Professional Documents

Culture Documents

Instructions For Form N-20: Partnership Return of Income

Instructions For Form N-20: Partnership Return of Income

Uploaded by

davey0 ratings0% found this document useful (0 votes)

23 views8 pagesThis document provides instructions for filling out Form N-20, the Partnership Return of Income for Hawaii. It notes that Hawaii has not adopted some recent federal tax law changes. It highlights several recent changes to Hawaii tax law through various Acts. It provides guidance on when and where to file, who must file, record keeping requirements, and how to round numbers. The instructions are intended to help partnerships complete their Hawaii income tax return.

Original Description:

Form n-20

Original Title

n20ins

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides instructions for filling out Form N-20, the Partnership Return of Income for Hawaii. It notes that Hawaii has not adopted some recent federal tax law changes. It highlights several recent changes to Hawaii tax law through various Acts. It provides guidance on when and where to file, who must file, record keeping requirements, and how to round numbers. The instructions are intended to help partnerships complete their Hawaii income tax return.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

23 views8 pagesInstructions For Form N-20: Partnership Return of Income

Instructions For Form N-20: Partnership Return of Income

Uploaded by

daveyThis document provides instructions for filling out Form N-20, the Partnership Return of Income for Hawaii. It notes that Hawaii has not adopted some recent federal tax law changes. It highlights several recent changes to Hawaii tax law through various Acts. It provides guidance on when and where to file, who must file, record keeping requirements, and how to round numbers. The instructions are intended to help partnerships complete their Hawaii income tax return.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

2020

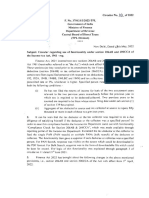

STATE OF HAWAII—DEPARTMENT OF TAXATION

(REV. 2020) INSTRUCTIONS FOR FORM N-20

Partnership Return of Income

(Section references are to the Internal Revenue Code (IRC) unless otherwise specified.)

(NOTE: References to “married” and “unmarried” are also references to “in a civil union” and “not in a civil union,” respectively.)

ATTENTION: plies to taxable years beginning after Decem-

ber 31, 2021.

vices qualifying under this provision. Timely filing

of mail which does not bear the U.S. Post Office

Hawaii has not adopted the increased cancellation mark or the date recorded or marked

Act 261, SLH 2019 – This act amends the re-

expensing deduction under IRC section 179 by the designated delivery service will be deter-

search activity credit that references to the

(Hawaii limit is $25,000) or the “bonus” depre- mined by reference to other competent evidence.

base amount in section 41 of the IRC shall

ciation provisions. The private delivery service can tell you how to

not apply, and credit for all qualified research

Hawaii has not adopted the domestic activi- expenses may be taken without regard to the get written proof of the mailing date.

ties production deduction under IRC section 199. amount of expenses for previous years. Also Six-month automatic extension of time to

transfers certification to the Department of

Where To Get Tax Forms Business, Economic Development, and Tour-

file. Section 18-235-98, Hawaii Administrative

Rules, allows an automatic six-month extension

Hawaii tax forms, instructions, and schedules ism and the aggregate cap per taxable year of time to file a return without filing an application

may be obtained at any taxation district office or is $5,000,000. Applies to taxable years begin- for extension. This extension does not include an

from the Department of Taxation’s website at tax. ning after December 31, 2019 and this credit extension of time to pay. File Form N-201V, Busi-

hawaii.gov, or you may contact a customer ser- is repealed on December 31, 2024. ness Income Tax Payment Voucher, to make a

vice representative at: 808-587-4242 or 1-800- Act 267, SLH 2019 – This act establishes a non- payment (if applicable). For more information, go

222-3229 (Toll-Free). refundable income tax credit equal to 30 per to tax.hawaii.gov/eservices/.

Changes You Should Note cent of the qualified rehabilitated expendi-

tures that are certified by the historic preser-

Rounding Off to Whole Dollars

Act 13, Session Laws of Hawaii (SLH) 2020 vation division of the Department of Land and The Department is requiring taxpayers to

— This act amends Hawaii Income Tax Law Natural Resources. If a deduction is taken un- round off cents to the nearest whole dollar for all

under chapter 235, Hawaii Revised Statutes der section 179, no tax credit shall be allowed dollar entries on the tax return and schedules.

(HRS), to conform to certain provisions of the for that portion of the qualified expense. This To do so, drop amounts under 50 cents and in-

IRC, as amended as of March 27, 2020. act takes effect on July 1, 2019 and shall be crease amounts from 50 to 99 cents to the next

Act 61, SLH 2020 – The Renewable Energy repealed on December 31, 2024. dollar. For example: $1.39 becomes $1 and $2.69

Technologies Income Tax Credit (RETITC) is becomes $3. If you have to add two or more

Purpose of Form amounts to figure the amount to enter on a line,

amended by repealing the RETITC for com-

mercial projects with a total output capacity Form N-20 is used to report the income, de- schedule, or worksheet, you may choose to use

of 5 megawatts or greater for taxable years ductions, credits, gains, and losses from the op- one of two methods. Once a method of rounding

beginning after December 31, 2019 and pro- eration of a partnership. Form N-20 for 2020 is an is established, you must use the same method

vides grandfathering exceptions for commer- information return for the calendar year 2020 or throughout the return. The first method is to in-

cial solar projects with a: (1) Total output ca- other fiscal year beginning in 2020. clude the cents when adding and round off only

the total. The other method is to round off each

pacity of 5 megawatts or greater if the project Who Must File entry. For example: You received two 1099-INT

received a Public Utilities Commission (PUC)

Every partnership, including limited liability forms, one showing interest of $50.55 and one

approval prior to December 31, 2019; and (2)

companies treated as partnerships for federal in- showing interest of $185.73. For rounding meth-

Pumped hydroelectric energy storage system

come tax purposes, unless expressly exempted, od 1, show your total interest as $236 ($50.55 +

provided that the applicable project approval

shall, for its taxable year, make a return of in- $185.73 = $236.28 rounded to $236). For round-

filings have been made to the PUC by De-

come on Form N-20 stating specifically the items ing method 2, show your total interest as $237

cember 31, 2021.

of gross income and allowable deductions, and ($50.55 rounded to $51 + $185.73 rounded to

Act 96, SLH 2019 – This act amends the rules such additional information as required below. $186 = $51 + $186 = $237).

for sourcing the sales factor for net income tax The partnership return shall include the income,

to impose market-based sourcing for sales of deductions, and credits attributable everywhere Recordkeeping

intangibles and services to where it is used in together with the income, deductions, and cred- The partnership records must be kept as long

the State. Applies to taxable years beginning its attributable only to Hawaii. If the return is filed as they may be needed for the administration of

after December 31, 2019. on behalf of a syndicate, pool, joint venture, or any provision of the IRC. Usually, records that

Act 221, SLH 2019 – This act adds a new sec- similar group which group was created on or af- support an item of income, deduction, or credit

tion to chapter 235. A person that lacks physi- ter January 1, 1958, a copy of the agreement, on the partnership return must be kept for three

cal presence in the State is presumed to be together with all amendments thereto, should be years from the date the return is due or is filed,

systematically and regularly engaging in busi- attached to the return, if not already filed. whichever is later. Keep records that verify the

ness in the State and taxable under this chap- partnership’s basis in property for as long as they

ter if, during the current or preceding calendar When and Where to File are needed to figure the basis of the original or

year: The return of a partnership must be filed on or replacement property.

