Professional Documents

Culture Documents

4 BIR Ruling 344-16 - Req Extension of Time To File Estate Tax Return & Pay Estate Tax (Dominga Villaluz) - Balucanag

4 BIR Ruling 344-16 - Req Extension of Time To File Estate Tax Return & Pay Estate Tax (Dominga Villaluz) - Balucanag

Uploaded by

Vikki AmorioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 BIR Ruling 344-16 - Req Extension of Time To File Estate Tax Return & Pay Estate Tax (Dominga Villaluz) - Balucanag

4 BIR Ruling 344-16 - Req Extension of Time To File Estate Tax Return & Pay Estate Tax (Dominga Villaluz) - Balucanag

Uploaded by

Vikki AmorioCopyright:

Available Formats

BIR Ruling 344-16

Request for Extension of Time to File Estate Tax Return and to Pay Estate Tax (Dominga Villaluz)

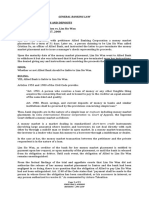

Facts:

On December 2, 2015, the children (heirs) of Dominga Villaluz (deceased) sent a letter to the BIR requesting for an

extension of time to file estate tax return and to pay estate tax, due to the following reasons:

1. They are still collating information to verify the assets of Dominga, aside from her conjugal properties; and,

2. They need to raise funds to pay the estate taxes because, for Dominga ’s treatment, they incurred substantial

medical expenses through personal loans that are still being paid.

Issue:

WON the extension of time shall be granted?

Ruling of the BIR:

Yes. Sections 90 (C) and 91 (B) of the 1997 Tax Code provide, viz:

“Sec 90. Estate Tax Returns -

xxx xxx xxx

(C) Extension of Time - The Commissioner shall have authority to grant, in meritorious cases, a reasonable extension

not exceeding thirty (30) days for filing the return.

“Sec 91. Payment of Tax -

xxx xxx xxx

(B) Extension of Time - When the Commissioner finds that the payment on the due date of the estate tax or of any

part thereof would impose undue hardship upon the estate or any of the heirs, he may extend the time for payment

of such tax or any part thereof not to exceed five (5) years, in case the estate is settled through the courts, or two (2)

years in case the estate is settled extrajudicially.

In such case, the amount in respect of which the extension is granted shall be paid on or before the date of the expiration of

the period of the extension, and the running of the Statute of Limitations for assessment as provided in Section 203 of this

Code shall be suspended for the period of any such extension.

If an extension is granted, the Commissioner may require the executor, or administrator, or beneficiary, as the case may be,

to furnish a bond in such amount, not exceeding double the amount of the tax and with such sureties as the Commissioner

deems necessary, conditioned upon the payment of the said tax in accordance with the terms of the extension.”

As to the request to extend the filing of the estate tax return, the Office finds justifiable reason and extends the filing to

January 18, 2016, which is 30 days counted from the last day of filing the estate tax return of the late Dominga Villaluz, or

from December 19, 2015.

As to the payment of the estate tax, since the heirs are still collating all documents and information necessary for the

preparation of the return, they have two (2) years (where the estate will be settled extra-judicially) within which to pay the

estate tax. Thus, the heirs shall pay the estate tax within two (2) years reckoned from the actual filing of the return or on

January 18, 2016, whichever comes first, provided that the executor, or administrator, or beneficiary, as the case may be, to

furnish a bond in such amount, not exceeding double the amount of the tax and with such sureties as the Commissioner

deems necessary, conditioned upon the payment of the said tax in accordance with the terms of the extension.

However, the heirs shall be liable for the interest accrued from January 18, 2016 up to the time of payment of the estate tax

due on the transmission of the estate of its properties to the heirs pursuant to Section 249 of the 1997 Tax Code.

