Professional Documents

Culture Documents

My Private Health Report

My Private Health Report

Uploaded by

Namhar AnimasCopyright:

Available Formats

You might also like

- My Private Health ReportDocument19 pagesMy Private Health ReportNamhar AnimasNo ratings yet

- My Private Health ReportDocument16 pagesMy Private Health ReportNamhar AnimasNo ratings yet

- My Private Health ReportDocument10 pagesMy Private Health ReportNamhar AnimasNo ratings yet

- SL50 TASSingleDocument2 pagesSL50 TASSingleMahdi MahnazNo ratings yet

- Flexifed 1 Elect Individual Option BrochureDocument25 pagesFlexifed 1 Elect Individual Option BrochurescannertplinkNo ratings yet

- Top Hospital Essential ExtrasDocument8 pagesTop Hospital Essential ExtrasJody HeydonNo ratings yet

- Flexifed 1 Individual Option BrochureDocument25 pagesFlexifed 1 Individual Option BrochureBabalwa MpongosheNo ratings yet

- QInsurance Factsheet Bronze Hospital PlusDocument2 pagesQInsurance Factsheet Bronze Hospital PlusHanny KeeNo ratings yet

- Inspire Policy Docs - 1216Document20 pagesInspire Policy Docs - 1216JuanQuagliaNo ratings yet

- Basic Visitor Cover FactsheetDocument2 pagesBasic Visitor Cover FactsheetVivekNo ratings yet

- AHM Black White Boost FlexiDocument10 pagesAHM Black White Boost FlexiDani Kirky Ylagan100% (1)

- Member Booklets Pmi Ia Medical Global Plan Lta 1120 PDFDocument12 pagesMember Booklets Pmi Ia Medical Global Plan Lta 1120 PDFbkourfatima8No ratings yet

- Easy HealthDocument15 pagesEasy HealthSumit BhandariNo ratings yet

- Budget Visitor CoverDocument2 pagesBudget Visitor CoverRohan lamaNo ratings yet

- Brochure 3 BupaDocument13 pagesBrochure 3 BupaprinceNo ratings yet

- Overseas Visitors Short StayDocument4 pagesOverseas Visitors Short StayDinesh ManoharanNo ratings yet

- Family Care Plan - Dubai & Northern EmiratesDocument6 pagesFamily Care Plan - Dubai & Northern Emiratesneelkant sharmaNo ratings yet

- Group MediCare 360 - BrochureDocument4 pagesGroup MediCare 360 - Brochuresubharam1997No ratings yet

- 05+Onsurity+Benefit+Summary+for+TopUp PDFDocument4 pages05+Onsurity+Benefit+Summary+for+TopUp PDFYohan BahlNo ratings yet

- Personal Healthcare IpidDocument2 pagesPersonal Healthcare IpidarthurNo ratings yet

- Health Care in AustraliaDocument6 pagesHealth Care in AustraliaNeil MenezesNo ratings yet

- Group Health Insurance - Policy OverviewDocument16 pagesGroup Health Insurance - Policy OverviewSujithaNo ratings yet

- Focus On The Ingwe Option: Momentumhealth - Co.zaDocument7 pagesFocus On The Ingwe Option: Momentumhealth - Co.zaRoe Wekwa NyembaNo ratings yet

- Benefits Guide Colombia 2021Document10 pagesBenefits Guide Colombia 2021Luis Carlos Gutierrez PedrazaNo ratings yet

- OSHC Policy EssentialsDocument12 pagesOSHC Policy EssentialsRini MathewNo ratings yet

- Enhanced IncomeShield Brochure - WebsiteDocument18 pagesEnhanced IncomeShield Brochure - WebsiteAntony VijayNo ratings yet

- Enhanced Income ShieldDocument18 pagesEnhanced Income ShieldHihiNo ratings yet

- Arogya Supreme: Protect Your Loved Ones With A Comprehensive PolicyDocument14 pagesArogya Supreme: Protect Your Loved Ones With A Comprehensive Policytaxsachin16No ratings yet

- GHI Summary HealthPro MembershipDocument4 pagesGHI Summary HealthPro MembershipVedansh SNo ratings yet

- Benefit Manual M&V 23-24 - Jan 1Document22 pagesBenefit Manual M&V 23-24 - Jan 1mdmoosasohail8No ratings yet

- OSHC Essentials Policy Wording 160317Document12 pagesOSHC Essentials Policy Wording 160317khushbu patelNo ratings yet

- USC SH - Insurance Brochure - Fall2021Document5 pagesUSC SH - Insurance Brochure - Fall2021Adib MustofaNo ratings yet

