Professional Documents

Culture Documents

Case 3: Rockboro Machine Tools Corporation Executive Summary

Case 3: Rockboro Machine Tools Corporation Executive Summary

Uploaded by

Maricel GuarinoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 3: Rockboro Machine Tools Corporation Executive Summary

Case 3: Rockboro Machine Tools Corporation Executive Summary

Uploaded by

Maricel GuarinoCopyright:

Available Formats

Case 3: Rockboro Machine Tools Corporation

Executive Summary

Rockboro Machine Tools Corporation started as a machine tool manufacturer & industrial equipment

manufacturer which then entered the field of computer-aided design and computer-aided manufacturing

(CAD/CAM). It successfully developed a superior line of CAD software and equipment in 1980s. But in the

time of great recession, the company fell behind its competition in developing user-friendly software and

integrating designs. Their net margin dropped and in order to improve their financials, the management

sold 3 unprofitable business lines and 2 plants, eliminated 5 leased facilities in 2012. They also refocused

the marketing and ads and even restructured their personnel in 2014 which resulted to the largest per-

share earnings loss. Dividends were maintained at $0.64 per year until the board voted to pay only the

half for 2014.

In that same year, Rockboro introduced a new system known as the Artificial Intelligence Workforce (AIW)

which first shipped with high orders totaling to $115M with backlog orders of $150M by the year-end. It

was viewed to help restore the margins not seen in years that the management established their

corporate goals with high expectations in their revenues, yielding at an average annual compound rate of

15% through 2021. The board, whom declared no dividend payout at the start of 2015, even committed

to resume payment ideally at the end of the year. Conversely, the management stayed concerned about

the apparent developments from competitors and an unfavorable prediction in US & major economies in

the coming years.

For the past 4 years, investments in Rockbro returned no capital gains to its shareholders. With a current

stock price of $15.25 which has been the same as it had been on September 15, 2011. The CFO of the firm,

Sara Larson, needs to submit a recommendation regarding the company’s dividend policy. Larson even

recalls that the company repurchased their stocks back in 2009, but no apparent impact had been gained.

Using the Sources-and-Uses model of Rockboro, the group projected the possible earnings until 2021 to

align with the company’s corporate goals. The company had an impression that 40% Debt-to-Equity ratio

would work best for them. The projection suggested a 32% payout rate to comply with the 40% D/E ratio

until 2021, assuming the consistent sales growth of 15%. The current stock price was tested and thought

to be undervalued, but buying back stocks would only reduce the available resources intended for any

dividend payout so it is not suggested to be pushed through.

You might also like

- Group B&D - Case 19 - Fonderia PresentationDocument24 pagesGroup B&D - Case 19 - Fonderia PresentationVinithi Thongkampala100% (2)

- Case 26 Rockboro Group ADocument27 pagesCase 26 Rockboro Group AKanoknad KalaphakdeeNo ratings yet

- Rockboro Machine Tools Corporation Case QuestionsDocument1 pageRockboro Machine Tools Corporation Case QuestionsMasumiNo ratings yet

- Case Report "Stryker: In-Sourcing PCBS"Document2 pagesCase Report "Stryker: In-Sourcing PCBS"Vishakha ChopraNo ratings yet

- Case 7Document3 pagesCase 7Shaarang BeganiNo ratings yet

- Case Study On Gainesboro Machine Tools CorporationDocument13 pagesCase Study On Gainesboro Machine Tools Corporationemehmehmeh86% (7)

- Eastboro Case SolutionDocument22 pagesEastboro Case Solutionuddindjm100% (2)

- Individual Case Writing AssignmentDocument6 pagesIndividual Case Writing Assignmentapi-273010008No ratings yet

- OM Scott Case AnalysisDocument20 pagesOM Scott Case AnalysissushilkhannaNo ratings yet

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- Massachusetts Financial Services Case AnalysisDocument4 pagesMassachusetts Financial Services Case AnalysisNayan Manik Tripura100% (2)