(1) The person engages in 200 or more business before the 20th day of the fourth month following Copies of the filed partnership returns should

transactions with persons within the State; or the close of the taxable year of the partnership, also be kept as part of the partnership’s records.

with the Hawaii Department of Taxation, P.O. Box

(2) The sum of the value of the person’s gross They help in preparing future returns and in mak-

3559, Honolulu, Hawaii 96811-3559. Note: If the

income attributable to sources in this State ing computations when filing an amended return.

due date falls on a Saturday, Sunday, or legal

equals or exceeds $100,000 in sales. Amended Return

holiday, the return shall be due on the next suc-

Applies to taxable years beginning after De- ceeding day which is not a Saturday, Sunday, or If, after filing its return, the partnership be-

cember 31, 2019. legal holiday. comes aware of any changes it must make to

Act 260, SLH 2019 – This act establishes a non- Private delivery services. Hawaii has adopt- income, deductions, credits, etc., it should file an

refundable income tax credit equal to 30 per ed the IRC provision to allow documents and pay- amended Form N-20 and an amended Schedule

cent of the ship repair industry costs paid or ments delivered by a designated private delivery K-1 for each partner. Check the box on Form N-20

incurred to design and construct the purpose- service to qualify for the “timely mailing treated at Item E(4), page 1. Give a corrected Schedule

built floating dry dock to be used by the United as timely filing/paying rule.” The Department of K-1 (Form N-20) to each partner. Check the box

States Navy in Pearl Harbor. The aggregate Taxation (Department) will conform to the Inter- at Item F(2) on each Schedule K-1 to indicate

cap is $6,000,000 per year. This act also re- nal Revenue Service (IRS) listing of designated that it is an amended Schedule K-1. Fill in the

peals the capital infrastructure tax credit. Ap- private delivery service and type of delivery ser- return with all of the correct information and at-

Page 2

tach a completed Schedule AMD, Explanation of section on the printed form to which the informa- 2. The testimony of disinterested persons;

Changes on Amended Return, to the amended tion relates. 3. The relationship of the parties;

return. Also, attach all schedules, forms, and at- To assist us in processing the return, please 4. The abilities and contributions of each; and

tachments required to file a complete return. complete every applicable entry space on Form 5. The control each has over the partnership in-

Change in Federal Taxable Income N-20. Do not attach statements and do not write come and the purposes for which the income

In general, a change to your federal return, “See attached” in lieu of completing the entry is used.

whether it is made by you, or by the IRS, must be spaces on the form.

A joint undertaking merely to share expenses

reported to the State of Hawaii. An entity that elects to be classified as a part- is not a partnership. Mere co-ownership of prop-

1) Section 235-101(b), HRS, requires a report nership by filing federal Form 8832 with the IRS erty that is maintained and leased or rented does

(an amended return) to the Department if the shall attach a copy of that form to the entity’s not constitute a partnership. However, if the co-

amount of IRC taxable income is changed, Form N-20 covering the first taxable year in which owners provide services to the tenants, a part-

corrected, adjusted or recomputed as stated the entity carries on business in Hawaii, derives nership exists.

in (3). income from sources in Hawaii, or makes distri-

butions that are received by a partner who is ei- Some partnerships may be excluded com-

2) This report must be made: pletely or partially from being treated as partner-

ther a resident of Hawaii or carries on business in

a) Within 90 days after a change, correction, Hawaii and is subject to Hawaii income taxation. ships for federal income tax purposes upon the

adjustment or recomputation is finally deter- election of all of the members. See Specific In-

mined. Payments structions below for more information.

b) Within 90 days after a federal amended re- In some instances, payments may have to b. General Partner. A general partner is a

turn is filed. be made with the Form N-20. Enter the amount member of the organization who is personally li-

c) At the time of filing the next income tax re- on line 17 payment due. Payment must be made able for the obligations of the partnership.

turn, if earlier than set forth in a) or b). through Hawaii Tax Online at hitax.hawaii.gov.

c. Limited Partner. A limited partner is one

3) A report within the time set out in (2) is re- Interest due under the look-back method whose potential personal liability for partnership

quired if: for completed long-term contracts. If the part- debts is limited to the amount of money or other

nership used the look-back method under IRC property that the partner contributed or is re-

a) The amount of taxable income as returned

section 460(b)(2) for certain long-term contracts, quired to contribute to the partnership.

to the United States is changed, corrected,

complete federal Form 8697, Interest Computa-

or adjusted by an officer of the United States d. Limited Partnership. A limited partnership

tion Under the Look-Back Method for Completed

or other competent authority. is a partnership composed of at least one general

Long-Term Contracts. If you will owe interest on

b) A change in taxable income results from a partner and one or more limited partners.

an unpaid amount, calculate the amount due us-

renegotiation of a contract with the United ing the rate of 2/3 of 1% per month, or part of a e. Nonrecourse Loan. Nonrecourse loans

States or a subcontract thereunder. month, beginning the first calendar day after the are those liabilities of the partnership for which

c) A recomputation of the income tax imposed date prescribed for payment whether or not that none of the partners have any personal liability.

by the United States under the IRC results first calendar day falls on a Saturday, Sunday, f. Limited Liability Company. A limited li-

from any cause. or legal holiday. Include the amount of interest ability company (LLC) is an entity formed under

d) An amended income tax return is made to due on line 17 payment due. Attach Form 8697 state law by filing articles of organization as an

the United States. with a check made payable to “Hawaii State Tax LLC. Unlike a partnership, none of the members

4) The report referred to above shall be in the Collector” to Form N-20. Write the partnership’s of an LLC are personally liable for its debts. An

form of an amended Hawaii income tax return. FEIN, daytime phone number, and “Form 8697 LLC may be classified for federal income tax pur-

interest” on the check. If you are due a refund, poses as a disregarded entity, partnership, or a

5) The statutory period for the assessment of any do not attach Form 8697 to your Form N-20. In- corporation, depending on elections made by the

deficiency or the determination of any refund stead, file federal Form 8697 separately with the LLC and the number of members. Chapter 428,

attributable to the report shall not expire be- Department. Complete the signature section of HRS, allows LLCs to operate following proper

fore the expiration of one year from the date federal Form 8697 following the instructions for approval from the Department of Commerce and

the Department is notified by the taxpayer or the signature section of Form N-20. File federal Consumer Affairs (DCCA), Business Registration

the IRS, whichever is earlier, of such a report Form 8697 by the date you are required to file Division. Hawaii conforms to the federal stan-

in writing. Before the expiration of this one- your Form N-20 (including extensions). dards in determining whether an LLC is classified

year period, the Department and the taxpayer

may agree in writing to the extension of this Withholding of Taxes on the Income as either a partnership or a corporation following

proper approval by the DCCA.

period. The period so agreed upon may be of Nonresident Partners

further extended by subsequent agreements Pursuant to Act 232, SLH 2019, and appli- Use of Instructions for Federal Form

in writing made before the expiration of the pe- 1065 —

cable to taxable years beginning after December

riod previously agreed upon. 31, 2018, partnerships are required to withhold In an effort to streamline Hawaii’s partner-

Information Returns and pay to the State on behalf of their nonresi- ship return instructions, the discussion of certain

Every partnership must file information re- dent partners an amount equal to the highest topics already discussed in the federal instruc-

turns if it makes payments of rents, commissions, marginal tax rate applicable to individuals, cur- tions for Form 1065, U.S. Partnership Return of

or other fixed or determinable income totaling rently 11%, multiplied by the amount of the part- Income, will not be repeated. Please refer to the

$600 or more to any one person in the course ner’s distributive share of income attributable to federal instructions for discussions on the follow-

of its trade or business during the calendar year. the State reflected on the partnership’s return ing topics which Hawaii conforms to:

It must report interest payments if they total $10 for the taxable period. Form N-201V is used for

- Termination of the Partnership;

or more. reporting and paying this withholding by the part-

nership to the Department. - Accounting Methods;

Use Form N-196, Annual Summary and

Definitions - Accounting Periods;

Transmittal of Hawaii Information Returns, to

summarize and send information returns to your a. Partnership. The term “partnership” in- - Elections Made by the Partnership;

respective taxation district office. For more in- cludes a limited partnership, syndicate, group, - Elections Made by Each Partner;

formation about filing information returns and pool, joint venture, or other unincorporated orga- - Partner’s Dealings With Partnership;

exceptions, see the instructions for Form N-196. nization, through or by which any business, finan-

cial operation, or venture is carried on, and that - Contributions to the Partnership;

