Professional Documents

Culture Documents

Billing of Revenue or Income: Name: Jean Rose T. Bustamante Bsma - 3

Billing of Revenue or Income: Name: Jean Rose T. Bustamante Bsma - 3

Uploaded by

Jean Rose Tabagay Bustamante0 ratings0% found this document useful (0 votes)

53 views4 pagesThe document discusses the budgeting process for the national government, which includes four stages: budget planning, budget authorization, budget implementation, and budget transparency. It provides details on each stage, including the key players involved and legal bases. Budget preparation involves cost estimation, budget proposals, and submission of the executive budget. Budget authorization is done through an appropriations ordinance passed by the local legislature. Budget review determines compliance with requirements. Budget execution involves allotment releases, obligations, disbursements, and delivery of goods and services. Budget accountability involves tracking revenues and expenditures through management controls and evaluating financial and physical performance.

Original Description:

Original Title

Bustamante_JE-NPO

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the budgeting process for the national government, which includes four stages: budget planning, budget authorization, budget implementation, and budget transparency. It provides details on each stage, including the key players involved and legal bases. Budget preparation involves cost estimation, budget proposals, and submission of the executive budget. Budget authorization is done through an appropriations ordinance passed by the local legislature. Budget review determines compliance with requirements. Budget execution involves allotment releases, obligations, disbursements, and delivery of goods and services. Budget accountability involves tracking revenues and expenditures through management controls and evaluating financial and physical performance.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

53 views4 pagesBilling of Revenue or Income: Name: Jean Rose T. Bustamante Bsma - 3

Billing of Revenue or Income: Name: Jean Rose T. Bustamante Bsma - 3

Uploaded by

Jean Rose Tabagay BustamanteThe document discusses the budgeting process for the national government, which includes four stages: budget planning, budget authorization, budget implementation, and budget transparency. It provides details on each stage, including the key players involved and legal bases. Budget preparation involves cost estimation, budget proposals, and submission of the executive budget. Budget authorization is done through an appropriations ordinance passed by the local legislature. Budget review determines compliance with requirements. Budget execution involves allotment releases, obligations, disbursements, and delivery of goods and services. Budget accountability involves tracking revenues and expenditures through management controls and evaluating financial and physical performance.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

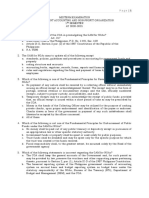

Name: JEAN ROSE T.

