Professional Documents

Culture Documents

Profit N Loss of Parle

Profit N Loss of Parle

Uploaded by

Honey Ali0 ratings0% found this document useful (0 votes)

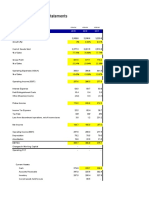

201 views3 pagesThis document contains financial information for a company over several years including income statement items like sales, costs, profits and balance sheet items like investments and liabilities. It shows steady increases in most line items like sales, costs and profits from 1999 to 2006. It also includes ratios analyzing profitability, growth and payouts. Finally sales breakouts by product category and volumes are given for biscuits and candy from 1998 to 2001.

Original Description:

Profit n loss of parle

Original Title

Profit n loss of parle

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains financial information for a company over several years including income statement items like sales, costs, profits and balance sheet items like investments and liabilities. It shows steady increases in most line items like sales, costs and profits from 1999 to 2006. It also includes ratios analyzing profitability, growth and payouts. Finally sales breakouts by product category and volumes are given for biscuits and candy from 1998 to 2001.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

201 views3 pagesProfit N Loss of Parle

Profit N Loss of Parle

Uploaded by

Honey AliThis document contains financial information for a company over several years including income statement items like sales, costs, profits and balance sheet items like investments and liabilities. It shows steady increases in most line items like sales, costs and profits from 1999 to 2006. It also includes ratios analyzing profitability, growth and payouts. Finally sales breakouts by product category and volumes are given for biscuits and candy from 1998 to 2001.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Profit & loss account (Rs mn)

Period ended 03/99 03/04 03/05 03/06

No. of months 12 12 12 12

Gross Sales 8,478.4 10,301.4 11,698.4 13,384.2

Excise Duty (235.7) (277.7) (302.9) (525.1)

Net sales 8,242.7 10,023.8 11,395.5 12,859.0

Other income 113.4 130.6 159.1 161.2

Total income 8,356.1 10,154.4 11,554.6 13,020.2

Raw materials 2,863.4 3,653.2 4,042.1 3,880.7

Stock adjustment (Inc)/ Dec (52.3) (33.7) (45.2) (114.9)

Purchase of finished goods 949.6 1,224.7 1,257.3 1,850.1

Cost of material 3,760.7 4,844.1 5,254.2 5,615.9

Employee cost 725.7 829.1 904.5 953.0

Power & fuel 107.7 123.2 161.2 152.9

Advertising/ promotion/

525.2 584.0 770.1 852.9

public

Freight & forwarding 318.5 401.0 471.5 613.8

Other expenses 2,326.9 2,632.1 2,957.8 3,519.6

Cost of sales 7,764.6 9,413.6 10,519.2 11,708.1

PBIDT 591.4 740.8 1,035.5 1,312.2

Interest & finance charges 49.2 6.3 73.2 100.9

PBDT 542.2 734.5 962.3 1,211.3

Depreciation 118.2 158.9 171.8 188.9

PBT 424.0 575.6 790.5 1,022.4

Provision for taxation 134.7 180.0 260.7 434.1

Extraordinary items/ Prior

- - (19.6) 117.1

year adj.

Adjusted PAT 289.3 395.6 510.2 705.4

Dividend payout 102.1 113.4 139.1 168.8

Forex inflow 64.4 39.6 29.4 23.5

Forex outflow 128.2 148.9 159.1 129.4

Book value of quoted

150.4 577.0 283.1 69.0

investments

Market value of quoted

165.3 630.6 320.0 88.9

investments

Contingent liabilities 167.3 405.5 207.9 592.0

RATIOS

As % of net sales

Gross sales 102.9 102.8 102.7 104.1

Excise duty (2.9) (2.8) (2.7) (4.1)

Net sales 100.0 100.0 100.0 100.0

Other income 1.4 1.3 1.4 1.3

Total income 101.4 101.3 101.4 101.3

Cost of material 45.6 48.3 46.1 43.7

Employee costs 8.8 8.3 7.9 7.4

Selling expense 10.2 9.8 10.9 11.4

Other expenses 28.2 26.3 26.0 27.4

Cost of sales 94.2 93.9 92.3 91.0

Profitability ratios (%)

