport Business Plan Iron Orearun1974100% (1)

- Cast Wheel in Indian Rlys-Present StatusDocument6 pagesCast Wheel in Indian Rlys-Present StatusDevarshi GaurNo ratings yet

- Jindal Steel & Power LTD: Test CertificateDocument2 pagesJindal Steel & Power LTD: Test CertificateAmandeep Singh50% (2)

- Procurement Plan URSIP - Newform - 20181101 (DRAFT)Document22 pagesProcurement Plan URSIP - Newform - 20181101 (DRAFT)Abib Ansari100% (2)

- Exam Sample AbsorbtionDocument12 pagesExam Sample AbsorbtionMa Joyce Imperial100% (1)

- CHALK 2017-09-29 Complaint PDFDocument39 pagesCHALK 2017-09-29 Complaint PDFal_crespoNo ratings yet

- SEML PresentationDocument47 pagesSEML PresentationalparathiNo ratings yet

- Mickey Metals LTDDocument13 pagesMickey Metals LTDBhavin SagarNo ratings yet

- Analyst Meet Presentation Jan 08Document37 pagesAnalyst Meet Presentation Jan 08Varun KumarNo ratings yet

- HDFC Securities Technical Pick - Sunflag Iron & Steel CoDocument10 pagesHDFC Securities Technical Pick - Sunflag Iron & Steel CoManish SinghNo ratings yet

- Sterlite Industries: Management Meet NoteDocument5 pagesSterlite Industries: Management Meet NotemittleNo ratings yet

- Pre Feasibility Project Report: Sarda Energy & Minerals LTDDocument49 pagesPre Feasibility Project Report: Sarda Energy & Minerals LTDPriyanshu ShrivastavNo ratings yet

- NTDC Services Charges - OverallDocument1 pageNTDC Services Charges - OverallMuhammad KhanNo ratings yet

- MSP Steel & PowerDocument7 pagesMSP Steel & PowerraghuNo ratings yet

- State Investment Promotion Board: List of Effective Mou'S For Chhattisgarh (Up To September, 2019)Document30 pagesState Investment Promotion Board: List of Effective Mou'S For Chhattisgarh (Up To September, 2019)suraj pandeyNo ratings yet

- Mining Industry ReportDocument27 pagesMining Industry ReportAbhinav YadavNo ratings yet

- Current Holding ReportDocument2 pagesCurrent Holding Reportnikhilesh singhNo ratings yet

- Bhushan Power and Steel LTDDocument8 pagesBhushan Power and Steel LTDAkshay AgarwalNo ratings yet

- Metals 164 Tata Steel Jamshedpur 0 PDFDocument41 pagesMetals 164 Tata Steel Jamshedpur 0 PDFkalaiNo ratings yet

- Project Report: Godawari Power and Ispat LimitedDocument28 pagesProject Report: Godawari Power and Ispat LimitedR.C.PerumalNo ratings yet

- SR - No. Details For Pending Bills & Risk & Cost Amount 1 GST Bill Amount @7% 2 Delay BG Submission in (INR) 3 Total (1+2+3)Document9 pagesSR - No. Details For Pending Bills & Risk & Cost Amount 1 GST Bill Amount @7% 2 Delay BG Submission in (INR) 3 Total (1+2+3)AJAY BHOSALENo ratings yet

- Iron Ore Pelletization Technology & NeedDocument55 pagesIron Ore Pelletization Technology & NeedVeeresh Gouda100% (2)

- Metorex Int Dec07Document12 pagesMetorex Int Dec07Take OneNo ratings yet

- Tata Steel - Value Chain AnalysisDocument11 pagesTata Steel - Value Chain AnalysisKiranNo ratings yet

- List of MoUsDocument24 pagesList of MoUsSrinivasa Rao VenkumahanthiNo ratings yet

- Hindustan ZincDocument40 pagesHindustan ZincRavi GuptaNo ratings yet

- Corporate PresentationDocument39 pagesCorporate PresentationSheshank VermaNo ratings yet

- JSW Steel LTD - Section 3 - R2 PDFDocument21 pagesJSW Steel LTD - Section 3 - R2 PDFrajesh shekarNo ratings yet

- Toromocho Jan2017 Competent Persons ReportDocument147 pagesToromocho Jan2017 Competent Persons Reportmaría joséNo ratings yet

- ICICI Securities Update On Metals Q4FY24 Preview Non Ferrous PlayersDocument8 pagesICICI Securities Update On Metals Q4FY24 Preview Non Ferrous Playersmanitjainm21No ratings yet

- F I R S T C A L L: TATA Sponge Iron LTDDocument16 pagesF I R S T C A L L: TATA Sponge Iron LTDImteyaz Ahmed KhanNo ratings yet

- Tata Sponge 080910Document2 pagesTata Sponge 080910gurubalaji15No ratings yet

- Enduring Value Through: Values ValuesDocument37 pagesEnduring Value Through: Values ValuesminingnovaNo ratings yet

