Professional Documents

Culture Documents

Coronavirus Recession

Coronavirus Recession

Uploaded by

CuriousMan870 ratings0% found this document useful (0 votes)

6 views1 pageOriginal Title

coronavirus_recession

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views1 pageCoronavirus Recession

Coronavirus Recession

Uploaded by

CuriousMan87Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Monitoring trends for over 70 years

Subject: The Coronavirus Recession July 24, 2020

From: Richard Curtin, Director

The coronavirus recession is unlike any past economic downturn. While it shares some broadly similar characteristics, such

as steep declines in employment and incomes, its most unique feature is that the recession cannot be reversed solely by

economic policies. To be sure, financial relief to millions of households has eased the economic pain, but without a vaccine

or effective treatment for covid-19, the economic crisis will not end. How much has the coronavirus altered the lives and

economic behavior of households? Is their main concern the threat to their family’s health, do they find the required social

isolation the most onerous, or does the impact on their personal finances pose the greatest threat? These questions were

included in the April survey with the expectation that these concerns would shift along with changes in the incidence of

infections and deaths. Although the incidence of the virus has changed dramatically across the nation, consumers’ perceptions

of the threats posed by the coronavirus have remained remarkably constant from April to July. Regulations designed to slow

the virus spread must take into account the health threats as well as the cumulative emotional and economic costs. It is likely

these costs will be incurred for another six months to a year, at best. In order to effectively reduce all of these costs,

regulations are needed that aim at substantial but not perfect compliance, replacing the current all-or-nothing partisan views.

When asked to assess the overall impact on their lives, 45% of all consumers reported that their lives had changed a great deal

due to the coronavirus, while just 20% reported little or no change. Note that those who reported a greater impact of the

coronavirus reported a Sentiment Index value consistent with a recession, while those who reported little or no impact of the

coronavirus on their lives had a Sentiment Index value consistent with economic expansion. Differences in educational

attainment had the largest effect on the perceived impact of the coronavirus, with those who expressed little or no impact

falling from 31% among the least educated to just 10% among the most educated. Differences in household income are related

to education, although the relationship between the top and bottom income fifths was more attenuated. No systematic trends

were recorded across age subgroups. Note that Northeast residents voiced the greatest impact on their lives, perhaps indicating

that more successful countermeasures by state and local governments were associated with greater disruptions of daily lives.

The top concern associated with the pandemic was the perceived threat to their family’s health, reported by 60%. The required

social isolation and the personal financial impact were each mentioned as the top concern by 20% of households. Note that

the Sentiment Index was lowest among those whose top concern was health, and the Sentiment Index was highest among those

who thought the required social isolation was the most onerous consequence. The proportion of consumers who identified the

health threat as their most important concern rose along with the age of the respondent, and the impact on the household’s

personal finances declined as people aged, especially after retirement. The personal financial consequences of the pandemic,

however, showed no systematic relationship with the level of household income, reported by 22% in the top and bottom

income fifths. The same weak relationship with education was found, with the health threat somewhat higher for those with

the college education and concerns for personal finances slightly lower than those with less formal education.

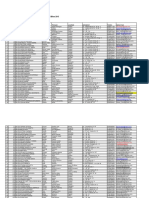

Impact of the Coronavirus on Daily Lives and Top Potential Threats, April to July 2020

How Much Has Life Changed Due to Coronavirus Top Pandemic Concern

Great Deal Somewhat Little/None Total Health Threat Social Isolation Personal Finances Total