BUSTAMANTE BSMA -3

1. Billing of revenue or income

Accounts Receivable 300,000

Rent/Lease Income 30,000

Waterworks System fees 50,000

Power supply system fees 100,000

Seaport system fees 45,000

Landing and parking fees 75,000

*To recognize billing of income

2. Collections

Cash-collecting officers 10,000

Accounts Receivable 10,000

*To recognize collection of prior year’s billed income

3. Receipt of allotment from the DBM

PS 650,000

MODE 750,000

CO 1,000,000

TOTAL 2,400,000

*Posting to the appropriate RAPAL and RAOD

4. Receipt of notice of Cash of Allocation from DBM (net of tax)

a. Cash-modified disbursement regular 1,200,000

Subsidy from National Government 1,200,000

*To recognize receipt of NCA from the DBM

b. Cash-modified disbursement regular 1,000,000

Subsidy from National Government 1,000,000

*To recognize receipt of NCA from the DBM

5. Set up of payables to officers and employees upon approval of payroll

Salaries and Wages Regular 510,000

Personnel Economic Relief Allowance 55,000

Due to BIR 51,000

Due to GSIS 15,300

Due to PAG-IBIG 10,200

Due to PhilHealth 510

Due to officers and employees 489, 990

*To recognize liabilities to officers and employees upon approval of payroll

6. Grant of cash advance for payroll

Advance for payroll 487, 990

Cash-modified disbursement system, regular 487, 990

*To recognize grant of cash advance for payroll

7. Issuance of supplies and materials to end users

Office supplies expenses 12, 420

Office supplies inventory 12, 420

*To take up issuance of supplies and materials based on monthly report

8. Payments of MOOE and accounts payable

*To recognize issuance of MDS checks based on the RCI

9. Remittance of the GSIS, PAG-IBIG and PhilHealth

Due to GSIS 15, 300

Due to PAG-IBIG 10, 200

Due to PhilHealth 510

Cash-modified disbursement system, regular 26, 010

*To recognize remittance to GSIS, Pag-IBIG and PhilHealth

10. Adjustment for unused NCA

Subsidy from National Government 132, 196

Cash-modified disbursement system, regular 132, 196

*To recognize reversion of unused NCA

11-20 Budgeting Process for Government

Budget planning, budget authorization, budget implementation, and budget

transparency are the four (4) distinct mechanisms or stages of budgeting for the

national government. Both mechanisms converge in the execution of a fiscal year,

despite the fact that they are different. Government budgeting is the allocation of

public funds to attain the economic and social goals of the country. It also entails

the management of government expenditures to create the most impact from the

production and delivery of goods and services. Budget preparation is the first

phase of the local budget process. It involves cost estimation per PPA, preparation

of budget proposals, executive review of budget proposals, and preparation of the

LEP and the Budget Message. This phase starts with the issuance of the Budget

Call, and ends with submission of the Executive Budget to the Sanggunian on or

before October 16 of each year. Legal Basis of Budget Preparation – Upon receipt

of the statements of income and expenditures from the treasurer, the budget

proposals of the heads of departments and offices and the estimates of income

and budgetary ceilings from the local finance committee, the local chief executive

shall prepare the executive budget for the ensuing year in accordance with the

provisions of [Title V, Book II of RA No. 7160] (Section 318, RA No. 7160).

Budget Legislation Authorization of the budget is done through an

Appropriation Ordinance enacted by the Local Sanggunian in accordance with the

fundamental principle that, “No money shall be paid out of the local treasury except

in pursuance of an Appropriation Ordinance or law” (Section 305 (a), RA No. 7160).

Legal Basis of Budget Authorization On or before the end of the current fiscal year,

the Sanggunian concerned shall enact, through an ordinance, the annual budget

of the local government unit for the ensuing fiscal year on the basis of the estimates

of income and expenditures submitted by the local chief executive (Section 319,

RA No. 7160). Key Players in Budget Authorization (a) Local Chief

Executive - The LCE shall submit the LEP to the Sanggunian for authorization

(Section 318, RA No. 7160). (b) Sanggunian - The Sanggunian may, by ordinance,

authorize the LCE or the Presiding Officer of the Sanggunian to augment any item

in the approved annual budget for their respective offices from savings in other

items within the same expense class of their respective appropriations (Section

336, RA No. 7160; Article 454[b], IRR of RA No. 7160). (c)Finance –shall be

responsible for conducting a preliminary review and evaluation of the Local

Expenditure Program. It shall submit its report and recommendation to the

Sanggunian proper. (d) Secretary to the Sanggunian – The Secretary to the

Sanggunian shall stamp the Appropriation Ordinance with the seal of the

Sanggunian and record the same in a book kept for the purpose. (Section 469, RA

No. 7160) and (Sec. 59 (b), RA No. 7160). (e) Local Finance Committee - The LFC

shall assist the Sanggunian in the analysis and review of the annual and

supplemental budgets to determine compliance with statutory and administrative

requirements (Section 316 [g], RA No. 7160). (f) Heads of Departments and Offices

– explain or justify their proposals. (g) CSOs and Private Sector Groups – Should

the Sanggunian allow the CSOs to participate in the budget authorization phase, it

may refer to the Handbook on the Participation of Civil Society Organizations in

the Local Budget Process.

Budget Review is the third phase in the local budget process. Its primary

purpose is to determine whether the Appropriation Ordinance has complied with

the budgetary requirements and general limitations set forth in the Local

Government Code of 1991, as well as provisions of other applicable laws. It starts

from the time the reviewing authority receives the Appropriation Ordinance for

review and ends with the issuance of the review action. Legal Bases of Budget

Review the Department of Budget and Management shall review ordinances

authorizing the annual or supplemental appropriations of provinces, highly

urbanized cities, independent component cities, and municipalities within the

Metropolitan Manila Area in accordance with Section 327 of RA No. 7160 (Section

326 of RA No. 7160).

