Professional Documents

Culture Documents

RTP Dec 18 QN

RTP Dec 18 QN

Uploaded by

binuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RTP Dec 18 QN

RTP Dec 18 QN

Uploaded by

binuCopyright:

Available Formats

CHARTERED ACCOUNTANCY PROFESSIONAL CAP-II

REVISION TEST PAPER

December 2018

The Institute of Chartered Accountants of Nepal

The Institute of Chartered Accountants of Nepal

Paper 1: Advanced Accounting

The Institute of Chartered Accountants of Nepal

Revision Questions

Business Combination

Question No 1:

The following is the Balance Sheet of Blue Star Ltd. as at 32nd Ashadh, 2075:

Liabilities Rs. Assets Rs.

8,000 equity shares of Rs.100 each 800,000 Building 340,000

10% debentures 400,000 Machinery 640,000

Term Loan from Bank 160,000 Stock 220,000

Creditors 320,000 Debtors 260,000

General Reserve 80,000 Bank 136,000

Goodwill 130,000

Deferred Revenue Exp. 34,000

1,760,000 1,760,000

Big Star Ltd. agreed to acquire Blue Star Ltd. on the following terms and conditions:

(1) Big Star Ltd. would take over all Assets, except bank balance at their book values less

10%. Goodwill is to be valued at 4 year’s purchase of super profits, assuming that the

normal rate of return be 8% on the combined amount of share capital and general

reserve.

(2) Big Star Ltd. is to take over creditors at book value.

(3) The purchase consideration is to be paid in cash to the extent of Rs. 600,000 and the

balance in fully paid equity shares of Rs.100 each at Rs.125 per share.

The average profit is Rs. 124,400. The liquidation expenses amounted to Rs. 16,000 to be

borne by Big Star Ltd. Blue Star Ltd. had purchased prior to 32 nd Ashadh, 2075 goods

costing Rs. 120,000 from Big Star Ltd. for Rs. 160,000. Rs. 100,000 worth of goods is still

in stock of Blue Star Ltd. on 32 nd Ashadh, 2075. Creditors of Blue Star Ltd. include

Rs.40,000 still due to Big Star Ltd.

Show the necessary Ledger Accounts to close the books of Blue Star Ltd. and prepare the

Balance Sheet (extract) of Big Star Ltd. as at 1 st Shrawan, 2075 after the acquisition.

Question No 2:

Following is given the Balance Sheets of M/s Himal Ltd. and Hill Ltd. for further course of actions:

Balance Sheet of Himal Ltd.

Rs. Rs.

The Institute of Chartered Accountants of Nepal

Share Capital 20,00,000 Fixed Assets 15,00,000

General Reserve 15,00,000 Investment 2,50,000

Current Liabilities 15,00,000 Current Assets 32,50,000

50,00,000 50,00,000

Balance Sheet of Hill Ltd.

Rs. Rs.

Share Capital 10,00,000 Fixed Assets 3,00,000

General Reserve 5,00,000 Goodwill 1,00,000

Current Liabilities 2,00,000 Current Assets 14,00,000

Proposed dividend 1,00,000

18,00,000 18,00,000

Himal Ltd. absorbed Hill Ltd. on following terms & conditions:

a) Hill Ltd declares a dividend of 10% before absorption for the payment of which it is to

retain sufficient amount of cash.

b) The net worth of Hill Ltd. is valued at Rs. 1,450,000.

c) The purchase consideration is satisfied by the allotment of fully paid shares of Rs. 100

each in Himal Ltd.

Following additional information is also to be taken in to consideration:

Himal Ltd. holds 2,500 shares of Hill Ltd. at a cost of Rs 200,000.

The stock of Hill Ltd. includes items valued at Rs. 50,000 from Himal Ltd. (cost Rs.

37,500)

The creditors of Hill Ltd include Rs. 15,000 due to Himal Ltd.

Required: Show ledger account in the books of Hill Ltd. to give effect to the above and Balance Sheet of

Himal Ltd. after completion of absorption.

Internal Reconstruction

Question No 3:

The following is the Balance Sheet of Pokhara Light Ltd. as on 31.3.2073:

Liabilities Rs. Assets Rs.

Equity shares of 10,000,000 Fixed assets 12,500,000

Rs.100 each

12% cumulative 5,000,000 Investments 1,000,000

preference (Mark

The Institute of Chartered Accountants of Nepal

shares of et

Rs.100 each value

Rs.950

,000)

10% debentures of 4,000,000 Current assets 10,000,000

Rs.100 each

Sundry creditors 5,000,000 P & L A/c 400,000

Provision for 100,000 Preliminary 200,000

taxation expens

es

24,100,000 24,100,000

The following scheme of reorganization is sanctioned by the AGM and Company Registrar:

(i) All the existing equity shares are reduced to Rs.40 each.

(ii) All preference shares are reduced to Rs.60 each.

(iii) The rate of interest on debentures is increased to 12%. The debenture holders surrender

their existing debentures of Rs.100 each and exchange the same for fresh debentures of

Rs. 70 each for every debenture held by them.

(iv) One of the creditors of the company to whom the company owes Rs. 2,000,000 decides

to forgo 40% of his claim. He is allotted 30,000 equity shares of Rs.40 each in full

satisfaction of his claim.

(v) Fixed assets are to be written down by 30%.

(vi) Current assets are to be revalued at Rs. 4,500,000.

(vii) The taxation liability of the company is settled at Rs.150,000.

(viiii) Investments to be brought to their market value.

(ix) It is decided to write off the fictitious assets.

Pass Journal entries and show the Balance sheet of the company after giving effect to the above.

Cash Flow Statement

Question No 4:

The summarized Balance Sheet of Raniban Pvt. Ltd. as on 31st December 2015 and 2016 are as

follows:

.

