Professional Documents

Culture Documents

Profit Maximization Under Monopolistic Competition: Choosing The Profit-Maximizing Output and Price

Profit Maximization Under Monopolistic Competition: Choosing The Profit-Maximizing Output and Price

Uploaded by

Carla Mae F. DaduralCopyright:

Available Formats

You might also like

- Mod 1 - TVM - Intuition Discounting - Problem Set 1Document15 pagesMod 1 - TVM - Intuition Discounting - Problem Set 1Natarajan Rajasekaran0% (1)

- 02 - The Secret To Reading Price Chart Like A ProDocument8 pages02 - The Secret To Reading Price Chart Like A ProISHAN SHARMA100% (2)

- Homework 5 - Part - I - AKDocument14 pagesHomework 5 - Part - I - AKBagus SaputroNo ratings yet

- Integrated Approach For Supply ChainDocument9 pagesIntegrated Approach For Supply ChainSai GaneshNo ratings yet

- Trader Tom's TA NotesDocument32 pagesTrader Tom's TA Notesctrader100% (1)

- A Summary of Comparing Cost and Revenue To Maximize ProfitDocument4 pagesA Summary of Comparing Cost and Revenue To Maximize ProfitMaria JessaNo ratings yet

- Micro-Econ Final PresentationDocument9 pagesMicro-Econ Final PresentationmichellebaileylindsaNo ratings yet

- Module IIDocument36 pagesModule IIYash UpasaniNo ratings yet

- Marjorie Bse 4a EconomicsDocument25 pagesMarjorie Bse 4a Economics062691No ratings yet

- Microeconomics Assignment 8Document17 pagesMicroeconomics Assignment 8abreaNo ratings yet

- Fixed Variable and Marginal Costs PDFDocument14 pagesFixed Variable and Marginal Costs PDFHam ZaNo ratings yet

- Summary Break Even AnalysisDocument5 pagesSummary Break Even AnalysisIveta Nguyen ThiNo ratings yet

- Eco Project FinalDocument36 pagesEco Project FinalSakshamNo ratings yet

- ECON101 2015-16 Fall Final Answer KeyDocument8 pagesECON101 2015-16 Fall Final Answer Keytrungly doNo ratings yet

- WikiDocument7 pagesWikiklfenker100% (1)

- MICROECONOMICSDocument11 pagesMICROECONOMICSMichael GuanzingNo ratings yet

- EC1000 Tutorial3 AnswersDocument4 pagesEC1000 Tutorial3 AnswersSabin Sadaf100% (1)

- Oligopoly and Cournot ModelDocument10 pagesOligopoly and Cournot ModelBerk YAZARNo ratings yet

- According To The Case, The Distribution Method Is Shown BelowDocument4 pagesAccording To The Case, The Distribution Method Is Shown BelowrizqighaniNo ratings yet

- Night Racers ProductionDocument4 pagesNight Racers ProductionKateryna TernovaNo ratings yet

- Cost-Volume-Profit Analysis: Preston UniversityDocument22 pagesCost-Volume-Profit Analysis: Preston Universitydeepak boraNo ratings yet

- Unit 5Document10 pagesUnit 5Bedilu MesfinNo ratings yet

- Profits and Perfect Competition: (Unit VI.i Problem Set Answers)Document12 pagesProfits and Perfect Competition: (Unit VI.i Problem Set Answers)nguyen tuanhNo ratings yet

- Guia Examen EconomiaDocument10 pagesGuia Examen Economiajavi.zuniga20No ratings yet

- Market TypesDocument32 pagesMarket TypesJintu Moni BarmanNo ratings yet

- Team Member's: Varun Aggarwal Jyoti Chauhan Shashank Rana Preeti Pawaria Rahul Yadav Vijay Kundra Nitin Kumar Sapna RanaDocument75 pagesTeam Member's: Varun Aggarwal Jyoti Chauhan Shashank Rana Preeti Pawaria Rahul Yadav Vijay Kundra Nitin Kumar Sapna Ranagoyal_khushbu88No ratings yet

- MicroPS 5Document2 pagesMicroPS 5sidrajaffri72No ratings yet

- 6.2 - Tutorial QuestionsDocument14 pages6.2 - Tutorial QuestionsMacxy TanNo ratings yet

- Lab Report - Break Even AnalysisDocument11 pagesLab Report - Break Even AnalysisKokoriaNo ratings yet

- Micro Eportfolio Competition Spreadsheet Data-Fall 18Document4 pagesMicro Eportfolio Competition Spreadsheet Data-Fall 18api-334921583No ratings yet

- CVP NumericalDocument13 pagesCVP NumericalChandan JobanputraNo ratings yet

- Fixed Price Incentive Fee ContractDocument3 pagesFixed Price Incentive Fee ContractPMPNo ratings yet

- Short Run EquilibriumDocument5 pagesShort Run EquilibriumGhosty RoastyNo ratings yet

- Ass 2Document10 pagesAss 2张昊泽No ratings yet

- Assignment No. 2: Course: Advanced Microeconomics Code: 805 Semester: Spring, 2020 Level: M.Sc. EconomicsDocument14 pagesAssignment No. 2: Course: Advanced Microeconomics Code: 805 Semester: Spring, 2020 Level: M.Sc. EconomicsAmmara RukhsarNo ratings yet

- Ôn tập 3Document7 pagesÔn tập 3Gia HânNo ratings yet

- Assignment 3: Course Title: ECO101Document4 pagesAssignment 3: Course Title: ECO101Rashik AhmedNo ratings yet

