Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsGulf Takeover Excel

Gulf Takeover Excel

Uploaded by

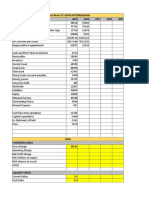

NarinderThe document contains calculations to determine the weighted average cost of capital (WACC) for Gulf, which is 14.11%. It also contains assumptions and calculations to value Gulf as a perpetuity, estimating the enterprise value at $26936 and the equity value at $28557. Given 165.3 million outstanding shares, the estimated value per share is $173. The document also analyzes the net present value of Gulf's exploration and development program and determines the optimal bid price range for Gulf's shares.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Finance For Non-Financial Managers 7th Canadian EditionDocument618 pagesFinance For Non-Financial Managers 7th Canadian EditionAziz80% (5)

- Smith Family Financial PDocument11 pagesSmith Family Financial PNarinder50% (2)

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- Final Examination Case Study FIN 855 Spring 2021 Professor Jim SewardDocument1 pageFinal Examination Case Study FIN 855 Spring 2021 Professor Jim SewardNarinderNo ratings yet

- Ultimate Guide To Debt & Leveraged Finance - Wall Street PrepDocument18 pagesUltimate Guide To Debt & Leveraged Finance - Wall Street PrepPearson SunigaNo ratings yet

- IRR and NPVDocument21 pagesIRR and NPVAbdul Qayyum100% (1)

- Anandam Manufacturing Company: Analysis of Financial StatementsDocument5 pagesAnandam Manufacturing Company: Analysis of Financial StatementsNarinderNo ratings yet

- Model Formule - ExerciseDocument8 pagesModel Formule - Exercisemaxball53000No ratings yet

- 4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFDocument3 pages4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFAkshit SoniNo ratings yet

- Investment and Portfolio ManagementDocument3 pagesInvestment and Portfolio ManagementHAMZA WAHEEDNo ratings yet

- DCF Valuation TemplateDocument15 pagesDCF Valuation TemplateDEV DUTT VASHIST 22111116No ratings yet

- Power Plant Financial AnalysisDocument16 pagesPower Plant Financial AnalysisGaurav BasnyatNo ratings yet

- The Bell 07 October 2010Document3 pagesThe Bell 07 October 2010Khawaja UsmanNo ratings yet

- Thi ThiDocument26 pagesThi ThiNhật HạNo ratings yet

- Valuasi Bisnis PT Astra InternasionalDocument3 pagesValuasi Bisnis PT Astra InternasionalSisilia EkklesiaNo ratings yet

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument13 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- Pepsico DCF Valuation SolutionDocument45 pagesPepsico DCF Valuation SolutionSuryapratap KhuntiaNo ratings yet

- Class 1 7th Feb OxygenDocument17 pagesClass 1 7th Feb OxygenAmit JainNo ratings yet

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- Mo Hinh Ky Thuat Phan Tich Tai ChinhDocument39 pagesMo Hinh Ky Thuat Phan Tich Tai ChinhĐào Mạnh Quân Pete'rNo ratings yet

- Brand CoDocument7 pagesBrand CoCamila VillamilNo ratings yet

- Delta4 122006Document8 pagesDelta4 122006mariaplacerda.fradeNo ratings yet

- Real Estate Equity Waterfall With GP Catch Up v1.6Document66 pagesReal Estate Equity Waterfall With GP Catch Up v1.6Vishal VermaNo ratings yet

- Stuti Mehta pgmb2149 FinanceDocument12 pagesStuti Mehta pgmb2149 FinanceStutiNo ratings yet

- A. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Document11 pagesA. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Hoàng QuânNo ratings yet

- Valuation: Chapter 17: 6,9,11,13,15Document37 pagesValuation: Chapter 17: 6,9,11,13,15hunt4dollarNo ratings yet

- PifDocument2 pagesPifrumeet10No ratings yet

- M&a ValluationDocument11 pagesM&a ValluationSumeet BhatereNo ratings yet

- Inventory and Recievables FormulasDocument7 pagesInventory and Recievables FormulasJoshua CabinasNo ratings yet

- OrderID 87944Document14 pagesOrderID 87944Navya VinnyNo ratings yet

- Bus ModelDocument1 pageBus Modelshrish guptaNo ratings yet

- Analiza FinanciaraDocument40 pagesAnaliza FinanciaraMarius LazarNo ratings yet

- BRS3B Assessment Opportunity 1 2019Document11 pagesBRS3B Assessment Opportunity 1 2019221103909No ratings yet