The execution of the budget in accordance with existing rules, laws and

regulations is the fourth phase of the budget process in local governments. After

the usual recording of appropriations in the proper registries, the execution of the

budget involves the release of allotments, the certification of available

appropriations and cash, the recording of actual obligations and disbursements of

funds for approved PPAs and the delivery of goods and services to target clients

in the most efficient, effective, economical and ethical way. The fundamental

principles governing all financial transactions in local governments are covered in

Section 305 of RA No. 7160. The responsibility, however, for the execution of

authorized annual and supplemental budgets shall be vested upon the Local Chief

Executive (Section 320 of RA No. 7160).The use of appropriated Funds pursuant

to Section 336 of RA No. 7160 shall be exclusively for the specific purpose for

which they have been appropriated. Another legal basis in Budget Execution is the

Certification requirement before local funds are utilized. Section 344 of R.A.

No.7160 provides that “No money shall be disbursed unless the local budget officer

certifies to the existence of appropriation that has been legally made for the

purpose, the local accountant has obligated said appropriation, and the local

treasurer certifies to the availability of funds for the purpose.

Budget Accountability, in simple terms, is accounting for the budget. It

involves the use of a management control techniques to assist in tracking receipts

of income/revenues and controlling expenditures. The five (5) phases of the budget

is incomplete without accountability. An integral part of accountability is the

evaluation of the financial and physical performance of the LGU. This review and

assessment of performance is necessary to introduce improvements and reforms

to make the budget more transparent to the people and stakeholders. Other local

officers, who, though not accountable by the nature of their duties, may likewise be

held accountable and responsible for local government funds through their

participation in the use or application thereof.

You might also like

- 1 Prof Chauvins Instructions For Bingham CH 4Document35 pages1 Prof Chauvins Instructions For Bingham CH 4Danielle Baldwin100% (2)

- p2 - Guerrero Ch11Document24 pagesp2 - Guerrero Ch11JerichoPedragosa100% (2)

- Midterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsDocument12 pagesMidterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsLeny Joy Dupo33% (3)

- Midterm ExamDocument12 pagesMidterm ExamGracias0% (2)

- Circular Entitled RN Lax And: LocalDocument6 pagesCircular Entitled RN Lax And: Localjoseph iii goNo ratings yet

- AC - Acctg Gov Quiz 01 SolutionsDocument12 pagesAC - Acctg Gov Quiz 01 SolutionsErjohn Papa100% (1)

- NBT Company Presentation DraftDocument39 pagesNBT Company Presentation DraftS.A.MNo ratings yet

- Accounting For Disbursement and Related TransactionsDocument16 pagesAccounting For Disbursement and Related TransactionsKattNo ratings yet

- PLP Government Accounting Mid-Term ExamDocument4 pagesPLP Government Accounting Mid-Term ExamApril Manjares100% (2)

- Pamantasan NG Lungsod NG Pasig: Test I - True or FalseDocument4 pagesPamantasan NG Lungsod NG Pasig: Test I - True or FalseJOHN PAUL DOROIN100% (1)

- Chapter 3 The Government Accounting ProcessDocument10 pagesChapter 3 The Government Accounting ProcessEthel Joy Tolentino GamboaNo ratings yet

- ADVACC3 ATsDocument5 pagesADVACC3 ATsgazer beam100% (1)

- 2017 CobDocument14 pages2017 CobOrne PaulNo ratings yet

- Government Accounting Quiz 2 Write The Letter Pertaining To Best AnswerDocument6 pagesGovernment Accounting Quiz 2 Write The Letter Pertaining To Best AnswerWilliam DC RiveraNo ratings yet

- Engaging Activity 1-Unit 3 Government Accounting ProcessDocument6 pagesEngaging Activity 1-Unit 3 Government Accounting ProcessJaihlyn DemataNo ratings yet

- MidTerm-Govt.-accounting-RAMOS, ROSEMARIE CDocument12 pagesMidTerm-Govt.-accounting-RAMOS, ROSEMARIE Cagentnic100% (1)

- Government Accounting Process: Basic Transactions of The Government EntityDocument20 pagesGovernment Accounting Process: Basic Transactions of The Government EntityMaricar San AntonioNo ratings yet

