Professional Documents

Culture Documents

PPC Ian: Dividend Stock Investing Strategy

PPC Ian: Dividend Stock Investing Strategy

Uploaded by

MuciOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PPC Ian: Dividend Stock Investing Strategy

PPC Ian: Dividend Stock Investing Strategy

Uploaded by

MuciCopyright:

Available Formats

PPC Ian: Dividend Stock Investing Strategy

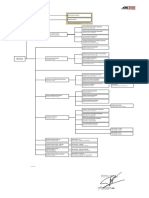

PPCIan.com | 1/12/21 | Copyright (c) IJL Productions LLC

High-Growth Dividend Stocks: Typical Yield Examples:

Examples: Speculative Investments BTC, HYLN,

1% or Less; Funny Fact: "Growth" investors UTZ, CHD, (Optional): No Yield; Fun Angel

are often surprised to learn that these stocks HRL, Fact: Typically utilize gains Investments,

are owned by dividend investors; Fun Fact: WDFC, to invest back into Employee

These longer-term "moonshots" offer a huge RPM, SMG cash-flowing investments Stock

ability for yield-on-cost

Options

(Stocks in-between: AAPL, HON)

Ancillary

Dividend

Stocks: Typical

Cash Flowing

Core " Ride or Die" Dividend Yield 2-4%

Examples: Real Estate:

Stocks: Typical Yield 2-4% (averaging in

CPB, GIS, Commercial

(averaging in the 3s); Fun Examples: the 3s); Fun

WMT, CB; Real Estate,

Fact: These robust JNJ, PEP, Fact: These are

Can Include Rental Real

companies provide a MCD, CLX, close to being

Turnaround Estate, Direct

dependable and growing SBUX, PG, Core stocks,

Plays Like: Ownership (not

stream of dividend income, MMM, O but don't quite

WFC, ABBV falling for

with the ultimate "sleep well make the cut,

syndication nor

at night factor" but I also

platforms)

cannot live

without owning

them.

(Stocks in-between: MO, PM, BTI)

Bond-Like Dividend Stocks: Typical Yield 4-8%; Funny Fact: Many "growth investors" Examples: DUK, SO, UVV,

think this box alone is the entirety of dividend stock investing Example with optionality: PPL

Disclosure: I am long UTZ, CHD, HRL, BTC, AAPL, HON, JNJ, PEP, MCD, CLX, SBUX,

PG, MMM, O, CPB, GIS, WMT, CB, WFC, ABBV, MO, PM, BTI, DUK, SO, UVV, PPL

Disclaimer: I'm not a licensed investment advisor, and today's document is just for entertainment and fun. This document

is NOT investment advice. Please talk to your licensed investment advisor before making any financial decisions.

You might also like

- 62 BIWS Bank Valuation PDFDocument6 pages62 BIWS Bank Valuation PDFsm1205No ratings yet

- Investorpresentation: Jpmorgan Chase Acquiring Bear StearnsDocument9 pagesInvestorpresentation: Jpmorgan Chase Acquiring Bear StearnsmickweNo ratings yet

- Raport Fitch StatiDocument2 pagesRaport Fitch StatiRadu BurdujanNo ratings yet

- 62 BIWS Bank Valuation PDFDocument6 pages62 BIWS Bank Valuation PDFNNNo ratings yet

- Presentation Mirae Asset Nifty Smallcap 250 Momentum Quality 100 Etf Fund of FundDocument32 pagesPresentation Mirae Asset Nifty Smallcap 250 Momentum Quality 100 Etf Fund of Fundlatest badlaNo ratings yet

- BMO Low Volatility US Equity ETF-EN-CAD UnitsDocument4 pagesBMO Low Volatility US Equity ETF-EN-CAD Unitsmaxime1.pelletierNo ratings yet

- SAS Market Perspectives - May23Document49 pagesSAS Market Perspectives - May23wqtg5kkm29No ratings yet

- Investments 1Document1 pageInvestments 1Lyanna MormontNo ratings yet

- Pekan 13.2 - Odd2023-24Document12 pagesPekan 13.2 - Odd2023-24Axell ValentinoNo ratings yet

