Professional Documents

Culture Documents

Class: Tybaf Sub: Fa Vii Sem: Vi: Unit Number Question Text

Class: Tybaf Sub: Fa Vii Sem: Vi: Unit Number Question Text

Uploaded by

Aditya DeodharOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Class: Tybaf Sub: Fa Vii Sem: Vi: Unit Number Question Text

Class: Tybaf Sub: Fa Vii Sem: Vi: Unit Number Question Text

Uploaded by

Aditya DeodharCopyright:

Available Formats

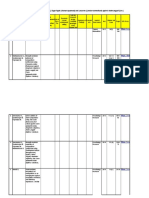

CLASS: TYBAF

SUB: FA VII

SEM : VI

UNIT NUMBER QUESTION TEXT

1 Balance Sheet of a Electricity Company is presented in _______.

1 _________ A/c shows the sources from which fixed capital is raised.

1 Balance on capital A/c is shown in the Balance Sheet on _____ side.

1 Depreciation is shown in ____________________.

1 Depreciation on fixed asset is credited to ________________ A/c.

1 Fixed Assets are shown at cost in ________ A/c.

1 Interest on Debentures is shown as ________.

1 _________ shows the operating result of the organisation.

1 Premium on issue of securities is retained as __________ item.

1 Expenses incurred are shown in _____.

1 Balance Sheet of Electricity Company is presented in

1 Fixed Assets are shown at cost in

1 Premium on issue of securities is retained as

1 Depreciation is shown as a depreciation in

1 Depreciation on fixed asset is credited to

1 Operating result is shown by

1 Preliminary Expenses are treated as

1 Under Double A/c system old asset continues to appear at

1 Book value of old asset is w/off under

1 The Electricity Act, 2003 has replaced

1 The authorities under the Electricity Act 2003 are

1 Security Deposit is credited to

Customer’s contribution for service line is disclosed in the balance sheet

1

under

1 For Capital expenditure purposes investment component has

1 In special category states 100% of the project cost is provided.

UNIT NUMBER QUESTION TEXT

2 The Maharashtra Coop. Societies Act was passed in ______.

2 Apex society operates at ______ ______.

2 Housing society is formed to provide ______ to members.

2 Register of members must be maintained in ______ Form.

2 Balance Sheet of a Coop. Society is prepared in Form ______.

Section ______ of the Coop. Societies Act provides for investment of

2

funds of a Coop. Society.

2 A cooperative form of Organisation is based on the principle of

2 Cooperative societies are formed by

2 The aim of cooperative societies is

2 The Maharashtra coop. Societies Act was passed in

2 Maharashtra coop. societies rules are framed in

2 The society doing the business of bank is called as

2 Register of members should be maintained in form

Annual statements of accounts should be prepared with in – days of close

2

of the accounting year

Balance sheet and P & L A/C of a cooperative society should be

2

prepared in form

2 The amount of profit to be transferred to Reserve fund is

2 Payment of dividend by the society should not exceed

2 The amount to be set aside for chartable purpose is

2 Debentures should be shown under

2 Fixed deposits should be shown under

2 Live stock should be disclosed under

2 Goodwill should be disclosed under

2 Prepaid expenses should be disclosed under

2 Loose tools should be disclosed under

2 Govt. securities purchased should be disclosed under

UNIT NUMBER QUESTION TEXT

Register of allotment of flats is to be maintained by a Co. Op. _____

3

Society.

A Co. Op. Hsg. Society has to contribute ` _____ per member towards

3

education fund.

A Co. Op. _____ Society has to raise a bill on the members for outgoing

3

of the society.

3 The transfer fees should not exceed ` _____.

3 Income & Expenditure A/c is to be prepared in _____ Form.

3 Balance sheet of a co.op. Hsg. Society is to be prepared in _____ Form.

Property taxes in the case of co. op. Hsg. Societies are levied by _____

3

authority.

Sinking Fund is provided by a Co. Op. Hsg. Society as per by laws

3

_____.

3 Lease Rent is based on the _____ up area of the flat.

A Co.op. Hsg. Society has to transfer _____ of the net profit to _____

3

Fund.

Honorarium to office bearers should not exceed _____ % of the net

3

profit.