- Practice Questions & AnswerDocument5 pagesPractice Questions & AnswerAreej Fatima 29No ratings yet

- Module 6 MicroeconomicsDocument3 pagesModule 6 MicroeconomicsChristian VillanuevaNo ratings yet

- THURGA Tutorial 5Document5 pagesTHURGA Tutorial 5thurgakannanNo ratings yet

- M11 CHP 09 1 Flex Bud Variances 2011 0524Document47 pagesM11 CHP 09 1 Flex Bud Variances 2011 0524tobeh ibrahimNo ratings yet

- Econ 112: Review For Final ExamDocument9 pagesEcon 112: Review For Final ExamOmar RaoufNo ratings yet

- Chapter 06-Sales Mix and ICPDocument11 pagesChapter 06-Sales Mix and ICPbbckk1No ratings yet

- Problem 1: Short-Run Costs (15 Points)Document6 pagesProblem 1: Short-Run Costs (15 Points)Sanaa2510No ratings yet

- Economics 100 New Class 11 and 12Document9 pagesEconomics 100 New Class 11 and 12airtonfelixNo ratings yet

- Micro Eportfolio Monopoly Spreadsheet Data - SPG 18 1Document3 pagesMicro Eportfolio Monopoly Spreadsheet Data - SPG 18 1api-334921583No ratings yet

- Perfect CompttDocument36 pagesPerfect CompttAdil EhsanNo ratings yet

- Eco10004: Economic Principles Week 5 - Tutorial SolutionsDocument5 pagesEco10004: Economic Principles Week 5 - Tutorial SolutionsMacxy TanNo ratings yet

- Topic 3 - Economic OptimizationDocument5 pagesTopic 3 - Economic Optimizationsherryl caoNo ratings yet

- PracticeDocument12 pagesPracticeNguyễn QuỳnhNo ratings yet

- Shorya Agarwal Class Text 2Document14 pagesShorya Agarwal Class Text 2vidhantmaanthapaNo ratings yet

- Chapter 10: Market Power: Monopoly and Monopsony: P MC 1 + 1 EDocument5 pagesChapter 10: Market Power: Monopoly and Monopsony: P MC 1 + 1 EKalyan SaikiaNo ratings yet

- A. Williams Module 2Document16 pagesA. Williams Module 2awilliams2641No ratings yet

- Week 9 Suggested Solutions To Class QuestionsDocument8 pagesWeek 9 Suggested Solutions To Class QuestionspartyycrasherNo ratings yet

- Perfectly Competitive Supply and Monopolies-1Document62 pagesPerfectly Competitive Supply and Monopolies-1Samiur RahmanNo ratings yet

- Chapter 5 - Perfect CompetitionDocument5 pagesChapter 5 - Perfect CompetitionYonas D. EbrenNo ratings yet

- Analysis of Monopoly: Total and Marginal RevenueDocument6 pagesAnalysis of Monopoly: Total and Marginal RevenueTemesgen TakeleNo ratings yet

- Analysis of Monopoly: Total and Marginal RevenueDocument6 pagesAnalysis of Monopoly: Total and Marginal RevenueTemesgen TakeleNo ratings yet

- Types of Market StructureDocument16 pagesTypes of Market StructureCatarina CoelhoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Scalping and Pre-set Value Trading: Football Double Chance Market - Betfair ExchangeFrom EverandScalping and Pre-set Value Trading: Football Double Chance Market - Betfair ExchangeNo ratings yet

- Scalping and Pre-set Value Trading: Football Double Chance Market - Betfair Exchange: Scalping and Pre-set Value TradingFrom EverandScalping and Pre-set Value Trading: Football Double Chance Market - Betfair Exchange: Scalping and Pre-set Value TradingNo ratings yet

- Accounting, Maths and Computing Principles for Business Studies V11From EverandAccounting, Maths and Computing Principles for Business Studies V11No ratings yet

- The Shutdown Point: Scenario 1Document10 pagesThe Shutdown Point: Scenario 1Carla Mae F. DaduralNo ratings yet

- Negative Externalities: PollutionDocument8 pagesNegative Externalities: PollutionCarla Mae F. DaduralNo ratings yet

- Equilibrium, Surplus, and ShortageDocument4 pagesEquilibrium, Surplus, and ShortageCarla Mae F. DaduralNo ratings yet

- Causes of Growing Inequality: Changing Composition of American HouseholdsDocument3 pagesCauses of Growing Inequality: Changing Composition of American HouseholdsCarla Mae F. DaduralNo ratings yet

- Figure 1. A Production Possibilities Frontier Showing Health Care and EducationDocument2 pagesFigure 1. A Production Possibilities Frontier Showing Health Care and EducationCarla Mae F. DaduralNo ratings yet

- Economies of ScaleDocument5 pagesEconomies of ScaleCarla Mae F. DaduralNo ratings yet

- Regulating Natural MonopoliesDocument5 pagesRegulating Natural MonopoliesCarla Mae F. DaduralNo ratings yet

- The Foundations of The Demand CurveDocument4 pagesThe Foundations of The Demand CurveCarla Mae F. DaduralNo ratings yet

- Employment Discrimination: Earnings Gaps by Race and GenderDocument7 pagesEmployment Discrimination: Earnings Gaps by Race and GenderCarla Mae F. DaduralNo ratings yet