- Fin Model Class9 Merger Model Using DCF MethodologyDocument1 pageFin Model Class9 Merger Model Using DCF MethodologyGel viraNo ratings yet

- FR 2 Full SolutionDocument16 pagesFR 2 Full SolutionANo ratings yet

- Assignment Capital BudgetingDocument7 pagesAssignment Capital BudgetingSufyan AshrafNo ratings yet

- AFM WorkingDocument7 pagesAFM Workingsairad1999No ratings yet

- DCF - Interactive Exercise (Template)Document15 pagesDCF - Interactive Exercise (Template)marie.courlierNo ratings yet

- Capital Cash FlowDocument6 pagesCapital Cash Flowbhavin shahNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- DCF ModelDocument6 pagesDCF ModelKatherine ChouNo ratings yet

- Cab Service ModelDocument2 pagesCab Service ModelPooja AdhikariNo ratings yet

- Airthread Acquisition: Income StatementDocument31 pagesAirthread Acquisition: Income StatementnidhidNo ratings yet

- KKL25Document5 pagesKKL25kalharaeheliyaNo ratings yet

- FM 07 Jun 22, Tarik SirDocument5 pagesFM 07 Jun 22, Tarik SirTowhidul IslamNo ratings yet

- 2) Integrating Statements PDFDocument8 pages2) Integrating Statements PDFAkshit SoniNo ratings yet

- Ratio AnalysisDocument17 pagesRatio Analysisdora76pataNo ratings yet

- Assignment N3Document12 pagesAssignment N3Maiko KopadzeNo ratings yet

- Acquisition Cash FlowDocument3 pagesAcquisition Cash Flowkaeya alberichNo ratings yet

- Hertz Write UpDocument5 pagesHertz Write Uprishabh jainNo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- AirThread Class 2020Document21 pagesAirThread Class 2020Son NguyenNo ratings yet

- DCF ModellDocument7 pagesDCF Modellsandeep0604No ratings yet

- 3 Spread Sheet For Corp & ME001 Sultan FeedDocument5 pages3 Spread Sheet For Corp & ME001 Sultan Feedmuhammad ihtishamNo ratings yet

- Day 1. Expenses and Cost (MY)Document12 pagesDay 1. Expenses and Cost (MY)Jhilmil JeswaniNo ratings yet

- Sneakers With Risk Analysis Scenario Raw File 2022Document3 pagesSneakers With Risk Analysis Scenario Raw File 2022Smit SanganiNo ratings yet

- Standard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesDocument4 pagesStandard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Date of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J ContactDocument11 pagesDate of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J Contactapi-3702531No ratings yet

- Ratio Analysis Exercise1Document1 pageRatio Analysis Exercise1syed.aliNo ratings yet

- Sampleprofit ForecastDocument9 pagesSampleprofit ForecastKhánh Linh Nguyễn NgọcNo ratings yet

- To Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenDocument4 pagesTo Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenYash ModiNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- OB Sunday FINAL EXAM (Subjective Paper)Document2 pagesOB Sunday FINAL EXAM (Subjective Paper)NarinderNo ratings yet

- Running Head: QVC 1Document13 pagesRunning Head: QVC 1NarinderNo ratings yet

- FPSC@FPSC Gov PKDocument72 pagesFPSC@FPSC Gov PKNarinderNo ratings yet

- The Walt Disney CompanyDocument11 pagesThe Walt Disney CompanyNarinderNo ratings yet

- Water & Power Development Authority Phase XIV (WAPDA-XIV) (469) Application Form For The Post of 02. Assistant Director (Computer Operations)Document4 pagesWater & Power Development Authority Phase XIV (WAPDA-XIV) (469) Application Form For The Post of 02. Assistant Director (Computer Operations)NarinderNo ratings yet

- Jetblue Airways: Deicing at Logan AirportDocument4 pagesJetblue Airways: Deicing at Logan AirportNarinderNo ratings yet

- Running Head: K.Peabody Firm: Creating Elusive Profits 1Document13 pagesRunning Head: K.Peabody Firm: Creating Elusive Profits 1NarinderNo ratings yet

- Sciencedirect: Guidelines For Successful CrowdfundingDocument6 pagesSciencedirect: Guidelines For Successful CrowdfundingNarinderNo ratings yet

