Professional Documents

Culture Documents

Intermediate Accounting II Chapter 18

Intermediate Accounting II Chapter 18

Uploaded by

izza zahratunnisaCopyright:

Available Formats

You might also like

- The Dark ManDocument2 pagesThe Dark ManHyemi Mimi100% (1)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisKimberly AsanteNo ratings yet

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Wiring Diagram Elevator: 123/INDSBY-ELC/1014Document22 pagesWiring Diagram Elevator: 123/INDSBY-ELC/1014Gogik Anto85% (13)

- Nokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: StockDocument2 pagesNokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: StockMohtasim Bin HabibNo ratings yet

- Socw - 1263543589Document7 pagesSocw - 1263543589dolevov652No ratings yet

- 6884 - Statement of Comprehensive IncomeDocument2 pages6884 - Statement of Comprehensive IncomeMaximusNo ratings yet

- NU - Correction of Errors Single Entry Cash To AccrualDocument8 pagesNU - Correction of Errors Single Entry Cash To AccrualJem ValmonteNo ratings yet

- Auditing Problems: Ap - 01: Correction of ErrorsDocument15 pagesAuditing Problems: Ap - 01: Correction of ErrorsPrinces100% (2)

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- Far-Single Entry PDFDocument7 pagesFar-Single Entry PDFJanica June FiscalNo ratings yet

- CFABK60 Phân Tích BCTCDocument5 pagesCFABK60 Phân Tích BCTCThắng Trần NgọcNo ratings yet

- Chapter 1 Practice Test - Problems (Answers)Document12 pagesChapter 1 Practice Test - Problems (Answers)anonymousNo ratings yet

- ACT 302 - ASSIGNMENT (Statement of Cash Flows) - 2024Document4 pagesACT 302 - ASSIGNMENT (Statement of Cash Flows) - 2024rafikdaachasalamNo ratings yet

- Scarry CompanyDocument3 pagesScarry CompanyBuenaventura, Elijah B.No ratings yet

- Activity 4 Financial Reporting in Hyperinflationary EconomiesDocument5 pagesActivity 4 Financial Reporting in Hyperinflationary Economiesnglc srzNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- 8506 - Installment Sales - 113910598Document4 pages8506 - Installment Sales - 113910598Ryan CornistaNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Module 2 Statement of Comprehensive IncomeDocument8 pagesModule 2 Statement of Comprehensive IncomeStella MarieNo ratings yet

- B7AF102 Financial Accounting May 2020Document9 pagesB7AF102 Financial Accounting May 2020dayahNo ratings yet

- Acc5115 - Intermediate Financial Reporting Statement of Comprehensive Income and Changes in Owner'S Equity Problem ADocument6 pagesAcc5115 - Intermediate Financial Reporting Statement of Comprehensive Income and Changes in Owner'S Equity Problem ARachel LuberiaNo ratings yet

- 6804 - Statement of Comprehensive IncomeDocument2 pages6804 - Statement of Comprehensive IncomeAins M. BantuasNo ratings yet

- AP W1 Correction of ErrorsDocument4 pagesAP W1 Correction of ErrorsALYZA ANGELA ORNEDONo ratings yet

- Baf 422 Continous Assessment Test Class Assignment 20240328Document5 pagesBaf 422 Continous Assessment Test Class Assignment 20240328briankuria21No ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Be0003735496 2023 02 10Document2 pagesBe0003735496 2023 02 10paulgsozaNo ratings yet

- ACCT2014 Final Exam 2021-2022 - K.Ashman v2Document9 pagesACCT2014 Final Exam 2021-2022 - K.Ashman v2Christina StephensonNo ratings yet

- University of Bradford Financial Accounting, Afe5008-B Final ExaminationDocument9 pagesUniversity of Bradford Financial Accounting, Afe5008-B Final ExaminationDiana TuckerNo ratings yet

- Financial PlanDocument20 pagesFinancial Planzhijaescosio25No ratings yet

- Pembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 2019Document64 pagesPembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 201917HARISA SETYA HANDININo ratings yet

- Fm2quizb4 QoDocument10 pagesFm2quizb4 QoYe YongshiNo ratings yet

- ACCT1002 Assignment 3B 2nd S 2021-2022Document16 pagesACCT1002 Assignment 3B 2nd S 2021-2022Zenika PetersNo ratings yet

