Professional Documents

Culture Documents

What Are The Risks of Trading Cryptocurrencies?: Forks

What Are The Risks of Trading Cryptocurrencies?: Forks

Uploaded by

Yannah HidalgoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Are The Risks of Trading Cryptocurrencies?: Forks

What Are The Risks of Trading Cryptocurrencies?: Forks

Uploaded by

Yannah HidalgoCopyright:

Available Formats

What are the risks of trading cryptocurrencies?

The risks of trading cryptocurrencies are mainly related to its volatility. They are high-

risk and speculative, and it is important that you understand the risks before you start

trading.

RISKS

They are volatile: unexpected changes in market sentiment can lead to sharp

and sudden moves in price. It is not uncommon for the value of cryptocurrencies

to quickly drop by hundreds, if not thousands of dollars.

They are unregulated: cryptocurrencies are currently unregulated by both

governments and central banks. However, recently they have started to attract

more attention. For example, there are questions about whether to classify them

as a commodity or a virtual currency

They are susceptible to error and hacking: there is no perfect way to prevent

technical glitches, human error or hacking.

They can be affected by forks or discontinuation: cryptocurrency trading

carries additional risks such as hard forks or discontinuation. You should

familiarise yourself with these risks before trading these products. When a hard

fork occurs, there may be substantial price volatility around the event, and we

may suspend trading throughout if we do not have reliable prices from the

underlying market.

RETURNS

The returns of cryptocurrency can be predicted by two factors specific to its markets –

momentum and investors attention. The more investors are present, the more momentum it gets.

The value rises as more inventors joins.

There is a study that health care and consumer goods industries significantly and

positively co-move with Bitcoin returns, while the finance, retail, and wholesale

industries do not. At the same time, there is evidence that Ethereum returns significantly

and negatively co-move with the financial industry.

We will endeavour to notify you of potential blockchain forks. However, it is

ultimately your responsibility to ensure you find out when these might occur.

Risks of cryptocurrency spread bets and CFDs

With CMC Markets you can trade bitcoin and ethereum via a spread bet or CFD

account. This means you are exposed to slightly different risks compared to when

buying these cryptocurrencies outright.

They are high-risk speculative products: with spread betting and CFD trading

you only need to deposit a percentage of the value of a trade to open a position.

Profits and losses are based on the full value of the trade. The volatility of

cryptocurrencies, combined with trading on margin, could lead to significant

losses.

They can be affected by gapping: market volatility can cause prices to move

from one level to another without actually passing through the level in between.

Gapping (or slippage) usually occurs during periods of high market volatility. As a

result, your stop-loss could be executed at a worse level than you had requested.

This can worsen losses if the market moves against you.

Charges may be greater than with other asset classes: you should review all

costs involved before you trade. Charges may be higher when spread betting or

trading CFD cryptocurrencies. The likelihood of making a profit versus the impact

of these fees should be considered.

Pricing variations: compared with currencies, there can be significant variations

in the pricing of cryptocurrencies used to determine the value of spread bet and

CFD positions.

You might also like

- How To Invest Rubenstein en 45227Document6 pagesHow To Invest Rubenstein en 45227AraceliDemetrioNo ratings yet

- Crypto Trading For Beginner Traders PDFDocument23 pagesCrypto Trading For Beginner Traders PDFRAJIV KUMAR100% (2)

- Trading - Level To LevelDocument63 pagesTrading - Level To Levelmandiv100% (1)

- Chapter 7 Case - Valuation Ratios in The Restaurant IndustryDocument2 pagesChapter 7 Case - Valuation Ratios in The Restaurant IndustrySarah Ihugo40% (5)

- Profile CheatsheetDocument3 pagesProfile Cheatsheetjadie aliNo ratings yet

- Txbit Exchange Responsible Trading Guide PDFDocument5 pagesTxbit Exchange Responsible Trading Guide PDFAndreNo ratings yet

- Lesson 1 Notes CryptocurrencyDocument6 pagesLesson 1 Notes CryptocurrencySeif KhaledNo ratings yet