- Bond Buyback at Deutsche Bank: Running Head: 1Document10 pagesBond Buyback at Deutsche Bank: Running Head: 1NarinderNo ratings yet

- How I Planted The Tree and Saved The Enviroment: by (Perkma Devi 36747)Document3 pagesHow I Planted The Tree and Saved The Enviroment: by (Perkma Devi 36747)NarinderNo ratings yet

- Jetblue Airways: Deicing at Logan AirportDocument5 pagesJetblue Airways: Deicing at Logan AirportNarinderNo ratings yet

- THE WALT DISNEY COMPANY - EditedDocument11 pagesTHE WALT DISNEY COMPANY - EditedNarinderNo ratings yet

- Astral - XLS: Assumptions / InputsDocument6 pagesAstral - XLS: Assumptions / InputsNarinderNo ratings yet

- Inventory Sample Exercise - 2Document8 pagesInventory Sample Exercise - 2jangjangNo ratings yet

- Insolvency NotesDocument25 pagesInsolvency NotesV.Vidhya VasiniNo ratings yet

- SSRN Id3578482Document7 pagesSSRN Id3578482Sukruth B SNo ratings yet

- Chapter 6 - Capital Gains TaxationDocument4 pagesChapter 6 - Capital Gains Taxationclaritaquijano526No ratings yet

- Tax 303 - Input VatDocument7 pagesTax 303 - Input VatiBEAYNo ratings yet

- Carrefour's Current Development Situation and Its Valuation: Qixuan HuaDocument8 pagesCarrefour's Current Development Situation and Its Valuation: Qixuan HuaadobeawilliamsNo ratings yet

- (LCCI Cert in Advance Business Calculations L3) ASE3003 Series 4 2015 Question PaperDocument12 pages(LCCI Cert in Advance Business Calculations L3) ASE3003 Series 4 2015 Question PaperAung Zaw Htwe100% (1)

- An Hoài Thu CHAP 10 + FIN202Document18 pagesAn Hoài Thu CHAP 10 + FIN202An Hoài ThuNo ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- Astrid C Arboleda: Personal InfoDocument19 pagesAstrid C Arboleda: Personal InfoSergio LitumaNo ratings yet

- 1 D Ifrs 16 Example Lease Modification Scope Increase and Decrease 02Document7 pages1 D Ifrs 16 Example Lease Modification Scope Increase and Decrease 02Imelda FebriputriNo ratings yet

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicDocument29 pagesSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- College Accounting 14th Edition Price Test BankDocument97 pagesCollege Accounting 14th Edition Price Test BankLuther MelendezNo ratings yet

- Inventory HowjekDocument7 pagesInventory Howjeksilent spritsNo ratings yet

- Acct 100 SyllabusDocument4 pagesAcct 100 Syllabusa26736No ratings yet

- Quiz 2 Part 2 On Foreign TransactionsDocument5 pagesQuiz 2 Part 2 On Foreign TransactionsKathrine YapNo ratings yet

- Technical - Analysis and Short Selling - Yi - Yu - SenecaDocument71 pagesTechnical - Analysis and Short Selling - Yi - Yu - SenecaHeisen LukeNo ratings yet

- Entrep 11 More QuizzesDocument4 pagesEntrep 11 More QuizzesKyle Torres AnchetaNo ratings yet

- UntitledDocument2 pagesUntitledUmi AnggraeniNo ratings yet

- Essentials of Corporate Finance Australian 3rd Edition Ross Solutions ManualDocument34 pagesEssentials of Corporate Finance Australian 3rd Edition Ross Solutions Manualupwindscatterf9ebp100% (33)

- share capital pp solDocument21 pagesshare capital pp solvaibhavsethia71691No ratings yet

- trắc nghiệmDocument6 pagestrắc nghiệmuyenvtt2002No ratings yet

- Chapter 13 GuerreroDocument40 pagesChapter 13 GuerreroJose Sas100% (2)

- 22bca20044 Exp1Document2 pages22bca20044 Exp1Yash SiwachNo ratings yet

- BCD CorporationDocument3 pagesBCD CorporationJohn Rey GalichaNo ratings yet

- Full Download pdf of (eBook PDF) Essentials of Corporate Finance 8th Edition all chapterDocument23 pagesFull Download pdf of (eBook PDF) Essentials of Corporate Finance 8th Edition all chapterelomrtkocz100% (6)

- Final Examination in Business Combi 2021Document7 pagesFinal Examination in Business Combi 2021Michael BongalontaNo ratings yet

Gulf Takeover Excel

Gulf Takeover Excel

Uploaded by

Narinder0 ratings0% found this document useful (0 votes)

12 views7 pagesThe document contains calculations to determine the weighted average cost of capital (WACC) for Gulf, which is 14.11%. It also contains assumptions and calculations to value Gulf as a perpetuity, estimating the enterprise value at $26936 and the equity value at $28557. Given 165.3 million outstanding shares, the estimated value per share is $173. The document also analyzes the net present value of Gulf's exploration and development program and determines the optimal bid price range for Gulf's shares.