- Health Insurance: Presented By: Group 1Document33 pagesHealth Insurance: Presented By: Group 1Vaibhav TiwariNo ratings yet

- Focus On The Custom Option 2017Document9 pagesFocus On The Custom Option 2017C.I. R.E.No ratings yet

- HS360Document5 pagesHS360abhishek160912No ratings yet

- Health Insurance HandbookDocument10 pagesHealth Insurance HandbookvinaysekharNo ratings yet

- #Maxima Plus Individual Option Brochure 2023Document54 pages#Maxima Plus Individual Option Brochure 2023Piet ConradieNo ratings yet

- Sbi General'S Arogya Plus Policy: Assure Your Health For A Fixed PremiumDocument9 pagesSbi General'S Arogya Plus Policy: Assure Your Health For A Fixed Premiumdinesh banaNo ratings yet

- Assurant Health Maxplan: TexasDocument10 pagesAssurant Health Maxplan: TexasRuthStewartNo ratings yet

- CIS Yuva Bharat Health PolicyDocument7 pagesCIS Yuva Bharat Health PolicyS PNo ratings yet

- A Plus Recover EN 0111Document2 pagesA Plus Recover EN 0111testNo ratings yet

- Medical Insurance BenifitsDocument13 pagesMedical Insurance BenifitsdhineshNo ratings yet

- InHealth Persona PrimerDocument13 pagesInHealth Persona PrimerEmmanuel Martin Racho AsuntoNo ratings yet

- Health Insurance Handbook (English)Document10 pagesHealth Insurance Handbook (English)Harsh NarwareNo ratings yet

- Standard Overseas Visitors Cover Fact SheetDocument2 pagesStandard Overseas Visitors Cover Fact Sheetang_yu_3No ratings yet

- Prospectus New India Asha Kiran PolicyDocument17 pagesProspectus New India Asha Kiran PolicySHYLAJA DNo ratings yet

- Prospectus - Star Special Care: Star Health and Allied Insurance Company LimitedDocument4 pagesProspectus - Star Special Care: Star Health and Allied Insurance Company LimitedGopi223No ratings yet

- Prospectus Atmanirbhar Health PolicyDocument18 pagesProspectus Atmanirbhar Health PolicyHimanshu KashyapNo ratings yet

- Health Insurance HandbookDocument10 pagesHealth Insurance HandbookDipsonNo ratings yet

- Extra Care PlusDocument9 pagesExtra Care Plusgrr.homeNo ratings yet

- Prospectus Yuva Bharat Health PolicyDocument29 pagesProspectus Yuva Bharat Health PolicyAlen KarbiaNo ratings yet

- BYUH Student Medical BenifitDocument36 pagesBYUH Student Medical BenifitAndy D. CNo ratings yet

- Keymed: Time Insurance Company John Alden Life Insurance CompanyDocument8 pagesKeymed: Time Insurance Company John Alden Life Insurance CompanyRuthStewart100% (2)

- IntroductionDocument3 pagesIntroductionAARTI MAURYANo ratings yet

- Health Gain Brocher BrochureDocument2 pagesHealth Gain Brocher Brochuremksnake77No ratings yet

- Product BookletDocument46 pagesProduct BookletNARESH JANDIALNo ratings yet

- PolicyDocument9 pagesPolicytridarsinomNo ratings yet

- Senior Med: Securing The Cost of Old AgeDocument12 pagesSenior Med: Securing The Cost of Old AgeHASIRULNIZAM BIN HASHIMNo ratings yet

- Oshc Important InformationDocument22 pagesOshc Important Information818888No ratings yet

- My Private Health ReportDocument16 pagesMy Private Health ReportNamhar AnimasNo ratings yet

- My Private Health ReportDocument10 pagesMy Private Health ReportNamhar AnimasNo ratings yet

- My Private Health ReportDocument19 pagesMy Private Health ReportNamhar AnimasNo ratings yet

- MATH 350-Introduction To Analysis: Catalog DescriptionDocument2 pagesMATH 350-Introduction To Analysis: Catalog DescriptionNamhar AnimasNo ratings yet

My Private Health Report

My Private Health Report

Uploaded by

Namhar AnimasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

My Private Health Report

My Private Health Report

Uploaded by

Namhar AnimasCopyright:

Available Formats

Your Search Results

The Private Health Information Statements (PHIS) for the policies you selected are attached.

You can use these PHIS to compare selected features of health insurance policies but please

bear in mind that it is only a summary of key product features. If you are unsure, contact the

insurer to confirm whether a specific item is covered.