- Gold MinersDocument5 pagesGold Minerssaurabh.shrivastavNo ratings yet

- Phil Metallic Mineral Production H1 2021 VS H1 2020Document4 pagesPhil Metallic Mineral Production H1 2021 VS H1 2020Mik SerranoNo ratings yet

- Presentation For AluminaDocument31 pagesPresentation For AluminaMohammad Abubakar SiddiqNo ratings yet

- Q1-FY23-Godawari & IspatDocument44 pagesQ1-FY23-Godawari & IspatshyamNo ratings yet

- 47623-30902 CSDocument1 page47623-30902 CSMuhammad Shoaib Aslam KhichiNo ratings yet

- HSL - Commodities Pack Report - 2021-202108182348310059173Document16 pagesHSL - Commodities Pack Report - 2021-202108182348310059173SHAIK AHMEDNo ratings yet

- Jindal Steels & Power LimitedDocument10 pagesJindal Steels & Power LimitedHIMANSHU RAWATNo ratings yet

- Anand Ratpital Goods Q2FY22 Result PreviewDocument13 pagesAnand Ratpital Goods Q2FY22 Result PreviewRaktim BiswasNo ratings yet

- 1-25 ET 500 Company List 2022Document2 pages1-25 ET 500 Company List 20220000000000000000No ratings yet

- Sesa Goa Ceases Mining at ThakuraniDocument4 pagesSesa Goa Ceases Mining at Thakuranisumits1977No ratings yet

- IPO and Disinvestment in Covid-19: Group Number 8Document13 pagesIPO and Disinvestment in Covid-19: Group Number 8Raksha ShettyNo ratings yet

- VAluation On TATA Corus DealDocument32 pagesVAluation On TATA Corus Dealromeel3079% (14)

- CESC Limited CESC Limited: Investor Update - Q3 FY11Document14 pagesCESC Limited CESC Limited: Investor Update - Q3 FY11Namuduri RamakanthNo ratings yet

- Protfolio Selection Group 2Document7 pagesProtfolio Selection Group 2Dulon DuttaNo ratings yet

- Advance Release: Sierra Leone 2017-18 TextDocument4 pagesAdvance Release: Sierra Leone 2017-18 TextestevaoNo ratings yet

- Operations & Supply Chain of Tata Steel: by Pankaj Singh Rawat 0807PGPM22Document11 pagesOperations & Supply Chain of Tata Steel: by Pankaj Singh Rawat 0807PGPM22melotusNo ratings yet

- Sesa & Sterlite - Q4FY13 Combined Result Update - Centrum 02052013 EDITEDDocument13 pagesSesa & Sterlite - Q4FY13 Combined Result Update - Centrum 02052013 EDITEDcanaryhillNo ratings yet

- Yash Competition AnalysisDocument4 pagesYash Competition AnalysisEdu PlatformNo ratings yet

- Yash Competition AnalysisDocument4 pagesYash Competition AnalysisEdu PlatformNo ratings yet

- MDKA Consolidated Mineral Resources and Ore Reserves Statement 31 Dec 2020Document13 pagesMDKA Consolidated Mineral Resources and Ore Reserves Statement 31 Dec 2020Leonie SaputriNo ratings yet

- Iron Ore India & NMDCDocument16 pagesIron Ore India & NMDCKanwar P SinghNo ratings yet

- Executive Summery-Integrated Steel CompanyDocument2 pagesExecutive Summery-Integrated Steel Companyjeet3184No ratings yet

- ICICI Pru Balanced Fund - (G) ::::::::: GraphDocument13 pagesICICI Pru Balanced Fund - (G) ::::::::: GraphVivek GusaniNo ratings yet

- Project Report On Working Capital Management at Tata Steel Ltd.Document8 pagesProject Report On Working Capital Management at Tata Steel Ltd.Ankit Agrawal50% (4)

- Bhaspe 95Document4 pagesBhaspe 95priyapmb898No ratings yet

- Usha Martin ExampleDocument2 pagesUsha Martin ExampleonkarNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Telecallers Candidate Profile For Fresher and ExperiencedDocument6 pagesTelecallers Candidate Profile For Fresher and ExperiencedNandita ThukralNo ratings yet

- Army - FM4 30X3 - Maintenance Operations and ProceduresDocument482 pagesArmy - FM4 30X3 - Maintenance Operations and ProceduresMeowmix100% (3)

- 6 PDFDocument1 page6 PDFkhraieric16No ratings yet

- Cut Off PercentilesDocument5 pagesCut Off Percentileskill_my_kloneNo ratings yet

- Guide To The Location of Gasoline (Motor Fuel) Filling Stations and Filling-Cum-Serv1Ce Stations in Urban Areas ForewordDocument8 pagesGuide To The Location of Gasoline (Motor Fuel) Filling Stations and Filling-Cum-Serv1Ce Stations in Urban Areas ForewordRenugopalNo ratings yet

- Rashid Intrenship ReportDocument6 pagesRashid Intrenship ReportMUHAMMAD RASHIDNo ratings yet

