Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

23 viewsTax Quiz

Tax Quiz

Uploaded by

PLO COMVAL1. The term 'corporation' includes partnerships, joint-stock companies, joint accounts, associations, and general professional partnerships.

2. A 'domestic' corporation operates in the Philippines.

3. A 'nonresident citizen' is a citizen of the Philippines who establishes residence abroad with the intention to reside there indefinitely.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- PIMCO COF IV Marketing Deck - Israel - 03232023 - 5732Document64 pagesPIMCO COF IV Marketing Deck - Israel - 03232023 - 5732moshe2mosheNo ratings yet

- Code) As Two or More Persons Contributing Money, Property, or Industry To A Common Fund, WithDocument11 pagesCode) As Two or More Persons Contributing Money, Property, or Industry To A Common Fund, WithMichelle Gozon100% (1)

- Income Tax Banggawan2019 Ch9Document13 pagesIncome Tax Banggawan2019 Ch9Noreen Ledda83% (6)

- Tax Banggawan2019 Ch.15-ADocument12 pagesTax Banggawan2019 Ch.15-ANoreen LeddaNo ratings yet

- Taxation Answer Sheet 2 PDFDocument37 pagesTaxation Answer Sheet 2 PDFGuinevere100% (1)

- Classification of TaxpayerDocument5 pagesClassification of Taxpayers2120130No ratings yet

- Tax Code: Partnerships' Are Partnerships Formed by Persons For TheDocument10 pagesTax Code: Partnerships' Are Partnerships Formed by Persons For Thegabriel omliNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document33 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Taxation Midterm ReviewerDocument5 pagesTaxation Midterm ReviewerMaria RochelleNo ratings yet

- CHAPTER 9 To CHAPTER 15 ANSWERSDocument38 pagesCHAPTER 9 To CHAPTER 15 ANSWERSryanmartintaanNo ratings yet

- TAXATION TRUE OR FALSE TEST BANK - CorporationsDocument3 pagesTAXATION TRUE OR FALSE TEST BANK - CorporationsMagbanu Andrea JoneleNo ratings yet

- Tax On IncomeDocument29 pagesTax On IncomeJeff Cacayurin TalattadNo ratings yet

- Income Taxation - Chapter 1 DefinitionDocument3 pagesIncome Taxation - Chapter 1 DefinitionAntonioGloriaComiqueNo ratings yet

- Income Tax On Resident Foreign CorporationDocument6 pagesIncome Tax On Resident Foreign CorporationElaiNo ratings yet

- Tax ReviewerDocument4 pagesTax ReviewerMel Loise DelmoroNo ratings yet

- Tax CorporateDocument5 pagesTax CorporateJorenz ObiedoNo ratings yet

- TaxationDocument13 pagesTaxationAubrey LegaspiNo ratings yet

- Classification of TaxpayerDocument2 pagesClassification of TaxpayerEduard Morelos100% (1)

- TRUE OR FALSE (p.179,180)Document2 pagesTRUE OR FALSE (p.179,180)Aberin GalenzogaNo ratings yet

- Inclusions in The Gross IncomeDocument7 pagesInclusions in The Gross Incomedarlene floresNo ratings yet

- Income TaxationDocument27 pagesIncome TaxationAries Gonzales CaraganNo ratings yet

- Resident and Foreign CorporationDocument4 pagesResident and Foreign CorporationIris Grace Culata0% (1)

- Classification of TaxpayerDocument2 pagesClassification of Taxpayerhannahmousa83% (24)

- Cbtax01 Chapter4Document11 pagesCbtax01 Chapter4Christelle JosonNo ratings yet

- CH09B Income and Business TaxationDocument20 pagesCH09B Income and Business TaxationArt MelancholiaNo ratings yet

- Sources of IncomeDocument1 pageSources of IncomeGian Carlo RamonesNo ratings yet

- Income Tax 1 - Seatwork Signabon-MalaoDocument16 pagesIncome Tax 1 - Seatwork Signabon-MalaoLarry Fritz SignabonNo ratings yet

- Chapter 5 Final TaxDocument2 pagesChapter 5 Final Taxcherry blossomNo ratings yet