Attachments

is not, within the meaning of the federal IRC, a - Dispositions of Contributed Property;

If you need more space on the forms or corporation, trust, estate, or sole proprietorship. If

schedules, attach separate sheets. Use the - Recognition of Precontribution Gain on

an organization more nearly resembles a corpo-

same arrangement as the printed forms. Show Certain Partnership Distributions;

ration than a partnership or trust, it is considered

the totals on the printed forms. Put the partner- an association taxed as a corporation. - Unrealized Receivables and Inventory

ship’s name and Federal Employer Identification Items; and

Number (FEIN) on each sheet. Also, be sure that Important factors in determining whether a

partnership exists include: - Passive Activity Limitations.

each separate sheet clearly indicates the line or

1. The parties’ conduct in carrying out the provi-

sions of the partnership agreement;

Page 3

Net Operating Loss Deduction Form N-20 fied research” means (1) the same as in section

41(d) of the Internal Revenue Code; (2) the de-

A partnership is not allowed the deduction for Amended Return Checkbox velopment and design of computer software for

net operating losses. (See section 703(a)(2)(D).)

If you are amending a return previously filed, ultimate commercial sale, lease, license or to be

Signatures check the AMENDED Return box. otherwise marketed, for economic consideration.

With respect to the software’s development and

General Partner or LLC Member IRS Adjustment Checkbox design, the business shall have substantial con-

Form N-20 is not considered a return unless If you are filing an amended return due to an trol and retain substantial rights to the resulting

it is signed. One general partner or LLC mem- IRS adjustment, check the IRS Adjustment box in intellectual property; (3) biotechnology; (4) per-

ber must sign the return. If a receiver, trustee in addition to the AMENDED return box and file an forming arts products; (5) sensor and optic tech-

bankruptcy, or assignee controls the organiza- amended Schedule K-1 for each partner. Check nologies; (6) ocean sciences; (7) astronomy; or

tion’s property or business, that person must sign the box on Form N-20 Item E(3) and (4) on page (8) nonfossil fuel energy-related technology. All

the return. 1. Give a corrected Schedule K-1 (Form N-20) to income earned and proceeds derived from stock

each partner. Check the box at Item F(2) on each options or stock, including stock issued through

Paid Preparer’s Information Schedule K-1 to indicate that it is an amended the exercise of stock options or warrants, from

If someone prepares the return and does not Schedule K-1. Fill in the return with all of the cor- a qualified high technology business or from a

charge the partnership, that person should not rect information and attach a completed Sched- holding company of a qualified high technology

sign the partnership return. ule AMD, Explanation of Changes on Amended business by an employee, officer, or director of

Generally, anyone who is paid to prepare the Return, to the amended return. Also, attach all the qualified high technology business, or inves-

partnership return must sign the return and fill in schedules, forms, and attachments required to tor who qualified for the high technology business

the other blanks in the Paid Preparer’s Informa- file a complete return. investment tax credit is excluded from income. If

tion area of the return. Individual preparers may the partnership is a qualified high technology

Address Change

furnish their alternative identifying number for in- business and has included royalties and other

If your mailing address has changed, you income derived from patents, copyrights, and

come tax return preparers (PTIN) instead of their

must notify the Department of the change by trade secrets the partnership owns in the income

social security number.

completing Form ITPS-COA, Change of Address reported on line 1, these amounts should be in-

The preparer required to sign the partner- Form, or log in to your Hawaii Tax Online account cluded in the deductions shown on line 14c. If

ship’s return MUST complete the required pre- at hitax.hawaii.gov. Failure to do so may prevent the amount reported on line 14c includes these

parer information and: your address from being updated, any refund due royalties and other income from patents, copy-

• Sign the return in the space provided for the to you from being delivered (the U.S. Postal Ser- rights, and trade secrets, these amounts should

preparer’s signature. Paid preparers may vice is not permitted to forward your State refund be identified by attaching a separate schedule or

sign original returns, amended returns, or re- check), and delay important notices or corre- listing.

quests for filing extensions by rubber stamp, spondence to you regarding your return.

mechanical device, or computer software pro- Line 11a

Name, Mailing Address, Federal

gram. List deductions taken for federal tax purpos-

Employer I.D. Number and Hawaii Tax

• Give the partnership a copy of the return in I.D. Number

es but not allowed, or allowable only in part, for

addition to the copy to be filed with your taxa- Hawaii tax purposes. For example, deductions

tion district office. The partnership may use its legal or trade connected with income not taxable for Hawaii

name on all tax returns and other documents purposes or section 199 domestic activities de-

The partnership may authorize the Depart-

filed. Print or type the partnership’s legal name duction.

ment to discuss its tax return with its paid pre-

parer by checking the “Yes” box above the paid and mailing address on the appropriate line. If Line 11b

preparer’s signature. Checking “Yes” will allow the this is a foreign address, enter the information

Caution: Include only ordinary gains or losses

Department to contact the paid preparer to an- in the following order: city, province or state,

from the sale, exchanges, or involuntary conversion

swer any questions that may arise during the pro- country, and postal code. Do not abbreviate the

of assets used in a trade or business activity. Or-

cessing of the partnership’s return. This designa- country name. Show the Federal Employer I.D.

dinary gains or losses from the sale, exchange, or

tion does not allow the paid preparer to call the Number in item A on page 1 of Form N-20 and

involuntary conversion of rental activity assets will

Department for information about the processing the Hawaii Tax I.D. Number in item D.

be reported separately on Schedules K and K-1,

of the return or for other issues relating to the Lines 1 - 9 generally, as a part of the net income (loss) from the

return. This designation does not replace Form rental activity. If the partner does not materially par-

Enter on lines 1 through 9 the requested

N-848, Power of Attorney. ticipate in the trade or business, the gains or losses

amounts as they appear on the partnership’s fed-

reported on line 11b will be subject to the passive

Specific Instructions eral return. Writing “See attached federal return”

on Form N-20 and attaching a copy of the part- activity rules.

These instructions follow the line numbers on nership’s Form 1065 is not acceptable. Line 11c

the first page of Form N-20 and on the schedules

You are NOT required to attach a copy of the Enter the portion of the Hawaii jobs credit

that accompany it. Specific instructions for most

partnership’s federal return (Form 1065) to Form claimed, applicable to current year new employ-

of the lines have been provided. Those lines that

N-20. ees that is reported on Schedule K line 20.

do not appear in the instructions are self-explan-

atory. If this is a return of a partnership with Line 11d

trade or business activities in several states,

File only one return for each partnership. As noted on page 1 of these instructions, Ha-

including Hawaii, and the ordinary income or

Mark “duplicate copy” on any copy you give to a waii has not adopted federal “bonus” depreciation

loss from trade or business activities report-

partner. provisions. If a depreciation deduction is claimed

ed on this return is determined using separate

If a syndicate, pool, joint venture, or similar accounting, attach a schedule of the partner- for Hawaii tax purposes, the partnership must:

group files Form N-20, a copy of the agreement ship’s Hawaii trade or business activities in- (a) complete a federal Form 4562 for Hawaii tax

and all amendments must be attached to the re- come and expenses. Enter on lines 1 through purposes using the federal depreciation guide-

turn, unless a copy has already been filed. Un- 9 applicable amounts from this schedule in- lines in effect before the adoption of the “bonus”

der section 761(a), an investing unincorporated stead of from the partnership’s federal return. depreciation provisions, (b) attach the completed

organization or one participating in the joint pro- federal Form 4562 to the Hawaii tax return, (c)

