Professional Documents

Culture Documents

About The First Home Buyers Assistance Scheme

About The First Home Buyers Assistance Scheme

Uploaded by

Ishan SaneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

About The First Home Buyers Assistance Scheme

About The First Home Buyers Assistance Scheme

Uploaded by

Ishan SaneCopyright:

Available Formats

First Home Buyers

Assistance Scheme.

The First Home Buyers

Assistance scheme is a

NSW Government initiative

which provides exemptions

or concessions on stamp About the First Home

duty for eligible NSW first Buyers Assistance Scheme.

home buyers. This includes The First Home Buyers Assistance scheme provides eligible purchasers with

exemptions on stamp duty on new and existing homes valued up to $650,000

vacant land on which you and concessions on duty for new and existing homes valued between

intend to build your first home. $650,000 and $800,000.

Eligible purchasers buying a vacant block of residential land to build their

home on will pay no duty on vacant land valued up to $350,000, and will

The First Home Buyers receive concessions on duty for vacant land valued between $350,000 and

Assistance scheme $450,000.

commenced from 1 July 2017. To qualify for First Home Buyers Assistance, you must meet the criteria listed

below:

The First Home Buyers Assistance scheme has Proof

of Identity requirements, the details of which are l The contract and the transfer must be for the purchase of the whole of the

contained in the Application and Lodgement Guide. property.

l All purchasers must be ‘eligible purchasers’.

l An ‘eligible purchaser’ is a natural person (i.e. not a company or trust) at

least 18 years of age who has not, and whose spouse/de facto has not:

l at any time owned (either solely or with someone else) residential

property in Australia other than property owned solely as trustee or

executor

l previously received an exemption or concession under First Home

- New Home.

l At least 1 eligible purchaser must occupy the home as their principal place

of residence for a continuous period of 6 months, commencing within 12

Calculating the months of completion of the agreement. (Where an eligible purchaser was

a member of the permanent forces of the Australian Defence Force and all

concessions on duty. purchasers were enrolled on the NSW electoral roll, as at the transaction

date, then all purchasers are exempt from the residence requirement).

You can calculate the exact amount of your

concession for new and existing homes, vacant

land and shared equity arrangements using the Note: If all purchasers are not ‘eligible purchasers’, you may still qualify for

First Home Buyers Assistance calculator. a concession under the shared equity arrangements in First Home Buyers

Available online: osr.nsw.gov.au/grants/fhba Assistance scheme.

Call 131 878 or

visit avjennings.com.au

Shared Equity Arrangements under

First Home Buyers Assistance.

First Home Buyers Assistance shared equity arrangements allow eligible

purchasers to buy property with other parties and still receives a concession.

To qualify, the eligible purchasers must buy at least 50 per cent of the

property. The value limits and other eligibility criteria of First Home Buyers

Assistance apply.

Stamp duty is calculated with reference to the proportion of the property

purchased by other parties. However, this interest is disregarded if it is not

more than 5%.

You can calculate the exact amount of your concession using the First Home

Buyers Assistance calculator.

Note: If the first home buyer’s spouse has previously owned a home or received

a benefit under First Home Buyers Assistance, the first home buyer will not be

entitled to the shared equity arrangements concession under First Home

Buyers Assistance, regardless of whether or not the spouse is also a purchaser.

How to apply for First Home Buyers

Assistance.

To apply for a first home buyers exemption or concession, you must complete

the First Home Buyers Assistance Scheme application form and provide to

your solicitor/conveyancer for processing.

Your application must be accompanied by all supporting documents. You

must have already exchanged contracts to purchase your first home or

vacant land.

Note: All purchasers must also complete a Purchaser/Transferee Declaration.

False claims. Where can I obtain

There are substantial penalties for knowingly making false or misleading more information?

statements in connection with an application for First Home Buyers

Assistance. Contact the NSW Office

of State Revenue

The OSR conduct investigations and compliance checks to ensure the duty

exemption/concession is given only to those applicants who are entitled to 1300 130 624

receive them. The OSR audits claims with current and historical data held by www.osr.nsw.gov.au

other State and Territory agencies and commercial organisations. first.home.benefits@osr.nsw.gov.au

Disclaimer:

All descriptions contained in this brochure are indicative only and have been prepared in good faith with due care using the NSW First Home Owner Grant (New Homes) sheet printed from

www.osr.nsw.gov.au dated July 2017. You should seek legal advice with respect to your eligibility to claim the First Home Benefits and should not seek to solely rely on the contents of this

document when deciding whether to enter into a contract for the purchase of a new home in reliance on receiving any concessions or exemptions. Alterations to the eligibility criterion for the

exemption/concession may occur without notice. You agree not to make any claim (of any nature whatsoever) against AVJennings Properties Limited with respect to the contents of this

document. Alterations may occur without notice after the date of printing (July 2017). Purchasers should inform and assure themselves by inspection, independent advice or as otherwise

necessary prior to purchase. ®Registered Trademark. ©AVJennings Properties Limited. ABN 50 004 601 503. Builders Licence 39168C.

Call 131 878 or

visit avjennings.com.au

You might also like

- Deraf Winding Up & AfidavitDocument37 pagesDeraf Winding Up & AfidavitKenny Wong100% (2)

- DPS Custodial Terms and Conditions Dec2022 v29Document7 pagesDPS Custodial Terms and Conditions Dec2022 v29Roxana Ignat100% (1)

- Pornhub and Modelhub Co-Performer Agreement PDFDocument2 pagesPornhub and Modelhub Co-Performer Agreement PDFAnn VannyNo ratings yet

- Naked MoneyDocument341 pagesNaked MoneyIshan SaneNo ratings yet

- Pakyaw AgreementDocument1 pagePakyaw AgreementVincent John Lao91% (11)

- How to have a Brilliant Career in Estate Agency: The ultimate guide to success in the property industry.From EverandHow to have a Brilliant Career in Estate Agency: The ultimate guide to success in the property industry.Rating: 5 out of 5 stars5/5 (1)

- Guide To The Selling Process of Real Estate Properties in The PhilippinesDocument5 pagesGuide To The Selling Process of Real Estate Properties in The PhilippinesJohnson SambranoNo ratings yet

- Florida's Construction Lien Law: Protect Yourself and Your InvestmentDocument2 pagesFlorida's Construction Lien Law: Protect Yourself and Your InvestmentpeterNo ratings yet

- Sub026 - Grain Trade AustraliaDocument38 pagesSub026 - Grain Trade AustraliaIshan SaneNo ratings yet

- Share Housing: Tenants Rights Factsheet 15Document2 pagesShare Housing: Tenants Rights Factsheet 15Danny AthertonNo ratings yet

- NSW Property Tax Application FormDocument15 pagesNSW Property Tax Application FormShiela NobeloNo ratings yet

- Education in HomeopathyDocument10 pagesEducation in Homeopathyelispasova86No ratings yet

- Fs 10 06Document3 pagesFs 10 06sjrooks1No ratings yet

- Investment News: First-Time Home Buyer Tax CreditDocument14 pagesInvestment News: First-Time Home Buyer Tax CreditKim in Kansas City100% (2)

- 2010 Tax Credit For New Home / First-Time BuyerDocument3 pages2010 Tax Credit For New Home / First-Time Buyerapi-26176222No ratings yet

- First Home Owner Grant Act 2000Document4 pagesFirst Home Owner Grant Act 2000Andrew ParryNo ratings yet

- Pre-Approval/Approval Application Form Determination For Previous Home Owner FormDocument12 pagesPre-Approval/Approval Application Form Determination For Previous Home Owner FormmossdusNo ratings yet

- 08 What Do I Need To Know Before Moving Out STUHDocument2 pages08 What Do I Need To Know Before Moving Out STUHSon T. NguyenNo ratings yet

- HAFA Policies Bank of AmericaDocument5 pagesHAFA Policies Bank of AmericaMelissa Rose Zavala100% (1)

- DLUHC How To Rent Oct2023Document19 pagesDLUHC How To Rent Oct2023Vali MatauNo ratings yet

- How To Rent Guide 02 October 2023Document19 pagesHow To Rent Guide 02 October 2023rNo ratings yet

- Glossary Home Buying2 Tcm21-108363Document13 pagesGlossary Home Buying2 Tcm21-108363rkrgupta991No ratings yet

- LISAInvestor DeclarationDocument2 pagesLISAInvestor DeclarationFelipe BerettaNo ratings yet

- Summary of Foreign Investment Review Board Policy ChangesDocument4 pagesSummary of Foreign Investment Review Board Policy ChangesOzDamoclesNo ratings yet