Liabilities 2015 2016 Assets 2015 2016

Share Capital 100,000 100,000 Building 46,800 45,000

General Reserve 38,400 42,000 Plant & Machinery 38,280 42,030

Creditors 9750 6380 Goodwill 13,000 13,000

Tax Provision 19,000 21,000 Investment 10,000 11,250

Prov. for doubtful debt 1,000 1,200 Stock 30,000 28,000

Debtors 22,070 22,300

Cash 8,000 9,000

The Institute of Chartered Accountants of Nepal

Total 168,150 170,580 Total 168,150 170,580

After taking the following information into account, prepare a cash flow statement for the year

ended on 31st December 2016.

i) Profit for year 2016 was Rs. 8,600 against this had been charged depreciation Rs. 3,050

and increase in provision for doubtful debt Rs.200/-.

ii) Income Tax Rs. 18,000 was paid during the year charged against the provision and in

addition Rs. 20,000 was charged against profit and carried to the provision.

iii) An interim dividend of Rs. 5,000 was paid in January 2016.

iv) Additional Plant was purchased in September 2015 for Rs. 5,000

v) Investments (cost Rs. 5,000) were sold for Rs. 4,800 in 2016 and on 1 st March 2016

another investment was made for Rs. 6,250.

Insurance Claim

Question No 5:

A fire broke out in the godown of a business house on Shrawan 08, 2074. Goods costing Rs. 203,000

in a small sub-godown remain unaffected by fire. The goods retrieved in a damaged condition from

the main godown were valued at Rs. 197,000. The following particulars were available from the

books of account:

Stock on the last balance sheet date at 31.03.2074 was Rs. 1,572,000

Purchases for the period from Shrawan 01 to Shrawan 07 were Rs. 3,710,000

Sales during the same period amounted to Rs. 5,260,000

The average gross profit margin was 30% on sales.

The business house has a fire insurance policy for Rs. 1,000,000 in respect of its entire stock.

Required: Assist the accountant of the business house in computing the amount of claim of loss by

fire.

Question No 6:

A fire occurred in the premises of M/s Gadbadh Co. on 30 th Mangsir 2073. Following particulars is

provided to the period 1 st Shrawan 2073 to 30 th Mangsir 2073.

Rs.

st

i) Stock as per Balance Sheet as at 31 Ashadh 2073 99,000

ii) Purchases (including purchase of a machinery Costing Rs. 30,000) 170,000

iii) Wages (including wages for the installation of Machinery Rs. 3,000) 50,000

iv) Sales (including goods sold on approval basis amounting to Rs. 49,500.

No confirmation had been received in respect of two-thirds of such Goods sold on approval basis.

275,000

v) Sales value of goods drawn by proprietor 15,000

vi) Cost of goods sent to consignee on 15 Mangsir 2073 lying unsold With them 16,500

vii) Sales value of goods distributed as free samples 1,500

The average rate of gross profit had been 20% in the past. This selling price had been increased by

20% with effect from 1st Shrawan 2073.

The Institute of Chartered Accountants of Nepal

For valuing the stocks for the Balance Sheet as at 31st Ashadh 2073, Rs. 1,000 had been written off

in respect of a slow moving item, the cost of which was Rs. 5,000. A portion of those goods were

sold at a loss of Rs. 500 on the original cost of Rs. 2,500. The remainder of the stock was now

estimated to be worth the original cost.

Subject to the above exceptions, the gross profit had remained at a uniform rate throughout. The

value of goods salvaged was estimated at Rs. 25,000. The enterprise had taken an insurance policy

for Rs. 60,000 which was subject to the average clause.

Required: To ascertain the amount of claim to be filed with the insurance company for the loss of

stock.

Contract Accounting

Question No 7:

M/s Santi Construction started working on a contract on 1 stBaisakh 2074 for Rs. 500,000. On

31stAshad 2074, when the company prepared its final accounts, the following information relating to

the contractor was extracted from his books of accounts:

Particulars Rs.

Material issued from stores and sent to site 160,000

Wages paid 101,200

Wages outstanding on 31-03-2074 37,520

New machines purchased and sent to the site on 1-1-2074 148,000

Direct charges paid 7,500

Direct charges outstanding on 31-03-2074 600

Establishment charges apportioned to contract 6,400

On 31 Ashad 2074 materials lying unused at the site were valued at Rs.21,620. Machines were

depreciated at 20% per annum. Value of work certified by 31stAshad 2074 was Rs. 350,000 while the

cost of work done but yet not certified as on that date was Rs.18,000. On the basis of architect‘s

certificate, the company had received a total sum of Rs. 280,000 from the contractee till 31 stAshadh

2074.

Required: Contract account and relevant portion of the balance sheet in the books of M/s Santi

Construction.

Hire Purchase Transactions

Question No 8:

Omega Enterprises sells computers on hire purchase basis at cost plus 25%. Terms of sales are Rs.

10,000 as down payment and 8 monthly instalments of Rs. 5,000 for each computer. From the

following particulars prepare Hire Purchase Trading Account for the year 2017.

As on 1st January, 2017 last instalment on 30 computers was outstanding as these were not due up to

the end of the previous year.

During 2017 the firm sold 240 computers. As on 31 st December, 2017 the position of instalments

outstanding were as under :

Instalments due but not collected :

The Institute of Chartered Accountants of Nepal

2 instalments on 2 computers and last instalment on 6 computers.

Instalments not yet due :

8 instalments on 50 computers, 6 instalments on 30 and last instalment on 20 computers.

Two computers on which 6 instalments were due and one instalment not yet due on 31.12.2017 had to be

repossessed. Repossessed stock is valued at 50% of cost. All other instalments have been received.

Issue of Shares and Debentures

Question No 9:

Kitkit Limited recently made a public issue in respect of which the following information is

available:

a) No. of partly convertible debentures issued 200,000; face value and issue price NRs.100 per

debenture.

b) Convertible portion per debenture 60%, date of conversion on expiry of 6 months from the date of

closing of issue.

c) Date of closure of subscription lists 1.5.2016, date of allotment 1.6.2016, rate of interest on

debenture 15% payable from the date of allotment, value of equity share for the purpose of

conversion NRs. 60 (Face Value NRs. 10).

d) Underwriting Commission 2%.

e) No. of debentures applied for 150,000.

f) Interest payable on debentures half-yearly on 30th September and 31st March.

Write relevant journal entries for all transactions arising out of the above during the year ended 31st

March, 2017 (including cash and bank entries).