Amounts received by a qualified high technol- make the necessary adjustments to the Hawaii

duction, extraction, or use of property under an

ogy business as royalties and other income de- tax return for the depreciation difference between

operating agreement or an organization of deal-

rived from patents, copyrights, and trade secrets federal and Hawaii, and (d) attach to the Hawaii

ers in securities for a short period for the purpose

owned by the qualified high technology busi- tax return any worksheet showing the computa-

of underwriting, selling, or distributing a particular

ness and developed and arising out of a quali- tion of the adjustments. The partnership must

issue of securities may elect not to be treated as

fied high technology business are excluded from also keep records of the differences in the as-

a partnership. Make the election by attaching a

Hawaii income. Expenses related to this income set’s depreciable basis for federal and Hawaii tax

statement to Form N-20 for the first year for which

are deductible. “Qualified high technology busi- purposes.

the partnership wants the exclusion.

ness” means a business conducting more than

Fill in applicable lines and schedules. 50% of its activities in qualified research. “Quali-

Page 4

Schedule D the partnership is valued (or capitalized) at eight

times the net annual rental rate. Where property

sive of specially allocated items is divided evenly

among three partners but some special items are

Capital Gains and Losses

is rented for less than a 12 month period, the rent allocated 50% to one, 30% to another, and 20%

Purpose of Schedule.—Use Schedule D paid for the actual period of rental shall constitute to the third partner, report the special items on

(Form N-20) to report the sale or exchange of the annual rental rate for the tax period. The pay- the appropriate line of the applicable partner’s

capital assets, except capital gains (losses) that roll factor is a fraction, the numerator of which is Schedule K-1 and the total on the appropriate

are specially allocated to any partners. the total amount paid in this State during the tax line of Schedule K instead of on the numbered

period by the partnership for compensation, and lines on page 1 of Form N-20 or Schedule D.

For detailed information, see the instructions

the denominator of which is the total compensa- If the partnership agreement does not provide

on Schedule D (Form N-20).

tion paid everywhere during the tax period. The for the partner’s share of income, gain, loss, de-

Schedule K and sales (or gross receipts) factor is a fraction, the duction, or credit, or if the allocation under the

numerator of which is the total sales of the part-

Schedule K-1 nership in this State during the tax period, and

agreement does not have the substantial eco-

nomic effect, the partner’s share is determined

Partners’ Share of Income, the denominator of which is the total sales of the according to the partner’s interest in the partner-

Credits, Deductions, etc. partnership everywhere during the tax period. ship. (See section 704(b).)

Purpose If this apportionment does not fairly represent

Schedule K is a summary schedule of all the the extent of the partnership’s business activity in Specific Instructions

this State, the partnership may request the use (Schedule K only)

partners’ shares of the partnership’s income, de-

of separate accounting, the exclusion of one or

ductions, credits, etc. Prepare Schedule K-1 in Enter the total distributive amount for each

more of the factors, the inclusion of one or more

triplicate. A copy of each partner’s K-1 must be applicable items listed.

additional factors, or the use of any other method

attached to the Form N-20 filed with the Depart-

ment, one copy to be sent to each partner, and to accurately reflect the partnership’s business (Schedule K-1 only)

activity in the State. Complete Schedules O and

one copy retained for the partnership’s files. Prepare and give a Schedule K-1 to each

P (Form N-20) to show this computation.

Although the partnership is not subject to in- person who was a partner in the partnership at

Other items are attributed as follows: any time during the year. Schedule K-1 must be

come tax, the members are liable for income tax

on their shares of the partnership income, wheth- • Net rents and royalties from real property provided to each partner on or before the day

er or not distributed, and must include their share located in Hawaii are attributed to Hawaii. on which the partnership return is required to

on their tax returns. Federal Form 8825 may be attached to Form be filed.

N-20 as a schedule of expenses. Note: Generally, any person who holds an inter-

The total amount of the distributive share

items (columns b and c) reported on each line on • Net rents and royalties from tangible personal est in a partnership as a nominee for another per-

all of the partners’ Schedules K-1 should equal property are attributed to Hawaii if and to the son is required to furnish to the partnership the

the amount reported on the same line of Sched- extent that the property is utilized in Hawaii. name, address, etc., of the other person.

ule K of Form N-20 through line 33. • Capital gains and losses from sale of real On each Schedule K-1, enter the names, ad-

property located in Hawaii are attributed to dresses, and identifying numbers of the partner

Complete Schedule K-1 for each partner.

Hawaii. and partnership and the partner’s distributive

Schedules K and K-1 have the same line num-

bers through line 32 to make it easier for the • Capital gains and losses from sales of tan- share of each item.

partnership to prepare Schedule K-1. In addition, gible personal property are attributable to Ha- For an individual partner, enter the partner’s

Schedule K-1 has questions A through F and waii if the property had a situs in Hawaii at the social security number. For all other partners,

item G. Additional copies of Schedule K-1 are time of the sale. enter the partner’s FEIN. (However, if a partner

available from your district tax office. • Interest and dividends are attributed to Hawaii is an individual retirement arrangement (IRA),

Attributable to Hawaii if the partnership’s commercial domicile is in enter the identifying number of the custodian of

Hawaii. the IRA. Do not enter the social security number

Each partnership must state specifically the

income attributable to the State and the income • Patent and copyright royalties are attributed of the person for whom the IRA is maintained.)

to Hawaii if and to the extent that the patent If a taxpayer and spouse each had an interest

attributable everywhere with respect to each

or copyright is utilized by the payor in Hawaii. in the partnership, prepare a separate Schedule

partner.

Ordinary income or (loss) from trade or busi- • Intangible property is attributed to Hawaii if it K-1 for each of them. If a taxpayer and spouse

is used in Hawaii. held an interest together, prepare one Schedule

ness activities shall be attributed to the State by K-1 if the two of them are considered to be one

the use of the apportionment of business income • Services are attributed to Hawaii if it is used partner.

allocation provisions of the Uniform Division of or consumed in Hawaii.

Income for Tax Purposes Act (UDITPA), section Amounts received by a qualified high technol- Note: Space has been provided after line 38 of

235-29, HRS. Business income shall be appor- ogy business as royalties and other income de- Schedule K-1 for you to provide information to the

tioned to this State by multiplying the income by rived from patents, copyrights, and trade secrets partners. This space may be used in lieu of attach-

a fraction, the numerator of which is the property owned by the qualified high technology business ments.

factor plus the payroll factor plus the sales factor, and developed and arising out of a qualified high Question A.—Is This Partner a General

and the denominator of which is three. If the de- technology business are excluded from Hawaii Partner?

nominator of the property factor, payroll factor, or income. Expenses related to this income are de- Question A must be answered for all partners.

sales factor is zero, the denominator of the frac- ductible. If a partner holds interests as both a general and

tion in section 235-29, HRS, is reduced by the How Income Is Shared Among Partners limited partner, attach a schedule for each ac-

number of factors with a zero denominator, and tivity which shows the amounts allocable to the

the numerator of that fraction shall not include Income (loss) is allocated to a partner only

for the part of the year in which that person is a partner’s interest as a limited partner.

any factor with a zero denominator. The prop-

erty factor is a fraction, the numerator of which member of the partnership. The partnership will Question B.—What Type of Entity Is This

is the average value of the partnership’s real and either allocate on a daily basis or divide the part- Partner? State on this line whether the partner

tangible personal property owned or rented and nership year into segments and allocate income, is an individual, a corporation, a fiduciary, a part-

used in this State during the tax period and the loss, or special items in each segment among the nership, an exempt organization, or a nominee

denominator of which is the average value of persons who were partners during that segment. (custodian). If the partner entity is an LLC and it

all the partnership’s real and tangible personal (See section 706(c)(2) for more information and is treated as other than a disregarded entity for

property owned or rented and used during the for the termination of a partner’s interest.) state income tax purposes, the partnership must

tax period. Property owned by the partnership Allocate shares of income, gain, loss, deduc- enter the LLC’s classification for state income tax

is valued at its original cost. The average value tion, or credit among the partners according to purposes (that is, a corporation or partnership).

of property shall be determined by averaging the the partnership agreement for sharing income If the partner is a nominee, use one of the fol-

values at the beginning and ending of the tax pe- or loss generally. If the partners agree, specific lowing codes after the word “nominee” to indicate

riod. The use of monthly values may be required items may be allocated among them in a ratio dif- the type of entity the nominee represents: I—In-

if necessary to properly reflect the average value ferent from the ratio for sharing income or loss dividual; C—Corporation; F—Fiduciary; P—Part-

of the partnership’s property. Property rented by generally. For instance, if the net income exclu- nership; E—Exempt Organization; or IRA—Indi-

vidual Retirement Arrangement.