- T.1 Bahasa Inggris NiagaDocument2 pagesT.1 Bahasa Inggris NiagaNovi Risa0% (2)

- Introduction of Volkswagen Do Brasil Driving Strategy With The Balanced Scorecard Case Solutio1Document3 pagesIntroduction of Volkswagen Do Brasil Driving Strategy With The Balanced Scorecard Case Solutio1Pepito PerezNo ratings yet

- Rockboro Machine Tools Corporation: Source: Author EstimatesDocument10 pagesRockboro Machine Tools Corporation: Source: Author EstimatesMasumi0% (2)

- Dividend Policy Case (Gainesboro Machine Tools) - Session 2-Group 8Document19 pagesDividend Policy Case (Gainesboro Machine Tools) - Session 2-Group 8api-2001200071% (7)

- Envy Rides Case DecisionDocument4 pagesEnvy Rides Case DecisionMikey MadRatNo ratings yet

- Target Corporation: Ackman Versus The Board: FM2 Case Study AnalysisDocument6 pagesTarget Corporation: Ackman Versus The Board: FM2 Case Study AnalysisSuman MandalNo ratings yet

- Anagene - Final Case AssignmentDocument19 pagesAnagene - Final Case AssignmentSantiago Fernandez Moreno100% (1)

- Solutions To Chapters 7 and 8 Problem SetsDocument21 pagesSolutions To Chapters 7 and 8 Problem SetsMuhammad Hasnain100% (1)

- Group B&D Case 19 FonderiaDocument12 pagesGroup B&D Case 19 FonderiaVinithi ThongkampalaNo ratings yet

- This Study Resource Was: Group 9 - M&M Pizza Case StudyDocument2 pagesThis Study Resource Was: Group 9 - M&M Pizza Case StudyAsma AyedNo ratings yet

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDocument5 pagesCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashNo ratings yet

- Case 26 Assignment AnalysisDocument1 pageCase 26 Assignment AnalysisNiyanthesh Reddy50% (2)

- Buckeye Bank CaseDocument7 pagesBuckeye Bank CasePulkit Mathur0% (2)

- Facebook IPO Valuation AnalysisDocument13 pagesFacebook IPO Valuation AnalysisMegha BepariNo ratings yet

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- Hill CountryDocument8 pagesHill CountryAtif Raza AkbarNo ratings yet

- Final Case Study G M Machine Tools CorpDocument5 pagesFinal Case Study G M Machine Tools CorpShadab Akhter100% (1)

- Rockboro CaseDocument4 pagesRockboro CaseVan Arloe YuNo ratings yet

- Vers Hire Company Study CaseDocument11 pagesVers Hire Company Study CaseAradhysta SvarnabhumiNo ratings yet

- Eastboro Machine Tools CorporationDocument32 pagesEastboro Machine Tools Corporationrifki100% (2)

- Overview of The Problem:: 0%, 20%, 40% Dividend Payout Along With Residual Payout PolicyDocument2 pagesOverview of The Problem:: 0%, 20%, 40% Dividend Payout Along With Residual Payout PolicyJhonSteveNo ratings yet

- Case 25 Gainesboro-Exh8Document1 pageCase 25 Gainesboro-Exh8odie99No ratings yet

- Case Bidding For Antamina: This Study Resource Was Shared ViaDocument6 pagesCase Bidding For Antamina: This Study Resource Was Shared ViaRishavLakraNo ratings yet

- This Study Resource WasDocument7 pagesThis Study Resource WasmdNo ratings yet

- Jetblue: Relevant Sustainability Leadership (A) : Situational AnalysisDocument1 pageJetblue: Relevant Sustainability Leadership (A) : Situational AnalysisShivani KarkeraNo ratings yet

- Session 10 Simulation Questions PDFDocument6 pagesSession 10 Simulation Questions PDFVAIBHAV WADHWA0% (1)

