Professional Documents

Culture Documents

Cred Trans Part 9 Assigned

Cred Trans Part 9 Assigned

Uploaded by

averellabrasaldoCopyright:

Available Formats

You might also like

- Understanding Asset Swapped Convertible Option Transactions MSDWDocument24 pagesUnderstanding Asset Swapped Convertible Option Transactions MSDWhchan267% (6)

- NYSF Walmart Templatev2Document49 pagesNYSF Walmart Templatev2Avinash Ganesan100% (1)

- Security Bank v. RTC Makati, 263 SCRA 453 (1996)Document3 pagesSecurity Bank v. RTC Makati, 263 SCRA 453 (1996)Fides DamascoNo ratings yet

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersFrom EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersRating: 3 out of 5 stars3/5 (1)

- Petty Cash ReportDocument1 pagePetty Cash ReportAziz Khan LodhiNo ratings yet

- RR 2-98 - AmendmentsDocument196 pagesRR 2-98 - AmendmentsArchie Guevarra100% (2)

- Petitioners Respondent: Spouses Leopoldo S. Viola and Mercedita Viola, - Equitable Pci Bank, Inc.Document8 pagesPetitioners Respondent: Spouses Leopoldo S. Viola and Mercedita Viola, - Equitable Pci Bank, Inc.Jakie CruzNo ratings yet

- Credit TransDocument153 pagesCredit TransMaricar Corina CanayaNo ratings yet

- 171669-2015-Spouses Baysa v. Spouses Plantilla20210630-11-XclcgrDocument8 pages171669-2015-Spouses Baysa v. Spouses Plantilla20210630-11-XclcgrWayneNoveraNo ratings yet

- Petitioner Vs Vs Respondent: First DivisionDocument6 pagesPetitioner Vs Vs Respondent: First DivisionKyla ReyesNo ratings yet

- D.M. Ragasa Enterprises, Inc. v. Banco de Oro, Inc. (Formerly Equitable Pci Bank, Inc.)Document11 pagesD.M. Ragasa Enterprises, Inc. v. Banco de Oro, Inc. (Formerly Equitable Pci Bank, Inc.)Juana Dela CruzNo ratings yet

- CIV 2 - Krisha CDs - CREDIT TRANSACTIONS PDFDocument113 pagesCIV 2 - Krisha CDs - CREDIT TRANSACTIONS PDFAikeeBeltranNo ratings yet

- G.R. No. 190512, June 20, 2018 - D.M. Ragasa Enterprises, Inc., Petitioner, V. Banco de Oro, Inc. (Formerly Equitable Pci Bank, Inc.), Respondent. - June 2018 - Philipppine Supreme Court DecisionsDocument15 pagesG.R. No. 190512, June 20, 2018 - D.M. Ragasa Enterprises, Inc., Petitioner, V. Banco de Oro, Inc. (Formerly Equitable Pci Bank, Inc.), Respondent. - June 2018 - Philipppine Supreme Court DecisionsramilgarciaNo ratings yet

- Andal vs. PNB GR 194201, Nov. 27, 2013 PDFDocument9 pagesAndal vs. PNB GR 194201, Nov. 27, 2013 PDFRoselito MaligroNo ratings yet

- GR 194201Document7 pagesGR 194201RajkumariNo ratings yet

- Petitioner Vs Vs Respondents Cauton Associates Francisco G. MendozaDocument5 pagesPetitioner Vs Vs Respondents Cauton Associates Francisco G. MendozaIan Timothy SarmientoNo ratings yet

- G.R. No. 190512, June 20, 2018Document14 pagesG.R. No. 190512, June 20, 2018yvettequebral163No ratings yet

- Viola V Equitable Pci BankDocument2 pagesViola V Equitable Pci BankCzar Ian AgbayaniNo ratings yet

- RAGASA vs. BDODocument15 pagesRAGASA vs. BDOJohannes YapyapanNo ratings yet

- Sps Bautista v. Pilar DevelopmentDocument4 pagesSps Bautista v. Pilar DevelopmentakosivansotNo ratings yet

- Credit Case DigestDocument10 pagesCredit Case DigestBianca de GuzmanNo ratings yet

- 059 Cuyco V Cuyco - PeraltaDocument2 pages059 Cuyco V Cuyco - PeraltaClarisse Anne PeraltaNo ratings yet

- 42 Sps. Andal vs. PNBDocument6 pages42 Sps. Andal vs. PNBRobert Jayson UyNo ratings yet

- Credit Transactions Batch 2 (Feb 15, 2018)Document28 pagesCredit Transactions Batch 2 (Feb 15, 2018)Carmel LouiseNo ratings yet

- 1REM PowerToSell G.R. No. 159271Document6 pages1REM PowerToSell G.R. No. 159271Tj CabacunganNo ratings yet

- Full Text - 2eDocument473 pagesFull Text - 2eFrancis Mae FerrerNo ratings yet

- D.M. Ragasa Enterprises, Inc., Petitioner, V. Banco de Oro, Inc. (Formerly Equitable Pci Bank, Inc.), Respondent. Decision Caguioa, J.Document14 pagesD.M. Ragasa Enterprises, Inc., Petitioner, V. Banco de Oro, Inc. (Formerly Equitable Pci Bank, Inc.), Respondent. Decision Caguioa, J.Big BoysNo ratings yet

- SPs. Andal v. PNB GR No.194201 Nov 27 2013Document6 pagesSPs. Andal v. PNB GR No.194201 Nov 27 2013Christine Rose Bonilla LikiganNo ratings yet

- Sps. Andal v. PNBDocument8 pagesSps. Andal v. PNBEd Von Fernandez CidNo ratings yet

- Andal vs. PNBDocument14 pagesAndal vs. PNBpoiuytrewq9115No ratings yet

- Estores V Spouses Supangan, G. R. No. 175139, April18, 2012Document4 pagesEstores V Spouses Supangan, G. R. No. 175139, April18, 2012CresteynTeyngNo ratings yet

- Oblicon Week 3 DigestDocument33 pagesOblicon Week 3 DigestTom Louis HerreraNo ratings yet

- Ligutan v. CADocument3 pagesLigutan v. CABeltran KathNo ratings yet

- Group 5 Case DigestsDocument22 pagesGroup 5 Case Digestsnaomi_mateo_4No ratings yet

- Almeda V CA - GR 113412Document9 pagesAlmeda V CA - GR 113412jovelyn davoNo ratings yet