- An Introduction to Forex Trading: A Guide for BeginnersFrom EverandAn Introduction to Forex Trading: A Guide for BeginnersRating: 4 out of 5 stars4/5 (6)

- What Is Cryptocurrency Trading?: CFD Trading On CryptocurrenciesDocument5 pagesWhat Is Cryptocurrency Trading?: CFD Trading On CryptocurrenciesRobinson MaduNo ratings yet

- Risk Disclosure NoticeDocument3 pagesRisk Disclosure NoticeAïman PAMPAMENo ratings yet

- Crypto TradingDocument12 pagesCrypto TradingJames WaweruNo ratings yet

- 1foreign Exchange RiskDocument11 pages1foreign Exchange Riskpriya_desaiNo ratings yet

- CRYPTO TRADING: Mastering the Art of Cryptocurrency Trading (2024 Guide for Traders)From EverandCRYPTO TRADING: Mastering the Art of Cryptocurrency Trading (2024 Guide for Traders)No ratings yet

- Crypto Currency InvestmentDocument6 pagesCrypto Currency InvestmentBilal AhmadNo ratings yet

- Cryptocurrency vs. StocksDocument8 pagesCryptocurrency vs. Stocksnaitik9No ratings yet

- Investing in Stock vs. Crypto CurrenciesDocument9 pagesInvesting in Stock vs. Crypto CurrenciesranasohailiqbalNo ratings yet

- Risk Disclosure: Terms and ConditionsDocument6 pagesRisk Disclosure: Terms and Conditionsgowindha rismawanNo ratings yet

- Are Cryptocurrencies Worth Investing inDocument3 pagesAre Cryptocurrencies Worth Investing inraffi dominguezNo ratings yet

- CFTC Advisory - Understand The Risks of Virtual Currency TradingDocument2 pagesCFTC Advisory - Understand The Risks of Virtual Currency TradingZaineb AbbadNo ratings yet

- General Risk Disclosure: Updated On 6.9.2018Document6 pagesGeneral Risk Disclosure: Updated On 6.9.2018የኛ TubeNo ratings yet

- Common Crypto Investment Pitfalls And How To Avoid: A DYOR (Do Your Own Research) GuideFrom EverandCommon Crypto Investment Pitfalls And How To Avoid: A DYOR (Do Your Own Research) GuideNo ratings yet

- Risk Disclosure and Warnings Notice: The BahamasDocument4 pagesRisk Disclosure and Warnings Notice: The BahamasHernán Gabriel PerezNo ratings yet

- Financial Derivatives: The Role in The Global Financial Crisis and Ensuing Financial ReformsDocument26 pagesFinancial Derivatives: The Role in The Global Financial Crisis and Ensuing Financial Reformsqazwsx4321No ratings yet

- Guide To Crypto DerivativesDocument11 pagesGuide To Crypto DerivativesHumphrey Wampula100% (1)

- Crypto Investing 101:: Five Mistakes Every New Investor Must AvoidDocument15 pagesCrypto Investing 101:: Five Mistakes Every New Investor Must AvoidenmardukgalNo ratings yet

- FX NoteDocument6 pagesFX NoteMinit JainNo ratings yet

- Foreignexchangebasics PDFDocument6 pagesForeignexchangebasics PDFVinayNo ratings yet

- KeyInformationDocument-CFD On An Forex Currency PairDocument3 pagesKeyInformationDocument-CFD On An Forex Currency PairTensonNo ratings yet

- Derivatives and Risk ManagementDocument4 pagesDerivatives and Risk ManagementXxx vidios Hot videos Xnxx videos Sexy videosNo ratings yet

- The Foreign Exchange Market: International Trade GuidesDocument6 pagesThe Foreign Exchange Market: International Trade GuidesehabmicNo ratings yet

- Money Management and Portfolio ManagementDocument3 pagesMoney Management and Portfolio Managementhassan hassan khalilNo ratings yet

