Professional Documents

Culture Documents

Opening Bell: Market Outlook Today's Highlights

Opening Bell: Market Outlook Today's Highlights

Uploaded by

Porus Saranjit SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Opening Bell: Market Outlook Today's Highlights

Opening Bell: Market Outlook Today's Highlights

Uploaded by

Porus Saranjit SinghCopyright:

Available Formats

Opening Bell

March 18, 2021

Market Outlook Today’s Highlights

Indian markets are likely to see a gap up opening tracking Events: EU trade balance, US initial jobless

strong global cues amid upbeat guidance from the Federal claims

Reserve. However, global news flows and sector specific

development will be key monitorables.

Index Movement

Markets Yesterday 55000 16000

Domestic markets ended lower on the back of losses across 52000 15000

sectors amid mixed global cues 49000 14000

46000 13000

US markets ended higher post the Federal Reserve keeping

43000 12000

interest rates unchanged and raising GDP growth

40000 11000

projections

18-Feb

21-Feb

24-Feb

27-Feb

2-Mar

5-Mar

8-Mar

11-Mar

14-Mar

17-Mar

Key Developments BSE (LHS) NSE (RHS)

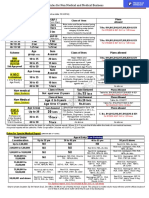

Close Previous Chg (%) MTD(%) YTD(%) P/E (1yrfwd)

Direct tax collection for the fiscal year were at | 9.18 lakh Sensex 49,802 50,364 -1.1 1.4 4.3 29.2

crore as of March-16, about | 18,000 crore higher than the Nifty 14,721 14,910 -1.3 1.3 5.3 27.9

revised estimates. This surge in tax mop-up was led by a

rise in advance tax collection from companies. Overall, Institutional Activity

corporation tax collection jumped nearly 7% to | 4.7 lakh CY19 CY20 YTD CY21 Yesterday Last 5 Days

crore. This is higher than the revised estimate of | 4.46 FII (| cr) 40,893 64,379 56,791 2,626 2,435

lakh crore. On the other hand, income-tax collection of DII (| cr) 44,478 -28,544 -31,427 -562 -384

| 4.21 lakh crore is still short of the revised estimates of

| 4.59 lakh crore World Indices – Monthly performance

France Germany Dow Jones U.K. Nikkei

NHAI is ramping up the pipeline of projects to be awarded 6,055 14,597 33,015 6,763 29,914

in Q1FY22, after awarding activity is expected to reach 5.7% 5.1% 4.8% 2.2% -1.2%

~4,500 km of highways in FY21. The authority is likely to Kospi Nasdaq NSE BSE Shanghai

3,048 13,525 14,721 49,802 3,446

bid out projects worth ~ | 50,000 crore in Q1FY22. So far,

-2.8% -3.2% -3.2% -3.7% -5.7%

in FY21, the authority has awarded highways totalling

2,350 km in length and worth | 1.3 lakh crore

Nifty Heat Map

211 1,387 2,516 3,113 3,378

ITC Infosys HDFC Ltd TCS Divis Lab

1.3% 0.2% 0.2% 0.1% 0.0%

2,647 3,468 1,020 837 2,226

Eicher Britannia TechM M&M HUL

-0.5% -0.6% -0.6% -0.7% -0.8%

423 590 Bajaj 9,525 1,495 7,065

JSW Steel ICICI Bank HDFC Bank Maruti

-0.8% -0.9% Finserv -0.9% -1.1% -1.2%

Markets Today (Updated till yesterday)

Bharti 523 1,367 728 1,438 16,456

Grasim Ind Axis Bank L&T Nestle

Airtel Commodities Close Previous Chng (%) MTD(%) YTD(%)

-1.2% -1.3% -1.3% -1.7% -1.7%

Gold (|/10 gm) 44,967 44,813 0.3 -1.7 -10.3

Bajaj 5,360 609 220 6,520 1,868 Silver (|/kg) 67,230 66,919 0.5 0.0 -1.3

UPL Power Grid Ultratech Kotak Bank

Finance -1.8% -1.8% -1.8% -1.8% -1.8% Crude ($/barrel) 67.7 68.4 -1.0 2.4 30.8

Asian 2,423 690 1,473 987 3,191 Copper ($/tonne) 8,965 9,164 -2.2 -1.9 15.7

HDFC Life Titan HCl Tech Hero Moto

Paints -1.8% -1.9% -1.9% -2.0% -2.0% Currency

USD/INR 72.5 72.5 0.0 1.3 0.7

4,356 Shree 26,842 Reliance 2,055 98 326

Dr Reddy IOC Hindalco EUR/USD 1.2 1.2 0.1 -1.4 -2.5

-2.1% Cement -2.1% Ind. -2.2% -2.2% -2.2% USD/YEN 109.1 109.1 -0.1 -2.3 -5.3

420 3,570 Indusind 1,009 772 704 ADRs

Wipro Bajaj Auto Cipla Tata Steel

-2.2% -2.3% Bank -2.5% -2.5% -2.7% HDFC Bank 82.3 80.8 1.9 4.0 13.9

ICICI Bank 16.7 16.7 0.2 0.6 12.4

107 889 368 Sun 585 138

NTPC SBI Life SBI GAIL Tata Motors 21.8 21.9 -0.4 -0.8 73.1

-2.7% -2.7% -2.7% Pharma -2.9% -3.4%

Infosys 19.3 19.2 0.9 12.9 14.0

140 688 Tata 306 432 109 Dr Reddys Labs 61.7 60.2 2.4 2.8 -13.5

Coal India Adani Ports BPCL ONGC

-4.0% -4.1% Motors -4.4% -4.8% -5.0% Wipro 6.6 6.6 1.2 8.3 17.5

Opening Bell ICICI Direct Research

Key Data Points Exchange Cash Turnover (| crore)