- Crush Wine Trademark ComplaintDocument14 pagesCrush Wine Trademark ComplaintMark JaffeNo ratings yet

- Global Trends in Investment Operations OutsourcingDocument9 pagesGlobal Trends in Investment Operations OutsourcingCognizantNo ratings yet

- Art 1956-1957Document6 pagesArt 1956-1957Kathleen Rose TaninasNo ratings yet

- MGT 210Document19 pagesMGT 210FAYAZ AHMEDNo ratings yet

- Freyr Electronic Trial Master File: The GuideDocument7 pagesFreyr Electronic Trial Master File: The GuideFreyr IncNo ratings yet

- TE Chemical 2015Document22 pagesTE Chemical 2015Shivam MarkadNo ratings yet

- Turtle Map CMDocument6 pagesTurtle Map CMmtechewitNo ratings yet

- Gideon Hatsu Cv...Document4 pagesGideon Hatsu Cv...Gideon HatsuNo ratings yet

- Customer Lifetime ValueDocument16 pagesCustomer Lifetime Valuearpit_9688No ratings yet

- Chapter 6Document3 pagesChapter 6Ricky LavillaNo ratings yet

- Gross InefficiencyDocument2 pagesGross InefficiencyNowell SimNo ratings yet

- Addressing Competition and Driving GrowthDocument25 pagesAddressing Competition and Driving GrowthJabran AhmedNo ratings yet

- Chris Jerome Federal LawsuitDocument93 pagesChris Jerome Federal LawsuitLansingStateJournalNo ratings yet

- Painting The Future Bright - The Daily StarDocument5 pagesPainting The Future Bright - The Daily StarAkash79No ratings yet

- McDonald's Analysis of ChangeDocument6 pagesMcDonald's Analysis of ChangeSeemaKapoorNo ratings yet

- Sew What Inc - Case StudyDocument12 pagesSew What Inc - Case Studytaniya17No ratings yet

- Taxation of Cooperatives PDFDocument110 pagesTaxation of Cooperatives PDFJaquelyn RaccaNo ratings yet

- Risk Management Toolkit - August 2014 PDFDocument51 pagesRisk Management Toolkit - August 2014 PDFarwindaNo ratings yet

- Chethan KC: Business Development ExecutiveDocument1 pageChethan KC: Business Development Executivenithin aradhyaNo ratings yet

Sarda Energy MLR Sec 13-01-11

Sarda Energy MLR Sec 13-01-11

Uploaded by

sameeranadeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sarda Energy MLR Sec 13-01-11

Sarda Energy MLR Sec 13-01-11

Uploaded by

sameeranadeCopyright:

Available Formats

Sarda Energy & Minerals Ltd | Management Meet Note

13th January 2010

Not Rated We met the management of Sarda Energy & Minerals Ltd.

Price (INR) 297 SEML is into production of Steel and Ferro Alloys. The company

Target (INR) NA

Return (%) NA

has acquired Coal, Iron Ore and Manganese ore mines which

Beta (Sensex) 1.79 are at various stages of getting operational. The company also

has plans for significant capacity addition in Thermal and Hydro

power. Once the mines get operational they will significantly

contribute to improvement in EBITDA margins. The power pro-

Market Data jects and additional capacities for Wire Rod, Ferro Alloy & Steel

Mar Cap (INR Mn) 9,815

will drive revenue growth in the longer term.

Enterprise Value (INR Mn) 15,967

Total Shares (Mn) 34

The conversion of reconnaissance permit / prospecting licenses

Avg Qtr Dly Vol (000's) 329

into mining lease and easing of naxal activities will play key

role in company’s revenue and profitability outlook going

ahead. The stock is currently trading at 9.7 x Adj Cons EPS of

Shareholding INR 30 for FY10. We do not have a rating on the stock.