Question No 10:

Yeti Ltd. with an authorized capital of Rs. 30,000,000 offered to public 400,000 ordinary shares of

NRs.50 each at a premium of NRs.5 each. The payment was to be made as;

NRs.15 on application,

NRs.25 on allotment (including premium) and

NRs.15 on first and final call.

Application totalled 800,000 shares; shares were allotted on a pro-rata basis. Amit who had applied for

800 shares and to whom 400 shares had been allotted failed to pay the balance of allotment money due

from him. His shares were forfeited and then reissued to Tanka as Rs.40 (including premium of NRs.5) per

share as fully paid up. Rojina, another shareholder, failed to pay the call money on 100 shares held by her.

Her shares were also forfeited. Later, these shares were reissued as fully paid to Suchitra for NRs.60 per

share.

Expenses of the issue of shares came to Rs.12,000.

Required: Pass necessary journal entries in the books of M/s Yeti Ltd.

Underwriting of Shares and Debentures

Question No 11:

The Institute of Chartered Accountants of Nepal

Nepal Capital Ltd. came out with an issue of 450,000 equity shares of Rs. 100 each at a premium of

Rs. 20 per share. The promoters took 20% of the issue and the balance was offered to the public. The

issue was equally underwritten by A & Co; B & Co. and C & Co.

Each underwriter took firm underwriting of 10,000 shares each. Subscriptions for 310,000 equity

shares were received with marked forms for the underwriters as given below:

A & Co. 72,500 shares

B & Co. 84,000 shares

C & Co. 131,000 shares

Total 287,500 shares

The underwriters are eligible for a commission of 5% on face value of shares. The entire amount

towards shares subscription has to be paid along with application. You are required to:

(a) Prepare the statement showing the underwriters‘ liability (number of shares)

(b) Compute the amounts payable or due to underwriters; and

(c) Pass necessary journal entries in the books of Nepal Capital Ltd. relating to underwriting.

Incomplete Records

Question No 12

The following is the Balance Sheet of Mr. Sanjay Rijal, a small trader as on 32.3.2075 :

(Figures in Rs. ‗000)

Liabilities Rs. Assets Rs.

Capital 200 Fixed Assets 145

Creditors 50 Stock 40

Debtors 50

Cash in Hand 5

Cash at Bank 10

250 250

A fire destroyed the accounting records as well as the closing cash of the trader on 32.3.2075. However,

the following information was available :

(a) Debtors and creditors on 32.3.2075 showed an increase of 20% as compared to 31.3.2074.

(b) Credit Period :

Debtors – 1 month Creditors – 2 months

(c) Stock was maintained at the same level throughout the year.

(d) Cash sales constituted 20% of total sales.

(e) All purchases were for credit only.

(f) Current ratio as on 32.3.2075 was exactly 2.

(g) Total expenses excluding depreciation for the year amounted to Rs. 250,000.

(h) Depreciation was provided at 10% on the closing value of fixed assets.

The Institute of Chartered Accountants of Nepal

(i) Bank and cash transactions :

(1) Payments to creditors included Rs. 50,000 by cash.

(2) Receipts from debtors included Rs. 5,90,000 by way of cheques.

(3) Cash deposited into the bank Rs. 1,20,000.

(4) Personal drawings from bank Rs. 50,000.

(5) Fixed assets purchased and paid by cheques Rs. 2,25,000.

You are required to prepare:

(a) The Trading and Profit & Loss Account of business for the year ended 32.3.2075 and

(b) A Balance Sheet as on that date.

Assume that cash destroyed by fire is written off in the Profit and Loss Account.

Ratio Analysis

Question No 13:

M/s Nyatapola Enterprises asked you to prepare their Balance Sheet from the particulars furnished

hereunder:

Gross Profit Margin: 10%

Stock Velocity: 12

Capital turnover ratio: 2

Fixed assets turnover ratio: 5

Debt collection period: 1 month

Creditor‘s payment period: 73 days

Gross Profit: Rs. 100,000

Excess of closing stock over opening stock: Rs. 30,000

Make suitable assumptions wherever necessary.

Profit or Loss Pre and Post Incorporation

Question No 14:

The partnership of Bara Enterprises decided to convert the partnership into private limited company

named Churimai Company Pvt. Ltd. with effect from 1 st Baisakh 2071. The consideration was agreed

at Rs. 23,400,000 based on firm‘s Balance Sheet as on 31 st Chaitra 2070. However, due to some

procedural difficulties, the company could be incorporated only on 1 st Shrawan 2071. Meanwhile, the

business was continued on behalf of the company and the consideration was settled on that day with

interest at 12% p.a. The same books of accounts were continued by the company, which closed its

accounts for the first time on 31 st Ashadh, 2072 and prepared the following summarized profit and

loss account:

Particulars Rs. Particulars Rs.

To Cost of goods sold 327,60,000 By sales 468,00,000

Managing Director‘s Salary 180,000

Profit 3834,000

The Institute of Chartered Accountants of Nepal

The company‘s only borrowing was a loan of Rs. 100,00,000 at 12% p.a. to pay the purchase

consideration due to the firm and for working capital requirements. The company was able to

double the monthly average sales of the company from 1 st Shrawan 2071 but the salaries treble

from that date. It had to occupy additional space from 1 st Kartik 2071 for which rent was Rs.

60,000 per month.

Prepare a statement showing apportionment of costs and revenue between pre -incorporation and

post-incorporation periods.

Liquidator’s Final Statement

Question No 15:

The following is the Balance Sheet of Himchuli Co. Limited as at 31st Ashadh, 2073:

Liabilities Rs. Assets Rs.

Share Capital: Fixed Assets:

2,000 Equity Shares of Rs. 100 Land & Buildings 400,000

each Rs. 75 per share paid up 150,000 Plant and Machineries 380,000

6,000 equity shares of Rs. 100 Current Assets:

each Rs. 60 per share paid up 360,000 Stock at Cost 110,000

2,000 10% Preference Share of Cash at Bank 60,000

Rs. 100 each fully paid up 200,000 Profit and Loss A/c 240,000

10% Debentures (having a floating Sundry Debtors 220,000

charge on all assets) 200,000

Interest accrued on Debentures

(also secured as above) 10,000

Sundry Creditors 490,000

1,410,000 1,410,000

On that date, the company went into Voluntary Liquidation. The dividends on preference shares were

in arrear for the last two years. Sundry Creditors include a loan of Rs. 90,000 on mortgage of Land

and Buildings. The assets realized were as under:-

Rs.