Key Economic Indicator Period Latest Prior Values

70,782

67,257

60,004

59,472

58,997

100000

54,392

RBI Cash Reserve Ratio N/A 3.00% 3.00%

RBI Repo Rate N/A 4.00% 4.00%

50000

9,783

8,460

RBI Reverse Repo Rate N/A 3.35% 3.35%

4,974

4,824

3,910

3,700

CPI YY Feb 5.03% 4.06%

Current Account Balance Q2 15.5bln $ 19.8bln $ 0

9-Mar 10-Mar 12-Mar 15-Mar 16-Mar 17-Mar

Opening Bell

Exports - USD Feb 27.9 bln$ 27.4 bln$

BSE Cash NSE Cash

FX Reserves, USD Final Feb 585 bln$ 590 bln$

GDP Quarterly yy Q3 0.40% -7.50%

GDP Annual FY20 4.20% 6.10% NSE Derivative Turnover (| crore)

Imports - USD Feb 40.5 bln $ 42 bln $ 8000000

46,87,496

72,55,789

42,45,096

34,56,033

Industrial Output yy Jan -1.60% 1.00%

32,62,881

27,89,169

6000000

Manufacturing Output Jan -2.00% 1.60%

Trade Deficit Govt - USD Feb -12.6bln $ -15.7bln $ 4000000

WPI Food yy Feb 3.31% -0.26% 2000000

WPI Fuel yy Feb 0.58% -4.78%

WPI Inflation yy Feb 4.17% 2.03% 0

9-Mar 10-Mar 12-Mar 15-Mar 16-Mar 17-Mar

WPI Manuf Inflation yy Feb 5.81% 5.13%

NSE Derivative

Corporate Action Tracker Sectoral Performance – Monthly Returns (%)

Security name Action Ex Date Record Date Status Price (|)

Metals 5.8

ICICI Securities – Retail Equity Research

The Anup Enginnering Buyback Ongoing IT 4.9

BSE Small Cap 4.2

Jagran Prakashan Buyback Ongoing Power 4.1

Arvind Fashions Rights Issue Ongoing 135.00 Oil & Gas 1.6

Consumer Durables 1.0

Astral Poly Technik Bonus Issue 18-Mar-21 19-Mar-21 01:03 PSU 0.1

Coal India Dividend 15-Mar-21 16-Mar-21 5.00 FMCG -0.6

BSE Midcap -1.0

Engineers India Dividend 18-Mar-21 19-Mar-21 1.40 Capital Goods -3.6

IIFL Securities Dividend 18-Mar-21 19-Mar-21 1.00 Real Estate -5.1

Healthcare -5.2

Ambuja Cements Dividend 19-Mar-21 22-Mar-21 1.00 Auto -7.3

Banks -7.4

-10.0 -5.0 0.0 5.0 10.0

(%)

Key News for Today

Company/I News View Impact

ndustry

Telecom As per Trai monthly subscriber data, Airtel The subscriber addition momentum

sector added 5.9 million (mn) customers in January, continues to be robust for Airtel with

2021, while Jio added 1.95 mn. Vodafone continued leadership among peers for the

Idea (VIL) added 1.7 mn subscribers. In terms last six months. VIL has finally started net

of active subscriber, Airtel added 6.9 mn

customers in January, while Jio lost 3.4 mn

subscribers and VIL lost 0.3 mn active

addition (after 15 months), led by

completion of integration process, which

is positive

subscribers. Even in terms of data

subscribers, Airtel led with 5.5 mn addition,

Jio added 1.95 mn, while VIL added 1.9 mn

subscribers

ICICI Securities | Retail Research

Opening Bell ICICI Direct Research

Bhel Bhel has emerged as lowest bidder for tender Bhel has won orders worth ~| 9100 crore

worth ~| 10800 crore for fleet mode tender for 9MFY21. Further, this large nuclear

floated by Nuclear Power Corporation of India order would aid Bhel's order intake for

for the 6x700 MW Turbine Island Package FY21E despite the challenging

Projects environment in the power sector.

Significantly, with this, Bhel has retained

its market leadership position of being the

sole Indian supplier of nuclear steam

turbines. However, recent execution

headwinds in the power segment due to

various issues leading to project delays

and working capital stress are major near

term challenges and need to be resolved

quickly to recover reduced revenue amid

pandemic

Indian As per media sources, Delhivery is in talks An expected completion of the deal with

express with multiple global investors, including above valuation (50% jump in three

logistics Fidelity, for funding before its initial public months), would also provide a boost in

sector, offer (IPO) that would value the startup at valuation multiple for the entire express

BlueDart around $3 billion. It was valued at ~$2 billion logistics sector (especially profitable

at its earlier round of funding in December, competitors like BlueDart)