You might also like

- Revenue Regulations No 01-81Document5 pagesRevenue Regulations No 01-81RaymondNo ratings yet

- Memo 201412: Official Statement Re System FailureDocument4 pagesMemo 201412: Official Statement Re System FailureAteneo COMELEC100% (1)

- Deed of Absolute Sale SampeDocument6 pagesDeed of Absolute Sale SampeKKCDIALNo ratings yet

- Ma 2 - Past Year Questions - PMDocument10 pagesMa 2 - Past Year Questions - PMAna FarhanaNo ratings yet

- BIR Ruling No. 010-00, 5 Jan 2000Document1 pageBIR Ruling No. 010-00, 5 Jan 2000Jani MisterioNo ratings yet

- Managing Corporate Governance:: Legal/Regulatory Environment and Corporate Governance Practices in The PhilippinesDocument17 pagesManaging Corporate Governance:: Legal/Regulatory Environment and Corporate Governance Practices in The Philippinesmayank.sabharwal6317No ratings yet

- Case Digests 3Document15 pagesCase Digests 3Mary Ann ChoaNo ratings yet

- Republic vs. Court of Appeals, Apr. 15, 1988Document1 pageRepublic vs. Court of Appeals, Apr. 15, 1988Gamar AlihNo ratings yet

- (2018) New BIR Income Tax Rates andDocument31 pages(2018) New BIR Income Tax Rates andGlenn Cacho Garce100% (1)

- Philippines Ifrs ProfileDocument6 pagesPhilippines Ifrs Profilejsus22No ratings yet

- RR 16-99Document6 pagesRR 16-99matinikkiNo ratings yet

- PEZA Registration in The PhilippinesDocument14 pagesPEZA Registration in The PhilippinesKeleeNo ratings yet

- RMO 20-90 - Proper Execution of The Waiver of PrescriptionDocument2 pagesRMO 20-90 - Proper Execution of The Waiver of PrescriptionTenten ConanNo ratings yet

- Byblgg: Itinerary ReceiptDocument4 pagesByblgg: Itinerary Receiptcherry lyn calama-anNo ratings yet

- DNFBPs PDFDocument2 pagesDNFBPs PDFRonbert Alindogan RamosNo ratings yet

- Notes To Financial StatementsDocument9 pagesNotes To Financial StatementsCheryl FuentesNo ratings yet

- RMC 038-12 Q&A Further Clarifying RR 7-2020 Regarding Senior Citizen's PrivilegesDocument17 pagesRMC 038-12 Q&A Further Clarifying RR 7-2020 Regarding Senior Citizen's PrivilegesRaymart SalamidaNo ratings yet

- Bir Ruling Da (Vat 050) 282 09Document3 pagesBir Ruling Da (Vat 050) 282 09doraemoanNo ratings yet

- Tax ExemptionDocument5 pagesTax ExemptionRamon TambisNo ratings yet

- LifeBlood - Assessment Process Tax 2Document17 pagesLifeBlood - Assessment Process Tax 2Monjid AbpiNo ratings yet

- Ysmael Maritime Corporation vs. AvelinoDocument6 pagesYsmael Maritime Corporation vs. AvelinoAlexNo ratings yet

- Legitime Legitimate Children and Descendants Legitimate Parents and AscendantsDocument4 pagesLegitime Legitimate Children and Descendants Legitimate Parents and AscendantsVel JuneNo ratings yet

- Pag-Ibig Loan Availment PDFDocument24 pagesPag-Ibig Loan Availment PDFalfx216No ratings yet

- Adsum Notes - (Remedies of The Government)Document26 pagesAdsum Notes - (Remedies of The Government)Raz SPNo ratings yet

- Ra 9679 - Pag-Ibig HDMFDocument14 pagesRa 9679 - Pag-Ibig HDMFKYLA JANE BALOLOYNo ratings yet

- DOMICIANO A. AGUAS, Petitioner, vs. CONRADO G. DE LEON and COURT OF APPEALS, RespondentsDocument38 pagesDOMICIANO A. AGUAS, Petitioner, vs. CONRADO G. DE LEON and COURT OF APPEALS, RespondentsPmbNo ratings yet

- Preparation of Financial Statements 081112 RevisedDocument89 pagesPreparation of Financial Statements 081112 RevisedNorhian AlmeronNo ratings yet

- Fundamental Principles Governing Real Property TaxationDocument5 pagesFundamental Principles Governing Real Property TaxationgraceNo ratings yet

- From Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETDocument7 pagesFrom Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETAndrew Miguel SantosNo ratings yet

- De Minimis and FringeDocument1 pageDe Minimis and FringeAlicia Jane NavarroNo ratings yet

- Tax Practice MCQDocument16 pagesTax Practice MCQZenedel De JesusNo ratings yet

- Attendance Sheet - Hoa by LawsDocument1 pageAttendance Sheet - Hoa by LawsLisa CalderonNo ratings yet