- Activity 01 PDFDocument5 pagesActivity 01 PDFJennifer AdvientoNo ratings yet

- Error Correction SolutionDocument3 pagesError Correction SolutionMary Grace Garcia VergaraNo ratings yet

- Numbers 36 and 37 (Installment Sales)Document2 pagesNumbers 36 and 37 (Installment Sales)elsana philipNo ratings yet

- H and V Anal ExerciseDocument3 pagesH and V Anal ExerciseSummer ClaronNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Icag Nov 2020-Group Discuss...Document6 pagesIcag Nov 2020-Group Discuss...Papa Ekow ArmahNo ratings yet

- Bafacr4X Non-Financial Liabilities: Problem 4.1Document7 pagesBafacr4X Non-Financial Liabilities: Problem 4.1Aga Mathew MayugaNo ratings yet

- Thegodfather CF Student CdADocument8 pagesThegodfather CF Student CdAPablo MichavilaNo ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Auditing Problems MidtermDocument20 pagesAuditing Problems MidtermjasfNo ratings yet

- Lorent PracticeDocument17 pagesLorent PracticeagneswahyuNo ratings yet

- DeanDocument16 pagesDeanJames De TorresNo ratings yet

- Correction of Errors QuizDocument3 pagesCorrection of Errors QuizEISEN BELWIGANNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Nokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: StockDocument2 pagesNokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: Stockthala dineshNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- Activity 4.1 JKL Company Horizontal AnalysisDocument4 pagesActivity 4.1 JKL Company Horizontal AnalysisChancellor RimuruNo ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- Activity 6 Statement of Cash FlowsDocument2 pagesActivity 6 Statement of Cash Flowsnglc srzNo ratings yet

- Error Correction - ExercisesDocument4 pagesError Correction - ExercisesDe Chavez May Ann M.No ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Assignment 1 - Financial ManagementDocument2 pagesAssignment 1 - Financial Managementizza zahratunnisaNo ratings yet

- Advanced Accounting SyllabusDocument4 pagesAdvanced Accounting Syllabusizza zahratunnisaNo ratings yet

- Auditing Assignment Session 3Document1 pageAuditing Assignment Session 3izza zahratunnisaNo ratings yet

- Intermediate Accounting II Assignment Session 7Document2 pagesIntermediate Accounting II Assignment Session 7izza zahratunnisaNo ratings yet

- Intermediate Accounting II Chapter 17Document2 pagesIntermediate Accounting II Chapter 17izza zahratunnisaNo ratings yet

- Intermediate Accounting II Chapter 15Document3 pagesIntermediate Accounting II Chapter 15izza zahratunnisa100% (1)

- Indonesian Society and Culture: Weekly ReviewDocument1 pageIndonesian Society and Culture: Weekly Reviewizza zahratunnisaNo ratings yet

- Current ElectricityDocument93 pagesCurrent ElectricitySurya SNo ratings yet

- Jatiya Kabi Kazi Nazrul Islam UniversityDocument12 pagesJatiya Kabi Kazi Nazrul Islam UniversityAl-Muzahid EmuNo ratings yet

- No Overlord Rulebook For Descent: Journeys in The Dark (2nd Edition)Document21 pagesNo Overlord Rulebook For Descent: Journeys in The Dark (2nd Edition)Jeremy ForoiNo ratings yet

- Empower B2 Unit 10 QuizDocument2 pagesEmpower B2 Unit 10 QuizGuidance Teuku Nyak Arif Fatih Bilingual SchoolNo ratings yet

- 3HAC052610 AM Functional Safety and SafeMove2 RW 6-En PDFDocument236 pages3HAC052610 AM Functional Safety and SafeMove2 RW 6-En PDFlesnarjp jpNo ratings yet

- Cost Leadership Porter Generic StrategiesDocument7 pagesCost Leadership Porter Generic StrategiesRamar MurugasenNo ratings yet

- Fs Tco Battery Diesel Delivery Trucks Jun2022Document3 pagesFs Tco Battery Diesel Delivery Trucks Jun2022The International Council on Clean TransportationNo ratings yet

- Taylor Swift LyricsDocument2 pagesTaylor Swift LyricsElsie DomeNo ratings yet

- Yamabe Flow On Nilpotent Lie GroupsDocument20 pagesYamabe Flow On Nilpotent Lie GroupsEnzo RicNo ratings yet