PBIDT excl. other income 5.8 6.1 7.7 9.0

PBIDT 7.2 7.4 9.1 10.2

PBDT 6.6 7.3 8.4 9.4

Profit before tax 5.1 5.7 6.9 8.0

Profit after tax 3.5 3.9 4.5 5.5

Growth ratios (% you)

Net sales 13.5 21.6 13.7 12.8

PBIDT 61.0 25.3 39.8 26.7

PBT 43.8 35.8 37.3 29.3

PAT 61.8 36.8 29.0 38.3

Payout ratios (%)

Tax (% of PBT) 31.8 31.3 33.0 42.5

Dividend (% of PAT) 35.3 28.7 27.3 23.9

Sales breakup

Period ended 03/98 03/99 03/00 03/01

No. of months 12 12 12 12

Sales value(Rs mn)

Biscuits 7,248.0 8,621.6 9,783.7 11,073.0

Candy 169.8 237.4 242.3 271.4

Sales volume(unit)

Biscuits (Ton) 144,213.0 167,467.0 192,646.0 214,214.0

Candy 2,249.0 2,809.0 3,003.0 3,082.0

Unit realization (Rs/unit)

Biscuits (Ton) 50,259 51,482 50,786 51,691

Candy 75,495 84,504 80,698 88,050

You might also like

- Handbook On The Participation of The CSO in The Local Budget ProcessDocument44 pagesHandbook On The Participation of The CSO in The Local Budget ProcessDBM CALABARZON93% (14)

- Case 11 Horniman Horticulture 20170504Document16 pagesCase 11 Horniman Horticulture 20170504Chittisa Charoenpanich100% (4)

- Marketing Audit ExampleDocument35 pagesMarketing Audit ExamplejanakaedNo ratings yet

- Case 11 Horniman HorticultureDocument4 pagesCase 11 Horniman HorticultureFaza FadhilahNo ratings yet

- The Pitch and Business Plan For Investors and Partners PDFDocument6 pagesThe Pitch and Business Plan For Investors and Partners PDFparamedicboy1No ratings yet

- Edexcel IGCSE Economics Official GlossaryDocument9 pagesEdexcel IGCSE Economics Official GlossaryAshley Lau100% (2)

- Corporate Finance-AssignmentDocument4 pagesCorporate Finance-AssignmentAssignment HelperNo ratings yet

- CASE STUDY - Political GlobalizationDocument5 pagesCASE STUDY - Political GlobalizationMichaela CatacutanNo ratings yet

- Peng Plasma Solutions Tables PDFDocument12 pagesPeng Plasma Solutions Tables PDFDanielle WalkerNo ratings yet

- 2012 2013 2014 2015 2016e Input Profit and Loss Statement: Cash Flow EstimatesDocument3 pages2012 2013 2014 2015 2016e Input Profit and Loss Statement: Cash Flow EstimatesBilal AhmedNo ratings yet

- 06 Horniman Student F-1512xDocument5 pages06 Horniman Student F-1512xjohn galt0% (2)

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Swot Analysis For IoclDocument4 pagesSwot Analysis For IoclHoney Ali100% (1)

- Brita CaseDocument2 pagesBrita CasePraveen Abraham100% (1)

- Tugas Pertemuan 10 - Sopianti (1730611006)Document12 pagesTugas Pertemuan 10 - Sopianti (1730611006)sopiantiNo ratings yet

- Nike - Case StudyDocument9 pagesNike - Case StudyAnchal ChokhaniNo ratings yet

- Nike - Case Study MeenalDocument9 pagesNike - Case Study MeenalAnchal ChokhaniNo ratings yet

- Tarson Products (Woking Sheet - FRA)Document9 pagesTarson Products (Woking Sheet - FRA)RR AnalystNo ratings yet

- Marriott (2) ..Document13 pagesMarriott (2) ..veninsssssNo ratings yet

- Trent LTDDocument23 pagesTrent LTDpulkitnarang1606No ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- Review: Ten Year (Standalone)Document10 pagesReview: Ten Year (Standalone)maruthi631No ratings yet

