Professional Documents

Culture Documents

Financial Markets and Instruments Assignment-1

Financial Markets and Instruments Assignment-1

Uploaded by

diveshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Markets and Instruments Assignment-1

Financial Markets and Instruments Assignment-1

Uploaded by

diveshCopyright:

Available Formats

Divesh

PGP/24/387

Financial Markets and Instruments

Assignment-1

Q1. What are the advantages and disadvantages of retained earnings? (Ch-17, Q7)

Advantages - The retained earnings are readily available and infuse additional equity to the firm

which requires no issue cost and ensures no dilution of control.

Disadvantages - These earnings are limited and leads to loss of dividends by shareholders. Also,

easily availability of equity leads the company to invest in bad projects.

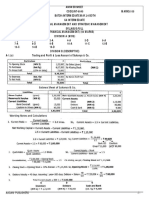

Q2. How do various instruments of long-term financing compare? (Ch-17, Q13)

The following table shows the comparison between various long-term financing instruments:

Type of Financing Issuing Cost Dilution of Control Risk Restrictive Conditions

Equity Capital High Yes Nil No

Equity

Retained Earnings Moderate No Nil No

Hybrid Preference Capital Moderate No Nil No

Term Loans Low No High Moderate

Debt

Debentures Low No High Low

Q3. What are the tasks of the manager of a public issue? (Ch-18, Q7)

The prime task of a public issue manager includes critical examination of the issue, preparation,

finalization and submission of draft prospectus, marketing of issue using conferences and

advertising. He also coordinates various team units and ensures the demat credit and dispatch of

share certificates after the allotment in given timeline and monitor the issue during subscription

period.

Q4. What is the difference between private placement and preferential allotment? (Ch-18,Q17)

The following table shows the major difference between the private placement and preferential

allotment:

Private Placement Preferential Allotment

Shares offered to selected group of persons Shares offered to existing shareholders

not exceeding 200 and outsiders as well

Company can issue shares in cheque,

Company can issue shares in cash

demand draft etc but not in cash

Valuation report is not mandatory Valuation report is mandatory

Minimum subscription of 20,000 of the face

No minimum subscription is required

value is mandatory

Q5. What are the types of appraisal done by financial institutions? (Ch-18, Q21)

The following types of appraisals are done by the financial institutions:

Market Appraisal- Assessment of demand projection and market infrastructure adequacy

Divesh

PGP/24/387

Technical Appraisal- Assessment of technical aspects like manufacturing process, raw materials,

plant and equipment, machinery, site etc

Financial Appraisal- Assessment of the reliability on cost, expenses, future revenues and

profitability of the project

Economic Appraisal- Calculates economic rate of return, effective rate of protection and

domestic resource cost

Managerial Appraisal- Assessment of technical and managerial staff, schedule, staffing and

renumeration

Q5. Interpretation of any interesting information relevant to PC chapter 17 from one of the latest

financial newspaper (within 100 words with source mentioned clearly as reference)

https://www.business-standard.com/article/companies/reliance-capital-defaults-on-interest-

payments-to-hdfc-axis-bank-120030301233_1.html Accessed on 25th August, 2020

Reliance Capital Ltd. used term loan instrument from HDFC and Axis Bank. HDFC and Axis bank had

extended a loan of 523 crore and 100 crores respectively which demands interest payments from

the borrower. However, due to the decision by Delhi High Court on 20 th November, 2019 prohibited

the company to transfer, encumbering or disposing the possession owned by the company leading

to delays in debt interest payment. The total financial debt on the company including long-term and

short-term borrowings is around 11,955 crores.

Q6. Interpretation of any interesting information relevant to PC chapter 18 from one of the latest

financial newspaper (within 100 words with source mentioned clearly as reference)

https://economictimes.indiatimes.com/industry/banking/finance/sidbi-venture-capital-looks-to-tap-

lic-sbi-pnb-for-rs-750-crore-new-horizons-fund/articleshow/77021868.cms Accessed on 25th

August,2020.

SIDBI venture capital (subsidiary of Small Industrial Development Bank of India) is planning to

include Life Insurance Corporation, Punjab National Bank, State Bank of Indi and Bank of Baroda in

investing 750 crore funds in early growth and mid stage start-ups working in the consumption

sector, agro-technology, green technology, drinking water and sanitation.