2020

Container As per The Economic Times, to tide over the With 34 CFSEes, JNPT, set up as a CFS

freight crisis of falling business volume and plunging port, is the largest CFSes facility in the

stations margins, down over 50% from the pre-DPD country, followed by Chennai with around

days, CFS association has requested to allow 30, Mundra (14) and Kochi, Pipavav and

CFS to utilise their excess capacity by Hazira having two each, among others.

handling non-exim cargo, especially domestic According to the association, the ~160

cargo bound for coastal shipping, in the new CFSes across the ports have been

logistics policy operating at around 40% capacity on one

hand, and on wafer-thin margins on the

other, as most containers are directly

delivered to consignees

Intellect Intellect Design Arena (Intellect) hosted an We believe the company is poised to

Design analyst meet to highlight it's key product benefit from healthy traction in its

Arena features and its cloud & API ready products. products. However, recent run up in stock

The company also highlighted that its retail price factors in most of the positives

banking product (~30% of revenues) is

expected to do well and its overall market is

expected to grow at a CAGR of 10% till

FY25E. In addition, it's insurance product

(20% of topline) is expected to witness

healthy traction

Key developments (Continued…)

The Ministry for Corporate Affairs has hinted that the suspension of the Insolvency and Bankruptcy Code (IBC)

is likely to be revoked after March 24, 2021, as per Business Line

RBI’s list of systemically important banks may widen, given the changes in the pecking order after the merger

of state-run players. As on date, only State Bank of India (SBI), HDFC Bank and one large private bank figure in

the central bank’s classification of domestic systemically important banks (D-SIBs), but this list could get

reworked, as reported in Business Standard

As per Business Line, Indian ports handled ~16.1 million TeUs of container at all ports in 2019, of which 12

million TeUs (75% of total) were gateway and 4 million TeU (25%) was transshipment. Colombo port handled

2.5 million TeU of transshipment while Singapore and Port Klang handled 0.9 million

ICICI Securities | Retail Research

Opening Bell ICICI Direct Research

Banks have written to the Reserve Bank of India seeking an extension of the March 31 deadline for repayment

of interest accrued on working capital loans during the moratorium. With two weeks remaining for the

deadline, around | 15,000-20,000 crore of working capital interest in the banking system remains unpaid by the

borrowers. Banks have sought extension on the deadline beyond March 2021 as reported in Financial Express

According to The Economic Times, a proposed US immigration bill if enacted would lead to 35% annual

increase in green cards. The number of persons obtaining lawful permanent residency would rise by 3,75,000

each year to about 1.5 million in total

As per Business Line, Gati has started air freight solutions for pharma, electronics and auto ancillaries sectors

and plans to spend about | 100 crore on infrastructure and technology development in this area in FY22

IOC has formed a JV with Phinergy, IOC Phinergy Pvt Ltd to manufacture ultra-lightweight metal-air batteries

for electric vehicles

Somany Ceramics has planned to a) modernise/expand the production line of double fast firing to produce

large format wall tile at the Kassar Plant. Post modernisation, the capacity will increase to ~16000 square metre

per day from current ~7000 square metre per day of wall tile. The total investment required is | 45 crore.

Additionally, the company has decided to make investment in a) Sudha Somany Ceramics (a subsidiary of the

Company): maximum cap of | 42 crore towards the capacity expansion of 3.6 mn sq ft per annum of glaze

vitrified tiles, b) Somany Piastrelle (a wholly owned subsidiary), maximum cap of | 90 crore towards setting up

a greenfield project of 3.48 mn sq ft per annum of glazed vitrified tiles at Gujarat. The company has also

declared Interim dividend of | 2.40 per equity share for FY21

Dixon Technologies had announced for split the face value of its shares from | 10 to | 2 on February 2021. The

share will be quoting on an ex-split basis from March 18, 2021

Astral Poly shares will turn ex-bonus today. The company announced one bonus share for every four shares on

February 2021

Icra has upgraded the rating for Indian Metal and Ferro Alloys of long term loans from banks to A from A- with

stable outlook and short-term loans from banks to A1 from A2+

ICICI Securities | Retail Research

Opening Bell ICICI Direct Research

Nifty Weekly Chart Technical Outlook

Equity benchmarks edged lower on Wednesday

amid subdued global cues ahead of ahead of US

Fed policy. Nifty settled the session at 14721,

down 189 points or 1.3%. In the coming session,

volatility would remain high owing to volatile global

cues and weekly derivative expiry. We expect the

index to maintain positive bias after a gap up

opening. Hence, after a positive opening use

intraday dips towards 14810-14835 to create long

position for target of 14924.

Going ahead, 14700 will be the key levels to watch,

as holding above 14700 on a closing basis would

keep pullback option open towards psychological

mark of 15000 levels. Failure to do so will lead to

extended breather. Bank Nifty is also placed

around the key support area of 34000. As it

commands 40% weight in Nifty, hence holding

above the key support area of 34000 on a closing

basis will lead to a meaningful pullback in bank

index which would lead nifty higher.