- Ligutan v. CADocument3 pagesLigutan v. CAMaria Lourdes DatorNo ratings yet

- 49 Agro Conglomerate Vs CADocument5 pages49 Agro Conglomerate Vs CACharm Divina LascotaNo ratings yet

- Security Bank V RTC Makati 263 SCRA 453 1996Document3 pagesSecurity Bank V RTC Makati 263 SCRA 453 1996Xyrus Bucao100% (1)

- Spouses Jovenal Toring and Cecilia EscalonaDocument3 pagesSpouses Jovenal Toring and Cecilia EscalonadaryllNo ratings yet

- Spouses Toring v. Spouses Olan G.R. No. 168782 October 10 2008 589 PHIL 362 370Document6 pagesSpouses Toring v. Spouses Olan G.R. No. 168782 October 10 2008 589 PHIL 362 370rggconde11No ratings yet

- Almeda Vs Court of Appeals and PNB G.R. No. 113412 April 17Document8 pagesAlmeda Vs Court of Appeals and PNB G.R. No. 113412 April 17Raymond JamoraNo ratings yet

- G.R. No. 113926. October 23, 1996.: - First DivisionDocument8 pagesG.R. No. 113926. October 23, 1996.: - First DivisionMalolosFire BulacanNo ratings yet

- Almeda vs. CADocument7 pagesAlmeda vs. CAAnonymous oDPxEkdNo ratings yet

- Obligations and Contracts Obligations With Penal Clause - Art. 1226-1229Document14 pagesObligations and Contracts Obligations With Penal Clause - Art. 1226-1229Kirsten Rose Boque ConconNo ratings yet

- Banco Filipino V. YbanezDocument7 pagesBanco Filipino V. YbanezWarren Codoy ApellidoNo ratings yet

- Credit CasesDocument77 pagesCredit CasesJMXNo ratings yet

- Buenaventura vs. Metropolitan Bank and Trust CompanyDocument27 pagesBuenaventura vs. Metropolitan Bank and Trust Companyral cbNo ratings yet

- 1306 - Autonomy of ContractsDocument2 pages1306 - Autonomy of ContractsSarah Jane UsopNo ratings yet

- Oblicon Cases IVDocument370 pagesOblicon Cases IVMaurice PinayNo ratings yet

- 34 G.R. No. 113926Document4 pages34 G.R. No. 113926Jessel MaglinteNo ratings yet

- MDocument19 pagesMJoannah SalamatNo ratings yet

- Sps. Mallari v. Prudential Bank (BPI)Document3 pagesSps. Mallari v. Prudential Bank (BPI)Lorie Jean UdarbeNo ratings yet

- Bulatao vs. Estonactoc, 927 SCRA 535, December 10, 2019Document25 pagesBulatao vs. Estonactoc, 927 SCRA 535, December 10, 2019YiNo ratings yet

- PNB Vs CADocument4 pagesPNB Vs CAAJ PaladNo ratings yet

- Bustamante Vs Rosel DigestedDocument2 pagesBustamante Vs Rosel Digestedmcvinpurcil3No ratings yet

- 23 Spouses Andal v. Philippine National BankDocument9 pages23 Spouses Andal v. Philippine National BankOke HarunoNo ratings yet

- 056-Violeta Tudtud Banate Et Al vs. Philippine Countryside Rural Bank (Liloan, Cebu), Inc G.R. No. 163825 July 13, 2010Document6 pages056-Violeta Tudtud Banate Et Al vs. Philippine Countryside Rural Bank (Liloan, Cebu), Inc G.R. No. 163825 July 13, 2010wewNo ratings yet

- Bautista vs. Pilar Development Corporation, 312 SCRA 611, G.R. No. 135046 August 17, 1999Document5 pagesBautista vs. Pilar Development Corporation, 312 SCRA 611, G.R. No. 135046 August 17, 1999Daysel FateNo ratings yet

- 2.tayug Rural Bank v. CBDocument7 pages2.tayug Rural Bank v. CBsnhlaoNo ratings yet

- Estores v. Spouses Supangan (G.R. No. 175139)Document13 pagesEstores v. Spouses Supangan (G.R. No. 175139)aitoomuchtvNo ratings yet

- Estores v. Spouses Supangan, G.R. No. 175139Document11 pagesEstores v. Spouses Supangan, G.R. No. 175139noemi alvarezNo ratings yet

- Spouses Poon V Prime Savings BankDocument13 pagesSpouses Poon V Prime Savings BankAce Asyong AlveroNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Practice Makes PerfectDocument8 pagesPractice Makes PerfectaverellabrasaldoNo ratings yet

- Mass Media & TreatyDocument1 pageMass Media & TreatyaverellabrasaldoNo ratings yet

- (PracCourt 2) Last Minute NotesDocument5 pages(PracCourt 2) Last Minute NotesaverellabrasaldoNo ratings yet

- SpecPro NotesDocument6 pagesSpecPro NotesaverellabrasaldoNo ratings yet

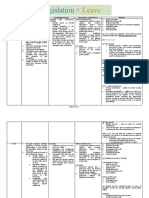

- Social LegislationDocument10 pagesSocial LegislationaverellabrasaldoNo ratings yet

- Remedies and JurisdictionDocument4 pagesRemedies and JurisdictionaverellabrasaldoNo ratings yet

- Caguioa, J.Document2 pagesCaguioa, J.averellabrasaldoNo ratings yet

- Taxation 2 Review AssessmentDocument11 pagesTaxation 2 Review AssessmentaverellabrasaldoNo ratings yet

- Odr & PerDocument4 pagesOdr & PeraverellabrasaldoNo ratings yet

- Cred Trans Part 11Document17 pagesCred Trans Part 11averellabrasaldoNo ratings yet

- Cred Trans Part 10Document20 pagesCred Trans Part 10averellabrasaldoNo ratings yet

- Cred Trans Part 2iiiDocument33 pagesCred Trans Part 2iiiaverellabrasaldoNo ratings yet

- Cred Trans Part 2iiDocument20 pagesCred Trans Part 2iiaverellabrasaldoNo ratings yet

- Special Laws Title 3Document12 pagesSpecial Laws Title 3averellabrasaldoNo ratings yet

- Legal Ethics - Sanctions For Practice or Appearance Without Authority and Public Officials and Practice of Law CasesDocument5 pagesLegal Ethics - Sanctions For Practice or Appearance Without Authority and Public Officials and Practice of Law CasesaverellabrasaldoNo ratings yet

- Cred Trans Part 9iDocument34 pagesCred Trans Part 9iaverellabrasaldoNo ratings yet