As with all types of insurance, conditions will apply, so don't just rely on the Statement. Once you

have full details from a fund, make sure you read the policy carefully before signing up and

paying your premium.

Benefits will vary depending on the treatments you are having, who treats you and in what

hospital. Please make sure you discuss possible out-of-pocket costs with your doctor, insurer

and the hospital before undergoing treatment.

The premiums shown on the PHIS are the standard premiums which do not include any

applicable Government rebates, Lifetime Health Cover loading, 18-29-year-old discounts or

insurer discounts. The actual premium will vary depending on your circumstances.

Products you selected

CDH Benefits Fund - SILVER+ Young Hospital Cover (Excess2) (Single) (Hospital)

Latrobe Health Services - Gold Hospital Choice Members (Hospital)

Mildura Health Fund - Five Star Gold $750 Excess - F4 (Hospital)

Health Partners - Gold Hospital $750 Excess (Hospital)

If you have any queries about these Private Health Information Statements, please contact the

relevant health fund (contact details are at the top left of each PHIS).

You can find more information on private health insurance and search for additional policies that

match your needs on our website https://privatehealth.gov.au

Thank you for using PrivateHealth.gov.au.

Generated 13 April 2021 www.PrivateHealth.gov.au

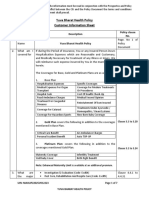

Private Health Information Statement - Hospital policy

SILVER+ Young Hospital Cover (Excess2) (Single)

CDH Benefits Fund Monthly Premium Covers only one person

http://www.hunterhi.com.au Available in Victoria

enquiries@hunterhi.com.au

$209.21 #

(before any rebate, loading or discount)

02 4990 1385

# You may be entitled to an Australian Government rebate on the above premium. Your premium may also include a Lifetime Health Cover loading or

an insurer discount. Check with your insurer for details.

Hospital cover Covered

For information on what is covered under each category, see

https://privatehealth.gov.au/categories

This policy exempts you from the Medicare Levy

Surcharge. Restricted

Restricted categories partially cover your hospital costs as a

This policy provides accident cover and benefits for travel private patient in a public hospital. You may incur significant

or accommodation (outside of hospital) - check with your expenses in a private room or private hospital.

insurer for details.

Not Covered

These categories are not covered by this policy.

This policy includes cover for

Back, neck and spine Gastrointestinal endoscopy Pain management

Blood Gynaecology Pain management with device

Bone, joint and muscle Heart and vascular system Plastic and reconstructive surgery (medically necessary)

Podiatric surgery (provided by a registered podiatric surgeon

Brain and nervous system Hernia and appendix

– limited benefits)

Implantation of hearing

Breast surgery (medically necessary) Pregnancy and birth

devices

Chemotherapy, radiotherapy and

Insulin pumps Skin

immunotherapy for cancer

Dental surgery Joint reconstructions Sleep studies

Diabetes management (excluding insulin

Kidney and bladder Tonsils, adenoids and grommets

pumps)

Digestive system Lung and chest Hospital psychiatric services

Ear, nose and throat Male reproductive system Palliative care

Miscarriage and termination of

Eye (not cataracts) Rehabilitation

pregnancy

This policy does not include cover for

Assisted reproductive services Dialysis for chronic kidney failure Weight loss surgery

Cataracts Joint replacements

The benefits paid for hospital treatment will depend on the type of cover you purchase and whether your fund has an

agreement in place with the hospital in which you are treated. See ‘Agreement Hospitals’ on privatehealth.gov.au for

which hospitals have arrangements with your insurer – https://privatehealth.gov.au/dynamic/agreementhospitals.

PrivateHealth.gov.au Date statement issued: 01 April 2021

PolicyID: CDH/H6/VCCI10 Page 1 of 2

Under this policy, you may have to pay out-of-pocket costs above what you get from Medicare or your private health

insurer. Before you go to hospital, you should ask your doctors, hospital and health insurer about any out-of-pocket

costs that may apply to you.

The following payments may also apply for hospital admissions

Excess: You will have to pay an excess of $500 per admission. This is limited to a maximum of $500 per year.

Co-payments: No co-payment

The following waiting periods for hospital admissions apply to new or upgrading members

Waiting periods:

2 months for palliative care, rehabilitation and hospital psychiatric treatments, even if pre-existing

12 months for other pre-existing conditions

12 months for pregnancy and birth

2 months for all other treatments

Other features of this hospital cover

NSW/ACT residents -Ambulance coverage is included Australia wide. Residents of all other States please contact the

fund for details. NOTE: This Hospital cover provides cover for a Gap Cover Scheme minimising Out-of-Pocket expenses

for Doctors services. ***Accident cover is allowed provided you are admitted to hospital (1 day waiting period).