- Profit Maximization For A Monopoly: Demand Curves Perceived by A Perfectly Competitive Firm and by A MonopolyDocument8 pagesProfit Maximization For A Monopoly: Demand Curves Perceived by A Perfectly Competitive Firm and by A MonopolyCarla Mae F. DaduralNo ratings yet

- Labor Market Power by EmployersDocument7 pagesLabor Market Power by EmployersCarla Mae F. DaduralNo ratings yet

- Trade and Efficiency: Getting A Good Deal or Making A Good DealDocument3 pagesTrade and Efficiency: Getting A Good Deal or Making A Good DealCarla Mae F. DaduralNo ratings yet

- 122333Document2 pages122333Carla Mae F. DaduralNo ratings yet

- Rules For Maximizing UtilityDocument7 pagesRules For Maximizing UtilityCarla Mae F. DaduralNo ratings yet

- Customers and Changing CostsDocument3 pagesCustomers and Changing CostsCarla Mae F. DaduralNo ratings yet

- The Role of The GATT in Reducing Barriers To TradeDocument6 pagesThe Role of The GATT in Reducing Barriers To TradeCarla Mae F. DaduralNo ratings yet

- Outcome: The Shutdown PointDocument10 pagesOutcome: The Shutdown PointCarla Mae F. DaduralNo ratings yet

- Unit 1: Introduction To EconomicsDocument2 pagesUnit 1: Introduction To EconomicsCarla Mae F. DaduralNo ratings yet

- Reading: The Production Possibilities FrontierDocument9 pagesReading: The Production Possibilities FrontierCarla Mae F. DaduralNo ratings yet

- Positive and Normative StatementsDocument2 pagesPositive and Normative StatementsCarla Mae F. DaduralNo ratings yet

- Behavioral Economics: An Alternative Viewpoint: Irrational Consumer BehaviorDocument2 pagesBehavioral Economics: An Alternative Viewpoint: Irrational Consumer BehaviorCarla Mae F. DaduralNo ratings yet

- Reading: The Production Possibilities FrontierDocument9 pagesReading: The Production Possibilities FrontierCarla Mae F. DaduralNo ratings yet

- Market-Oriented Environmental Tools: Effluent ChargesDocument6 pagesMarket-Oriented Environmental Tools: Effluent ChargesCarla Mae F. DaduralNo ratings yet

- Regulating Anticompetitive BehaviorDocument7 pagesRegulating Anticompetitive BehaviorCarla Mae F. DaduralNo ratings yet

- 1.1.3: Review of Data Representation and Mathematics For EconomicsDocument4 pages1.1.3: Review of Data Representation and Mathematics For EconomicsCarla Mae F. DaduralNo ratings yet

- 1.1.2: Getting To Know Economics: The Economic Way of ThinkingDocument10 pages1.1.2: Getting To Know Economics: The Economic Way of ThinkingCarla Mae F. DaduralNo ratings yet

- Outcome: Entry and Exit DecisionsDocument4 pagesOutcome: Entry and Exit DecisionsCarla Mae F. DaduralNo ratings yet

- Reading: Measuring Income Inequality: How Do You Separate Poverty and Income Inequality?Document6 pagesReading: Measuring Income Inequality: How Do You Separate Poverty and Income Inequality?Carla Mae F. DaduralNo ratings yet

- R11 - Should You Make The First OfferDocument5 pagesR11 - Should You Make The First OfferMANVI PANDEYNo ratings yet

- Case Study Subsidized Wheat Production in Japan-1Document2 pagesCase Study Subsidized Wheat Production in Japan-1anh.nguyen210176No ratings yet

- The Management of Society's Resources Is Important Because Resources Is ScarceDocument1 pageThe Management of Society's Resources Is Important Because Resources Is ScarceRodel Amante MedicoNo ratings yet

- Strategic Management Cia 1 Component 1: Submitted By: Hrithik Agrawal 1720614 5 Bba FDocument5 pagesStrategic Management Cia 1 Component 1: Submitted By: Hrithik Agrawal 1720614 5 Bba FSAHILNo ratings yet

- Cardamom in NepalDocument10 pagesCardamom in NepalRewanta LuitelNo ratings yet

- 10.allocative EfficiencyDocument5 pages10.allocative EfficiencySpartanNo ratings yet

- Indiareit Apartment FundDocument18 pagesIndiareit Apartment FundSandeep BorseNo ratings yet

- C H A P T E R Three: Business Strategies and Their Marketing ImplicationsDocument20 pagesC H A P T E R Three: Business Strategies and Their Marketing ImplicationsNguyen AnhNo ratings yet

- ACCTG 22 DepartmentalDocument12 pagesACCTG 22 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- CHAPTER 11 Marketing - 1.2Document334 pagesCHAPTER 11 Marketing - 1.2Joanna GarciaNo ratings yet

- Coffee Shops Thesis WIT With InstrumentDocument50 pagesCoffee Shops Thesis WIT With InstrumentJullienne PasaporteNo ratings yet

- Anuja ResumeDocument3 pagesAnuja ResumeAnujaKhareNo ratings yet

- Milk For The NationDocument59 pagesMilk For The Nationmihin.wimalasena100% (2)

- Design Space Planning Req 1Document14 pagesDesign Space Planning Req 1Michael Joshua SegayaNo ratings yet

- Ebook en 50SuccesfulTradersDocument61 pagesEbook en 50SuccesfulTradersYANESKANo ratings yet

