Professional Documents

Culture Documents

Assuming Dell Sales Will Grow 50% in 1997, How Might The Company Fund Its Growth Internally?

Assuming Dell Sales Will Grow 50% in 1997, How Might The Company Fund Its Growth Internally?

Uploaded by

DivyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assuming Dell Sales Will Grow 50% in 1997, How Might The Company Fund Its Growth Internally?

Assuming Dell Sales Will Grow 50% in 1997, How Might The Company Fund Its Growth Internally?

Uploaded by

DivyaCopyright:

Available Formats

Assuming Dell sales will grow 50% in 1997, how might the company fund its

growth internally?

To determine the source of funding for 1997, we only need to analyze major cash

flows, rather than breaking them down in terms of operating, investing and financing

activities. Only debt financing is considered to be external funding. Accounts

payable, can also be considered as external funding, since creditors are considered

to be external entities, so they are excluded from the analysis. Moreover, in this,

change in equity is being considered as injection from sponsors only, making it to be

an internal source.

Assumptions that we need to undertake include constant net profit margin (net profit

as % of sales) of 5.136% and operating assets, as percent of sales, of 29.40%. In

the absence of any non cash charges, such as depreciation, and other information

net income and increase in Equity & Liabilities are accounted for as the only cash

inflows.

As per the analysis in the attached excel sheet, net profit after tax amounted to USD

408 million whilst change in total operating assets amounted to USD 779 million.

After accounting for Equity & Liabilities, cash inflows would amount to USD 1,249

million whereas cash outflows, increase in operating assets, amounted to USD 779

million. This reflects that in 1997 also, internal sources would be sufficient to fund the

growth of the company.

You might also like

- Tire City IncDocument3 pagesTire City IncAlberto RcNo ratings yet

- Typical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetDocument7 pagesTypical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetSylvan EversNo ratings yet

- Sun Brewing Case ExhibitsDocument26 pagesSun Brewing Case ExhibitsShshankNo ratings yet

- GA1 - Syndicate 10 - 29118149Document8 pagesGA1 - Syndicate 10 - 29118149devanmadeNo ratings yet

- Coming Home Funeral Services: Ericsson Internal - Mar 15 - Page 1Document3 pagesComing Home Funeral Services: Ericsson Internal - Mar 15 - Page 1KaranSinghNo ratings yet

- MCL 450.1243 - 1241 - 702 Resident Agent InfoDocument1 pageMCL 450.1243 - 1241 - 702 Resident Agent Inforicetech100% (2)

- MBE I - ActualDocument77 pagesMBE I - ActualCleve Collado67% (9)

- Quiz 1.07 Revaluation To Intangible Assets Submissions: Standalone AssignmentDocument15 pagesQuiz 1.07 Revaluation To Intangible Assets Submissions: Standalone AssignmentJohn Lexter Macalber100% (1)

- Case 32 - CPK AssignmentDocument9 pagesCase 32 - CPK AssignmentEli JohnsonNo ratings yet

- Finance Minicase 1 Sunset BoardsDocument12 pagesFinance Minicase 1 Sunset Boardsapi-31397810480% (5)

- Final Draft - MFIDocument38 pagesFinal Draft - MFIShaquille SmithNo ratings yet

- Balakrishnan MGRL Solutions Ch07Document50 pagesBalakrishnan MGRL Solutions Ch07deeNo ratings yet

- Does IT Payoff Strategies of Two Banking GiantsDocument10 pagesDoes IT Payoff Strategies of Two Banking GiantsScyfer_16031991No ratings yet

- Mogen, Inc. Case StudyDocument18 pagesMogen, Inc. Case StudyAirlangga Prima Satria MaruapeyNo ratings yet

- Fonderia Case AssignmentDocument1 pageFonderia Case Assignmentpoo_granger5229No ratings yet

- Nu WareDocument22 pagesNu WaresslbsNo ratings yet

- Bearn Sterns and Co.Document10 pagesBearn Sterns and Co.eidel18400% (1)