For further information about this policy see

http://www.cdhbf.com.au/SilvHosp.html

Ambulance cover

Pensioner Concession Card and Healthcare Card holders are entitled to free clinically necessary ambulance transport. If

you are not eligible for a concession and want to be covered, you can purchase insurance from a private health insurer or

take out a subscription with the state ambulance service (https://www.ambulance.vic.gov.au/membership).

For further information about this policy see

http://www.cdhbf.com.au/Ambul_cover.html

Disclaimer

The information contained in this Private Health Information Statement was provided by the insurer and is intended as

general information. It may not take into account your particular circumstances. For information please contact the

insurer.

PrivateHealth.gov.au Date statement issued: 01 April 2021

PolicyID: CDH/H6/VCCI10 Page 2 of 2

Private Health Information Statement - Hospital policy

Gold Hospital Choice Members

Latrobe Health Services Monthly Premium Covers only one person

http://www.latrobehealth.com.au Available in All States

info@lhs.com.au

$218.77 #

(before any rebate, loading or discount)

1300 362 144

# You may be entitled to an Australian Government rebate on the above premium. Your premium may also include a Lifetime Health Cover loading,

an age-based discount or an insurer discount. Check with your insurer for details.

Hospital cover Covered

For information on what is covered under each category, see

https://privatehealth.gov.au/categories

This policy exempts you from the Medicare Levy

Surcharge. Restricted

Restricted categories partially cover your hospital costs as a

This policy provides accident cover - check with your private patient in a public hospital. You may incur significant

insurer for details. expenses in a private room or private hospital.

This policy does not provide benefits for travel or Not Covered

These categories are not covered by this policy.

accommodation (outside of hospital).

This policy includes cover for

Assisted reproductive services Eye (not cataracts) Miscarriage and termination of pregnancy

Gastrointestinal

Back, neck and spine Pain management

endoscopy

Blood Gynaecology Pain management with device

Heart and vascular

Bone, joint and muscle Palliative care

system

Brain and nervous system Hernia and appendix Plastic and reconstructive surgery (medically necessary)

Hospital psychiatric Podiatric surgery (provided by a registered podiatric surgeon –

Breast surgery (medically necessary)

services limited benefits)

Implantation of hearing

Cataracts Pregnancy and birth

devices

Chemotherapy, radiotherapy and

Insulin pumps Rehabilitation

immunotherapy for cancer

Dental surgery Joint reconstructions Skin

Diabetes management (excluding insulin

Joint replacements Sleep studies

pumps)

Dialysis for chronic kidney failure Kidney and bladder Tonsils, adenoids and grommets

Digestive system Lung and chest Weight loss surgery

Male reproductive

Ear, nose and throat

system

The benefits paid for hospital treatment will depend on the type of cover you purchase and whether your fund has an

agreement in place with the hospital in which you are treated. See ‘Agreement Hospitals’ on privatehealth.gov.au for

which hospitals have arrangements with your insurer – https://privatehealth.gov.au/dynamic/agreementhospitals.

PrivateHealth.gov.au Date statement issued: 01 April 2021

PolicyID: LHS/H5/AABO10 Page 1 of 2

Under this policy, you may have to pay out-of-pocket costs above what you get from Medicare or your private health

insurer. Before you go to hospital, you should ask your doctors, hospital and health insurer about any out-of-pocket

costs that may apply to you.

The following payments may also apply for hospital admissions

Excess: No excess

Co-payments: Every time you go to hospital you will have to pay:

$70 a day for a shared room - up to $490 per hospital stay

$70 a day for a private room - up to $490 per hospital stay

$30 for day surgery (no overnight stay)

The following waiting periods for hospital admissions apply to new or upgrading members

Waiting periods:

2 months for palliative care, rehabilitation and hospital psychiatric treatments, even if pre-existing

12 months for other pre-existing conditions

12 months for pregnancy and birth

2 months for all other treatments

Other features of this hospital cover

Co-payment is not payable for public hospital admissions. Additional medical gap benefits are payable on this policy.

Discounts are given for premiums paid by direct debit and for quarterly, half-yearly and yearly premiums paid by other

methods.

Ambulance cover

In All States this policy provides:

Emergency: Unlimited with a waiting period of 1 day.

Call-out fees: will be paid for each attendance, including emergency treatment without transport to hospital.

State schemes provide ambulance services for residents of Tasmania (https://www.dhhs.tas.gov.au/ambulance) and

Queensland (https://www.ambulance.qld.gov.au/).