- Fee Structure 2024-25Document5 pagesFee Structure 2024-25Sujoy GhoshNo ratings yet

- Presentation On Green MarketingDocument16 pagesPresentation On Green Marketingkamdica71% (7)

- Chapter One: Introduction To Financial Markets and InstitutionDocument14 pagesChapter One: Introduction To Financial Markets and InstitutionSADIQUE SIFATNo ratings yet

- Document 2Document21 pagesDocument 2Muhammad HafizNo ratings yet

- Building Customer Loyalty Through QualityDocument30 pagesBuilding Customer Loyalty Through QualityfirebirdshockwaveNo ratings yet

- London Housing Market Case StudyDocument5 pagesLondon Housing Market Case StudySimran LakhwaniNo ratings yet

- 3 Case StudyDocument15 pages3 Case StudyAlliah Victoria SapadenNo ratings yet

- Cost ProblemsDocument7 pagesCost ProblemsMadanNo ratings yet

- Inverse and Quanto Inverse Options in A Black-Scholes WorldDocument36 pagesInverse and Quanto Inverse Options in A Black-Scholes WorldJulien KuntzNo ratings yet

- 探討中美貿易戰爭對台灣各產業股價之影響 Explore the Impact of China-U.S. Trade War on the Share Price of the Taiwan IndustryDocument49 pages探討中美貿易戰爭對台灣各產業股價之影響 Explore the Impact of China-U.S. Trade War on the Share Price of the Taiwan IndustryAngel ChiangNo ratings yet

- PT Telekomunikasi Indonesia, TBK: Fairly Steady 1Q20 ResultsDocument9 pagesPT Telekomunikasi Indonesia, TBK: Fairly Steady 1Q20 ResultsSugeng YuliantoNo ratings yet

Profit Maximization Under Monopolistic Competition: Choosing The Profit-Maximizing Output and Price

Profit Maximization Under Monopolistic Competition: Choosing The Profit-Maximizing Output and Price

Uploaded by

Carla Mae F. DaduralOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profit Maximization Under Monopolistic Competition: Choosing The Profit-Maximizing Output and Price

Profit Maximization Under Monopolistic Competition: Choosing The Profit-Maximizing Output and Price

Uploaded by

Carla Mae F. DaduralCopyright:

Available Formats

Profit Maximization under Monopolistic Competition

Choosing the Profit-Maximizing Output and Price

The monopolistically competitive firm decides on its profit-maximizing quantity and price

in much the same way as a monopolist. A monopolistic competitor, like a monopolist,

faces a downward-sloping demand curve, and so it will choose some combination of

price and quantity along its perceived demand curve.

As an example of a profit-maximizing monopolistic competitor, consider the Authentic

Chinese Pizza store, which serves pizza with cheese, sweet and sour sauce, and your

choice of vegetables and meats. Although Authentic Chinese Pizza must compete

against other pizza businesses and restaurants, it has a differentiated product. The

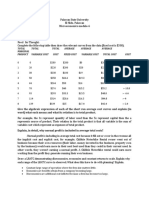

firm’s perceived demand curve is downward sloping, as shown in Figure 1 and the first

two columns of Table 1.

Figure 1. How a Monopolistic Competitor Chooses its Profit Maximizing Output and Price. To maximize

profits, the Authentic Chinese Pizza shop would choose a quantity where marginal revenue equals marginal

cost, or Q where MR = MC. Here it would choose a quantity of 40 and a price of $16.

Table 1. Revenue and Cost Schedule

Quantit Pric Total Marginal Total Marginal

Table 1. Revenue and Cost Schedule

y e Revenue Revenue Cost Cost

10 $23 $230 — $340 –

20 $20 $400 $17 $400 $6

30 $18 $540 $14 $480 $8

40 $16 $640 $10 $580 $10

50 $14 $700 $6 $700 $12

60 $12 $720 $2 $840 $14

70 $10 $700 –$2 $1,020 $18

80 $8 $640 –$6 $1,280 $26

The combinations of price and quantity at each point on the demand curve can be

multiplied to calculate the total revenue that the firm would receive, which is shown in

the third column of Table 1. The fourth column, marginal revenue, is calculated as the

change in total revenue divided by the change in quantity. The final columns of Table 1

show total cost, marginal cost, and average cost. As always, marginal cost is calculated

by dividing the change in total cost by the change in quantity, while average cost is

calculated by dividing total cost by quantity. The following example shows how these

firms calculate how much of its product to supply at what price.

HOW A MONOPOLISTIC COMPETITOR DETERMINES HOW MUCH TO PRODUCE

AND AT WHAT PRICE

The process by which a monopolistic competitor chooses its profit-maximizing quantity and

price resembles closely how a monopoly makes these decisions process. First, the firm selects

the profit-maximizing quantity to produce. Then the firm decides what price to charge for that

quantity.

Step 1. The monopolistic competitor determines its profit-maximizing level of output. In this

case, the Authentic Chinese Pizza company will determine the profit-maximizing quantity to

produce by considering its marginal revenues and marginal costs. Two scenarios are possible:

If the firm is producing at a quantity of output where marginal revenue exceeds

marginal cost, then the firm should keep expanding production, because each

marginal unit is adding to profit by bringing in more revenue than its cost. In this

way, the firm will produce up to the quantity where MR = MC.

If the firm is producing at a quantity where marginal costs exceed marginal

revenue, then each marginal unit is costing more than the revenue it brings in, and

the firm will increase its profits by reducing the quantity of output until MR = MC.

