Professional Documents

Culture Documents

India PMI June 2020 Serv

India PMI June 2020 Serv

Uploaded by

CuriousMan87Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India PMI June 2020 Serv

India PMI June 2020 Serv

Uploaded by

CuriousMan87Copyright:

Available Formats

News Release

Embargoed until 1030 IST (0500 UTC) 3 June 2020

IHS Markit India Services PMI®

Including IHS Markit India Composite PMI®

Extreme slide in business activity seen once

again during May

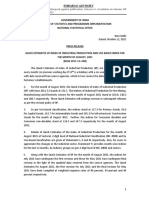

Key findings Services Business Activity Index

sa, >50 = growth since previous month

GDP

% yr/yr

80 25

Services activity contracts sharply due to COVID-19

pandemic 60

15

5

Demand for services plummets amid lockdown 40

-5

measures

20

-15

Firms cut employment as business expectations turn

0 -25

negative '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20

May data were collected 12-27 May 2020. Sources: IHS Markit, CSO.

Business activity across India's service sector fell drastically of surveyed companies reporting a fall in foreign demand

during May as the unfavourable economic effects of the when compared to April. The global COVID-19 pandemic was

coronavirus disease 2019 (COVID-19) pandemic impaired overwhelmingly mentioned as the factor causing international

business operations, restricted consumer footfall and led business to decrease.

demand to collapse. While most measures came off the With many businesses remaining shut down during May, the

unprecedented lows seen in April, survey data still pointed to extent to which spare capacity grew slowed markedly as a

extreme month-to-month declines in output and new orders. number of firms reported a build-up in unfinished work due to

Spare capacity continued to rise, albeit to a far lesser degree idle operations. Nevertheless, backlogs of work declined overall.

than in May as prolonged shutdowns led to a rise in incomplete In response to absent demand pressures and low business

work at some companies. Meanwhile, employment continued requirements, employment at Indian service sector companies

to fall in response to weak demand and expectations of further was reduced during the latest survey period. The rate of job

challenging conditions. shedding remained strong by historical comparisons, despite

The IHS Markit India Services Business Activity Index recorded easing since April.

12.6 in May. Although the headline figure rose from April's Lower staffing levels also coincided with a further deterioration

unprecedented low of 5.4, it remained at a level which, prior to in business sentiment. Output expectations for the coming 12

the coronavirus pandemic, was unparalleled in over 14 years months slumped to their most negative since records began

of data collection and pointed to an extreme drop in services in December 2005 amid forecasts of prolonged economic

activity across India. weakness domestically and overseas.

According to panel member reports, output sank sharply due Lastly, prices data showed deflationary trends across both

to extended business shutdowns and very weak demand input costs and output charges midway through the second

conditions. Latest survey data pointed to a substantial decline quarter. However, while the rate at which output price fell

in new work intakes at Indian service providers during May. slowed, operating expenses dropped at the fastest rate in the

Measures imposed to stem the spread of COVID-19 were a key survey history.

reason behind the latest drop in sales, as per anecdotal reasons.

The rate of decrease was marginally softer than seen in April,

but was nonetheless steep by historical comparisons.

New business from overseas markets collapsed on an

unprecedented scale once again during May, with around 95%

continued...

© 2020 IHS Markit

IHS Markit India Services PMI®

IHS Markit India Composite PMI®

Economic downturn remains severe in May Composite Output Index GDP

sa, >50 = growth since previous month % yr/yr

80 20

The Composite* PMI Output Index, which measures combined 15

services and manufacturing output, signalled a further severe 60 10

contraction in private sector business activity during May. 5

Posting 14.8, from 7.2 in April, the latest reading was consistent 40 0

with a further decline in output which was unparalleled prior to -5

the COVID-19 outbreak. 20 -10

Both manufacturing and service sector output fell at similarly- -15

substantial rates during May, although the sharpest decline 0 -20

'08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20

remained among the latter. Demand for goods and services

continued to sink at a considerable pace, despite rates of Sources: IHS Markit, CSO.

contraction easing at both manufacturers and service providers.

Aggregate employment fell further during May, although a Manufacturing Output Index

Services Business Activity Index

weaker decline at services companies contrasted with a steeper sa, >50 = growth since previous month

drop at goods producers.