Pivot Points CNX Nifty Technical Picture

Index/Stocks Trend Close S1 S2 R1 R2 Nifty 50 Intraday Short Term

SENSEX Negative 49801.6 49493 49185 50335 50869 Trend Up Range Bound

Nifty 50 Negative 14721.3 14625 14531 14886 15052 Support 14770-14700 14700

ACC Ltd Negative 1727.7 1707 1687 1762 1797 Resistance 14890-14940 15000

20 day EMA 0 14929.0

Axis Bank Ltd Negative 727.9 722 715 739 749

200 day EMA 0 12972.0

HDFC BANK LTD Negative 1495.4 1477 1459 1526 1557

SBI Negative 368.2 362 357 376 385

HERO MOTOCORP LT Negative 3190.6 3151 3111 3255 3319 Advances/Declines

MOTHERSON SUMI Positive 220.6 218 215 225 229 Advances Declines Unchanged

Tata Motors Negative 305.8 300 294 316 326 BSE 795 2188 142

M&M FIN SERVICES Negative 203.5 200 197 210 215 NSE 385 1579 56

BAJAJ AUTO LTD Negative 3569.6 3524 3479 3646 3723

TCS Positive 3113.0 3081 3048 3151 3188 Daily Technical Calls

INDIAN OIL CORP Negative 98.2 97 96 100 102 Daily Technical Calls

CIPLA LTD Negative 772.2 763 754 788 804 1. Buy TCS in the range of 3126.00-3132.00

PIDILITE INDS Positive 1723.6 1710 1698 1739 1756

2. Sell Amara Raja in the range of 879.00-882.00

Reliance Industries Negative 2055.4 2025 1996 2093 2132

BHARTI AIRTEL Negative 522.9 517 512 529 536 All recommendations of March Future

DR REDDY'S LABS Negative 4355.9 4311 4267 4432 4509 See Momentum Pick for more details

Nifty Call – Put Strike (Number of shares in lakh) – March, 2021 Intraday Derivative Strategy

i) Page Industries

14300 18 0 Buy PAGEIND MAR Fut at ₹28750.00-28800.00

14400 12 1 CMP: 28710.70

14500 37 7 Target 1: 29075 Target 2: 29525

14600 8 2 Stop Loss: 28475

14700 15 6

14800 6 12 ii) Manapurram Finance

14900 8 11 Sell MANAFI MAR Fut at ₹159.30-159.60

15000 22 33 CMP: 159.95

15100 5 16 Target 1:158 Target 2: 155.7

50.0 40.0 30.0 20.0 10.0 0.0 10.0 20.0 30.0 40.0 Stop Loss: 161

Put Call

See Derivatives view for more details

ICICI Securities |Retail Research

See Daily Derivatives for more details

Opening Bell ICICI Direct Research

Results/Events Calendar

01 March 02 March 03 March 04 March 05 March 06 March

Monday Tuesday Wednesday Thursday Friday Saturday

IN Nikkei Markit Manuf. PMI EU CPI (YoY) EU Services PMI EU Retail Sales US Exports CH Imports

IN Bank Loan Growth JP Services PMI EU PPI YoY EU Unemployment Rate IN FX Reserves USD CH Exports YoY

IN Deposit Growth IN Exports US Services PMI US Initial Jobless Claims US Trade Balance CH Trade Balance

JP Unemployment Rate IN Imports US Crude Oil Inventories 0 US Unemployment Rate CH FX Reserves

US Manufacturing PMI IN Trade Balance 0 0 US Federal Budget 0

08 March 09 March 10 March 11 March 12 March 13 March

Monday Tuesday Wednesday Thursday Friday Saturday

JP GDP QoQ EU GDP QoQ US CPI YoY EU Deposit Facility Rate IN CPI YoY, US PPI MoM 0

CH Trade Balance CH CPI YoY US Federal Budget Balance EU Interest Rate Decision IN Industrial Production YoY 0

0 CH PPI YoY US Crude Oil Inventories 0 IN Manufacturing Output MoM 0

0 0 JP PPI YoY 0 IN FX Reserves USD,CH FDI 0

0 0 0 0 IN Bank loan growth 0

15 March 16 March 17 March 18 March 19 March 20 March

Monday Tuesday Wednesday Thursday Friday Saturday

IN WPI Inflation US Retail Sales EU CPI YoY EU Trade Balance IN FX Reserves (USD) 0

IN WPI Manuf. Inflation US Capacity Utilisation EU Construction Output US Initial Jobless Claims 0 0

IN Imports US Industrial Prod YoY US Crude Oil Inventories EU Trade Balance 0 0

IN Exports JP Exports,JP Imports 0 0 0 0

IN Trade Balance JP Trade Balance 0 0 0 0

22 March 23 March 24 March 25 March 26 March 27 March

Monday Tuesday Wednesday Thursday Friday Saturday

US Existing Home Sales UK Unemployement Rate EU Manufacturing PMI US GDP QoQ US Goods Trade Balance 0

0 JP Manufacturing PMI EU Services PMI 0 US Personal Spending 0

0 US New Home Sales EU Consumer Confidence 0 US Personal Income 0

0 UK Unemployment Rate US Manufacturing PMI 0 CH Industrial Profit 0

0 US Current Account US Services PMI 0 0 0

29 March 30 March 31 March 01 April 02 April 03 April

Monday Tuesday Wednesday Thursday Friday Saturday

JP Unemployment Rate EU Consumer Confidence EU CPI YoY EU Manufacturing PMI US Unemployment Rate 0

JP Retail Sales US CB Consumer Confidence IN Federal Fiscal Deficit US Manufacturing PMI 0 0

0 CH Manufacturing PMI IN Infrastructure Output(YoY)0 0 0

0 CH Non-Manufacturing PMI IN Foreign Debt 0 0 0

0 0 JP Manufacturing PMI 0 0 0

Major Economic Events this Week Bulk Deals

Date Event Country Period Actual Expected No. of Price

Company Client Name Type

15-Mar WPI Inflation IN Mar 4.2% 3.2% shares (|)

BSE*

15-Mar WPI Manufacturing Inflation IN Mar 5.8% -

Hinduja Global AASIA Management &

15-Mar Imports IN Feb 40.54B - Buy 10,40,000 1210.0

Solutions Limited Consultancy P Ltd.