- Tax DigestDocument4 pagesTax DigestJP De La PeñaNo ratings yet

- Non-Resident Alien Engaged in Business in The Phil: Income Tax RR2Document8 pagesNon-Resident Alien Engaged in Business in The Phil: Income Tax RR2Jm CruzNo ratings yet

- Nirc As Amended by TrainDocument16 pagesNirc As Amended by TrainKDANo ratings yet

- Module 4 - Lesson 18 - FinalDocument8 pagesModule 4 - Lesson 18 - FinalMai RuizNo ratings yet

- Tax Law ReviewDocument8 pagesTax Law ReviewIon FashNo ratings yet

- Income Tax 2Document10 pagesIncome Tax 2Blaise VENo ratings yet

- Tax 1 ReviewerDocument16 pagesTax 1 ReviewerverkieNo ratings yet

- Passive IncomeDocument2 pagesPassive Incomeallain_matiasNo ratings yet

- PRELIM Chapter 9 10 11Document37 pagesPRELIM Chapter 9 10 11Bisag AsaNo ratings yet

- Tax 05 Final Taxes Part 1Document5 pagesTax 05 Final Taxes Part 1Panda CocoNo ratings yet

- Report Tax RevDocument10 pagesReport Tax RevMarga ErumNo ratings yet

- Template - Post Test - Classification of Taxpayers Other Than IndividualsDocument3 pagesTemplate - Post Test - Classification of Taxpayers Other Than IndividualsAleksander DagreytNo ratings yet

- MamalateoDocument12 pagesMamalateoKim Orven M. SolonNo ratings yet

- Final Withholding Taxes and Withholdiing of Business Taxes On Government Income Payments (Part Iii)Document109 pagesFinal Withholding Taxes and Withholdiing of Business Taxes On Government Income Payments (Part Iii)Bien Bowie A. CortezNo ratings yet

- Classification of Individual Taxpayers:: Income Tax RatesDocument21 pagesClassification of Individual Taxpayers:: Income Tax RatesAngelica E. RefuerzoNo ratings yet

- Chapter 3Document7 pagesChapter 3cerayNo ratings yet

- Definitions SEC. 22 Definitions - When Used in This Title:: National Internal Revenue Code of The PhilippinesDocument5 pagesDefinitions SEC. 22 Definitions - When Used in This Title:: National Internal Revenue Code of The PhilippinesCzari MuñozNo ratings yet

- SEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenDocument11 pagesSEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenMiguel BerguNo ratings yet

- IRR of Republic Act No 7042Document21 pagesIRR of Republic Act No 7042andrea ibanezNo ratings yet

- Taxation LawDocument107 pagesTaxation LawDave A ValcarcelNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document29 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Situs of IncomeDocument3 pagesSitus of IncomeElsie CayetanoNo ratings yet

- Chapter 5 TaxDocument9 pagesChapter 5 Taxxavia9531No ratings yet

- Chapter 2 InctaxDocument14 pagesChapter 2 InctaxLiRose SmithNo ratings yet

- Assignment No.2-Retail-implementing Rules and RegulationsDocument15 pagesAssignment No.2-Retail-implementing Rules and RegulationscefyNo ratings yet

- Income TaxationDocument3 pagesIncome Taxationm.bagnas.488669No ratings yet

- Chap. 9 12Document58 pagesChap. 9 122vpsrsmg7jNo ratings yet

- tAX LESSON B .Document10 pagestAX LESSON B .intramuramazingNo ratings yet

- Daily Time Record Daily Time Record: Holiday HolidayDocument1 pageDaily Time Record Daily Time Record: Holiday HolidayPLO COMVALNo ratings yet

- Daily Time Record Daily Time Record: Holiday HolidayDocument1 pageDaily Time Record Daily Time Record: Holiday HolidayPLO COMVALNo ratings yet

- Daily Time Record Daily Time Record: Holiday HolidayDocument1 pageDaily Time Record Daily Time Record: Holiday HolidayPLO COMVALNo ratings yet

- Crvprint - 2022-06-01T082309.323Document1 pageCrvprint - 2022-06-01T082309.323PLO COMVALNo ratings yet

