Professional Documents

Culture Documents

2021.04.12 - Ira Rumors and Conspiracy Theories

2021.04.12 - Ira Rumors and Conspiracy Theories

Uploaded by

Jay AnnCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Tanishq Case StudyDocument2 pagesTanishq Case StudyHutanshuNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- San Diego Venture Capital FirmsDocument4 pagesSan Diego Venture Capital FirmsJoseph KymmNo ratings yet

- 20 - Reversing Entries PDFDocument3 pages20 - Reversing Entries PDFAB CloydNo ratings yet

- 2023.05.04 - Inherited Roth Iras and Roth Conversions Todays Slott Report MailbagDocument1 page2023.05.04 - Inherited Roth Iras and Roth Conversions Todays Slott Report MailbagJay AnnNo ratings yet

- 2023.05.31 - Irs Delays Effective Date of Ira Self-Correction ProgramDocument1 page2023.05.31 - Irs Delays Effective Date of Ira Self-Correction ProgramJay AnnNo ratings yet

- 2023.05.17 - Hsa Benefits That May Surprise YouDocument1 page2023.05.17 - Hsa Benefits That May Surprise YouJay AnnNo ratings yet

- HAPPINESSDocument1 pageHAPPINESSJay AnnNo ratings yet

- 2023.05.08 - Conversion As A Gift To Your BeneficiariesDocument2 pages2023.05.08 - Conversion As A Gift To Your BeneficiariesJay AnnNo ratings yet

- 2023.05.10 - Mandatory Roth Catch-Up Contributions Required For 2024Document1 page2023.05.10 - Mandatory Roth Catch-Up Contributions Required For 2024Jay AnnNo ratings yet

- 2023.05.01 - How The Retirement Plan Compensation Limit WorksDocument1 page2023.05.01 - How The Retirement Plan Compensation Limit WorksJay AnnNo ratings yet

- 2023.05.03 - The 3 Ira Beneficiary Categories - Again and Again and AgainDocument2 pages2023.05.03 - The 3 Ira Beneficiary Categories - Again and Again and AgainJay AnnNo ratings yet

- LIFEDocument5 pagesLIFEJay AnnNo ratings yet

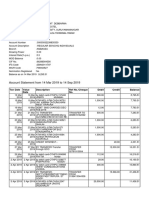

- San Felipe Executive Summary 2019Document4 pagesSan Felipe Executive Summary 2019Jay AnnNo ratings yet

- LiveDocument3 pagesLiveJay AnnNo ratings yet

- San Felipe Executive Summary 2020Document5 pagesSan Felipe Executive Summary 2020Jay AnnNo ratings yet

- San Antonio Executive Summary 2019Document6 pagesSan Antonio Executive Summary 2019Jay AnnNo ratings yet

- 2021.04.26 - The Irs May Be Coming After Your Solo 401 (K) PlanDocument1 page2021.04.26 - The Irs May Be Coming After Your Solo 401 (K) PlanJay AnnNo ratings yet

- 2021.04.21 - Active Participation and Ira DeductibilityDocument1 page2021.04.21 - Active Participation and Ira DeductibilityJay AnnNo ratings yet

- Good Communication in WorkplaceDocument6 pagesGood Communication in WorkplaceJay AnnNo ratings yet

- Emergency Purchase FormDocument1 pageEmergency Purchase FormJay AnnNo ratings yet

- CH 4 Responsibility CentersDocument22 pagesCH 4 Responsibility CentersAurellia AngelineNo ratings yet

- Sachdevajk, Journal Manager, 5-4-3 - Sumeet-1Document26 pagesSachdevajk, Journal Manager, 5-4-3 - Sumeet-1Parth DongaNo ratings yet

- HARD ROCK COMPANY Statement of Financial PositionDocument3 pagesHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoNo ratings yet

- Exercise MishkinDocument4 pagesExercise MishkinSerena WestNo ratings yet

- FSSA Document Center PO Box 1810 Marion, IN 46952: FSS407AE001FDTS40W4Document6 pagesFSSA Document Center PO Box 1810 Marion, IN 46952: FSS407AE001FDTS40W4Black LoveNo ratings yet

- National College of Business Administration & Economics MultanDocument36 pagesNational College of Business Administration & Economics MultanMuhammad Sohaib HashmiNo ratings yet