- RMC No. 32-2022Document5 pagesRMC No. 32-2022Shiela Marie MaraonNo ratings yet

- BIR's New Invoicing Requirements Effective June 30, 2013Document2 pagesBIR's New Invoicing Requirements Effective June 30, 2013lito77No ratings yet

- Commercial DigestDocument25 pagesCommercial DigestArrianne ObiasNo ratings yet

- Atty. Cardona Tax 1 Syllabus RevDocument12 pagesAtty. Cardona Tax 1 Syllabus RevnayhrbNo ratings yet

- Cost Accounting Questions and Answers Part1Document1 pageCost Accounting Questions and Answers Part1Kyo TieNo ratings yet

- Bir Ruling No. 108-93Document2 pagesBir Ruling No. 108-93saintkarriNo ratings yet

- Bir Ruling 294-88Document1 pageBir Ruling 294-88matinikkiNo ratings yet

- Percentage Tax ReviewerDocument5 pagesPercentage Tax ReviewerJerico ManaloNo ratings yet

- Jocelyn Amor M. Gonda: Brief Descriptions of Our Internal Quality Review ProcessDocument2 pagesJocelyn Amor M. Gonda: Brief Descriptions of Our Internal Quality Review ProcessBillcounterNo ratings yet

- Revenue Memorandum Circular No. 09-06: January 25, 2006Document5 pagesRevenue Memorandum Circular No. 09-06: January 25, 2006dom0202No ratings yet

- Gross Estate The Value of All The Property, Real or Personal, TangibleDocument40 pagesGross Estate The Value of All The Property, Real or Personal, TangibleRomz NuneNo ratings yet

- AOI Template SECDocument15 pagesAOI Template SECEdison Flores0% (1)

- 39 - 2007 Income Tax VAT Treatment Security Agencies WithholdingDocument28 pages39 - 2007 Income Tax VAT Treatment Security Agencies WithholdingChristy SanguyuNo ratings yet

- Rmo 16-2007Document4 pagesRmo 16-2007Jaypee LegaspiNo ratings yet

- Taxation Law Review Case ListDocument18 pagesTaxation Law Review Case ListSabritoNo ratings yet

- M4-Intro To Income Tax & Exclusion To Income Tax - Students'Document38 pagesM4-Intro To Income Tax & Exclusion To Income Tax - Students'micaella pasionNo ratings yet

- INDIVIDUALSDocument6 pagesINDIVIDUALSAnne KimNo ratings yet

- Additonal Disclosure RR 15 2010Document5 pagesAdditonal Disclosure RR 15 2010Emil A. MolinaNo ratings yet

- Peza Erd Form No. 03-01 2018Document2 pagesPeza Erd Form No. 03-01 2018John LuNo ratings yet

- RDO No. 64 - Talisay, Camarines NorteDocument483 pagesRDO No. 64 - Talisay, Camarines NortedebbeelawNo ratings yet

- IAS 21 - Effects of Changes in Foreign Exchange PDFDocument22 pagesIAS 21 - Effects of Changes in Foreign Exchange PDFJanelle SentinaNo ratings yet

- Viuda de Tan Toco vs. Municipal Council of IloiloDocument10 pagesViuda de Tan Toco vs. Municipal Council of IloiloJerome ArañezNo ratings yet

- Revenue Regulations No 02-40Document19 pagesRevenue Regulations No 02-40corky01No ratings yet

- Insurance Law in PhilippinesDocument67 pagesInsurance Law in PhilippinesAileen Vasquez-MendozaNo ratings yet

- Remedies in General As Per Tax Code Sec. 202-204Document3 pagesRemedies in General As Per Tax Code Sec. 202-2042022107419No ratings yet

- Taxpayer'S Obligations and Privileges: I. General Audit Procedures and DocumentationDocument4 pagesTaxpayer'S Obligations and Privileges: I. General Audit Procedures and DocumentationKristen StewartNo ratings yet

- Samar-I Electric Cooperative vs. CirDocument2 pagesSamar-I Electric Cooperative vs. CirRaquel DoqueniaNo ratings yet

- G.R. No. 207112 Case DigestDocument3 pagesG.R. No. 207112 Case DigestAlvin Earl NuydaNo ratings yet