- Accounting For The IphoneDocument9 pagesAccounting For The IphoneFatihahZainalLim100% (1)

- Stanley Black & Decker IncDocument6 pagesStanley Black & Decker IncNitesh RajNo ratings yet

- Sealed Air CorporationDocument4 pagesSealed Air CorporationValdemar Miguel SilvaNo ratings yet

- Case #7 Butler LumberDocument2 pagesCase #7 Butler LumberBianca UcheNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- New Heritage Doll Company Capital BudgetDocument5 pagesNew Heritage Doll Company Capital BudgetCarlosNo ratings yet

- Sec6 Group13 SimulationDocument5 pagesSec6 Group13 SimulationAvinashDeshpande1989100% (1)

- Sealed Air Corporation's Leveraged Recapitalization (A)Document7 pagesSealed Air Corporation's Leveraged Recapitalization (A)Jyoti GuptaNo ratings yet

- Eastboro Case Write Up For Presentation1Document4 pagesEastboro Case Write Up For Presentation1Paula Elaine ThorpeNo ratings yet

- Sealed Air CorporationDocument7 pagesSealed Air CorporationMeenal MalhotraNo ratings yet

- Case Nike - Cost of Capital Fix 1Document9 pagesCase Nike - Cost of Capital Fix 1Yousania RatuNo ratings yet

- How Does The Internal Market For Innovation at Nypro FunctionDocument2 pagesHow Does The Internal Market For Innovation at Nypro Functionprerna004No ratings yet

- Linear Technology Payout Policy Case 3Document4 pagesLinear Technology Payout Policy Case 3Amrinder SinghNo ratings yet

- FM Project Archroma FinalDocument10 pagesFM Project Archroma FinalRameen Nadeem IqbalNo ratings yet

- Star RiverDocument8 pagesStar Riverjack stauberNo ratings yet

- Deconstructing Roe: Improving Efficiency An Important Parameter While Investing in CompaniesDocument5 pagesDeconstructing Roe: Improving Efficiency An Important Parameter While Investing in CompaniesAkshit GuptaNo ratings yet

- Turn Around Strategy For Avon ProductsDocument10 pagesTurn Around Strategy For Avon ProductsEmmanuel Kibaya OmbiroNo ratings yet

- Gainesboro CaseDocument16 pagesGainesboro Caseapi-402685925No ratings yet

- Financial Performance Evaluation Using RATIO ANALYSISDocument31 pagesFinancial Performance Evaluation Using RATIO ANALYSISGurvinder Arora100% (1)

- Final Project On Engro FinalDocument27 pagesFinal Project On Engro FinalKamran GulNo ratings yet

- Flash Memory IncDocument3 pagesFlash Memory IncAhsan IqbalNo ratings yet

- Fin201 Final Assignment ReportDocument13 pagesFin201 Final Assignment ReportAasif26No ratings yet

- Tata Motors Ratio AnalysisDocument12 pagesTata Motors Ratio AnalysisVasu AgarwalNo ratings yet

- Salesforce Fy 2023 Annual ReportDocument132 pagesSalesforce Fy 2023 Annual ReportsergioNo ratings yet

- Monzon, Jessa Marie M. Law 3E Special ProceedingsDocument4 pagesMonzon, Jessa Marie M. Law 3E Special ProceedingsRonna Faith MonzonNo ratings yet

- Assignment 4.2 Accounting For Income TaxDocument2 pagesAssignment 4.2 Accounting For Income TaxMon RamNo ratings yet

- MujiDocument5 pagesMujiHương PhanNo ratings yet

- Who Moved My Interest Rate - Leading The Reserve Bank of India Through Five Turbulent Years (PDFDrive)Document294 pagesWho Moved My Interest Rate - Leading The Reserve Bank of India Through Five Turbulent Years (PDFDrive)dev guptaNo ratings yet