Other features of this ambulance cover

You are covered by Latrobe's emergency ambulance, for details regarding comprehensive ambulance cover for your

state, please visit our website. Those who hold a concession card should refer to their card issuer or state service for

ambulance cover details.

For further information about this policy see

https://www.latrobehealth.com.au/health-cover/emergency-ambulance-cover/

Disclaimer

The information contained in this Private Health Information Statement was provided by the insurer and is intended as

general information. It may not take into account your particular circumstances. For information please contact the

insurer.

PrivateHealth.gov.au Date statement issued: 01 April 2021

PolicyID: LHS/H5/AABO10 Page 2 of 2

Private Health Information Statement - Hospital policy

Five Star Gold $750 Excess - F4

Mildura Health Fund Monthly Premium Covers only one person

http://www.mildurahealthfund.com.au Available in All States

mhf@mildurahealthfund.com.au

$202.25 #

(before any rebate, loading or discount)

(03) 5023 0269

# You may be entitled to an Australian Government rebate on the above premium. Your premium may also include a Lifetime Health Cover loading,

an age-based discount or an insurer discount. Check with your insurer for details.

Hospital cover Covered

For information on what is covered under each category, see

https://privatehealth.gov.au/categories

This policy exempts you from the Medicare Levy

Surcharge. Restricted

Restricted categories partially cover your hospital costs as a

This policy does not provide accident cover or benefits for private patient in a public hospital. You may incur significant

travel and accommodation (outside of hospital). expenses in a private room or private hospital.

Not Covered

These categories are not covered by this policy.

This policy includes cover for

Assisted reproductive services Eye (not cataracts) Miscarriage and termination of pregnancy

Gastrointestinal

Back, neck and spine Pain management

endoscopy

Blood Gynaecology Pain management with device

Heart and vascular

Bone, joint and muscle Palliative care

system

Brain and nervous system Hernia and appendix Plastic and reconstructive surgery (medically necessary)

Hospital psychiatric Podiatric surgery (provided by a registered podiatric surgeon –

Breast surgery (medically necessary)

services limited benefits)

Implantation of hearing

Cataracts Pregnancy and birth

devices

Chemotherapy, radiotherapy and

Insulin pumps Rehabilitation

immunotherapy for cancer

Dental surgery Joint reconstructions Skin

Diabetes management (excluding insulin

Joint replacements Sleep studies

pumps)

Dialysis for chronic kidney failure Kidney and bladder Tonsils, adenoids and grommets

Digestive system Lung and chest Weight loss surgery

Male reproductive

Ear, nose and throat

system

The benefits paid for hospital treatment will depend on the type of cover you purchase and whether your fund has an

agreement in place with the hospital in which you are treated. See ‘Agreement Hospitals’ on privatehealth.gov.au for

which hospitals have arrangements with your insurer – https://privatehealth.gov.au/dynamic/agreementhospitals.

PrivateHealth.gov.au Date statement issued: 01 April 2021

PolicyID: MDH/H8/AACA10 Page 1 of 2

Under this policy, you may have to pay out-of-pocket costs above what you get from Medicare or your private health

insurer. Before you go to hospital, you should ask your doctors, hospital and health insurer about any out-of-pocket

costs that may apply to you.

The following payments may also apply for hospital admissions

Excess: You will have to pay an excess of $750 per admission. This is limited to a maximum of $750 per person and $750

per policy per year.

Co-payments: No co-payment

The following waiting periods for hospital admissions apply to new or upgrading members

Waiting periods:

2 months for palliative care, rehabilitation and hospital psychiatric treatments, even if pre-existing

12 months for other pre-existing conditions

12 months for pregnancy and birth

2 months for all other treatments

Other features of this hospital cover

Additional medical gap benefits may be payable on this cover, contact the Fund for details. Members paying by direct

debit will receive a 2.5% discount (Credit Card excluded). No excess is payable on same day procedures at the Mildura

Health Private Hospital. NSW & ACT residents are automatically covered for emergency transportation within either

NSW or ACT. For more information go to the Ambulance NSW website www.ambulance.nsw.gov.au or ACT Ambulance

http://esa.act.gov.au/actas/fees-and-charges/.

For further information about this policy see

http://www.mildurahealthfund.com.au

Ambulance cover

Ambulance cover is provided by the State government in Tasmania (https://www.dhhs.tas.gov.au/ambulance) and

Queensland (https://www.ambulance.qld.gov.au/). In other states concession card holders may have free cover and

there are subscription services in several states

(https://privatehealth.gov.au/health_insurance/what_is_covered/ambulance.htm)

For further information about this policy see

http://www.mildurahealthfund.com.au

Disclaimer

The information contained in this Private Health Information Statement was provided by the insurer and is intended as

general information. It may not take into account your particular circumstances. For information please contact the

insurer.