Original Description:

Original Title

Copy of Gulf Takeover Excel

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains calculations to determine the weighted average cost of capital (WACC) for Gulf, which is 14.11%. It also contains assumptions and calculations to value Gulf as a perpetuity, estimating the enterprise value at $26936 and the equity value at $28557. Given 165.3 million outstanding shares, the estimated value per share is $173. The document also analyzes the net present value of Gulf's exploration and development program and determines the optimal bid price range for Gulf's shares.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views7 pagesGulf Takeover Excel

Gulf Takeover Excel

Uploaded by

NarinderThe document contains calculations to determine the weighted average cost of capital (WACC) for Gulf, which is 14.11%. It also contains assumptions and calculations to value Gulf as a perpetuity, estimating the enterprise value at $26936 and the equity value at $28557. Given 165.3 million outstanding shares, the estimated value per share is $173. The document also analyzes the net present value of Gulf's exploration and development program and determines the optimal bid price range for Gulf's shares.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 7

WACC Calculations (Gulf):

Debt Ratio 11%

Equity Ratio 89%

Cost of Debt 13.50%

Tax Rate 50%

After tax cost of debt 7%

Risk Free Rate of Return 11%

Rm 8.80%

Beta 1.15

Cost of Equity 21%

WACC Gulf 20%

GULF WACC

Cost of debt 13.50%

Weight of debt 11%

Weight of equity 89%

Tax Rate 50%

Risk Free Rate (Yield on Intermediate term bonds) 11%

Market Return (S&P 500) 14.50%

Gulf Beta 1.1500

Cost of equity 15.025%

WACC - GULF 14.11%

Gulf Valuation - Perpetuity

Assumptions

Tax Rate 50%

Nominal Growth Rate 4%

WACC 14%

FCFF Calculation

Revenues 6503

Less: Costs

Production 911

Wellhead taxes 792

Depriciation Expense 1000

Other operating Expenses 351

EBIT 3449

EBIT*(1-Tax) 1725

Add: Depriciation 1000

Free Cash Flow 2725

Enterprise Value (perpetuity) 26936

Valuation - E&D Program

Value of Exploration and Developement Program 12458

Total Enterprise Value 39393

Less Debt 10836

Equity Value 28557

No. of Oustanding Shares 165.3

Value per share 173

Price offered 70

discount (Premium) on shares 103

Rate of Return 59%

Gulf Valuation - Perpetuity

Assumptions

Tax Rate 50%

Nominal Growth Rate 4%

WACC 14%

FCFF Calculation

Revenues 6503

Less: Costs

Production 911

Wellhead taxes 792

Depriciation Expense 1000

Other operating Expenses 351

EBIT 3449

EBIT*(1-Tax) 1725

Add: Depriciation 1000

Free Cash Flow 2725

Enterprise Value (perpetuity) 26936

Less Debt 10836

Equity Value 10836

No. of Oustanding Sahres 165.3

Value per share 66

Price offered 70

discount (Premium) on shares -4

Rate of Return -7%

Operating Profit Per Barrrel:

Results of Operations after costs and income taxes 915

income taxes 1933

Operating Profits 2848

Average Reserves 3004

Reserves to production ratio 8

Barrels produced in 8 years 375

Operating Profit Per Barrrel Produced in 1983 8

Operating Profit Per Barrel in 8 years:

Inflation Rate 5%

Operating Profit Per Barrrel Produced in 1983 8

Period 8

Operating Profit Per Barrel in 8 years 5

NPV of Exploration and Development Program:

Total Exploration Cost 1982 2646

Total Exploration Cost 1983 2189

Average Exploration Cost 2418

Barrel produced 375

Operating Profit Total in 8 years 1928

PV of Tax Shelters Exp'd 629.0476190476

PV of Tax Shelters Cap'd 1673

NPV of 1 year of Exploration and Development 1813

Nominal Growth Rate 5%

Discount Rate 20%

NPV Exploration and Development Program 12458

Optimal Bid Price Levels:

Minimum Bid Price Level

Maximum Bid Price at NPV=Zero

Cash Outflow for purchases = Price * No. of Outstanding Shares

At 0 NPV,

Cash Outflow for purcahses = Enterprise Value

Enterprise Value (Equity Value)

No. of Outsatnding Shares

Maximum Bid Price Level

75

28557

165.3

173

You might also like

- Finance For Non-Financial Managers 7th Canadian EditionDocument618 pagesFinance For Non-Financial Managers 7th Canadian EditionAziz80% (5)

- Smith Family Financial PDocument11 pagesSmith Family Financial PNarinder50% (2)

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- Final Examination Case Study FIN 855 Spring 2021 Professor Jim SewardDocument1 pageFinal Examination Case Study FIN 855 Spring 2021 Professor Jim SewardNarinderNo ratings yet

- Ultimate Guide To Debt & Leveraged Finance - Wall Street PrepDocument18 pagesUltimate Guide To Debt & Leveraged Finance - Wall Street PrepPearson SunigaNo ratings yet

- IRR and NPVDocument21 pagesIRR and NPVAbdul Qayyum100% (1)

- Anandam Manufacturing Company: Analysis of Financial StatementsDocument5 pagesAnandam Manufacturing Company: Analysis of Financial StatementsNarinderNo ratings yet

- Model Formule - ExerciseDocument8 pagesModel Formule - Exercisemaxball53000No ratings yet

- 4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFDocument3 pages4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFAkshit SoniNo ratings yet

- Investment and Portfolio ManagementDocument3 pagesInvestment and Portfolio ManagementHAMZA WAHEEDNo ratings yet

- DCF Valuation TemplateDocument15 pagesDCF Valuation TemplateDEV DUTT VASHIST 22111116No ratings yet

- Power Plant Financial AnalysisDocument16 pagesPower Plant Financial AnalysisGaurav BasnyatNo ratings yet

- The Bell 07 October 2010Document3 pagesThe Bell 07 October 2010Khawaja UsmanNo ratings yet

- Thi ThiDocument26 pagesThi ThiNhật HạNo ratings yet

- Valuasi Bisnis PT Astra InternasionalDocument3 pagesValuasi Bisnis PT Astra InternasionalSisilia EkklesiaNo ratings yet

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument13 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- Pepsico DCF Valuation SolutionDocument45 pagesPepsico DCF Valuation SolutionSuryapratap KhuntiaNo ratings yet

- Class 1 7th Feb OxygenDocument17 pagesClass 1 7th Feb OxygenAmit JainNo ratings yet

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- Mo Hinh Ky Thuat Phan Tich Tai ChinhDocument39 pagesMo Hinh Ky Thuat Phan Tich Tai ChinhĐào Mạnh Quân Pete'rNo ratings yet

- Brand CoDocument7 pagesBrand CoCamila VillamilNo ratings yet

- Delta4 122006Document8 pagesDelta4 122006mariaplacerda.fradeNo ratings yet

- Real Estate Equity Waterfall With GP Catch Up v1.6Document66 pagesReal Estate Equity Waterfall With GP Catch Up v1.6Vishal VermaNo ratings yet

- Stuti Mehta pgmb2149 FinanceDocument12 pagesStuti Mehta pgmb2149 FinanceStutiNo ratings yet

- A. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Document11 pagesA. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Hoàng QuânNo ratings yet

- Valuation: Chapter 17: 6,9,11,13,15Document37 pagesValuation: Chapter 17: 6,9,11,13,15hunt4dollarNo ratings yet

- PifDocument2 pagesPifrumeet10No ratings yet

- M&a ValluationDocument11 pagesM&a ValluationSumeet BhatereNo ratings yet

- Inventory and Recievables FormulasDocument7 pagesInventory and Recievables FormulasJoshua CabinasNo ratings yet

- OrderID 87944Document14 pagesOrderID 87944Navya VinnyNo ratings yet

- Bus ModelDocument1 pageBus Modelshrish guptaNo ratings yet

- Analiza FinanciaraDocument40 pagesAnaliza FinanciaraMarius LazarNo ratings yet

- BRS3B Assessment Opportunity 1 2019Document11 pagesBRS3B Assessment Opportunity 1 2019221103909No ratings yet