- 1 ActenantinfoDocument2 pages1 ActenantinfoKelvin LeongNo ratings yet

- WHRE Rental Application 2019Document10 pagesWHRE Rental Application 2019Sarah ClarkeNo ratings yet

- Delaware Real Estate Exam Questions and AnswersDocument26 pagesDelaware Real Estate Exam Questions and AnswersstaciakaniniwambuiNo ratings yet

- Information For Tenant: Form 1acDocument2 pagesInformation For Tenant: Form 1acTsz Yim LeeNo ratings yet

- Wholesaling Contract Sell Side CompletedDocument7 pagesWholesaling Contract Sell Side CompletedIan Jakovan DunlapNo ratings yet

- How To Rent Guide 2023Document18 pagesHow To Rent Guide 2023tarek.hamid12No ratings yet

- ID Assisted Home Ownership Schemes Eligibility Criteria PolicyDocument6 pagesID Assisted Home Ownership Schemes Eligibility Criteria PolicyThis guyNo ratings yet

- Tenancy ConditionsDocument15 pagesTenancy ConditionsFirrdhaus SahabuddinNo ratings yet

- Key Documents You Are Likely To Prepare in The Implementation and Disposal of The Project As A Sales AgentDocument4 pagesKey Documents You Are Likely To Prepare in The Implementation and Disposal of The Project As A Sales AgentWycee einssNo ratings yet

- Cash For KeysDocument5 pagesCash For KeysRamin OstowariNo ratings yet

- Documents You Must Include With Your Application:: Mortgage Pre-QualificationDocument8 pagesDocuments You Must Include With Your Application:: Mortgage Pre-QualificationAnonymous RtqTxAn7wNo ratings yet

- Renting Guide: Beginning The Tenancy Entry CostsDocument4 pagesRenting Guide: Beginning The Tenancy Entry CostsRebecca DooleyNo ratings yet

- IApartments UK - Guidelines For Prospective TenantsDocument12 pagesIApartments UK - Guidelines For Prospective TenantsGoldenOtakuNo ratings yet

- Renting A Home A Guide For Tenants New LegislationDocument6 pagesRenting A Home A Guide For Tenants New LegislationClarkBarcelonNo ratings yet

- CAV Renters GuideDocument6 pagesCAV Renters GuideClarkBarcelonNo ratings yet

- Your Home Buying GuideDocument13 pagesYour Home Buying Guideapi-182635653No ratings yet

- 1631 Lise42 Sbsbprdsa10 02 01Document2 pages1631 Lise42 Sbsbprdsa10 02 01wd216No ratings yet

- First Home Finance BrochureDocument6 pagesFirst Home Finance BrochureThabzNo ratings yet

- Fore Closer Facts For TenantsDocument2 pagesFore Closer Facts For TenantstfjieldNo ratings yet

- Doclib001 Homebuyer Disclosure StatementDocument4 pagesDoclib001 Homebuyer Disclosure StatementgreenfieldwindersNo ratings yet

- New California Homebuyer Tax CreditDocument1 pageNew California Homebuyer Tax Creditapi-26177170No ratings yet

- Fhlds Fact SheetDocument2 pagesFhlds Fact SheetMegh ThakkarNo ratings yet

- Letters Sent To Residents of Holgate ManorDocument11 pagesLetters Sent To Residents of Holgate ManorKGW NewsNo ratings yet

- Shared Home Ownership FaqsDocument6 pagesShared Home Ownership FaqschrystalleeholsteinNo ratings yet

- Boarding House Tenancy AgreementDocument25 pagesBoarding House Tenancy Agreementeuan.ansley01No ratings yet

- ConsumernoticeDocument2 pagesConsumernoticeelfantNo ratings yet

- More - Info - Purchase - House - D5 - 11062014Document7 pagesMore - Info - Purchase - House - D5 - 11062014sambasivammeNo ratings yet

- Residential Tenancies Guides Renting enDocument8 pagesResidential Tenancies Guides Renting enandre leducNo ratings yet

- CAV Renters GuideDocument6 pagesCAV Renters GuideClarkBarcelonNo ratings yet

- Affordable Housing Options PDFDocument8 pagesAffordable Housing Options PDFTheo A W JacksonNo ratings yet

- Real Estate Purchase AgreementDocument31 pagesReal Estate Purchase AgreementacheseotonyeNo ratings yet