Around 75% of the early stage start-ups, dependent upon the foreign investment, are highly

impacted by the Covid-19 outbreak. Hence, venture capital like SIDBI are helping these start-ups for

initial investment to initiate their business and inclined to bear high risk expecting a high profit

margin.

You might also like

- Research 2023 Grade 11Document8 pagesResearch 2023 Grade 11noxolo dwane83% (18)

- Management Accounting - HCA16ge - Ch21Document63 pagesManagement Accounting - HCA16ge - Ch21Corliss Ko100% (1)

- Physiology PF PuerperiumDocument34 pagesPhysiology PF PuerperiumKholoud Kholoud100% (4)

- REVISED CITIZENS CHARTER-NWRB Dec 10 2013 PDFDocument41 pagesREVISED CITIZENS CHARTER-NWRB Dec 10 2013 PDFJecky Delos ReyesNo ratings yet

- Brine Shrimp Lab ReportDocument3 pagesBrine Shrimp Lab ReportKaisen Yao100% (3)

- Project Finance Set 2Document7 pagesProject Finance Set 2Titus ClementNo ratings yet

- Moodys - Sample Questions 4Document12 pagesMoodys - Sample Questions 4ivaNo ratings yet

- Assignment - PM0012 - Project Finance and Budgeting - Set 2Document7 pagesAssignment - PM0012 - Project Finance and Budgeting - Set 2Bhupinder SinghNo ratings yet

- Working Capital FinancingDocument44 pagesWorking Capital FinancingShoib ButtNo ratings yet

- 08 Chapter 2Document38 pages08 Chapter 2Bryan GonzalesNo ratings yet

- Kickoff Lonas With Embedded Derivatives-EnGDocument3 pagesKickoff Lonas With Embedded Derivatives-EnGCristina AlexandraNo ratings yet

- Assignment 4Document6 pagesAssignment 4nirajpathak143No ratings yet

- Smart Task 03 SubmissionDocument13 pagesSmart Task 03 SubmissionRAVI KUMARNo ratings yet

- Module-1 - BAV For Students ReferenceDocument54 pagesModule-1 - BAV For Students ReferenceYash LataNo ratings yet

- Chapter 5Document38 pagesChapter 54zfq8g84rkNo ratings yet

- ED Unit 3 Part (A&B) (Q&A)Document28 pagesED Unit 3 Part (A&B) (Q&A)Kalaivani SubburajNo ratings yet

- TM 1 - M&a - Corporate Due DiligenceDocument28 pagesTM 1 - M&a - Corporate Due DiligenceNeha ButalaNo ratings yet

- PFA 3e 2021 SM CH 01 - Accounting in BusinessDocument57 pagesPFA 3e 2021 SM CH 01 - Accounting in Businesscalista sNo ratings yet

- Financial Notes by JMR SirDocument70 pagesFinancial Notes by JMR SirAlekhya ThirumaniNo ratings yet

- Criteria For Capital Budgeting DecisionsDocument12 pagesCriteria For Capital Budgeting DecisionsKapil JainNo ratings yet

- Due Diligence in Project Finance - Corporate Finance InstituteDocument6 pagesDue Diligence in Project Finance - Corporate Finance Instituteavinash singhNo ratings yet

- Project Finance (Smart Task 3)Document13 pagesProject Finance (Smart Task 3)Aseem Vashist100% (1)

- Modes of Project FinancingDocument81 pagesModes of Project FinancingjasiaahmedNo ratings yet

- Vanraj Smart Task 2Document4 pagesVanraj Smart Task 2Vanraj MakwanaNo ratings yet

- Project Finance Smart Task 3Document13 pagesProject Finance Smart Task 3Abhishek KumarNo ratings yet

- 27-3-24... 4110 Both... Int-6040... Fm-Sm... AnsDocument10 pages27-3-24... 4110 Both... Int-6040... Fm-Sm... Ansnikulgauswami9033No ratings yet

- Smart Task 2 SubmissionDocument5 pagesSmart Task 2 SubmissionPrateek JoshiNo ratings yet