- HMT (U4)Document23 pagesHMT (U4)maniNo ratings yet

- Assignment 04 Solved (NAEEM HUSSAIN 18-CS-47)Document7 pagesAssignment 04 Solved (NAEEM HUSSAIN 18-CS-47)NAEEM HUSSAINNo ratings yet

- 1.2 FMCC221 - Introduction To International Businesss - Part 1Document19 pages1.2 FMCC221 - Introduction To International Businesss - Part 1Bernie D. TeguenosNo ratings yet

- Jadwal Pertandingan Liga Inggris 2009-2010Document11 pagesJadwal Pertandingan Liga Inggris 2009-2010Adjie SatryoNo ratings yet

- Quality Supervisor Job DescriptionDocument8 pagesQuality Supervisor Job Descriptionqualitymanagement246No ratings yet

- TakeawayDocument6 pagesTakeawayWilman VasquezNo ratings yet

- Benefits of Professional Forensics MethodologyDocument57 pagesBenefits of Professional Forensics Methodologysharath_rakkiNo ratings yet

- Parent Involvement in Education: Kathleen Cotton and Karen Reed WikelundDocument17 pagesParent Involvement in Education: Kathleen Cotton and Karen Reed WikelundMohsin khaliqNo ratings yet

- Decision Trees and Boosting: Helge Voss (MPI-K, Heidelberg) TMVA WorkshopDocument30 pagesDecision Trees and Boosting: Helge Voss (MPI-K, Heidelberg) TMVA WorkshopAshish TiwariNo ratings yet

- ASTM D8210 - 19bDocument13 pagesASTM D8210 - 19bmancjaNo ratings yet

- Chapter 1 3 THESISDocument64 pagesChapter 1 3 THESISLyka Cartagena-Pandili Manalo-CabelloNo ratings yet

- PP QM Integration With PS MM FICODocument26 pagesPP QM Integration With PS MM FICOAshwini Harwale SonwaneNo ratings yet

- pdfGenerateNewCustomer SAOAO1030380906Reciept SAOAO1030380906ResidentAccountOpenFormDocument11 pagespdfGenerateNewCustomer SAOAO1030380906Reciept SAOAO1030380906ResidentAccountOpenFormajsingh0702No ratings yet

- The Holy Spirit: A New LifeDocument2 pagesThe Holy Spirit: A New LifeKatu2010No ratings yet

- Law Enforcement Agency Indentifiers Crosswalk, 2012Document23 pagesLaw Enforcement Agency Indentifiers Crosswalk, 2012Samuel KaminNo ratings yet

- Chroma Bidirectional DC Power Supply Model 62000D SeriesDocument12 pagesChroma Bidirectional DC Power Supply Model 62000D SeriesaboofazilNo ratings yet

- Feasibility of Ethanol Production From Coffee Husks: Biotechnology Letters June 2009Document6 pagesFeasibility of Ethanol Production From Coffee Husks: Biotechnology Letters June 2009Jher OcretoNo ratings yet

- 3M CorporationDocument3 pages3M CorporationIndoxfeeds GramNo ratings yet

- Peptides and Proteins: M.Prasad Naidu MSC Medical Biochemistry, PH.DDocument30 pagesPeptides and Proteins: M.Prasad Naidu MSC Medical Biochemistry, PH.DDr. M. Prasad NaiduNo ratings yet

Intermediate Accounting II Chapter 18

Intermediate Accounting II Chapter 18

Uploaded by

izza zahratunnisaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intermediate Accounting II Chapter 18

Intermediate Accounting II Chapter 18

Uploaded by

izza zahratunnisaCopyright:

Available Formats

Izza Zahratunnisa

Intermediate Accounting II

19/438318/EK/22150 IUP 2021

Assignment — Chapter 18

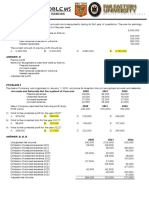

Exercise 18-27:

(a) To record sales revenue, warranties, and related cost of goods sold:

October 1 2019

Cash/Accounts receivables 3,600

Sales revenue 3,200

Unearned warranty revenue 400

Cost of goods sold 1,440

Inventory 1,440

To record warranty expense on October 25 2019:

Warranty expense 200

Cash, parts, labour 200

(b) Celic company takes notice of the warranty expenses associated with the assurance-

type warranty when actual warranty costs are received during the 90 day period after the

customer receives the repaired computer. The company recognises the unearned service

revenue associated with the service-type warranty and revenue (during the extended

warranty period) and takes notice of the costs associated with providing the service-type

warranty as the money is received.