In this example, MR and MC intersect at a quantity of 40, which is the profit-maximizing level of

output for the firm.

Step 2. The monopolistic competitor decides what price to charge. When the firm has

determined its profit-maximizing quantity of output, it can then look to its perceived demand

curve to find out what it can charge for that quantity of output. On the graph, this process can be

shown as a vertical line reaching up through the profit-maximizing quantity until it hits the firm’s

perceived demand curve. For Authentic Chinese Pizza, it should charge a price of $16 per pizza

for a quantity of 40.

Although the process by which a monopolistic competitor makes decisions about

quantity and price is similar to the way in which a monopolist makes such decisions, two

differences are worth remembering. First, although both a monopolist and a

monopolistic competitor face downward-sloping demand curves, the monopolist’s

perceived demand curve is the market demand curve, while the perceived demand

curve for a monopolistic competitor is based on the extent of its product differentiation

and how many competitors it faces. Second, a monopolist is surrounded by barriers to

entry and need not fear entry, but a monopolistic competitor who earns profits must

expect the entry of firms with similar, but differentiated, products.

TRY IT

Calculating Profits

Once the monopollstic competitor has determined the profit-maximizing quantity of

output to supply, the next step is to calculate how much profit it is earning. We use the

same process that was used with perfect competition and monopoly. This is illustrated

in Figure 2, using the data from Table 2, which extends the data from to Table 1 to

include average total cost in the last column.

Figure 2. Computing Profit for a Monopolistic Competitor. To calculate profit, start from the profit-

maximizing quantity, which is 40. Next find total revenue which is the area of the rectangle with the height of P

= $16 times the base of Q = 40. Next find total cost which is the area of the rectangle with the height of AC =

$14.50 times the base of Q = 40. The difference between the two areas is profit, the small rectangle above total

cost in the figure.

Table 2. Revenue and Cost Schedule, including Average Cost

Margina

Total

Quantit Pric l Total Margina Averag

Revenu

y e Revenu Cost l Cost e Cost

e

e

10 $23 $230 — $340 – $34

20 $20 $400 $17 $400 $6 $20

30 $18 $540 $14 $480 $8 $16

40 $16 $640 $10 $580 $10 $14.50

50 $14 $700 $6 $700 $12 $14

60 $12 $720 $2 $840 $14 $14

Table 2. Revenue and Cost Schedule, including Average Cost

$1,02

70 $10 $700 –$2 $18 $14.57

0

$1,28

80 $8 $640 –$6 $26 $16

0

We start by identifying the profit-maximizing level of output, where marginal revenue

equals marginal cost. This is Q = 40. Next, look for the profit margin, the difference

between price and average cost. The price is $16, which you can read off the demand

curve for quantity equals 40. The average cost is $14.50, which you can read off the

average cost curve for quantity equals 40. The profit margin is $16.00 – $14.50 = $1.50

for each unit that the firm sells. Total profit is the profit margin times the quantity or

$1.50 x 40 = $60.

Alternatively, we can compute profit as total revenue minus total cost. Total revenue is

price times quantity or $16.00 x 40 = $640. This is the area of the rectangle that starts at

the origin, goes up to a price of $16, goes over to the demand curve, down to the

quantity of 40 and back to the origin. Total cost is average cost times quantity or $14.50

x 40 = $580. This is the area of the rectangle that starts at the origin, goes up the

vertical axis to an average cost of $14.50, goes over to the average cost curve, down to

the quantity of 40 and back to the origin. Profit is the difference between the two areas,

$640 – $580 = $60. This is shown graphically as the area of the rectangle on top of total

cost, or the price minus average cost, times quantity. Note that if the firm was earning

zero economic profits, the rectangles of total revenue and total cost would be the same

—there would be no profit rectangle. The break-even point occurs where the demand

curve intersects with average cost, so P = AC. Note also that if the firm was making a

loss, the negative profit (i.e. loss) would be the rectangle on top of total revenue.

You might also like

- Mod 1 - TVM - Intuition Discounting - Problem Set 1Document15 pagesMod 1 - TVM - Intuition Discounting - Problem Set 1Natarajan Rajasekaran0% (1)

- 02 - The Secret To Reading Price Chart Like A ProDocument8 pages02 - The Secret To Reading Price Chart Like A ProISHAN SHARMA100% (2)

- Homework 5 - Part - I - AKDocument14 pagesHomework 5 - Part - I - AKBagus SaputroNo ratings yet

- Integrated Approach For Supply ChainDocument9 pagesIntegrated Approach For Supply ChainSai GaneshNo ratings yet

- Trader Tom's TA NotesDocument32 pagesTrader Tom's TA Notesctrader100% (1)

- A Summary of Comparing Cost and Revenue To Maximize ProfitDocument4 pagesA Summary of Comparing Cost and Revenue To Maximize ProfitMaria JessaNo ratings yet

- Micro-Econ Final PresentationDocument9 pagesMicro-Econ Final PresentationmichellebaileylindsaNo ratings yet

- Module IIDocument36 pagesModule IIYash UpasaniNo ratings yet

- Marjorie Bse 4a EconomicsDocument25 pagesMarjorie Bse 4a Economics062691No ratings yet

- Microeconomics Assignment 8Document17 pagesMicroeconomics Assignment 8abreaNo ratings yet