- Cred Trans Part 3i-IiDocument18 pagesCred Trans Part 3i-IiaverellabrasaldoNo ratings yet

- Cred Trans Part 9Document18 pagesCred Trans Part 9averellabrasaldoNo ratings yet

- Assigned Case ProvidentDocument2 pagesAssigned Case ProvidentaverellabrasaldoNo ratings yet

- Legal Ethics - Appearance of Non-Lawyers CasesDocument11 pagesLegal Ethics - Appearance of Non-Lawyers CasesaverellabrasaldoNo ratings yet

- Legal Ethics IDocument14 pagesLegal Ethics IaverellabrasaldoNo ratings yet

- Corpo Cases 8th WeekDocument26 pagesCorpo Cases 8th WeekaverellabrasaldoNo ratings yet

- Legal Ethics - WHO MAY PRACTICE LAW (Rules 138 of The Rules of Court) CasesDocument7 pagesLegal Ethics - WHO MAY PRACTICE LAW (Rules 138 of The Rules of Court) CasesaverellabrasaldoNo ratings yet

- Special Laws Title 1Document53 pagesSpecial Laws Title 1averellabrasaldoNo ratings yet

- Special Laws Title 7Document16 pagesSpecial Laws Title 7averellabrasaldoNo ratings yet

- Special Laws Title 7.1Document16 pagesSpecial Laws Title 7.1averellabrasaldoNo ratings yet

- Special Laws Title 5Document24 pagesSpecial Laws Title 5averellabrasaldoNo ratings yet

- Corpo Cases 10th Week AssignedDocument2 pagesCorpo Cases 10th Week AssignedaverellabrasaldoNo ratings yet

- Special Laws Title 2Document12 pagesSpecial Laws Title 2averellabrasaldoNo ratings yet

- PALE Cases B-DDocument40 pagesPALE Cases B-DaverellabrasaldoNo ratings yet

- UBL Internship ReportDocument78 pagesUBL Internship Reportnocent_dvil83% (12)

- Project Management Lecture Note 3 - Feasibility StudyDocument22 pagesProject Management Lecture Note 3 - Feasibility StudySixd Waznine100% (1)

- SpecPro OutlineDocument7 pagesSpecPro OutlineCautious LotharioNo ratings yet

- Tps Case StudyDocument16 pagesTps Case StudyHomework Ping100% (1)

- Receivable FinancingDocument5 pagesReceivable FinancingAphol Joyce MortelNo ratings yet

- Amaia PampangaDocument1 pageAmaia PampangadusteezapedaNo ratings yet

- Chapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFDocument24 pagesChapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFChristian GoNo ratings yet

- TVM CalcDocument34 pagesTVM CalcSam Sep A SixtyoneNo ratings yet

- Den ADocument157 pagesDen AParthivi KapoorNo ratings yet

- Affidavit of Adverse Claim: Republic of The Philippines) City of Manila) S.SDocument2 pagesAffidavit of Adverse Claim: Republic of The Philippines) City of Manila) S.SJUSTICE DEE100% (2)

- MisjoinderDocument39 pagesMisjoinderPritish MishraNo ratings yet

- Portic Vs CristobalDocument3 pagesPortic Vs CristobalDeniel Salvador B. MorilloNo ratings yet

- The Time Value of MoneyDocument24 pagesThe Time Value of Moneysaliljain2001No ratings yet

- 2015-2017 Remedial Law Bar Exam QuestionsDocument9 pages2015-2017 Remedial Law Bar Exam QuestionsMarie Mariñas-delos ReyesNo ratings yet

- Certificate in Import Export Procedure and DocumentationDocument99 pagesCertificate in Import Export Procedure and DocumentationUsman RazaNo ratings yet

- The Rehabilitation PlanDocument6 pagesThe Rehabilitation PlanTricia MontoyaNo ratings yet

- Risk Management Through Derivative in Indian Stock MarketDocument29 pagesRisk Management Through Derivative in Indian Stock MarketHimanshu RastogiNo ratings yet

- Profitability Sustainability RatiosDocument3 pagesProfitability Sustainability RatiosRhodelbert Rizare Del SocorroNo ratings yet

- Presentation On Money & BankingDocument15 pagesPresentation On Money & BankingRahul VyasNo ratings yet

- Chapter 3 - TaxDocument23 pagesChapter 3 - TaxNilda Sahibul BaclayanNo ratings yet

- Enhancing Sme PerformanceDocument20 pagesEnhancing Sme PerformanceHadiBiesNo ratings yet

- Dividend Policy and Firm ValueDocument10 pagesDividend Policy and Firm ValueKrishan BorwalNo ratings yet

- QuestionDocument2 pagesQuestionyaniNo ratings yet

- Chapter 11 Dividend Policy: 1. ObjectivesDocument8 pagesChapter 11 Dividend Policy: 1. Objectivessamuel_dwumfourNo ratings yet

- RA 8424 and Revisions 1997-2011Document280 pagesRA 8424 and Revisions 1997-2011heraroseNo ratings yet

- 2 UnitDocument13 pages2 UnitYogyata MishraNo ratings yet

Cred Trans Part 9 Assigned

Cred Trans Part 9 Assigned

Uploaded by

averellabrasaldoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cred Trans Part 9 Assigned

Cred Trans Part 9 Assigned

Uploaded by

averellabrasaldoCopyright:

Available Formats

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

G.R. No. 177886 November 27, 2008 In its Answer, respondent denied petitioners’ assertions,

(c) Penalty at 3% per

month from 03/31/98 contending, inter alia, that the absence of stipulation in the

to 02/23/02 P7,896,078.15 mortgage contract securing the payment of 15% interest per

SPOUSES LEOPOLDO S. VIOLA and MERCEDITA

annum on the principal loan, as well as the 3% penalty fee

VIOLA, petitioners, P14,024,623.22 3

(Underscoring per month on the outstanding amount, is immaterial since the

vs. supplied) mortgage contract is "a mere accessory contract which must

EQUITABLE PCI BANK, INC., respondent.

take its bearings from the principal Credit Line Agreement."7

DECISION Respondent thus extrajudicially foreclosed the mortgage

before the Office of the Clerk of Court & Ex-Officio Provincial During the pre-trial conference, the parties defined as sole

Sheriff of the Regional Trial Court (RTC) of Marikina City. issue in the case whether the mortgage contract also