Land and Buildings 340,000

Plant & Machineries 360,000

Stock 120,000

Sundry Debtors 160,000

Interest accrued on loan on mortgage of buildings upto the date of payment amounted to Rs.

10,000. The expenses of Liquidation amounted to Rs. 4,600. The Liquidator is entitled to a

remuneration of 3% on all the assets realized (except cash at bank) and 2% on the amounts

distributed among equity shareholders. Sundry creditor included preferential creditors Rs.

30,000. All payments were made on 31 st Ashwin 2073. Prepare the liquidator‘s final statement.

Accounting for Partnership

Question No 16:

The following is the trial balance as on 31 st Ashad 2074 of Amar, Bisnhu and Chetan who had

branches at different places and who shared profits & losses in the ratio of 2:1:2 respectively,

Rs. Rs.

Dr. Cr.

The Institute of Chartered Accountants of Nepal

Capitals, 1st Shrawan 2073

Amar 140,000

Bishnu 140,000

Chetan 20,000

Drawings

Amar 22,720

Bishnu 19,920

Chetan 9,160

Patents & Trade Marks 24,000

Sundry Creditors 69,800

Profit & Loss account for the year (before allowing interest @ 10%

on capital, as a charge) 25,000

Sundry Debtors-

Dhankuta 67,500

Pokhara 32,500

Kailali 15,000

Furniture-

Dhankuta 10,000

Pokhara 5,000

Kailali 6,000

Stock-

Dhankuta 46,000

Pokhara 34,000

Kailali 53,000

_______ _______

369,800 369,800

The firm was dissolved on that date. Amar took over Dhankuta Branch, and Bisnu took over Pokhara

Branch; the assets being taken at 10% less than the book values. Patents and Trade Marks were found

valueless. The business at Kailali was sold to a limited company which allotted 6,000 equity shares of

Rs. 10 each credited as fully paid. To pay the liabilities, Amar and Bisnhu introduced cash in the

profit sharing ratio. The cost of winding up came to Rs. 4,000 for which Amar advanced cash. Chetan

is insolvent and can pay nothing. Bishnu received all the shares.

Required: Necessary accounts to close the books of the firm; partners give effect to the correct

position without having to make up losses in cash. Assume the capitals to be fluctuating. Amar

and Bishnu settles accounts themselves.

Accounting for Non-profit making Organization

Question No 17:

Following information has been given for Himalayan Sports Club, Lalitpur for the year ending

31.3.2073 and 31.3.2074

The Institute of Chartered Accountants of Nepal

31.3.2073 31.3.2074

Building (subject to 10% depreciation for the current year) 60,000 ?

Furniture (subject to 10% depreciation for the current year) - 20,000

Stock of Sports Materials 5,000 2,000

Prepaid Insurance 3,000 6,000

Subscription Receivable 12,000 8,000

Advance Subscription 6,000 4,000

Locker Rent receivable - 6,000

Advance Locker Rent received - 2,000

Outstanding Rent for Godown 6,000 3,000

12% Investment –General Fund 200,000 200,000

Accrued Interest on Investment - 4,000

Cash Balance 1,000 64,000

Bank Balance 2,000 -

Bank Overdraft - 2,000

Additional information:

(i) Entrance fees received Rs. 20,000, Life membership fees received Rs. 20,000 during the

year.

(ii) Surplus from income and expenditure account Rs. 60,000.

(iii) It is the policy of the club to treat 60% of entrance fees and 40% of life membership fees as

revenue nature.

(iv) The furniture was purchased on 1.4.2073.

Prepare Balance Sheets of the club as on 31.3.2073 and 31.3.2074

Accounting for Banks

Question No 18:

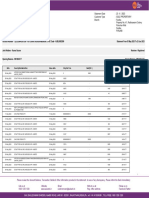

Following information as at third quarter ending FY 2074/75 were drawn from the records of

M/s Mechi Bank Limited as under:

Loan outstanding for Amount Rs.

Upto 3 months 1,673,000

More than 3 months but not more than 6 months 13,612

More than 6 months but not more than 12 months 782

The Institute of Chartered Accountants of Nepal

More than 12 months 2,198

Total 1,689,592

The bank has not restructured or rescheduled any of its credit

Following additional information relating to previous quarter ending were extracted from the

records of the bank:

Particulars Amount Rs.

Paid up Equity Share Capital 171,010

General Reserve 155,432

Retained Earnings 87,886

General Loan Loss Provision 16,983

Exchange Equalization Reserve 22,313

Un-audited current year profit 31,991

Deferred Revenue expenses 2,884

The bank is in the process of preparing the documents for quarterly reporting. The bank has

also provided a term loan of Rs.125,000 to a single party during the period under review. As a

reporting and compliance officer of the bank you are required to calculate movement in loan

loss provision amount.

Question No 19:

From the following information calculate Core capital ratio and total capital adequacy ratio of

DDD Bank Ltd. and suggest management about the compliance of the same:

In lakh

Paid up Capital 20,000

General Reserve Fund 377

Retained Earnings 308

Profit for current year 1,945

General Loan Loss Provision 1,215

Investment Adjustment Reserve 22

Loan Given to Relatives of Staffs 37

Risk weighted Exposure for Credit Risk 213,546

Risk weighted Exposure for Operational Risk 4,235

Risk Weighted Exposure for Market Risk 1,618

The Institute of Chartered Accountants of Nepal

Accounting for Departments

Question No 20:

Department Blue sells goods to Department Black at a profit of 25% on cost and to Department

Pink at 10% profit on cost. Department Black sells goods to Blue and Pink at a profit of 15%

and 20% on sales, respectively. Department Pink charges 20% and 25% profit on cost to

Department Blue and Black, respectively.

Department Managers are entitled to 10% commission on net profit subject to unrealized profit on

departmental sales being eliminated. Departmental profits after charging Managers‘ commission, but

before adjustment of unrealized profit are as under:

Rs.

Department Blue 36,000

Department Black 27,000

Department Pink 18,000

Stocks lying at different departments at the end of the year are as under:

Dept. Blue Dept. Black Dept. Pink

Rs. Rs. Rs.