- Worksheet Eco BanksDocument3 pagesWorksheet Eco BanksAryan KalthiaNo ratings yet

- Introduction To Quantity SurveyingDocument41 pagesIntroduction To Quantity SurveyingJohn Mofire100% (1)

- Akm P21-1, P21-2Document5 pagesAkm P21-1, P21-2nandya rizkyNo ratings yet

- BBA Revised Codes2 PDFDocument129 pagesBBA Revised Codes2 PDFMuhammad ShahzadNo ratings yet

- Bank GuaranteeDocument11 pagesBank GuaranteeAnanya ChoudharyNo ratings yet

- 4 $Document2 pages4 $Raju RjNo ratings yet

- Sage X3 - Reports Examples 2008 - TRLBAL (Trial Balance) PDFDocument2 pagesSage X3 - Reports Examples 2008 - TRLBAL (Trial Balance) PDFcaplusincNo ratings yet

- HP MouseDocument1 pageHP MousevishwanathNo ratings yet

- Tax Invoice BBNL - Bangalore Broadband Network PVT, LTD: Subject To Bangalore JurisdictionDocument1 pageTax Invoice BBNL - Bangalore Broadband Network PVT, LTD: Subject To Bangalore Jurisdictionsanta jonesNo ratings yet

- Pooling of Interest MethodDocument10 pagesPooling of Interest MethodSreejith ShajiNo ratings yet

- Merger & AcquisitionDocument29 pagesMerger & AcquisitionHamizar HassanNo ratings yet

- Liquidity-Risk-Disclosure - Sept-2021 KrazybeeDocument2 pagesLiquidity-Risk-Disclosure - Sept-2021 KrazybeePaytel technologiesNo ratings yet

- Reckoning Date of ValuationDocument25 pagesReckoning Date of ValuationRobert LavinaNo ratings yet

- Doing God's Work: How Goldman Sachs Rigs The GameDocument22 pagesDoing God's Work: How Goldman Sachs Rigs The GameSpin Watch100% (2)

- F1 - Financial OperationsDocument20 pagesF1 - Financial OperationsMarcin MichalakNo ratings yet

- 1568430593139S034PzzLn2wre37Z PDFDocument5 pages1568430593139S034PzzLn2wre37Z PDFPrasenjit DebbarmaNo ratings yet

- Certificate of Sale PNBDocument4 pagesCertificate of Sale PNBGirish SharmaNo ratings yet

- City of BaltimoreDocument4 pagesCity of BaltimoreAnonymous Feglbx5No ratings yet

- A Project Report: ON Customer Perception Towards Plastic MoneyDocument47 pagesA Project Report: ON Customer Perception Towards Plastic Moneyfrnds4everzNo ratings yet

- Hanjin LocalchagreDocument5 pagesHanjin LocalchagreTrần Minh CườngNo ratings yet

- MBA (FM) 2ndDocument1 pageMBA (FM) 2ndAnonymous E7H50wDJA6No ratings yet

2021.04.12 - Ira Rumors and Conspiracy Theories

2021.04.12 - Ira Rumors and Conspiracy Theories

Uploaded by

Jay AnnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2021.04.12 - Ira Rumors and Conspiracy Theories

2021.04.12 - Ira Rumors and Conspiracy Theories

Uploaded by

Jay AnnCopyright:

Available Formats

IRA RUMORS AND CONSPIRACY

THEORIES

Monday, April 12, 2021

By Andy Ives, CFP®, AIF®

IRA Analyst

Follow Us on Twitter: @theslottreport

With all the recent changes to IRAs under the SECURE Act [i.e., required minimum

distribution (RMD) age raised to 72, new rules for beneficiaries, etc.], combined with the

CARES Act waiver of RMDs last year, it comes as no surprise that we are hearing

rumors and conspiracy theories about what will happen next. Here are a couple of the

more popular speculations:

Will RMDs be waived again in 2021?

I highly doubt it. Any definitive claim that they will be waived again is unjustified

speculation. It makes no sense. Why? RMDs have only been waived twice in the past -

2009 and 2020. In both instances we were experiencing total market meltdown.

For example, last year the Dow Jones Industrial Average (DJIA) was over 29,000 in

early February. By mid-March, as news and effects of the pandemic swept across the

world, the DJIA had tumbled to just over 19,000. IRA and 401(k) balances plummeted.