- Crvprint - 2022-06-02T073947.471Document1 pageCrvprint - 2022-06-02T073947.471PLO COMVALNo ratings yet

- Daily Time Record Daily Time Record: OB OB OB OB OB OBDocument1 pageDaily Time Record Daily Time Record: OB OB OB OB OB OBPLO COMVALNo ratings yet

- Crvprint - 2022-06-02T073852.530Document1 pageCrvprint - 2022-06-02T073852.530PLO COMVALNo ratings yet

- Crvprint - 2022-06-02T142740.167Document1 pageCrvprint - 2022-06-02T142740.167PLO COMVALNo ratings yet

- Deed of Sale of Motor Vehicle MaunaDocument1 pageDeed of Sale of Motor Vehicle MaunaPLO COMVALNo ratings yet

- Republic of The Philippines Province of Davao de Oro Provincial Legal OfficeDocument2 pagesRepublic of The Philippines Province of Davao de Oro Provincial Legal OfficePLO COMVALNo ratings yet

- Very Truly Yours,: Atty. Niel John A. VillaricoDocument1 pageVery Truly Yours,: Atty. Niel John A. VillaricoPLO COMVALNo ratings yet

- Arellano vs. CADocument1 pageArellano vs. CAPLO COMVALNo ratings yet

- Affidavit No Pending Case 2Document1 pageAffidavit No Pending Case 2PLO COMVALNo ratings yet

- Rule 128 General Provisions: Page - 1Document12 pagesRule 128 General Provisions: Page - 1PLO COMVALNo ratings yet

- Rule 128 General Provisions: Page - 1Document12 pagesRule 128 General Provisions: Page - 1PLO COMVALNo ratings yet

- Labor 1st PartDocument25 pagesLabor 1st PartPLO COMVALNo ratings yet

- Capitol Medical Center v. Trajano, Et. Al., G.R. No. 155690, Jun. 30, 2005Document64 pagesCapitol Medical Center v. Trajano, Et. Al., G.R. No. 155690, Jun. 30, 2005PLO COMVALNo ratings yet

- Tax DigestDocument51 pagesTax DigestPLO COMVALNo ratings yet

- The Relationship Between The Usage of Xero Accounting Software and The Intellectual Capital of The Selected Companies in PampangaDocument56 pagesThe Relationship Between The Usage of Xero Accounting Software and The Intellectual Capital of The Selected Companies in PampangaAlvin GalangNo ratings yet

- Coca Cola - Introduction To ManagementDocument24 pagesCoca Cola - Introduction To ManagementUmasha NelumNo ratings yet

- Fesco Online BillDocument2 pagesFesco Online Billghazanfarhayat000046No ratings yet

- Deepak Bhai - Repaired - FINALDocument107 pagesDeepak Bhai - Repaired - FINALNehaNo ratings yet

- ME Course Plan Oct 2023 Send DoneDocument6 pagesME Course Plan Oct 2023 Send DoneSharon CNo ratings yet

- Accounting Fifo LifoDocument7 pagesAccounting Fifo LifoFariha tamannaNo ratings yet

- Feasibility Analysis of Broiler Farm With Partnership PatternDocument12 pagesFeasibility Analysis of Broiler Farm With Partnership PatternZohour AfifyNo ratings yet

- MRP Ii and ErpDocument34 pagesMRP Ii and ErpShailesh ShirguppikarNo ratings yet

- Pom - Inventory ManagementDocument5 pagesPom - Inventory ManagementMURALI KRISHNA VELAVETI Dr.No ratings yet

- Ratio ShreeDocument12 pagesRatio ShreeMandeep BatraNo ratings yet

- CostingDocument11 pagesCostingJustine VitorinoNo ratings yet

- Equal Payment SeriesDocument5 pagesEqual Payment SeriesMaya OlleikNo ratings yet

- TL9000Document18 pagesTL9000madan1981100% (1)

- Subject: Class: MBA I Sem-I Full Name: Roll No. 220111 Company Name: ITCDocument140 pagesSubject: Class: MBA I Sem-I Full Name: Roll No. 220111 Company Name: ITCKshitija NevaseNo ratings yet