15-Mar Exports IN Feb 27.93B - NSE*

15-Mar Trade Balance IN Feb -12.62B -12.90B Infibeam Avenues L7 HITECH PRIVATE

Buy 74,43,723 102.2

16-Mar Retail Sales US Feb -3.0% -0.5% Limited LIMITED

16-Mar Capacity Utilisation Rate US Feb 73.8% 75.5%

16-Mar Industrial Production YoY US Feb -4.3% -

16-Mar Exports JP Mar -4.5% -0.8%

16-Mar Imports JP Mar 11.8% 11.9%

16-Mar Trade Balance JP Mar 217.4B 420.4B

17-Mar Crude Oil Inventories US Feb 2.396M 2.964M

17-Mar Construction Output EU Feb 0.8% -

17-Mar CPI YoY EU Feb 0.9% 0.9% Recent Releases

17-Mar Fed Interest Rate Decision US Mar 0.3% 0.3% Date Report

Date Event Country Period Expected Previous March 17,2021 Company Update-SAIL

18-Mar Trade Balance EU Mar 25.3B 29.2B

March 17,2021 Company Update-Indian Brokerage Industry

18-Mar Initial Jobless Claims US Mar 705K 712K

March 16,2021 Idirect Instinct-Indian Energy Exchange

18-Mar FX Reserves IN Mar - 584.55B

March 15,2021 Company Update-Action Construction

March 12,2021 Company Update-Blue Dart Express

ICICI Securities |Retail Research

Opening Bell ICICI Direct Research

SSSSSSV,

Pankaj Pandey Head – Research

pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities |Retail Research

Opening Bell ICICI Direct Research

Disclaimer

ANALYST CERTIFICATION

I/We, Pankaj Pandey, Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about

the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. It

is also confirmed that above mentioned Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months and do not serve

as an officer, director or employee of the companies mentioned in the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products.

ICICI Securities is Sebi registered stock broker, merchant banker, investment adviser, portfolio manager and Research Analyst. ICICI Securities is registered with Insurance Regulatory Development

Authority of India Limited (IRDAI) as a composite corporate agent and with PFRDA as a Point of Presence. ICICI Securities Limited Research Analyst SEBI Registration Number – INH000000990. ICICI

Securities Limited SEBI Registration is INZ000183631 for stock broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries

engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available

on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment

banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities and its analysts, persons reporting to analysts

and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing on

a company's fundamentals and, as such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical Research

Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions

expressed in this document may or may not match or may be contrary with the views, estimates, rating, and target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential

and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in

any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or

keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular

security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting

in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed.

This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or

other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as

customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable

or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions,

based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient.

The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason.

ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance.

Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in

projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any othe r

assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for

services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific

transaction.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not

receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities

nor Research Analysts and their relatives have any material conflict of interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of

the month preceding the publication of the research report.

Since associates of ICICI Securities and ICICI Securities as a entity are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various

companies including the subject company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such

jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are

required to inform themselves of and to observe such restriction.

ICICI Securities |Retail Research

You might also like

- Pakistan ATE ListDocument8 pagesPakistan ATE ListZaid Ahmad0% (1)

- Opening BellDocument9 pagesOpening BellAkshay keerNo ratings yet

- Opening Bell: Market Outlook Today's HighlightsDocument10 pagesOpening Bell: Market Outlook Today's HighlightsParsuram JiNo ratings yet

- Premarket OpeningBell ICICISec 07.02.19Document9 pagesPremarket OpeningBell ICICISec 07.02.19rchawdhry123No ratings yet

- Opening Bell: Market Outlook Today's HighlightsDocument7 pagesOpening Bell: Market Outlook Today's Highlightsvikrampunia3No ratings yet

- Opening Bell: Market Outlook Today's HighlightsDocument7 pagesOpening Bell: Market Outlook Today's HighlightsDevendra MahajanNo ratings yet

- Premarket OpeningBell ICICISec 08.02.19Document9 pagesPremarket OpeningBell ICICISec 08.02.19rchawdhry123No ratings yet

- Market Openingbell IciciDocument8 pagesMarket Openingbell IciciPrince ANo ratings yet

- Market - Opening Bell - ID - 2.8.2021Document14 pagesMarket - Opening Bell - ID - 2.8.2021Atish MukherjeeNo ratings yet

- Opening Bell: July 13, 2022 Market Outlook Today's HighlightsDocument8 pagesOpening Bell: July 13, 2022 Market Outlook Today's HighlightsPorus Saranjit SinghNo ratings yet

- OpeningbellDocument11 pagesOpeningbellBhagwan BachaiNo ratings yet

- Opening Bell: September 22, 2021 Market Outlook Today's HighlightsDocument8 pagesOpening Bell: September 22, 2021 Market Outlook Today's HighlightsPorus Saranjit SinghNo ratings yet