- Government Accounting DiscussionDocument8 pagesGovernment Accounting DiscussionSamantha Alice LysanderNo ratings yet

- Screenshot 2024-04-29 at 8.19.26 PMDocument8 pagesScreenshot 2024-04-29 at 8.19.26 PMLeux Bryle AbgaoNo ratings yet

- Je Homework GovaccDocument6 pagesJe Homework GovaccEizzel SamsonNo ratings yet

- Alegria Executive Summary 2015Document8 pagesAlegria Executive Summary 2015Reyna YlenaNo ratings yet

- College of Accountancy First Grading Examination ACCTG 156/8A InstructionsDocument8 pagesCollege of Accountancy First Grading Examination ACCTG 156/8A Instructionserica insiong100% (1)

- PLP Government Accounting Final ExamDocument4 pagesPLP Government Accounting Final ExamApril ManjaresNo ratings yet

- Midterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsDocument12 pagesMidterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsNate Dela Cruz100% (1)

- The Government Accounting ProcessDocument33 pagesThe Government Accounting Processanna paulaNo ratings yet

- Government Accounting Quiz 1 Write The Letter Pertaining To Best AnswerDocument4 pagesGovernment Accounting Quiz 1 Write The Letter Pertaining To Best AnswerWilliam DC RiveraNo ratings yet

- Problem 3 56 GOVTDocument5 pagesProblem 3 56 GOVTskmasambongcouncilNo ratings yet

- Module No - Title: MO5 - Disbursements Time Frame: 1 Week - 3 Hrs Learning ObjectivesDocument5 pagesModule No - Title: MO5 - Disbursements Time Frame: 1 Week - 3 Hrs Learning Objectivesbobo kaNo ratings yet

- PPE Page 28Document107 pagesPPE Page 28Barangay Uno LucenaCityNo ratings yet

- Virgen Milagrosa University Foundation San Carlos City, PangasinanDocument11 pagesVirgen Milagrosa University Foundation San Carlos City, PangasinanGraciasNo ratings yet

- HO 3 - Journal Entries - Revenue and Other ReceiptsDocument9 pagesHO 3 - Journal Entries - Revenue and Other ReceiptsMELBERT JOHN M. BRILLANTESNo ratings yet

- Executive SummaryDocument5 pagesExecutive SummaryDanica GodornesNo ratings yet

- Group 6 Exercises 05022021 TTH ClassDocument8 pagesGroup 6 Exercises 05022021 TTH ClassShara Monique RolunaNo ratings yet

- SOLUTION Illustrative Problem Government Accounting ProcessDocument7 pagesSOLUTION Illustrative Problem Government Accounting ProcessVicente, Liza Mae C.No ratings yet

- Aa4102 Group4 ExerciseDocument7 pagesAa4102 Group4 ExerciseShara Monique RolunaNo ratings yet

- NGAS - NPOS - With AnswersDocument10 pagesNGAS - NPOS - With AnswersDardar Alcantara100% (1)

- Government Accounting Chapter 3: Government Accounting ProcessDocument5 pagesGovernment Accounting Chapter 3: Government Accounting Process뿅아리No ratings yet

- Josefina Executive Summary 2017Document8 pagesJosefina Executive Summary 2017Virgo Philip Wasil ButconNo ratings yet

- Ngas & NposDocument7 pagesNgas & NposRenalyn MadeloNo ratings yet

- Essentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions Manual Full Chapter PDFDocument39 pagesEssentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions Manual Full Chapter PDFarianytebh100% (15)

- Essentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions ManualDocument18 pagesEssentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions Manualdaineil2td100% (28)

- BUDGET AUTHORIZATION LECTURE-BARANGAYS-2020 - DesDocument66 pagesBUDGET AUTHORIZATION LECTURE-BARANGAYS-2020 - DesFernando ComedoyNo ratings yet

- Rmo 13-2006Document3 pagesRmo 13-2006Ellen Grace LongosNo ratings yet

- Morong Executive Summary 2021Document6 pagesMorong Executive Summary 2021Marvelouz Kate AbarioNo ratings yet