Promoter 70.1%

DII 8.0% Wire Rod to boost sales, improve operating margin and

FII 6.4% profits

Non Institution 15.6%

Ferro Alloys: Increasing demand, better realizations and ca-

pacity expansion to drive earnings

Coal, Iron Ore & Manganese Ore resources to help in back-

Stock Code

NSE SARDAEN ward integration

BSE 504614

Bloomberg SEML IN Thermal and Hydro power projects, to scale up the business

Reuters SAEM.BO in the longer term

Source : MLR, Company

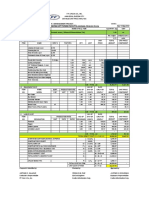

Standalone Quarterly Financials (INR Mn) Sep-10 Sep-09 Var% Jun-10 Jun-09 Var%

Net Sales 2,002.1 1,020.0 96.3 2,167.2 930.8 132.8

Other operating income 0.0 0.0 0.0 0.0

Net Sales & Other Operating Income 2,002.1 1,020.0 96.3 2,167.2 930.8 132.8

Total Expenditure 1,840.7 958.4 92.1 1,806.8 884.4 104.3

PBIDT (Excl OI) 161.3 61.6 162.1 360.5 46.4 677.0

Other Income 278.5 21.1 1,219.5 8.4 142.0 -94.1

Operating Profit 439.9 82.7 432.1 368.8 188.4 95.8

Interest 56.6 25.3 123.7 26.9 16.9 58.9

Exceptional Items 0.0 60.2 -100.0 0.0 -14.0 100.0

PBDT 383.3 117.6 226.0 341.9 157.5 117.2

Depreciation 136.4 106.3 28.4 135.7 81.2 67.2

PBT 246.9 11.3 2,077.3 206.2 76.3 170.4

Tax 70.7 -4.2 1,799.8 68.5 16.3 321.5

Profit After Tax 176.2 15.5 1,036.8 137.7 60.0 129.4

Extraordinary Items 0.0 0.0

Net Profit (after Extraordinary Items) 176.2 15.5 1,036.8 137.7 60.0 129.4

EPS 5.2 0.5 1,026.1 4.0 1.8 129.6

PBIDTM% (Excl OI) 7.4 5.6 31.6 15.6 5.0 212.6

PATM% 8.1 1.4 470.7 6.0 6.5 -7.7

1 MLR Investment Research

Sarda Energy & Minerals Ltd | Management Meet Note

13th January 2010

Status of Projects and Mining Resources

Steel & Product Location Capacity (TPA) Status

Ferro Alloys Pellet Plant Chattisgarh 600,000 Operational

Sponge Iron Chattisgarh 360,000 Operational

Crude Steel Chattisgarh 240,000 Operational

Wire Rod Chattisgarh 180,000 Operational

Ferro Alloys Chattisgarh 82,500 Operational

Ferro Alloys Andhra Pradesh 125,000 Operational by Mar'12

Coal Washery Chattisgarh 960,000 Operational by Apr'11

Integrated Steel Chattisgarh 1,000,000 Land Acquired

Thermal Resource Location Reserves (Mn Tn) Status

Thermal Coal Chattisgarh 100 Operational

Coal

Thermal Coal Chattisgarh 36 Environment Clearance Awaited

Thermal Coal Indonesia (50% Economic Interest) 300 Operational by Dec'11

Iron Ore Resource Location Reserves (Mn Tn) Status

Iron Ore Chattisgarh 20 Operational by Mar'11

Iron Ore Chattisgarh 200 (to be acertained) 4 RP & 1 PL Received

Manganese Resource Location Reserves (Mn Tn) Status

Ore Manganese Ore Goa 6 Environment Clearance Awaited

Manganese Ore Madhya Pradesh 25 (to be acertained) 3 RP & 2 PL Received

Thermal Power Location Capacity (MW) Status

Power Thermal Chattisgarh (Captive) 81.5 Operational

Thermal Andhra Pradesh (Captive) 80 Operational by Mar'12

Thermal Chattisgarh 300 Land Acquired

Thermal Chattisgarh 1320 Land Acquired

Hydro Power Location Capacity (MW) Status

Hydro Uttranchal 4.8 Operational

Power

Hydro Sikkim 96 Operational by FY15

Hydro Chattisgarh 101 Financial Closure Awaited

Source : MLR, Company

Company Background

Sarda Energy & Minerals Ltd is into production of Steel and Ferro Alloys. The com-

pany has acquired Coal, Iron ore and Manganese ore mines in India and Indonesia

for backward integration. It also has a captive thermal power plant and has plans

for additional capacities for thermal and hydro power.

The company is based in Raigarh, Chattisgarh. Mr Kamal Kishore Sarda is the chair-

man & managing director of the company.

Recently SEML has allotted 5% of its equity to Asia Minerals Ltd. AML is a Hong

Kong based company and is specialized in all Manganese related business from

Ores to Alloys, Metals and Chemicals.

2 MLR Investment Research

Sarda Energy & Minerals Ltd | Management Meet Note

13th January 2010

Wire Rod to boost sales, improve operating margin and profits

The company has set up a Wire Rod mill with a capacity of

180,000 TPA. The plant has started trial production; however,

commercial production will start only in FY12.

The demand for Wire Rod is likely to increase due to higher in-

vestments in the infrastructure sector. Also, the realization for

Wire Rod is higher than Billets as Wire Rod is a finished product.

The operating margin will also improve as the increase in realiza-

tion is higher than the conversion expense.

The company will also be selling Sponge Iron which will aid reve-

nue growth from Steel division.

Ferro Alloys: Increasing demand, better realizations and capac-

ity expansion to drive earnings

The demand for steel in India, the world’s second fastest grow-

ing economy is increasing at a faster pace than the rest of the

world. The demand for ferro alloys is directly related to the de-

mand for steel and the growth outlook looks bright.

The capacity addition in the ferro alloys space is not happening

at a fast pace and demand is likely to outpace supply resulting in

decrease in exports and better realizations.

The company at present has an installed capacity of 82,500 TPA

and has plans to add 125,000 TPA of fresh capacity in Andhra

Pradesh, the new plant will also be having a captive power plant

of 80 MW. The company expects the plant to be operational by

Mar’12.