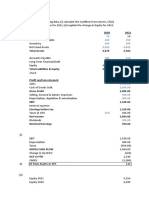

Exercise 18-33:

(a) gross profit recognised in:

2019 2020 2021

Contract $1,600,000 $1,600,000 $1,600,000

price

Costs:

Costs to date $400,000 $825,000 $1,070,000

Estimated 600,000 1,000,000 275,000 1,100,000 0 1,070,000

costs to

complete

Total 600,000 500,000 530,000

estimated

profit

Izza Zahratunnisa

Intermediate Accounting II

19/438318/EK/22150 IUP 2021

2019 2020 2021

Percentage 40% 75% 100%

completed to

date

Total gross 240,000 375,000 530,000

profit

recognised

Less: gross 0 240,000 375,000

profit

recognised in

previous

years

Gross profit $240,000 $135,000 $155,000

recognised in

current year

(b) 2020:

Construction in process 425,000

Materials, cash, payables 425,000

Accounts receivable 600,000

Billings on construction in 600,000

process

Cash 540,000

Accounts receivable 540,000

Construction expenses 425,000

Construction in process 135,000

Revenue from long-term 560,000

contracts

(c)

gross profit recognised in:

2019 2020 2021

Gross profit $0 $0 $30,000

You might also like

- The Dark ManDocument2 pagesThe Dark ManHyemi Mimi100% (1)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisKimberly AsanteNo ratings yet

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Wiring Diagram Elevator: 123/INDSBY-ELC/1014Document22 pagesWiring Diagram Elevator: 123/INDSBY-ELC/1014Gogik Anto85% (13)

- Nokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: StockDocument2 pagesNokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: StockMohtasim Bin HabibNo ratings yet

- Socw - 1263543589Document7 pagesSocw - 1263543589dolevov652No ratings yet

- 6884 - Statement of Comprehensive IncomeDocument2 pages6884 - Statement of Comprehensive IncomeMaximusNo ratings yet

- NU - Correction of Errors Single Entry Cash To AccrualDocument8 pagesNU - Correction of Errors Single Entry Cash To AccrualJem ValmonteNo ratings yet

- Auditing Problems: Ap - 01: Correction of ErrorsDocument15 pagesAuditing Problems: Ap - 01: Correction of ErrorsPrinces100% (2)

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- Far-Single Entry PDFDocument7 pagesFar-Single Entry PDFJanica June FiscalNo ratings yet

- CFABK60 Phân Tích BCTCDocument5 pagesCFABK60 Phân Tích BCTCThắng Trần NgọcNo ratings yet

- Chapter 1 Practice Test - Problems (Answers)Document12 pagesChapter 1 Practice Test - Problems (Answers)anonymousNo ratings yet

- ACT 302 - ASSIGNMENT (Statement of Cash Flows) - 2024Document4 pagesACT 302 - ASSIGNMENT (Statement of Cash Flows) - 2024rafikdaachasalamNo ratings yet

- Scarry CompanyDocument3 pagesScarry CompanyBuenaventura, Elijah B.No ratings yet

- Activity 4 Financial Reporting in Hyperinflationary EconomiesDocument5 pagesActivity 4 Financial Reporting in Hyperinflationary Economiesnglc srzNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- 8506 - Installment Sales - 113910598Document4 pages8506 - Installment Sales - 113910598Ryan CornistaNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Module 2 Statement of Comprehensive IncomeDocument8 pagesModule 2 Statement of Comprehensive IncomeStella MarieNo ratings yet

- B7AF102 Financial Accounting May 2020Document9 pagesB7AF102 Financial Accounting May 2020dayahNo ratings yet

- Acc5115 - Intermediate Financial Reporting Statement of Comprehensive Income and Changes in Owner'S Equity Problem ADocument6 pagesAcc5115 - Intermediate Financial Reporting Statement of Comprehensive Income and Changes in Owner'S Equity Problem ARachel LuberiaNo ratings yet

- 6804 - Statement of Comprehensive IncomeDocument2 pages6804 - Statement of Comprehensive IncomeAins M. BantuasNo ratings yet

- AP W1 Correction of ErrorsDocument4 pagesAP W1 Correction of ErrorsALYZA ANGELA ORNEDONo ratings yet