All 45% 35% 20% 100% 60% 20% 20% 100%

Index of Consumer Sentiment 64.3 78.3 87.9 70.1 83.1 73.8

Income

Bottom 20% 40 34 26 100 56 22 22 100

Second 20% 47 33 20 100 58 20 22 100

Third 20% 42 35 23 100 61 21 18 100

Fourth 20% 46 37 17 100 62 20 18 100

Top 20% 51 38 11 100 59 19 22 100

Age

18 - 24 43 34 23 100 52 25 23 100

25 - 34 43 37 20 100 60 16 24 100

35 - 44 46 38 16 100 54 23 23 100

45 - 54 53 32 15 100 60 18 22 100

55 - 64 46 34 20 100 62 18 20 100

65 or older 42 36 22 100 63 23 14 100

Education

High School or less 39 30 31 100 57 22 21 100

Some College 44 33 23 100 56 20 24 100

College Degree 43 41 16 100 63 19 18 100

Graduate Studies 54 36 10 100 61 22 17 100

Region

West 45 36 19 100 58 22 20 100

Midwest 44 36 20 100 56 21 23 100

Northeast 51 33 16 100 64 18 18 100

South 44 35 21 100 61 20 19 100

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cmonthly WPI Jan 2021Document5 pagesCmonthly WPI Jan 2021CuriousMan87No ratings yet

- Cmonthly WPI May 2021Document5 pagesCmonthly WPI May 2021CuriousMan87No ratings yet

- Eight - Core Indus Jan 2021Document4 pagesEight - Core Indus Jan 2021CuriousMan87No ratings yet

- External - Sector - Statistics Jan 2021Document9 pagesExternal - Sector - Statistics Jan 2021CuriousMan87No ratings yet

- Iip J Aug 21Document6 pagesIip J Aug 21CuriousMan87No ratings yet

- Cmonthly WPI Jan 2021Document6 pagesCmonthly WPI Jan 2021CuriousMan87No ratings yet

- Industrial - Statistics Key Indi Jan 2021Document5 pagesIndustrial - Statistics Key Indi Jan 2021CuriousMan87No ratings yet

- Eight - Infra Apr 2021Document4 pagesEight - Infra Apr 2021CuriousMan87No ratings yet

- Pandemic UMCSIDocument1 pagePandemic UMCSICuriousMan87No ratings yet

- 2021 May Service PMIDocument3 pages2021 May Service PMICuriousMan87No ratings yet

- Returns of ICICI Prudential Nifty Index Fund - Growth Option As On June 30, 2021Document2 pagesReturns of ICICI Prudential Nifty Index Fund - Growth Option As On June 30, 2021CuriousMan87No ratings yet

- AXIS MF Nov 2020Document213 pagesAXIS MF Nov 2020CuriousMan87No ratings yet

- Returns of ICICI Prudential Bluechip Fund - Growth Option As On June 30, 2021Document2 pagesReturns of ICICI Prudential Bluechip Fund - Growth Option As On June 30, 2021CuriousMan87No ratings yet

- Uppsala Monitoring Centre Uppsala Reports 77 - WebDocument19 pagesUppsala Monitoring Centre Uppsala Reports 77 - WebCuriousMan87No ratings yet

- Zomato DamodaranDocument64 pagesZomato DamodaranCuriousMan87No ratings yet

- Quarterly Dashboard - ETFs and Index Funds - Dec 2021Document14 pagesQuarterly Dashboard - ETFs and Index Funds - Dec 2021CuriousMan87No ratings yet

- Greater Loss Likely 202005 UMCSIDocument1 pageGreater Loss Likely 202005 UMCSICuriousMan87No ratings yet

- IHS Markit PMI IntroductionDocument14 pagesIHS Markit PMI IntroductionCuriousMan87No ratings yet

- Rob 202009 PmiDocument3 pagesRob 202009 PmiCuriousMan87No ratings yet

- USA July 2020 PMI ManuDocument27 pagesUSA July 2020 PMI ManuCuriousMan87No ratings yet

- Rob 202009 S VcsDocument3 pagesRob 202009 S VcsCuriousMan87No ratings yet

- Ofad 30133 Machine Shorthand With Laboratory 1Document72 pagesOfad 30133 Machine Shorthand With Laboratory 1Alea Foby GelidoNo ratings yet

- The 7 SealDocument11 pagesThe 7 Sealendalkachew gudeta100% (1)

- Lista MF 01 - 05 - 2015Document11 pagesLista MF 01 - 05 - 2015CsordásCsaba-JózsefNo ratings yet

- Ingles De, I PaaaaaaaaaaaaaaaDocument20 pagesIngles De, I PaaaaaaaaaaaaaaaJaz PintoNo ratings yet

- Project Management Process GroupsDocument10 pagesProject Management Process GroupsQueen Valle100% (1)