- Complete P&L Statement TemplateDocument4 pagesComplete P&L Statement TemplateGolamMostafaNo ratings yet

- Ducati Valuation - LPDocument11 pagesDucati Valuation - LPuygh gNo ratings yet

- Altagas Green Exhibits With All InfoDocument4 pagesAltagas Green Exhibits With All InfoArjun NairNo ratings yet

- Fima Midterm ActsDocument4 pagesFima Midterm ActsKatrina PaquizNo ratings yet

- Stryker Corporation: Capital BudgetingDocument8 pagesStryker Corporation: Capital Budgetinggaurav sahuNo ratings yet

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- Weekends TareaDocument9 pagesWeekends Tareasergio ramozNo ratings yet

- Acova Radiateurs SolutionDocument14 pagesAcova Radiateurs SolutionSarvagya Jha100% (1)

- AirThread Valuation SheetDocument11 pagesAirThread Valuation SheetAngsuman BhanjdeoNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- (Daweoo Express) : Income StatementDocument1 page(Daweoo Express) : Income StatementHammad AltafNo ratings yet

- Gaurav Kavitkar Project On Parle ProductDocument52 pagesGaurav Kavitkar Project On Parle ProductJitendra tawariNo ratings yet

- Exhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Document2 pagesExhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Hằng Dương Thị MinhNo ratings yet

- Guna Fibre Financial AnalysisDocument5 pagesGuna Fibre Financial AnalysissumeetkantkaulNo ratings yet

- BCTC Case 2Document10 pagesBCTC Case 2Trâm Nguyễn QuỳnhNo ratings yet

- Siddhi Chokhani - 65: Rahul Gupta - 31 Shyam Parasrampuria - 40 Reema Parkar - 54 Vidhi Gala - 57 Radhika Bajaj - 64Document31 pagesSiddhi Chokhani - 65: Rahul Gupta - 31 Shyam Parasrampuria - 40 Reema Parkar - 54 Vidhi Gala - 57 Radhika Bajaj - 64avinash singhNo ratings yet

- Golden State Canning Company, Inc.: Selected Income Statement Items, Year Ending December 31Document1 pageGolden State Canning Company, Inc.: Selected Income Statement Items, Year Ending December 31dynaNo ratings yet

- Nike Case Study VrindaDocument4 pagesNike Case Study VrindaAnchal ChokhaniNo ratings yet

- Caso 2 Excel 1Document8 pagesCaso 2 Excel 1Carolina NunezNo ratings yet

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- Book 1Document1 pageBook 1Aditi JoshiNo ratings yet

- Werner - Financial Model - Final VersionDocument2 pagesWerner - Financial Model - Final VersionAmit JainNo ratings yet

- Annual Report 2021Document161 pagesAnnual Report 2021paulgsozaNo ratings yet

- WorkingsDocument10 pagesWorkingsKi KiNo ratings yet

- Financial Supplement Fy 2022 enDocument9 pagesFinancial Supplement Fy 2022 enAntonelly Baca MoncayoNo ratings yet

- Management Control CaseDocument9 pagesManagement Control Casera.manriquedNo ratings yet

- XLS728 XLS EngDocument10 pagesXLS728 XLS EngFRANKNo ratings yet

- Report Card: Attribute Value DateDocument20 pagesReport Card: Attribute Value DateMp SunilNo ratings yet

- Marel q3 2019 Condensed Consolidated Interim Financial Statements ExcelDocument5 pagesMarel q3 2019 Condensed Consolidated Interim Financial Statements ExcelAndre Laine AndreNo ratings yet

- Financial Statements-Kingsley AkinolaDocument4 pagesFinancial Statements-Kingsley AkinolaKingsley AkinolaNo ratings yet

- Dion Global Solutions LimitedDocument10 pagesDion Global Solutions LimitedArthurNo ratings yet

- Project Report of ParleDocument53 pagesProject Report of ParleParth prajapatiNo ratings yet

- Valuation of Airthread April 2012Document26 pagesValuation of Airthread April 2012Perumalla Pradeep KumarNo ratings yet