- Power of Attorney (Poa) in Favour of Iifl Securities LimitedDocument4 pagesPower of Attorney (Poa) in Favour of Iifl Securities LimitedPankaj KaleNo ratings yet

- Franklin Templeton Investment Funds Annual Report (Full)Document478 pagesFranklin Templeton Investment Funds Annual Report (Full)read allNo ratings yet

- 2020 2021 Purples Notes TaxationDocument310 pages2020 2021 Purples Notes TaxationMichael James Madrid MalinginNo ratings yet

- ACCA108 Problem 15-11 To 15-14Document3 pagesACCA108 Problem 15-11 To 15-14Dominic RomeroNo ratings yet

- Alliance Broadband Package For Rest of IndiaDocument2 pagesAlliance Broadband Package For Rest of IndiaSonela RoyNo ratings yet

- Pandit Automotive Pvt. Ltd.Document6 pagesPandit Automotive Pvt. Ltd.JudicialNo ratings yet

- Fall of BPL ReportDocument18 pagesFall of BPL ReportUday HiremathNo ratings yet

- Be 20231208Document6 pagesBe 20231208jherwi.ocretoNo ratings yet

- Financial Econometrics Modeling Market Microstructure, Factor Models and Financial Risk MeasuresDocument281 pagesFinancial Econometrics Modeling Market Microstructure, Factor Models and Financial Risk MeasuresTayyaba ShahNo ratings yet

- Regional Economics Class NotesDocument21 pagesRegional Economics Class NotesCabletv10No ratings yet

- Lecture 4 - Project Management IDocument3 pagesLecture 4 - Project Management IcliffNo ratings yet

- PP On Fuel StationDocument20 pagesPP On Fuel StationGurraacha Abbayyaa100% (2)

- Types of IndustriesDocument29 pagesTypes of IndustriesMilton MosquitoNo ratings yet

- Income Tax Declarations Form (SMCI) FY 2022 2023Document1 pageIncome Tax Declarations Form (SMCI) FY 2022 2023Nitesh KumarNo ratings yet

- Cost Benefit Analysis Is Done To Determine How WellDocument5 pagesCost Benefit Analysis Is Done To Determine How WellShaikh JahirNo ratings yet

Tax Quiz

Tax Quiz

Uploaded by

PLO COMVAL0 ratings0% found this document useful (0 votes)

23 views1 page1. The term 'corporation' includes partnerships, joint-stock companies, joint accounts, associations, and general professional partnerships.

2. A 'domestic' corporation operates in the Philippines.

3. A 'nonresident citizen' is a citizen of the Philippines who establishes residence abroad with the intention to reside there indefinitely.

Original Description:

Original Title

TAX QUIZ

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The term 'corporation' includes partnerships, joint-stock companies, joint accounts, associations, and general professional partnerships.

2. A 'domestic' corporation operates in the Philippines.

3. A 'nonresident citizen' is a citizen of the Philippines who establishes residence abroad with the intention to reside there indefinitely.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

23 views1 pageTax Quiz

Tax Quiz

Uploaded by

PLO COMVAL1. The term 'corporation' includes partnerships, joint-stock companies, joint accounts, associations, and general professional partnerships.

2. A 'domestic' corporation operates in the Philippines.

3. A 'nonresident citizen' is a citizen of the Philippines who establishes residence abroad with the intention to reside there indefinitely.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

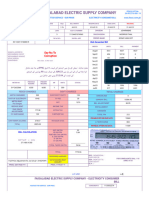

Tax 1 true or false

1. The term 'corporation' shall include partnerships, no matter how created or

organized, joint-stock companies, joint accounts, association, or insurance

companies, and general professional partnerships.

2. The term 'domestic', when applied to a corporation, means operating in the

Philippines.

3. The term 'nonresident citizen' means a citizen of the Philippines who

establishes his physical presence abroad with a definite intention to reside

therein.

4. The term 'nonresident citizen' means citizen of the Philippines who works and

derives income from abroad and whose employment thereat requires him to

be physically present abroad most of the time during the taxable year.