- Kaizen 5W 1H PDFDocument20 pagesKaizen 5W 1H PDFSUBA NANTINI A/P M.SUBRAMANIAMNo ratings yet

- Inferno Flipkart MarketingReportDocument21 pagesInferno Flipkart MarketingReportRaghav BanthiaNo ratings yet

- Web Class8Document19 pagesWeb Class8Christos MaiNo ratings yet

- Furniture Brochure 2021Document8 pagesFurniture Brochure 2021Haider QadriNo ratings yet

- Development of Capital Markets in ZambiaDocument9 pagesDevelopment of Capital Markets in ZambiaBernard SimwanzaNo ratings yet

- Project Investment Appraisal Process PDFDocument24 pagesProject Investment Appraisal Process PDFsowra vsahaNo ratings yet

- Chap006-Intercompany Transfers of Services and Non Current AssetsDocument41 pagesChap006-Intercompany Transfers of Services and Non Current Assets_casals100% (4)

- Australian Super BrochureDocument4 pagesAustralian Super Brochurehail capiralNo ratings yet

- Unit 8. English Daily Test For Grade 5Document3 pagesUnit 8. English Daily Test For Grade 5NINGSIHNo ratings yet

- Safe OP - Working Machinery On Slopes: General Safety Rules and GuidanceDocument2 pagesSafe OP - Working Machinery On Slopes: General Safety Rules and Guidanceminov minovitchNo ratings yet

- Chap 5 - Contract PerformanceDocument35 pagesChap 5 - Contract PerformancePhương TrươngNo ratings yet

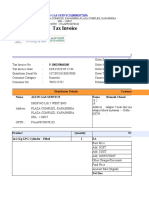

- Tax Invoice: JATIN GAS SERVICE (0000107209)Document4 pagesTax Invoice: JATIN GAS SERVICE (0000107209)RiseNo ratings yet

- Portugal Real Estate Market Research - 19 AprilDocument5 pagesPortugal Real Estate Market Research - 19 AprilTamNo ratings yet

- Handout CHE F343Document3 pagesHandout CHE F343Aryan ShuklaNo ratings yet

- Business Proposal Nutela Cupcake: The Fisher Valley College Taguig CityDocument26 pagesBusiness Proposal Nutela Cupcake: The Fisher Valley College Taguig CityMarlon RaquelNo ratings yet

- 5a - FreddyDocument29 pages5a - Freddyaliona.simon.ousviatsevNo ratings yet

- Basics of Accounting: By: Dr. Bhupendra Singh HadaDocument84 pagesBasics of Accounting: By: Dr. Bhupendra Singh HadaAryanSinghNo ratings yet

- Om FinalDocument37 pagesOm FinalAkliluNo ratings yet

- Black Book AjayDocument59 pagesBlack Book AjayMarshall CountyNo ratings yet

- Chapter 6 - Principles Products Services of IFDocument54 pagesChapter 6 - Principles Products Services of IFYaaga DharsiniNo ratings yet

- Increasing Productivity Through Implementation of 5S Methodology in A Manufacturing Industry: A Case StudyDocument7 pagesIncreasing Productivity Through Implementation of 5S Methodology in A Manufacturing Industry: A Case StudyGCOERC TEAM 5SNo ratings yet

- BQ Prime-RBI - S - Restrictions - On - Deferred - Consideration - Ready - For - Covid - 19Document8 pagesBQ Prime-RBI - S - Restrictions - On - Deferred - Consideration - Ready - For - Covid - 19Aryan StarkNo ratings yet

- Business Model Canvas Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocument2 pagesBusiness Model Canvas Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsLuqman SyahbudinNo ratings yet

- RI Annexure Editable-1Document6 pagesRI Annexure Editable-1pranay jambhaleNo ratings yet

- Project Final Submission (Ajith)Document136 pagesProject Final Submission (Ajith)Amal SunnyNo ratings yet