- Sample Help To Buy Authority To Proceed LetterDocument4 pagesSample Help To Buy Authority To Proceed LetterHuda LestraNo ratings yet

- Andlord Enant AW: Olding EpositsDocument5 pagesAndlord Enant AW: Olding EpositsRoldan LualhatiNo ratings yet

- Lease #1Document9 pagesLease #1Sammy JohnsonNo ratings yet

- BOFA AddendumDocument6 pagesBOFA AddendumkwillsonNo ratings yet

- Aussie First Home Buyers GuideDocument36 pagesAussie First Home Buyers Guidegear123nNo ratings yet

- Held Lawyers: Law MattersDocument2 pagesHeld Lawyers: Law Mattersapi-284203178No ratings yet

- Rental Qualification Standards: Fair HousingDocument3 pagesRental Qualification Standards: Fair HousingFernandez El VincenteNo ratings yet

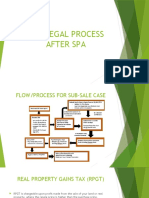

- The Legal Process After SpaDocument16 pagesThe Legal Process After SpaIzat AmirNo ratings yet

- Legal Room Rental AgreementDocument6 pagesLegal Room Rental AgreementMolly ClarkNo ratings yet

- CBOT-Understanding BasisDocument26 pagesCBOT-Understanding BasisIshan SaneNo ratings yet

- The Future Predictions of The Blind MysticDocument13 pagesThe Future Predictions of The Blind MysticIshan SaneNo ratings yet

- Pierian Data - Python For Finance & Algorithmic Trading Course NotesDocument11 pagesPierian Data - Python For Finance & Algorithmic Trading Course NotesIshan SaneNo ratings yet

- 19-00351 DATA61 REPORT AgricultureWorkforce WEB 191031Document80 pages19-00351 DATA61 REPORT AgricultureWorkforce WEB 191031Ishan SaneNo ratings yet

- Crown Sydney Cirq Food MenuDocument3 pagesCrown Sydney Cirq Food MenuIshan SaneNo ratings yet

- Chickpea Marketing IndiaDocument19 pagesChickpea Marketing IndiaIshan SaneNo ratings yet

- 2019 Salary Guide: Hudson AnalyticsDocument7 pages2019 Salary Guide: Hudson AnalyticsIshan SaneNo ratings yet

- The Vessel Scheduling Problem in A Liner ShippingDocument17 pagesThe Vessel Scheduling Problem in A Liner ShippingIshan SaneNo ratings yet

- The Nomenclature of Jewelry Part 3 - Rings - International Gem Society IGSDocument4 pagesThe Nomenclature of Jewelry Part 3 - Rings - International Gem Society IGSIshan SaneNo ratings yet

- The Nomenclature of Jewelry Part 1 - Settings - International Gem Society IGSDocument9 pagesThe Nomenclature of Jewelry Part 1 - Settings - International Gem Society IGSIshan SaneNo ratings yet

- ACF Supply and Demand Report - October 18Document6 pagesACF Supply and Demand Report - October 18Ishan SaneNo ratings yet

- Commodity Trading Goes Back To The FutureDocument10 pagesCommodity Trading Goes Back To The FutureIshan SaneNo ratings yet

- SeniorResearchAnalystCOFCO MichaelMoscaDocument3 pagesSeniorResearchAnalystCOFCO MichaelMoscaIshan SaneNo ratings yet

- Mahesh Gowande: ContactDocument2 pagesMahesh Gowande: ContactIshan SaneNo ratings yet

- Sample: For Your InformationDocument28 pagesSample: For Your InformationIshan SaneNo ratings yet

- Making Money Investing in Gems - International Gem Society IGSDocument9 pagesMaking Money Investing in Gems - International Gem Society IGSIshan SaneNo ratings yet

- Backwardation Returns Commodity FutDocument30 pagesBackwardation Returns Commodity FutIshan SaneNo ratings yet

- Education Lesson Inventory: CoursesDocument21 pagesEducation Lesson Inventory: CoursesIshan SaneNo ratings yet

- Performance Management ProcedureDocument6 pagesPerformance Management ProcedureIshan SaneNo ratings yet

- Continuous Futures Data Series For Back Testing and Technical AnalysisDocument6 pagesContinuous Futures Data Series For Back Testing and Technical AnalysisIshan SaneNo ratings yet