- Ratio Analysis - DABURDocument9 pagesRatio Analysis - DABURabhilash hazraNo ratings yet

- Annual Trading Report: Strictly ConfidentialDocument3 pagesAnnual Trading Report: Strictly ConfidentialMunazza FawadNo ratings yet

- 6 Years at A Glance: 2015 Operating ResultsDocument2 pages6 Years at A Glance: 2015 Operating ResultsHassanNo ratings yet

- CV Case 3Document40 pagesCV Case 3neelakanta srikarNo ratings yet

- CH 32Document2 pagesCH 32Mukul KadyanNo ratings yet

- Valuation, Case #KEL790Document40 pagesValuation, Case #KEL790neelakanta srikarNo ratings yet

- Financial statements US GAAP Q4 2023 h92dd2Document8 pagesFinancial statements US GAAP Q4 2023 h92dd2xzavierxuNo ratings yet

- Polaroid Corporation ENGLISHDocument14 pagesPolaroid Corporation ENGLISHAtul AnandNo ratings yet

- Also Annual Report Gb2022 enDocument198 pagesAlso Annual Report Gb2022 enmihirbhojani603No ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Consumer Behavior and Marketing StrategyDocument3 pagesConsumer Behavior and Marketing StrategyHoney AliNo ratings yet

- ConclusionDocument3 pagesConclusionHoney AliNo ratings yet

- Housing Development Finance Corporation LimitedDocument3 pagesHousing Development Finance Corporation LimitedHoney AliNo ratings yet

- ConclusionDocument3 pagesConclusionHoney AliNo ratings yet

- PARLE Is The Market Leader in The Organized Biscuit and Candy Market in IndiaDocument3 pagesPARLE Is The Market Leader in The Organized Biscuit and Candy Market in IndiaHoney AliNo ratings yet

- Factors Affecting Buying Behaviour Consumer of Parle ProductDocument2 pagesFactors Affecting Buying Behaviour Consumer of Parle ProductHoney AliNo ratings yet

- Functions of Research DesignDocument3 pagesFunctions of Research DesignHoney Ali100% (1)

- Equity Mutual FundsDocument3 pagesEquity Mutual FundsHoney AliNo ratings yet

- Mr. Vijay K L Chauhan ResearchDocument3 pagesMr. Vijay K L Chauhan ResearchHoney AliNo ratings yet

- Types of Mutual Funds SchemesDocument4 pagesTypes of Mutual Funds SchemesHoney AliNo ratings yet

- HDFC Asset Management Company LimitedDocument3 pagesHDFC Asset Management Company LimitedHoney AliNo ratings yet

- Organization of Mutual FundDocument2 pagesOrganization of Mutual FundHoney AliNo ratings yet

- New Product LaunchesDocument5 pagesNew Product LaunchesHoney AliNo ratings yet

- Iocl-An Introduction: VisionDocument3 pagesIocl-An Introduction: VisionHoney AliNo ratings yet

- For The Degree of Master of Aarts: A English Project Report ONDocument5 pagesFor The Degree of Master of Aarts: A English Project Report ONHoney AliNo ratings yet

- Payment OptionsDocument2 pagesPayment OptionsHoney AliNo ratings yet

- INDIAN OIL Graphical PresentationDocument3 pagesINDIAN OIL Graphical PresentationHoney AliNo ratings yet

- Mba Project Report On HDFC BankDocument80 pagesMba Project Report On HDFC BankVikash ThomasNo ratings yet

- Preface: Cipla LTD' Was An Effort To Analyze The Market of Four Molecules of Cipla Ltd. The Main ObjectiveDocument1 pagePreface: Cipla LTD' Was An Effort To Analyze The Market of Four Molecules of Cipla Ltd. The Main ObjectiveHoney AliNo ratings yet

- IOC-Products: 1. AutogasDocument3 pagesIOC-Products: 1. AutogasHoney AliNo ratings yet

- Internal Control SystemsDocument3 pagesInternal Control SystemsHoney AliNo ratings yet

- Qualities of A Good Technical ReportDocument65 pagesQualities of A Good Technical ReportHoney Ali100% (1)