- 2010.06.18 - 0105PM - Kisan - 533151 - KRChoksey DB Corporation Limited Event - Rally10Document4 pages2010.06.18 - 0105PM - Kisan - 533151 - KRChoksey DB Corporation Limited Event - Rally10itsmnjNo ratings yet

- SFMRDocument6 pagesSFMRAli RazaNo ratings yet

- ETF Note - July 21-202107091524452442313Document6 pagesETF Note - July 21-202107091524452442313anirudhjayNo ratings yet

- MMSF FS 202304Document2 pagesMMSF FS 202304beddybair98No ratings yet

- Evaluating Markets by Motilal OswalDocument54 pagesEvaluating Markets by Motilal OswalSaurabh NyatiNo ratings yet

- Opening Bell: Market Outlook Today's HighlightsDocument7 pagesOpening Bell: Market Outlook Today's HighlightsShivangi RathiNo ratings yet

- Markets at 60000 Level Our View and RecommendationDocument7 pagesMarkets at 60000 Level Our View and Recommendationamit raviNo ratings yet

- Deepening The Onshore IRS Market: BNM's Market InitiativeDocument6 pagesDeepening The Onshore IRS Market: BNM's Market InitiativenanaNo ratings yet

- 169227225516856971691685695950the Phoenix Mills LTD - January 2023 D SignedDocument9 pages169227225516856971691685695950the Phoenix Mills LTD - January 2023 D SignedAnupam SharmaNo ratings yet

- Excel Project ManagerDocument30 pagesExcel Project ManagerMohamed LabbeneNo ratings yet

- CMS Report 2024Document20 pagesCMS Report 2024Nilesh KumarNo ratings yet

- Global Economic Outlook 2021Document44 pagesGlobal Economic Outlook 2021malimalineeNo ratings yet

- Monetary Policy Mar-21-3Document1 pageMonetary Policy Mar-21-3kalimNo ratings yet

- FMR - May 2013Document12 pagesFMR - May 2013Salman ArshadNo ratings yet

- Dolat Capital Modi Era S Century An AnalysisDocument21 pagesDolat Capital Modi Era S Century An AnalysisRohan ShahNo ratings yet

- Concept Note 9Document12 pagesConcept Note 9Nirup ChaudhuryNo ratings yet

- Stewart & Mackertich Research - India Strategy March 2017Document44 pagesStewart & Mackertich Research - India Strategy March 2017sannjay3917No ratings yet

- 7.05.2021 - BCR Info Macro Si FinanciarDocument3 pages7.05.2021 - BCR Info Macro Si FinanciarAdrian LasloNo ratings yet

- Coasting Along A Strong and Stable Growth Trajectory: Strong Traction in Digital Lending and Trade FinanceDocument10 pagesCoasting Along A Strong and Stable Growth Trajectory: Strong Traction in Digital Lending and Trade Financekarnasutputra0No ratings yet

- ITC by EdelweissDocument9 pagesITC by EdelweissdarshanmadeNo ratings yet

- ITC Limited - Trading Buy: Welcome Value, Bye Bye ESGDocument9 pagesITC Limited - Trading Buy: Welcome Value, Bye Bye ESGgkNo ratings yet

- 1638528631MRE Nov 2021Document18 pages1638528631MRE Nov 2021Diksha SinghNo ratings yet

- IDirect SunPharma Q4FY22Document9 pagesIDirect SunPharma Q4FY22Sanjana OberoiNo ratings yet

- Timesheet Roto # 16 Feb - 15 Mar 2022Document2 pagesTimesheet Roto # 16 Feb - 15 Mar 2022setianidarwatiNo ratings yet

- Poker League 10 JANDocument1 pagePoker League 10 JANmr_hiboyNo ratings yet

- KASB 2021 Equity StrategyDocument98 pagesKASB 2021 Equity StrategymirzaNo ratings yet

- CBRE Research Figures Australia Office Q1 2024Document10 pagesCBRE Research Figures Australia Office Q1 2024dawaknightNo ratings yet

- Excel Project ManagerDocument30 pagesExcel Project ManagerConception & Fabrication MécaniqueNo ratings yet

- Jsil FMR Dec 2022Document24 pagesJsil FMR Dec 2022MUHAMMAD QASIMNo ratings yet

- Torrent Power PDFDocument10 pagesTorrent Power PDFAniket DhanukaNo ratings yet

- JB Chemicals & Pharma - BUY: Focus-Products To Drive India OutperformanceDocument6 pagesJB Chemicals & Pharma - BUY: Focus-Products To Drive India OutperformanceAnupam JainNo ratings yet

- Hortifrut - Comprar - La Compañía Fortalece Su Presencia en Europa A Lo Largo de La Cadena de ValorDocument2 pagesHortifrut - Comprar - La Compañía Fortalece Su Presencia en Europa A Lo Largo de La Cadena de ValorAndres UrrutiaNo ratings yet

- Hortifrut - Comprar - La Compañía Fortalece Su Presencia en Europa A Lo Largo de La Cadena de ValorDocument2 pagesHortifrut - Comprar - La Compañía Fortalece Su Presencia en Europa A Lo Largo de La Cadena de ValorAndres UrrutiaNo ratings yet

- Parte 2Document34 pagesParte 2Odla Sedlej OcopihcNo ratings yet

- MER January 2022Document29 pagesMER January 2022Arden Muhumuza KitomariNo ratings yet