- PMAC LU1 (1) (2) .PPSXDocument43 pagesPMAC LU1 (1) (2) .PPSXNadiaNo ratings yet

- Upslope+Capital+ +Creativity+in+Short Selling Final+ +publicDocument32 pagesUpslope+Capital+ +Creativity+in+Short Selling Final+ +publicSebastian ZNo ratings yet

- Conviction: Paul VolkerDocument2 pagesConviction: Paul VolkerFrank RuffingNo ratings yet

- The Financial Environment: Markets, Institutions & Intrest RatesDocument34 pagesThe Financial Environment: Markets, Institutions & Intrest Ratesnumlit1984No ratings yet

- A. Main Functions of Financial System: 47.1. Market Organization & Structure (Part 1)Document9 pagesA. Main Functions of Financial System: 47.1. Market Organization & Structure (Part 1)Phương LinhNo ratings yet

- Investment Matrix For Phinvest (By U - Speqter and U - Tagongpangalan)Document5 pagesInvestment Matrix For Phinvest (By U - Speqter and U - Tagongpangalan)Tristan Tabago ConsolacionNo ratings yet

- Ratio Analysis: 1. Liquidity RatiosDocument2 pagesRatio Analysis: 1. Liquidity RatiosJawad AliNo ratings yet

- Chapter 4 (Money Market)Document29 pagesChapter 4 (Money Market)janellemoralestNo ratings yet

- Chapter Five: Money MarketsDocument37 pagesChapter Five: Money MarketsLannie Mae SamayangNo ratings yet

- Business y BaDocument6 pagesBusiness y BaJAMES PETER O'SHEA PETRINOVICNo ratings yet

- Market Snapshot - Sept 2023Document18 pagesMarket Snapshot - Sept 2023wqtg5kkm29No ratings yet

- InsuranceDocument15 pagesInsurancekananguptaNo ratings yet

- To Segment Market and Define Target Market For Ilacs?: EssayDocument13 pagesTo Segment Market and Define Target Market For Ilacs?: EssayLinh ĐinhNo ratings yet

- RatiosDocument2 pagesRatiosMina EskandarNo ratings yet

- 2020 Level I OnDemandVideo SS14 R42 Module 1Document4 pages2020 Level I OnDemandVideo SS14 R42 Module 1Arturos lanNo ratings yet

- Portfolio Make StrategyDocument16 pagesPortfolio Make Strategysubham mohantyNo ratings yet

- Gross Profit Net Profit/ EBIT: Return On Capital EmployesDocument9 pagesGross Profit Net Profit/ EBIT: Return On Capital Employesshekhar371No ratings yet

- Reading Material CFIDocument15 pagesReading Material CFISwikriti SethNo ratings yet

- Investments Cheatsheet 1Document2 pagesInvestments Cheatsheet 1ejn eifie'No ratings yet

- Formulae For RatiosDocument1 pageFormulae For Ratioskristishadelandro11No ratings yet

- Diligent Equity The Ultimate VC Metrics Cheat SheetDocument2 pagesDiligent Equity The Ultimate VC Metrics Cheat Sheetyileg71667No ratings yet

- Afar - Partnership AccountingDocument3 pagesAfar - Partnership Accountingfarah mae raquinioNo ratings yet

- Dividend Model NotesDocument8 pagesDividend Model NotesLumumba KuyelaNo ratings yet

- Finance Formula BankDocument2 pagesFinance Formula BankMELISSA ANN COLOMANo ratings yet

- CAMELS RatingsDocument1 pageCAMELS RatingsAyush53No ratings yet

- Zrive IB 1Q23 Intro To Valuation Methods Up2Document9 pagesZrive IB 1Q23 Intro To Valuation Methods Up2Luis Soldevilla MorenoNo ratings yet

- Securities & Financial StatementsDocument4 pagesSecurities & Financial StatementsMuhammad Istiyansyah IdrisNo ratings yet