Coal, Iron Ore & Manganese Ore resources to help in backward

integration

The company has two coal mines in Chhattisgarh with a total

reserve of 136 Mn Tn. The company has also acquired a coal

mine in Indonesia with approximate reserve of 300 Mn Tn, how-

ever the Indonesian coal mine is not likely to become opera-

tional before Dec’11. The coal mined from the captive resources

would be used for the production of sponge iron and power

plants.

3 MLR Investment Research

Sarda Energy & Minerals Ltd | Management Meet Note

13th January 2010

The company is having an Iron Ore mine in Chhattisgarh with a

reserve of 20 Mn Tn and is likely to become operational by

Mar’11. It has received prospecting license for one mine and rec-

ommended prospecting license for four mines in the state of

Chhattisgarh. The five mines are likely to have total Iron Ore re-

serve of 200 Mn Tn.

The company is having a Manganese Ore mine in Goa with a re-

serve of 6 Mn Tn. It has also received reconnaissance permit and

prospecting license for Manganese Ore mines in the state of

Madhya Pradesh. The reserve of these mines is yet to be ascer-

tained.

The company has set up a pellet plant and a coal washery. The

pellet plant has a capacity of 600,000 TPA and started produc-

tion from Q1 FY11. The captive iron ore and pellet plant will re-

sult in a saving of INR 6000/Tn of Steel. It is also setting up a Coal

washery facility with a capacity of 960,000 TPA and the facility is

expected to be operational by Apr’11.

The mining resources combined with the pellet plant and coal

washery would aid in improving the margin.

Thermal and Hydro power projects, to scale up the business in

the longer term

The company at present is having a total power capacity of 81.5

MW, 30 MW is waste heat recovery based power and 51.5 MW

is coal based. The current power capacities are captive, how-

ever, at times when steel prices are subdued the company has

been selling power in the open market. The company is also

planning a 300 MW coal based power plant in Chhattisgarh near

its coal mines. The land for the project has been acquired.

The company is planning two hydro power projects in Sikkim and

Chhattisgarh with capacities of 96 MW and 101 MW respec-

tively. The Sikkim project has been appraised by PFC and civil

contract has been awarded, the project is likely to be opera-

tional by FY15. The work on Chhattisgarh hydro power project is

yet to start and the financial closure is awaited.

A 1320 MW (2*660 MW) in Chattisgarh is also at its initial

stages, the land for the project has been acquired, coal linkage

and water permissions has also been received.

4 MLR Investment Research

Sarda Energy & Minerals Ltd | Management Meet Note

13th January 2010

Financials (Consolidated, INR Mn)