CARPIO MORALES, J.: The mortgaged properties were sold on April 10, 2003 secured the payment of 15% interest per annum on the

for P4,284,000.00 at public auction to respondent, after principal loan of P4,700,000.00 and the 3% penalty fee per

which a Certificate of Sale dated April 21, 20034 was issued. month on the outstanding amount, which interest and penalty

Via a contract denominated as "CREDIT LINE AND REAL fee are stipulated only in the Credit Line Agreement.8

ESTATE MORTGAGE AGREEMENT FOR PROPERTY

LINE"1(Credit Line Agreement) executed on March 31, 1997, More than five months later or on October 8, 2003,

Leo-Mers Commercial, Inc., as the Client, and its officers petitioners filed a complaint5 for annulment of foreclosure By Decision9 of September 14, 2005, the trial court sustained

spouses Leopoldo and Mercedita Viola (petitioners) obtained sale, accounting and damages before the Marikina RTC, respondent’s affirmative position on the issue but found the

a loan through a credit line facility in the maximum amount docketed as Civil Case No. 2003-905-MK and raffled to questioned interest and penalty fee "excessive and

of P4,700,000.00 from the Philippine Commercial Branch 192. Petitioners alleged, inter alia, that they had exorbitant." Thus, it equitably reduced the interest on the

International Bank (PCI Bank), which was later merged with made substantial payments of P3,669,210.67 receipts of principal loan from 15% to 12% per annum and the penalty

Equitable Bank and became known as Equitable PCI Bank, which were issued without respondent specifying "whether fee per month on the outstanding amount from 3%

Inc. (respondent). the payment was for interest, penalty or the principal to 1.5% per month.

obligation;" that based on respondent’s statement of

The Credit Line Agreement stipulated that the loan would account, not a single centavo of their payments was applied Accordingly, the court nullified the foreclosure proceedings

bear interest at the "prevailing PCIBank lending rate" per to the principal obligation; that every time respondent sent and the Certificate of Sale subsequently issued, "without

annum on the principal obligation and a "penalty fee of three them a statement of account and demand letters, they prejudice" to the holding anew of foreclosure proceedings

percent (3%) per month on the outstanding amount." requested for a proper accounting for the purpose of based on the "re-computed amount" of the indebtedness, "if

determining their actual obligation, but all their requests were the circumstances so warrant."

unjustifiably ignored on account of which they were forced to

To secure the payment of the loan, petitioners executed also discontinue payment; that "the foreclosure proceedings and

on March 31, 1997 a "Real Estate Mortgage" 2 in favor of auction sale were not only irregularly and prematurely held The dispositive portion of the trial court’s Decision reads:

PCIBank over their two parcels of land covered by Transfer but were null and void because the mortgage debt is

Certificates of Title No. N-113861 (consisting of 300 square only P2,224,073.31 on the principal obligation WHEREFORE, judgment is hereby rendered as

meters, more or less ) and N-129036 (consisting of 446 and P1,455,137.36 on the interest, or a total of follows:

square meters, more or less) of the Registry of Deeds of only P3,679,210.67 as of April 15, 2003, but the mortgaged

Marikina. properties were sold to satisfy an inflated and erroneous

principal obligation of P4,783,254.69, plus 3% penalty fee 1) The interest on the principal loan in the amount

per month or 33% per year and 15% interest per year, which of Four Million Seven Hundred Thousand

Petitioners availed of the full amount of the loan.

amounted to P14,024,623.22 as of September 30, (P4,700,000.00) Pesos should

Subsequently, they made partial payments which

2002;" that "the parties never agreed and stipulated in the be recomputed at 12% per annum;

totaled P3,669,210.67. By respondent’s claim, petitioner had

since November 24, 2000 made no further payments and real estate mortgage contract" that the 15% interest per

despite demand, they failed to pay their outstanding annum on the principal loan and the 3% penalty fee per 2) The 3% per month penalty on delinquent

obligation which, as of September 30, 2002, month on the outstanding amount would be covered or account as stipulated by the parties in the Credit

totaled P14,024,623.22, broken down as follows: secured by the mortgage; that assuming respondent could Line Contract dated March 31, 1997 is

impose such interest and penalty fee, the same are hereby REDUCED to 1.5% per month;

"exorbitant, unreasonable, iniquitous and unconscionable,

(a Principal obligation hence, must be reduced;" and that respondent is only

) P4,783,254.69 allowed to impose the legal rate of interest of 12% per 3) The foreclosure sale conducted on April 10,

annum on the principal loan absent any stipulation thereon.6 2003 by the Clerk of Court and Ex-Officio Sheriff of

(b Past due interest from Marikina, to satisfy the plaintiff’s mortgage

) 11/24/00 to 09/30/02 indebtedness, and the Certificate of Sale issued as

at 15% interest P1,345,290.38 a consequence of the said

Averell B. Abrasaldo – II-Sanchez Roman 1

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

proceedings, are declared NULL and VOID, withou deceive, and an obligation is not secured by a mortgage x x x x.16 (Underscoring supplied)

t prejudice to the conduct of another foreclosure pr unless it comes fairly within the terms of the mortgage.15

oceedings on the basis of there-computed amount

The Real Estate Mortgage contract states its coverage, thus:

of the plaintiff’s indebtedness, if the circumstances

In the case at bar, the parties executed two separate

so warrant.

documents on March 31, 1997 – the Credit Line

That for and in consideration of certain loans,

Agreement granting the Client a loan through a credit facility

credit and other banking facilities obtained x x x

No pronouncement as to costs. in the maximum amount of P4,700,000.00, and the Real

from the Mortgagee, the principal amount of which

Estate Mortgage contract securing the payment thereof.

is PESOS FOUR MILLION SEVEN HUNDERED

Undisputedly, both contracts were prepared by respondent

SO ORDERED. (Underscoring supplied) THOUSAND ONLY (P4,700,000.00) Philippine

and written in fine print, single space.