Page 5

Item C.—Partner’s Profit, Loss, and Capital (Schedules K and K-1 unless K-1. The partners report their shares in the year

Sharing Percentages. Enter in item C(ii) the per- in which the property is placed in service. Show

otherwise noted)

centage existing at the end of the year. However, the total section 179 expense on Schedule K, line

if a partner’s interest terminated during the year, Income (loss) 13, and allocate it to each partner on Schedule

enter in item C(i) the percentages that existed Line 1 K-1, line 13.

immediately before the termination. When the The partnership must specify the item(s) of

profit or loss sharing percentage has changed Enter the partner’s share of the ordinary in-

come (loss) reported on Form N-20, line 16. If section 179 property which it elects to treat as an

during the year, show the percentage before the expense and the portion of the cost of each item

change in item C(i) and the end of year percent- line 16 is a loss, enter the partner’s full share

of the loss. If the partner holds interests in the which is being treated as an expense. Do this on

age in item C(ii). If there are multiple changes federal Form 4562, Depreciation and Amortiza-

in the profit and loss sharing percentage during partnership both as a general partner and as a

limited partner, enter the total loss for all interests tion, and on a schedule attached to Schedule

the year, attach a statement giving the date and K-1. Generally, any election made under section

percentage before each change. “Ownership of held in the partnership. Enter the loss without ref-

erence to the adjusted basis of the partner’s in- 179 may not be revoked except with the consent

capital” means the portion of the capital that the of the Director.

partner would receive if the partnership was liqui- terest in the partnership or the partner’s amount

dated at year end by the distribution of undivided at risk. Line 1 should reflect the total ordinary in- Depreciation or amortization may not be tak-

interests in partnership assets and liabilities. come (loss) from all trade or business operations. en on any amount for which a deduction is al-

lowed under section 179.

Item D.—Partner’s Share of Liabilities. En- Line 4

ter each partner’s share of nonrecourse liabilities, See section 179 and federal Form 4562 for

Enter: (1) the guaranteed payments to part-

partnership-level qualified nonrecourse financ- more information.

ners for salaries and interest deducted by the

ing, and other liabilities. If the partner terminated partnership and included on Form N-20, line 9; Please note that Hawaii has not adopted fed-

his or her interest in the partnership during the and (2) the guaranteed payments to partners that eral provisions relating to the increase of the sec-

year, enter the share that existed immediately be- the partnership is required to capitalize, such as tion 179 deduction and “bonus” depreciation.

fore the total disposition. In all other cases, enter payments or credits to a partner for services ren- Line 15

it as of the end of the year. dered in organizing a partnership.

Enter any other deductions not included on

If the partnership is engaged in two or more Line 10 line 12 through 14, such as:

different types of at-risk activities, or a combina-

Enter the net section 1231 gain (loss) from a. Amounts, other than investment interest, paid

tion of at-risk activities and any other activity, at-

Schedule D-1, line 8. by the partnership that would be itemized de-

tach a statement showing the partner’s share of

nonrecourse liabilities, partnership-level qualified Do not include net gain or loss from involun- ductions on any of the partners’ income tax

nonrecourse financing, and other liabilities for tary conversions due to casualty or theft. Report returns if they were paid directly by a partner

each activity. See sections 465(c)(2) and (3) to net gain or loss from involuntary conversions due for the same purpose. These amounts in-

determine if the partnership is engaged in more to casualty or theft on line 11. clude, but are not limited to expenses under

than one at-risk activity. section 212 for the production of income other

Line 11 than from the partnership’s trade or business.

If a partnership is engaged in an activity sub- Enter any other items of income, gain, or loss b. Any interest penalty on early withdrawal of

ject to the limitations of section 465(c)(1), give not included on lines 1 through 10, such as: savings. The federal Form 1099-INT given to

each partner his or her share of the total pre-

a. Gains from the disposition of farm recapture the partnership by a bank or savings and loan

1976 losses from the section 465(c)(1) activity

property (see Schedule D-1) and other items association will show the amount of any inter-

(i.e., film or video tape, section 1245 property

to which section 1252 apply. est penalty the partnership was charged be-

leasing, farm, or oil and gas property) for which

b. Recoveries of bad debts, prior taxes, and de- cause it withdrew funds from its time savings

there existed a corresponding amount of nonre-

linquency amounts (section 111). deposit before its maturity.

course liability at the end of each year in which

the losses occurred. c. Gains and losses from wagering (section c. Soil and water conservation expenditures

165(d)). (section 175).

Items E.—Publicly Traded Partnerships. If

the box in Item E is checked, you are a partner d. Any income, gain, or loss to the partnership d. Expenditures for the removal of architectural

in a publicly traded partnership and must follow under section 751(b). and transportation barriers to the elderly and

the rules for Publicly Traded Partnerships. See handicapped and which the partnership has

e. Net gain or loss from involuntary conversions

federal Partner’s Instructions for Schedule K-1 elected to treat as a current expense (section

due to casualty or theft. Give each partner a

(Form 1065) for more information. 190).

schedule that separately shows each part-

ner’s share of the amount to be reported on e. Contributions to a capital construction fund.

Item G.—Reconciliation of Partner’s Capi-

tal Account. If you are not required to complete federal Form 4684, Casualties and Theft. f. Any amounts paid during the tax year for

health insurance coverage for a partner (in-

Item L on Schedule K-1 (Form 1065), you are not Deductions

required to complete Item G on Schedule K-1 cluding that partner’s spouse and depen-

(Form N-20). Line 12 dents).

Note: The partnership must maintain a State Ac- Enter the total amount of charitable contri- g. Payments for a partner to an IRA, qualified

cumulated Adjustments Account. butions, and each amount subject to the 50%, plan, or simplified employee pension (SEP)

30%, and 20% limitations paid by the partnership or SIMPLE IRA plan. If a qualified plan is a

Box b - Report in this box the capital contribu- during the tax year. Attach an itemized list that defined benefit plan, a partner’s distribu-

tions as reported on the partnership’s books. separately shows the partnership’s charitable tive share of payments is determined in the

Box c - Enter in this box the sum of the contributions subject to the 50%, 30%, and 20% same manner as his or her distributive share

amounts on lines 1 through 11, column c of this limitations. of partnership taxable income. For a defined

Schedule K-1 and any nontaxable income. If the partnership made a qualified conser- benefit plan, attach to the Schedule K-1 for

Box d - Enter in this box the sum of the vation contribution under section 170(h), also each partner a statement showing the amount

amounts on lines 12 through 15 and 32a, column include the fair market value of the underlying of benefit accrued for the tax year.

c of this Schedule K-1 and any disallowed deduc- property before and after the donation, the type h. Interest expense allocated to debt-financed

tions. of legal interest contributed, and describe the distributions. See Internal Revenue Service

conservation purpose furthered by the donation. Notice 89-35 for more information.