The rate of dividend cannot exceed _____% in the case of co. op.

3

societies.

3 Entrance fees received from the members is to be _____.

3 Premium on transfer of flat should be _____.

3 Subscription to education fund is to be deposited with _____.

3 A cooperative form of Organisation is based on the principle of

3 Cooperative societies are formed by

3 The aim of cooperative societies is

3 The Maharashtra coop. Societies Act was passed in

3 Maharashtra coop. societies rules are framed in

3 The society doing the business of bank is called as

3 Register of members should be maintained in form

Annual statements of accounts should be prepared with in – days of close

3

of the accounting year

Balance sheet and P & L A/C of a cooperative society should be

3

prepared in form

3 The amount of profit to be transferred to Reserve fund is

UNIT NUMBER QUESTION TEXT

The investment intended to be held for less than _____ months is called

4

_____ investment as per AS–13.

The carrying amount of current investment is to be shown at _____ or

4

_____ which ever is lower.

The interest due upto date of purchase is to segregated from total price of

4

investment, if price is _____

4 The interest on investment is to be calculated on _____ of investment.

4 AS–13 provides for accounting for investment in _____ or _____.

UNIT NUMBER QUESTION TEXT

5 Asset management company manages _____.

5 Close ended fund has stipulated _____.

5 Growth oriented schemes offer higher _____.

5 Debt schemes invest in _____.

5 Return in debt schemes is _____.

5 Hybrid schemes invest in _____.

5 Mutual fund investments are _____.

5 _____ is the highest advantage of investing in mutual funds.

5 _____ _____ is the function of M.F.

5 M.F. may be _____ or _____.

5 FOF stands for _____ of _____ scheme.

5 _____ _____ _____ does not charge for entry or exit.

5 _____ _____ charges for entry or exit.

5 _____ _____ A/c are included in the Annual Report of a M.F.

5 Investment is carried in the Balance sheet at _____ _____.

UNIT NUMBER QUESTION TEXT

6 IFRS stands for ______ ______ ______ ______.

6 IFRS enhances ______ in accounting principles.

6 Financial statements based on IFRS become ______.

6 Companies Act ______ IFRS.

6 A core group is constituted by ______.

OPTION_a OPTION_b OPTION_c OPTION_d

Schedule IV Schedule V Schedule III Schedule I

Original cost Replacement price Capital None of the above

Finance Cost Balance Sheet Liability None of the above

P & L statement Fixed Assets Finance Cost None of the above

Fixed Assets Original cost Capital None of the above

Balance Sheet Replacement price Original cost None of the above

Finance Cost Original cost Replacement price None of the above

Reserves & Surplus P & L statement General Balance Sheet None of the above

Original cost Reserves & Surplus Capital A/c None of the above

Capital A/c P & L statement Reserves & Surplus None of the above

Schedule III Format Three Parts Four Parts Five Parts

Revenue A/c Capital A/c Net Revenue A/c Balance Sheet

General Balance Sheet

Reserves & Surplus Revenue Item Net Revenue Item

Item

Reserve A/c P & L Statement General Balance Sheet Capital A/c

Depreciation Fund Revenue A/c Fixed Asset A/c Capital A/c

P & L Statement Net Revenue A/c Balance Sheet Capital A/c

Reserve Expenditure Other Current Assets Deferred Revenue A/c None of the above

Original cost Replacement price Market price None

Double Account system Single Account system Double Entry system Single Entry System.

Indian Electricity Act, Electricity Supply Act,

Electricity Rules, 1956 All of the above

1910 1948

Central Electricity Central Electricity State Electricity

All of the above

Authority Regulatory Regulatory Commission

Security Deposit A/c Customer’s A/c Electricity Co’s A/c All of the above

Share Capital Reserves & Surplus Non-Current Liability None of the above

Grant & Loans

Grant Component Loan Component All of the above

Component

90% Grants & 10% Loan 60% Grants & 40% Loan 30% Grants & 70% Loan None of the above