Transfer from Department Blue — 15,000 11,000

Transfer from Department Black 14,000 — 12,000

Transfer from Department Pink 6,000 5,000 —

Required: Correct departmental Profits after charging Managers‘ commission.

Nepal Accounting Standards (NAS)

Question No 21:

a. Shree Ganesh Ltd. is a manufacturing company produces durable consumer goods with an annual

turnover of Rs. 100 crores. The company receives orders from its commission agents all over the

country, but goods are dispatched directly to the customers. The documents including transport

bills are sent through the bank for collection. At the end of the 6th year, it is found that documents

covering the dispatch of goods worth Rs. 10 crores were still lying with the banks not cleared by

the customers even though the normal collection period of 15 days from the date of dispatch has

expired. Should revenue be recognized in the above case?

b. While preparing its final accounts for the year ended 32nd Ashad, 2075, a company made

provision for bad debts @5% of its total debtors. In the last week of Jestha 2075 a debtor for Rs.

20 lakhs had suffered heavy loss due to a heavy fire; the loss was not covered by any insurance

policy. In Shrawan 2075 the debtor became a bankrupt. Can the company provide for the full loss

arising out of insolvency of the debtor in the final accounts for the year ended 32 nd Ashad, 2075?

Give your opinion on the basis of relevant NAS.

The Institute of Chartered Accountants of Nepal

c. A company is in a dispute involving allegation of infringement of patents by a competitor

company who is seeking damages of a huge sum of Rs. 20 million. The directors are of the

opinion that the claim can be successfully resisted by the company. How would you deal with the

same in the annual accounts of the company?

d. ABC Co. took a machine on lease from XYZ Co. the fair value being Rs. 1,000,000. The

economic life of the machine as well as lease term is 4 years. At the end of each year, ABC Co.

pays Rs. 350,000. The lessee has guaranteed a residual value of Rs. 40,000 on expiry of lease to

the lessor. However, XYZ Co. estimates that the residual value of the machinery will be Rs.

35,000 only. The implicit rate of return is 16% and PV factors at 16% for year 1, year 2, year 3

and year 4 are 0.8621, 0.7432, 0.6407 and 0.5523 respectively. You are required to calculate the

value of machinery to be considered by ABC Co.

e. Discuss on ‘Other comprehensive income’ as outlined in Nepal Accounting Standard.

f. A company capitalizes interest cost of holding investments and adds to cost of investment every

year, thereby understating interest cost in profit and loss account. Comment on the accounting

treatment done by the company in context of the relevant NAS.

Write Short Notes

Question No 22:

(a). Leases

(b). Re-Insurance

(c). Contingent Assets

(d). Non Banking Assets

(e). Debt Service Coverage Ratio

(f). Watch List in Loan loss provisioning

(g). Government Accounting System in Nepal

(h). Outsourcing the Accounting function to third party

The Institute of Chartered Accountants of Nepal

SUGGESTED ANSWERS HINT

Business Combination

Answer No 1:

Books of Blue Star Limited

Realization Account

Rs. Rs.

To Building 3,40,000 By Creditors 3,20,000

To Machinery 6,40,000 By B Ltd. 12,10,000

To Stock 2,20,000 By Equity Shareholders A/c (Loss) 60,000

To Debtors 2,60,000

To Goodwill 1,30,000

1,590,000 1,590,000

Bank Account

To Balance b/d 136,000 By 10% debentures 400,000

To Big Star Ltd. 600,000 By Loan from A 160,000

By Equity shareholders A/c 176,000

736,000 736,000

Big Star Ltd. Account

To Realisation A/c 1,210,000 By Bank A/c 600,000

By Equity Share holders A/c

(4,880 shares at Rs.125 each in Big Star

Ltd.) 610,000

1,210,000 1,210,000

Equity Shareholders Account

To Realisation A/c 60,000 By Equity Share Capital 800,000

To Deferred Revenue Exp. 34,000 By General Reserve 80,000

To Equity shares in Big Star Ltd. 610,000

To Bank A/c 176,000

880,000 880,000

Big Star Ltd.

Balance Sheet as on 1 st Shrawan, 2075 (An extract)

Liabilities Rs. Assets Rs.

4880 Equity shares of Rs.100 each 488,000 Goodwill 232,000

(Shares have been issued for Building 306,000

consideration other than cash)

Securities Premium 122,000 Machine 576,000

The Institute of Chartered Accountants of Nepal

Profit and Loss A/c ….

Less: unrealized profit 15,000 …..

Creditors (320,000 - 40,000) 280,000 Stock (198,000 -15,000) 183,000

Bank Overdraft 616,000 Debtors (260,000 – 40,000) 220,000

Less: Provision for bad debts 26,000 194,000

Working Notes:

1. Valuation of Goodwill Rs.

Average profit 124,400

Less: 8% of Rs. 880,000 70,400

Super profit 54,000

Value of Goodwill = 54,000 x 4 216,000

2. Net Assets for purchase consideration

Goodwill as valued in W.N.1 216,000

Building 306,000

Machinery 576,000

Stock 198,000

Debtors 260,000

Total Assets 1,556,000

Less: Creditors 320,000

Provision for bad debts 26,000 346,000

Net Assets 1,210,000

Out of this Rs. 600,000 is to be paid in cash and remaining i.e., (1,210,000–600,000) Rs. 610,000 in

shares of Rs. 125/-. Thus, the number of shares to be allotted 610,000/125 = 4,880 shares.

3. Unrealized Profit on Stock Rs.

The stock of Blue Star Ltd. includes goods worth Rs. 100,000 which was sold by

40,000

Big Star Ltd. on profit. Unrealized profit on this stock will be 1,00,000 25,000

1,60,000

As Big Star Ltd. purchased assets of Blue Star Ltd. at a price 10% less than the (10,000)

book value, 10% need to be adjusted from the stock i.e., 10% of Rs.100,000.

Amount of unrealized profit 15,000

4. Liquidation expenses borne by the Big Star Ltd. so that should be debited to Goodwill Account.

The Institute of Chartered Accountants of Nepal

Answer No 2:

Books of Hill Ltd.