Businesses were shuttered. Unemployment skyrocketed. Forcing account owners to

withdraw retirement dollars in such a chaotic atmosphere would have been

unconscionable. Hence, the CARES Act RMD waiver at the end of March 2020 and

subsequent guidance for returning unwanted RMDs.

Where are we today? The DJIA has surged and is currently over 33,000. IRA and

401(k) account balances have rebounded. We have vaccines for the virus and are

administering millions of shots per day. Businesses and states are reopening. Air travel

is up. Despite the dire news on television, the future is far brighter than the past 12

months. Why would RMDs be waived in such an atmosphere? It makes little sense.

Will Roth IRA earnings become taxable?

Once again, highly doubtful. Of course, the CPA mantra is that “tax laws are written in

pencil.” However, while anything is possible, there are a few reasons why I do not think

Roth IRA earnings will be taxed.

Politically, it would be an extremely risky move. If government were to go back on its

promise of a tax-free retirement savings account, it could be detrimental to political

careers. Congress is already somewhat paralyzed as is, so a big reversal decision like

this does not appear to be in the cards.

Second, Roth IRAs are funded with after-tax dollars. Therefore, the federal government

collects taxes on the front end. If taxes are also imposed on Roth IRA earnings (the

back end), there would be no reason to fund them, so the government would lose

current tax revenues. Additionally, the trend in recent proposed legislation is more

“Rothification,” not less.

Can we trust the federal government to keep its word about certain tax laws? No. Look

at what the SECURE Act did to most IRA beneficiaries and their ability to stretch

payments. However, the rumors about RMDs being waived again in 2021 and Roth IRA

earnings getting taxed appear to be nothing more than unfounded conspiracy theories.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Tanishq Case StudyDocument2 pagesTanishq Case StudyHutanshuNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- San Diego Venture Capital FirmsDocument4 pagesSan Diego Venture Capital FirmsJoseph KymmNo ratings yet

- 20 - Reversing Entries PDFDocument3 pages20 - Reversing Entries PDFAB CloydNo ratings yet

- 2023.05.04 - Inherited Roth Iras and Roth Conversions Todays Slott Report MailbagDocument1 page2023.05.04 - Inherited Roth Iras and Roth Conversions Todays Slott Report MailbagJay AnnNo ratings yet

- 2023.05.31 - Irs Delays Effective Date of Ira Self-Correction ProgramDocument1 page2023.05.31 - Irs Delays Effective Date of Ira Self-Correction ProgramJay AnnNo ratings yet

- 2023.05.17 - Hsa Benefits That May Surprise YouDocument1 page2023.05.17 - Hsa Benefits That May Surprise YouJay AnnNo ratings yet

- HAPPINESSDocument1 pageHAPPINESSJay AnnNo ratings yet

- 2023.05.08 - Conversion As A Gift To Your BeneficiariesDocument2 pages2023.05.08 - Conversion As A Gift To Your BeneficiariesJay AnnNo ratings yet

- 2023.05.10 - Mandatory Roth Catch-Up Contributions Required For 2024Document1 page2023.05.10 - Mandatory Roth Catch-Up Contributions Required For 2024Jay AnnNo ratings yet

- 2023.05.01 - How The Retirement Plan Compensation Limit WorksDocument1 page2023.05.01 - How The Retirement Plan Compensation Limit WorksJay AnnNo ratings yet

- 2023.05.03 - The 3 Ira Beneficiary Categories - Again and Again and AgainDocument2 pages2023.05.03 - The 3 Ira Beneficiary Categories - Again and Again and AgainJay AnnNo ratings yet

- LIFEDocument5 pagesLIFEJay AnnNo ratings yet

- San Felipe Executive Summary 2019Document4 pagesSan Felipe Executive Summary 2019Jay AnnNo ratings yet

- LiveDocument3 pagesLiveJay AnnNo ratings yet

- San Felipe Executive Summary 2020Document5 pagesSan Felipe Executive Summary 2020Jay AnnNo ratings yet

- San Antonio Executive Summary 2019Document6 pagesSan Antonio Executive Summary 2019Jay AnnNo ratings yet

- 2021.04.26 - The Irs May Be Coming After Your Solo 401 (K) PlanDocument1 page2021.04.26 - The Irs May Be Coming After Your Solo 401 (K) PlanJay AnnNo ratings yet