- Advantages and Disadvantages of Credit CardsDocument3 pagesAdvantages and Disadvantages of Credit CardsAsif AliNo ratings yet

- COMPANY INTRODUCTION CiplaDocument2 pagesCOMPANY INTRODUCTION CiplaHoney Ali100% (1)

- Pd-1214-U B. Ed. Examination, 2020: Fkeâef&Document2 pagesPd-1214-U B. Ed. Examination, 2020: Fkeâef&Honey AliNo ratings yet

- The Role of Gender and Women's Leadership in Water GovernanceDocument10 pagesThe Role of Gender and Women's Leadership in Water GovernanceADBGADNo ratings yet

- International Contracts and E-Commerce - Course Hand OutDocument3 pagesInternational Contracts and E-Commerce - Course Hand Outpravinsankalp100% (2)

- Annexure 1Document4 pagesAnnexure 1Jalaj JainNo ratings yet

- BSBSUS601 - Learner Guide (Student)Document77 pagesBSBSUS601 - Learner Guide (Student)Natti Nonglek100% (1)

- Dell Computer: Refining and Extending The Business Model With ITDocument18 pagesDell Computer: Refining and Extending The Business Model With ITTathagataNo ratings yet

- Impacts That Matter - Product Sustainability Overview - 54959 - PDFDocument4 pagesImpacts That Matter - Product Sustainability Overview - 54959 - PDFOptima StoreNo ratings yet

- After Sales Services of Selected Car Insurance Companies - Chapter 1 5 - RevisedDocument68 pagesAfter Sales Services of Selected Car Insurance Companies - Chapter 1 5 - RevisedMariel AdventoNo ratings yet

- World ScaleDocument2 pagesWorld Scalekeerthi86No ratings yet

- 1001 (1) c3Document1 page1001 (1) c3I am CanapeeNo ratings yet

- Costing T Ch8Document40 pagesCosting T Ch8FarrukhsgNo ratings yet

- Topic: 1.1 What Is Accounting? 1.2 Who Uses The Accounting Data 1.3 The Basic Accounting EquationDocument6 pagesTopic: 1.1 What Is Accounting? 1.2 Who Uses The Accounting Data 1.3 The Basic Accounting EquationAnn Ameera OraisNo ratings yet

- RizalDocument4 pagesRizalChadBeancoL.GabejanNo ratings yet

- Family BudgetDocument3 pagesFamily BudgetThuoNo ratings yet

- Benchmarking and Best Practices in The Malaysian Retail IndustryDocument18 pagesBenchmarking and Best Practices in The Malaysian Retail Industrydipti_pNo ratings yet

- Citizenscharter2020 PDFDocument650 pagesCitizenscharter2020 PDFLeulaDianneCantosNo ratings yet

- Central, New York, NY April 20XX: Sample Monthly Congregation Accounts Report-Cash VersionDocument2 pagesCentral, New York, NY April 20XX: Sample Monthly Congregation Accounts Report-Cash VersionAbel ServinNo ratings yet

- A Ratio Analysis Report On FINALDocument34 pagesA Ratio Analysis Report On FINALArsal AliNo ratings yet

- Syllabus CPM DiplomaDocument6 pagesSyllabus CPM DiplomaGirman ranaNo ratings yet

- Chapter 3 Marginal Analisys For Optimal DecisionsDocument20 pagesChapter 3 Marginal Analisys For Optimal DecisionsNadeen ZNo ratings yet

- Unemployment in India UnemploymentDocument5 pagesUnemployment in India UnemploymentRaj GuptaNo ratings yet

- Examiners' Commentaries 2014: FN3092 Corporate FinanceDocument19 pagesExaminers' Commentaries 2014: FN3092 Corporate FinanceBianca KangNo ratings yet

- 179848-Article Text-459072-1-10-20181119Document9 pages179848-Article Text-459072-1-10-20181119Oyebola Akin-DeluNo ratings yet

- GST Issues For Works Contract CA Yashwant Kasar - 31st July 2021Document73 pagesGST Issues For Works Contract CA Yashwant Kasar - 31st July 2021fintech ConsultancyNo ratings yet