- Baf 422 Continous Assessment Test Class Assignment 20240328Document5 pagesBaf 422 Continous Assessment Test Class Assignment 20240328briankuria21No ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Be0003735496 2023 02 10Document2 pagesBe0003735496 2023 02 10paulgsozaNo ratings yet

- ACCT2014 Final Exam 2021-2022 - K.Ashman v2Document9 pagesACCT2014 Final Exam 2021-2022 - K.Ashman v2Christina StephensonNo ratings yet

- University of Bradford Financial Accounting, Afe5008-B Final ExaminationDocument9 pagesUniversity of Bradford Financial Accounting, Afe5008-B Final ExaminationDiana TuckerNo ratings yet

- Financial PlanDocument20 pagesFinancial Planzhijaescosio25No ratings yet

- Pembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 2019Document64 pagesPembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 201917HARISA SETYA HANDININo ratings yet

- Fm2quizb4 QoDocument10 pagesFm2quizb4 QoYe YongshiNo ratings yet

- ACCT1002 Assignment 3B 2nd S 2021-2022Document16 pagesACCT1002 Assignment 3B 2nd S 2021-2022Zenika PetersNo ratings yet

- Activity 01 PDFDocument5 pagesActivity 01 PDFJennifer AdvientoNo ratings yet

- Error Correction SolutionDocument3 pagesError Correction SolutionMary Grace Garcia VergaraNo ratings yet

- Numbers 36 and 37 (Installment Sales)Document2 pagesNumbers 36 and 37 (Installment Sales)elsana philipNo ratings yet

- H and V Anal ExerciseDocument3 pagesH and V Anal ExerciseSummer ClaronNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Icag Nov 2020-Group Discuss...Document6 pagesIcag Nov 2020-Group Discuss...Papa Ekow ArmahNo ratings yet

- Bafacr4X Non-Financial Liabilities: Problem 4.1Document7 pagesBafacr4X Non-Financial Liabilities: Problem 4.1Aga Mathew MayugaNo ratings yet

- Thegodfather CF Student CdADocument8 pagesThegodfather CF Student CdAPablo MichavilaNo ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Auditing Problems MidtermDocument20 pagesAuditing Problems MidtermjasfNo ratings yet

- Lorent PracticeDocument17 pagesLorent PracticeagneswahyuNo ratings yet

- DeanDocument16 pagesDeanJames De TorresNo ratings yet

- Correction of Errors QuizDocument3 pagesCorrection of Errors QuizEISEN BELWIGANNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Nokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: StockDocument2 pagesNokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: Stockthala dineshNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- Activity 4.1 JKL Company Horizontal AnalysisDocument4 pagesActivity 4.1 JKL Company Horizontal AnalysisChancellor RimuruNo ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- Activity 6 Statement of Cash FlowsDocument2 pagesActivity 6 Statement of Cash Flowsnglc srzNo ratings yet

- Error Correction - ExercisesDocument4 pagesError Correction - ExercisesDe Chavez May Ann M.No ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Assignment 1 - Financial ManagementDocument2 pagesAssignment 1 - Financial Managementizza zahratunnisaNo ratings yet

- Advanced Accounting SyllabusDocument4 pagesAdvanced Accounting Syllabusizza zahratunnisaNo ratings yet

- Auditing Assignment Session 3Document1 pageAuditing Assignment Session 3izza zahratunnisaNo ratings yet

- Intermediate Accounting II Assignment Session 7Document2 pagesIntermediate Accounting II Assignment Session 7izza zahratunnisaNo ratings yet

- Intermediate Accounting II Chapter 17Document2 pagesIntermediate Accounting II Chapter 17izza zahratunnisaNo ratings yet

- Intermediate Accounting II Chapter 15Document3 pagesIntermediate Accounting II Chapter 15izza zahratunnisa100% (1)

- Indonesian Society and Culture: Weekly ReviewDocument1 pageIndonesian Society and Culture: Weekly Reviewizza zahratunnisaNo ratings yet

- Current ElectricityDocument93 pagesCurrent ElectricitySurya SNo ratings yet

- Jatiya Kabi Kazi Nazrul Islam UniversityDocument12 pagesJatiya Kabi Kazi Nazrul Islam UniversityAl-Muzahid EmuNo ratings yet

- No Overlord Rulebook For Descent: Journeys in The Dark (2nd Edition)Document21 pagesNo Overlord Rulebook For Descent: Journeys in The Dark (2nd Edition)Jeremy ForoiNo ratings yet