- Fixed Variable and Marginal Costs PDFDocument14 pagesFixed Variable and Marginal Costs PDFHam ZaNo ratings yet

- Summary Break Even AnalysisDocument5 pagesSummary Break Even AnalysisIveta Nguyen ThiNo ratings yet

- Eco Project FinalDocument36 pagesEco Project FinalSakshamNo ratings yet

- ECON101 2015-16 Fall Final Answer KeyDocument8 pagesECON101 2015-16 Fall Final Answer Keytrungly doNo ratings yet

- WikiDocument7 pagesWikiklfenker100% (1)

- MICROECONOMICSDocument11 pagesMICROECONOMICSMichael GuanzingNo ratings yet

- EC1000 Tutorial3 AnswersDocument4 pagesEC1000 Tutorial3 AnswersSabin Sadaf100% (1)

- Oligopoly and Cournot ModelDocument10 pagesOligopoly and Cournot ModelBerk YAZARNo ratings yet

- According To The Case, The Distribution Method Is Shown BelowDocument4 pagesAccording To The Case, The Distribution Method Is Shown BelowrizqighaniNo ratings yet

- Night Racers ProductionDocument4 pagesNight Racers ProductionKateryna TernovaNo ratings yet

- Cost-Volume-Profit Analysis: Preston UniversityDocument22 pagesCost-Volume-Profit Analysis: Preston Universitydeepak boraNo ratings yet

- Unit 5Document10 pagesUnit 5Bedilu MesfinNo ratings yet

- Profits and Perfect Competition: (Unit VI.i Problem Set Answers)Document12 pagesProfits and Perfect Competition: (Unit VI.i Problem Set Answers)nguyen tuanhNo ratings yet

- Guia Examen EconomiaDocument10 pagesGuia Examen Economiajavi.zuniga20No ratings yet

- Market TypesDocument32 pagesMarket TypesJintu Moni BarmanNo ratings yet

- Team Member's: Varun Aggarwal Jyoti Chauhan Shashank Rana Preeti Pawaria Rahul Yadav Vijay Kundra Nitin Kumar Sapna RanaDocument75 pagesTeam Member's: Varun Aggarwal Jyoti Chauhan Shashank Rana Preeti Pawaria Rahul Yadav Vijay Kundra Nitin Kumar Sapna Ranagoyal_khushbu88No ratings yet

- MicroPS 5Document2 pagesMicroPS 5sidrajaffri72No ratings yet

- 6.2 - Tutorial QuestionsDocument14 pages6.2 - Tutorial QuestionsMacxy TanNo ratings yet

- Lab Report - Break Even AnalysisDocument11 pagesLab Report - Break Even AnalysisKokoriaNo ratings yet

- Micro Eportfolio Competition Spreadsheet Data-Fall 18Document4 pagesMicro Eportfolio Competition Spreadsheet Data-Fall 18api-334921583No ratings yet

- CVP NumericalDocument13 pagesCVP NumericalChandan JobanputraNo ratings yet

- Fixed Price Incentive Fee ContractDocument3 pagesFixed Price Incentive Fee ContractPMPNo ratings yet

- Short Run EquilibriumDocument5 pagesShort Run EquilibriumGhosty RoastyNo ratings yet

- Ass 2Document10 pagesAss 2张昊泽No ratings yet

- Assignment No. 2: Course: Advanced Microeconomics Code: 805 Semester: Spring, 2020 Level: M.Sc. EconomicsDocument14 pagesAssignment No. 2: Course: Advanced Microeconomics Code: 805 Semester: Spring, 2020 Level: M.Sc. EconomicsAmmara RukhsarNo ratings yet

- Ôn tập 3Document7 pagesÔn tập 3Gia HânNo ratings yet

- Assignment 3: Course Title: ECO101Document4 pagesAssignment 3: Course Title: ECO101Rashik AhmedNo ratings yet

- Practice Questions & AnswerDocument5 pagesPractice Questions & AnswerAreej Fatima 29No ratings yet

- Module 6 MicroeconomicsDocument3 pagesModule 6 MicroeconomicsChristian VillanuevaNo ratings yet

- THURGA Tutorial 5Document5 pagesTHURGA Tutorial 5thurgakannanNo ratings yet

- M11 CHP 09 1 Flex Bud Variances 2011 0524Document47 pagesM11 CHP 09 1 Flex Bud Variances 2011 0524tobeh ibrahimNo ratings yet

- Econ 112: Review For Final ExamDocument9 pagesEcon 112: Review For Final ExamOmar RaoufNo ratings yet

- Chapter 06-Sales Mix and ICPDocument11 pagesChapter 06-Sales Mix and ICPbbckk1No ratings yet

- Problem 1: Short-Run Costs (15 Points)Document6 pagesProblem 1: Short-Run Costs (15 Points)Sanaa2510No ratings yet

- Economics 100 New Class 11 and 12Document9 pagesEconomics 100 New Class 11 and 12airtonfelixNo ratings yet

- Micro Eportfolio Monopoly Spreadsheet Data - SPG 18 1Document3 pagesMicro Eportfolio Monopoly Spreadsheet Data - SPG 18 1api-334921583No ratings yet

- Perfect CompttDocument36 pagesPerfect CompttAdil EhsanNo ratings yet

- Eco10004: Economic Principles Week 5 - Tutorial SolutionsDocument5 pagesEco10004: Economic Principles Week 5 - Tutorial SolutionsMacxy TanNo ratings yet