OPTION_a OPTION_b OPTION_c OPTION_d

1956 1965 1960 1966

Under investment Separately State level None of the above

social welfare charity Houses None of the above

II IV I V

N I D C

70 50 60 20

democracy autocracy unity team spirit

weaker sections of the

rich people farmers Govt. servants

society

service profit social welfare charity

1912 1960 1980 1961

1980 1961 1985 1912

Central bank Cooperative bank Maha Bank Apex bank

A I D C

90 days 45 days 65 days 180 days

A N D B

10% 20% 25% 35%

10% 20% 12% 15%

10% 20% 25% 35%

Secured loans Unsecured loans Reserve fund None of the above

Loans Deposits Unsecured loans Current liabilities

Current assets Fixed assets Other assets Misc. expedience

Fixed assets Misc. Exp Intangible assets Tangible assets

Other items Advances Current assets none of the above

Fixed assets Current assets Other items Misc. Expenses

Investments Current assets Other items Misc. Expenses

OPTION_a OPTION_b OPTION_c OPTION_d

Housing Repairs Maintenance Renewal of property

`3 `5 ` 10 `7

Housing profit social welfare None of the above

` 20,000 ` 25,000 ` 15,000 ` 5,000

C N I D

I N D C

Built Local

10 12 13 14

social welfare Local Built

10% Reserve Fund 20% Reserve Fund 25% Reserve Fund 15% Reserve Fund

15% 25% 20% 5%

15% 10% 2% 8%

Capitalised Repairs Maintenance None of the above

Capitalised profit Maintenance None of the above

Maharashtra Rajya

Renewal of property Maintenance None of the above

Sahakars Sangh

democracy autocracy unity team spirit

weaker sections of the

rich people farmers Govt. servants

society

service profit social welfare charity

1912 1960 1980 1961

1980 1961 1985 1912

Central bank Cooperative bank Maha Bank Apex bank

A I D C

90 days 45 days 65 days 180 days

A N D (B)

10% 20% 25% 35%

OPTION_a OPTION_b OPTION_c OPTION_d

9, current 2, current 12, current 5, current

number shares held face value of shares cost or market value None of the above

cost or market value no. of shares cum-interest None of the above

number shares held face value of shares face value None of the above

shares or debentures added to cost face value None of the above

OPTION_a OPTION_b OPTION_c OPTION_d

Maturity Period Fund of funds Mutual Fund None of the above

No load fund Debt Securities Maturity Period All of the above

Reserve for unrealised

Highly Liquid Capital Appreciation All of the above

gain

Market value Accrual Debt Securities None of the above

Load fund Mutual Fund Fixed All of the above

Accrual Debt & Equity Accrual All of the above

Market value Highly Liquid Accrual All of the above

Accrual Liquidity Market value All of the above

Open ended, Close

Formulation, scheme Balancesheet, Revenue None of the above

ended

Open ended / Close Balancesheet /

Formulation / scheme None of the above

ended Revenue

Fund of funds Mutual Fund No load fund All of the above

No load fund Load fund Mutual Fund All of the above

Load fund Mutual Fund No load fund All of the above

Balancesheet / Open ended / Close

Formulation / scheme None of the above

Revenue ended

Market value Accrual Debt Securities None of the above

OPTION_a OPTION_b OPTION_c OPTION_d

Financial, Current, Non- International Financial

Initial, Planning, Execution None of the above

current Reporting Standards

Trading Override Uniformity None of the above

Override Trading Reliable None of the above

Expected Realisable Uniformity Override None of the above

IAS IFRS MCA None of the above

You might also like

- Test Bank For Financial Reporting Financial Statement Analysis and Valuation A Strategic Perspective 6th Edition by StickneyDocument35 pagesTest Bank For Financial Reporting Financial Statement Analysis and Valuation A Strategic Perspective 6th Edition by StickneyTiffany CarswellNo ratings yet

- Chapter-5 - Financial Aspect RevisedDocument17 pagesChapter-5 - Financial Aspect RevisedCM Lance75% (4)

- Harare - Essential Guide To Management of Common Obstetric and GynaecologicDocument98 pagesHarare - Essential Guide To Management of Common Obstetric and GynaecologicTapiwa Munikwa100% (5)

- Partnership OperationDocument52 pagesPartnership OperationMark Reyes100% (1)