5. A regional or area headquarters is a corporation established in the

Philippines which office do not earn or derive income from the Philippines.

6. The term 'long-term deposit or investment certificate' shall refer to certificate

of time deposit or investment with a maturity period of not less than five (5)

years.

7. A resident citizen is taxable on all income derived from sources within and

without the Philippines.

8. An individual citizen of the Philippines who is working and deriving income

from abroad as an overseas contract worker is taxable on all income derived

from sources within and without the Philippines.

9. A Filipino seaman who receives compensation for services rendered as a

member of the complement of a vessel engaged exclusively in international

trade shall be taxable on all income derived from sources within the

Philippines.

10. ALL alien individuals are taxable only on income derived from sources

within the Philippines.

11. If any income cannot be definitely attributed to or identified as income

exclusively earned or realized by either of the spouses, the same shall be

deemed to be earned by the husband.

12. Interest earned by MJB Lending is subject to 20% final tax.

13. Prizes amounting to 5,000 pesos shall be subject to tax under

Subsection (A) of Section 24 (5%-32%).

14. Segurista invested 1Million for 7 years. Segurista pre-terminated her

investment after 40 months. The investment will earn 5% interest.

15. A final tax of 20% shall be imposed upon the cash or property

dividends actually or constructively received by an individual from a domestic

corporation.

16. Capital Gains Tax of 6% shall be prescribed from Sale of Shares of

Stock not Traded in the Stock Exchange.

17. A final tax of six percent (6%) based on the gross selling price or

current fair market value as determined in accordance with Section 6(E) of

this Code, whichever is higher, is hereby imposed upon capital gains

presumed to have been realized from the sale, exchange, or other disposition

of real property classified as ordinary asset.

18. A Filipino employed by Regional or Area Headquarters and Regional

Operating Headquarters of Multinational Companies shall be subject to tax

under Subsection (A) of Section 24 (5%-32%).

19. For purposes of computing the distributive share of the partners, the

net income of the partnership shall be computed in the same manner as a

corporation.

20. Persons engaging in business as partners in a general professional

partnership shall be liable for income tax only in their separate and individual

capacities.

You might also like

- PIMCO COF IV Marketing Deck - Israel - 03232023 - 5732Document64 pagesPIMCO COF IV Marketing Deck - Israel - 03232023 - 5732moshe2mosheNo ratings yet

- Code) As Two or More Persons Contributing Money, Property, or Industry To A Common Fund, WithDocument11 pagesCode) As Two or More Persons Contributing Money, Property, or Industry To A Common Fund, WithMichelle Gozon100% (1)

- Income Tax Banggawan2019 Ch9Document13 pagesIncome Tax Banggawan2019 Ch9Noreen Ledda83% (6)

- Tax Banggawan2019 Ch.15-ADocument12 pagesTax Banggawan2019 Ch.15-ANoreen LeddaNo ratings yet

- Taxation Answer Sheet 2 PDFDocument37 pagesTaxation Answer Sheet 2 PDFGuinevere100% (1)

- Classification of TaxpayerDocument5 pagesClassification of Taxpayers2120130No ratings yet

- Tax Code: Partnerships' Are Partnerships Formed by Persons For TheDocument10 pagesTax Code: Partnerships' Are Partnerships Formed by Persons For Thegabriel omliNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document33 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Taxation Midterm ReviewerDocument5 pagesTaxation Midterm ReviewerMaria RochelleNo ratings yet

- CHAPTER 9 To CHAPTER 15 ANSWERSDocument38 pagesCHAPTER 9 To CHAPTER 15 ANSWERSryanmartintaanNo ratings yet

- TAXATION TRUE OR FALSE TEST BANK - CorporationsDocument3 pagesTAXATION TRUE OR FALSE TEST BANK - CorporationsMagbanu Andrea JoneleNo ratings yet

- Tax On IncomeDocument29 pagesTax On IncomeJeff Cacayurin TalattadNo ratings yet

- Income Taxation - Chapter 1 DefinitionDocument3 pagesIncome Taxation - Chapter 1 DefinitionAntonioGloriaComiqueNo ratings yet