- UK CFD Stocks KID 2022 v3Document3 pagesUK CFD Stocks KID 2022 v3Naif TurkyNo ratings yet

- Crypto Trading For Beginner Traders PDFDocument25 pagesCrypto Trading For Beginner Traders PDFbpy2d5c2y6No ratings yet

- International Banking and Foreign ExchangeDocument8 pagesInternational Banking and Foreign ExchangeShambhavi BhansaliNo ratings yet

- How To Get Started Trading Cryptocurrency (Step by Step Guide)Document5 pagesHow To Get Started Trading Cryptocurrency (Step by Step Guide)Jisoo KimNo ratings yet

- KID On CFD Spot Precious Metals enDocument3 pagesKID On CFD Spot Precious Metals enKhadim HussainNo ratings yet

- Risk Management in Forex MarketDocument13 pagesRisk Management in Forex MarketfarzsabiNo ratings yet

- Forex Trading (MODULE)Document15 pagesForex Trading (MODULE)Daniel Jade100% (1)

- Crypto PresentationDocument7 pagesCrypto PresentationSulaiman ShehuNo ratings yet

- Crypto AgainstDocument3 pagesCrypto AgainstRonan WeislyNo ratings yet

- Risk Disclosure Statement 0Document5 pagesRisk Disclosure Statement 0nhlakaNo ratings yet

- BITCOIN OPTIONS & MARGIN TRADING TIPS USING TRADING BOTS: Maximizing Profits and Minimizing Risks in Bitcoin Options and Margin Trading with Automated Bots (2024)From EverandBITCOIN OPTIONS & MARGIN TRADING TIPS USING TRADING BOTS: Maximizing Profits and Minimizing Risks in Bitcoin Options and Margin Trading with Automated Bots (2024)No ratings yet

- Cryptocurrency Trading StrategiesDocument10 pagesCryptocurrency Trading StrategiesjeevandranNo ratings yet

- Top 5 Reasons To Invest in CurrenciesDocument2 pagesTop 5 Reasons To Invest in CurrenciesAmit JainNo ratings yet

- What Is Spread Betting (Good) PDFDocument4 pagesWhat Is Spread Betting (Good) PDFMyriam GrissaNo ratings yet

- The Complete Newbies Guide To Online Forex TradingDocument23 pagesThe Complete Newbies Guide To Online Forex TradingTeresa CarterNo ratings yet

- What Is Cryptocurrency Trading, and How To Trade Cryptocurrency For BeginnersDocument3 pagesWhat Is Cryptocurrency Trading, and How To Trade Cryptocurrency For BeginnersDianacruzeNo ratings yet

- Key Points To Note On Financial Markets (AutoRecovered)Document13 pagesKey Points To Note On Financial Markets (AutoRecovered)SAP PI AUTOMATIONSNo ratings yet

- Risk DisclosureDocument7 pagesRisk Disclosuredarunn2003No ratings yet

- Cryptocurrency Trading, Explained: What Is Crypto Trading?Document2 pagesCryptocurrency Trading, Explained: What Is Crypto Trading?Dach EisenbergNo ratings yet

- How Banks Make Money in DerivativesDocument7 pagesHow Banks Make Money in DerivativesKiran S KNo ratings yet

- IFM Question Paper AnswrersDocument18 pagesIFM Question Paper AnswrersMoin KhanNo ratings yet

- FxPro Risk Disclosure ABDocument4 pagesFxPro Risk Disclosure ABmacuachambalNo ratings yet

- Strategy OverviewDocument5 pagesStrategy OverviewAlex GolovinNo ratings yet

- 10 Things You Should Beware of During Currency TradingDocument1 page10 Things You Should Beware of During Currency TradingJit Pratap SinghNo ratings yet

- Only Cryptocurrency Can Save Your Money NowDocument4 pagesOnly Cryptocurrency Can Save Your Money NowTimileyin AdigunNo ratings yet

- How To Trade CryptoDocument8 pagesHow To Trade CryptoDawo InvestorNo ratings yet