- TB19 Earnings Per ShareDocument20 pagesTB19 Earnings Per Sharescrapped prince100% (3)

- Flowers - A Golden Nature GuideDocument164 pagesFlowers - A Golden Nature GuideKenneth93% (15)

- Adv FA II - Worksheet - EditedDocument25 pagesAdv FA II - Worksheet - EditedYared GirmaNo ratings yet

- ExamView - Homework CH 4Document9 pagesExamView - Homework CH 4Brooke LevertonNo ratings yet

- Retained Earnings Sample QuizDocument9 pagesRetained Earnings Sample QuizGali jizNo ratings yet

- Essential of Finance Corporate Chapter 3Document12 pagesEssential of Finance Corporate Chapter 3Linas Sutkaitis100% (1)

- 23 PartnershiptheoryDocument10 pages23 PartnershiptheorySanjeev MiglaniNo ratings yet

- Financial Accounting - Review: HUL Q4 Misses Estimates, Profit Dips 1% To Rs 1,519 Crore, Volume Shrinks 7%Document10 pagesFinancial Accounting - Review: HUL Q4 Misses Estimates, Profit Dips 1% To Rs 1,519 Crore, Volume Shrinks 7%anishjoseph007No ratings yet

- Accountancy August 2021Document7 pagesAccountancy August 2021Bey BeatzzNo ratings yet

- Chap012 2Document125 pagesChap012 2Aai NurrNo ratings yet

- Financial AspectDocument7 pagesFinancial AspectKevin Nichols AbacanNo ratings yet

- Toa Quizzer 1: Multiple ChoiceDocument18 pagesToa Quizzer 1: Multiple ChoiceRukia KuchikiNo ratings yet

- Original 1436552353 VICTORIA ProjectDocument12 pagesOriginal 1436552353 VICTORIA ProjectShashank SharanNo ratings yet

- Module 3 Partnership OperationsDocument17 pagesModule 3 Partnership OperationsClaire CastrenceNo ratings yet

- Mediocre Non-Profit OrganizationDocument12 pagesMediocre Non-Profit OrganizationveenaNo ratings yet

- Financial Accounting and Analysis (D)Document17 pagesFinancial Accounting and Analysis (D)sushainkapoor photoNo ratings yet

- Asis 2 (CH 4) - PertanyaanDocument4 pagesAsis 2 (CH 4) - PertanyaanAndre JonathanNo ratings yet

- Solution Final Advanced Acc. First09 10Document6 pagesSolution Final Advanced Acc. First09 10RodNo ratings yet

- CFF20968-C6B4-49F5-BBD9-7396D104482EDocument10 pagesCFF20968-C6B4-49F5-BBD9-7396D104482EMuhammad Zaifan HakimNo ratings yet

- Financial Planning & AnalysisDocument12 pagesFinancial Planning & Analysissunil sharmaNo ratings yet

- Profit & Loss Appropriation Account, Admission, Retirement and Death of A Partner, and Dissolution of A Partnership FirmDocument10 pagesProfit & Loss Appropriation Account, Admission, Retirement and Death of A Partner, and Dissolution of A Partnership Firmd-fbuser-65596417No ratings yet

- NCERT Solutions for Class 11 Accountancy Chapter 9 Financial Statements 1Document44 pagesNCERT Solutions for Class 11 Accountancy Chapter 9 Financial Statements 1harshbut15No ratings yet

- Accounting & Financial ManagementDocument4 pagesAccounting & Financial ManagementVikash ChaudharyNo ratings yet

- Mock QualiDocument22 pagesMock QualiMay SignosNo ratings yet

- Colegio de San Juan de Letran: NAME - SECTIONDocument2 pagesColegio de San Juan de Letran: NAME - SECTIONRed YuNo ratings yet

- Study Guide CH 12Document7 pagesStudy Guide CH 12Stephanie RobinsonNo ratings yet

- PDFsam MergeDocument17 pagesPDFsam MergeStephanie RobinsonNo ratings yet

- PL Appropriation AcDocument6 pagesPL Appropriation AcShivangi Aggarwal100% (1)

- Statement of Change in Equity: Aiza C. Hampton Lpt. MbaDocument20 pagesStatement of Change in Equity: Aiza C. Hampton Lpt. MbaAiza Carimat HamptonNo ratings yet