70

There was a notable easing in the rate of output price deflation, 60

which continued to be outpaced by the drop in operating costs.

50

*Composite indices are weighted averages of comparable 40

manufacturing and services indices. Weights reflect the relative

30

size of the manufacturing and service sectors according to official

GDP data. The India Composite Output Index is a weighted 20

average of the Manufacturing Output Index and the Services 10

Business Activity Index. 0

'08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20

Source: IHS Markit.

Comment

Commenting on the latest survey results, remained closed and footfall remains

Joe Hayes, Economist at IHS Markit, said: drastically below normal levels.

"With economic output set to fall

"Service sector activity in India is still enormously in the first half of 2020, it is

effectively on hold, latest PMI data clear that the recovery to pre-COVID-19

suggest, as output fell at an extreme levels of GDP is going to be very slow."

rate once again during May. Given the

stringency of the lockdown measures

imposed in India, it is no surprise to see the

severity of the declines in April and May.

"Demand for services, both domestically

and overseas, continued to plummet

in May as clients' businesses

© 2020 IHS Markit

IHS Markit India Services PMI®

Services Employment Index Services Prices Charged Index

sa, >50 = growth since previous month sa, >50 = inflation since previous month

56 65

54

60

52

50 55

48

46 50

44

45

42

40 40

'08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20

Source: IHS Markit. Source: IHS Markit.

Contact

Joe Hayes Bernard Aw Katherine Smith

Economist Principal Economist Public Relations

IHS Markit IHS Markit IHS Markit

T: +44 1491 461 006 T: +65 6922 4226 T: +1 781 301 9311

joseph.hayes@ihsmarkit.com bernard.aw@ihsmarkit.com katherine.smith@ihsmarkit.com

Survey methodology About IHS Markit

The IHS Markit India Services PMI® is compiled by IHS Markit from responses to questionnaires sent IHS Markit (NYSE: INFO) is a world leader in critical information, analytics and solutions for the major

to a panel of around 400 service sector companies. The sectors covered include consumer (excluding industries and markets that drive economies worldwide. The company delivers next-generation

retail), transport, information, communication, finance, insurance, real estate and business services. information, analytics and solutions to customers in business, finance and government, improving

The panel is stratified by detailed sector and company workforce size, based on contributions to GDP. their operational efficiency and providing deep insights that lead to well-informed, confident

decisions. IHS Markit has more than 50,000 business and government customers, including 80

Survey responses are collected in the second half of each month and indicate the direction of change percent of the Fortune Global 500 and the world’s leading financial institutions.

compared to the previous month. A diffusion index is calculated for each survey variable. The index

is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses. IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and

The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared product names may be trademarks of their respective owners © 2020 IHS Markit Ltd. All rights

to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted. reserved.

The headline figure is the Services Business Activity Index. This is a diffusion index calculated from If you prefer not to receive news releases from IHS Markit, please email katherine.smith@ihsmarkit.

a question that asks for changes in the volume of business activity compared with one month com. To read our privacy policy, click here.

previously. The Services Business Activity Index is comparable to the Manufacturing Output Index.

It may be referred to as the ‘Services PMI’ but is not comparable with the headline manufacturing

PMI figure. About PMI

The Composite Output Index is a weighted average of the Manufacturing Output Index and the Purchasing Managers’ Index® (PMI®) surveys are now available for over 40 countries and also for key

Services Business Activity Index. The weights reflect the relative size of the manufacturing and regions including the eurozone. They are the most closely watched business surveys in the world,

service sectors according to official GDP data. The Composite Output Index may be referred to as the favoured by central banks, financial markets and business decision makers for their ability to provide

‘Composite PMI’ but is not comparable with the headline manufacturing PMI figure. up-to-date, accurate and often unique monthly indicators of economic trends.

Underlying survey data are not revised after publication, but seasonal adjustment factors may be ihsmarkit.com/products/pmi.html.

revised from time to time as appropriate which will affect the seasonally adjusted data series.

For further information on the PMI survey methodology, please contact economics@ihsmarkit.com.

Survey dates and history

May data were collected 12-27 May 2020.