- AFM Assignment 3Document6 pagesAFM Assignment 3Zuhair NasirNo ratings yet

- VCE Summer Internship Program 2020: Ruchit GuptaDocument5 pagesVCE Summer Internship Program 2020: Ruchit Guptaruchit guptaNo ratings yet

- SKANS ECampus FM Study NotesDocument117 pagesSKANS ECampus FM Study NoteschimbanguraNo ratings yet

- Mf0017 & Merchant Banking and Financial ServicesDocument13 pagesMf0017 & Merchant Banking and Financial ServicesMadhusudhan GowdaNo ratings yet

- Unit 3 - Final SFMDocument16 pagesUnit 3 - Final SFMFalguni ChaudhariNo ratings yet

- F9最新版基础讲义Document158 pagesF9最新版基础讲义Kevin Ch LiNo ratings yet

- Project Evaluation and Planning: I) What Do You Understand by Capital Investment? Its Importance and DifficultiesDocument5 pagesProject Evaluation and Planning: I) What Do You Understand by Capital Investment? Its Importance and DifficultiesGãurãv SãndhãlNo ratings yet

- Non Financial Criteria and Factors Affecting Project SelectionDocument18 pagesNon Financial Criteria and Factors Affecting Project SelectionreajithkumarNo ratings yet

- Smart Task 2 - HarshitDocument5 pagesSmart Task 2 - HarshitHarshit AroraNo ratings yet

- Central University of South Bihar: Submitted To Course Instructor Submitted by StudentDocument8 pagesCentral University of South Bihar: Submitted To Course Instructor Submitted by StudentDivya MeghnaNo ratings yet

- MF0017 AnswersDocument15 pagesMF0017 AnswersPratibha DograNo ratings yet

- UU-Project Chapter 3Document74 pagesUU-Project Chapter 3Kiya Tesfaye100% (1)

- FM CH 13 PDFDocument18 pagesFM CH 13 PDFLayatmika SahooNo ratings yet

- EEA Unit VDocument26 pagesEEA Unit VDr Gampala PrabhakarNo ratings yet

- Capital BudgetingDocument62 pagesCapital Budgetingtanya100% (1)

- Project Report On Investment Decision in MarketingDocument23 pagesProject Report On Investment Decision in Marketingparimol r balsarafNo ratings yet

- IRAC Norms & NPA ManagementDocument29 pagesIRAC Norms & NPA ManagementSarvar PathanNo ratings yet

- Unit 2Document10 pagesUnit 2Vansh MishraNo ratings yet

- Capital BudgetingDocument38 pagesCapital BudgetingTaha MadniNo ratings yet

- Cacs Paper 2 Practice Questions PDF FreeDocument16 pagesCacs Paper 2 Practice Questions PDF FreeYufei Chow BooshNo ratings yet

- ch-5 4Document34 pagesch-5 4danielNo ratings yet

- Chapter 2: Capital Budgeting: An OverviewDocument15 pagesChapter 2: Capital Budgeting: An OverviewSharif UllahNo ratings yet

- Presentation Financial Analysis MMBDocument88 pagesPresentation Financial Analysis MMBSamir Raihan ChowdhuryNo ratings yet

- MSA-2-Winter-2017 QNDocument19 pagesMSA-2-Winter-2017 QNAsad TariqNo ratings yet

- Capital BudgetingDocument62 pagesCapital Budgetingtanya100% (1)

- Revenue ModelDocument6 pagesRevenue ModelSayed Naved HaleemNo ratings yet

- Capital Budgeting - THEORYDocument9 pagesCapital Budgeting - THEORYAarti PandeyNo ratings yet

- Mba-IV-project, Appraisal, Planning & Control (12mbafm425) - NotesDocument77 pagesMba-IV-project, Appraisal, Planning & Control (12mbafm425) - Notesghostriderr29No ratings yet

- Finance and Investment Cycle - Module AUD 300 2024Document20 pagesFinance and Investment Cycle - Module AUD 300 2024kekanarose356No ratings yet

- Unit - Vi: Capital BudgetingDocument19 pagesUnit - Vi: Capital BudgetingPatnana ArunaNo ratings yet

- 2013IJBValuationmethodP590 2correctedDocument9 pages2013IJBValuationmethodP590 2correctedHana SupportNo ratings yet