- Topic 3 - Economic OptimizationDocument5 pagesTopic 3 - Economic Optimizationsherryl caoNo ratings yet

- PracticeDocument12 pagesPracticeNguyễn QuỳnhNo ratings yet

- Shorya Agarwal Class Text 2Document14 pagesShorya Agarwal Class Text 2vidhantmaanthapaNo ratings yet

- Chapter 10: Market Power: Monopoly and Monopsony: P MC 1 + 1 EDocument5 pagesChapter 10: Market Power: Monopoly and Monopsony: P MC 1 + 1 EKalyan SaikiaNo ratings yet

- A. Williams Module 2Document16 pagesA. Williams Module 2awilliams2641No ratings yet

- Week 9 Suggested Solutions To Class QuestionsDocument8 pagesWeek 9 Suggested Solutions To Class QuestionspartyycrasherNo ratings yet

- Perfectly Competitive Supply and Monopolies-1Document62 pagesPerfectly Competitive Supply and Monopolies-1Samiur RahmanNo ratings yet

- Chapter 5 - Perfect CompetitionDocument5 pagesChapter 5 - Perfect CompetitionYonas D. EbrenNo ratings yet

- Analysis of Monopoly: Total and Marginal RevenueDocument6 pagesAnalysis of Monopoly: Total and Marginal RevenueTemesgen TakeleNo ratings yet

- Analysis of Monopoly: Total and Marginal RevenueDocument6 pagesAnalysis of Monopoly: Total and Marginal RevenueTemesgen TakeleNo ratings yet

- Types of Market StructureDocument16 pagesTypes of Market StructureCatarina CoelhoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Scalping and Pre-set Value Trading: Football Double Chance Market - Betfair ExchangeFrom EverandScalping and Pre-set Value Trading: Football Double Chance Market - Betfair ExchangeNo ratings yet

- Scalping and Pre-set Value Trading: Football Double Chance Market - Betfair Exchange: Scalping and Pre-set Value TradingFrom EverandScalping and Pre-set Value Trading: Football Double Chance Market - Betfair Exchange: Scalping and Pre-set Value TradingNo ratings yet

- Accounting, Maths and Computing Principles for Business Studies V11From EverandAccounting, Maths and Computing Principles for Business Studies V11No ratings yet

- The Shutdown Point: Scenario 1Document10 pagesThe Shutdown Point: Scenario 1Carla Mae F. DaduralNo ratings yet

- Negative Externalities: PollutionDocument8 pagesNegative Externalities: PollutionCarla Mae F. DaduralNo ratings yet

- Equilibrium, Surplus, and ShortageDocument4 pagesEquilibrium, Surplus, and ShortageCarla Mae F. DaduralNo ratings yet

- Causes of Growing Inequality: Changing Composition of American HouseholdsDocument3 pagesCauses of Growing Inequality: Changing Composition of American HouseholdsCarla Mae F. DaduralNo ratings yet

- Figure 1. A Production Possibilities Frontier Showing Health Care and EducationDocument2 pagesFigure 1. A Production Possibilities Frontier Showing Health Care and EducationCarla Mae F. DaduralNo ratings yet

- Economies of ScaleDocument5 pagesEconomies of ScaleCarla Mae F. DaduralNo ratings yet

- Regulating Natural MonopoliesDocument5 pagesRegulating Natural MonopoliesCarla Mae F. DaduralNo ratings yet

- The Foundations of The Demand CurveDocument4 pagesThe Foundations of The Demand CurveCarla Mae F. DaduralNo ratings yet

- Employment Discrimination: Earnings Gaps by Race and GenderDocument7 pagesEmployment Discrimination: Earnings Gaps by Race and GenderCarla Mae F. DaduralNo ratings yet

- Profit Maximization For A Monopoly: Demand Curves Perceived by A Perfectly Competitive Firm and by A MonopolyDocument8 pagesProfit Maximization For A Monopoly: Demand Curves Perceived by A Perfectly Competitive Firm and by A MonopolyCarla Mae F. DaduralNo ratings yet

- Labor Market Power by EmployersDocument7 pagesLabor Market Power by EmployersCarla Mae F. DaduralNo ratings yet

- Trade and Efficiency: Getting A Good Deal or Making A Good DealDocument3 pagesTrade and Efficiency: Getting A Good Deal or Making A Good DealCarla Mae F. DaduralNo ratings yet

- 122333Document2 pages122333Carla Mae F. DaduralNo ratings yet

- Rules For Maximizing UtilityDocument7 pagesRules For Maximizing UtilityCarla Mae F. DaduralNo ratings yet

- Customers and Changing CostsDocument3 pagesCustomers and Changing CostsCarla Mae F. DaduralNo ratings yet

- The Role of The GATT in Reducing Barriers To TradeDocument6 pagesThe Role of The GATT in Reducing Barriers To TradeCarla Mae F. DaduralNo ratings yet

- Outcome: The Shutdown PointDocument10 pagesOutcome: The Shutdown PointCarla Mae F. DaduralNo ratings yet

- Unit 1: Introduction To EconomicsDocument2 pagesUnit 1: Introduction To EconomicsCarla Mae F. DaduralNo ratings yet

- Reading: The Production Possibilities FrontierDocument9 pagesReading: The Production Possibilities FrontierCarla Mae F. DaduralNo ratings yet

- Positive and Normative StatementsDocument2 pagesPositive and Normative StatementsCarla Mae F. DaduralNo ratings yet