- Michael McClintock Case1Document2 pagesMichael McClintock Case1Mike MCNo ratings yet

- Jacobs Division PDFDocument5 pagesJacobs Division PDFAbdul wahabNo ratings yet

- DPC Case SolutionDocument11 pagesDPC Case Solutionburiticas992No ratings yet

- This Study Resource Was: Midterm-Final Exam Aec 215 - Business TaxationDocument8 pagesThis Study Resource Was: Midterm-Final Exam Aec 215 - Business TaxationGray JavierNo ratings yet

- Bryan Burgess For Oberlin City CouncilDocument2 pagesBryan Burgess For Oberlin City CouncilThe Morning JournalNo ratings yet

- All Keller HomeworksDocument175 pagesAll Keller HomeworksYigit Ali Alben100% (1)

- Dell CaseDocument22 pagesDell CaseShaikh Saifullah KhalidNo ratings yet

- BOEING 7e7Document5 pagesBOEING 7e7EVA Rental AdminNo ratings yet

- BBBY S CaseDocument4 pagesBBBY S CaseKarina Taype NunuraNo ratings yet

- Daktronics E Dividend Policy in 2010Document26 pagesDaktronics E Dividend Policy in 2010IBRAHIM KHANNo ratings yet

- Aurora Textile CompanyDocument47 pagesAurora Textile CompanyMoHadrielCharki63% (8)

- Aurora PaperDocument6 pagesAurora PaperZhijian Huang100% (1)

- 18-Conway IndustriesDocument5 pages18-Conway IndustriesKiranJumanNo ratings yet

- Calculating The NPV of The AcquisitionDocument23 pagesCalculating The NPV of The Acquisitionkooldude1989100% (1)

- VIB Case Study On RJR NabiscoDocument1 pageVIB Case Study On RJR NabiscoSatyajeet SenapatiNo ratings yet

- Cima Et Al. - 2011 - Use of Lean and Six Sigma Methodology To Improve Operating Room Efficiency in A High-Volume Tertiary-Care Academic PDFDocument10 pagesCima Et Al. - 2011 - Use of Lean and Six Sigma Methodology To Improve Operating Room Efficiency in A High-Volume Tertiary-Care Academic PDFDragan DragičevićNo ratings yet

- Gemini ElectronicsDocument1 pageGemini ElectronicsSreeda PerikamanaNo ratings yet

- Diageo Was Conglomerate Involved in Food and Beverage Industry in 1997Document6 pagesDiageo Was Conglomerate Involved in Food and Beverage Industry in 1997Prashant BezNo ratings yet

- Fonderia Di Torino PDFDocument4 pagesFonderia Di Torino PDFBilly GemaNo ratings yet

- Primus Automotion Devision Case 2002Document9 pagesPrimus Automotion Devision Case 2002Devin Fortranansi FirdausNo ratings yet

- Sealed Air Leveraged RecapitalizationDocument4 pagesSealed Air Leveraged RecapitalizationMridul GuptaNo ratings yet

- Deluxe Corporation Case StudyDocument3 pagesDeluxe Corporation Case StudyHEM BANSALNo ratings yet

- Butler Lumber CoDocument2 pagesButler Lumber Cokumarsharma123No ratings yet

- XLS EngDocument19 pagesXLS EngCuong NguyenNo ratings yet

- O.M Scoott and Sons Case Study HarvardDocument6 pagesO.M Scoott and Sons Case Study Harvardnicole rodríguezNo ratings yet

- Clarkson Lumber Analysis - TylerDocument9 pagesClarkson Lumber Analysis - TylerTyler TreadwayNo ratings yet

- HP Case Competition PresentationDocument17 pagesHP Case Competition PresentationNatalia HernandezNo ratings yet

- Case #2 NIKE INCDocument6 pagesCase #2 NIKE INCSamantha LunaNo ratings yet

- UVA-F-1264: Printicomm's Proposed Acquisition of Digitech: Negotiating Price and Form of PaymentDocument14 pagesUVA-F-1264: Printicomm's Proposed Acquisition of Digitech: Negotiating Price and Form of PaymentKumarNo ratings yet