Income Statement FY06 FY07 FY08 FY09 FY10

Revenue 2,156.4 3,678.6 6,249.2 9,488.2 5,277.1

Operating Expense 1,956.3 2,980.3 4,544.5 7,673.0 4,494.5

EBITDA 200.1 698.3 1,704.6 1,815.1 782.6

Other Income 42.7 169.9 53.2 88.7 1,237.1

Dep & Amo 66.1 225.7 223.1 281.3 409.3

Interest 31.8 135.0 136.7 34.8 22.5

Tax 24.8 81.9 179.9 263.2 144.1

Minority Interest 0.0 0.0 0.0 0.1 1.6

Net Income 120.2 425.7 1,218.0 1,324.4 1,442.1

Non Recurring Item 0.0 0.0 0.0 -449.2 430.3

Adjusted Net Income 120.2 425.7 1,218.0 1,773.6 1,011.8

Balance Sheet FY06 FY07 FY08 FY09 FY10

Share Capital 130.8 130.8 340.5 340.5 340.5

Reserve 540.9 1,945.8 3,687.4 4,908.1 6,172.7

Total Equity 671.7 2,076.6 4,027.8 5,248.5 6,513.2

Loan Fund 1,034.8 2,087.4 3,238.4 7,438.4 6,220.7

Minority Capital 0.0 0.0 0.0 0.0 258.5

Deferred Tax Liability 131.7 170.8 194.4 283.0 286.5

Total Capital 1,838.3 4,334.8 7,460.6 12,969.9 13,278.8

Fixed Asset 1,227.3 2,901.8 4,678.2 7,143.0 9,063.7

Investment 1.0 218.5 179.9 3,766.8 2,111.6

Cash 10.3 214.5 993.0 366.8 628.0

Inventory 335.9 682.8 1,498.9 996.3 1,520.0

Other Current Asset 349.4 846.7 1,346.0 1,295.2 957.8

Total Current Liabilitiy 85.6 529.5 1,235.4 598.2 1,002.3

Net Current Asset 609.9 1,214.5 2,602.5 2,060.1 2,103.5

Total Asset 1,838.3 4,334.8 7,460.6 12,969.9 13,278.8

Ratio Analysis FY06 FY07 FY08 FY09 FY10

Revenue Growth (%) -5.1 70.6 69.9 51.8 -44.4

EBITDA Margin (%) 9.3 19.0 27.3 19.1 14.8

EBITDA Growth (%) -44.3 248.9 144.1 6.5 -56.9

Adj Net Income Margin (%) 5.6 11.6 19.5 18.7 19.2

Adj Net Income Growth (%) -33.7 254.2 186.1 45.6 -43.0

Asset Turnover (x) 1.3 1.2 1.1 0.9 0.4

Financial Leverage (x) 2.6 2.2 1.9 2.2 2.2

RoE (%) 18.8 31.0 39.9 38.2 17.2

BVPS (INR) 51.4 158.8 118.3 154.2 191.3

P/BV (x) 5.6 1.8 2.4 1.9 1.5

Adj EPS (INR) 9.2 32.5 35.8 52.1 29.7

Adj P/E (x) 31.4 8.9 8.1 5.5 9.7

Source : MLR, Company

5 MLR Investment Research

Sarda Energy & Minerals Ltd | Management Meet Note

13th January 2010

Research Analyst

Saurabh singh +91 22 40023026 saurabh.singh@mlrsecurities.com

Head of Research

Aditya Damani +91 22 22630125 aditya.damani@mlrsecurities.com

Head Office

4th Floor, Surya Mahal

5, Burjorji Bharucha Marg

Fort

Mumbai-400001

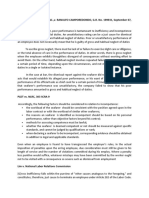

Disclaimer : This document has been prepared by MLR Securities Pvt. Ltd. This document does not constitute an offer or solicitation for the pur-

chase or sale of any financial instrument. The information contained herein is from publicly available data or other sources believed to be reliable,

but we do not represent that it is accurate or complete and it should not be relied on as such. MLR Securities Pvt. Ltd. or any of its affiliates/ group

companies shall not be in any way responsible for any loss or damage that may arise to any person from any information contained in this report.

The user assumes the entire risk of any use made of this information. We and our affiliates, group companies, officers, directors, and employees

may have potential conflict of interest with respect to any recommendation and related information and opinions. This information is strictly

confidential and is being furnished to you solely for your information. This information should not be reproduced or redistributed or passed on

directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or in-

tended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdic-

tion, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject MLR Securities Pvt. Ltd.

and affiliates/ group companies to any registration or licensing requirements within such jurisdiction.

6 MLR Investment Research

You might also like

- Tejpal Sheth - Business Law-Pearson India (2017) PDFDocument649 pagesTejpal Sheth - Business Law-Pearson India (2017) PDFAhsan Raza67% (6)

- Ac Sur-004Document80 pagesAc Sur-004AO BeltranNo ratings yet

- Tata Steel - Value Chain AnalysisDocument11 pagesTata Steel - Value Chain AnalysisKiranNo ratings yet

- Report Business Plan Iron OreDocument37 pagesReport Business Plan Iron Orearun1974100% (1)

- Cast Wheel in Indian Rlys-Present StatusDocument6 pagesCast Wheel in Indian Rlys-Present StatusDevarshi GaurNo ratings yet

- Jindal Steel & Power LTD: Test CertificateDocument2 pagesJindal Steel & Power LTD: Test CertificateAmandeep Singh50% (2)

- Procurement Plan URSIP - Newform - 20181101 (DRAFT)Document22 pagesProcurement Plan URSIP - Newform - 20181101 (DRAFT)Abib Ansari100% (2)

- Exam Sample AbsorbtionDocument12 pagesExam Sample AbsorbtionMa Joyce Imperial100% (1)

- CHALK 2017-09-29 Complaint PDFDocument39 pagesCHALK 2017-09-29 Complaint PDFal_crespoNo ratings yet

- SEML PresentationDocument47 pagesSEML PresentationalparathiNo ratings yet

- Mickey Metals LTDDocument13 pagesMickey Metals LTDBhavin SagarNo ratings yet

- Analyst Meet Presentation Jan 08Document37 pagesAnalyst Meet Presentation Jan 08Varun KumarNo ratings yet

- HDFC Securities Technical Pick - Sunflag Iron & Steel CoDocument10 pagesHDFC Securities Technical Pick - Sunflag Iron & Steel CoManish SinghNo ratings yet

- Sterlite Industries: Management Meet NoteDocument5 pagesSterlite Industries: Management Meet NotemittleNo ratings yet

- Pre Feasibility Project Report: Sarda Energy & Minerals LTDDocument49 pagesPre Feasibility Project Report: Sarda Energy & Minerals LTDPriyanshu ShrivastavNo ratings yet

- NTDC Services Charges - OverallDocument1 pageNTDC Services Charges - OverallMuhammad KhanNo ratings yet

- MSP Steel & PowerDocument7 pagesMSP Steel & PowerraghuNo ratings yet

- State Investment Promotion Board: List of Effective Mou'S For Chhattisgarh (Up To September, 2019)Document30 pagesState Investment Promotion Board: List of Effective Mou'S For Chhattisgarh (Up To September, 2019)suraj pandeyNo ratings yet

- Mining Industry ReportDocument27 pagesMining Industry ReportAbhinav YadavNo ratings yet