- InflationDocument42 pagesInflationTwinkle MehtaNo ratings yet

- AllfmrDocument11 pagesAllfmrAli RazaNo ratings yet

- Annual Outlook For 2024 Equity and Fixed Income Combineddoc 240101115850 142ec8c3Document56 pagesAnnual Outlook For 2024 Equity and Fixed Income Combineddoc 240101115850 142ec8c3wqxpyjpmuvrclzqihuNo ratings yet

- Buy Indusind Bank (Iib) : Guidance of Deposit Growth Improvement Asset Quality DeterioratesDocument7 pagesBuy Indusind Bank (Iib) : Guidance of Deposit Growth Improvement Asset Quality DeterioratesshaikhsaadahmedNo ratings yet

- Shifting The Savings Appetite of Nigerian InvestorsDocument26 pagesShifting The Savings Appetite of Nigerian InvestorsST KnightNo ratings yet

- Hold HCL Technologies: A EBIT Margin SurpriseDocument11 pagesHold HCL Technologies: A EBIT Margin SurpriseChristianStefanNo ratings yet

- Spark How Economic Activities Shaping Under Covid 19 Week 5Document17 pagesSpark How Economic Activities Shaping Under Covid 19 Week 5ABHISHEK DALAL 23No ratings yet

- Excel Project ManagerDocument34 pagesExcel Project ManagerErlang PratamaNo ratings yet

- Excel Project ManagerDocument30 pagesExcel Project ManagerFika JeNo ratings yet

- W99 Lifting Station Work PlanningDocument1 pageW99 Lifting Station Work PlanningAmar AizadNo ratings yet

- AKD Index Tracker Fund: Fund Manager's CommentsDocument1 pageAKD Index Tracker Fund: Fund Manager's CommentsAli RazaNo ratings yet

- Toilet Cleaning Check ListDocument2 pagesToilet Cleaning Check ListSreejith VarmaNo ratings yet

- CRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2020Document48 pagesCRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2020MohitNo ratings yet

- IDirect HCLTech Q1FY23Document10 pagesIDirect HCLTech Q1FY23Porus Saranjit SinghNo ratings yet

- IDirect Mindtree Q1FY23Document11 pagesIDirect Mindtree Q1FY23Porus Saranjit SinghNo ratings yet

- Porus Singh 1 Page CV 17-Oct-2023Document1 pagePorus Singh 1 Page CV 17-Oct-2023Porus Saranjit SinghNo ratings yet

- Weekly Derivative Report 26 June 2023 - 26-06-2023 - 09Document8 pagesWeekly Derivative Report 26 June 2023 - 26-06-2023 - 09Porus Saranjit SinghNo ratings yet

- Weekly Currency Report 12 June 2023 - 11-06-2023 - 22Document4 pagesWeekly Currency Report 12 June 2023 - 11-06-2023 - 22Porus Saranjit SinghNo ratings yet

- Aptus Value Housing Finance LTD - Pick of The Week - Axis Direct - 100623 (1) - 12-06-2023 - 09Document4 pagesAptus Value Housing Finance LTD - Pick of The Week - Axis Direct - 100623 (1) - 12-06-2023 - 09Porus Saranjit SinghNo ratings yet

- Metals & Mining: Steel Companies' Ebitda/Tonne Likely To Soften QoqDocument5 pagesMetals & Mining: Steel Companies' Ebitda/Tonne Likely To Soften QoqPorus Saranjit SinghNo ratings yet

- Derivatives Weekly View: Positive Bias Remains Intact Till Nifty Holds Above 15900Document13 pagesDerivatives Weekly View: Positive Bias Remains Intact Till Nifty Holds Above 15900Porus Saranjit SinghNo ratings yet

- 5paisa Capital: Curb in Opex Aids BottomlineDocument6 pages5paisa Capital: Curb in Opex Aids BottomlinePorus Saranjit SinghNo ratings yet

- HSL - End of The Day Summary 15072022-202207151712151972854Document4 pagesHSL - End of The Day Summary 15072022-202207151712151972854Porus Saranjit SinghNo ratings yet

- Daily Derivative Report - 15072022 - 15-07-2022 - 07Document5 pagesDaily Derivative Report - 15072022 - 15-07-2022 - 07Porus Saranjit SinghNo ratings yet

- Daily Derivative Report - 13072022 - 13-07-2022 - 09Document5 pagesDaily Derivative Report - 13072022 - 13-07-2022 - 09Porus Saranjit SinghNo ratings yet

- Currency Report - Daily - 13 July 2022 - 13-07-2022 - 09Document4 pagesCurrency Report - Daily - 13 July 2022 - 13-07-2022 - 09Porus Saranjit SinghNo ratings yet

- Cement - Q4FY22 Earnings Preview - 06-04-2022 - 10Document9 pagesCement - Q4FY22 Earnings Preview - 06-04-2022 - 10Porus Saranjit SinghNo ratings yet

- Currency Report - Daily - 14 July 2022 - 13-07-2022 - 22Document4 pagesCurrency Report - Daily - 14 July 2022 - 13-07-2022 - 22Porus Saranjit SinghNo ratings yet

- Currency Report - Daily - 15 June 2022 - 15-06-2022 - 07Document4 pagesCurrency Report - Daily - 15 June 2022 - 15-06-2022 - 07Porus Saranjit SinghNo ratings yet