- Empower B2 Unit 10 QuizDocument2 pagesEmpower B2 Unit 10 QuizGuidance Teuku Nyak Arif Fatih Bilingual SchoolNo ratings yet

- 3HAC052610 AM Functional Safety and SafeMove2 RW 6-En PDFDocument236 pages3HAC052610 AM Functional Safety and SafeMove2 RW 6-En PDFlesnarjp jpNo ratings yet

- Cost Leadership Porter Generic StrategiesDocument7 pagesCost Leadership Porter Generic StrategiesRamar MurugasenNo ratings yet

- Fs Tco Battery Diesel Delivery Trucks Jun2022Document3 pagesFs Tco Battery Diesel Delivery Trucks Jun2022The International Council on Clean TransportationNo ratings yet

- Taylor Swift LyricsDocument2 pagesTaylor Swift LyricsElsie DomeNo ratings yet

- Yamabe Flow On Nilpotent Lie GroupsDocument20 pagesYamabe Flow On Nilpotent Lie GroupsEnzo RicNo ratings yet

- HMT (U4)Document23 pagesHMT (U4)maniNo ratings yet

- Assignment 04 Solved (NAEEM HUSSAIN 18-CS-47)Document7 pagesAssignment 04 Solved (NAEEM HUSSAIN 18-CS-47)NAEEM HUSSAINNo ratings yet

- 1.2 FMCC221 - Introduction To International Businesss - Part 1Document19 pages1.2 FMCC221 - Introduction To International Businesss - Part 1Bernie D. TeguenosNo ratings yet

- Jadwal Pertandingan Liga Inggris 2009-2010Document11 pagesJadwal Pertandingan Liga Inggris 2009-2010Adjie SatryoNo ratings yet

- Quality Supervisor Job DescriptionDocument8 pagesQuality Supervisor Job Descriptionqualitymanagement246No ratings yet

- TakeawayDocument6 pagesTakeawayWilman VasquezNo ratings yet

- Benefits of Professional Forensics MethodologyDocument57 pagesBenefits of Professional Forensics Methodologysharath_rakkiNo ratings yet

- Parent Involvement in Education: Kathleen Cotton and Karen Reed WikelundDocument17 pagesParent Involvement in Education: Kathleen Cotton and Karen Reed WikelundMohsin khaliqNo ratings yet

- Decision Trees and Boosting: Helge Voss (MPI-K, Heidelberg) TMVA WorkshopDocument30 pagesDecision Trees and Boosting: Helge Voss (MPI-K, Heidelberg) TMVA WorkshopAshish TiwariNo ratings yet

- ASTM D8210 - 19bDocument13 pagesASTM D8210 - 19bmancjaNo ratings yet

- Chapter 1 3 THESISDocument64 pagesChapter 1 3 THESISLyka Cartagena-Pandili Manalo-CabelloNo ratings yet

- PP QM Integration With PS MM FICODocument26 pagesPP QM Integration With PS MM FICOAshwini Harwale SonwaneNo ratings yet

- pdfGenerateNewCustomer SAOAO1030380906Reciept SAOAO1030380906ResidentAccountOpenFormDocument11 pagespdfGenerateNewCustomer SAOAO1030380906Reciept SAOAO1030380906ResidentAccountOpenFormajsingh0702No ratings yet

- The Holy Spirit: A New LifeDocument2 pagesThe Holy Spirit: A New LifeKatu2010No ratings yet

- Law Enforcement Agency Indentifiers Crosswalk, 2012Document23 pagesLaw Enforcement Agency Indentifiers Crosswalk, 2012Samuel KaminNo ratings yet

- Chroma Bidirectional DC Power Supply Model 62000D SeriesDocument12 pagesChroma Bidirectional DC Power Supply Model 62000D SeriesaboofazilNo ratings yet

- Feasibility of Ethanol Production From Coffee Husks: Biotechnology Letters June 2009Document6 pagesFeasibility of Ethanol Production From Coffee Husks: Biotechnology Letters June 2009Jher OcretoNo ratings yet

- 3M CorporationDocument3 pages3M CorporationIndoxfeeds GramNo ratings yet

- Peptides and Proteins: M.Prasad Naidu MSC Medical Biochemistry, PH.DDocument30 pagesPeptides and Proteins: M.Prasad Naidu MSC Medical Biochemistry, PH.DDr. M. Prasad NaiduNo ratings yet