- Initial Public Offering Netscape Communication: By: Divya Pritwani Roll: 10DCP-008Document9 pagesInitial Public Offering Netscape Communication: By: Divya Pritwani Roll: 10DCP-008Divyya PritwaniNo ratings yet

- Yeats Valves Controls Inc SolutionDocument6 pagesYeats Valves Controls Inc SolutionEfri DwiyantoNo ratings yet

- Netscape ProformaDocument6 pagesNetscape ProformabobscribdNo ratings yet

- 8db6 - ING Insurance - Asia-PacificDocument16 pages8db6 - ING Insurance - Asia-PacificJessica LopezNo ratings yet

- Final AssignmentDocument15 pagesFinal AssignmentUttam DwaNo ratings yet

- Worldwide Paper CompanyDocument3 pagesWorldwide Paper CompanyGANESWAR BARIKNo ratings yet

- Sealed Air Corp Case Write Up PDFDocument3 pagesSealed Air Corp Case Write Up PDFRamjiNo ratings yet

- Autozone: Case StudyDocument17 pagesAutozone: Case StudyPatcharanan SattayapongNo ratings yet

- Genzyme DCF PDFDocument5 pagesGenzyme DCF PDFAbinashNo ratings yet

- Fonderia Torino Solution 2Document4 pagesFonderia Torino Solution 2Marco ArnaldiNo ratings yet

- The Quaker Oats Company and Subsidiaries Consolidated Statements of IncomeDocument3 pagesThe Quaker Oats Company and Subsidiaries Consolidated Statements of IncomeNaseer AhmedNo ratings yet

- Ratio InterpretationDocument1 pageRatio Interpretationjanuaryjanuary1203No ratings yet

- Zooming in On NOIDocument8 pagesZooming in On NOIandrewpereiraNo ratings yet

- Pertemuan 9BDocument36 pagesPertemuan 9Bleny aisyahNo ratings yet

- AFN Additional Fund Needed - WPS OfficeDocument3 pagesAFN Additional Fund Needed - WPS OfficeAra mercilieNo ratings yet

- Financial InfoDocument23 pagesFinancial InfojohnsolarpanelsNo ratings yet

- Write Up m201802 SinghalDocument14 pagesWrite Up m201802 Singhalshalini singhalNo ratings yet

- Additional Funds Needed MasDocument22 pagesAdditional Funds Needed MasWilmer Mateo Bernardo100% (1)

- Analyzing and Interpreting Financial StatementsDocument42 pagesAnalyzing and Interpreting Financial StatementsLiluNo ratings yet

- Conical Scanning and Sequential LobingDocument6 pagesConical Scanning and Sequential LobingDivyaNo ratings yet

- EC6015 - Radar and Navigational Aids Question Bank VII Semester ECEDocument3 pagesEC6015 - Radar and Navigational Aids Question Bank VII Semester ECEDivyaNo ratings yet

- Satellite Communication Unit Test - 2 Answers Part - A 1. List The Ionospheric Effects On Space LinkDocument9 pagesSatellite Communication Unit Test - 2 Answers Part - A 1. List The Ionospheric Effects On Space LinkDivyaNo ratings yet

- EE6352 EEI Question BankDocument10 pagesEE6352 EEI Question BankDivyaNo ratings yet

- Logic Gates: Structural ModellingDocument3 pagesLogic Gates: Structural ModellingDivyaNo ratings yet

- Question BankDocument3 pagesQuestion BankDivyaNo ratings yet

- Part - A Answer All The Questions (10x2 20 Marks)Document3 pagesPart - A Answer All The Questions (10x2 20 Marks)DivyaNo ratings yet

- Pros and Cons of Granite Quarrying in TamilnaduDocument3 pagesPros and Cons of Granite Quarrying in TamilnaduDivyaNo ratings yet