Currency, and for the purpose of securing the

payment thereof, including the interest and bank

Petitioners filed a Motion for Partial

The Credit Line Agreement contains the following chargesaccruing thereon, the costs of collecting

Reconsideration,10 contending that the penalty fee per month

stipulations on interest and delinquency charges: the same and of taking possession of and keeping

on the outstanding amount should have been taken out of

the mortgaged propert[ies], and all other expenses

the coverage of the mortgage contract as it was not

to which the Mortgagee may be put in connection

stipulated therein. By Order dated December 6, 2005, the A. CREDIT FACILITY

with or as an incident to this mortgage, as well as

trial court denied the motion.

the faithful compliance with the terms and

9. INTEREST ON AVAILMENTS conditions of this agreement and of the separate

On appeal by petitioners, the Court of Appeals, by instruments under which the credits hereby

Decision11 of February 21, 2007, dismissed the same for lack secured were obtained, the Mortgagor does

The CLIENT shall pay the BANK interest

of merit, holding that "the Real Estate Mortgage covers not hereby constitute in favor of the Mortgagee, its

on each availment against the Credit

only the principal amount [of P4,700,000.00] but also the successors or assigns, a mortgage on the real

Facility at the rate of:

‘interest and bank charges,’ which [phrase bank charges] property particularly described, and the location of

refers to the penalty charges stipulated in the Credit Line which is set forth, in the list appearing at the back

Agreement."12 PREVAILING PCIBANK hereof and/or appended hereto, of which the

LENDING RATE Mortgagor declare that he is the absolute owner

and the one in possession thereof, free and clear

Petitioners’ Motion for Reconsideration having been denied of any liens, encumbrances and adverse

by Resolution13 of May 16, 2007, they filed the present for the first interest period as defined in A(10) claims.17 (Emphasis and underscoring supplied)

Petition for Review on Certiorari, alleging that – hereof. x x x.

The immediately-quoted provision of the mortgage contract

THE HONORABLE COURT OF APPEALS xxxx does not specifically mention that, aside from the principal

COMMITTED A REVERSIBLE ERROR IN loan obligation, it also secures the payment of "a penalty fee

DECIDING THE CASE NOT IN ACCORD WITH

15. DELINQUENCY of three percent (3%) per month of the outstanding amount

LAW AND APPLICABLE DECISIONS OF THE to be computed from the day deficiency is incurred up to the

SUPREME COURT BY RULING THAT THERE date of full payment thereon," which penalty as the above-

IS NOAMBIGUITY IN CONSTRUING TOGETHER CLIENT’s account shall be considered quoted portion of the Credit Line Agreement expressly

THE CREDIT LINE AND MORTGAGE delinquent if the availments exceed the stipulates.

CONTRACTS WHICH amount of the line and/or in case the

PROVIDED CONFLICTING PROVISIONS AS TO Account is debited for unpaid interest

INTEREST AND PENALTY.14 and the Available Balance is insufficient Since an action to foreclose "must be limited to the amount

to cover the amount debited. In such mentioned in the mortgage"18 and the penalty fee of 3% per

cases, the Available Balance shall month of the outstanding obligation is not mentioned in the

The only issue is whether the mortgage contract also

become negative and the CLIENT shall mortgage, it must be excluded from the computation of the

secured the penalty fee per month on the outstanding

pay the deficiencyimmediately in amount secured by the mortgage.

amount as stipulated in the Credit Line Agreement.

addition to collection expenses incurred

by the BANK and a penalty fee of three The ruling of the Court of Appeals in its assailed Decision

The Court holds not. percent (3%) per month of the that the phrase "including the interest and bank charges" in

outstanding amount to be computed the mortgage contract "refers to the penalty

from the day deficiency is incurred up to charges stipulated in the Credit Line Agreement" is

A mortgage must "sufficiently describe the debt sought to be

the date of full payment thereon. unavailing.

secured, which description must not be such as to mislead or

Averell B. Abrasaldo – II-Sanchez Roman 2

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

"Penalty fee" is entirely different from "bank charges." The The Court is unconvinced, for the cases relied principal Credit Line Agreement,"21 fails. Such

phrase "bank charges" is normally understood to refer to upon by the petitioner are inapplicable. x x x. absence is significant as it

compensation for services. A "penalty fee" is likened to a

compensation for damages in case of breach of the

xxxx creates an ambiguity between the two contracts, which

obligation. Being penal in nature, such fee must

ambiguity must be resolved in favor of petitioners and

be specific and fixed by the contracting parties, unlike in the

against respondent who drafted the contracts. Again, as

present case which slaps The mortgage contract is also one of adhesion as

stressed by the Court in Philippine Bank of Communications:

a 3% penalty fee per month of the outstanding amount of it was prepared solely by the petitioner and the

the obligation. only participation of the other party was the affixing

of his signature or "adhesion" thereto. Being a There is also sufficient authority to declare that any

contract of adhesion, the mortgage is to be strictly ambiguity in a contract whose terms are

Moreover, the "penalty fee" does not belong to the species of

construed against the petitioner, the party which susceptible of different interpretations must be

obligation enumerated in the mortgage contract, namely:

prepared the agreement. read against the party who drafted it.

"loans, credit and other banking facilities obtained x x x from

the Mortgagee, . . . including the interest and bank charges, .

. . the costs of collecting the same and of taking possession A reading, not only of the earlier quoted provision, A mortgage and a note secured by it are deemed

of and keeping the mortgaged properties, and all other but of the entire mortgage contract yields no parts of one transaction and are construed

expenses to which the Mortgagee may be put in connection mention of penalty charges. Construing this together, thus, an ambiguity is created when the

with or as an incident to this mortgage . . ." silence strictly against the petitioner, it can fairly be notes provide for the payment of a penalty but

concluded that the petitioner did not intend to the mortgage contract does not . Construing the

include the penalties on the promissory notes in ambiguity against the petitioner, it follows that no

In Philippine Bank of Communications v. Court of

the secured amount. This explains the finding by penalty was intended to be covered by the

Appeals19 which raised a similar issue, this Court held:

the trial court, as affirmed by the Court of Appeals, mortgage. The mortgage contract consisted of

that "penalties and charges are not due for want of three pages with no less than seventeen

The sole issue in this case is whether, in the stipulation in the mortgage contract." conditions in fine print; it included provisions for

foreclosure of a real estate mortgage, the penalties interest and attorney’s fees similar to those in the

stipulated in two promissory notes secured by the promissory notes; and it even provided for the

