Professional Documents

Culture Documents

Reporting Changes For Calworks and Calfresh

Reporting Changes For Calworks and Calfresh

Uploaded by

LOLAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reporting Changes For Calworks and Calfresh

Reporting Changes For Calworks and Calfresh

Uploaded by

LOLACopyright:

Available Formats

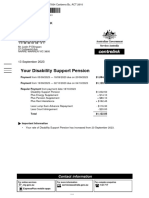

STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

REPORTING CHANGES FOR CalWORKs CASE NAME:

AND CALFRESH CASE NUMBER:

WORKER NUMBER:

Because you get nCalWORKs nCalFresh, you must Penalty for not reporting

report within 10 days when your TOTAL income reaches If you do not report when your income is more than your

a certain level. You must report anytime your household’s household’s IRT limit you may get more benefits than you

total monthly income is more than your current Income should. You must repay any extra benefits you get based

Reporting Threshold (IRT). on income you do not report. If you do not report on

purpose to try to get more benefits, this is fraud, and you

may be charged with a crime.

Benefit Type CalWORKs CalFresh

Because you get CalWORKs, you MUST ALSO report

Family Size the things below within 10 days of when they happen:

Your Current Income 1. Anytime someone moves into or out of your

household.

Your IRT is

2. Anytime someone joins, or is in your household,

who is in violation of a condition of probation or

Note: If your IRT for CalFresh is listed as “N/A”, you are not parole.

required to report income changes for CalFresh until

your next SAR 7 or recertification, whichever comes 3. Anytime someone joins, or is in your household,

first. However, if you have an IRT amount listed for who is running from the law.

CalWORKs, you must report when your gross income 4. Anytime you have an address change.

goes over that amount.

If you get CalFresh, you MUST ALSO report the

How to report? following:

If your total income is over the IRT amount listed above, you ● If you are an Able Bodied Adult Without

must report this to the County within 10 days. You can Dependents (ABAWD), you must report anytime

report this information to the County by calling the County your work or training hours drop to less than 20

or reporting it in writing.

hours a week or 80 hours a month.

By “total monthly income” we mean:

[ Any money you get (both earned and unearned).

Voluntarily reporting information

[ The amount before any deductions are taken out.

You may also voluntarily report changes to the County

anytime. Reporting some changes may get you more

(Examples of deductions are: taxes, Social Security benefits. For example:

or other retirement contributions,

garnishments, etc.) ● Someone in the house becomes pregnant.

● Someone on cash aid has a special need, such

What will happen? as: a pregnancy, a special diet prescribed by a

[ Your benefits may be lowered or stopped based on

doctor, household emergency, etc.

income over your IRT. ● For CalFresh, if someone disabled or age 60 or

[ Your IRT may change when your income changes or

older has new or higher out of pocket medical

costs.

when someone moves in or out of your home.

[ The County will let you know in writing each time

your IRT changes.

[ You also need to report during your annual

redetermination/recertification (RD/RC) all income

the RD/RC form asks about, even if you already

reported that money.

AR 2 SAR (3/15) REPORTING CHANGES FOR CALWORKS AND CALFRESH - REQUIRED FORM - SUBSTITUTES PERMITTED

You might also like

- IMO Manual On Oil Pollution - Section II Contingency PlanningDocument81 pagesIMO Manual On Oil Pollution - Section II Contingency PlanningSatria 'igin' Girindra Nugraha100% (2)

- Sc2 Self Certification FormDocument2 pagesSc2 Self Certification FormdiannehoosonNo ratings yet

- General Payroll, Employment and DeductionsDocument6 pagesGeneral Payroll, Employment and DeductionsJosh LeBlancNo ratings yet

- 1453104607550Document10 pages1453104607550JGNo ratings yet

- Drug Testing in Child WelfareDocument49 pagesDrug Testing in Child WelfareLOLA100% (1)

- Reporting Changes For Cash Aid and CalFreshDocument1 pageReporting Changes For Cash Aid and CalFreshElizabeth OctiveaNo ratings yet

- Rights and Responsibilities SNAP FSSA pg2Document1 pageRights and Responsibilities SNAP FSSA pg2Franco CaffaNo ratings yet