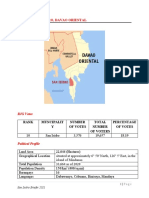

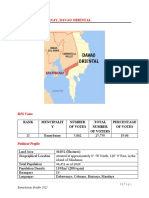

- Santa Maria BrieferDocument3 pagesSanta Maria BrieferYannah HidalgoNo ratings yet

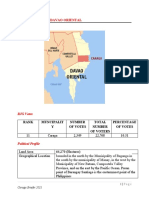

- Briefer Magsaysay, Davao Del Sur: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument3 pagesBriefer Magsaysay, Davao Del Sur: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Davao City, Davao Del Sur: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument7 pagesBriefer Davao City, Davao Del Sur: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Don Marcelino, Davao Occidental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument3 pagesBriefer Don Marcelino, Davao Occidental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Digos City, Davao Del Sur: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument4 pagesBriefer Digos City, Davao Del Sur: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Kiblawan, Davao Del Sur: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument4 pagesBriefer Kiblawan, Davao Del Sur: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah Hidalgo100% (1)

- Briefer Sarangani, Davao Occidental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument3 pagesBriefer Sarangani, Davao Occidental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Don Marcelino BrieferDocument3 pagesDon Marcelino BrieferYannah HidalgoNo ratings yet

- Briefer Malita, Davao Occidental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument4 pagesBriefer Malita, Davao Occidental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Sarangani BrieferDocument3 pagesSarangani BrieferYannah HidalgoNo ratings yet

- Briefer Sulop, Davao Del Sur: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument3 pagesBriefer Sulop, Davao Del Sur: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Jose Abad Santos-BrieferDocument4 pagesJose Abad Santos-BrieferYannah HidalgoNo ratings yet

- Malita BrieferDocument4 pagesMalita BrieferYannah HidalgoNo ratings yet

- Briefer San Isidro, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument4 pagesBriefer San Isidro, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Baganga, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument3 pagesBriefer Baganga, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Kalingalan Caluang, Sulu: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument3 pagesBriefer Kalingalan Caluang, Sulu: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Indanan, Sulu: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument3 pagesBriefer Indanan, Sulu: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Tarragona, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument4 pagesBriefer Tarragona, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Manay, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument4 pagesBriefer Manay, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Cateel, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument3 pagesBriefer Cateel, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Banaybanay BrieferDocument4 pagesBanaybanay BrieferYannah HidalgoNo ratings yet

- Briefer Caraga, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument4 pagesBriefer Caraga, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Boston, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument3 pagesBriefer Boston, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Mati City, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument4 pagesBriefer Mati City, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Lupon, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument4 pagesBriefer Lupon, Davao Oriental: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Hadji Panglima Tahil-BrieferDocument3 pagesHadji Panglima Tahil-BrieferYannah HidalgoNo ratings yet

- Briefer Asuncion, Davao Del Norte: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument3 pagesBriefer Asuncion, Davao Del Norte: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Briefer Kalingalan Caluang, Sulu: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument3 pagesBriefer Kalingalan Caluang, Sulu: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah HidalgoNo ratings yet

- Island Garden City of Samal - BrieferDocument4 pagesIsland Garden City of Samal - BrieferYannah HidalgoNo ratings yet

- Briefer Carmen, Davao Del Norte: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesDocument4 pagesBriefer Carmen, Davao Del Norte: Rank Muncipalit Y Number of Votes Total Number of Voters Percentage of VotesYannah Hidalgo0% (1)

- 2%SDP-10%DP23mos-88 Amaia Land Corp. Amaia Scapes General TriasDocument1 page2%SDP-10%DP23mos-88 Amaia Land Corp. Amaia Scapes General TriasNicolo MendozaNo ratings yet

- Economics Chapter 3 Handwritten Notes Money and Credit EconomicsDocument11 pagesEconomics Chapter 3 Handwritten Notes Money and Credit EconomicsRenu Yadav100% (1)