- 2021.04.21 - Active Participation and Ira DeductibilityDocument1 page2021.04.21 - Active Participation and Ira DeductibilityJay AnnNo ratings yet

- Good Communication in WorkplaceDocument6 pagesGood Communication in WorkplaceJay AnnNo ratings yet

- Emergency Purchase FormDocument1 pageEmergency Purchase FormJay AnnNo ratings yet

- CH 4 Responsibility CentersDocument22 pagesCH 4 Responsibility CentersAurellia AngelineNo ratings yet

- Sachdevajk, Journal Manager, 5-4-3 - Sumeet-1Document26 pagesSachdevajk, Journal Manager, 5-4-3 - Sumeet-1Parth DongaNo ratings yet

- HARD ROCK COMPANY Statement of Financial PositionDocument3 pagesHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoNo ratings yet

- Exercise MishkinDocument4 pagesExercise MishkinSerena WestNo ratings yet

- FSSA Document Center PO Box 1810 Marion, IN 46952: FSS407AE001FDTS40W4Document6 pagesFSSA Document Center PO Box 1810 Marion, IN 46952: FSS407AE001FDTS40W4Black LoveNo ratings yet

- National College of Business Administration & Economics MultanDocument36 pagesNational College of Business Administration & Economics MultanMuhammad Sohaib HashmiNo ratings yet

- Worksheet Eco BanksDocument3 pagesWorksheet Eco BanksAryan KalthiaNo ratings yet

- Introduction To Quantity SurveyingDocument41 pagesIntroduction To Quantity SurveyingJohn Mofire100% (1)

- Akm P21-1, P21-2Document5 pagesAkm P21-1, P21-2nandya rizkyNo ratings yet

- BBA Revised Codes2 PDFDocument129 pagesBBA Revised Codes2 PDFMuhammad ShahzadNo ratings yet

- Bank GuaranteeDocument11 pagesBank GuaranteeAnanya ChoudharyNo ratings yet

- 4 $Document2 pages4 $Raju RjNo ratings yet

- Sage X3 - Reports Examples 2008 - TRLBAL (Trial Balance) PDFDocument2 pagesSage X3 - Reports Examples 2008 - TRLBAL (Trial Balance) PDFcaplusincNo ratings yet

- HP MouseDocument1 pageHP MousevishwanathNo ratings yet

- Tax Invoice BBNL - Bangalore Broadband Network PVT, LTD: Subject To Bangalore JurisdictionDocument1 pageTax Invoice BBNL - Bangalore Broadband Network PVT, LTD: Subject To Bangalore Jurisdictionsanta jonesNo ratings yet

- Pooling of Interest MethodDocument10 pagesPooling of Interest MethodSreejith ShajiNo ratings yet

- Merger & AcquisitionDocument29 pagesMerger & AcquisitionHamizar HassanNo ratings yet

- Liquidity-Risk-Disclosure - Sept-2021 KrazybeeDocument2 pagesLiquidity-Risk-Disclosure - Sept-2021 KrazybeePaytel technologiesNo ratings yet

- Reckoning Date of ValuationDocument25 pagesReckoning Date of ValuationRobert LavinaNo ratings yet

- Doing God's Work: How Goldman Sachs Rigs The GameDocument22 pagesDoing God's Work: How Goldman Sachs Rigs The GameSpin Watch100% (2)

- F1 - Financial OperationsDocument20 pagesF1 - Financial OperationsMarcin MichalakNo ratings yet

- 1568430593139S034PzzLn2wre37Z PDFDocument5 pages1568430593139S034PzzLn2wre37Z PDFPrasenjit DebbarmaNo ratings yet

- Certificate of Sale PNBDocument4 pagesCertificate of Sale PNBGirish SharmaNo ratings yet

- City of BaltimoreDocument4 pagesCity of BaltimoreAnonymous Feglbx5No ratings yet

- A Project Report: ON Customer Perception Towards Plastic MoneyDocument47 pagesA Project Report: ON Customer Perception Towards Plastic Moneyfrnds4everzNo ratings yet

- Hanjin LocalchagreDocument5 pagesHanjin LocalchagreTrần Minh CườngNo ratings yet

- MBA (FM) 2ndDocument1 pageMBA (FM) 2ndAnonymous E7H50wDJA6No ratings yet