Survey data were first collected December 2005.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to IHS Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any

data appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors,

inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the

data. Purchasing Managers’ Index® and PMI® are either registered trade marks of Markit Economics Limited or licensed to Markit Economics Limited. IHS Markit is a registered trademark of IHS Markit Ltd. and/or

its affiliates.

© 2020 IHS Markit

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- VP - PSV SEA VEGA REV.0 (New Logo) r2Document4 pagesVP - PSV SEA VEGA REV.0 (New Logo) r2Sugiman LayantoNo ratings yet

- PDF Bobcat s175 s185 Service Repair Manual SN 525011001 525111001 525211001 525311001 and AboveDocument933 pagesPDF Bobcat s175 s185 Service Repair Manual SN 525011001 525111001 525211001 525311001 and AboveChristian Cepeda86% (7)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Calculation of Septic Tank & Sock PitDocument11 pagesCalculation of Septic Tank & Sock Pitakram1978No ratings yet

- Barangay Nutrition Scholar Monthly AccomplishmentDocument7 pagesBarangay Nutrition Scholar Monthly AccomplishmentDianka Glory Cenabre Edrozo75% (4)

- Lung AnatomyDocument19 pagesLung AnatomyScott Yee100% (2)

- Eight - Core Indus Jan 2021Document4 pagesEight - Core Indus Jan 2021CuriousMan87No ratings yet

- External - Sector - Statistics Jan 2021Document9 pagesExternal - Sector - Statistics Jan 2021CuriousMan87No ratings yet

- Cmonthly WPI May 2021Document5 pagesCmonthly WPI May 2021CuriousMan87No ratings yet

- Cmonthly WPI Jan 2021Document6 pagesCmonthly WPI Jan 2021CuriousMan87No ratings yet

- Pandemic UMCSIDocument1 pagePandemic UMCSICuriousMan87No ratings yet

- Cmonthly WPI Jan 2021Document5 pagesCmonthly WPI Jan 2021CuriousMan87No ratings yet

- Iip J Aug 21Document6 pagesIip J Aug 21CuriousMan87No ratings yet

- Eight - Infra Apr 2021Document4 pagesEight - Infra Apr 2021CuriousMan87No ratings yet

- 2021 May Service PMIDocument3 pages2021 May Service PMICuriousMan87No ratings yet

- Industrial - Statistics Key Indi Jan 2021Document5 pagesIndustrial - Statistics Key Indi Jan 2021CuriousMan87No ratings yet

- AXIS MF Nov 2020Document213 pagesAXIS MF Nov 2020CuriousMan87No ratings yet

- Quarterly Dashboard - ETFs and Index Funds - Dec 2021Document14 pagesQuarterly Dashboard - ETFs and Index Funds - Dec 2021CuriousMan87No ratings yet

- Returns of ICICI Prudential Nifty Index Fund - Growth Option As On June 30, 2021Document2 pagesReturns of ICICI Prudential Nifty Index Fund - Growth Option As On June 30, 2021CuriousMan87No ratings yet

- Returns of ICICI Prudential Bluechip Fund - Growth Option As On June 30, 2021Document2 pagesReturns of ICICI Prudential Bluechip Fund - Growth Option As On June 30, 2021CuriousMan87No ratings yet

- Greater Loss Likely 202005 UMCSIDocument1 pageGreater Loss Likely 202005 UMCSICuriousMan87No ratings yet

- Zomato DamodaranDocument64 pagesZomato DamodaranCuriousMan87No ratings yet

- USA July 2020 PMI ManuDocument27 pagesUSA July 2020 PMI ManuCuriousMan87No ratings yet

- IHS Markit PMI IntroductionDocument14 pagesIHS Markit PMI IntroductionCuriousMan87No ratings yet

- Rob 202009 PmiDocument3 pagesRob 202009 PmiCuriousMan87No ratings yet

- Rob 202009 S VcsDocument3 pagesRob 202009 S VcsCuriousMan87No ratings yet

- Uppsala Monitoring Centre Uppsala Reports 77 - WebDocument19 pagesUppsala Monitoring Centre Uppsala Reports 77 - WebCuriousMan87No ratings yet

- Maps of Consciousness Yi King TarotDocument171 pagesMaps of Consciousness Yi King TarotRichard Hansoul100% (7)