- 12 AccountancyDocument4 pages12 AccountancygattulokhandeNo ratings yet

- LU2 Lecturer NotesDocument23 pagesLU2 Lecturer NotesShweta SinghNo ratings yet

- Price List 7.8.23 Include CNG in PunchDocument6 pagesPrice List 7.8.23 Include CNG in Punchkrishna11143No ratings yet

- Overview of Banking PrinciplesDocument22 pagesOverview of Banking PrinciplesMichael TochukwuNo ratings yet

- GDP - Class NotesDocument42 pagesGDP - Class NotesPeris WanjikuNo ratings yet

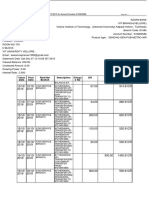

- Statement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Document2 pagesStatement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Sayan SarkarNo ratings yet

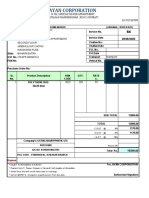

- Ayan Corp Exel PDFDocument1 pageAyan Corp Exel PDFmaharaj ( prashant dave)No ratings yet

- AVANDA 2021 Wedding Mara & Mario 3 December 2021Document1 pageAVANDA 2021 Wedding Mara & Mario 3 December 2021Steven BeggaNo ratings yet

- Fiscal Policy Notes ECON UNIT 2 CAPEDocument7 pagesFiscal Policy Notes ECON UNIT 2 CAPErobert903No ratings yet

- Module 8. International Financial Market and Innovations ObjectivesDocument9 pagesModule 8. International Financial Market and Innovations ObjectivesSalma AbdullahNo ratings yet

- Pass The Necessary Journal Entries and Post The Entries in The Ledger AccountsDocument28 pagesPass The Necessary Journal Entries and Post The Entries in The Ledger Accountskarunakar vNo ratings yet

- Group 2 - Derivatives Market in VietnamDocument5 pagesGroup 2 - Derivatives Market in VietnamNhật HạNo ratings yet

- Laura and John Arnold Foundation Report On Dallas PensionsDocument13 pagesLaura and John Arnold Foundation Report On Dallas PensionsTristan HallmanNo ratings yet

- Type of Account TallyDocument20 pagesType of Account TallyVERMA NEERAJ100% (2)

- Negotiable Instruments Act 1881Document40 pagesNegotiable Instruments Act 1881Tanvir PrantoNo ratings yet

- 18-5-SA-V1-S1 Solved Problem Cfs PDFDocument19 pages18-5-SA-V1-S1 Solved Problem Cfs PDFSubbu ..No ratings yet

- Don't Put All Your Eggs in One BasketDocument25 pagesDon't Put All Your Eggs in One BasketChristine Leal - EstenderNo ratings yet

- Audit ReportDocument22 pagesAudit ReportTasya Febriani AdrianaNo ratings yet

- Ratio Table - ACCT 3BDocument10 pagesRatio Table - ACCT 3BHoàng Minh ChuNo ratings yet

- IndirectDocument4 pagesIndirectPayal KaraiyaNo ratings yet

- Volatility Spreads - Trading Vol - Amit GhoshDocument217 pagesVolatility Spreads - Trading Vol - Amit Ghoshcodingfreek007No ratings yet

- Alternative Means of Government FinanceDocument20 pagesAlternative Means of Government FinanceFatihMANo ratings yet

- Tle6 Q1 Week2Document6 pagesTle6 Q1 Week2Roy Bautista Manguyot100% (1)

- Plant Tender EZ OffDocument16 pagesPlant Tender EZ OffGowri GaneshNo ratings yet

- Value Date Post Date Remitter Branch Description Chequ Eno DR CR BalanceDocument5 pagesValue Date Post Date Remitter Branch Description Chequ Eno DR CR BalancePRANAV KUMARNo ratings yet

- Assignment 2.2Document6 pagesAssignment 2.2GLEN JORDAN ANTONIONo ratings yet