- FF 10Document8 pagesFF 10DavidNo ratings yet

- About Sanda Islam Your Family Assistance: Reference: 605 730 292XDocument3 pagesAbout Sanda Islam Your Family Assistance: Reference: 605 730 292XAriful RussellNo ratings yet

- Family Tax Benefit - P240529828Document4 pagesFamily Tax Benefit - P240529828Izzy BaeNo ratings yet

- Notify For ChangesDocument1 pageNotify For Changesyip90No ratings yet

- 1040es Estimated Tax 2014 For IndividualsDocument12 pages1040es Estimated Tax 2014 For IndividualsClaudia MaldonadoNo ratings yet

- Reporting Requirements For SNAP - NoticeDocument2 pagesReporting Requirements For SNAP - NoticeWeir GabrielNo ratings yet

- Ben Fits of It FilingDocument3 pagesBen Fits of It Filingptnagarjuna55No ratings yet

- US Internal Revenue Service: p501 - 1994Document21 pagesUS Internal Revenue Service: p501 - 1994IRSNo ratings yet

- Family Tax Benefit - A210123093Document3 pagesFamily Tax Benefit - A210123093michelle.marsh82No ratings yet

- Paid Parental Leave (PPL) ApplicationDocument8 pagesPaid Parental Leave (PPL) ApplicationConan McClellandNo ratings yet

- Change Report Form DCO 0234Document6 pagesChange Report Form DCO 0234skyholy222No ratings yet

- Income Tax Course Manual (2021 T1) PDFDocument138 pagesIncome Tax Course Manual (2021 T1) PDFMrDorakonNo ratings yet

- US Internal Revenue Service: p524 - 1995Document12 pagesUS Internal Revenue Service: p524 - 1995IRSNo ratings yet

- Redundancy Payments Are TaxedDocument2 pagesRedundancy Payments Are TaxedVivian KongNo ratings yet

- En 05 10022Document2 pagesEn 05 10022awi86No ratings yet

- Tax Impact of Job LossDocument7 pagesTax Impact of Job LossbullyrayNo ratings yet

- Payroll Deductions-The Basics For An Employer - BDC - CaDocument3 pagesPayroll Deductions-The Basics For An Employer - BDC - CaIgor MirandaNo ratings yet

- US Internal Revenue Service: p4128Document6 pagesUS Internal Revenue Service: p4128IRSNo ratings yet

- OffSr Description A211435940Document4 pagesOffSr Description A2114359407zsjkkyyfnNo ratings yet

- Payment Information A212883814Document2 pagesPayment Information A212883814Lisa ManoelNo ratings yet

- Age Pension B295053424Document2 pagesAge Pension B295053424JOHAN SEBASTIAN GOMEZ ALVAREZNo ratings yet

- 01 Income Compliance Program Refunds FactsheetDocument2 pages01 Income Compliance Program Refunds Factsheetyelpreviewer888No ratings yet

- How To Release An IRS Wage Garnishment or Bank LevyDocument9 pagesHow To Release An IRS Wage Garnishment or Bank LevyKeith Duke JonesNo ratings yet

- Centre LinkDocument3 pagesCentre Linkkanxiragam11No ratings yet

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This PackageCaliCain MendezNo ratings yet

- US Internal Revenue Service: I1040sse - 2006Document4 pagesUS Internal Revenue Service: I1040sse - 2006IRSNo ratings yet

- 55 Plus: A Manitoba Income SupplementDocument1 page55 Plus: A Manitoba Income SupplementDJ MedinaNo ratings yet

- US Internal Revenue Service: p531 - 1996Document7 pagesUS Internal Revenue Service: p531 - 1996IRSNo ratings yet

- Caution - Guidance For Use of The 2009 Form 1040-ES, Estimated Tax For IndividualsDocument8 pagesCaution - Guidance For Use of The 2009 Form 1040-ES, Estimated Tax For Individualsezra242No ratings yet

- US Internal Revenue Service: I1040sse - 2005Document4 pagesUS Internal Revenue Service: I1040sse - 2005IRSNo ratings yet

- Tax Midterm CompiledDocument50 pagesTax Midterm CompiledMarga Mancelita VelascoNo ratings yet

- Important Information - J310118916Document2 pagesImportant Information - J310118916Justin EllingsenNo ratings yet

- Notice of ComputationDocument2 pagesNotice of ComputationarationalactorNo ratings yet