- Acc101 RevCh1 3Document29 pagesAcc101 RevCh1 3Waqar AliNo ratings yet

- Acc101 RevCh1 3 PDFDocument29 pagesAcc101 RevCh1 3 PDFWaqar AliNo ratings yet

- CFS PDFDocument29 pagesCFS PDFMary Anne AnaneyNo ratings yet

- Hoyle Sg03Document17 pagesHoyle Sg03AgentSkySkyNo ratings yet

- Retirement of Partner, Treatment of GoodwillDocument6 pagesRetirement of Partner, Treatment of GoodwillBoobalan RNo ratings yet

- 3 Partnership AccountsDocument93 pages3 Partnership AccountsCA K D Purkayastha100% (1)

- Nature of Partnership - Acctg 102Document2 pagesNature of Partnership - Acctg 102belliissiimmaaNo ratings yet

- Corporate Accounting AssignmentDocument6 pagesCorporate Accounting AssignmentKarthikacauraNo ratings yet

- Asm1 25560Document12 pagesAsm1 25560shivanshu11o3o6No ratings yet

- WORKSHEET ON ACCOUNTING FOR PARTNERSHIP Retirement and Death Board QuestionsDocument14 pagesWORKSHEET ON ACCOUNTING FOR PARTNERSHIP Retirement and Death Board QuestionsAhmedNo ratings yet

- Ty Baf Sem Vi Regular Exam Sample PapersDocument33 pagesTy Baf Sem Vi Regular Exam Sample PapersDurvasNo ratings yet

- Jeter Advanced Accounting 4eDocument14 pagesJeter Advanced Accounting 4eMinh NguyễnNo ratings yet

- Managerial Accounting, 6e: Achievement Test 5: Chapters 9-10Document9 pagesManagerial Accounting, 6e: Achievement Test 5: Chapters 9-10Ley EsguerraNo ratings yet

- TQ FinalsDocument5 pagesTQ FinalsDodongNo ratings yet

- Chapter 1. General Considerations: The Evolution of Turnover, Net Result and Total Assets of The CompanyDocument17 pagesChapter 1. General Considerations: The Evolution of Turnover, Net Result and Total Assets of The CompanyPatkas AlinNo ratings yet

- Accounting For Partnership - UnaDocument13 pagesAccounting For Partnership - UnaJastine Beltran - PerezNo ratings yet

- AJE QuizDocument4 pagesAJE QuizJohn cookNo ratings yet

- Double Account SystemDocument14 pagesDouble Account SystemRizul96 GuptaNo ratings yet

- INTERMEDIATE ACCOUNTING - MIDTERM - 2019-2020 - 2nd Semester - PART2Document4 pagesINTERMEDIATE ACCOUNTING - MIDTERM - 2019-2020 - 2nd Semester - PART2Renalyn ParasNo ratings yet

- Ncert SolutionsDocument33 pagesNcert SolutionsArif ShaikhNo ratings yet

- Ratios Test PaperDocument7 pagesRatios Test Papermeesam2100% (1)

- CH 01Document14 pagesCH 01Dave Magarian100% (3)

- At 5Document9 pagesAt 5Joshua GibsonNo ratings yet

- Fundamantal of Partnership PPT As On 21 12 2020Document50 pagesFundamantal of Partnership PPT As On 21 12 2020jeevan varma100% (1)

- Sample Problems in PartnershipDocument6 pagesSample Problems in PartnershipAina OracionNo ratings yet

- Tybaf Sem Vi Indirect TaxDocument6 pagesTybaf Sem Vi Indirect TaxAditya DeodharNo ratings yet

- T.Y.Baf Cost Accounting Sem Vi (Regular) Apr 2021: Option A Option B Option C Option DDocument5 pagesT.Y.Baf Cost Accounting Sem Vi (Regular) Apr 2021: Option A Option B Option C Option DAditya DeodharNo ratings yet

- TYBAF SEM 6 Financial ManagementDocument10 pagesTYBAF SEM 6 Financial ManagementAditya DeodharNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument5 pagesBajaj Allianz General Insurance Company LTDAditya DeodharNo ratings yet