- Current Holding ReportDocument2 pagesCurrent Holding Reportnikhilesh singhNo ratings yet

- Bhushan Power and Steel LTDDocument8 pagesBhushan Power and Steel LTDAkshay AgarwalNo ratings yet

- Metals 164 Tata Steel Jamshedpur 0 PDFDocument41 pagesMetals 164 Tata Steel Jamshedpur 0 PDFkalaiNo ratings yet

- Project Report: Godawari Power and Ispat LimitedDocument28 pagesProject Report: Godawari Power and Ispat LimitedR.C.PerumalNo ratings yet

- SR - No. Details For Pending Bills & Risk & Cost Amount 1 GST Bill Amount @7% 2 Delay BG Submission in (INR) 3 Total (1+2+3)Document9 pagesSR - No. Details For Pending Bills & Risk & Cost Amount 1 GST Bill Amount @7% 2 Delay BG Submission in (INR) 3 Total (1+2+3)AJAY BHOSALENo ratings yet

- Iron Ore Pelletization Technology & NeedDocument55 pagesIron Ore Pelletization Technology & NeedVeeresh Gouda100% (2)

- Metorex Int Dec07Document12 pagesMetorex Int Dec07Take OneNo ratings yet

- Tata Steel - Value Chain AnalysisDocument11 pagesTata Steel - Value Chain AnalysisKiranNo ratings yet

- List of MoUsDocument24 pagesList of MoUsSrinivasa Rao VenkumahanthiNo ratings yet

- Hindustan ZincDocument40 pagesHindustan ZincRavi GuptaNo ratings yet

- Corporate PresentationDocument39 pagesCorporate PresentationSheshank VermaNo ratings yet

- JSW Steel LTD - Section 3 - R2 PDFDocument21 pagesJSW Steel LTD - Section 3 - R2 PDFrajesh shekarNo ratings yet

- Toromocho Jan2017 Competent Persons ReportDocument147 pagesToromocho Jan2017 Competent Persons Reportmaría joséNo ratings yet

- ICICI Securities Update On Metals Q4FY24 Preview Non Ferrous PlayersDocument8 pagesICICI Securities Update On Metals Q4FY24 Preview Non Ferrous Playersmanitjainm21No ratings yet

- F I R S T C A L L: TATA Sponge Iron LTDDocument16 pagesF I R S T C A L L: TATA Sponge Iron LTDImteyaz Ahmed KhanNo ratings yet

- Tata Sponge 080910Document2 pagesTata Sponge 080910gurubalaji15No ratings yet

- Enduring Value Through: Values ValuesDocument37 pagesEnduring Value Through: Values ValuesminingnovaNo ratings yet

- Gold MinersDocument5 pagesGold Minerssaurabh.shrivastavNo ratings yet

- Phil Metallic Mineral Production H1 2021 VS H1 2020Document4 pagesPhil Metallic Mineral Production H1 2021 VS H1 2020Mik SerranoNo ratings yet

- Presentation For AluminaDocument31 pagesPresentation For AluminaMohammad Abubakar SiddiqNo ratings yet

- Q1-FY23-Godawari & IspatDocument44 pagesQ1-FY23-Godawari & IspatshyamNo ratings yet

- 47623-30902 CSDocument1 page47623-30902 CSMuhammad Shoaib Aslam KhichiNo ratings yet

- HSL - Commodities Pack Report - 2021-202108182348310059173Document16 pagesHSL - Commodities Pack Report - 2021-202108182348310059173SHAIK AHMEDNo ratings yet

- Jindal Steels & Power LimitedDocument10 pagesJindal Steels & Power LimitedHIMANSHU RAWATNo ratings yet

- Anand Ratpital Goods Q2FY22 Result PreviewDocument13 pagesAnand Ratpital Goods Q2FY22 Result PreviewRaktim BiswasNo ratings yet

- 1-25 ET 500 Company List 2022Document2 pages1-25 ET 500 Company List 20220000000000000000No ratings yet

- Sesa Goa Ceases Mining at ThakuraniDocument4 pagesSesa Goa Ceases Mining at Thakuranisumits1977No ratings yet

- IPO and Disinvestment in Covid-19: Group Number 8Document13 pagesIPO and Disinvestment in Covid-19: Group Number 8Raksha ShettyNo ratings yet

- VAluation On TATA Corus DealDocument32 pagesVAluation On TATA Corus Dealromeel3079% (14)

- CESC Limited CESC Limited: Investor Update - Q3 FY11Document14 pagesCESC Limited CESC Limited: Investor Update - Q3 FY11Namuduri RamakanthNo ratings yet

- Protfolio Selection Group 2Document7 pagesProtfolio Selection Group 2Dulon DuttaNo ratings yet

- Advance Release: Sierra Leone 2017-18 TextDocument4 pagesAdvance Release: Sierra Leone 2017-18 TextestevaoNo ratings yet

- Operations & Supply Chain of Tata Steel: by Pankaj Singh Rawat 0807PGPM22Document11 pagesOperations & Supply Chain of Tata Steel: by Pankaj Singh Rawat 0807PGPM22melotusNo ratings yet