- Opening Bell: July 13, 2022 Market Outlook Today's HighlightsDocument8 pagesOpening Bell: July 13, 2022 Market Outlook Today's HighlightsPorus Saranjit SinghNo ratings yet

- IDirect JSWSteel Q4FY22Document10 pagesIDirect JSWSteel Q4FY22Porus Saranjit SinghNo ratings yet

- Opening Bell: September 22, 2021 Market Outlook Today's HighlightsDocument8 pagesOpening Bell: September 22, 2021 Market Outlook Today's HighlightsPorus Saranjit SinghNo ratings yet

- Covid Recovery Pulse: September 17, 2021Document7 pagesCovid Recovery Pulse: September 17, 2021Porus Saranjit SinghNo ratings yet

- IDirect NeogenChemicals ICDocument18 pagesIDirect NeogenChemicals ICPorus Saranjit SinghNo ratings yet

- Paras Defence & Space Technologies LTD: UnratedDocument12 pagesParas Defence & Space Technologies LTD: UnratedPorus Saranjit SinghNo ratings yet

- Annual Report 2016 Kewal KiranDocument196 pagesAnnual Report 2016 Kewal KiranPorus Saranjit SinghNo ratings yet

- Recipe of Vada PavDocument6 pagesRecipe of Vada PavPorus Saranjit Singh0% (1)

- Companies List With Contact DetailsDocument80 pagesCompanies List With Contact DetailsAshu VohraNo ratings yet

- N&K - Grower PresentationDocument15 pagesN&K - Grower Presentationbrenda.greyvensteynNo ratings yet

- P KumaresanDocument13 pagesP KumaresanJohn Luis Nebreja Ferrera100% (1)

- Marriott-Key Financial IndicatorsDocument4 pagesMarriott-Key Financial Indicatorssheersha kkNo ratings yet

- Densitya Keyto Wood QualityDocument198 pagesDensitya Keyto Wood QualityAna Marcia LadeiraNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument19 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceblinkfinance7No ratings yet

- B-F Customer List 2007-2012Document40 pagesB-F Customer List 2007-2012Pantas MotorNo ratings yet

- Operating Segments - Problems: A. 1, 4, and 5Document2 pagesOperating Segments - Problems: A. 1, 4, and 5venice cambryNo ratings yet

- Delhi EscortsDocument3 pagesDelhi EscortsRekha ShuklaNo ratings yet

- Berger PaintDocument93 pagesBerger PaintYash SamarthNo ratings yet

- NSTP Proj. ProposalDocument3 pagesNSTP Proj. Proposalalegarbes PatNo ratings yet

- MS 3413 Activity-Based Costing SystemDocument5 pagesMS 3413 Activity-Based Costing SystemMonica GarciaNo ratings yet

- Chapter 4 - Sentence TemplatesDocument4 pagesChapter 4 - Sentence TemplatesDy DươngNo ratings yet

- NCR NegoSale Batch 15080 072621Document36 pagesNCR NegoSale Batch 15080 072621JarekNo ratings yet

- Dokumen - Tips Hsbcnet Mt940 Id Rev2Document6 pagesDokumen - Tips Hsbcnet Mt940 Id Rev2Emmanuel AristyaNo ratings yet

- Application of The Control Framework For The Billing ProcessDocument13 pagesApplication of The Control Framework For The Billing ProcessNadira Fadhila HudaNo ratings yet

- Policy Doc PDFDocument4 pagesPolicy Doc PDFhiteshmohakar15No ratings yet

- GTC Evidences Edited With ANNEXDocument7 pagesGTC Evidences Edited With ANNEXLorieNo ratings yet

- Economy Analysis of Kullu Bhuntar Urban AgglomerationDocument4 pagesEconomy Analysis of Kullu Bhuntar Urban Agglomerationpriyesh waghmare100% (1)

- Overview of Management Services Exercises and MCDocument3 pagesOverview of Management Services Exercises and MCAbi PiNo ratings yet

- PDF BMC FinalDocument17 pagesPDF BMC Finalshela may billanesNo ratings yet

- Test Bank For Managerial Accounting, 17e Ray Garrison, Eric Noreen, Peter BrewerDocument53 pagesTest Bank For Managerial Accounting, 17e Ray Garrison, Eric Noreen, Peter Brewershehzadfarukh68No ratings yet

- Vdocuments - MX Kawasaki Fury Parts DiagramDocument113 pagesVdocuments - MX Kawasaki Fury Parts Diagramᜇᜒᜃ᜔ᜐ᜔ ᜀᜎ᜔ᜆᜓᜇNo ratings yet

- Module Anaplan - Level 1Document14 pagesModule Anaplan - Level 1Hanifan NurhudaNo ratings yet

- Cruce de Referencias Transponder-CtaDocument1 pageCruce de Referencias Transponder-CtaGregori LoayzaNo ratings yet

- Pakistan'S Economy & The Role of Imf & World Bank On ITDocument15 pagesPakistan'S Economy & The Role of Imf & World Bank On ITAsaad Imtiaz100% (1)

- Delivery ChecklistDocument2 pagesDelivery ChecklistManish SrivastavaNo ratings yet

- Le Meridien JakartaDocument6 pagesLe Meridien JakartaAlvin AloysiusNo ratings yet

- Rules For Non Medical BusinessDocument1 pageRules For Non Medical BusinessAbhijit AminpurNo ratings yet