Realisation Account

Particulars Amount Rs. Particulars Amount Rs.

To Good will 1,00,000 By Current Liabilities 2,00,000

To Fixed Assets 3,00,000 By Himal Ltd. 10,87,500

To Current Assets 13,00,000 By Share Capital 2,50,000

By Equity Shareholders a/c ( loss) 1,62,500

17,00,000 17,00,000

Equity Shareholders (outside) Account

Particulars Amount Rs. Particulars Amount Rs.

To Realisation 2,50,000 By Share Capital 10,00,000

To Realisation Loss 1,62,500 By General reserve 5,00,000

To Shares in Himal Ltd 10,87,500

15,00,000 15,00,000

Balance Sheet of Himal Ltd.

(After completion of absorption)

Capital & Liabilities Amount Rs. Assets Amount Rs.

Share Capital 30,87,500 Fixed Assets 18,00,000

30875 shares @ Rs. 100 fully Himal Ltd. 15,00,000

paid Hill Ltd. 3,00,000

Reserve & Surplus 16,25,000 Investment 50,000

General reserve 15,25,000

Capital reserve 1,00,000 Current Assets 45,47,500

Current Liabilities 16,85,000

63,97,500 63,97,500

Workings:

The Institute of Chartered Accountants of Nepal

Adjusted Balance Sheet of Hill Ltd.

Capital & Liabilities Amount Rs Assets Amount Rs.

Share Capital 10,00,000 Fixed assets 3,00,000

General Reserve 5,00,000 Goodwill 1,00,000

Current Liabilities 2,00,000 Current assets 13,00,000*

17,00,000 17,00,000

Hill Ltd retains Rs. 100,000 in cash for dividend (10%) ( 1,400,000-100,000)

1. Total Purchase consideration (based on net worth of Hill Ltd.) is Rs. 1,450,000.

2. Himal Ltd. holds 2,500 shares in Hill Ltd. The percentage of holding is 25%

3. The net purchase consideration to pay Rs. 1,450,000 * ¾ = 1,087,500

4. Calculation of Current Assets

Current assets of Himal Ltd. 3,250,000

Add Dividend 25,000

3,275,000

Less: intercompany amount 15,000

3,260,000

Current Assets of Hill Ltd. 1,300,000

Less unrealized profit 12,500

(Rs. 50,000-37,500) 1,287,500

Total Current Assets 4,547,500

5. Calculation of Current Liabilities

Himal Ltd. 1,500,000

Hill Ltd. (200,000-15,000) 185,000

1,685,000

6. Calculation of Capital Reserve

Assets taken over from Hill Ltd:

Fixed assets 300,000

Current assets (1,300,000-12,500) 1,287,500

1,587,500

Liabilities:

Investment in Hill Ltd. 200,000

Current Liabilities 200,000

Purchase consideration 1,087,500 1,487,500

Capital Reserve 100,000

The Institute of Chartered Accountants of Nepal

Internal Reconstruction

Answer No 3:

Journal Entries

in the books of Pokhara Light Ltd.

Rs.

Rs.

(i) Equity Share Capital (Rs.100) A/c Dr. 1,00,00,000

To Equity Share Capital (Rs.40) A/c 40,00,000

To Reconstruction A/c 60,00,000

(Being conversion of equity share capital of Rs.100 each into Rs.40 each as

per reconstruction scheme)

(ii) 12% Cumulative Preference Share capital (Rs.100) A/c Dr. 50,00,000

To 12% Cumulative Preference Share Capital (Rs.60) A/c 30,00,000

To Reconstruction A/c 20,00,000

(Being conversion of 12% cumulative preference share capital of Rs.100 each

into Rs.60 each as per reconstruction scheme)

(iii) 10% Debentures A/c Dr. 40,00,000

To 12% Debentures A/c 28,00,000

To Reconstruction A/c 12,00,000

(Being 12% debentures issued to 10% debenture-holders for 70% of their

claims. The balance transferred to capital reduction account as per

reconstruction scheme)

(iv) Sundry Creditors A/c Dr. 20,00,000

To Equity Share Capital A/c 12,00,000

To Reconstruction A/c 8,00,000

(Being a creditor of Rs.20,00,000 agreed to surrender his claim by 40% and

was allotted 30,000 equity shares of Rs.40 each in full settlement of his dues

as per reconstruction scheme)

(v) Provision for Taxation A/c Dr. 1,00,000

Reconstruction A/c Dr. 50,000

To Current Assets (Bank A/c) 1,50,000

(Being conversion of the provision for taxation into liability for taxation for

settlement of the amount due)

(vi) Reconstruction A/c Dr. 99,50,000

To P & L A/c 4,00,000

To Preliminary Expenses A/c 2,00,000

To Fixed Assets A/c 37,50,000

To Current Assets A/c 55,00,000

The Institute of Chartered Accountants of Nepal

You might also like

- UB Sir New QuestionsDocument16 pagesUB Sir New QuestionsbinuNo ratings yet

- Service CostingDocument6 pagesService Costingbinu100% (1)

- Internal Reco Dec 2020Document12 pagesInternal Reco Dec 2020binuNo ratings yet

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddineNo ratings yet

- June 2019 All Paper SuggestedDocument120 pagesJune 2019 All Paper SuggestedEdtech NepalNo ratings yet

- Corporate Law RTP CAP-II June 2016Document18 pagesCorporate Law RTP CAP-II June 2016Artha sarokar100% (1)

- Extracted Chapter 1Document103 pagesExtracted Chapter 1PalisthaNo ratings yet

- RTP June 19 AnsDocument27 pagesRTP June 19 AnsbinuNo ratings yet

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- Suggested Answer CAP II December 2012Document62 pagesSuggested Answer CAP II December 2012Sankalpa NeupaneNo ratings yet

- Illustrations AmalgamationDocument4 pagesIllustrations Amalgamationajay2741100% (1)

- Revision Test Paper CAP III June 2020Document233 pagesRevision Test Paper CAP III June 2020Roshan PanditNo ratings yet

- Suggested - Answer - CAP - II - June - 2011 4Document64 pagesSuggested - Answer - CAP - II - June - 2011 4Dipen Adhikari100% (1)