Box e - Report in this box the withdrawals

and distributions as reported on the partnership’s Give a copy of this information to each partner. i. Interest paid or accrued on debt properly al-

books. Line 13 locable to each general partner’s share of a

working interest in any oil or gas property (if

Box f - The amount to enter in this box is the A partnership may elect to expense part of the partner’s liability is not limited). General

sum of the amounts from boxes a, b, and c less the cost (up to $25,000) of recovery property partners that did not materially participate in

the sum of the amounts from boxes d and e. that the partnership purchased this year for use the oil or gas activity treat this interest as in-

in its trade or business. The partnership may not vestment interest; for other general partners,

deduct the section 179 expense, but should re- it is a trade or business interest.

port the expense separately on Schedules K and

Page 6

Credits Schedule K-1, Line 38 payments for the participating partner’s distribu-

tive share of Hawaii source income based on

Lines 16 - 31 See instructions for federal Form 1065, their own individual tax rate but with no standard

Schedule K-1 for what to report on line 38.

See Instructions for schedule CR for more in- deduction or personal exemption, provided the

formation on specific credits. Analysis (Schedule K only) following conditions are met:

Line 32 Lines 34a and 34b • The partner must be an individual.

Investment Interest For each type of partner shown, enter the por- • The partner’s income from the partnership is

tion of the amount shown on line 34a of Sched- the partner’s only income from Hawaii sourc-

Lines 32a-32b(2) must be completed whether ule K that was allocated to that type of partner. es. If a partner has other income from Hawaii

or not a partner is subject to the investment inter- The sum of the amounts shown on line 34b must sources such as multiple partnerships, even

est rules. equal the amount shown on line 34a. though the partnerships are related, a sepa-

Line 32a. Investment Interest Expense.— rate net income tax return must be filed by

In classifying partners who are individuals as

Include on this line interest paid or accrued to that partner.

“active” or “passive,” the partnership should apply

purchase or carry property held for investment. the following rules: • The partnership will obtain a Power-of-Attor-

Property held for investment includes property ney from each of its partners to permit the

1. If the partnership’s principal activity is a trade

that produces portfolio income (interest, divi- partnership to file an income tax return on the

or business activity, classify a general partner

dends, annuities, royalties, etc.). Therefore, inter- partners’ behalf. A copy of each power of at-

as “active” if the partner materially participat-

est expense allocable to portfolio income should torney is to be attached to the initial compos-

ed in all partnership trade or business activi-

be reported on line 32a of Schedule K-1 (rather ite tax return filed by the partnership.

ties; otherwise, classify a general partner as

than line 14 of Schedule K-1).

“passive.” • The partnership, as an agent for the partici-

Property held for investment includes a part- pating partners, shall pay tax, additions to tax,

2. If the partnership’s principal activity consists

ner’s interest in a trade or business activity that is interest, and penalties otherwise required to

of working interest in an oil or gas well, clas-

not a passive activity to the partner and in which be paid by the partners.

sify a partner holding a working interest in the

the partner does not materially participate. An The composite Hawaii Nonresident Individual

oil or gas well through an entity that does not

example would be a partner’s working interest in Income Tax Return, Form N-15, shall be

limit the partner’s liability as “active;” other-

oil and gas property (i.e., the partner’s interest completed as follows:

wise, classify the partner as “passive.”

is not limited) if the partner does not materially

participate in the oil and gas activity. 3. If the partnership’s principal activity is a rental 1. Fill in the oval indicating this is a compos-

real estate activity, classify a general partner ite return;

Investment interest does not include interest as “active” if the partner actively participated

expense allocable to a passive activity. 2. The first name on the return shall be “Part-

in all of the partnership’s rental real estate ac- ners” and the last name is the partner-

The amount on line 32a will be deducted (af- tivities; otherwise, classify a general partner ship’s name;

ter applying the investment interest expense limi- as “passive.”

tations of section 163(d)) by individual partners 3. The partnership’s FEIN shall be used

4. If the partnership’s principal activity is a port-

on their Form N-11 or N-15. in place of the taxpayers’ social security

folio activity, classify all partners as “active.” number. Enter the partnership’s FEIN in

Lines 32b(1) and 32b(2). Investment In- 5. Classify all limited partners and all partners social security number format (i.e., 123-

come and Expenses.—Enter on line 32b(1) in a partnership whose principal activity is a 45-6789);

only the investment income included on lines 5 rental activity other than a rental real estate

through 7 of Schedule K-1. Enter on line 32b(2) 4. Indicate the partnership’s mailing address

activity as “passive.”

only the investment expense included on line 14 as the taxpayers’ address;

6. If the partnership cannot make a reasonable

of Schedule K-1. determination as to whether or not a partner’s 5. Indicate the partnership’s principal busi-

If there are items of investment income or ex- participation in a trade or business activity is ness activity in Hawaii as the taxpayers’

pense included in the amounts that are required material or whether or not a partner’s partici- occupation;

to be passed through separately to the partner pation in a rental real estate activity is active, 6. Filing status will be single. No personal ex-

on Schedule K-1 (items other than the amounts classify the partner as “passive.” emption is allowed;

included on lines 5 through 7 and 14 of Sched- In applying the above rules, a partnership 7. Complete pages 2 and 3, Col. B, lines 17

ule K-1), give each partner a schedule identifying should classify each partner to the best of its and 35;

these amounts. knowledge and belief. It is assumed that in most 8. Deductions necessary to determine each

Investment income includes gross income cases the level of a particular partner’s participa- partner’s distributive share of the partner-

from property held for investment, gain attribut- tion in an activity will be apparent. ship income are allowed;

able to the disposition of property held for invest-

ment, and other amounts that are gross portfolio Schedules O and P 9. Credits directly attributable to the partner-

income. Investment income and investment ex- Allocation and Apportionment of Income ship are allowed;

penses do not include any income or expenses 10. On line 37, enter zero since worldwide

If the partnership had ordinary income or

from a passive activity. source income of each nonresident part-

(loss) from trade or business activities both within

Property subject to a net lease is not treated ner is not required, itemized deductions

and without Hawaii, complete Schedules O and

as investment property because it is subject to calculated using the ratio of Hawaii adjust-

P to determine the business income or (loss) ap-

the passive loss rules. Do not reduce investment ed gross income to total adjusted gross

portioned to Hawaii. For more details, see the in-

income by losses from passive activities. income may not be claimed. Also, tax

structions for “Attributable to Hawaii” on page 4, credits which are based on total adjusted

Investment expenses are deductible expens- under Schedule K and Schedule K-1. Attach a gross income from all sources may not be

es (other than interest) directly connected with copy of Schedules O and P to Form N-20. claimed;

the production of investment income.

Composite Returns for 11. Complete page 3 by:

Other

Schedule K, Lines 33 - 37 Nonresident Partners a. determining the taxable income for

each nonresident partner and enter

At present, there are no statutory provisions

Report on lines 33 through 37 of Schedule the total on lines 41 and 43;

that: (1) allow partnerships the option to file

K, credit recapture amounts for the Hawaii Low- b. determining the tax for each nonresi-

composite returns on behalf of their nonresident

Income Housing Tax Credit, the Capital Goods dent partner and enter the total on line

partners, and (2) grant the election to be taxed

Excise Tax Credit, the Tax Credit for Flood Vic- 44; and

at the nonresident partners’ own individual tax

tims, the Important Agricultural Land Qualified

rates but with no standard deduction or personal c. completing lines 45 through 51 as ap-

Agricultural Cost Tax Credit, and the Capital In-

exemption. However, the Department of Taxation propriate, and line 52 (note: on Sched-

frastructure Tax Credit.

will administratively allow partnerships to elect ule CR, skip line 9).

See instructions for federal Form 1065, to file composite Hawaii nonresident income tax

Schedule K for what else to report on line 33. 12. Complete page 4, lines 53 through 66 as

returns on behalf of participating partners, all of appropriate.

whom are nonresidents, and make composite

Page 7

A schedule is attached to the return detailing year and who are allowed to be included on quarter - $200; N-1, 2nd quarter - $300;

each partner’s: the composite return may have those payments etc.) made by the individual.