- Kotak Technology Fund FAQsDocument4 pagesKotak Technology Fund FAQsjayalekshmicvNo ratings yet

- Financial Institutions and ManagementDocument45 pagesFinancial Institutions and ManagementRutwik PatilNo ratings yet

- PA00W99WDocument32 pagesPA00W99WNicolas ndongoNo ratings yet

- Raise Rs 698 Crore Via Bonus Debentures/articleshow/83202375.cmsDocument6 pagesRaise Rs 698 Crore Via Bonus Debentures/articleshow/83202375.cmsHarmeet kapoorNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Appraising Business Opportunities: The Stratisquare FrameworkFrom EverandAppraising Business Opportunities: The Stratisquare FrameworkNo ratings yet

- PGP 387 Divesh Paper ManufacturingDocument3 pagesPGP 387 Divesh Paper ManufacturingdiveshNo ratings yet

- Managing Business Markets: Case AnalysisDocument2 pagesManaging Business Markets: Case AnalysisdiveshNo ratings yet

- Managing Business Markets - A: R5: A Roadmap For Branding in Industrial MarketsDocument9 pagesManaging Business Markets - A: R5: A Roadmap For Branding in Industrial MarketsdiveshNo ratings yet

- Cost and Management Accounting in Practise: An Industry Specific PerspectiveDocument16 pagesCost and Management Accounting in Practise: An Industry Specific PerspectivediveshNo ratings yet

- CMA Project Shivam GroudDocument18 pagesCMA Project Shivam GrouddiveshNo ratings yet

- Roll No Preference 1 Preference 2 Preference 3 CourseDocument2 pagesRoll No Preference 1 Preference 2 Preference 3 CoursediveshNo ratings yet

- Group 7 - Assignment 2Document2 pagesGroup 7 - Assignment 2diveshNo ratings yet

- Divesh - 387 - Edinburgh Tram SystemxDocument27 pagesDivesh - 387 - Edinburgh Tram SystemxdiveshNo ratings yet

- Cost and Management Accounting in Practise: An Industryspecific PerspectiveDocument16 pagesCost and Management Accounting in Practise: An Industryspecific PerspectivediveshNo ratings yet

- Consumer Behaviour Pre-Exercise: New Smartphone PurchaseDocument2 pagesConsumer Behaviour Pre-Exercise: New Smartphone PurchasediveshNo ratings yet

- Group 1 - CodingdfDocument10 pagesGroup 1 - CodingdfdiveshNo ratings yet

- Lakhs Lakhs Lakhs Lakhs Urban Rural Urban Rural Urban RuralDocument5 pagesLakhs Lakhs Lakhs Lakhs Urban Rural Urban Rural Urban RuraldiveshNo ratings yet

- Case Study For Round 1 of HCCB Case Challenge Season 1Document4 pagesCase Study For Round 1 of HCCB Case Challenge Season 1diveshNo ratings yet

- Exercise Assignment Qstns FADocument3 pagesExercise Assignment Qstns FAdiveshNo ratings yet

- Roll Name 380 Anurag Priyadarshi 390 Fiza Azmi 415 Sarthak AgrawalDocument12 pagesRoll Name 380 Anurag Priyadarshi 390 Fiza Azmi 415 Sarthak AgrawaldiveshNo ratings yet

- Information About The Focus GroupDocument4 pagesInformation About The Focus GroupdiveshNo ratings yet

- Zahurak Company: Group Assignment 4 Anurag Priyadarshi 380 Fiza Azmi 390 Sarthak Agrawal 415 3-19)Document5 pagesZahurak Company: Group Assignment 4 Anurag Priyadarshi 380 Fiza Azmi 390 Sarthak Agrawal 415 3-19)diveshNo ratings yet

- Focus Group Moderator Guide - Gfdfdfdroup 2Document5 pagesFocus Group Moderator Guide - Gfdfdfdroup 2diveshNo ratings yet

- Financial Accounting Group Assignment 2Document2 pagesFinancial Accounting Group Assignment 2diveshNo ratings yet

- Blood TestDocument2 pagesBlood TestKhalid GulNo ratings yet

- BS en Iso Iec 80079-38-2016Document66 pagesBS en Iso Iec 80079-38-2016MstefNo ratings yet