- UntitledDocument873 pagesUntitledjoker hotNo ratings yet

- Sugafax BulletinDocument4 pagesSugafax BulletinmndmattNo ratings yet

- PPE PosterDocument1 pagePPE PosterJalak PatelNo ratings yet

- Effectiveness of Banana Peel (Musa Acuminata) Extract As An Alternative InsecticideDocument34 pagesEffectiveness of Banana Peel (Musa Acuminata) Extract As An Alternative InsecticideBai Courtney Love Akmad100% (3)

- Annexure Dir Sug IDocument90 pagesAnnexure Dir Sug ISwetha MahendramaniNo ratings yet

- Principals Off Limits Nanny A Small Town Ex Boyfriends Dad Romance Elise Savage Download PDF ChapterDocument51 pagesPrincipals Off Limits Nanny A Small Town Ex Boyfriends Dad Romance Elise Savage Download PDF Chaptermary.schoonmaker770100% (9)

- The Hole Problem in Knit GoodsDocument13 pagesThe Hole Problem in Knit GoodsKathirrveluSubramainanNo ratings yet

- Food Grade Anti-Corrosion Grease: Special FeaturesDocument2 pagesFood Grade Anti-Corrosion Grease: Special Featureschem KhanNo ratings yet

- Commonly Used Drugs in The ERDocument2 pagesCommonly Used Drugs in The ERsberry522No ratings yet

- Chemistry Class Xi Chapter - 1Document8 pagesChemistry Class Xi Chapter - 1DoNga AstoRias TurNerNo ratings yet

- AS Level Biology Cell Structure, Function and Magnification Name: - 1Document7 pagesAS Level Biology Cell Structure, Function and Magnification Name: - 1Chryssa EconomouNo ratings yet

- Aba Over 21Document5 pagesAba Over 21Indiana Family to FamilyNo ratings yet

- 10P 2L8M D5 V3 Product SpecificationsDocument6 pages10P 2L8M D5 V3 Product SpecificationsAnkur PrasadNo ratings yet

- U.S. Army Journal of Installation Management, Winter 2011Document82 pagesU.S. Army Journal of Installation Management, Winter 2011U.S. Army Installation Management CommandNo ratings yet

- ReArm Bond EBADocument2 pagesReArm Bond EBARajesh GiriNo ratings yet

- Software Requirements Specification: Version 1.0 ApprovedDocument8 pagesSoftware Requirements Specification: Version 1.0 Approvedkirtika patelNo ratings yet

- Guide On Electric Vehicle Charging System (Evcs) 1Document31 pagesGuide On Electric Vehicle Charging System (Evcs) 1Muhammad Haikal Zoal Azha100% (1)

- Product Catalogue: BD Diagnostics - Preanalytical SystemsDocument44 pagesProduct Catalogue: BD Diagnostics - Preanalytical SystemsajibagNo ratings yet

- Exercise ReadingDocument3 pagesExercise ReadingMuhammadMa'rufYusnainNo ratings yet

- RRLDocument5 pagesRRLAyen Alecksandra CadaNo ratings yet

- Lesson Plan One For Observation - Sara El-AzizDocument11 pagesLesson Plan One For Observation - Sara El-AzizNānn OfficialNo ratings yet

- Development Tasks and Challenges Experienced During AdolescenceDocument10 pagesDevelopment Tasks and Challenges Experienced During AdolescenceWilly L. Jaranilla IIINo ratings yet

- Solutions ACC415Document46 pagesSolutions ACC415gloriyaNo ratings yet

- Lect NotesDocument6 pagesLect Notessichangi2008_2776556No ratings yet

- Partial Replacement of Cement With Marbl PDFDocument3 pagesPartial Replacement of Cement With Marbl PDFamish rajNo ratings yet

- Sbk3023 Food Science and NutritionDocument20 pagesSbk3023 Food Science and NutritionKuMohdSyafiqNo ratings yet

- Pharma - Statewise ListDocument7 pagesPharma - Statewise ListNitesh AmesarNo ratings yet

- COSMETOLOGYDocument20 pagesCOSMETOLOGYJun JunNo ratings yet