- CIR vs. Goodyear Philippines, Inc. GR No. 216130, 3 August 2016Document2 pagesCIR vs. Goodyear Philippines, Inc. GR No. 216130, 3 August 2016nnn aaaNo ratings yet

- CE QuestionsDocument4 pagesCE QuestionsVikki AmorioNo ratings yet

- EFFECTS OF POSSESSION ARTS 539-554 ReviewDocument12 pagesEFFECTS OF POSSESSION ARTS 539-554 ReviewVikki AmorioNo ratings yet

- Comment Manifestation From OSGDocument10 pagesComment Manifestation From OSGVikki AmorioNo ratings yet

- Elec Final NotesDocument69 pagesElec Final NotesVikki AmorioNo ratings yet

- USUFRUCTDocument12 pagesUSUFRUCTVikki AmorioNo ratings yet

- Penalties - Judge Adlawan Lecture (AutoRecovered)Document19 pagesPenalties - Judge Adlawan Lecture (AutoRecovered)Vikki AmorioNo ratings yet

- 2022 Banking Law Digest For Prelim - AMORIO, Vikki Mae J.Document21 pages2022 Banking Law Digest For Prelim - AMORIO, Vikki Mae J.Vikki AmorioNo ratings yet

- Batch 4Document2 pagesBatch 4Vikki AmorioNo ratings yet

- EASEMENTDocument16 pagesEASEMENTVikki AmorioNo ratings yet

- Civil Law 1-2Document34 pagesCivil Law 1-2Vikki AmorioNo ratings yet

- Calendar Assigned ReadingsDocument2 pagesCalendar Assigned ReadingsVikki AmorioNo ratings yet

- Danzas Corporation vs. AbrogarDocument10 pagesDanzas Corporation vs. AbrogarVikki AmorioNo ratings yet

- PDIC vs. AqueroDocument14 pagesPDIC vs. AqueroVikki AmorioNo ratings yet

- SpecPro Case DigestsDocument6 pagesSpecPro Case DigestsVikki AmorioNo ratings yet

- PDIC vs. vs. Philippine Countryside Rural Bank, Inc.Document37 pagesPDIC vs. vs. Philippine Countryside Rural Bank, Inc.Vikki AmorioNo ratings yet

- JudAff AccusedDocument4 pagesJudAff AccusedVikki AmorioNo ratings yet

- Vector Shippinh Corporation vs. American HomeDocument15 pagesVector Shippinh Corporation vs. American HomeVikki AmorioNo ratings yet

- Bitanga vs. PyramidDocument2 pagesBitanga vs. PyramidVikki AmorioNo ratings yet

- BPI vs. Lifetime Marketing CorporationDocument13 pagesBPI vs. Lifetime Marketing CorporationVikki AmorioNo ratings yet

- Ejercito vs. SandiganbayanDocument113 pagesEjercito vs. SandiganbayanVikki AmorioNo ratings yet

- Republic vs. Glasgow CreditDocument22 pagesRepublic vs. Glasgow CreditVikki AmorioNo ratings yet

- BPI vs. Casa Montessori InternationaleDocument50 pagesBPI vs. Casa Montessori InternationaleVikki AmorioNo ratings yet

- People vs. EstradaDocument34 pagesPeople vs. EstradaVikki AmorioNo ratings yet

- Jurisdiction How Acquired - Service of SummonsDocument2 pagesJurisdiction How Acquired - Service of SummonsVikki AmorioNo ratings yet

- Allied Banking Corporation vs. Sps. MacamDocument18 pagesAllied Banking Corporation vs. Sps. MacamVikki AmorioNo ratings yet

- Allied Bank vs. Lim Sio WanDocument26 pagesAllied Bank vs. Lim Sio WanVikki AmorioNo ratings yet

- Associated Bank vs. TanDocument20 pagesAssociated Bank vs. TanVikki AmorioNo ratings yet

- PNB vs. PikeDocument29 pagesPNB vs. PikeVikki AmorioNo ratings yet

- Garcia vs. VasquezDocument2 pagesGarcia vs. VasquezVikki Amorio100% (1)

- WILDVALLEY SHIPPING Vs COURT OF APPEALSDocument2 pagesWILDVALLEY SHIPPING Vs COURT OF APPEALSVikki AmorioNo ratings yet