- EU4 D1 M1 Composite MaterialsDocument29 pagesEU4 D1 M1 Composite MaterialsaerorenNo ratings yet

- Part 1 Hydraulic Design Calculation 473Document13 pagesPart 1 Hydraulic Design Calculation 473shashi rajhansNo ratings yet

- 3A2988C - XM PFP Mix Manifold, Instructions - Parts, EnglishDocument22 pages3A2988C - XM PFP Mix Manifold, Instructions - Parts, Englishjorge ChavezNo ratings yet

- HIVDocument38 pagesHIVFarhan Herjanto100% (1)

- SESSION (2021-22) Class-Xii (Science) SUB-Chemistry CHAPTER-Electrochemistry Notes, Activities and Assignments (2021)Document7 pagesSESSION (2021-22) Class-Xii (Science) SUB-Chemistry CHAPTER-Electrochemistry Notes, Activities and Assignments (2021)Ashok KumarNo ratings yet

- A Comparison of Two Models of Experimental Periodontitis in RatsDocument8 pagesA Comparison of Two Models of Experimental Periodontitis in RatsRoza NafilahNo ratings yet

- Navitron Panel AssemblyDocument23 pagesNavitron Panel AssemblyXe CohNo ratings yet

- Your Habit Body A Better Model of The Unconscious For EveryoneDocument24 pagesYour Habit Body A Better Model of The Unconscious For EveryoneBubi Sutomo100% (1)

- AKSA CUMMINS (700-1410 kVA) PDFDocument2 pagesAKSA CUMMINS (700-1410 kVA) PDFYacine Meziani100% (1)

- NCERT Solutions Class 10 Social Science - Geography Chapter 1: Resources and DevelopmentDocument8 pagesNCERT Solutions Class 10 Social Science - Geography Chapter 1: Resources and DevelopmentJahnavi MeharNo ratings yet

- NCERT Exemplar Solutions For Class 8 Science Chapter 2 Microorganisms Friend and FoeDocument10 pagesNCERT Exemplar Solutions For Class 8 Science Chapter 2 Microorganisms Friend and FoePradipti VermaNo ratings yet

- Effective Parent Consultation in Play TherapyDocument14 pagesEffective Parent Consultation in Play TherapyMich García Villa100% (1)

- Ayurvedic Medicine For Erectile Dysfunction - Diabetes and Erectile DysfunctionDocument9 pagesAyurvedic Medicine For Erectile Dysfunction - Diabetes and Erectile DysfunctionYahu NewsNo ratings yet

- Aircaft Avionics SystemDocument21 pagesAircaft Avionics SystemPavan KumarNo ratings yet

- Eng4 LM U4 PDFDocument108 pagesEng4 LM U4 PDFDan August GalliguezNo ratings yet

- Vane Shear TestDocument10 pagesVane Shear TestManikyaMayankNo ratings yet

- Brad Harrub, Bert Thompson-Truth About Human Origins-Apologetics Press, Inc (2000)Document530 pagesBrad Harrub, Bert Thompson-Truth About Human Origins-Apologetics Press, Inc (2000)hanymahrousNo ratings yet

- Leaves Can Also Store Food and WaterDocument5 pagesLeaves Can Also Store Food and WaterMaximos ManiatisNo ratings yet

- ASI4517 R3 V 06Document2 pagesASI4517 R3 V 06Дмитрий СпиридоновNo ratings yet

- QuesDocument3 pagesQuesbhanu sharmaNo ratings yet

- 333 Hollenbeck Street - Rochester, NY 14621 USA 585-336-2200 - Fax: 585-336-2357Document1 page333 Hollenbeck Street - Rochester, NY 14621 USA 585-336-2200 - Fax: 585-336-2357NiraNo ratings yet

- Hospital Response To A Major Incident: Initial Considerations and Longer Term EffectsDocument5 pagesHospital Response To A Major Incident: Initial Considerations and Longer Term EffectsMinaz PatelNo ratings yet

- 1-Introduction To Food ScienceDocument2 pages1-Introduction To Food SciencepavanidhawanNo ratings yet

- Amicor InformationDocument5 pagesAmicor InformationcciprainNo ratings yet