- Accounting For Government and Not-For-Profit OrganizationsDocument7 pagesAccounting For Government and Not-For-Profit OrganizationsAngela QuililanNo ratings yet

- New Government Accounting System & Non-Profit Organization #0005Document7 pagesNew Government Accounting System & Non-Profit Organization #0005Dardar AlcantaraNo ratings yet

- CHAPTER 3.pptx - ACC9 EditedDocument30 pagesCHAPTER 3.pptx - ACC9 EditedAngelica CastilloNo ratings yet

- AA 4102 TTH 3 430PM - Group 5 ExercisesDocument8 pagesAA 4102 TTH 3 430PM - Group 5 ExercisesShara Monique RolunaNo ratings yet

- Accounting For Government and Not-For-Profit Organizations: ACCO 30033Document24 pagesAccounting For Government and Not-For-Profit Organizations: ACCO 30033hehehedontmind me100% (1)

- SK Orientation 2019Document47 pagesSK Orientation 2019ArmandoACunananNo ratings yet

- HO 4 - Journal Entries - DisbursementsDocument12 pagesHO 4 - Journal Entries - DisbursementsMELBERT JOHN M. BRILLANTESNo ratings yet

- Chapter 4 - Accounting For DisbursementsDocument12 pagesChapter 4 - Accounting For DisbursementsErika Villanueva Magallanes0% (1)

- Financial Documents For Eligibilty Check: NFCC P - P 6,451,750.00 - 88,500.00 X 10 NFCC P 63,632,500.00Document1 pageFinancial Documents For Eligibilty Check: NFCC P - P 6,451,750.00 - 88,500.00 X 10 NFCC P 63,632,500.00aldred peraNo ratings yet

- AE119 Group-2Document7 pagesAE119 Group-2Richard Rhamil Carganillo Garcia Jr.No ratings yet

- Activity1 JournalizingDocument3 pagesActivity1 JournalizingLightNo ratings yet

- Comprehensive JEV Preparation NGAs 2Document2 pagesComprehensive JEV Preparation NGAs 2Eizzel SamsonNo ratings yet

- Bamban Executive Summary 2017Document6 pagesBamban Executive Summary 2017Reyna YlenaNo ratings yet

- The Barangay Budget ProcessDocument27 pagesThe Barangay Budget ProcessUbalMaliga100% (1)

- Government Accounting ProblemsDocument4 pagesGovernment Accounting ProblemsApril ManjaresNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Big Picture in Focus: Ulob. Account For Branch and Home Office Transactions and Prepare Financial Statements Let'S AnalyzeDocument3 pagesBig Picture in Focus: Ulob. Account For Branch and Home Office Transactions and Prepare Financial Statements Let'S AnalyzeJean Rose Tabagay BustamanteNo ratings yet

- Name: Jean Rose T. Bustamante Bsma-3: Let's CheckDocument10 pagesName: Jean Rose T. Bustamante Bsma-3: Let's CheckJean Rose Tabagay BustamanteNo ratings yet

- Name: Jean Rose T. Bustamante Bsma-3 Set B Income TaxationDocument5 pagesName: Jean Rose T. Bustamante Bsma-3 Set B Income TaxationJean Rose Tabagay BustamanteNo ratings yet

- Feasibility StudyDocument13 pagesFeasibility StudyJean Rose Tabagay BustamanteNo ratings yet

- Bustamante TAX CDocument19 pagesBustamante TAX CJean Rose Tabagay BustamanteNo ratings yet

- Physically Distanced But Academically Engaged: Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Document19 pagesPhysically Distanced But Academically Engaged: Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Jean Rose Tabagay Bustamante100% (1)

- Sir Putong (Arts)Document42 pagesSir Putong (Arts)Jean Rose Tabagay BustamanteNo ratings yet

- 06chapter6 PDFDocument26 pages06chapter6 PDFJean Rose Tabagay BustamanteNo ratings yet

- Dance ArtttsssssDocument78 pagesDance ArtttsssssJean Rose Tabagay BustamanteNo ratings yet