- A Concept Paper About LoveDocument5 pagesA Concept Paper About LoveStephen Rivera100% (1)

- HVAC ValidationDocument15 pagesHVAC Validationpiyusharora1964100% (3)

- 1 - 32 F-16C - ThunderbirdsDocument3 pages1 - 32 F-16C - ThunderbirdsDesmond GracianniNo ratings yet

- Neuropathic Pain: DR - Dr.Thomas Eko P. Sps (K) Bagian/Smf Neurologi FK Unud/ Rsup DenpasarDocument85 pagesNeuropathic Pain: DR - Dr.Thomas Eko P. Sps (K) Bagian/Smf Neurologi FK Unud/ Rsup DenpasarCox AbeeNo ratings yet

- (With Script) June 2021 Saturday WSF Teaching GuideDocument3 pages(With Script) June 2021 Saturday WSF Teaching GuideMichael T. BelloNo ratings yet

- GR 6 Voc Words 4th QTRDocument5 pagesGR 6 Voc Words 4th QTRAzlynn Courtney FernandezNo ratings yet

- Nurse Managers' Responsive Coaching To Facilitate Staff Nurses' Clinical Skills Development in Public Tertiary HospitalDocument10 pagesNurse Managers' Responsive Coaching To Facilitate Staff Nurses' Clinical Skills Development in Public Tertiary Hospitalvan royeNo ratings yet

- Dr. Henry Petroski: Morning Lecture NotesDocument5 pagesDr. Henry Petroski: Morning Lecture Notesapi-299647486No ratings yet

- Theis Topics - MA in Teaching English As A Foreign LanguageDocument14 pagesTheis Topics - MA in Teaching English As A Foreign LanguageAnadilBatoolNo ratings yet

- Pag-Iimahen Sa Batang Katutubo Sa Ilang PDFDocument28 pagesPag-Iimahen Sa Batang Katutubo Sa Ilang PDFLui BrionesNo ratings yet

- Main Slokas With MeaningDocument114 pagesMain Slokas With MeaningRD100% (1)

- Draft of The Newsletter: Trends in LeadershipDocument3 pagesDraft of The Newsletter: Trends in LeadershipAgus BudionoNo ratings yet

- Exercise 1 WorkDocument9 pagesExercise 1 Workعبد الكريم المصطفىNo ratings yet

- CortinaDocument2 pagesCortinatecnicoeletronico23No ratings yet

- Dwivedietal 2023 Metaverse PMDocument28 pagesDwivedietal 2023 Metaverse PMAnissaNo ratings yet

- Manual TreadDocument3 pagesManual Treadمدینة سرجيكل وہاڑیNo ratings yet

- Film - The GuardianDocument1 pageFilm - The GuardianfisoxenekNo ratings yet

- Effect of Sic Particles On Mechanical Properties of Aluminium Adc12 Composite Through Stir Casting ProcessDocument6 pagesEffect of Sic Particles On Mechanical Properties of Aluminium Adc12 Composite Through Stir Casting ProcessJosiah PasaribuNo ratings yet

- المؤسسات الناشئة وامكانيات النمو-دراسة في انشاء حاضنات الأعمال لمرافقة المشروعات الناشئةDocument16 pagesالمؤسسات الناشئة وامكانيات النمو-دراسة في انشاء حاضنات الأعمال لمرافقة المشروعات الناشئةoussama bekhitNo ratings yet

- Solutions OSI ExercisesDocument50 pagesSolutions OSI ExercisesHussam AlwareethNo ratings yet

- Classroom ArrangementsDocument5 pagesClassroom Arrangementsapi-427868008No ratings yet

- The Crest of The Tide of Renascence: Sankaradeva's Kirttan-GhosāDocument30 pagesThe Crest of The Tide of Renascence: Sankaradeva's Kirttan-GhosāBhargavNo ratings yet

- Soal Kalimat Prohibition SMP Kelas 7Document3 pagesSoal Kalimat Prohibition SMP Kelas 7yura chanNo ratings yet

- Phlebotomist TrackerDocument62 pagesPhlebotomist Trackertarun sharmaNo ratings yet

- Tia HistoryDocument11 pagesTia HistoryTiara AlmeidaNo ratings yet