Indeed, a mortgage must sufficiently describe

mortgage may be charged against the mortgagors payment of taxes and insurance charges. Plainly,

the debt sought to be secured , which description

as part of the sums secured, although the the petitioner can be as specific as it wants to be,

must not be such as to mislead or deceive, and an

mortgage contract does not mention the said yet it simply did not specify nor even allude to, that

obligation is not secured by a mortgage unless

penalties. the penalty in the promissory notes would be

it comes fairly within the terms of the

secured by the mortgage. This can then only be

mortgage. In this case, the mortgage contract

interpreted to mean that the petitioner had no

xxxx provides that it secures notes and other evidences

design of including the penalty in the amount

of indebtedness. Under the rule of ejusdem

secured.22 (Emphasis and underscoring supplied)

generis, where a description of things of a

We immediately discern that the mortgage contract

particular class or kind is "accompanied by words

does not at all mention the penalties stipulated in

of a generic character, the generic words will WHEREFORE, the assailed Court of Appeals Decision of

the promissory notes. However, the petitioner

usually be limited to things of a kindred nature with February 21, 2007 and Resolution of May 16, 2007 in CA-

insists that the penalties are covered by the

those particularly enumerated . . . " A penalty G.R. SP No. CA-G.R. CV No. 86412 affirming the trial court’s

following provision of the mortgage contract:

charge does not belong to the species of decision are, in light of the foregoing

obligations enumerated in the mortgage, disquisition, AFFIRMED withMODIFICATION in that the

This mortgage is given as security for hence, the said contract cannot be understood "penalty fee" per month of the outstanding obligation

the payment to the MORTGAGEE on to secure the penalty.20(Emphasis and is excluded in the computation of the amount secured by the

demand or at maturity, as the case may underscoring supplied) Real Estate Mortgage executed by petitioners in

be, of all promissory notes, letters of respondent’s favor.

credit, trust receipts, bills of exchange,

Respondent’s contention that the absence in the

drafts, overdrafts and all other

mortgage contract of a stipulation securing the SO ORDERED.

obligations of every kind already

payment of the 3% penalty fee per month on the

incurred or which hereafter may be

outstanding amount is of no consequence, the

incurred….

deed of mortgage being merely an "accessory

contract" that "must take its bearings from the

xxxx

Averell B. Abrasaldo – II-Sanchez Roman 3

You might also like

- Understanding Asset Swapped Convertible Option Transactions MSDWDocument24 pagesUnderstanding Asset Swapped Convertible Option Transactions MSDWhchan267% (6)

- NYSF Walmart Templatev2Document49 pagesNYSF Walmart Templatev2Avinash Ganesan100% (1)

- Security Bank v. RTC Makati, 263 SCRA 453 (1996)Document3 pagesSecurity Bank v. RTC Makati, 263 SCRA 453 (1996)Fides DamascoNo ratings yet

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersFrom EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersRating: 3 out of 5 stars3/5 (1)

- Petty Cash ReportDocument1 pagePetty Cash ReportAziz Khan LodhiNo ratings yet

- RR 2-98 - AmendmentsDocument196 pagesRR 2-98 - AmendmentsArchie Guevarra100% (2)

- Petitioners Respondent: Spouses Leopoldo S. Viola and Mercedita Viola, - Equitable Pci Bank, Inc.Document8 pagesPetitioners Respondent: Spouses Leopoldo S. Viola and Mercedita Viola, - Equitable Pci Bank, Inc.Jakie CruzNo ratings yet

- Credit TransDocument153 pagesCredit TransMaricar Corina CanayaNo ratings yet

- 171669-2015-Spouses Baysa v. Spouses Plantilla20210630-11-XclcgrDocument8 pages171669-2015-Spouses Baysa v. Spouses Plantilla20210630-11-XclcgrWayneNoveraNo ratings yet

- Petitioner Vs Vs Respondent: First DivisionDocument6 pagesPetitioner Vs Vs Respondent: First DivisionKyla ReyesNo ratings yet

- D.M. Ragasa Enterprises, Inc. v. Banco de Oro, Inc. (Formerly Equitable Pci Bank, Inc.)Document11 pagesD.M. Ragasa Enterprises, Inc. v. Banco de Oro, Inc. (Formerly Equitable Pci Bank, Inc.)Juana Dela CruzNo ratings yet

- CIV 2 - Krisha CDs - CREDIT TRANSACTIONS PDFDocument113 pagesCIV 2 - Krisha CDs - CREDIT TRANSACTIONS PDFAikeeBeltranNo ratings yet

- G.R. No. 190512, June 20, 2018 - D.M. Ragasa Enterprises, Inc., Petitioner, V. Banco de Oro, Inc. (Formerly Equitable Pci Bank, Inc.), Respondent. - June 2018 - Philipppine Supreme Court DecisionsDocument15 pagesG.R. No. 190512, June 20, 2018 - D.M. Ragasa Enterprises, Inc., Petitioner, V. Banco de Oro, Inc. (Formerly Equitable Pci Bank, Inc.), Respondent. - June 2018 - Philipppine Supreme Court DecisionsramilgarciaNo ratings yet

- Andal vs. PNB GR 194201, Nov. 27, 2013 PDFDocument9 pagesAndal vs. PNB GR 194201, Nov. 27, 2013 PDFRoselito MaligroNo ratings yet

- GR 194201Document7 pagesGR 194201RajkumariNo ratings yet

- Petitioner Vs Vs Respondents Cauton Associates Francisco G. MendozaDocument5 pagesPetitioner Vs Vs Respondents Cauton Associates Francisco G. MendozaIan Timothy SarmientoNo ratings yet

- G.R. No. 190512, June 20, 2018Document14 pagesG.R. No. 190512, June 20, 2018yvettequebral163No ratings yet

- Viola V Equitable Pci BankDocument2 pagesViola V Equitable Pci BankCzar Ian AgbayaniNo ratings yet

- RAGASA vs. BDODocument15 pagesRAGASA vs. BDOJohannes YapyapanNo ratings yet

- Sps Bautista v. Pilar DevelopmentDocument4 pagesSps Bautista v. Pilar DevelopmentakosivansotNo ratings yet

- Credit Case DigestDocument10 pagesCredit Case DigestBianca de GuzmanNo ratings yet

- 059 Cuyco V Cuyco - PeraltaDocument2 pages059 Cuyco V Cuyco - PeraltaClarisse Anne PeraltaNo ratings yet

- 42 Sps. Andal vs. PNBDocument6 pages42 Sps. Andal vs. PNBRobert Jayson UyNo ratings yet

- Credit Transactions Batch 2 (Feb 15, 2018)Document28 pagesCredit Transactions Batch 2 (Feb 15, 2018)Carmel LouiseNo ratings yet

- 1REM PowerToSell G.R. No. 159271Document6 pages1REM PowerToSell G.R. No. 159271Tj CabacunganNo ratings yet