PrivateHealth.gov.au Date statement issued: 01 April 2021

PolicyID: MDH/H8/AACA10 Page 2 of 2

Private Health Information Statement - Hospital policy

Gold Hospital $750 Excess

Health Partners Monthly Premium Covers only one person

http://www.healthpartners.com.au Available in Victoria

ask@healthpartners.com.au

$207.18 #

(before any rebate, loading or discount)

1300 113 113

# You may be entitled to an Australian Government rebate on the above premium. Your premium may also include a Lifetime Health Cover loading,

an age-based discount or an insurer discount. Check with your insurer for details.

Hospital cover Covered

For information on what is covered under each category, see

https://privatehealth.gov.au/categories

This policy exempts you from the Medicare Levy

Surcharge. Restricted

Restricted categories partially cover your hospital costs as a

This policy does not provide accident cover or benefits for private patient in a public hospital. You may incur significant

travel and accommodation (outside of hospital). expenses in a private room or private hospital.

Not Covered

These categories are not covered by this policy.

This policy includes cover for

Assisted reproductive services Eye (not cataracts) Miscarriage and termination of pregnancy

Gastrointestinal

Back, neck and spine Pain management

endoscopy

Blood Gynaecology Pain management with device

Heart and vascular

Bone, joint and muscle Palliative care

system

Brain and nervous system Hernia and appendix Plastic and reconstructive surgery (medically necessary)

Hospital psychiatric Podiatric surgery (provided by a registered podiatric surgeon –

Breast surgery (medically necessary)

services limited benefits)

Implantation of hearing

Cataracts Pregnancy and birth

devices

Chemotherapy, radiotherapy and

Insulin pumps Rehabilitation

immunotherapy for cancer

Dental surgery Joint reconstructions Skin

Diabetes management (excluding insulin

Joint replacements Sleep studies

pumps)

Dialysis for chronic kidney failure Kidney and bladder Tonsils, adenoids and grommets

Digestive system Lung and chest Weight loss surgery

Male reproductive

Ear, nose and throat

system

The benefits paid for hospital treatment will depend on the type of cover you purchase and whether your fund has an

agreement in place with the hospital in which you are treated. See ‘Agreement Hospitals’ on privatehealth.gov.au for

which hospitals have arrangements with your insurer – https://privatehealth.gov.au/dynamic/agreementhospitals.

PrivateHealth.gov.au Date statement issued: 01 October 2020

PolicyID: SPS/J17/VBPO10 Page 1 of 2

Under this policy, you may have to pay out-of-pocket costs above what you get from Medicare or your private health

insurer. Before you go to hospital, you should ask your doctors, hospital and health insurer about any out-of-pocket

costs that may apply to you.

The following payments may also apply for hospital admissions

Excess: You will have to pay an excess of $750 per admission. This is limited to a maximum of $750 per person and $750

per policy per year.

Co-payments: No co-payment

The following waiting periods for hospital admissions apply to new or upgrading members

Waiting periods:

2 months for palliative care, rehabilitation and hospital psychiatric treatments, even if pre-existing

12 months for other pre-existing conditions

12 months for pregnancy and birth

2 months for all other treatments

Other features of this hospital cover

Health Partners Support Programs: Hospital to Home; includes Hospital Guide, Hospital in the Home and Rehab in the

Home. Health Management Programs; Health Coaching & Newborn Support. Benefits directly related to an admission

and medically necessary: PBS approved prescriptions - 100% benefit & unlimited, Aids for recovery benefit 75% with

$100 limit, non-surgically implanted prosthesis benefit 75% with $150 limit. 12 month waiting period for insulin pumps

& hearing devices. Members can also access a range of discounts, refer to the ‘Member Discount’ page at

healthpartners.com.au.

For further information about this policy see

https://www.healthpartners.com.au/health-insurance/hospital-cover/

Ambulance cover

In Victoria this policy provides:

Emergency: Unlimited with a waiting period of 2 months.

Call-out fees: will be paid for each attendance, including emergency treatment without transport to hospital.

Other features of this ambulance cover

Unlimited emergency ambulance as defined by Health Partners, is for an unplanned event where there is a serious

threat to your health, as a result of an accident, serious medical event or trauma, and immediate medical treatment is

needed. Transport costs are covered from the place where you are initially treated, to the nearest hospital that can

provide the necessary emergency medical treatment. This includes treatment where no transport is provided. It also

includes transport between hospitals only where the required emergency care could not be provided at the transferring

hospital. See Health Partners Member Guide for Terms & Conditions.