- Income Tax On Resident Foreign CorporationDocument6 pagesIncome Tax On Resident Foreign CorporationElaiNo ratings yet

- Tax ReviewerDocument4 pagesTax ReviewerMel Loise DelmoroNo ratings yet

- Tax CorporateDocument5 pagesTax CorporateJorenz ObiedoNo ratings yet

- TaxationDocument13 pagesTaxationAubrey LegaspiNo ratings yet

- Classification of TaxpayerDocument2 pagesClassification of TaxpayerEduard Morelos100% (1)

- TRUE OR FALSE (p.179,180)Document2 pagesTRUE OR FALSE (p.179,180)Aberin GalenzogaNo ratings yet

- Inclusions in The Gross IncomeDocument7 pagesInclusions in The Gross Incomedarlene floresNo ratings yet

- Income TaxationDocument27 pagesIncome TaxationAries Gonzales CaraganNo ratings yet

- Resident and Foreign CorporationDocument4 pagesResident and Foreign CorporationIris Grace Culata0% (1)

- Classification of TaxpayerDocument2 pagesClassification of Taxpayerhannahmousa83% (24)

- Cbtax01 Chapter4Document11 pagesCbtax01 Chapter4Christelle JosonNo ratings yet

- CH09B Income and Business TaxationDocument20 pagesCH09B Income and Business TaxationArt MelancholiaNo ratings yet

- Sources of IncomeDocument1 pageSources of IncomeGian Carlo RamonesNo ratings yet

- Income Tax 1 - Seatwork Signabon-MalaoDocument16 pagesIncome Tax 1 - Seatwork Signabon-MalaoLarry Fritz SignabonNo ratings yet

- Chapter 5 Final TaxDocument2 pagesChapter 5 Final Taxcherry blossomNo ratings yet

- Tax DigestDocument4 pagesTax DigestJP De La PeñaNo ratings yet

- Non-Resident Alien Engaged in Business in The Phil: Income Tax RR2Document8 pagesNon-Resident Alien Engaged in Business in The Phil: Income Tax RR2Jm CruzNo ratings yet

- Nirc As Amended by TrainDocument16 pagesNirc As Amended by TrainKDANo ratings yet

- Module 4 - Lesson 18 - FinalDocument8 pagesModule 4 - Lesson 18 - FinalMai RuizNo ratings yet

- Tax Law ReviewDocument8 pagesTax Law ReviewIon FashNo ratings yet

- Income Tax 2Document10 pagesIncome Tax 2Blaise VENo ratings yet

- Tax 1 ReviewerDocument16 pagesTax 1 ReviewerverkieNo ratings yet

- Passive IncomeDocument2 pagesPassive Incomeallain_matiasNo ratings yet

- PRELIM Chapter 9 10 11Document37 pagesPRELIM Chapter 9 10 11Bisag AsaNo ratings yet

- Tax 05 Final Taxes Part 1Document5 pagesTax 05 Final Taxes Part 1Panda CocoNo ratings yet

- Report Tax RevDocument10 pagesReport Tax RevMarga ErumNo ratings yet

- Template - Post Test - Classification of Taxpayers Other Than IndividualsDocument3 pagesTemplate - Post Test - Classification of Taxpayers Other Than IndividualsAleksander DagreytNo ratings yet

- MamalateoDocument12 pagesMamalateoKim Orven M. SolonNo ratings yet

- Final Withholding Taxes and Withholdiing of Business Taxes On Government Income Payments (Part Iii)Document109 pagesFinal Withholding Taxes and Withholdiing of Business Taxes On Government Income Payments (Part Iii)Bien Bowie A. CortezNo ratings yet

- Classification of Individual Taxpayers:: Income Tax RatesDocument21 pagesClassification of Individual Taxpayers:: Income Tax RatesAngelica E. RefuerzoNo ratings yet

- Chapter 3Document7 pagesChapter 3cerayNo ratings yet

- Definitions SEC. 22 Definitions - When Used in This Title:: National Internal Revenue Code of The PhilippinesDocument5 pagesDefinitions SEC. 22 Definitions - When Used in This Title:: National Internal Revenue Code of The PhilippinesCzari MuñozNo ratings yet

- SEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenDocument11 pagesSEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenMiguel BerguNo ratings yet

- IRR of Republic Act No 7042Document21 pagesIRR of Republic Act No 7042andrea ibanezNo ratings yet

- Taxation LawDocument107 pagesTaxation LawDave A ValcarcelNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document29 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Situs of IncomeDocument3 pagesSitus of IncomeElsie CayetanoNo ratings yet

- Chapter 5 TaxDocument9 pagesChapter 5 Taxxavia9531No ratings yet

- Chapter 2 InctaxDocument14 pagesChapter 2 InctaxLiRose SmithNo ratings yet

- Assignment No.2-Retail-implementing Rules and RegulationsDocument15 pagesAssignment No.2-Retail-implementing Rules and RegulationscefyNo ratings yet

- Income TaxationDocument3 pagesIncome Taxationm.bagnas.488669No ratings yet

- Chap. 9 12Document58 pagesChap. 9 122vpsrsmg7jNo ratings yet

- tAX LESSON B .Document10 pagestAX LESSON B .intramuramazingNo ratings yet

- Daily Time Record Daily Time Record: Holiday HolidayDocument1 pageDaily Time Record Daily Time Record: Holiday HolidayPLO COMVALNo ratings yet

- Daily Time Record Daily Time Record: Holiday HolidayDocument1 pageDaily Time Record Daily Time Record: Holiday HolidayPLO COMVALNo ratings yet

- Daily Time Record Daily Time Record: Holiday HolidayDocument1 pageDaily Time Record Daily Time Record: Holiday HolidayPLO COMVALNo ratings yet

- Crvprint - 2022-06-01T082309.323Document1 pageCrvprint - 2022-06-01T082309.323PLO COMVALNo ratings yet

- Crvprint - 2022-06-02T073947.471Document1 pageCrvprint - 2022-06-02T073947.471PLO COMVALNo ratings yet

- Daily Time Record Daily Time Record: OB OB OB OB OB OBDocument1 pageDaily Time Record Daily Time Record: OB OB OB OB OB OBPLO COMVALNo ratings yet

- Crvprint - 2022-06-02T073852.530Document1 pageCrvprint - 2022-06-02T073852.530PLO COMVALNo ratings yet

- Crvprint - 2022-06-02T142740.167Document1 pageCrvprint - 2022-06-02T142740.167PLO COMVALNo ratings yet

- Deed of Sale of Motor Vehicle MaunaDocument1 pageDeed of Sale of Motor Vehicle MaunaPLO COMVALNo ratings yet

- Republic of The Philippines Province of Davao de Oro Provincial Legal OfficeDocument2 pagesRepublic of The Philippines Province of Davao de Oro Provincial Legal OfficePLO COMVALNo ratings yet

- Very Truly Yours,: Atty. Niel John A. VillaricoDocument1 pageVery Truly Yours,: Atty. Niel John A. VillaricoPLO COMVALNo ratings yet

- Arellano vs. CADocument1 pageArellano vs. CAPLO COMVALNo ratings yet

- Affidavit No Pending Case 2Document1 pageAffidavit No Pending Case 2PLO COMVALNo ratings yet

- Rule 128 General Provisions: Page - 1Document12 pagesRule 128 General Provisions: Page - 1PLO COMVALNo ratings yet

- Rule 128 General Provisions: Page - 1Document12 pagesRule 128 General Provisions: Page - 1PLO COMVALNo ratings yet

- Labor 1st PartDocument25 pagesLabor 1st PartPLO COMVALNo ratings yet

- Capitol Medical Center v. Trajano, Et. Al., G.R. No. 155690, Jun. 30, 2005Document64 pagesCapitol Medical Center v. Trajano, Et. Al., G.R. No. 155690, Jun. 30, 2005PLO COMVALNo ratings yet