- Rasooli, Zandi y DeLuca. Conceptualising Fairness in Classroom AssessmentDocument29 pagesRasooli, Zandi y DeLuca. Conceptualising Fairness in Classroom AssessmentManuel Pinto GuerraNo ratings yet

- Service To Mr. Alexey OliynikDocument10 pagesService To Mr. Alexey OliynikHollyRustonNo ratings yet

- v1 - 195. Republic Vs SilimDocument7 pagesv1 - 195. Republic Vs Silimmark anthony mansuetoNo ratings yet

- NOTES - Criminal Law 1Document6 pagesNOTES - Criminal Law 1Reylland RendalNo ratings yet

- Indian Data Protection Bill 2021 FinalDocument4 pagesIndian Data Protection Bill 2021 FinalShivang DuaNo ratings yet

- June 2023 CSEC Candidate Listing - Updated 10th February PDFDocument474 pagesJune 2023 CSEC Candidate Listing - Updated 10th February PDFjovann johnNo ratings yet

- Composite Water Management Index (CWMI)Document3 pagesComposite Water Management Index (CWMI)Avinash MishraNo ratings yet

- Mikel Best Criminal Procedure-2Document56 pagesMikel Best Criminal Procedure-2husnaNo ratings yet

- Guardians and Guardianship (Rules 92-97)Document33 pagesGuardians and Guardianship (Rules 92-97)Ronna Faith MonzonNo ratings yet

- Investigative Psychology: Sahrish Fatima Ali Roll No. 72042Document13 pagesInvestigative Psychology: Sahrish Fatima Ali Roll No. 72042Sahrish AliNo ratings yet

- Velasco Vs Ca - DigestDocument2 pagesVelasco Vs Ca - DigestJoshhh rcNo ratings yet

- The Role and Impact of NGOs On The Devel PDFDocument8 pagesThe Role and Impact of NGOs On The Devel PDFMuneebNo ratings yet

- 2021 Ughccd 72Document16 pages2021 Ughccd 72BALUKU JIMMYNo ratings yet

- L0015 Explanatory Note To Annual Report 2019Document2 pagesL0015 Explanatory Note To Annual Report 2019Chris Ian RaulNo ratings yet

- 504 Manual - Delano SchoolsDocument12 pages504 Manual - Delano Schoolsapi-234864493No ratings yet

- Ancient Magic Spells Worlds FinestDocument378 pagesAncient Magic Spells Worlds FinestSwetta Agarrwal50% (2)

- Case Assignment CivproDocument23 pagesCase Assignment CivproStella BertilloNo ratings yet

- Chapter 11Document1 pageChapter 11Tanisha JainNo ratings yet

- Search - Freedom of Speech PDFDocument236 pagesSearch - Freedom of Speech PDFIa HernandezNo ratings yet

- 2.03 Sharing With Uncle SamDocument3 pages2.03 Sharing With Uncle SamJakeFromStateFarmNo ratings yet

- WorksheetWorks Coordinate Picture 1Document2 pagesWorksheetWorks Coordinate Picture 1Ivis HerazoNo ratings yet

- 2020MORNBFIDocument1,304 pages2020MORNBFIJude ItutudNo ratings yet

- 3 Capacity Development Agenda For Barangays (Annex G-2)Document68 pages3 Capacity Development Agenda For Barangays (Annex G-2)Barangay Poblacion NaawanNo ratings yet

- Activity 2 New Trend in ArtDocument5 pagesActivity 2 New Trend in ArtKhim PingolNo ratings yet

- Trade With The FlagDocument17 pagesTrade With The FlagsafarisinferrarisNo ratings yet

- Literature After EDSA RevolutionDocument3 pagesLiterature After EDSA RevolutionJulie Fe VergaraNo ratings yet

- USA V RuizDocument2 pagesUSA V RuizAbigael SeverinoNo ratings yet

- Sagrada Orden de Predicadores Del Santisimo Rosario Filipinas vs. National Coconut (Sources of Obligations)Document7 pagesSagrada Orden de Predicadores Del Santisimo Rosario Filipinas vs. National Coconut (Sources of Obligations)AronJamesNo ratings yet

- Press ReleaseDocument2 pagesPress ReleaseMissy Jane LlenaresNo ratings yet