- Behavioral Economics: An Alternative Viewpoint: Irrational Consumer BehaviorDocument2 pagesBehavioral Economics: An Alternative Viewpoint: Irrational Consumer BehaviorCarla Mae F. DaduralNo ratings yet

- Reading: The Production Possibilities FrontierDocument9 pagesReading: The Production Possibilities FrontierCarla Mae F. DaduralNo ratings yet

- Market-Oriented Environmental Tools: Effluent ChargesDocument6 pagesMarket-Oriented Environmental Tools: Effluent ChargesCarla Mae F. DaduralNo ratings yet

- Regulating Anticompetitive BehaviorDocument7 pagesRegulating Anticompetitive BehaviorCarla Mae F. DaduralNo ratings yet

- 1.1.3: Review of Data Representation and Mathematics For EconomicsDocument4 pages1.1.3: Review of Data Representation and Mathematics For EconomicsCarla Mae F. DaduralNo ratings yet

- 1.1.2: Getting To Know Economics: The Economic Way of ThinkingDocument10 pages1.1.2: Getting To Know Economics: The Economic Way of ThinkingCarla Mae F. DaduralNo ratings yet

- Outcome: Entry and Exit DecisionsDocument4 pagesOutcome: Entry and Exit DecisionsCarla Mae F. DaduralNo ratings yet

- Reading: Measuring Income Inequality: How Do You Separate Poverty and Income Inequality?Document6 pagesReading: Measuring Income Inequality: How Do You Separate Poverty and Income Inequality?Carla Mae F. DaduralNo ratings yet

- R11 - Should You Make The First OfferDocument5 pagesR11 - Should You Make The First OfferMANVI PANDEYNo ratings yet

- Case Study Subsidized Wheat Production in Japan-1Document2 pagesCase Study Subsidized Wheat Production in Japan-1anh.nguyen210176No ratings yet

- The Management of Society's Resources Is Important Because Resources Is ScarceDocument1 pageThe Management of Society's Resources Is Important Because Resources Is ScarceRodel Amante MedicoNo ratings yet

- Strategic Management Cia 1 Component 1: Submitted By: Hrithik Agrawal 1720614 5 Bba FDocument5 pagesStrategic Management Cia 1 Component 1: Submitted By: Hrithik Agrawal 1720614 5 Bba FSAHILNo ratings yet

- Cardamom in NepalDocument10 pagesCardamom in NepalRewanta LuitelNo ratings yet

- 10.allocative EfficiencyDocument5 pages10.allocative EfficiencySpartanNo ratings yet

- Indiareit Apartment FundDocument18 pagesIndiareit Apartment FundSandeep BorseNo ratings yet

- C H A P T E R Three: Business Strategies and Their Marketing ImplicationsDocument20 pagesC H A P T E R Three: Business Strategies and Their Marketing ImplicationsNguyen AnhNo ratings yet

- ACCTG 22 DepartmentalDocument12 pagesACCTG 22 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- CHAPTER 11 Marketing - 1.2Document334 pagesCHAPTER 11 Marketing - 1.2Joanna GarciaNo ratings yet

- Coffee Shops Thesis WIT With InstrumentDocument50 pagesCoffee Shops Thesis WIT With InstrumentJullienne PasaporteNo ratings yet

- Anuja ResumeDocument3 pagesAnuja ResumeAnujaKhareNo ratings yet

- Milk For The NationDocument59 pagesMilk For The Nationmihin.wimalasena100% (2)

- Design Space Planning Req 1Document14 pagesDesign Space Planning Req 1Michael Joshua SegayaNo ratings yet

- Ebook en 50SuccesfulTradersDocument61 pagesEbook en 50SuccesfulTradersYANESKANo ratings yet

- Fee Structure 2024-25Document5 pagesFee Structure 2024-25Sujoy GhoshNo ratings yet

- Presentation On Green MarketingDocument16 pagesPresentation On Green Marketingkamdica71% (7)

- Chapter One: Introduction To Financial Markets and InstitutionDocument14 pagesChapter One: Introduction To Financial Markets and InstitutionSADIQUE SIFATNo ratings yet

- Document 2Document21 pagesDocument 2Muhammad HafizNo ratings yet

- Building Customer Loyalty Through QualityDocument30 pagesBuilding Customer Loyalty Through QualityfirebirdshockwaveNo ratings yet

- London Housing Market Case StudyDocument5 pagesLondon Housing Market Case StudySimran LakhwaniNo ratings yet

- 3 Case StudyDocument15 pages3 Case StudyAlliah Victoria SapadenNo ratings yet

- Cost ProblemsDocument7 pagesCost ProblemsMadanNo ratings yet

- Inverse and Quanto Inverse Options in A Black-Scholes WorldDocument36 pagesInverse and Quanto Inverse Options in A Black-Scholes WorldJulien KuntzNo ratings yet

- 探討中美貿易戰爭對台灣各產業股價之影響 Explore the Impact of China-U.S. Trade War on the Share Price of the Taiwan IndustryDocument49 pages探討中美貿易戰爭對台灣各產業股價之影響 Explore the Impact of China-U.S. Trade War on the Share Price of the Taiwan IndustryAngel ChiangNo ratings yet

- PT Telekomunikasi Indonesia, TBK: Fairly Steady 1Q20 ResultsDocument9 pagesPT Telekomunikasi Indonesia, TBK: Fairly Steady 1Q20 ResultsSugeng YuliantoNo ratings yet