- Full Text - 2eDocument473 pagesFull Text - 2eFrancis Mae FerrerNo ratings yet

- D.M. Ragasa Enterprises, Inc., Petitioner, V. Banco de Oro, Inc. (Formerly Equitable Pci Bank, Inc.), Respondent. Decision Caguioa, J.Document14 pagesD.M. Ragasa Enterprises, Inc., Petitioner, V. Banco de Oro, Inc. (Formerly Equitable Pci Bank, Inc.), Respondent. Decision Caguioa, J.Big BoysNo ratings yet

- SPs. Andal v. PNB GR No.194201 Nov 27 2013Document6 pagesSPs. Andal v. PNB GR No.194201 Nov 27 2013Christine Rose Bonilla LikiganNo ratings yet

- Sps. Andal v. PNBDocument8 pagesSps. Andal v. PNBEd Von Fernandez CidNo ratings yet

- Andal vs. PNBDocument14 pagesAndal vs. PNBpoiuytrewq9115No ratings yet

- Estores V Spouses Supangan, G. R. No. 175139, April18, 2012Document4 pagesEstores V Spouses Supangan, G. R. No. 175139, April18, 2012CresteynTeyngNo ratings yet

- Oblicon Week 3 DigestDocument33 pagesOblicon Week 3 DigestTom Louis HerreraNo ratings yet

- Ligutan v. CADocument3 pagesLigutan v. CABeltran KathNo ratings yet

- Group 5 Case DigestsDocument22 pagesGroup 5 Case Digestsnaomi_mateo_4No ratings yet

- Almeda V CA - GR 113412Document9 pagesAlmeda V CA - GR 113412jovelyn davoNo ratings yet

- Ligutan v. CADocument3 pagesLigutan v. CAMaria Lourdes DatorNo ratings yet

- 49 Agro Conglomerate Vs CADocument5 pages49 Agro Conglomerate Vs CACharm Divina LascotaNo ratings yet

- Security Bank V RTC Makati 263 SCRA 453 1996Document3 pagesSecurity Bank V RTC Makati 263 SCRA 453 1996Xyrus Bucao100% (1)

- Spouses Jovenal Toring and Cecilia EscalonaDocument3 pagesSpouses Jovenal Toring and Cecilia EscalonadaryllNo ratings yet

- Spouses Toring v. Spouses Olan G.R. No. 168782 October 10 2008 589 PHIL 362 370Document6 pagesSpouses Toring v. Spouses Olan G.R. No. 168782 October 10 2008 589 PHIL 362 370rggconde11No ratings yet

- Almeda Vs Court of Appeals and PNB G.R. No. 113412 April 17Document8 pagesAlmeda Vs Court of Appeals and PNB G.R. No. 113412 April 17Raymond JamoraNo ratings yet

- G.R. No. 113926. October 23, 1996.: - First DivisionDocument8 pagesG.R. No. 113926. October 23, 1996.: - First DivisionMalolosFire BulacanNo ratings yet

- Almeda vs. CADocument7 pagesAlmeda vs. CAAnonymous oDPxEkdNo ratings yet

- Obligations and Contracts Obligations With Penal Clause - Art. 1226-1229Document14 pagesObligations and Contracts Obligations With Penal Clause - Art. 1226-1229Kirsten Rose Boque ConconNo ratings yet

- Banco Filipino V. YbanezDocument7 pagesBanco Filipino V. YbanezWarren Codoy ApellidoNo ratings yet

- Credit CasesDocument77 pagesCredit CasesJMXNo ratings yet

- Buenaventura vs. Metropolitan Bank and Trust CompanyDocument27 pagesBuenaventura vs. Metropolitan Bank and Trust Companyral cbNo ratings yet

- 1306 - Autonomy of ContractsDocument2 pages1306 - Autonomy of ContractsSarah Jane UsopNo ratings yet

- Oblicon Cases IVDocument370 pagesOblicon Cases IVMaurice PinayNo ratings yet

- 34 G.R. No. 113926Document4 pages34 G.R. No. 113926Jessel MaglinteNo ratings yet

- MDocument19 pagesMJoannah SalamatNo ratings yet

- Sps. Mallari v. Prudential Bank (BPI)Document3 pagesSps. Mallari v. Prudential Bank (BPI)Lorie Jean UdarbeNo ratings yet

- Bulatao vs. Estonactoc, 927 SCRA 535, December 10, 2019Document25 pagesBulatao vs. Estonactoc, 927 SCRA 535, December 10, 2019YiNo ratings yet

- PNB Vs CADocument4 pagesPNB Vs CAAJ PaladNo ratings yet

- Bustamante Vs Rosel DigestedDocument2 pagesBustamante Vs Rosel Digestedmcvinpurcil3No ratings yet

- 23 Spouses Andal v. Philippine National BankDocument9 pages23 Spouses Andal v. Philippine National BankOke HarunoNo ratings yet

- 056-Violeta Tudtud Banate Et Al vs. Philippine Countryside Rural Bank (Liloan, Cebu), Inc G.R. No. 163825 July 13, 2010Document6 pages056-Violeta Tudtud Banate Et Al vs. Philippine Countryside Rural Bank (Liloan, Cebu), Inc G.R. No. 163825 July 13, 2010wewNo ratings yet

- Bautista vs. Pilar Development Corporation, 312 SCRA 611, G.R. No. 135046 August 17, 1999Document5 pagesBautista vs. Pilar Development Corporation, 312 SCRA 611, G.R. No. 135046 August 17, 1999Daysel FateNo ratings yet

- 2.tayug Rural Bank v. CBDocument7 pages2.tayug Rural Bank v. CBsnhlaoNo ratings yet

- Estores v. Spouses Supangan (G.R. No. 175139)Document13 pagesEstores v. Spouses Supangan (G.R. No. 175139)aitoomuchtvNo ratings yet

- Estores v. Spouses Supangan, G.R. No. 175139Document11 pagesEstores v. Spouses Supangan, G.R. No. 175139noemi alvarezNo ratings yet

- Spouses Poon V Prime Savings BankDocument13 pagesSpouses Poon V Prime Savings BankAce Asyong AlveroNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Practice Makes PerfectDocument8 pagesPractice Makes PerfectaverellabrasaldoNo ratings yet

- Mass Media & TreatyDocument1 pageMass Media & TreatyaverellabrasaldoNo ratings yet

- (PracCourt 2) Last Minute NotesDocument5 pages(PracCourt 2) Last Minute NotesaverellabrasaldoNo ratings yet

- SpecPro NotesDocument6 pagesSpecPro NotesaverellabrasaldoNo ratings yet

- Social LegislationDocument10 pagesSocial LegislationaverellabrasaldoNo ratings yet