For further information about this policy see

https://www.healthpartners.com.au/health-insurance/understanding-private-health-insurance/faqs/

Disclaimer

The information contained in this Private Health Information Statement was provided by the insurer and is intended as

general information. It may not take into account your particular circumstances. For information please contact the

insurer.

PrivateHealth.gov.au Date statement issued: 01 October 2020

PolicyID: SPS/J17/VBPO10 Page 2 of 2

You might also like

- My Private Health ReportDocument19 pagesMy Private Health ReportNamhar AnimasNo ratings yet

- My Private Health ReportDocument16 pagesMy Private Health ReportNamhar AnimasNo ratings yet

- My Private Health ReportDocument10 pagesMy Private Health ReportNamhar AnimasNo ratings yet

- SL50 TASSingleDocument2 pagesSL50 TASSingleMahdi MahnazNo ratings yet

- Flexifed 1 Elect Individual Option BrochureDocument25 pagesFlexifed 1 Elect Individual Option BrochurescannertplinkNo ratings yet

- Top Hospital Essential ExtrasDocument8 pagesTop Hospital Essential ExtrasJody HeydonNo ratings yet

- Flexifed 1 Individual Option BrochureDocument25 pagesFlexifed 1 Individual Option BrochureBabalwa MpongosheNo ratings yet

- QInsurance Factsheet Bronze Hospital PlusDocument2 pagesQInsurance Factsheet Bronze Hospital PlusHanny KeeNo ratings yet

- Inspire Policy Docs - 1216Document20 pagesInspire Policy Docs - 1216JuanQuagliaNo ratings yet

- Basic Visitor Cover FactsheetDocument2 pagesBasic Visitor Cover FactsheetVivekNo ratings yet

- AHM Black White Boost FlexiDocument10 pagesAHM Black White Boost FlexiDani Kirky Ylagan100% (1)

- Member Booklets Pmi Ia Medical Global Plan Lta 1120 PDFDocument12 pagesMember Booklets Pmi Ia Medical Global Plan Lta 1120 PDFbkourfatima8No ratings yet

- Easy HealthDocument15 pagesEasy HealthSumit BhandariNo ratings yet

- Budget Visitor CoverDocument2 pagesBudget Visitor CoverRohan lamaNo ratings yet

- Brochure 3 BupaDocument13 pagesBrochure 3 BupaprinceNo ratings yet

- Overseas Visitors Short StayDocument4 pagesOverseas Visitors Short StayDinesh ManoharanNo ratings yet

- Family Care Plan - Dubai & Northern EmiratesDocument6 pagesFamily Care Plan - Dubai & Northern Emiratesneelkant sharmaNo ratings yet

- Group MediCare 360 - BrochureDocument4 pagesGroup MediCare 360 - Brochuresubharam1997No ratings yet

- 05+Onsurity+Benefit+Summary+for+TopUp PDFDocument4 pages05+Onsurity+Benefit+Summary+for+TopUp PDFYohan BahlNo ratings yet

- Personal Healthcare IpidDocument2 pagesPersonal Healthcare IpidarthurNo ratings yet

- Health Care in AustraliaDocument6 pagesHealth Care in AustraliaNeil MenezesNo ratings yet

- Group Health Insurance - Policy OverviewDocument16 pagesGroup Health Insurance - Policy OverviewSujithaNo ratings yet

- Focus On The Ingwe Option: Momentumhealth - Co.zaDocument7 pagesFocus On The Ingwe Option: Momentumhealth - Co.zaRoe Wekwa NyembaNo ratings yet

- Benefits Guide Colombia 2021Document10 pagesBenefits Guide Colombia 2021Luis Carlos Gutierrez PedrazaNo ratings yet

- OSHC Policy EssentialsDocument12 pagesOSHC Policy EssentialsRini MathewNo ratings yet

- Enhanced IncomeShield Brochure - WebsiteDocument18 pagesEnhanced IncomeShield Brochure - WebsiteAntony VijayNo ratings yet

- Enhanced Income ShieldDocument18 pagesEnhanced Income ShieldHihiNo ratings yet

- Arogya Supreme: Protect Your Loved Ones With A Comprehensive PolicyDocument14 pagesArogya Supreme: Protect Your Loved Ones With A Comprehensive Policytaxsachin16No ratings yet

- GHI Summary HealthPro MembershipDocument4 pagesGHI Summary HealthPro MembershipVedansh SNo ratings yet