- Claiming A Tax Deduction For Personal Contributions 2020 - 21Document4 pagesClaiming A Tax Deduction For Personal Contributions 2020 - 21Arpit JainNo ratings yet

- Fs 46Document4 pagesFs 46pentesting.443No ratings yet

- Synergy Financial Group: Your Personal CFODocument4 pagesSynergy Financial Group: Your Personal CFOgvandykeNo ratings yet

- 2019 FNS 313 SNAP English For 508Document2 pages2019 FNS 313 SNAP English For 508gineth976No ratings yet

- Weekly Tax Table: Pay As You Go (PAYG) WithholdingDocument12 pagesWeekly Tax Table: Pay As You Go (PAYG) Withholdingwawen03No ratings yet

- Asd 6Document4 pagesAsd 6vinner3No ratings yet

- Notes About Finance in SGDocument7 pagesNotes About Finance in SGYeo JhNo ratings yet

- US Internal Revenue Service: F1040esn - 2002Document5 pagesUS Internal Revenue Service: F1040esn - 2002IRSNo ratings yet

- During Your Base Period? Were You Unable To WorkDocument1 pageDuring Your Base Period? Were You Unable To WorkKen SuNo ratings yet

- Youth Allowance - G331634168Document5 pagesYouth Allowance - G331634168vinniekbuchananNo ratings yet

- Water Help Application Form 2023Document2 pagesWater Help Application Form 2023carthy.annNo ratings yet

- An Overview of Itemized DeductionsDocument19 pagesAn Overview of Itemized DeductionsRock Rose100% (1)

- 2011 Instructions For Schedule SE (Form 1040) Self-Employment TaxDocument5 pages2011 Instructions For Schedule SE (Form 1040) Self-Employment Tax5sfsfdNo ratings yet

- En 05 10022Document2 pagesEn 05 10022Jeremy WebbNo ratings yet

- Isp 1151Document28 pagesIsp 1151haloandred7790No ratings yet

- US Internal Revenue Service: I1040sse - 1997Document3 pagesUS Internal Revenue Service: I1040sse - 1997IRSNo ratings yet

- F 1040 EsDocument12 pagesF 1040 EsEndu EnduroNo ratings yet

- Apply For A Payment On Compassionate GroundsDocument6 pagesApply For A Payment On Compassionate GroundsMax RamirezNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- Receipt For Documents: This County Received The FollowingDocument1 pageReceipt For Documents: This County Received The FollowingLOLANo ratings yet

- Authorization For Release, Use And/Or Disclosure of Health InformationDocument3 pagesAuthorization For Release, Use And/Or Disclosure of Health InformationLOLANo ratings yet

- CalWORKsIndex ParaRegsDocument94 pagesCalWORKsIndex ParaRegsLOLANo ratings yet

- Redetermination: Statement of Facts Supporting Eligibility For The Approved Relative Caregiver (Arc) Funding Option ProgramDocument2 pagesRedetermination: Statement of Facts Supporting Eligibility For The Approved Relative Caregiver (Arc) Funding Option ProgramLOLANo ratings yet

- Statement of Understanding Agency Adoptions ProgramDocument6 pagesStatement of Understanding Agency Adoptions ProgramLOLANo ratings yet

- Notification of Procedure in Lieu of Signing Relinquishment, Waiver or DenialDocument1 pageNotification of Procedure in Lieu of Signing Relinquishment, Waiver or DenialLOLANo ratings yet

- Chapter 22-000 State Hearing - General SectionDocument74 pagesChapter 22-000 State Hearing - General SectionLOLANo ratings yet

- Authorization Order TestsDocument1 pageAuthorization Order TestsLOLANo ratings yet

- Child Welfare Services Program Service DeliveryDocument52 pagesChild Welfare Services Program Service DeliveryLOLANo ratings yet

- Declaration of Exemption From Trustline Registration and Health and Safety Self-CertificationDocument1 pageDeclaration of Exemption From Trustline Registration and Health and Safety Self-CertificationLOLANo ratings yet

- Child Welfare Services Program Service DeliveryDocument48 pagesChild Welfare Services Program Service DeliveryLOLANo ratings yet