- Remedies and JurisdictionDocument4 pagesRemedies and JurisdictionaverellabrasaldoNo ratings yet

- Caguioa, J.Document2 pagesCaguioa, J.averellabrasaldoNo ratings yet

- Taxation 2 Review AssessmentDocument11 pagesTaxation 2 Review AssessmentaverellabrasaldoNo ratings yet

- Odr & PerDocument4 pagesOdr & PeraverellabrasaldoNo ratings yet

- Cred Trans Part 11Document17 pagesCred Trans Part 11averellabrasaldoNo ratings yet

- Cred Trans Part 10Document20 pagesCred Trans Part 10averellabrasaldoNo ratings yet

- Cred Trans Part 2iiiDocument33 pagesCred Trans Part 2iiiaverellabrasaldoNo ratings yet

- Cred Trans Part 2iiDocument20 pagesCred Trans Part 2iiaverellabrasaldoNo ratings yet

- Special Laws Title 3Document12 pagesSpecial Laws Title 3averellabrasaldoNo ratings yet

- Legal Ethics - Sanctions For Practice or Appearance Without Authority and Public Officials and Practice of Law CasesDocument5 pagesLegal Ethics - Sanctions For Practice or Appearance Without Authority and Public Officials and Practice of Law CasesaverellabrasaldoNo ratings yet

- Cred Trans Part 9iDocument34 pagesCred Trans Part 9iaverellabrasaldoNo ratings yet

- Cred Trans Part 3i-IiDocument18 pagesCred Trans Part 3i-IiaverellabrasaldoNo ratings yet

- Cred Trans Part 9Document18 pagesCred Trans Part 9averellabrasaldoNo ratings yet

- Assigned Case ProvidentDocument2 pagesAssigned Case ProvidentaverellabrasaldoNo ratings yet

- Legal Ethics - Appearance of Non-Lawyers CasesDocument11 pagesLegal Ethics - Appearance of Non-Lawyers CasesaverellabrasaldoNo ratings yet

- Legal Ethics IDocument14 pagesLegal Ethics IaverellabrasaldoNo ratings yet

- Corpo Cases 8th WeekDocument26 pagesCorpo Cases 8th WeekaverellabrasaldoNo ratings yet

- Legal Ethics - WHO MAY PRACTICE LAW (Rules 138 of The Rules of Court) CasesDocument7 pagesLegal Ethics - WHO MAY PRACTICE LAW (Rules 138 of The Rules of Court) CasesaverellabrasaldoNo ratings yet

- Special Laws Title 1Document53 pagesSpecial Laws Title 1averellabrasaldoNo ratings yet

- Special Laws Title 7Document16 pagesSpecial Laws Title 7averellabrasaldoNo ratings yet

- Special Laws Title 7.1Document16 pagesSpecial Laws Title 7.1averellabrasaldoNo ratings yet

- Special Laws Title 5Document24 pagesSpecial Laws Title 5averellabrasaldoNo ratings yet

- Corpo Cases 10th Week AssignedDocument2 pagesCorpo Cases 10th Week AssignedaverellabrasaldoNo ratings yet

- Special Laws Title 2Document12 pagesSpecial Laws Title 2averellabrasaldoNo ratings yet

- PALE Cases B-DDocument40 pagesPALE Cases B-DaverellabrasaldoNo ratings yet

- UBL Internship ReportDocument78 pagesUBL Internship Reportnocent_dvil83% (12)

- Project Management Lecture Note 3 - Feasibility StudyDocument22 pagesProject Management Lecture Note 3 - Feasibility StudySixd Waznine100% (1)

- SpecPro OutlineDocument7 pagesSpecPro OutlineCautious LotharioNo ratings yet

- Tps Case StudyDocument16 pagesTps Case StudyHomework Ping100% (1)

- Receivable FinancingDocument5 pagesReceivable FinancingAphol Joyce MortelNo ratings yet

- Amaia PampangaDocument1 pageAmaia PampangadusteezapedaNo ratings yet

- Chapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFDocument24 pagesChapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFChristian GoNo ratings yet

- TVM CalcDocument34 pagesTVM CalcSam Sep A SixtyoneNo ratings yet

- Den ADocument157 pagesDen AParthivi KapoorNo ratings yet

- Affidavit of Adverse Claim: Republic of The Philippines) City of Manila) S.SDocument2 pagesAffidavit of Adverse Claim: Republic of The Philippines) City of Manila) S.SJUSTICE DEE100% (2)

- MisjoinderDocument39 pagesMisjoinderPritish MishraNo ratings yet

- Portic Vs CristobalDocument3 pagesPortic Vs CristobalDeniel Salvador B. MorilloNo ratings yet

- The Time Value of MoneyDocument24 pagesThe Time Value of Moneysaliljain2001No ratings yet

- 2015-2017 Remedial Law Bar Exam QuestionsDocument9 pages2015-2017 Remedial Law Bar Exam QuestionsMarie Mariñas-delos ReyesNo ratings yet

- Certificate in Import Export Procedure and DocumentationDocument99 pagesCertificate in Import Export Procedure and DocumentationUsman RazaNo ratings yet

- The Rehabilitation PlanDocument6 pagesThe Rehabilitation PlanTricia MontoyaNo ratings yet

- Risk Management Through Derivative in Indian Stock MarketDocument29 pagesRisk Management Through Derivative in Indian Stock MarketHimanshu RastogiNo ratings yet

- Profitability Sustainability RatiosDocument3 pagesProfitability Sustainability RatiosRhodelbert Rizare Del SocorroNo ratings yet

- Presentation On Money & BankingDocument15 pagesPresentation On Money & BankingRahul VyasNo ratings yet

- Chapter 3 - TaxDocument23 pagesChapter 3 - TaxNilda Sahibul BaclayanNo ratings yet

- Enhancing Sme PerformanceDocument20 pagesEnhancing Sme PerformanceHadiBiesNo ratings yet

- Dividend Policy and Firm ValueDocument10 pagesDividend Policy and Firm ValueKrishan BorwalNo ratings yet

- QuestionDocument2 pagesQuestionyaniNo ratings yet

- Chapter 11 Dividend Policy: 1. ObjectivesDocument8 pagesChapter 11 Dividend Policy: 1. Objectivessamuel_dwumfourNo ratings yet

- RA 8424 and Revisions 1997-2011Document280 pagesRA 8424 and Revisions 1997-2011heraroseNo ratings yet

- 2 UnitDocument13 pages2 UnitYogyata MishraNo ratings yet