1. Name, address, social security number, credited to the composite return. The partnership The election to file a composite Hawaii non-

and filing status (single); may claim these payments on Form N-15, line resident return may be revoked by the Depart-

55, by entering the total of the estimated tax ment upon failure of the partnership to comply

2. Distributive share of income or (loss); payments along with “see attached schedule” with the terms and conditions of this election.

3. Allowable itemized deductions; in the amount column of line 55 and attaching

a schedule of the estimated tax payments by In making such an election, the partnership

4. Tax due computed on the taxable income will not be required to obtain from the partici-

of the individual partner; and stating each individual’s:

pating partners, income derived from non-entity

5. Distributive share of credits. 1. Name, address, and social security num- sources and claims for non-entity deductions.

ber, and

Nonresident partners who have made Hawaii

estimated tax payments during the 2020 tax 2. Each type of estimated payment and

amount of payment (e.g., N-201V, 1st

Page 8

RELATED FEDERAL/HAWAII PARTNERSHIP TAX FORMS

Copy of Fed.

Federal Use Form May Be

Form Number Title or Description of Federal Form Hawaii Form Used

970 Application To Use LIFO Inventory Method None Yes*

1065 U.S. Return of Partnership Income N-20 No

Schedule D Capital Gains and Losses Sch. D (N-20) No

Schedule K-1 Partner’s Share of Income, Deductions, Credits, Etc. Sch. K-1 (N-20) No

1128 Application to Adopt, Change, or Retain a Tax Year None Yes*

3115 Application for Change in Accounting Method None Yes*

4562 Depreciation and Amortization None Yes*

4684 Casualties and Thefts None Yes*

4797 Sales of Business Property Sch. D-1 No

5884 Work Opportunity Credit N-884 No

6198 At-Risk Limitations None Yes*

6781 Gains and Losses from Section 1256 None Yes*

Contracts and Straddles

8283 Noncash Charitable Contributions None Yes*

8582 Passive Activity Loss Limitations None Yes*

8586 Low-Income Housing Credit N-586 No

8693 Low-Income Housing Credit Disposition Bond N-587 No

8697 Interest Computation Under the Look-Back Method None Yes*

for Completed Long-Term Contracts

8824 Like-Kind Exchanges None Yes*

8825 Rental Real Estate Income and Expenses None Yes*

of a Partnership or an S Corporation

8832 Entity Classification Election None Yes*

8949 Sales and other Dispositions of Capital Assets None Yes*

* If there is no Hawaii equivalent form, the federal form must be used.

You might also like

- ss4 PDFDocument4 pagesss4 PDFKeith Muhammad: Bey100% (2)

- Income Tax Case DigestDocument8 pagesIncome Tax Case DigestFrancisCzeasarChuaNo ratings yet

- 03.0 Terp24 605 Form-Based ProcessesDocument91 pages03.0 Terp24 605 Form-Based ProcessesBatboy Batko100% (3)

- EY Tax Administration Is Going DigitalDocument12 pagesEY Tax Administration Is Going DigitalVahidin QerimiNo ratings yet

- 2021 Instructions For Schedule E: Supplemental Income and LossDocument12 pages2021 Instructions For Schedule E: Supplemental Income and Lossjyoti06ranjanNo ratings yet

- 142 150Document7 pages142 150NikkandraNo ratings yet

- Income Tax Amendments by Finance Act, 2021 Relevant For JUNE 2022Document30 pagesIncome Tax Amendments by Finance Act, 2021 Relevant For JUNE 2022yashNo ratings yet

- CIR V. Isabela Cultural Corp. (2007)Document2 pagesCIR V. Isabela Cultural Corp. (2007)Lorenz LuistroNo ratings yet

- Budget 2021Document15 pagesBudget 2021RohitKumarDiwakarNo ratings yet

- DT PROVISIONS ENACTED FINANCE ACT 2022 PankajDocument21 pagesDT PROVISIONS ENACTED FINANCE ACT 2022 Pankajnilanjan_kar_2No ratings yet

- B4 Nov MSDocument13 pagesB4 Nov MSCerealis FelicianNo ratings yet

- Tax FinalsDocument4 pagesTax FinalsNikki Beverly G. BacaleNo ratings yet

- Instructions For Form 1045 (2021) - Internal Revenue ServiceDocument36 pagesInstructions For Form 1045 (2021) - Internal Revenue ServiceDr. Varah SiedleckiNo ratings yet

- IF12572Document3 pagesIF12572chichponkli24No ratings yet

- Section-By-Section Coronavirus Tax Relief MeasuresDocument4 pagesSection-By-Section Coronavirus Tax Relief MeasuresFox News80% (5)

- Other LiabilitiesDocument4 pagesOther LiabilitiesAshanti LauricioNo ratings yet

- T2 GuideDocument137 pagesT2 GuideToofan KhanNo ratings yet

- Allowable Deductions From Gross Income - ReviewerDocument4 pagesAllowable Deductions From Gross Income - RevieweryzaNo ratings yet

- Qual Opp Zone ArticleDocument25 pagesQual Opp Zone ArticleWentong ZhangNo ratings yet

- Technical Summary of The Tax Relief For American Families and Workers ActDocument9 pagesTechnical Summary of The Tax Relief For American Families and Workers ActDaily Caller News FoundationNo ratings yet

- Inome Tax April 15Document2 pagesInome Tax April 15brainNo ratings yet

- RMC TaxDocument4 pagesRMC Taxmffaani107No ratings yet

- SKA - Sectionwise GST Analysis - Finance Bill 2021Document24 pagesSKA - Sectionwise GST Analysis - Finance Bill 2021Sandip GoyalNo ratings yet

- US Internal Revenue Service: I1120f - 1993Document20 pagesUS Internal Revenue Service: I1120f - 1993IRSNo ratings yet

- Budget 2022 BBDocument30 pagesBudget 2022 BBCA SRD & CONo ratings yet

- US Internal Revenue Service: I2220 - 1996Document4 pagesUS Internal Revenue Service: I2220 - 1996IRSNo ratings yet

- Getpdf 1Document61 pagesGetpdf 1WilliamNo ratings yet

- Atlas Consolidated Mining and Development Corporation vs. CIRDocument54 pagesAtlas Consolidated Mining and Development Corporation vs. CIRChristian Adrian CepilloNo ratings yet

- Partner's Instructions For Schedule K-1 (Form 1065)Document15 pagesPartner's Instructions For Schedule K-1 (Form 1065)Mario LaflammeNo ratings yet

- Research On NIRCDocument6 pagesResearch On NIRCFrancis RubioNo ratings yet

- Income Compilation Tax ReviewDocument13 pagesIncome Compilation Tax ReviewJosiebethAzueloNo ratings yet

- DHC Budget Snapshot 2023 24Document15 pagesDHC Budget Snapshot 2023 24Jigar ShahNo ratings yet

- All About New TDS Section 194R and Section 194S - Taxguru - inDocument7 pagesAll About New TDS Section 194R and Section 194S - Taxguru - inParag Jain DugarNo ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S) : Internal Revenue ServiceDocument8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S) : Internal Revenue ServiceIRSNo ratings yet

- Instructions Form IT-201Document72 pagesInstructions Form IT-201TomNo ratings yet

- Proctor & Gamble vs. CIRDocument15 pagesProctor & Gamble vs. CIRMarlene TongsonNo ratings yet

- Circular-No-10-2022 Income Tax ActDocument4 pagesCircular-No-10-2022 Income Tax Actsaurabh14014No ratings yet

- US Internal Revenue Service: I1065bsk - 2001Document10 pagesUS Internal Revenue Service: I1065bsk - 2001IRSNo ratings yet

- RSM India Union Budget 2021 HighlightsDocument132 pagesRSM India Union Budget 2021 HighlightsSunil KumarNo ratings yet

- Final Tax Audit-JigarDocument20 pagesFinal Tax Audit-JigarJigar MehtaNo ratings yet

- Circular No 10 2022Document4 pagesCircular No 10 2022Shobhit ShuklaNo ratings yet