- Benefit Manual M&V 23-24 - Jan 1Document22 pagesBenefit Manual M&V 23-24 - Jan 1mdmoosasohail8No ratings yet

- OSHC Essentials Policy Wording 160317Document12 pagesOSHC Essentials Policy Wording 160317khushbu patelNo ratings yet

- USC SH - Insurance Brochure - Fall2021Document5 pagesUSC SH - Insurance Brochure - Fall2021Adib MustofaNo ratings yet

- Health Insurance: Presented By: Group 1Document33 pagesHealth Insurance: Presented By: Group 1Vaibhav TiwariNo ratings yet

- Focus On The Custom Option 2017Document9 pagesFocus On The Custom Option 2017C.I. R.E.No ratings yet

- HS360Document5 pagesHS360abhishek160912No ratings yet

- Health Insurance HandbookDocument10 pagesHealth Insurance HandbookvinaysekharNo ratings yet

- #Maxima Plus Individual Option Brochure 2023Document54 pages#Maxima Plus Individual Option Brochure 2023Piet ConradieNo ratings yet

- Sbi General'S Arogya Plus Policy: Assure Your Health For A Fixed PremiumDocument9 pagesSbi General'S Arogya Plus Policy: Assure Your Health For A Fixed Premiumdinesh banaNo ratings yet

- Assurant Health Maxplan: TexasDocument10 pagesAssurant Health Maxplan: TexasRuthStewartNo ratings yet

- CIS Yuva Bharat Health PolicyDocument7 pagesCIS Yuva Bharat Health PolicyS PNo ratings yet

- A Plus Recover EN 0111Document2 pagesA Plus Recover EN 0111testNo ratings yet

- Medical Insurance BenifitsDocument13 pagesMedical Insurance BenifitsdhineshNo ratings yet

- InHealth Persona PrimerDocument13 pagesInHealth Persona PrimerEmmanuel Martin Racho AsuntoNo ratings yet

- Health Insurance Handbook (English)Document10 pagesHealth Insurance Handbook (English)Harsh NarwareNo ratings yet

- Standard Overseas Visitors Cover Fact SheetDocument2 pagesStandard Overseas Visitors Cover Fact Sheetang_yu_3No ratings yet

- Prospectus New India Asha Kiran PolicyDocument17 pagesProspectus New India Asha Kiran PolicySHYLAJA DNo ratings yet

- Prospectus - Star Special Care: Star Health and Allied Insurance Company LimitedDocument4 pagesProspectus - Star Special Care: Star Health and Allied Insurance Company LimitedGopi223No ratings yet

- Prospectus Atmanirbhar Health PolicyDocument18 pagesProspectus Atmanirbhar Health PolicyHimanshu KashyapNo ratings yet

- Health Insurance HandbookDocument10 pagesHealth Insurance HandbookDipsonNo ratings yet

- Extra Care PlusDocument9 pagesExtra Care Plusgrr.homeNo ratings yet

- Prospectus Yuva Bharat Health PolicyDocument29 pagesProspectus Yuva Bharat Health PolicyAlen KarbiaNo ratings yet

- BYUH Student Medical BenifitDocument36 pagesBYUH Student Medical BenifitAndy D. CNo ratings yet

- Keymed: Time Insurance Company John Alden Life Insurance CompanyDocument8 pagesKeymed: Time Insurance Company John Alden Life Insurance CompanyRuthStewart100% (2)

- IntroductionDocument3 pagesIntroductionAARTI MAURYANo ratings yet

- Health Gain Brocher BrochureDocument2 pagesHealth Gain Brocher Brochuremksnake77No ratings yet

- Product BookletDocument46 pagesProduct BookletNARESH JANDIALNo ratings yet

- PolicyDocument9 pagesPolicytridarsinomNo ratings yet

- Senior Med: Securing The Cost of Old AgeDocument12 pagesSenior Med: Securing The Cost of Old AgeHASIRULNIZAM BIN HASHIMNo ratings yet

- Oshc Important InformationDocument22 pagesOshc Important Information818888No ratings yet

- My Private Health ReportDocument16 pagesMy Private Health ReportNamhar AnimasNo ratings yet

- My Private Health ReportDocument10 pagesMy Private Health ReportNamhar AnimasNo ratings yet

- My Private Health ReportDocument19 pagesMy Private Health ReportNamhar AnimasNo ratings yet

- MATH 350-Introduction To Analysis: Catalog DescriptionDocument2 pagesMATH 350-Introduction To Analysis: Catalog DescriptionNamhar AnimasNo ratings yet