- WebSim - Price Volume PDFDocument10 pagesWebSim - Price Volume PDFNeelesh KumarNo ratings yet

- Fundamentals of Banking Institutions: AgendaDocument23 pagesFundamentals of Banking Institutions: AgendaYulan ShenNo ratings yet

- Corporation Transactions After FormationDocument14 pagesCorporation Transactions After FormationYanela YishaNo ratings yet

- Year Month Day Date Exchange Derivative Segment: 2021 January - Mse Interest Rate DerivativesDocument14 pagesYear Month Day Date Exchange Derivative Segment: 2021 January - Mse Interest Rate Derivativesmovie buffNo ratings yet

- The Formulas of All The Ratios: A. Financial Stability, Solvency, Liquidity, Balance Sheet RatiosDocument2 pagesThe Formulas of All The Ratios: A. Financial Stability, Solvency, Liquidity, Balance Sheet RatiosAayush AgrawalNo ratings yet

- Presentation No 1 Fixed Income IBA Fall 2021Document40 pagesPresentation No 1 Fixed Income IBA Fall 2021Food ClipsNo ratings yet

- 002 MAS FS Analysis Rev00 PDFDocument5 pages002 MAS FS Analysis Rev00 PDFCyvee Joy Hongayo OcheaNo ratings yet

- Overlook Value Investing in The Twilight Zone UploadDocument29 pagesOverlook Value Investing in The Twilight Zone UploadTimothyNgNo ratings yet

- Preliminary Company InformationDocument2 pagesPreliminary Company InformationswapnilsagarNo ratings yet

- Analisa Fundamental DasarDocument37 pagesAnalisa Fundamental DasarGogopay PayNo ratings yet

- Finance For Executives Managing For Value Creation 6Th Edition Gabriel Hawawini Full ChapterDocument67 pagesFinance For Executives Managing For Value Creation 6Th Edition Gabriel Hawawini Full Chapterjoyce.clewis414100% (20)

- ECON 219 Symbols and Abbreviations Used: Fall 2004, Intermediate Macroeconomics, Section 3/4Document2 pagesECON 219 Symbols and Abbreviations Used: Fall 2004, Intermediate Macroeconomics, Section 3/4Justin OliverNo ratings yet

- Newsletter April 20 PDFDocument3 pagesNewsletter April 20 PDFSindhu Arauvinth RaajNo ratings yet

- Cheat Sheet Earnings Per ShareDocument2 pagesCheat Sheet Earnings Per ShareJaneNo ratings yet

- Financial Derivatives CheatSheetDocument2 pagesFinancial Derivatives CheatSheetTiffanyNo ratings yet

- WST Cash Flow MetricsDocument2 pagesWST Cash Flow MetricsGabriel La MottaNo ratings yet

- Acc 1Document45 pagesAcc 1wengkeii07No ratings yet

- TAXATION & Audit IN CASE OF SHARE TRADING & F&O BY CA KAUSHIK & CA PRIYADocument7 pagesTAXATION & Audit IN CASE OF SHARE TRADING & F&O BY CA KAUSHIK & CA PRIYAHIrenNo ratings yet

- Introduction To Economics: The Economic Problem Opportunity Cost Production Possibility FrontiersDocument16 pagesIntroduction To Economics: The Economic Problem Opportunity Cost Production Possibility FrontiersSaad AhmedNo ratings yet

- Session 6Document25 pagesSession 6Bhargav D.S.No ratings yet

- Equity Investment 2 - ValuationDocument34 pagesEquity Investment 2 - Valuationnur syahirah bt ab.rahmanNo ratings yet

- (Download PDF) Finance For Executives Managing For Value Creation 6Th Edition Gabriel Hawawini Full Chapter PDFDocument69 pages(Download PDF) Finance For Executives Managing For Value Creation 6Th Edition Gabriel Hawawini Full Chapter PDFkingmajasrin40100% (10)

- 2020 Level I OnDemandVideo SS12 R36 Module 1Document3 pages2020 Level I OnDemandVideo SS12 R36 Module 1Arturos lanNo ratings yet