- Turing MachineDocument1 pageTuring MachineDivyaNo ratings yet

- Ec6015 QB 12Document13 pagesEc6015 QB 12DivyaNo ratings yet

- Sample MCQ - Facility Location and LayoutDocument3 pagesSample MCQ - Facility Location and LayoutDivyaNo ratings yet

- EC6301 - NotesDocument179 pagesEC6301 - NotesDivyaNo ratings yet

- 1813963359chapter 6Document10 pages1813963359chapter 6DivyaNo ratings yet

- Crowding OutDocument3 pagesCrowding OutsattysattuNo ratings yet

- Marketing of Financial ServicesDocument9 pagesMarketing of Financial ServicesPrince HussainNo ratings yet

- Retail Installment Contract TemplateDocument4 pagesRetail Installment Contract TemplatenathaliaanitaNo ratings yet

- My ResumeDocument2 pagesMy Resumeanon-477710No ratings yet

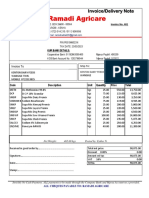

- Ramadi Agricare: Invoice/Delivery NoteDocument2 pagesRamadi Agricare: Invoice/Delivery NoteRamadi cyberNo ratings yet

- All SBR Topics Overview PDFDocument245 pagesAll SBR Topics Overview PDFRone garciaNo ratings yet

- Cable Industry in IndonesiaDocument85 pagesCable Industry in IndonesiaLucky Ariesandi100% (2)

- Consent Letter - Indra Nath MishraDocument2 pagesConsent Letter - Indra Nath MishraIndra MishraNo ratings yet

- Village MD CARES Webinar Slides FINALDocument14 pagesVillage MD CARES Webinar Slides FINALAbdcNo ratings yet

- Accounting 11 Activity 2Document1 pageAccounting 11 Activity 2Ma Trixia Alexandra CuevasNo ratings yet

- Presentation To AGM2Document24 pagesPresentation To AGM2Juf LewisNo ratings yet

- Ekonomi PeledakanDocument19 pagesEkonomi PeledakanRayabKabelNo ratings yet

- Offer To Purchase Tierra VerdeDocument2 pagesOffer To Purchase Tierra Verdeshrine obenietaNo ratings yet

- Submissions: Score: 1 Out of 1Document77 pagesSubmissions: Score: 1 Out of 1Geli AceNo ratings yet

- Implementing Corporate Strategy: Managing The Multi Business FirmDocument15 pagesImplementing Corporate Strategy: Managing The Multi Business FirmArjay MolinaNo ratings yet

- FAR-1 Mock Question PaperDocument9 pagesFAR-1 Mock Question Papernazish ilyasNo ratings yet

- Single Entry SystemDocument7 pagesSingle Entry SystemSanketh JainNo ratings yet

- 20 Venture Capital Advantages and DisadvantagesDocument9 pages20 Venture Capital Advantages and DisadvantagesFrancis BellidoNo ratings yet

- Financial Analysis Report OGDCLDocument16 pagesFinancial Analysis Report OGDCLRaza SohailNo ratings yet

- Intermediate Guide To E-Mini Futures Contracts - Rollover Dates and Expiration - InvestopediaDocument5 pagesIntermediate Guide To E-Mini Futures Contracts - Rollover Dates and Expiration - Investopediarsumant1No ratings yet

- HDFC Bank Was Amongst The First To Receive An PDFDocument83 pagesHDFC Bank Was Amongst The First To Receive An PDFSairam SajaneNo ratings yet

- Account Officer - MazabukaDocument4 pagesAccount Officer - Mazabukapeter mulilaNo ratings yet

- Modern Treasury - Accounting For Developers Parts I-IIIDocument32 pagesModern Treasury - Accounting For Developers Parts I-IIIfelipeap92No ratings yet

- Ranchi-Mumbai Train TicketDocument2 pagesRanchi-Mumbai Train TicketAditya PatilNo ratings yet

- Contract Act PropositionsDocument15 pagesContract Act PropositionsJudicial AspirantNo ratings yet