- Branch AccountingDocument50 pagesBranch AccountingyuvrajbarariaNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- CAP II Scanner Corporate LawDocument121 pagesCAP II Scanner Corporate LawEdtech NepalNo ratings yet

- Adv Accounts - AmalgamationDocument31 pagesAdv Accounts - Amalgamationmd samser50% (2)

- Suggested - Answer - CAP - II - June - 2010 2Document85 pagesSuggested - Answer - CAP - II - June - 2010 2Dipen AdhikariNo ratings yet

- CAP III - Suggested Answer Papers - All Subjects - June 2019 PDFDocument133 pagesCAP III - Suggested Answer Papers - All Subjects - June 2019 PDFsantosh thapa chhetriNo ratings yet

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarNo ratings yet

- Chap 3Document56 pagesChap 3Basant OjhaNo ratings yet

- TYBAF UnderwritingDocument49 pagesTYBAF UnderwritingJaimin VasaniNo ratings yet

- Important Points of Our Notes/Books:: TH THDocument42 pagesImportant Points of Our Notes/Books:: TH THpuru sharmaNo ratings yet

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- Not For Profit OrganizationDocument69 pagesNot For Profit OrganizationDristi SaudNo ratings yet

- CA Inter Cost Important Questions For CA Nov'22Document93 pagesCA Inter Cost Important Questions For CA Nov'2202 Tapasvee ShahNo ratings yet

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- (Finished Goods/stock in Trade) (Work - In-Progress) (Raw Material, Stores and Spares, Etc.)Document20 pages(Finished Goods/stock in Trade) (Work - In-Progress) (Raw Material, Stores and Spares, Etc.)razorNo ratings yet

- Direct Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesDocument5 pagesDirect Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesAbimanyu ShenilNo ratings yet

- Accounts Ques Nov06Document48 pagesAccounts Ques Nov06api-3825774No ratings yet

- Paper - 4: Cost Accounting andDocument56 pagesPaper - 4: Cost Accounting andemmanuel JohnyNo ratings yet

- Non-Integrated, Integrated & Reconciliation of Cost and Financial AccountsDocument107 pagesNon-Integrated, Integrated & Reconciliation of Cost and Financial Accountsanon_67206536267% (3)

- As 7 Construction ContractDocument5 pagesAs 7 Construction ContractPankaj MeenaNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- Chapter 22 Contract Costing - NoRestrictionDocument18 pagesChapter 22 Contract Costing - NoRestrictionMohammad SaadmanNo ratings yet

- Solutions To Text Book Exercises: Consignment AccountsDocument23 pagesSolutions To Text Book Exercises: Consignment AccountsM JEEVARATHNAM NAIDUNo ratings yet

- Branch AccountingDocument38 pagesBranch AccountingUmra khatoonNo ratings yet

- Paper 1 Advanced AccountingDocument576 pagesPaper 1 Advanced AccountingExcel Champ60% (5)

- VAT Compilation CAP IIDocument15 pagesVAT Compilation CAP IIbinuNo ratings yet

- Journal PostingDocument22 pagesJournal PostingPoonam JadhavNo ratings yet

- AmalgamationDocument6 pagesAmalgamationअक्षय गोयलNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- AS-20 QuestionDocument7 pagesAS-20 QuestionDeepthi R TejurNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- Banking CompaniesDocument34 pagesBanking CompaniesLodaNo ratings yet

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- Advanced Accounts 1 PDFDocument304 pagesAdvanced Accounts 1 PDFJohn Louie NunezNo ratings yet

- CA Inter Adv Accounts (New) Suggested Answer Dec21Document30 pagesCA Inter Adv Accounts (New) Suggested Answer Dec21omaisNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument29 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalsePiyush GoyalNo ratings yet

- Practice Accounts Prime PDFDocument56 pagesPractice Accounts Prime PDFShraddha NepalNo ratings yet

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaPraveen KumarNo ratings yet

- Suggested CAP II Group I June 2023Document43 pagesSuggested CAP II Group I June 2023pratyushmudbhari340No ratings yet

- Payout Policy SessionsDocument101 pagesPayout Policy SessionsAman PoddarNo ratings yet

- 123 - AS Question Bank by Rahul MalkanDocument182 pages123 - AS Question Bank by Rahul MalkanPooja GuptaNo ratings yet

- Additional Service Costing QuestionsDocument6 pagesAdditional Service Costing QuestionsSrushti AgarwalNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument39 pages© The Institute of Chartered Accountants of IndiaGowriNo ratings yet

- Inventory Valuation ProblemsDocument7 pagesInventory Valuation ProblemsRahul SinghNo ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- Revision Test Paper CAP II Dec 2017Document163 pagesRevision Test Paper CAP II Dec 2017Dipen AdhikariNo ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- RTP June 19 QnsDocument15 pagesRTP June 19 QnsbinuNo ratings yet

- Problems On Internal ReconstructionDocument7 pagesProblems On Internal Reconstructionlokeshwarareddy1999No ratings yet

- Binod Project Report BBS 4th Year FinalDocument48 pagesBinod Project Report BBS 4th Year FinalbinuNo ratings yet

- Nas 17Document17 pagesNas 17binuNo ratings yet

- Project Report Pratham_BBS 4th yearDocument54 pagesProject Report Pratham_BBS 4th yearbinuNo ratings yet

- 500 Questions - UpdatedDocument53 pages500 Questions - Updatedbinu0% (1)

- 1 Day Revision Note Portfolio ManagementDocument9 pages1 Day Revision Note Portfolio ManagementbinuNo ratings yet

- WHT, Advance Tax & Others (CAP II) - Summary NoteDocument10 pagesWHT, Advance Tax & Others (CAP II) - Summary NotebinuNo ratings yet

- NAS 21 The Effects of Changes in Foreign Exchange RatesDocument14 pagesNAS 21 The Effects of Changes in Foreign Exchange RatesbinuNo ratings yet

- BCDocument6 pagesBCbinuNo ratings yet

- Ind As 19Document86 pagesInd As 19binuNo ratings yet

- Share Based PaymentDocument65 pagesShare Based PaymentbinuNo ratings yet

- Advanced Auditing & Assurance Trend AnalysisDocument2 pagesAdvanced Auditing & Assurance Trend AnalysisbinuNo ratings yet