- 22.d CIR vs. BPI (G.R. No. 178490 July 7, 2009) - H DigestDocument2 pages22.d CIR vs. BPI (G.R. No. 178490 July 7, 2009) - H DigestHarleneNo ratings yet

- US Internal Revenue Service: I1065bsk - 2002Document10 pagesUS Internal Revenue Service: I1065bsk - 2002IRSNo ratings yet

- Philam Asset Management Inc. v. CommissionerDocument14 pagesPhilam Asset Management Inc. v. CommissionerLou Martin AquinoNo ratings yet

- US Internal Revenue Service: I1120pc - 1993Document16 pagesUS Internal Revenue Service: I1120pc - 1993IRSNo ratings yet

- Tax - Nature of BusinessDocument69 pagesTax - Nature of BusinessDhiraj MAkwanaNo ratings yet

- RR 2-2001Document7 pagesRR 2-2001Eumell Alexis PaleNo ratings yet

- Tell Me About The Kinds of Reports You Have Experience MakingDocument2 pagesTell Me About The Kinds of Reports You Have Experience MakingAnanya D RNo ratings yet

- 49 Insights June 2022V2Document24 pages49 Insights June 2022V2Rheneir MoraNo ratings yet

- Tax RemediesDocument6 pagesTax RemediesJollibee Bida BidaNo ratings yet

- KPMG - Newsletter Loi de Finances 2024 (English Version)Document6 pagesKPMG - Newsletter Loi de Finances 2024 (English Version)boukhlefNo ratings yet

- Overview of FinanceBill 2022Document2 pagesOverview of FinanceBill 2022Prashant MunotNo ratings yet

- What Did The Union Budget 2022 Do For Charitable Organisations?Document5 pagesWhat Did The Union Budget 2022 Do For Charitable Organisations?Aakash MalhotraNo ratings yet

- 1 MIS Reporting 2 SOP's Required For Each Item in The Financials 3 Standalone and Consolidated of Financials For The FY2021-21Document8 pages1 MIS Reporting 2 SOP's Required For Each Item in The Financials 3 Standalone and Consolidated of Financials For The FY2021-21Suresh KattamuriNo ratings yet

- Corpbook 2022Document27 pagesCorpbook 2022pamafritz07No ratings yet

- Systra Phils Inc v. CIRDocument1 pageSystra Phils Inc v. CIRBRYAN JAY NUIQUENo ratings yet

- Tar MRL Company PDFDocument18 pagesTar MRL Company PDFrishi Kr.No ratings yet

- Tax DigestDocument7 pagesTax DigestLeo Angelo LuyonNo ratings yet

- Decoding Indian Union BudgetDocument6 pagesDecoding Indian Union BudgetkumarNo ratings yet

- Instructions For Form 990: Internal Revenue ServiceDocument24 pagesInstructions For Form 990: Internal Revenue ServiceIRSNo ratings yet

- Tax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeDocument7 pagesTax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeJouhara ObeñitaNo ratings yet

- Income Tax ReviewerDocument5 pagesIncome Tax ReviewerClarissa de VeraNo ratings yet

- Mortgage Registry Tax: Mortgagor or Authorized Agent, Sign BelowDocument1 pageMortgage Registry Tax: Mortgagor or Authorized Agent, Sign BelowdaveyNo ratings yet

- Railroad Property RecordsDocument3 pagesRailroad Property RecordsdaveyNo ratings yet

- Revenue Recapture Act Certification: and Decertification and Modification RequestDocument1 pageRevenue Recapture Act Certification: and Decertification and Modification RequestdaveyNo ratings yet

- 2019 National Healthcare Safety Network Antimicrobial Use Option ReportDocument14 pages2019 National Healthcare Safety Network Antimicrobial Use Option ReportdaveyNo ratings yet

- Republic V RicarteDocument1 pageRepublic V RicarteReena MaNo ratings yet

- Important Information To Include On Your Tax Return Before Sending It To UsDocument10 pagesImportant Information To Include On Your Tax Return Before Sending It To UsChristopherJonesNo ratings yet

- Income Tax Return FormDocument3 pagesIncome Tax Return FormTru TaxNo ratings yet

- Income Tax Assessment TypesDocument2 pagesIncome Tax Assessment TypesJNVU WEBINARNo ratings yet

- IT-ELEC-03-G01 - How To Complete The Company Income Tax Return ITR14 EFiling - External GuideDocument39 pagesIT-ELEC-03-G01 - How To Complete The Company Income Tax Return ITR14 EFiling - External GuideOyama MosianeNo ratings yet

- The Ethics of Tax Accounting: Chapter NineDocument9 pagesThe Ethics of Tax Accounting: Chapter NinekianamarieNo ratings yet

- Maverick Tax Express 941 W Pioneer Pkwy ARLINGTON, TX 76013-6369 817-261-6287Document19 pagesMaverick Tax Express 941 W Pioneer Pkwy ARLINGTON, TX 76013-6369 817-261-6287Vignesh EswaranNo ratings yet

- Small Business Expense ReportDocument7 pagesSmall Business Expense ReportXYZNo ratings yet

- GAT General Analytical Questions and Answers Part1Document12 pagesGAT General Analytical Questions and Answers Part1HAFIZ IMRAN AKHTER67% (3)

- Student Activity Packet SC-1.2Document3 pagesStudent Activity Packet SC-1.2Kenneth ReedNo ratings yet

- Katrina Pierce IndictmentDocument29 pagesKatrina Pierce IndictmentTodd FeurerNo ratings yet

- Chapter 17Document42 pagesChapter 17Dyllan HolmesNo ratings yet

- Chapter 8 - Refundable Tax Credits, Benefits and T1 AdjustmentsDocument62 pagesChapter 8 - Refundable Tax Credits, Benefits and T1 AdjustmentsRyan YangNo ratings yet

- Navigating The College Financial Aid MazeDocument33 pagesNavigating The College Financial Aid MazeMike Rosich Sr.No ratings yet

- Instructions For Form 709: United States Gift (And Generation-Skipping Transfer) Tax ReturnDocument12 pagesInstructions For Form 709: United States Gift (And Generation-Skipping Transfer) Tax ReturnIRSNo ratings yet

- Federal Mafia Chap 1Document18 pagesFederal Mafia Chap 1LegalBegal100% (1)

- IRS Publication Form 8594Document2 pagesIRS Publication Form 8594Francis Wolfgang UrbanNo ratings yet

- TeresaZhou (US Tax Resume 06.01. 2015) CADocument3 pagesTeresaZhou (US Tax Resume 06.01. 2015) CALin ZhouNo ratings yet

- Midland Valley Monthly - November 2012Document16 pagesMidland Valley Monthly - November 2012Aiken StandardNo ratings yet

- Installemntdeferred Reporting PenaltiesDocument3 pagesInstallemntdeferred Reporting PenaltiesJane TuazonNo ratings yet

- IRS Publication 15 Withholding Tax Tables 2010Document73 pagesIRS Publication 15 Withholding Tax Tables 2010Wayne Schulz100% (1)

- E-Filling of Income Tax Return: A Case Study of Individual AssesseeDocument63 pagesE-Filling of Income Tax Return: A Case Study of Individual Assesseepraveen0% (1)

- Tax Evasion Part 1Document12 pagesTax Evasion Part 1henfaNo ratings yet

- F 3949 ADocument3 pagesF 3949 Aiamsomedude100% (3)

- XX. CIR vs. Fitness by Design, IncDocument11 pagesXX. CIR vs. Fitness by Design, IncStef OcsalevNo ratings yet

- TAX 2021 - Theories and Independent ProblemsDocument28 pagesTAX 2021 - Theories and Independent ProblemsMingcheng JeeNo ratings yet

- Reminder: Enquiries Should Be Addressed To SARSDocument2 pagesReminder: Enquiries Should Be Addressed To SARSHenry MeintjiesNo ratings yet