- Ch11 - CorporationsDocument95 pagesCh11 - CorporationsAnonymous LyVDGotjqfNo ratings yet

- Repoprt On Loans & Advances PDFDocument66 pagesRepoprt On Loans & Advances PDFTitas Manower50% (4)

- Estatement-202304 20230511111017Document2 pagesEstatement-202304 20230511111017SITI DZULAIHANo ratings yet

- Presentasi Kel5 - InovasiDocument21 pagesPresentasi Kel5 - Inovasid0r@emon100% (1)

- Auditing Theory Final ExamDocument8 pagesAuditing Theory Final ExamKatrina ObtinarioNo ratings yet

- 01 Financial Statement Analysis - LectureDocument40 pages01 Financial Statement Analysis - LectureChelsea ManuelNo ratings yet

- Plant and Intangible AssetsDocument51 pagesPlant and Intangible AssetsMULATNo ratings yet

- Feasibility Study On Agriculture and Agro IndustryDocument3 pagesFeasibility Study On Agriculture and Agro IndustryOyadare sarah0% (1)

- Various Sources of FinanceDocument16 pagesVarious Sources of FinanceBinoyRockzsNo ratings yet

- Employer Identification Number (EIN) Application / RegistrationDocument3 pagesEmployer Identification Number (EIN) Application / RegistrationLedger Domains LLC100% (1)

- 1979 Graph Arbitrage 2330182Document21 pages1979 Graph Arbitrage 2330182therm000No ratings yet

- Question Bank - 2Document3 pagesQuestion Bank - 2Titus ClementNo ratings yet

- Trends and Challenges of Public Health Care Financing System in Nigeria: The Way ForwardDocument8 pagesTrends and Challenges of Public Health Care Financing System in Nigeria: The Way ForwardMella PutriNo ratings yet

- QuestionnaireDocument3 pagesQuestionnaireMr. Khan100% (1)

- T13 Option PricingDocument2 pagesT13 Option PricingElizabethNo ratings yet

- Acctng 402 Essay ExamDocument2 pagesAcctng 402 Essay ExamMichael A. AlbercaNo ratings yet

- AP-100 (Audit of Shareholders' Equity)Document8 pagesAP-100 (Audit of Shareholders' Equity)Gwyneth CartallaNo ratings yet

- Presentation of History of Stock MarketDocument20 pagesPresentation of History of Stock MarketBishnu DhamalaNo ratings yet

- Goncalves y Salles (2008)Document7 pagesGoncalves y Salles (2008)laura_castañeda_22No ratings yet

- CPP ReportDocument15 pagesCPP ReportMAHADEVAN SNo ratings yet

- Nobles Finmgr6 PPT 04 RevisedDocument64 pagesNobles Finmgr6 PPT 04 RevisedzezegallyNo ratings yet

- Ushtrime Te ZgjidhuraDocument16 pagesUshtrime Te ZgjidhuraDenisa Allushaj Kuqari100% (4)

- PER Guide To A Career in SecondariesDocument11 pagesPER Guide To A Career in SecondariesMarco ErmantazziNo ratings yet

- Anant Raj Industries: Rs92 BuyDocument10 pagesAnant Raj Industries: Rs92 Buyshashvat.lakhanpal5793No ratings yet

- VNO LetterDocument15 pagesVNO LetterZerohedgeNo ratings yet

- Nitesh Khandelwal (PGFC1921) - BOCA (Central Bank of India)Document12 pagesNitesh Khandelwal (PGFC1921) - BOCA (Central Bank of India)Surbhî GuptaNo ratings yet

- Chapter 3 Acctng ProcessDocument46 pagesChapter 3 Acctng ProcessMary BNo ratings yet

- 18s ECO 341 Syllabus 9-1-17Document7 pages18s ECO 341 Syllabus 9-1-17Gabriel RoblesNo ratings yet

- Invoice: Dadlaw House, 3 Thasos Street P.O.BOX 22360 Nicosia, Cyprus Tax Reg. No: 12268654D VAT Reg. No: 10268654BDocument2 pagesInvoice: Dadlaw House, 3 Thasos Street P.O.BOX 22360 Nicosia, Cyprus Tax Reg. No: 12268654D VAT Reg. No: 10268654BSvetlana MitrovicNo ratings yet