- Finance Suggested Short Notes CompilationDocument15 pagesFinance Suggested Short Notes CompilationbinuNo ratings yet

- AFR Consolidation TrendDocument1 pageAFR Consolidation TrendbinuNo ratings yet

- Interim Reporting Nas 34Document34 pagesInterim Reporting Nas 34binuNo ratings yet

- Deepak Kumar Yadav ProposalDocument15 pagesDeepak Kumar Yadav ProposalbinuNo ratings yet

- Man Bahadur KhatriDocument41 pagesMan Bahadur KhatribinuNo ratings yet

- Income Tax 2075-2076Document8 pagesIncome Tax 2075-2076binuNo ratings yet

- Income Tax 2074-75 TransDocument9 pagesIncome Tax 2074-75 TransbinuNo ratings yet

- Budget Highlights - Crowe Nepal (78-79)Document72 pagesBudget Highlights - Crowe Nepal (78-79)binuNo ratings yet

- Overhead ControlDocument1 pageOverhead ControlbinuNo ratings yet

- Nsa 520 SM UpdatedDocument8 pagesNsa 520 SM UpdatedbinuNo ratings yet

- Investment For Cap 11Document8 pagesInvestment For Cap 11binuNo ratings yet

- Non Integrated AccountingDocument4 pagesNon Integrated AccountingbinuNo ratings yet

- Dissolutioni of Partnership FirmDocument69 pagesDissolutioni of Partnership FirmbinuNo ratings yet

- Nsa 230 Application Material UpdatedDocument12 pagesNsa 230 Application Material UpdatedbinuNo ratings yet

- Editor in chief,+EJBMR 1033+R300821Document7 pagesEditor in chief,+EJBMR 1033+R300821BigPalabraNo ratings yet

- HistoryDocument2 pagesHistoryQS OH OladosuNo ratings yet

- Unit 5 Mcqs QPDocument7 pagesUnit 5 Mcqs QPAdrian D'souzaNo ratings yet

- Dwnload Full Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions Manual PDFDocument36 pagesDwnload Full Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions Manual PDFjayden77evans100% (18)

- MLPT FinanceDocument180 pagesMLPT FinanceKris ValiantoNo ratings yet

- Accounting Tutorial 1Document5 pagesAccounting Tutorial 1Sim Pei YingNo ratings yet

- Fusion Assets - India Tax DepreciationDocument8 pagesFusion Assets - India Tax DepreciationshashankNo ratings yet

- Reading 85 Portfolio Management - An Overview - AnswersDocument12 pagesReading 85 Portfolio Management - An Overview - Answersyashporwal270No ratings yet

- Management Accounting - Fund Flow AnalysisDocument30 pagesManagement Accounting - Fund Flow AnalysisT S Kumar KumarNo ratings yet

- A Case Study On Financial Performance AnDocument83 pagesA Case Study On Financial Performance Anshresthanikhil078No ratings yet

- Mock On SAPMDocument3 pagesMock On SAPMDhaneshNo ratings yet

- FSA - Ch06 - Liquidity of Short-Term Assets Related Debt-Paying AbilityDocument46 pagesFSA - Ch06 - Liquidity of Short-Term Assets Related Debt-Paying AbilityAmine AbdesmadNo ratings yet

- Exercise 1: Discussion QuestionsDocument2 pagesExercise 1: Discussion QuestionsCharice Anne VillamarinNo ratings yet

- Jun 2004 - Qns Mod BDocument13 pagesJun 2004 - Qns Mod BHubbak Khan100% (1)

- The Following Information Is Available About The Capital Structure For PDFDocument1 pageThe Following Information Is Available About The Capital Structure For PDFLet's Talk With HassanNo ratings yet

- Account Statement: Hotel Sunny CotDocument3 pagesAccount Statement: Hotel Sunny Cotrohit. remooNo ratings yet

- Advanced Accounting 13th Edition Beams Test Bank Full Chapter PDFDocument59 pagesAdvanced Accounting 13th Edition Beams Test Bank Full Chapter PDFanwalteru32x100% (18)

- Intercompany Sale: Downstream and Upstream Sale of Inventory Downstream and Upstream Sale of Depreciable AssetsDocument13 pagesIntercompany Sale: Downstream and Upstream Sale of Inventory Downstream and Upstream Sale of Depreciable AssetsShaina AragonNo ratings yet

- Mini Paper AkuntansiDocument13 pagesMini Paper AkuntansiFathiya RachmasariNo ratings yet

- Do Accounting, Market, and Macroeconomic Factors Affect Financial Distress? Evidence in IndonesiaDocument17 pagesDo Accounting, Market, and Macroeconomic Factors Affect Financial Distress? Evidence in Indonesiamuhammad taufikNo ratings yet

- CHAPTER 3 - PracticeExerciseDocument5 pagesCHAPTER 3 - PracticeExerciseSerenity CarlyeNo ratings yet

- Synthesis On Cost of CapitalDocument2 pagesSynthesis On Cost of CapitalRu Martin100% (1)

- 03 - REIT - May 27Document4 pages03 - REIT - May 27MAUREEN BAN-EGNo ratings yet

- MTNLDocument1 pageMTNLa_halanNo ratings yet

- Chapter 14 Financing Liabilities: Bonds and Long-Term Notes PayableDocument71 pagesChapter 14 Financing Liabilities: Bonds and Long-Term Notes Payableamit patelNo ratings yet

- Morningstar Equities Research MethodologyDocument2 pagesMorningstar Equities Research Methodologykanika sengarNo ratings yet

- IFRS 9 Financial Instruments - v2Document93 pagesIFRS 9 Financial Instruments - v2Emil John SughuNo ratings yet

- Case StudyDocument18 pagesCase StudyalbertNo ratings yet

- Selected Accounts From Wills Sports Equipments Adjusted Trial Balance On September 30Document3 pagesSelected Accounts From Wills Sports Equipments Adjusted Trial Balance On September 30CharlotteNo ratings yet

- Ca Blog India: Accounting - A Capsule For Quick RevisionDocument21 pagesCa Blog India: Accounting - A Capsule For Quick RevisionkonaNo ratings yet