- Fin Model Class9 Merger Model Using DCF MethodologyDocument1 pageFin Model Class9 Merger Model Using DCF MethodologyGel viraNo ratings yet

- FR 2 Full SolutionDocument16 pagesFR 2 Full SolutionANo ratings yet

- Assignment Capital BudgetingDocument7 pagesAssignment Capital BudgetingSufyan AshrafNo ratings yet

- AFM WorkingDocument7 pagesAFM Workingsairad1999No ratings yet

- DCF - Interactive Exercise (Template)Document15 pagesDCF - Interactive Exercise (Template)marie.courlierNo ratings yet

- Capital Cash FlowDocument6 pagesCapital Cash Flowbhavin shahNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- DCF ModelDocument6 pagesDCF ModelKatherine ChouNo ratings yet

- Cab Service ModelDocument2 pagesCab Service ModelPooja AdhikariNo ratings yet

- Airthread Acquisition: Income StatementDocument31 pagesAirthread Acquisition: Income StatementnidhidNo ratings yet

- KKL25Document5 pagesKKL25kalharaeheliyaNo ratings yet

- FM 07 Jun 22, Tarik SirDocument5 pagesFM 07 Jun 22, Tarik SirTowhidul IslamNo ratings yet

- 2) Integrating Statements PDFDocument8 pages2) Integrating Statements PDFAkshit SoniNo ratings yet

- Ratio AnalysisDocument17 pagesRatio Analysisdora76pataNo ratings yet

- Assignment N3Document12 pagesAssignment N3Maiko KopadzeNo ratings yet

- Acquisition Cash FlowDocument3 pagesAcquisition Cash Flowkaeya alberichNo ratings yet

- Hertz Write UpDocument5 pagesHertz Write Uprishabh jainNo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- AirThread Class 2020Document21 pagesAirThread Class 2020Son NguyenNo ratings yet

- DCF ModellDocument7 pagesDCF Modellsandeep0604No ratings yet

- 3 Spread Sheet For Corp & ME001 Sultan FeedDocument5 pages3 Spread Sheet For Corp & ME001 Sultan Feedmuhammad ihtishamNo ratings yet

- Day 1. Expenses and Cost (MY)Document12 pagesDay 1. Expenses and Cost (MY)Jhilmil JeswaniNo ratings yet

- Sneakers With Risk Analysis Scenario Raw File 2022Document3 pagesSneakers With Risk Analysis Scenario Raw File 2022Smit SanganiNo ratings yet

- Standard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesDocument4 pagesStandard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Date of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J ContactDocument11 pagesDate of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J Contactapi-3702531No ratings yet

- Ratio Analysis Exercise1Document1 pageRatio Analysis Exercise1syed.aliNo ratings yet

- Sampleprofit ForecastDocument9 pagesSampleprofit ForecastKhánh Linh Nguyễn NgọcNo ratings yet

- To Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenDocument4 pagesTo Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenYash ModiNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- OB Sunday FINAL EXAM (Subjective Paper)Document2 pagesOB Sunday FINAL EXAM (Subjective Paper)NarinderNo ratings yet

- Running Head: QVC 1Document13 pagesRunning Head: QVC 1NarinderNo ratings yet

- FPSC@FPSC Gov PKDocument72 pagesFPSC@FPSC Gov PKNarinderNo ratings yet

- The Walt Disney CompanyDocument11 pagesThe Walt Disney CompanyNarinderNo ratings yet

- Water & Power Development Authority Phase XIV (WAPDA-XIV) (469) Application Form For The Post of 02. Assistant Director (Computer Operations)Document4 pagesWater & Power Development Authority Phase XIV (WAPDA-XIV) (469) Application Form For The Post of 02. Assistant Director (Computer Operations)NarinderNo ratings yet

- Jetblue Airways: Deicing at Logan AirportDocument4 pagesJetblue Airways: Deicing at Logan AirportNarinderNo ratings yet

- Running Head: K.Peabody Firm: Creating Elusive Profits 1Document13 pagesRunning Head: K.Peabody Firm: Creating Elusive Profits 1NarinderNo ratings yet

- Sciencedirect: Guidelines For Successful CrowdfundingDocument6 pagesSciencedirect: Guidelines For Successful CrowdfundingNarinderNo ratings yet

- Bond Buyback at Deutsche Bank: Running Head: 1Document10 pagesBond Buyback at Deutsche Bank: Running Head: 1NarinderNo ratings yet