- Acids, Bases and Salt Preparations 1 QPDocument8 pagesAcids, Bases and Salt Preparations 1 QPAbdullah SheikhNo ratings yet

- Application For Registration As A Vendor: Next PageDocument4 pagesApplication For Registration As A Vendor: Next PageMark KNo ratings yet

- AAADocument12 pagesAAAMisael CamposanoNo ratings yet

- Lec5 - Geotechnical Investigation Reports and Foundation Recommendations-Scope For Improvement-ExamplesDocument20 pagesLec5 - Geotechnical Investigation Reports and Foundation Recommendations-Scope For Improvement-ExamplesrohitNo ratings yet

- Module P&P (Specific Heat Capacity)Document11 pagesModule P&P (Specific Heat Capacity)Syazlina SamsudinNo ratings yet

- Adam S. Tricomo: Concordia University Irvine, Irvine, CADocument2 pagesAdam S. Tricomo: Concordia University Irvine, Irvine, CAapi-518371548No ratings yet

- Vashikaran Mantra For Love PDFDocument4 pagesVashikaran Mantra For Love PDFmustafaaldin0% (2)

- Coevolution of Hosts and ParasitesDocument5 pagesCoevolution of Hosts and ParasitesAshok KoyiNo ratings yet

- Animals in Zoos EssayDocument1 pageAnimals in Zoos EssayElina UllbrandtNo ratings yet

- Iso 50001 Enms - Manual-Procedures-Forms-Matrix - P-XXX NumbersDocument1 pageIso 50001 Enms - Manual-Procedures-Forms-Matrix - P-XXX NumbersAngelo SantiagoNo ratings yet

- Unfuck Your Anilingus - How To Keep Your Oral Butt Sex Classy - Faith G Harper - 2022 - Microcosm Publishing - 9781648411618 - Anna's ArchiveDocument28 pagesUnfuck Your Anilingus - How To Keep Your Oral Butt Sex Classy - Faith G Harper - 2022 - Microcosm Publishing - 9781648411618 - Anna's Archiverhy4kjgqx6No ratings yet

- YttrrtDocument9 pagesYttrrtImad AghilaNo ratings yet

- Bar97specs Part2Document47 pagesBar97specs Part2N J Vargas SampayoNo ratings yet

- PCAR Contractors ManualDocument219 pagesPCAR Contractors ManualDefendAChildNo ratings yet

- Abdikamalov Xodjabay Ismamutovich, Najimov Paraxat Ibrayimovich, Abstract. The Article Discusses The Importance and Necessity of PhysicalDocument7 pagesAbdikamalov Xodjabay Ismamutovich, Najimov Paraxat Ibrayimovich, Abstract. The Article Discusses The Importance and Necessity of PhysicalNurnazar PirnazarovNo ratings yet

- Hyva Oil Tank: Single Support Tank Double Support TankDocument4 pagesHyva Oil Tank: Single Support Tank Double Support TankPutera Bumi NusantaraNo ratings yet

- A Miracle of Flexibility and Fracture Resistance!: The New Niti File GenerationDocument6 pagesA Miracle of Flexibility and Fracture Resistance!: The New Niti File Generationshamshuddin patelNo ratings yet

- Managing People - AssignmentDocument10 pagesManaging People - AssignmentayeshaNo ratings yet

- 373 PDFDocument6 pages373 PDFIjdra Journal Jitendra BadjatyaNo ratings yet

- Vaxigrip Tetra Pi Nh19-20Document2 pagesVaxigrip Tetra Pi Nh19-20A. shahizaNo ratings yet

- MASS 2021 10-v2Document121 pagesMASS 2021 10-v2Fidel MangoldNo ratings yet

- Noise Control of Large Wet Cooling TowersDocument8 pagesNoise Control of Large Wet Cooling TowersMario LopezNo ratings yet

- Fuels LiquidDocument25 pagesFuels Liquidpranay639100% (1)

- Oxidation of N-Acetyl Alanine by Chloramine-T in Presence of Hydrochloric Acid: A Kinetic and Mechanistic StudyDocument10 pagesOxidation of N-Acetyl Alanine by Chloramine-T in Presence of Hydrochloric Acid: A Kinetic and Mechanistic StudyCentral Asian StudiesNo ratings yet