- Alteryx Inspire ConferenceDocument3 pagesAlteryx Inspire ConferenceIshan SaneNo ratings yet

- A Quantitative Analysis of Managed Futures Strategies: Lintner RevisitedDocument40 pagesA Quantitative Analysis of Managed Futures Strategies: Lintner RevisitedIshan SaneNo ratings yet

- Commodities, Inc. v. Daewoo Industrial Co. LTD., G.R. No. 100831, December 17, 1993)Document11 pagesCommodities, Inc. v. Daewoo Industrial Co. LTD., G.R. No. 100831, December 17, 1993)Ghatz CondaNo ratings yet

- Pretest Essay On LawDocument2 pagesPretest Essay On LawHechel DatinguinooNo ratings yet

- ST RDDocument2 pagesST RDSean ArcillaNo ratings yet

- Expert Determination Clauses in Contracts Providing For International ArbitrationDocument6 pagesExpert Determination Clauses in Contracts Providing For International ArbitrationJúlia de MarckNo ratings yet

- Tutoring Framework Agreement LatinHire - Brainly HumanitiesDocument9 pagesTutoring Framework Agreement LatinHire - Brainly HumanitiesMaría jose Ortega mejiaNo ratings yet

- 99 Integrated Construction V RelovaDocument1 page99 Integrated Construction V RelovaluigimanzanaresNo ratings yet

- Dejavu SansDocument2 pagesDejavu SansThiago MompeanNo ratings yet

- LicensesDocument4 pagesLicensesFernando GarciaNo ratings yet

- Housekeeping For State Assemblies ReviewedDocument3 pagesHousekeeping For State Assemblies Reviewedpaula_morrill668No ratings yet

- 60.inward Ri BusinessDocument7 pages60.inward Ri BusinessTarun YadavNo ratings yet

- Forex & DerivativesDocument6 pagesForex & Derivativessarahbee100% (1)

- 89 Quinto v. People - DIGESTDocument1 page89 Quinto v. People - DIGESTAllen Windel BernabeNo ratings yet

- Patent Granting and UMID Registration ProcedureDocument67 pagesPatent Granting and UMID Registration ProcedureDonna Cece MelgarNo ratings yet

- Batch 6 Consolidated Case DigestDocument74 pagesBatch 6 Consolidated Case DigestASGarcia24100% (1)

- Form 5Document2 pagesForm 5hdpanchal86No ratings yet

- Close Corporation Shareholder's Management AgreementDocument4 pagesClose Corporation Shareholder's Management AgreementDiego Antolini0% (1)

- IFRS17 Measurement and ApplicabilityDocument2 pagesIFRS17 Measurement and Applicabilityالخليفة دجوNo ratings yet

- SPV Agreement With Land Asset, With JV GROUP BEC-DDIPDocument3 pagesSPV Agreement With Land Asset, With JV GROUP BEC-DDIPmushir ahmedNo ratings yet

- Architect Consultant AgreementDocument6 pagesArchitect Consultant AgreementAndré Bento SantosNo ratings yet

- From (Abhay Raj Singh Chauhan (Abhay18290@gmail - Com) ) - ID (92) - CPCDocument22 pagesFrom (Abhay Raj Singh Chauhan (Abhay18290@gmail - Com) ) - ID (92) - CPCNikhil AradheNo ratings yet

- DONEDevelopment Bank of The Philippines V COADocument2 pagesDONEDevelopment Bank of The Philippines V COAKathlene JaoNo ratings yet

- MOOT SummaryDocument4 pagesMOOT SummaryCill123No ratings yet

- A Monopoly of Patents Is The Reward of The Inventor. Explain The Silent Features of The Patent Act 1970 in The Light of The Above Statement.Document3 pagesA Monopoly of Patents Is The Reward of The Inventor. Explain The Silent Features of The Patent Act 1970 in The Light of The Above Statement.Pratap RabhaNo ratings yet

- Anil Khanna Appt - LetterDocument5 pagesAnil Khanna Appt - Lettertestengine701921No ratings yet

- VIRGILIO R. ROMERO V CADocument2 pagesVIRGILIO R. ROMERO V CABeya Marie F. AmaroNo ratings yet

- Industrial Relation and Labour LawsDocument5 pagesIndustrial Relation and Labour Lawskartikmehrotra84No ratings yet

- 10000018256Document3 pages10000018256Chapter 11 DocketsNo ratings yet