- How I Planted The Tree and Saved The Enviroment: by (Perkma Devi 36747)Document3 pagesHow I Planted The Tree and Saved The Enviroment: by (Perkma Devi 36747)NarinderNo ratings yet

- Jetblue Airways: Deicing at Logan AirportDocument5 pagesJetblue Airways: Deicing at Logan AirportNarinderNo ratings yet

- THE WALT DISNEY COMPANY - EditedDocument11 pagesTHE WALT DISNEY COMPANY - EditedNarinderNo ratings yet

- Astral - XLS: Assumptions / InputsDocument6 pagesAstral - XLS: Assumptions / InputsNarinderNo ratings yet

- Inventory Sample Exercise - 2Document8 pagesInventory Sample Exercise - 2jangjangNo ratings yet

- Insolvency NotesDocument25 pagesInsolvency NotesV.Vidhya VasiniNo ratings yet

- SSRN Id3578482Document7 pagesSSRN Id3578482Sukruth B SNo ratings yet

- Chapter 6 - Capital Gains TaxationDocument4 pagesChapter 6 - Capital Gains Taxationclaritaquijano526No ratings yet

- Tax 303 - Input VatDocument7 pagesTax 303 - Input VatiBEAYNo ratings yet

- Carrefour's Current Development Situation and Its Valuation: Qixuan HuaDocument8 pagesCarrefour's Current Development Situation and Its Valuation: Qixuan HuaadobeawilliamsNo ratings yet

- (LCCI Cert in Advance Business Calculations L3) ASE3003 Series 4 2015 Question PaperDocument12 pages(LCCI Cert in Advance Business Calculations L3) ASE3003 Series 4 2015 Question PaperAung Zaw Htwe100% (1)

- An Hoài Thu CHAP 10 + FIN202Document18 pagesAn Hoài Thu CHAP 10 + FIN202An Hoài ThuNo ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- Astrid C Arboleda: Personal InfoDocument19 pagesAstrid C Arboleda: Personal InfoSergio LitumaNo ratings yet

- 1 D Ifrs 16 Example Lease Modification Scope Increase and Decrease 02Document7 pages1 D Ifrs 16 Example Lease Modification Scope Increase and Decrease 02Imelda FebriputriNo ratings yet

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicDocument29 pagesSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- College Accounting 14th Edition Price Test BankDocument97 pagesCollege Accounting 14th Edition Price Test BankLuther MelendezNo ratings yet

- Inventory HowjekDocument7 pagesInventory Howjeksilent spritsNo ratings yet

- Acct 100 SyllabusDocument4 pagesAcct 100 Syllabusa26736No ratings yet

- Quiz 2 Part 2 On Foreign TransactionsDocument5 pagesQuiz 2 Part 2 On Foreign TransactionsKathrine YapNo ratings yet

- Technical - Analysis and Short Selling - Yi - Yu - SenecaDocument71 pagesTechnical - Analysis and Short Selling - Yi - Yu - SenecaHeisen LukeNo ratings yet

- Entrep 11 More QuizzesDocument4 pagesEntrep 11 More QuizzesKyle Torres AnchetaNo ratings yet

- UntitledDocument2 pagesUntitledUmi AnggraeniNo ratings yet

- Essentials of Corporate Finance Australian 3rd Edition Ross Solutions ManualDocument34 pagesEssentials of Corporate Finance Australian 3rd Edition Ross Solutions Manualupwindscatterf9ebp100% (33)

- share capital pp solDocument21 pagesshare capital pp solvaibhavsethia71691No ratings yet

- trắc nghiệmDocument6 pagestrắc nghiệmuyenvtt2002No ratings yet

- Chapter 13 GuerreroDocument40 pagesChapter 13 GuerreroJose Sas100% (2)

- 22bca20044 Exp1Document2 pages22bca20044 Exp1Yash SiwachNo ratings yet

- BCD CorporationDocument3 pagesBCD CorporationJohn Rey GalichaNo ratings yet

- Full Download pdf of (eBook PDF) Essentials of Corporate Finance 8th Edition all chapterDocument23 pagesFull Download pdf of (eBook PDF) Essentials of Corporate Finance 8th Edition all chapterelomrtkocz100% (6)

- Final Examination in Business Combi 2021Document7 pagesFinal Examination in Business Combi 2021Michael BongalontaNo ratings yet