- Sesa & Sterlite - Q4FY13 Combined Result Update - Centrum 02052013 EDITEDDocument13 pagesSesa & Sterlite - Q4FY13 Combined Result Update - Centrum 02052013 EDITEDcanaryhillNo ratings yet

- Yash Competition AnalysisDocument4 pagesYash Competition AnalysisEdu PlatformNo ratings yet

- Yash Competition AnalysisDocument4 pagesYash Competition AnalysisEdu PlatformNo ratings yet

- MDKA Consolidated Mineral Resources and Ore Reserves Statement 31 Dec 2020Document13 pagesMDKA Consolidated Mineral Resources and Ore Reserves Statement 31 Dec 2020Leonie SaputriNo ratings yet

- Iron Ore India & NMDCDocument16 pagesIron Ore India & NMDCKanwar P SinghNo ratings yet

- Executive Summery-Integrated Steel CompanyDocument2 pagesExecutive Summery-Integrated Steel Companyjeet3184No ratings yet

- ICICI Pru Balanced Fund - (G) ::::::::: GraphDocument13 pagesICICI Pru Balanced Fund - (G) ::::::::: GraphVivek GusaniNo ratings yet

- Project Report On Working Capital Management at Tata Steel Ltd.Document8 pagesProject Report On Working Capital Management at Tata Steel Ltd.Ankit Agrawal50% (4)

- Bhaspe 95Document4 pagesBhaspe 95priyapmb898No ratings yet

- Usha Martin ExampleDocument2 pagesUsha Martin ExampleonkarNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Telecallers Candidate Profile For Fresher and ExperiencedDocument6 pagesTelecallers Candidate Profile For Fresher and ExperiencedNandita ThukralNo ratings yet

- Army - FM4 30X3 - Maintenance Operations and ProceduresDocument482 pagesArmy - FM4 30X3 - Maintenance Operations and ProceduresMeowmix100% (3)

- 6 PDFDocument1 page6 PDFkhraieric16No ratings yet

- Cut Off PercentilesDocument5 pagesCut Off Percentileskill_my_kloneNo ratings yet

- Guide To The Location of Gasoline (Motor Fuel) Filling Stations and Filling-Cum-Serv1Ce Stations in Urban Areas ForewordDocument8 pagesGuide To The Location of Gasoline (Motor Fuel) Filling Stations and Filling-Cum-Serv1Ce Stations in Urban Areas ForewordRenugopalNo ratings yet

- Rashid Intrenship ReportDocument6 pagesRashid Intrenship ReportMUHAMMAD RASHIDNo ratings yet

- Crush Wine Trademark ComplaintDocument14 pagesCrush Wine Trademark ComplaintMark JaffeNo ratings yet

- Global Trends in Investment Operations OutsourcingDocument9 pagesGlobal Trends in Investment Operations OutsourcingCognizantNo ratings yet

- Art 1956-1957Document6 pagesArt 1956-1957Kathleen Rose TaninasNo ratings yet

- MGT 210Document19 pagesMGT 210FAYAZ AHMEDNo ratings yet

- Freyr Electronic Trial Master File: The GuideDocument7 pagesFreyr Electronic Trial Master File: The GuideFreyr IncNo ratings yet

- TE Chemical 2015Document22 pagesTE Chemical 2015Shivam MarkadNo ratings yet

- Turtle Map CMDocument6 pagesTurtle Map CMmtechewitNo ratings yet

- Gideon Hatsu Cv...Document4 pagesGideon Hatsu Cv...Gideon HatsuNo ratings yet

- Customer Lifetime ValueDocument16 pagesCustomer Lifetime Valuearpit_9688No ratings yet

- Chapter 6Document3 pagesChapter 6Ricky LavillaNo ratings yet

- Gross InefficiencyDocument2 pagesGross InefficiencyNowell SimNo ratings yet

- Addressing Competition and Driving GrowthDocument25 pagesAddressing Competition and Driving GrowthJabran AhmedNo ratings yet

- Chris Jerome Federal LawsuitDocument93 pagesChris Jerome Federal LawsuitLansingStateJournalNo ratings yet

- Painting The Future Bright - The Daily StarDocument5 pagesPainting The Future Bright - The Daily StarAkash79No ratings yet

- McDonald's Analysis of ChangeDocument6 pagesMcDonald's Analysis of ChangeSeemaKapoorNo ratings yet

- Sew What Inc - Case StudyDocument12 pagesSew What Inc - Case Studytaniya17No ratings yet

- Taxation of Cooperatives PDFDocument110 pagesTaxation of Cooperatives PDFJaquelyn RaccaNo ratings yet

- Risk Management Toolkit - August 2014 PDFDocument51 pagesRisk Management Toolkit - August 2014 PDFarwindaNo ratings yet

- Chethan KC: Business Development ExecutiveDocument1 pageChethan KC: Business Development Executivenithin aradhyaNo ratings yet