- Tax DigestDocument51 pagesTax DigestPLO COMVALNo ratings yet

- The Relationship Between The Usage of Xero Accounting Software and The Intellectual Capital of The Selected Companies in PampangaDocument56 pagesThe Relationship Between The Usage of Xero Accounting Software and The Intellectual Capital of The Selected Companies in PampangaAlvin GalangNo ratings yet

- Coca Cola - Introduction To ManagementDocument24 pagesCoca Cola - Introduction To ManagementUmasha NelumNo ratings yet

- Fesco Online BillDocument2 pagesFesco Online Billghazanfarhayat000046No ratings yet

- Deepak Bhai - Repaired - FINALDocument107 pagesDeepak Bhai - Repaired - FINALNehaNo ratings yet

- ME Course Plan Oct 2023 Send DoneDocument6 pagesME Course Plan Oct 2023 Send DoneSharon CNo ratings yet

- Accounting Fifo LifoDocument7 pagesAccounting Fifo LifoFariha tamannaNo ratings yet

- Feasibility Analysis of Broiler Farm With Partnership PatternDocument12 pagesFeasibility Analysis of Broiler Farm With Partnership PatternZohour AfifyNo ratings yet

- MRP Ii and ErpDocument34 pagesMRP Ii and ErpShailesh ShirguppikarNo ratings yet

- Pom - Inventory ManagementDocument5 pagesPom - Inventory ManagementMURALI KRISHNA VELAVETI Dr.No ratings yet

- Ratio ShreeDocument12 pagesRatio ShreeMandeep BatraNo ratings yet

- CostingDocument11 pagesCostingJustine VitorinoNo ratings yet

- Equal Payment SeriesDocument5 pagesEqual Payment SeriesMaya OlleikNo ratings yet

- TL9000Document18 pagesTL9000madan1981100% (1)

- Subject: Class: MBA I Sem-I Full Name: Roll No. 220111 Company Name: ITCDocument140 pagesSubject: Class: MBA I Sem-I Full Name: Roll No. 220111 Company Name: ITCKshitija NevaseNo ratings yet

- Power of Attorney (Poa) in Favour of Iifl Securities LimitedDocument4 pagesPower of Attorney (Poa) in Favour of Iifl Securities LimitedPankaj KaleNo ratings yet

- Franklin Templeton Investment Funds Annual Report (Full)Document478 pagesFranklin Templeton Investment Funds Annual Report (Full)read allNo ratings yet

- 2020 2021 Purples Notes TaxationDocument310 pages2020 2021 Purples Notes TaxationMichael James Madrid MalinginNo ratings yet

- ACCA108 Problem 15-11 To 15-14Document3 pagesACCA108 Problem 15-11 To 15-14Dominic RomeroNo ratings yet

- Alliance Broadband Package For Rest of IndiaDocument2 pagesAlliance Broadband Package For Rest of IndiaSonela RoyNo ratings yet

- Pandit Automotive Pvt. Ltd.Document6 pagesPandit Automotive Pvt. Ltd.JudicialNo ratings yet

- Fall of BPL ReportDocument18 pagesFall of BPL ReportUday HiremathNo ratings yet

- Be 20231208Document6 pagesBe 20231208jherwi.ocretoNo ratings yet

- Financial Econometrics Modeling Market Microstructure, Factor Models and Financial Risk MeasuresDocument281 pagesFinancial Econometrics Modeling Market Microstructure, Factor Models and Financial Risk MeasuresTayyaba ShahNo ratings yet

- Regional Economics Class NotesDocument21 pagesRegional Economics Class NotesCabletv10No ratings yet

- Lecture 4 - Project Management IDocument3 pagesLecture 4 - Project Management IcliffNo ratings yet

- PP On Fuel StationDocument20 pagesPP On Fuel StationGurraacha Abbayyaa100% (2)

- Types of IndustriesDocument29 pagesTypes of IndustriesMilton MosquitoNo ratings yet

- Income Tax Declarations Form (SMCI) FY 2022 2023Document1 pageIncome Tax Declarations Form (SMCI) FY 2022 2023Nitesh KumarNo ratings yet

- Cost Benefit Analysis Is Done To Determine How WellDocument5 pagesCost Benefit Analysis Is Done To Determine How WellShaikh JahirNo ratings yet