- Saunders DOJ StudyDocument176 pagesSaunders DOJ StudyLOLANo ratings yet

- Fifteen Day Notice To Pay Rent or Quit: (Rent Demand For February 1, 2021 Through June 30, 2021)Document3 pagesFifteen Day Notice To Pay Rent or Quit: (Rent Demand For February 1, 2021 Through June 30, 2021)LOLANo ratings yet

- RT 11021 47 2014 MVL DT 10 06 2021-MergedDocument52 pagesRT 11021 47 2014 MVL DT 10 06 2021-MergedNikunj LathiyaNo ratings yet

- E311 EngDocument1 pageE311 EngHarvinder SainiNo ratings yet

- Human Rrights of Senior CitizensDocument32 pagesHuman Rrights of Senior CitizensRiya Singh100% (1)

- Substance Impairment PolicyDocument4 pagesSubstance Impairment PolicyryanmackintoshNo ratings yet

- BPO RisksDocument63 pagesBPO Risksadrian deocareza100% (2)

- How HMRC Handle Tax Credit OverpaymentsDocument15 pagesHow HMRC Handle Tax Credit OverpaymentsiamchrisliNo ratings yet

- It Works For Me: Benefits@Wipro - Career Level B2 and B3Document2 pagesIt Works For Me: Benefits@Wipro - Career Level B2 and B3Jyotshna DhandNo ratings yet

- Tadepalligudem - RevisedDocument24 pagesTadepalligudem - RevisedSurya thotaNo ratings yet

- ABYIPDocument12 pagesABYIPNelly Sajiin LayNo ratings yet

- An Essay On Health Tourism in IndiaDocument5 pagesAn Essay On Health Tourism in IndiaPallavi AryaNo ratings yet

- Defences (Criminal Law - Cape Law)Document26 pagesDefences (Criminal Law - Cape Law)Nikki LorraineNo ratings yet

- Australia Awards in Indonesia Additional Information Form Intake 2019Document18 pagesAustralia Awards in Indonesia Additional Information Form Intake 2019Adept Titu EkiNo ratings yet

- Project Execution Plan GeneralDocument5 pagesProject Execution Plan GeneralRocco Randazzo100% (1)

- EF - Registered Nurse - Grade 1 New To Role - Job DescriptionDocument2 pagesEF - Registered Nurse - Grade 1 New To Role - Job DescriptionLvcian LcNo ratings yet

- Draft National Policy For Women, 2016 0Document4 pagesDraft National Policy For Women, 2016 0Rhitayan GuhaNo ratings yet

- T2P 2024 Ae2 0007978 1Document3 pagesT2P 2024 Ae2 0007978 1Sameh AboulsoudNo ratings yet

- The Eastern Visayas Regional Medical CenterDocument11 pagesThe Eastern Visayas Regional Medical CenterSamuel ZaraNo ratings yet

- Code of MarketingDocument160 pagesCode of MarketingShimul HalderNo ratings yet

- PD 626 Labor Compensation LawDocument18 pagesPD 626 Labor Compensation LawUlysses RallonNo ratings yet

- Pharmacists 03-2019 Room AssignmentDocument29 pagesPharmacists 03-2019 Room AssignmentPRC BaguioNo ratings yet

- Manual Stack Emission Monitoring Guidance For OrganisationDocument19 pagesManual Stack Emission Monitoring Guidance For OrganisationMilena MaksimovicNo ratings yet

- Fullbench SRADocument135 pagesFullbench SRAHiten JhaveriNo ratings yet

- Urgentcare FormDocument4 pagesUrgentcare Formapi-287654333No ratings yet

- Vendor Registration Form: Address 1 Address 2 City State/CountryDocument2 pagesVendor Registration Form: Address 1 Address 2 City State/CountryLiu WongNo ratings yet

- 3rd Pty LOR - Jeremias - Robles-2 9.59.34 PMDocument2 pages3rd Pty LOR - Jeremias - Robles-2 9.59.34 PMcharlesNo ratings yet

- Nri Property ManagementDocument2 pagesNri Property Managementvenkat yeluri100% (1)

- Lecturer HomoeopathicDocument4 pagesLecturer Homoeopathicasratnu_41155700No ratings yet

- NGT 1021 8 17 - 2Document10 pagesNGT 1021 8 17 - 2markpestell68No ratings yet

- Claremont COURIER 11-08-13Document36 pagesClaremont COURIER 11-08-13Claremont CourierNo ratings yet