- AUDIT OF INVESTMENTS - AssociateDocument4 pagesAUDIT OF INVESTMENTS - AssociateJoshua LisingNo ratings yet

- Preface: Icfai Business School, ChandigarhDocument70 pagesPreface: Icfai Business School, ChandigarhSheetu GuptaNo ratings yet

- Derecognition of Financial InstrumentsDocument3 pagesDerecognition of Financial InstrumentsMinh TuệNo ratings yet

- 1 Annex I. Imprimatur Investment Agreement: Example Offer Letter, Key Terms and Outline ProcessDocument5 pages1 Annex I. Imprimatur Investment Agreement: Example Offer Letter, Key Terms and Outline ProcessAfandie Van WhyNo ratings yet

- Bian SL V2.5Document1 pageBian SL V2.5OktayNo ratings yet

- Principales Organismos ReguladoresDocument5 pagesPrincipales Organismos Reguladoresholger azael murillo gomezNo ratings yet

- Way2wealth Org Study Report 8 Nov 2022Document65 pagesWay2wealth Org Study Report 8 Nov 2022Manu DvNo ratings yet

- Business and Finance Solution FinalDocument8 pagesBusiness and Finance Solution FinalRashid Ali JatoiNo ratings yet

- CA FINAL SFM DERIVATIVES Futures SUMMARYDocument9 pagesCA FINAL SFM DERIVATIVES Futures SUMMARYsujeet mauryaNo ratings yet

- Pakistan Stock ExchangeDocument11 pagesPakistan Stock Exchangeumar jilaniNo ratings yet

- Calendar SpreadDocument7 pagesCalendar SpreadJames LiuNo ratings yet

- Pamantasan NG CabuyaoDocument2 pagesPamantasan NG CabuyaoHhhhhNo ratings yet

- Idbi BankDocument15 pagesIdbi BankAbhishek KumarNo ratings yet

- Financial ConclusionDocument2 pagesFinancial ConclusionjsinNo ratings yet

- Fomc Minutes 20231101Document10 pagesFomc Minutes 20231101ZerohedgeNo ratings yet

- Icici Prudential Value Discovery FunbDocument145 pagesIcici Prudential Value Discovery FunbAnuj RanaNo ratings yet

- Assignment 02 (Entrepreneurship - Feasibility Report)Document10 pagesAssignment 02 (Entrepreneurship - Feasibility Report)usama ilyas100% (1)

- Update Terbaru Struktur Organisasi Agt2022Document2 pagesUpdate Terbaru Struktur Organisasi Agt2022fmanggraNo ratings yet

- Moneylife 26 October 2017Document68 pagesMoneylife 26 October 2017ADNo ratings yet

- Blackstone SolutionsDocument2 pagesBlackstone SolutionsBianca KangNo ratings yet

- Our Strategy LHN Ar16Document44 pagesOur Strategy LHN Ar16Bilal El YoussoufiNo ratings yet

- Business DictionaryDocument124 pagesBusiness DictionaryVeera Karthik G0% (1)

- ACI Practice TestDocument33 pagesACI Practice TestAbdulqadir UmarNo ratings yet

- XFINMAN - Cash Flow AnalysisDocument17 pagesXFINMAN - Cash Flow AnalysisMae Justine Joy TajoneraNo ratings yet

- ECTSDocument17 pagesECTSsamuel debebeNo ratings yet

- MCQ - Financial ServicesDocument22 pagesMCQ - Financial ServicesRamees KpNo ratings yet

- Excel TemplateDocument48 pagesExcel TemplateigfhlkasNo ratings yet

- Practice Questions For Ratio AnalysisDocument11 pagesPractice Questions For Ratio AnalysisFaria AlamNo ratings yet

- HSBC Global Emerging Markets EM Banks JPDocument166 pagesHSBC Global Emerging Markets EM Banks JPdouglas_ferrisNo ratings yet

- Far410 Test Oct 2018 - QuestionDocument4 pagesFar410 Test Oct 2018 - Question2022478048No ratings yet